Key Insights

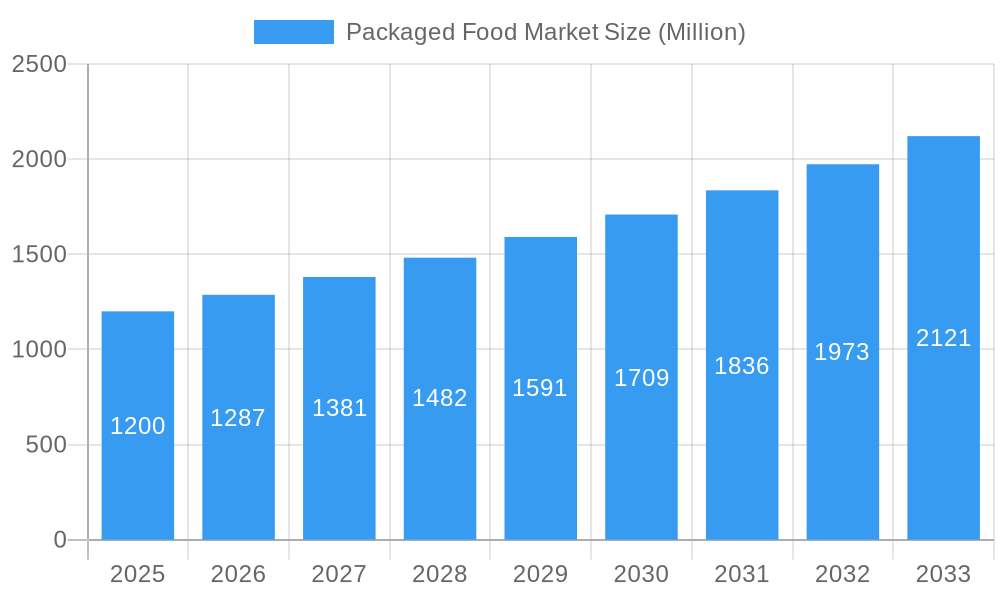

The global Packaged Food Market is poised for robust expansion, projected to reach a significant market size of approximately $1,200 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.43% through 2033. This sustained growth is primarily fueled by evolving consumer lifestyles, characterized by increased demand for convenience, longer shelf life, and ready-to-eat options. The burgeoning middle class in emerging economies, coupled with a growing awareness of food safety and hygiene standards, further bolsters the market's trajectory. Key product segments like dairy products, confectionery, and beverages are expected to lead the charge, driven by innovation in flavor profiles, healthier formulations, and convenient single-serving packaging. Additionally, the rising popularity of online retail stores is revolutionizing distribution, offering consumers wider accessibility and greater product choice, thus contributing to the overall market dynamism.

Packaged Food Market Market Size (In Billion)

However, the market is not without its challenges. Concerns regarding the environmental impact of packaging materials, particularly plastics, are leading to a growing preference for sustainable and eco-friendly alternatives. This evolving consumer sentiment, coupled with stringent government regulations on food packaging and labeling, presents a significant restraint. Furthermore, fluctuating raw material prices and intense competition among established players and new entrants necessitate continuous innovation and strategic pricing to maintain market share. Despite these hurdles, the Packaged Food Market's inherent resilience, driven by fundamental consumer needs for convenient and safe food solutions, ensures its continued upward growth and evolution over the forecast period.

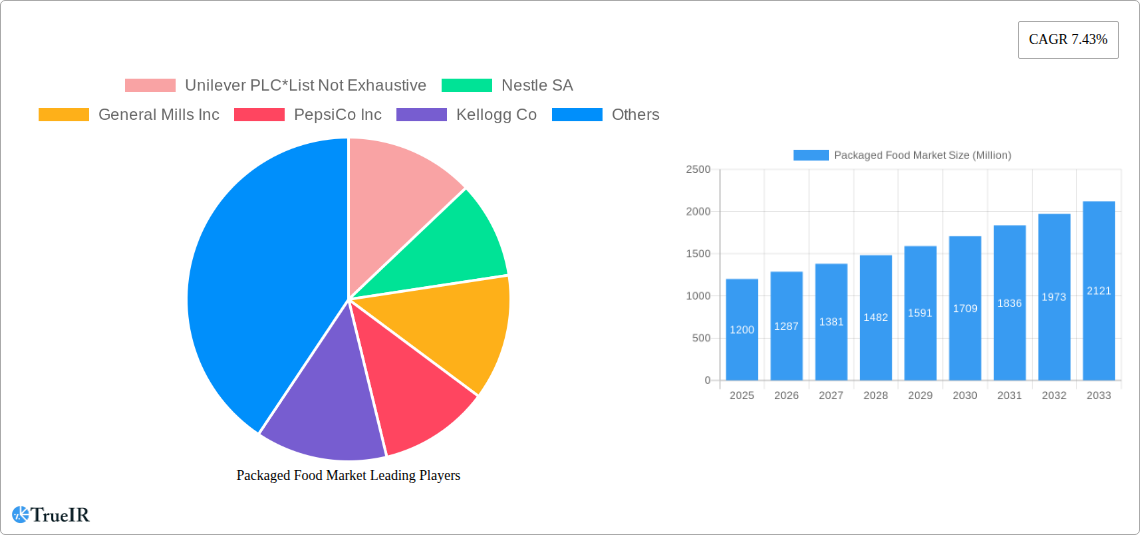

Packaged Food Market Company Market Share

Packaged Food Market: Comprehensive Analysis, Trends, Opportunities, and Future Outlook (2019–2033)

This in-depth report provides a meticulous analysis of the global packaged food market, offering critical insights into its current landscape, historical trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously dissects market structure, key trends, dominant segments, and competitive dynamics. Leveraging high-volume SEO keywords such as "packaged food market growth," "food industry trends," "convenience foods market," "global food packaging," and "ready-to-eat meals," this report is engineered for maximum search visibility and engagement within the industry. We delve into product types including Dairy Products, Confectionery, Beverages, Bakery, Snacks, Meat, Poultry and Seafood, Breakfast Cereals, and Ready Meals, analyzed across Plastic, Tetra Pack, and Metal Cans packaging types, and distributed through Supermarkets/Hypermarkets, Convenience Stores, and Online Retail Stores.

Packaged Food Market Market Structure & Competitive Landscape

The global packaged food market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, alongside a robust presence of regional and niche manufacturers. This competitive landscape is shaped by continuous innovation in product formulation, packaging technology, and marketing strategies. Key innovation drivers include the growing demand for healthier options, plant-based alternatives, and convenient meal solutions. Regulatory impacts, such as stringent food safety standards and evolving labeling requirements, also play a crucial role in shaping market entry and product development. The presence of numerous product substitutes, ranging from fresh produce to home-prepared meals, necessitates constant adaptation and value proposition enhancement by packaged food companies. End-user segmentation reveals a strong reliance on convenience-seeking demographics, including busy professionals and families. Mergers and acquisitions (M&A) trends are prevalent, as larger companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, in May 2022, General Mills’ acquisition of TNT Crust for approximately $xx Million highlights the strategic consolidations aimed at bolstering market position in specific segments. The market concentration ratio is estimated at around xx% for the top five players. M&A activities in the forecast period are projected to involve xx deals with a combined value of over $xxx Million, driven by the pursuit of synergistic growth and market consolidation.

Packaged Food Market Market Trends & Opportunities

The global packaged food market is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and expanding market access. Market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033, reaching an estimated value of $xxx Billion by the end of the forecast period. This expansion is underpinned by the increasing urbanization and busier lifestyles, which fuel the demand for convenient, ready-to-eat, and easy-to-prepare food options. Technological shifts are transforming the industry, from advanced food processing techniques that enhance shelf life and nutritional value to innovative packaging solutions that offer greater convenience and sustainability. For example, the rise of e-commerce and online grocery platforms has opened new distribution channels, increasing market penetration rates for packaged food products, especially in emerging economies. Consumer preferences are rapidly shifting towards healthier formulations, with a growing emphasis on natural ingredients, reduced sugar and salt content, and plant-based alternatives. This trend presents significant opportunities for product innovation and differentiation. The competitive dynamics are intensifying, with established players and agile startups alike vying for market share. Strategic partnerships and collaborations, such as those observed in product launches, are becoming crucial for navigating the complex market landscape. The market penetration rate for convenience foods is estimated to reach xx% by 2033. Opportunities also lie in developing personalized nutrition solutions, leveraging data analytics to understand consumer needs, and investing in sustainable packaging to appeal to environmentally conscious consumers. The global market size is estimated to grow from $xxx Billion in 2025 to $xxx Billion by 2033, signifying a significant expansion trajectory.

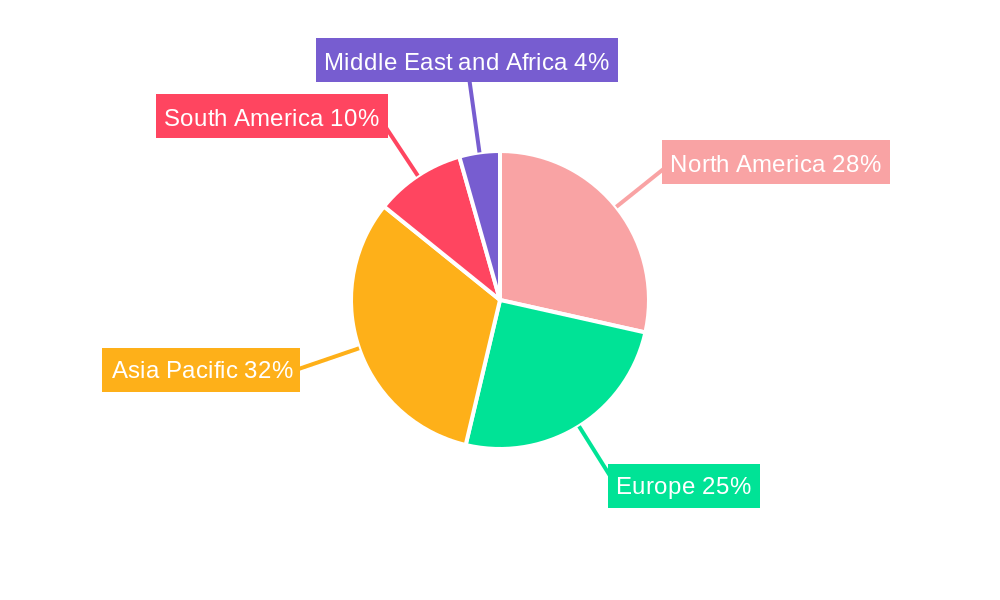

Dominant Markets & Segments in Packaged Food Market

The Supermarket/Hypermarket distribution channel is currently the dominant force in the packaged food market, accounting for an estimated xx% of global sales in 2025. This dominance is driven by their extensive product variety, attractive pricing strategies, and the convenience they offer to a broad consumer base. However, Online Retail Stores are experiencing the most rapid growth, projected to witness a CAGR of xx% during the forecast period, as e-commerce adoption accelerates worldwide. In terms of product type, Beverages represent the largest segment, with an estimated market share of xx% in 2025, driven by consistent demand for soft drinks, juices, and functional beverages. Snacks follow closely, fueled by the 'on-the-go' consumption trend. The Plastic packaging type holds the largest share, estimated at xx% in 2025, due to its versatility, cost-effectiveness, and durability. Yet, growing environmental concerns are propelling the growth of sustainable packaging alternatives like Tetra Pack. Regionally, North America continues to lead the packaged food market, driven by high disposable incomes and a well-established retail infrastructure. However, Asia-Pacific is emerging as the fastest-growing region, propelled by a burgeoning middle class, rapid urbanization, and increasing adoption of Western dietary habits. Key growth drivers in this dynamic market include:

- Infrastructure Development: Enhanced logistics and cold chain infrastructure, particularly in emerging economies, facilitate wider distribution of packaged foods.

- Government Policies: Favorable trade agreements and supportive food safety regulations can boost market access and consumer confidence.

- Urbanization: The shift of populations to urban centers increases access to retail outlets and drives demand for convenient food solutions.

- Rising Disposable Income: Greater purchasing power among consumers allows for increased expenditure on a wider variety of packaged food products.

- Digital Transformation: The proliferation of e-commerce platforms and digital payment systems is revolutionizing how packaged foods are bought and sold.

Packaged Food Market Product Analysis

Product innovation in the packaged food market is primarily focused on enhancing nutritional value, convenience, and sensory appeal. Companies are leveraging advanced food science to develop healthier alternatives, such as low-sugar, low-sodium, and gluten-free options, alongside a surge in plant-based protein products. Technological advancements in processing and preservation are extending shelf life while minimizing nutrient loss, thereby improving market fit for a global consumer base. Competitive advantages are being carved out through unique flavor profiles, functional ingredient integration (e.g., probiotics, omega-3s), and smart packaging solutions that offer enhanced convenience and traceability. The market is witnessing a rise in ready-to-eat and ready-to-cook meals, catering to the demand for quick meal solutions.

Key Drivers, Barriers & Challenges in Packaged Food Market

The packaged food market is propelled by several key drivers including the increasing demand for convenience driven by urbanization and evolving lifestyles, a growing global population, and the rising disposable incomes in emerging economies, enabling greater purchasing power for processed food items. Technological advancements in food processing and packaging further contribute by enhancing product quality, shelf-life, and consumer appeal. Policy-driven factors, such as favorable trade agreements and support for food manufacturing, also act as significant growth catalysts.

However, significant barriers and challenges restrain market growth. Supply chain disruptions, exacerbated by geopolitical events and climate change, can lead to increased costs and reduced availability of raw materials. Stringent regulatory hurdles related to food safety, labeling, and health claims in different regions require substantial compliance efforts and investment. Intense competitive pressures from both established brands and emerging players, alongside the growing consumer preference for fresh and minimally processed foods, pose ongoing challenges. For instance, the cost of raw materials can fluctuate by as much as xx%, impacting profit margins. Regulatory compliance costs can add up to xx% of operational expenses for businesses operating across multiple international markets.

Growth Drivers in the Packaged Food Market Market

Key growth drivers in the packaged food market are intrinsically linked to societal and economic shifts. Technologically, innovations in shelf-life extension and nutrient fortification are creating new product categories and expanding consumer appeal. Economically, rising disposable incomes, particularly in developing nations, are translating into increased consumer spending on processed and convenience foods. Policy-driven factors, such as government initiatives promoting food processing industries and trade liberalization, are also instrumental in fostering market expansion. For example, government subsidies for food manufacturers in Southeast Asia are estimated to boost regional market growth by xx% in the coming years. The demand for healthy and sustainable food options is also a powerful growth engine, pushing companies to innovate in product formulation and packaging.

Challenges Impacting Packaged Food Market Growth

Challenges impacting the packaged food market growth are multifaceted. Regulatory complexities, including evolving food safety standards and stringent labeling laws across different jurisdictions, create significant compliance burdens and can slow down product launches. Supply chain issues, such as volatility in raw material prices and disruptions due to logistical bottlenecks, directly impact production costs and product availability. Competitive pressures are mounting from both large multinational corporations and agile local players, as well as from the growing consumer trend towards fresh, minimally processed foods. For instance, the cost of key ingredients like grains has seen an average increase of xx% over the past year, posing a direct challenge to profitability. Consumer perception regarding the healthiness of packaged foods, despite ongoing innovation, remains a persistent concern for some market segments.

Key Players Shaping the Packaged Food Market Market

- Unilever PLC

- Nestle SA

- General Mills Inc

- PepsiCo Inc

- Kellogg Co

- Tyson Foods Inc

- Danone SA

- The Kraft Heinz Company

- The Coca-Cola Company

- Mondelz Global LLC

Significant Packaged Food Market Industry Milestones

- January 2023: PepsiCo Inc. launched Pepsi Zero Sugar, offering a zero-sugar recipe designed to meet evolving consumer flavor preferences and demand for healthier options.

- December 2022: PepsiCo Inc., in partnership with PepsiCo Foodservice Digital Lab and Popchew, launched "Doritos After Dark," capitalizing on consumer insights that highlight the popularity of snacking after dark, with 43% of consumers and 49% of Gen Z agreeing with this sentiment.

- June 2022: Conagra Brands introduced an extensive range of new product innovations and frozen meals as part of its summer line-up, featuring brands like Healthy Choice and Marie Callender's, focusing on contemporary flavors and convenient preparation.

- May 2022: General Mills acquired TNT Crust from private equity firm Peak Rock Capital, strengthening its position in the frozen pizza crust segment for both retail and foodservice channels.

Future Outlook for Packaged Food Market Market

The future outlook for the packaged food market is exceptionally robust, driven by sustained demand for convenience, innovation in health and wellness offerings, and the expansion of e-commerce channels. Strategic opportunities lie in the development of personalized nutrition solutions, leveraging AI and data analytics to cater to individual consumer needs. The increasing global focus on sustainability will drive significant growth in eco-friendly packaging solutions and ethically sourced ingredients. Emerging markets, with their rapidly growing middle class and urbanization, represent a substantial untapped potential. Companies that can effectively adapt to changing consumer preferences, embrace technological advancements, and navigate the evolving regulatory landscape are poised for significant growth and market leadership. The market is projected to witness continuous product diversification, with a strong emphasis on plant-based alternatives and functional foods, ensuring its relevance and expansion for years to come.

Packaged Food Market Segmentation

-

1. Product Type

- 1.1. Dairy Products

- 1.2. Confectionery

- 1.3. Beverage

- 1.4. Bakery

- 1.5. Snacks

- 1.6. Meat, Poultry and Seafood

- 1.7. Breakfast Cereals

- 1.8. Ready Meals

- 1.9. Other Product Types

-

2. Packaging Type

- 2.1. Plastic

- 2.2. Tetra Pack

- 2.3. Metal Cans

- 2.4. Other Packaging Types

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Convenience Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

Packaged Food Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Packaged Food Market Regional Market Share

Geographic Coverage of Packaged Food Market

Packaged Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Plant-based Packaged Food are Witnessing Immense Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaged Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dairy Products

- 5.1.2. Confectionery

- 5.1.3. Beverage

- 5.1.4. Bakery

- 5.1.5. Snacks

- 5.1.6. Meat, Poultry and Seafood

- 5.1.7. Breakfast Cereals

- 5.1.8. Ready Meals

- 5.1.9. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Plastic

- 5.2.2. Tetra Pack

- 5.2.3. Metal Cans

- 5.2.4. Other Packaging Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Packaged Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dairy Products

- 6.1.2. Confectionery

- 6.1.3. Beverage

- 6.1.4. Bakery

- 6.1.5. Snacks

- 6.1.6. Meat, Poultry and Seafood

- 6.1.7. Breakfast Cereals

- 6.1.8. Ready Meals

- 6.1.9. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Plastic

- 6.2.2. Tetra Pack

- 6.2.3. Metal Cans

- 6.2.4. Other Packaging Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarket/Hypermarket

- 6.3.2. Convenience Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Packaged Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dairy Products

- 7.1.2. Confectionery

- 7.1.3. Beverage

- 7.1.4. Bakery

- 7.1.5. Snacks

- 7.1.6. Meat, Poultry and Seafood

- 7.1.7. Breakfast Cereals

- 7.1.8. Ready Meals

- 7.1.9. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Plastic

- 7.2.2. Tetra Pack

- 7.2.3. Metal Cans

- 7.2.4. Other Packaging Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarket/Hypermarket

- 7.3.2. Convenience Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Packaged Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dairy Products

- 8.1.2. Confectionery

- 8.1.3. Beverage

- 8.1.4. Bakery

- 8.1.5. Snacks

- 8.1.6. Meat, Poultry and Seafood

- 8.1.7. Breakfast Cereals

- 8.1.8. Ready Meals

- 8.1.9. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Plastic

- 8.2.2. Tetra Pack

- 8.2.3. Metal Cans

- 8.2.4. Other Packaging Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarket/Hypermarket

- 8.3.2. Convenience Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Packaged Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dairy Products

- 9.1.2. Confectionery

- 9.1.3. Beverage

- 9.1.4. Bakery

- 9.1.5. Snacks

- 9.1.6. Meat, Poultry and Seafood

- 9.1.7. Breakfast Cereals

- 9.1.8. Ready Meals

- 9.1.9. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Plastic

- 9.2.2. Tetra Pack

- 9.2.3. Metal Cans

- 9.2.4. Other Packaging Types

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarket/Hypermarket

- 9.3.2. Convenience Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Packaged Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Dairy Products

- 10.1.2. Confectionery

- 10.1.3. Beverage

- 10.1.4. Bakery

- 10.1.5. Snacks

- 10.1.6. Meat, Poultry and Seafood

- 10.1.7. Breakfast Cereals

- 10.1.8. Ready Meals

- 10.1.9. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Plastic

- 10.2.2. Tetra Pack

- 10.2.3. Metal Cans

- 10.2.4. Other Packaging Types

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarket/Hypermarket

- 10.3.2. Convenience Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Unilever PLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kellogg Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tyson Foods Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danone SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Kraft Heinz Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Coca-Cola Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondelz Global LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Unilever PLC*List Not Exhaustive

List of Figures

- Figure 1: Global Packaged Food Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Packaged Food Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Packaged Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Packaged Food Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 5: North America Packaged Food Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Packaged Food Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America Packaged Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Packaged Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Packaged Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Packaged Food Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Packaged Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Packaged Food Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 13: Europe Packaged Food Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: Europe Packaged Food Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: Europe Packaged Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Packaged Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Packaged Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Packaged Food Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Packaged Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Packaged Food Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 21: Asia Pacific Packaged Food Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Asia Pacific Packaged Food Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Packaged Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Packaged Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Packaged Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Packaged Food Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Packaged Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Packaged Food Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 29: South America Packaged Food Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: South America Packaged Food Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: South America Packaged Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Packaged Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Packaged Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Packaged Food Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Packaged Food Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Packaged Food Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 37: Middle East and Africa Packaged Food Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Middle East and Africa Packaged Food Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Packaged Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Packaged Food Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Packaged Food Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaged Food Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Packaged Food Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Packaged Food Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Packaged Food Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Packaged Food Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global Packaged Food Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Packaged Food Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Packaged Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Packaged Food Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global Packaged Food Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 15: Global Packaged Food Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Packaged Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Spain Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Germany Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: France Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Italy Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Russia Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Packaged Food Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 25: Global Packaged Food Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 26: Global Packaged Food Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Packaged Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: China Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Japan Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: India Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Australia Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Packaged Food Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global Packaged Food Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 35: Global Packaged Food Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Packaged Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Packaged Food Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 41: Global Packaged Food Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 42: Global Packaged Food Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Packaged Food Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: South Africa Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Packaged Food Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaged Food Market?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the Packaged Food Market?

Key companies in the market include Unilever PLC*List Not Exhaustive, Nestle SA, General Mills Inc, PepsiCo Inc, Kellogg Co, Tyson Foods Inc, Danone SA, The Kraft Heinz Company, The Coca-Cola Company, Mondelz Global LLC.

3. What are the main segments of the Packaged Food Market?

The market segments include Product Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Plant-based Packaged Food are Witnessing Immense Growth.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

January 2023: PepsiCo Inc. launched Pepsi Zero Sugar which provides a zero-sugar recipe to consumers. According to the company, it is constantly identifying consumer trends and preferences and working to create flavor profiles that meet consumers' ever-evolving needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaged Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaged Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaged Food Market?

To stay informed about further developments, trends, and reports in the Packaged Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence