Key Insights

The Indian Breakfast Cereal Market is projected for substantial growth, estimated to reach USD 5.1 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 7.97%. This expansion is fueled by evolving consumer lifestyles, rising disposable incomes, and increased awareness of fortified cereals' health benefits. The "ready-to-eat" segment is expected to drive growth, meeting demand for convenient, nutritious breakfast options. Health and wellness trends are boosting demand for cereals enriched with vitamins, minerals, and fiber, appealing to health-conscious consumers. Growing urbanization is shifting preferences towards quick, nutritious breakfast solutions, further accelerating market expansion. Increased organized retail presence and the booming online channel are enhancing accessibility nationwide.

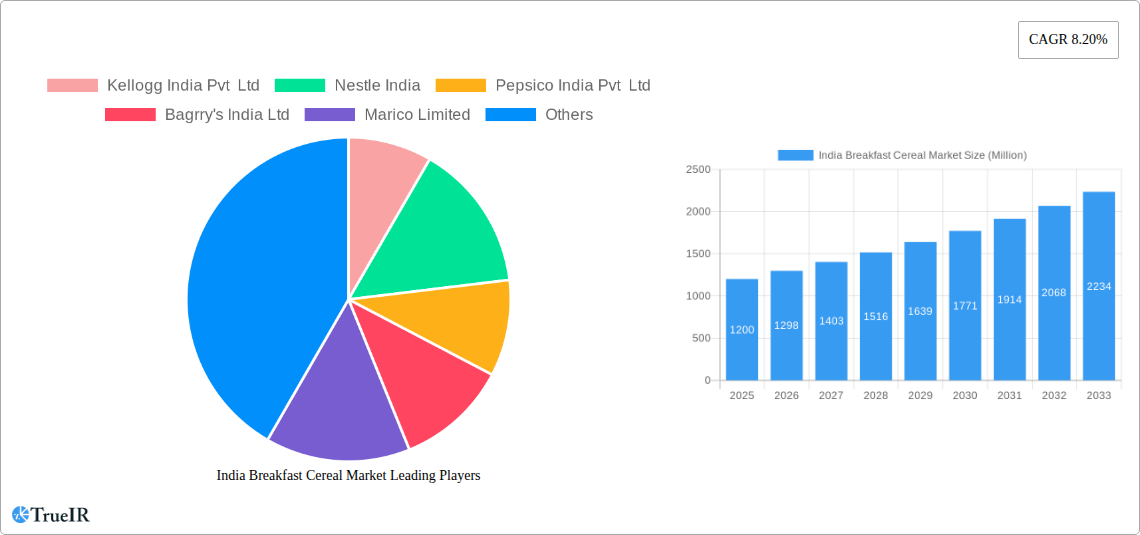

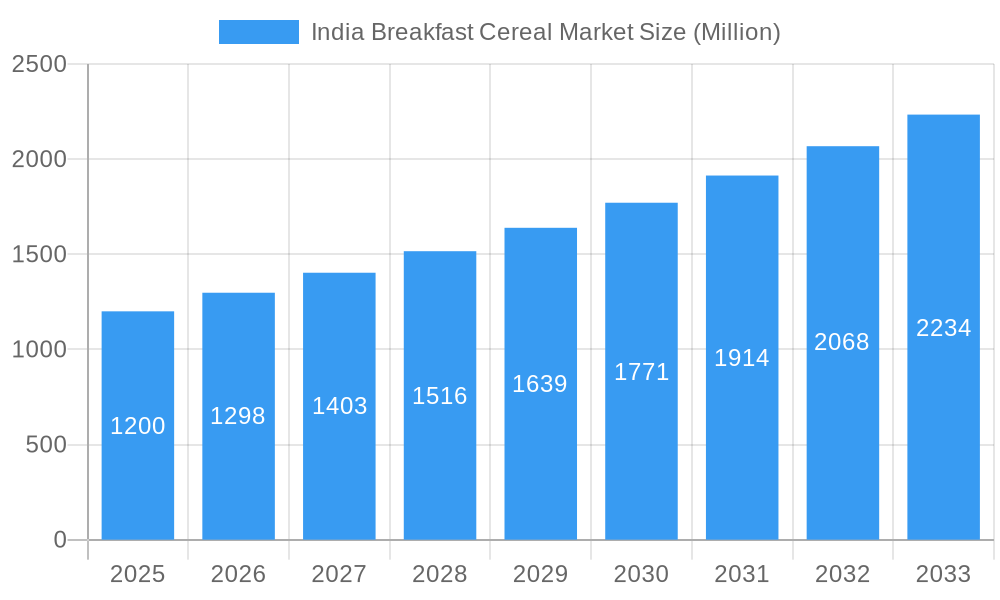

India Breakfast Cereal Market Market Size (In Billion)

Strategic product innovation and aggressive marketing by key players like Kellogg India, Nestle India, and PepsiCo India support market growth. These companies are diversifying product portfolios with healthier, gluten-free, and diet-specific options. Challenges include competitive pricing from traditional Indian breakfast alternatives and the perception of cereals as a premium product. However, increasing affordability of packaged cereals and value-for-money offerings are mitigating these concerns. Expanding distribution to Tier 2 and Tier 3 cities, alongside effective promotions, is vital for unlocking the market's full potential.

India Breakfast Cereal Market Company Market Share

India Breakfast Cereal Market Report: Growth, Trends, and Competitive Landscape 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic India Breakfast Cereal Market, offering insights into its structure, growth trends, dominant segments, and competitive landscape. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study leverages high-volume keywords to enhance SEO rankings and engage industry professionals. Dive deep into market size, consumer preferences, technological advancements, and the strategic initiatives of key players shaping the future of breakfast consumption in India.

India Breakfast Cereal Market Market Structure & Competitive Landscape

The Indian breakfast cereal market is characterized by a moderately concentrated structure, with a few major global and domestic players holding significant market share. Innovation remains a key driver, with companies consistently introducing new product variants catering to evolving health consciousness and taste preferences. Regulatory impacts, while present, are generally supportive of food industry growth. Product substitutes, such as traditional Indian breakfast options, continue to pose competition, necessitating strategic product differentiation. End-user segmentation reveals a growing preference for healthier options and convenience. Mergers and acquisitions are likely to play a role in future market consolidation, as companies seek to expand their product portfolios and market reach. The market is dynamic, with ongoing shifts in consumer behavior and product development strategies.

- Market Concentration: Dominated by a handful of major players.

- Innovation Drivers: Health benefits, convenience, and varied flavor profiles.

- Regulatory Impacts: Primarily related to food safety standards and labeling.

- Product Substitutes: Traditional Indian breakfast dishes, other ready-to-eat options.

- End-User Segmentation: Growing demand from urban middle-class, health-conscious consumers.

- M&A Trends: Potential for consolidation and strategic partnerships.

India Breakfast Cereal Market Market Trends & Opportunities

The India Breakfast Cereal Market is poised for significant expansion, driven by a confluence of factors including rising disposable incomes, increasing urbanization, and a growing awareness of health and wellness. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025-2033. Technological shifts are evident in product formulation, with a focus on fortified cereals, gluten-free options, and plant-based ingredients. Consumer preferences are increasingly leaning towards convenience, nutritional value, and diverse flavor profiles, moving beyond traditional breakfast offerings. The competitive dynamics are intense, with both established multinational corporations and burgeoning domestic brands vying for market share. Opportunities abound in tapping into the rural market, developing innovative product formats for on-the-go consumption, and leveraging digital platforms for enhanced reach and consumer engagement. The penetration rate of breakfast cereals, while still lower compared to developed markets, offers substantial headroom for growth. Furthermore, the trend of consuming cereals for occasions beyond breakfast, such as snacking, presents a significant untapped opportunity. The focus on value-added products, such as those fortified with vitamins, minerals, and protein, is a key trend that will continue to drive market growth. The increasing adoption of online retail channels further expands accessibility, creating new avenues for market penetration and sales growth across all segments of the Indian population.

Dominant Markets & Segments in India Breakfast Cereal Market

The Ready-to-eat Cereals segment is expected to maintain its dominance within the India Breakfast Cereal Market, driven by unparalleled convenience and a wide array of appealing flavors and formats. This segment benefits significantly from the rapidly growing Supermarkets/Hypermarkets and Online Retail Stores distribution channels. The increasing penetration of modern retail formats, particularly in Tier 1 and Tier 2 cities, alongside the exponential growth of e-commerce platforms, makes these channels highly accessible for consumers seeking breakfast cereals.

- Dominant Product Type: Ready-to-eat Cereals

- Key Growth Drivers:

- Unmatched convenience for busy lifestyles.

- Wide variety of flavors and appealing formats (flakes, puffs, clusters).

- Strong marketing efforts by major brands emphasizing taste and fun.

- Growing preference for quick and easy breakfast solutions.

- Key Growth Drivers:

- Dominant Distribution Channel: Supermarkets/Hypermarkets & Online Retail Stores

- Key Growth Drivers:

- Supermarkets/Hypermarkets: Increased modern retail penetration, organized shelf space, impulse purchase opportunities, and a one-stop shopping experience.

- Online Retail Stores: Growing internet and smartphone penetration, convenience of home delivery, wider product availability, and competitive pricing.

- Infrastructure Development: Improved logistics and supply chain networks supporting wider distribution.

- Consumer Habits: Increasing preference for organized retail and digital purchasing.

- Key Growth Drivers:

While Ready-to-cook cereals represent a significant segment, their growth is comparatively slower due to the time investment required for preparation. Specialty stores and convenience stores also play a role, but their contribution is less impactful compared to the larger formats and online channels. The independent retailers, though widespread, face challenges in competing with the promotional activities and product variety offered by modern retail and online platforms.

India Breakfast Cereal Market Product Analysis

Product innovation in the India Breakfast Cereal Market is intensely focused on catering to evolving consumer demands for health, taste, and convenience. Key advancements include the introduction of multigrain options, cereals fortified with essential vitamins and minerals, and a growing array of protein-rich and plant-based alternatives. Competitive advantages are being carved out through unique flavor combinations, allergen-free formulations, and the inclusion of natural ingredients like fruits, nuts, and seeds. The application of these products extends beyond traditional breakfast, with companies actively promoting them as healthy snack options throughout the day, thereby broadening their market appeal and usage occasions.

Key Drivers, Barriers & Challenges in India Breakfast Cereal Market

Key Drivers:

- Rising Health Consciousness: Increasing consumer awareness regarding the importance of a nutritious breakfast.

- Convenience Factor: Demand for quick and easy meal solutions for time-pressed lifestyles.

- Growing Disposable Income: Enhanced purchasing power of the Indian middle class.

- Product Innovation: Introduction of diverse flavors, textures, and health-focused variants.

- Urbanization: Increased adoption of Western dietary habits and modern retail.

Key Barriers & Challenges:

- Price Sensitivity: High price points compared to traditional Indian breakfast options can deter price-conscious consumers.

- Established Traditional Breakfast Habits: Deep-rooted cultural preference for indigenous breakfast dishes.

- Supply Chain Complexities: Ensuring consistent availability and freshness across a vast and diverse country.

- Regulatory Hurdles: Navigating food safety regulations and compliance requirements.

- Intense Competition: Presence of both multinational corporations and local players, leading to price wars and marketing saturation.

- Availability of Substitutes: Abundance of affordable and culturally relevant alternative breakfast choices.

Growth Drivers in the India Breakfast Cereal Market Market

The India Breakfast Cereal Market's growth is propelled by a potent combination of factors. Technological advancements in food processing enable the creation of more nutritious and appealing cereals, including fortified options and plant-based formulations. The economic driver of increasing disposable incomes among the burgeoning middle class fuels demand for convenient and perceived healthier breakfast choices. Policy-driven factors, such as government initiatives promoting healthy eating and food fortification, also contribute positively. Furthermore, the strategic push by companies to market cereals as a healthy snack option beyond breakfast opens new avenues for consumption and market expansion.

Challenges Impacting India Breakfast Cereal Market Growth

Despite the promising growth trajectory, the India Breakfast Cereal Market faces significant hurdles. Regulatory complexities in food production and labeling can pose compliance challenges for manufacturers. Supply chain issues, including last-mile delivery and maintaining product integrity across diverse climates, remain a constant concern in a vast country like India. Competitive pressures are intense, with established brands and emerging local players vying for consumer attention, often leading to aggressive pricing strategies. The deeply ingrained traditional breakfast habits also present a formidable barrier, requiring sustained marketing efforts to shift consumer preferences towards cereals.

Key Players Shaping the India Breakfast Cereal Market Market

- Kellogg India Pvt Ltd

- Nestle India

- Pepsico India Pvt Ltd

- Bagrry's India Ltd

- Marico Limited

- Patanjali Ayurved Limited

- Shanti's

- General Mills

- Future Consumer Enterprise Ltd

- B&G Foods

Significant India Breakfast Cereal Market Industry Milestones

- October 2022: Kellogg's India launched 'Kellogg's Pro Muesli', a high protein muesli that is 100% plant-based. Kellogg's Pro Muesli with 200 ml milk provides 29% of an adult's (sedentary woman's) protein requirement for the day.

- September 2022: Quacker Oats, a Pepsico brand, launched Quacker Oats Muesli. The product contains added fruits, nuts, and seeds. The product is available in two flavors, i.e., Fruit & Nut and Berries & Seeds.

- August 2021: Kellogg's launched Froot loops, a multigrain cereal made from corn, wheat, and oats. Additionally, these companies are pushing the consumption of cereals for occasions beyond breakfast. Kellog's introduced K Energy Bars, and Tata Soulfull has Ragi Bites Snacks.

Future Outlook for India Breakfast Cereal Market Market

The future outlook for the India Breakfast Cereal Market is exceptionally bright, driven by sustained growth catalysts such as increasing health consciousness, a rising middle class, and continuous product innovation. Strategic opportunities lie in tapping into the vast potential of rural markets, expanding the reach of online sales channels, and developing specialized product lines catering to specific dietary needs like gluten-free and high-protein options. The market potential is further enhanced by the growing acceptance of cereals as convenient and healthy snack alternatives, moving beyond their traditional breakfast role. The focus on sustainable sourcing and eco-friendly packaging will also gain prominence, aligning with evolving consumer values.

India Breakfast Cereal Market Segmentation

-

1. Product Type

- 1.1. Ready-to-cook Cereals

- 1.2. Ready-to-eat Cereals

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Specialty Stores

- 2.4. Independent Retailers

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

India Breakfast Cereal Market Segmentation By Geography

- 1. India

India Breakfast Cereal Market Regional Market Share

Geographic Coverage of India Breakfast Cereal Market

India Breakfast Cereal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Growth of Hot Cereal Meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Breakfast Cereal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ready-to-cook Cereals

- 5.1.2. Ready-to-eat Cereals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Independent Retailers

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kellogg India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pepsico India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bagrry's India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marico Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Patanjali Ayurved Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shanti's

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Future Consumer Enterprise Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 B&G Foods*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kellogg India Pvt Ltd

List of Figures

- Figure 1: India Breakfast Cereal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Breakfast Cereal Market Share (%) by Company 2025

List of Tables

- Table 1: India Breakfast Cereal Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: India Breakfast Cereal Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Breakfast Cereal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Breakfast Cereal Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: India Breakfast Cereal Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Breakfast Cereal Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Breakfast Cereal Market?

The projected CAGR is approximately 7.97%.

2. Which companies are prominent players in the India Breakfast Cereal Market?

Key companies in the market include Kellogg India Pvt Ltd, Nestle India, Pepsico India Pvt Ltd, Bagrry's India Ltd, Marico Limited, Patanjali Ayurved Limited, Shanti's, General Mills, Future Consumer Enterprise Ltd, B&G Foods*List Not Exhaustive.

3. What are the main segments of the India Breakfast Cereal Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Growth of Hot Cereal Meals.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Kellogg's India launched 'Kellogg's Pro Muesli', a high protein muesli that is 100% plant-based. Kellogg's Pro Muesli with 200 ml milk provides 29% of an adult's (sedentary woman's) protein requirement for the day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Breakfast Cereal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Breakfast Cereal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Breakfast Cereal Market?

To stay informed about further developments, trends, and reports in the India Breakfast Cereal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence