Key Insights

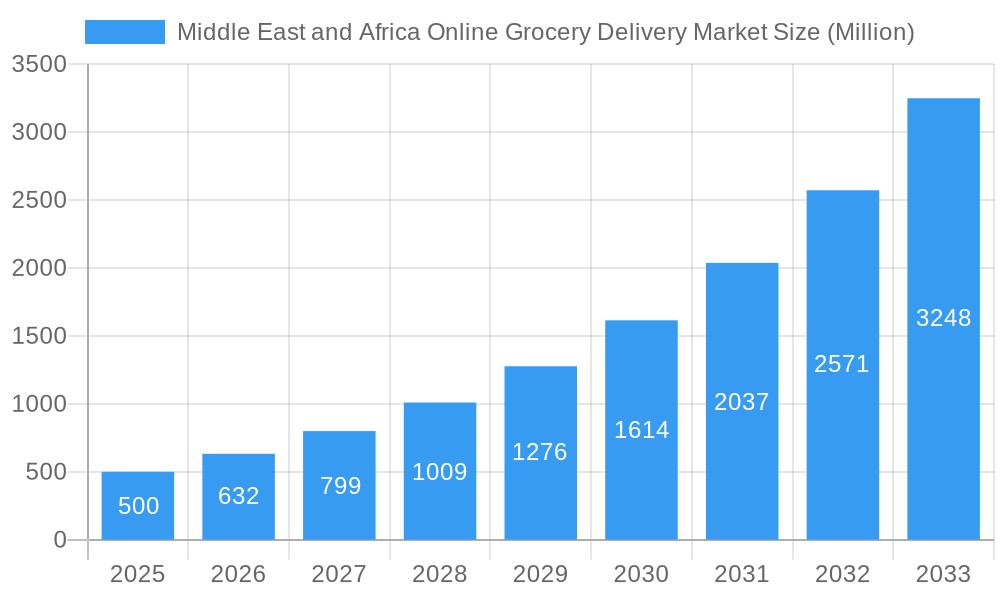

The Middle East and Africa (MEA) online grocery delivery market is experiencing rapid growth, fueled by increasing internet and smartphone penetration, a burgeoning young population accustomed to e-commerce, and the convenience offered by on-demand services. The market, valued at an estimated $X million in 2025 (assuming a logical extrapolation based on the provided CAGR and global trends), is projected to maintain a robust Compound Annual Growth Rate (CAGR) of 26.40% through 2033. Key drivers include rising disposable incomes, particularly in urban areas of the UAE, Saudi Arabia, and South Africa, leading to increased spending on convenience goods. Furthermore, the expanding presence of major international players like Amazon Fresh and DoorDash, alongside regional players, is fostering market competition and driving innovation in delivery models, including quick commerce and specialized services like meal kit delivery. The preference for contactless delivery, amplified by recent global events, further boosts the market's trajectory.

Middle East and Africa Online Grocery Delivery Market Market Size (In Million)

However, challenges remain. Infrastructure limitations in certain regions of MEA hinder efficient last-mile delivery, impacting operational costs and delivery times. Consumer concerns regarding food safety and quality, as well as a lack of trust in online payment systems in some areas, present significant hurdles to overcome. The segment breakdown reveals a strong preference for retail delivery services, but the quick commerce and meal kit delivery segments are gaining traction, offering lucrative growth opportunities for companies able to address logistical challenges and build consumer trust. Companies focusing on localized solutions, targeted marketing campaigns, and building robust supply chains will be best positioned to capture market share. Future growth will hinge on addressing these constraints while capitalizing on the rising demand for convenient and efficient online grocery shopping in the rapidly evolving MEA landscape.

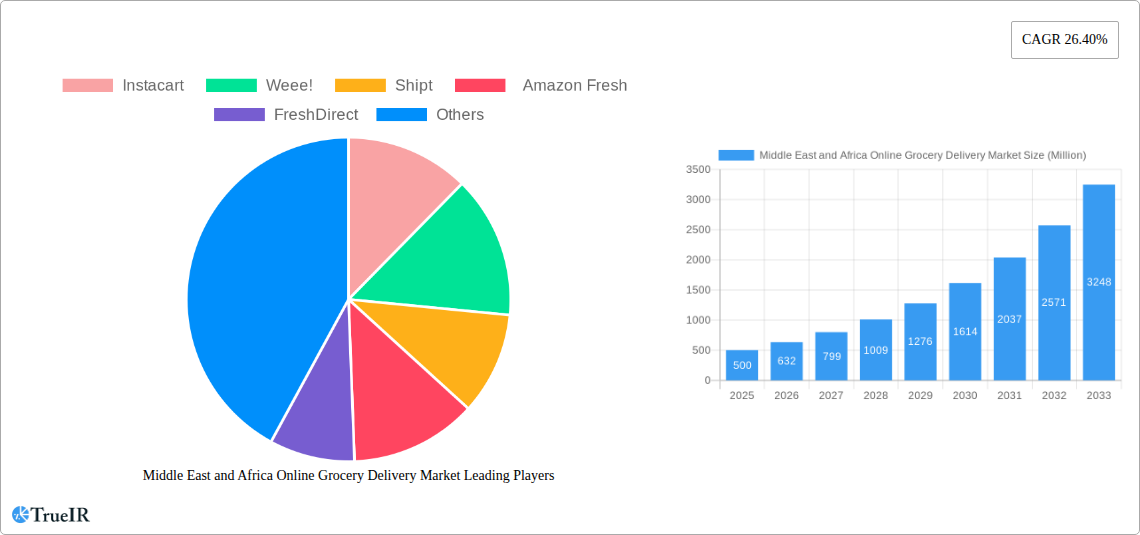

Middle East and Africa Online Grocery Delivery Market Company Market Share

Middle East and Africa Online Grocery Delivery Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Middle East and Africa online grocery delivery market, offering invaluable insights for investors, businesses, and industry stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We analyze market trends, competitive landscapes, growth drivers, and challenges to provide a clear understanding of this rapidly evolving sector. The report utilizes high-volume keywords, including "online grocery delivery," "Middle East Africa," "quick commerce," "grocery delivery apps," and "market size," to ensure maximum visibility and engagement.

Middle East and Africa Online Grocery Delivery Market Structure & Competitive Landscape

The Middle East and Africa online grocery delivery market is characterized by a dynamic competitive landscape, with a mix of established international players and emerging local companies. Market concentration is moderate, with a Herfindahl-Hirschman Index (HHI) of xx in 2024, indicating neither perfect competition nor complete monopoly. The market's structure is influenced by several factors:

- Innovation Drivers: Technological advancements such as AI-powered recommendation systems, efficient logistics solutions, and improved mobile app interfaces are driving market innovation.

- Regulatory Impacts: Varying regulations across different countries in the region influence market entry and operations. Differing data privacy laws and food safety regulations play a significant role.

- Product Substitutes: Traditional grocery stores and local markets remain significant competitors, particularly in areas with limited online penetration.

- End-User Segmentation: The market caters to diverse customer segments, including millennials, busy professionals, and families, each with unique purchasing behaviors and preferences.

- M&A Trends: The market has witnessed xx mergers and acquisitions in the historical period (2019-2024), driven by a desire for scale, technological capabilities, and wider market reach. This trend is expected to continue in the forecast period, with an estimated xx M&A deals anticipated.

Middle East and Africa Online Grocery Delivery Market Market Trends & Opportunities

The Middle East and Africa online grocery delivery market is experiencing substantial growth, driven by increasing internet and smartphone penetration, rising urbanization, and changing consumer lifestyles. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fuelled by several key trends:

- Technological Shifts: The adoption of advanced technologies, such as drone delivery and autonomous vehicles, is expected to revolutionize the sector.

- Consumer Preferences: Convenience, time-saving, and the ability to access a wide variety of products are key factors driving consumer adoption of online grocery delivery.

- Competitive Dynamics: Intense competition among players is leading to price wars, promotional offers, and innovation in service offerings. Market penetration rate currently stands at xx%, projected to reach xx% by 2033.

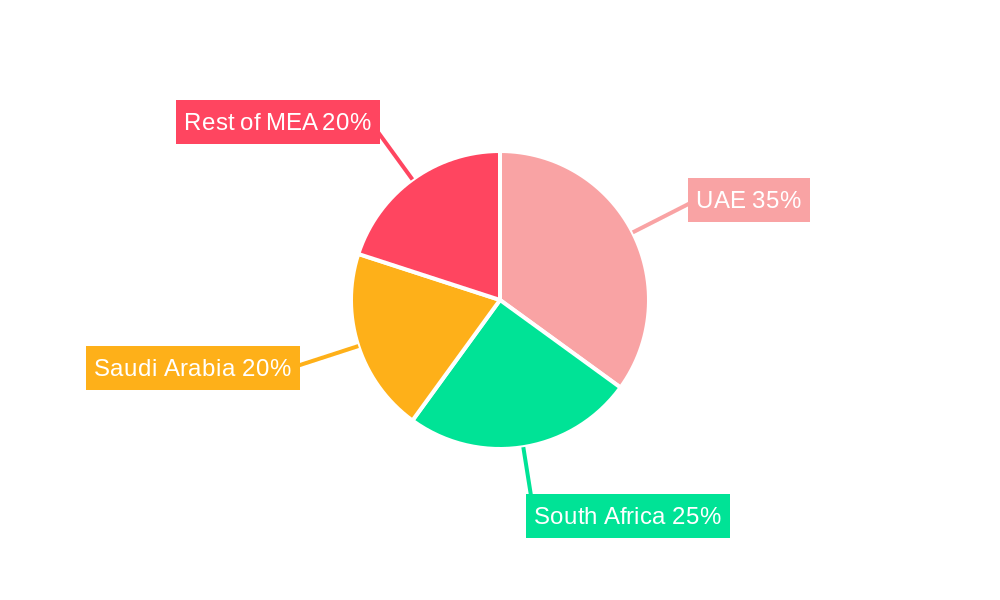

Dominant Markets & Segments in Middle East and Africa Online Grocery Delivery Market

The UAE and South Africa are currently the leading markets for online grocery delivery in the Middle East and Africa, exhibiting the highest growth rates and market penetration. Within the service type segment:

- Retail Delivery: This segment accounts for the largest market share, driven by the extensive reach of major retailers expanding their online presence.

- Quick Commerce: This segment is witnessing rapid growth, particularly in urban areas, due to the increasing demand for immediate delivery of grocery items.

- Meal Kit Delivery: While this segment is smaller compared to retail and quick commerce, it is growing steadily, attracting health-conscious consumers.

Key Growth Drivers:

- Improved Infrastructure: Expansion of internet and logistics networks is supporting the growth of online grocery delivery.

- Favorable Government Policies: Government initiatives promoting e-commerce and digitalization are creating a conducive environment for market expansion.

Middle East and Africa Online Grocery Delivery Market Product Analysis

Product innovation in this market is focused on enhancing convenience and personalization. Features like AI-powered recommendation systems, personalized offers, and subscription-based services are becoming increasingly common. The integration of advanced technologies such as blockchain for supply chain transparency and IoT for improved inventory management is also enhancing the efficiency and customer experience. The market is seeing a rise in specialized apps focusing on niche segments like organic products or specific dietary needs.

Key Drivers, Barriers & Challenges in Middle East and Africa Online Grocery Delivery Market

Key Drivers: Rising smartphone penetration, increasing urbanization, changing consumer preferences towards convenience, and government support for e-commerce are key drivers. Technological advancements such as improved logistics and AI-powered recommendations also contribute to market expansion.

Challenges: High logistics costs, particularly in remote areas, limited payment infrastructure in some regions, and concerns regarding food safety and quality remain significant hurdles. Competition from established traditional retailers and regulatory uncertainties also pose challenges to the sector. This results in xx% reduction in overall market profitability.

Growth Drivers in the Middle East and Africa Online Grocery Delivery Market Market

The key growth drivers are the increasing adoption of smartphones, expanding internet penetration, rising middle-class population, and increasing preference for convenient shopping solutions. Government initiatives to promote digital commerce and investments in logistics infrastructure are also contributing to the market's expansion.

Challenges Impacting Middle East and Africa Online Grocery Delivery Market Growth

Challenges include high infrastructure costs, particularly in less developed regions, inconsistent internet connectivity, concerns around data security and privacy, and potential regulatory hurdles. Competition from traditional grocery stores and the need for efficient cold-chain logistics also pose significant challenges.

Key Players Shaping the Middle East and Africa Online Grocery Delivery Market Market

- Instacart

- Weee!

- Shipt

- Amazon Fresh

- FreshDirect

- Boxed

- DoorDash

- Peapod

- Uber Eats

- Grubhub

Significant Middle East and Africa Online Grocery Delivery Market Industry Milestones

- July 2022: Launch of Veppy.com in the UAE, focusing on personalized recommendations and retailer partnerships.

- July 2022: Deliveroo UAE launches "Hop," a 15-minute grocery delivery service in partnership with Choithrams.

Future Outlook for Middle East and Africa Online Grocery Delivery Market Market

The Middle East and Africa online grocery delivery market is poised for significant growth over the next decade. Increasing internet and smartphone penetration, coupled with favorable government policies and ongoing technological advancements, will create substantial opportunities for market expansion. The emergence of innovative business models, such as quick commerce and hyperlocal delivery services, will further fuel market growth, creating significant potential for both established players and new entrants.

Middle East and Africa Online Grocery Delivery Market Segmentation

-

1. Service Type

- 1.1. Retail Delivery

- 1.2. Quick Commerce

- 1.3. Meal Kit Delivery

-

2. Geography

- 2.1. UAE

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Rest of Middle East and Africa

Middle East and Africa Online Grocery Delivery Market Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Online Grocery Delivery Market Regional Market Share

Geographic Coverage of Middle East and Africa Online Grocery Delivery Market

Middle East and Africa Online Grocery Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Mobile apps segment is anticipated to grow at a noticeable pace during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Retail Delivery

- 5.1.2. Quick Commerce

- 5.1.3. Meal Kit Delivery

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. UAE

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Rest of Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. UAE Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Retail Delivery

- 6.1.2. Quick Commerce

- 6.1.3. Meal Kit Delivery

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. UAE

- 6.2.2. Saudi Arabia

- 6.2.3. South Africa

- 6.2.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Saudi Arabia Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Retail Delivery

- 7.1.2. Quick Commerce

- 7.1.3. Meal Kit Delivery

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. UAE

- 7.2.2. Saudi Arabia

- 7.2.3. South Africa

- 7.2.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. South Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Retail Delivery

- 8.1.2. Quick Commerce

- 8.1.3. Meal Kit Delivery

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. UAE

- 8.2.2. Saudi Arabia

- 8.2.3. South Africa

- 8.2.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Middle East and Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Retail Delivery

- 9.1.2. Quick Commerce

- 9.1.3. Meal Kit Delivery

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. UAE

- 9.2.2. Saudi Arabia

- 9.2.3. South Africa

- 9.2.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. UAE Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 11. South Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 12. Saudi Arabia Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 13. Rest of MEA Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Instacart

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Weee!

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shipt

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Amazon Fresh

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 FreshDirect

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Boxed

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 DoorDash

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Peapod

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Uber Eats

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Grubhub

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Instacart

List of Figures

- Figure 1: Middle East and Africa Online Grocery Delivery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Online Grocery Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: UAE Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Africa Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Saudi Arabia Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of MEA Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 20: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Online Grocery Delivery Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Middle East and Africa Online Grocery Delivery Market?

Key companies in the market include Instacart , Weee! , Shipt , Amazon Fresh , FreshDirect , Boxed, DoorDash , Peapod, Uber Eats , Grubhub .

3. What are the main segments of the Middle East and Africa Online Grocery Delivery Market?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Mobile apps segment is anticipated to grow at a noticeable pace during the forecast period..

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2022: Considering the high level of competition in the market, the UAE's grocery delivery and quick commerce application 'Veppy.com' is allowing retailers to register their products on its website before its commercial launch at the end of August 2022. This was done in anticipation that the site could be in business right after its launch. Veppy.com makes shopping very personalized by recommending products based on what customers have bought on the site before and what the app has learned from that.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Online Grocery Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Online Grocery Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Online Grocery Delivery Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Online Grocery Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence