Key Insights

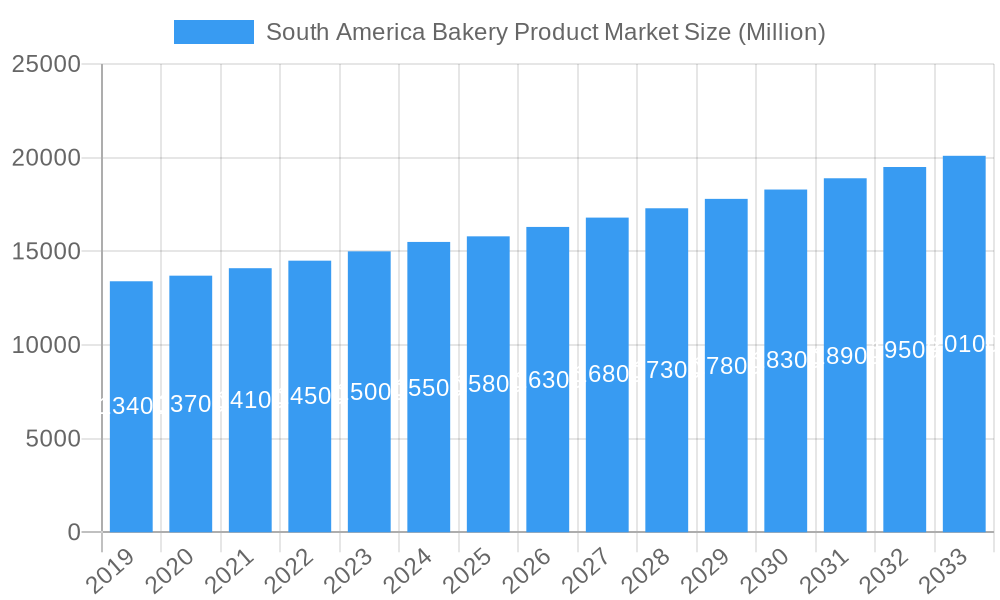

The South America Bakery Product Market is poised for steady growth, projected to reach a market size of approximately $15,800 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 3.11% through 2033. This expansion is primarily driven by evolving consumer preferences towards convenient and ready-to-eat options, coupled with an increasing demand for premium and artisanal bakery products. The growing middle class across the region, particularly in Brazil and Argentina, is contributing to higher disposable incomes, enabling consumers to spend more on value-added bakery items. Furthermore, the rising popularity of snacking and on-the-go consumption habits significantly bolsters the demand for biscuits, cookies, and morning goods. Modern retail formats, including supermarkets and hypermarkets, are expected to dominate distribution channels due to their extensive reach and product variety, while the burgeoning online retail segment presents a significant opportunity for market players to tap into a wider customer base and offer specialized products.

South America Bakery Product Market Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints. Fluctuations in the prices of key raw materials like wheat and sugar can impact profit margins for manufacturers. Additionally, increasing health consciousness among consumers, leading to a demand for healthier alternatives with reduced sugar and fat content, necessitates continuous product innovation. However, these challenges also present opportunities for companies to invest in research and development for healthier product lines and to adopt sustainable sourcing practices. The "Others" category within product types, encompassing items like donuts and muffins, is expected to see substantial growth, reflecting a diversification in consumer tastes. Geographically, Brazil is anticipated to lead the market in terms of size and growth, followed by Argentina, with the "Rest of South America" segment exhibiting strong potential driven by developing economies and increasing urbanization. Key players like Grupo Bimbo, Mondelez International, and PepsiCo are strategically positioned to capitalize on these market dynamics through product launches, acquisitions, and expanded distribution networks.

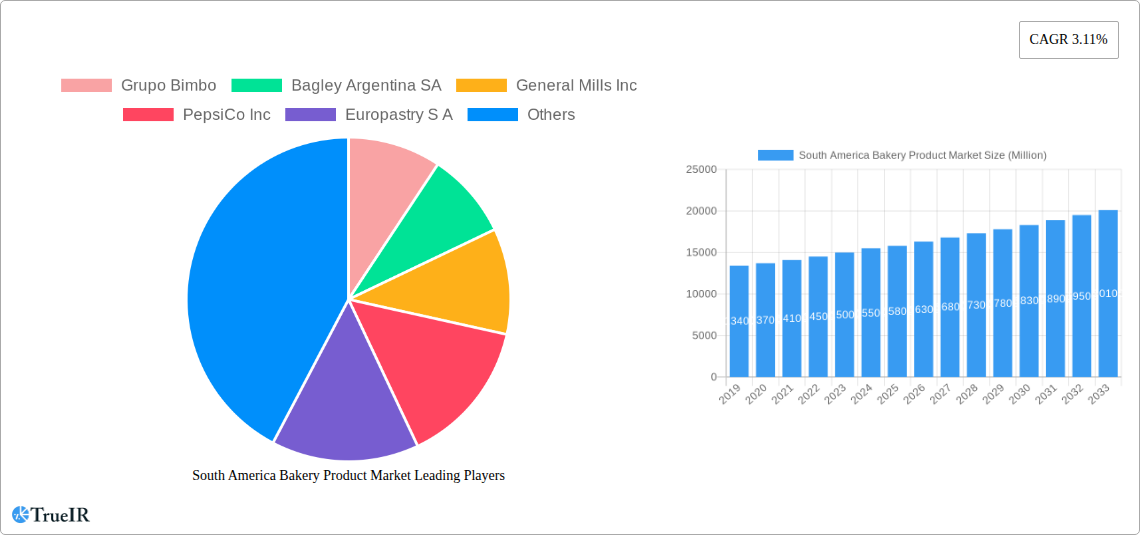

South America Bakery Product Market Company Market Share

South America Bakery Product Market Market Structure & Competitive Landscape

The South America Bakery Product Market is characterized by a moderately consolidated structure, with key players like Grupo Bimbo, Bagley Argentina SA, General Mills Inc., and PepsiCo Inc. holding significant market share. Innovation drivers are largely centered around health and wellness trends, demand for convenience, and the exploration of indigenous flavors. For instance, the rise in demand for gluten-free and reduced-sugar options has spurred product development. Regulatory impacts are primarily related to food safety standards, labeling requirements, and import/export policies across different South American nations, influencing product formulation and market entry strategies. Product substitutes, such as homemade baked goods and alternative snack categories, pose a competitive threat, necessitating continuous product differentiation and value proposition enhancement. End-user segmentation reveals a diverse consumer base, ranging from households seeking everyday staples to food service providers requiring bulk ingredients. Mergers & Acquisitions (M&A) trends indicate strategic consolidation and market expansion, with companies acquiring smaller local players to gain market access and diversify their portfolios. Estimated M&A volumes in the historical period (2019-2024) are in the range of $500 Million to $1.5 Billion, reflecting active deal-making. Concentration ratios suggest that the top five players account for approximately 45-55% of the market revenue.

South America Bakery Product Market Market Trends & Opportunities

The South America Bakery Product Market is poised for robust growth, projected to expand from an estimated $25 Billion in 2025 to $45 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.0% during the forecast period of 2025–2033. This growth trajectory is fueled by a confluence of evolving consumer preferences, technological advancements, and expanding distribution networks. A significant trend is the increasing consumer focus on health and wellness, leading to a higher demand for bakery products made with natural ingredients, whole grains, and reduced sugar and fat content. This presents a substantial opportunity for manufacturers to innovate and cater to this health-conscious demographic.

Technological shifts are also playing a pivotal role. Advancements in baking technology, including automated production lines and sophisticated ingredient processing, are enhancing efficiency, reducing costs, and improving product quality. The adoption of e-commerce platforms for bakery product sales is a burgeoning trend, driven by convenience and wider accessibility, particularly in urban centers. Online retail is expected to witness a CAGR of over 9.0% during the forecast period, opening new revenue streams for both established brands and smaller artisanal producers.

Competitive dynamics are intensifying as both global giants and local champions vie for market dominance. Companies are increasingly investing in marketing and branding to build consumer loyalty and differentiate their offerings. Furthermore, the exploration of unique, locally sourced ingredients and traditional flavors is gaining traction, allowing companies to tap into regional pride and cater to niche market segments. The "premiumization" of bakery products, offering higher quality ingredients and unique flavor profiles, is another significant trend, appealing to consumers willing to pay more for superior taste and experience. The market penetration rate of convenience-oriented bakery products, such as pre-packaged snacks and ready-to-eat items, continues to rise, reflecting the fast-paced lifestyles of South American consumers.

The growing middle class in several South American countries, coupled with increasing disposable incomes, is directly contributing to higher spending on food products, including bakery items. Opportunities lie in developing innovative product lines that cater to diverse dietary needs and preferences, such as vegan, gluten-free, and high-protein options. Strategic partnerships with local distributors and retailers are crucial for expanding market reach, especially in underserved rural areas. The demand for convenient and on-the-go bakery solutions is expected to remain a strong growth catalyst.

Dominant Markets & Segments in South America Bakery Product Market

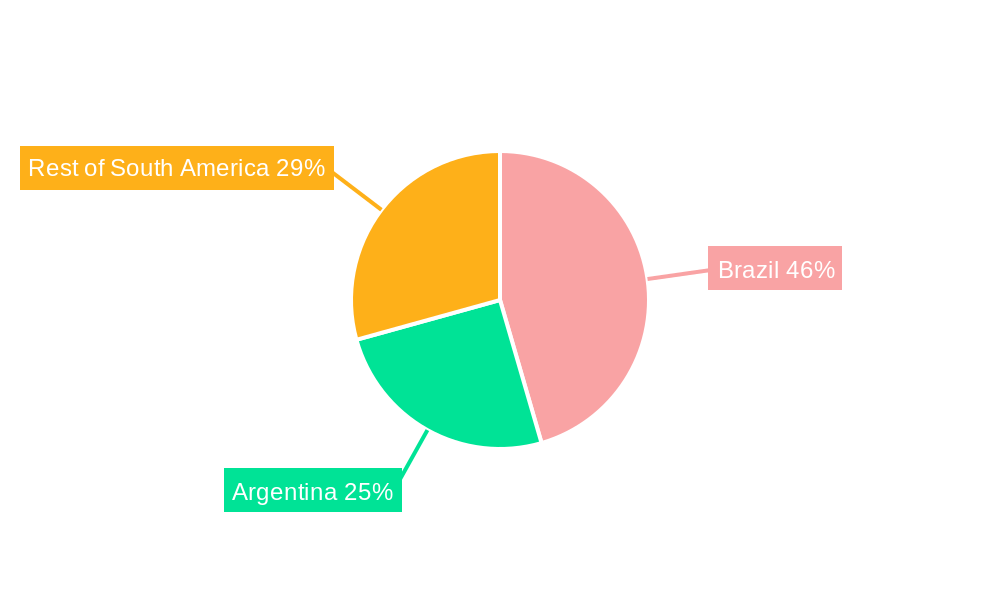

The South America Bakery Product Market is largely dominated by Brazil, which is projected to account for over 35% of the total market revenue by 2033, driven by its large population, expanding economy, and increasing consumer spending power. Argentina follows as a significant market, contributing an estimated 20% of the regional revenue, with a strong tradition of bakery consumption. The Rest of South America segment, encompassing countries like Colombia, Chile, Peru, and Ecuador, collectively represents a growing and diverse market, expected to capture the remaining share.

Within product segments, Bread remains the largest and most consumed category, with an estimated market share of 30% in 2025, driven by its staple status in daily diets across the region. Cakes and Pastries represent another substantial segment, projected to grow at a CAGR of 7.5%, fueled by demand for indulgent treats and celebratory occasions. Biscuits & Cookies are also a significant category, benefiting from their popularity as snacks and accompaniments, with an estimated market size of $6 Billion in 2025.

The Supermarkets/Hypermarkets distribution channel dominates the market, accounting for approximately 50% of sales in 2025, owing to their wide product availability and convenience for consumers. However, Online Retailers are emerging as a rapidly growing channel, projected to witness a CAGR of over 9.0%, driven by increasing internet penetration and e-commerce adoption. Convenience Stores also play a crucial role, particularly for impulse purchases and grab-and-go bakery items.

Key growth drivers for dominant regions include:

- Brazil:

- Large and growing population base.

- Increasing urbanization and disposable income.

- Significant investment in food processing infrastructure.

- Growing demand for convenient and ready-to-eat bakery products.

- Argentina:

- Strong cultural affinity for bakery products.

- Presence of established local and international players.

- Growing demand for premium and artisanal bakery items.

- Government initiatives supporting the food industry.

Market dominance in product types is influenced by:

- Bread: Staple food status, affordability, and variety of formulations (e.g., white, whole wheat, enriched).

- Cakes and Pastries: Growing trend for indulgence, celebration cakes, and impulse buys.

- Biscuits & Cookies: Convenience as snacks, diverse flavor profiles, and appeal across age groups.

South America Bakery Product Market Product Analysis

Product innovation in the South America Bakery Product Market is increasingly focused on health-conscious attributes, convenience, and the fusion of traditional and modern flavors. Manufacturers are actively developing products with reduced sugar, lower fat content, and the incorporation of whole grains and natural ingredients. The introduction of gluten-free and plant-based bakery options is gaining traction, catering to evolving dietary needs. For instance, a notable innovation is the development of shelf-stable, nutrient-fortified bread products designed for long-haul consumption. Competitive advantages are derived from strong branding, diverse product portfolios that cater to varied consumer preferences, and efficient supply chain management to ensure product freshness and availability.

Key Drivers, Barriers & Challenges in South America Bakery Product Market

Key Drivers: The South America Bakery Product Market is propelled by a growing middle class with increasing disposable income, leading to higher consumer spending on food products. The rising demand for convenient and ready-to-eat bakery items, driven by urbanization and busy lifestyles, is another significant driver. Technological advancements in baking processes are enhancing production efficiency and enabling product innovation. Furthermore, the trend towards healthier options, such as reduced sugar, gluten-free, and whole-grain products, is opening new market avenues.

Barriers & Challenges: Key challenges include the volatility of raw material prices, particularly for wheat and sugar, which can impact production costs and profitability. Complex regulatory frameworks and varying food safety standards across different South American countries pose market entry and compliance hurdles. Intense competition from both global brands and local artisanal bakeries necessitates continuous product differentiation and effective marketing strategies. Supply chain disruptions, including logistics and distribution inefficiencies in certain regions, can also impede market growth.

Growth Drivers in the South America Bakery Product Market Market

Key growth drivers for the South America Bakery Product Market include the expanding middle-class population across the region, leading to increased disposable income and higher spending on food. The rising demand for convenient and on-the-go bakery products, driven by urbanization and evolving consumer lifestyles, is a significant catalyst. Technological advancements in baking processes are enhancing efficiency and enabling the development of innovative and healthier product offerings. Furthermore, a growing consumer preference for products with perceived health benefits, such as reduced sugar and whole grains, presents substantial growth opportunities. Government support for the food processing industry in some countries also contributes to market expansion.

Challenges Impacting South America Bakery Product Market Growth

Challenges impacting the South America Bakery Product Market growth primarily revolve around the volatility of raw material prices, particularly for key ingredients like wheat and sugar, which can significantly affect production costs and profit margins. Navigating diverse and sometimes complex regulatory environments across different countries, including food safety standards and labeling requirements, presents a significant hurdle for market expansion. Intense competitive pressure from both established multinational corporations and agile local players necessitates continuous innovation and effective differentiation strategies. Furthermore, logistical and distribution challenges in certain regions can impact product availability and freshness, hindering overall market penetration and consumer satisfaction.

Key Players Shaping the South America Bakery Product Market Market

- Grupo Bimbo

- Bagley Argentina SA

- General Mills Inc.

- PepsiCo Inc.

- Europastry S A

- Associated British Foods PLC

- La Casa Alfajores

- Bakers Delight Holdings Limited

- Wickbold

- Mondelez International

Significant South America Bakery Product Market Industry Milestones

- 2019: Grupo Bimbo expands its product portfolio with a focus on healthier snack options.

- 2020: Increased adoption of e-commerce platforms for bakery product sales across major South American cities.

- 2021: Rise in demand for artisanal and sourdough bread varieties, signaling a shift towards premium bakery products.

- 2022: General Mills Inc. acquires a local South American bakery brand to strengthen its regional presence.

- 2023: Launch of plant-based and gluten-free bakery alternatives by several key players in response to growing consumer demand.

- 2024: Introduction of innovative packaging solutions aimed at extending shelf life and reducing food waste.

Future Outlook for South America Bakery Product Market Market

The future outlook for the South America Bakery Product Market is highly optimistic, driven by sustained economic development and evolving consumer preferences. Growth catalysts include the continued expansion of the middle class, increasing disposable incomes, and a persistent demand for convenience-oriented bakery products. Innovations focusing on health and wellness, such as reduced sugar, whole grains, and plant-based options, will continue to shape product development. The increasing penetration of online retail channels offers significant opportunities for market reach and sales growth. Strategic investments in advanced baking technologies and sustainable sourcing practices will also play a crucial role in market expansion and competitive advantage. The market is expected to witness further consolidation and strategic partnerships as players aim to capitalize on the region's vast potential.

South America Bakery Product Market Segmentation

-

1. Product Type

- 1.1. Cakes and Pastries

- 1.2. Biscuits & Cookies

- 1.3. Bread

- 1.4. Morning Goods

- 1.5. Pizza Crust

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailers

- 2.5. Others

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Bakery Product Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Bakery Product Market Regional Market Share

Geographic Coverage of South America Bakery Product Market

South America Bakery Product Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Demand for Convenience Food Products Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cakes and Pastries

- 5.1.2. Biscuits & Cookies

- 5.1.3. Bread

- 5.1.4. Morning Goods

- 5.1.5. Pizza Crust

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cakes and Pastries

- 6.1.2. Biscuits & Cookies

- 6.1.3. Bread

- 6.1.4. Morning Goods

- 6.1.5. Pizza Crust

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retailers

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cakes and Pastries

- 7.1.2. Biscuits & Cookies

- 7.1.3. Bread

- 7.1.4. Morning Goods

- 7.1.5. Pizza Crust

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retailers

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cakes and Pastries

- 8.1.2. Biscuits & Cookies

- 8.1.3. Bread

- 8.1.4. Morning Goods

- 8.1.5. Pizza Crust

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retailers

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Brazil South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 10. Argentina South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of South America South America Bakery Product Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Grupo Bimbo

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bagley Argentina SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 General Mills Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PepsiCo Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Europastry S A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Associated British Foods PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 La Casa Alfajores

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bakers Delight Holdings Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Wickbold

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Group Bimbo*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Mondelez International

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Grupo Bimbo

List of Figures

- Figure 1: South America Bakery Product Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Bakery Product Market Share (%) by Company 2025

List of Tables

- Table 1: South America Bakery Product Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: South America Bakery Product Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Bakery Product Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: South America Bakery Product Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Bakery Product Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Bakery Product Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Bakery Product Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of South America South America Bakery Product Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South America Bakery Product Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Bakery Product Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 13: South America Bakery Product Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: South America Bakery Product Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: South America Bakery Product Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 17: South America Bakery Product Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: South America Bakery Product Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 19: South America Bakery Product Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Bakery Product Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: South America Bakery Product Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Bakery Product Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the South America Bakery Product Market?

Key companies in the market include Grupo Bimbo, Bagley Argentina SA, General Mills Inc, PepsiCo Inc, Europastry S A, Associated British Foods PLC, La Casa Alfajores, Bakers Delight Holdings Limited, Wickbold, Group Bimbo*List Not Exhaustive, Mondelez International.

3. What are the main segments of the South America Bakery Product Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Demand for Convenience Food Products Drives the Market.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Bakery Product Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Bakery Product Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Bakery Product Market?

To stay informed about further developments, trends, and reports in the South America Bakery Product Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence