Key Insights

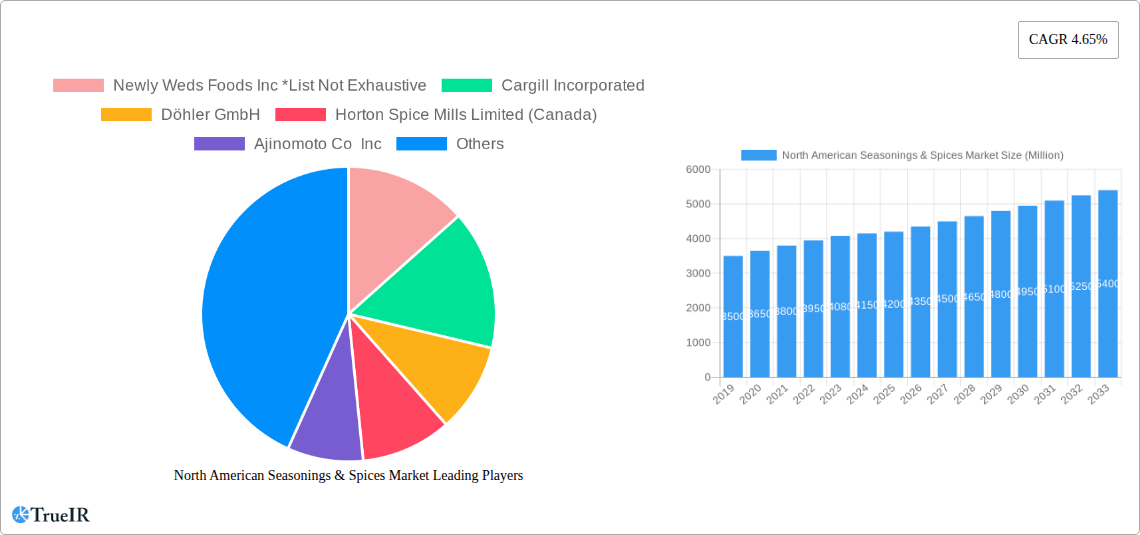

The North American Seasonings & Spices Market is poised for robust growth, projected to reach a substantial USD 4.20 billion by 2025. This expansion is fueled by an estimated compound annual growth rate (CAGR) of 4.65% through the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing consumer demand for convenience and diverse flavor profiles, particularly within the bakery and confectionery, soup, noodles, and pasta, and meat and seafood segments. As consumers become more adventurous with their culinary choices and seek to elevate home-cooked meals, the demand for a wide array of spices and seasonings, from staple peppers and turmerics to artisanal herb blends like thyme and oregano, continues to climb. Furthermore, the growing influence of global cuisines and a heightened awareness of the health benefits associated with certain spices are also contributing significantly to market expansion. The "Rest of North America" region, encompassing emerging markets and evolving consumer preferences, is anticipated to be a key area of growth, showcasing a dynamic shift towards premium and specialized seasoning options.

North American Seasonings & Spices Market Market Size (In Billion)

The market's dynamism is further shaped by distinct trends such as the rising popularity of natural and organic seasonings, driven by health-conscious consumers, and a surge in demand for functional ingredients that offer both flavor and added health benefits. This presents an opportunity for innovation in product development, focusing on clean labels and sustainably sourced ingredients. Conversely, challenges such as fluctuating raw material prices and complex supply chain logistics could present some headwinds. However, strategic partnerships and technological advancements in sourcing and processing are expected to mitigate these restraints. The market is segmented into product types including Salt and Salt Substitutes, a diverse range of Herbs and Seasonings (like Thyme, Basil, Oregano, Parsley), and a variety of Spices (including Pepper, Cardamom, Cinnamon, Clove, Nutmeg, Turmeric). The application spectrum spans across Bakery and Confectionery, Soups, Noodles, and Pasta, Meat and Seafood, Sauces, Salads and Dressings, and Savory Snacks, reflecting the widespread integration of seasonings and spices in everyday food consumption. Leading companies are actively investing in product innovation and market expansion to capture a larger share of this evolving landscape.

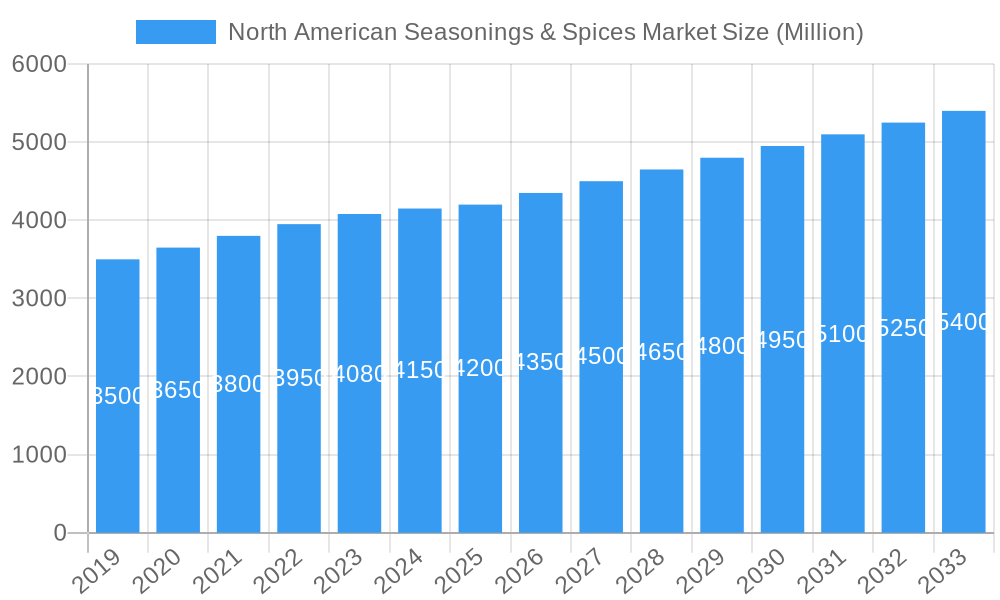

North American Seasonings & Spices Market Company Market Share

Unlock critical insights into the booming North American seasonings and spices market. This in-depth report provides a dynamic, SEO-optimized analysis covering market structure, trends, dominant segments, product innovations, key drivers, and future outlook. Leveraging high-volume keywords such as "spices market North America," "seasonings market growth," "bakery seasonings," "meat and seafood spices," and "natural flavorings," this research is designed to elevate search rankings and engage industry professionals, food manufacturers, ingredient suppliers, and market strategists. Analyze the market from 2019 to 2033, with a base year of 2025, offering a robust understanding of historical performance, current dynamics, and future projections.

North American Seasonings & Spices Market Market Structure & Competitive Landscape

The North American seasonings and spices market exhibits a moderately concentrated structure, with a few key players holding significant market share. Innovation remains a primary driver, fueled by evolving consumer demand for natural, organic, and functional ingredients. Regulatory impacts, particularly concerning food safety standards and labeling requirements, are crucial considerations for market participants. Product substitution is relatively low for core spices and herbs, but competition intensifies with the introduction of novel blends and flavor profiles. End-user segmentation is diverse, spanning major food categories like bakery, meat, and snacks. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of Olde Thompson by Olam Food Ingredients signifies a strategic move to bolster private-label capabilities. The market's competitive landscape is characterized by continuous product development, emphasis on supply chain transparency, and growing interest in sustainable sourcing practices.

North American Seasonings & Spices Market Market Trends & Opportunities

The North American seasonings and spices market is poised for substantial growth, driven by a confluence of factors including increasing consumer preference for convenience foods, a rising demand for diverse and exotic flavors, and a growing awareness of the health benefits associated with certain spices. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, reaching an estimated market value of over $30,000 million by the end of the forecast period. Technological advancements are playing a pivotal role, with innovations in extraction techniques, encapsulation technologies for enhanced shelf-life and flavor delivery, and the development of plant-based flavor solutions gaining traction. Consumer preferences are shifting towards natural, organic, and non-GMO ingredients, presenting significant opportunities for manufacturers focusing on clean-label products. The "spicy food trend" continues to influence product development, with consumers seeking more intense and authentic flavor experiences. Furthermore, the demand for functional ingredients, such as those with antioxidant or anti-inflammatory properties, is on the rise, particularly within the health-conscious segment. Competitive dynamics are intensifying, with both global giants and smaller artisanal producers vying for market share. Opportunities exist in emerging niches such as plant-based meat seasonings, global cuisine-inspired spice blends, and personalized flavor solutions. The market penetration rates for specialty and gourmet seasonings are expected to rise, as consumers become more adventurous in their culinary explorations.

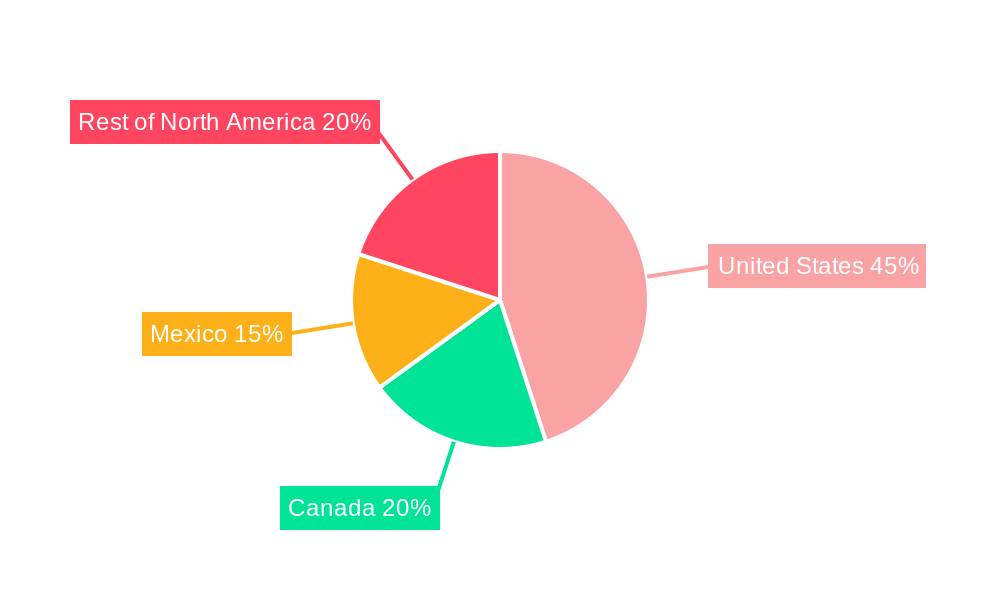

Dominant Markets & Segments in North American Seasonings & Spices Market

The United States represents the dominant market within North America for seasonings and spices, accounting for over 70% of the regional market share. This dominance is attributed to its large consumer base, strong food processing industry, and high disposable income. Canada and Mexico also contribute significantly to the market, with growing demand for diverse culinary ingredients.

Product Type Dominance:

- Herbs and Seasonings: This segment is expected to witness robust growth, driven by its widespread application in everyday cooking and convenience foods.

- Other Herbs and Seasonings: This sub-segment, encompassing blends and specialized flavorings, is a key growth area, catering to evolving consumer palates.

- Spices: Spices remain a cornerstone of the market, with significant demand for staple spices like pepper, cinnamon, and turmeric.

- Pepper: Remains the most consumed spice globally and in North America.

- Turmeric: Its perceived health benefits and vibrant color have propelled its demand.

- Salt and Salt Substitutes: While salt remains essential, the demand for salt substitutes, driven by health concerns, is steadily increasing.

Application Dominance:

- Meat and Seafood: This segment is a major consumer of seasonings and spices, utilized for marinades, rubs, and flavor enhancements. The growing popularity of processed meat products and seafood consumption fuels this demand.

- Soup, Noodles, and Pasta: The convenience food sector, including instant noodles and ready-to-eat pasta meals, represents a substantial market for seasoning mixes.

- Savory Snacks: The booming savory snack industry, encompassing chips, crackers, and extruded snacks, relies heavily on a wide array of spice and seasoning formulations for its flavor appeal.

- Bakery and Confectionery: While historically a smaller segment for savory spices, the demand for specialized spice blends and natural flavorings in baked goods and confectionery is growing.

Key growth drivers across these dominant segments include expanding food processing industries, increasing demand for convenience and ready-to-eat meals, a growing interest in international cuisines, and a strong focus on health and wellness, leading to demand for natural and functional ingredients.

North American Seasonings & Spices Market Product Analysis

Product innovation in the North American seasonings and spices market is characterized by a dual focus on enhancing natural flavors and developing functional ingredients. Companies are investing in advanced extraction technologies to capture the authentic essence of herbs and spices, while also developing innovative blends catering to specific culinary trends and dietary preferences, such as low-sodium and plant-based options. Competitive advantages are being built through product differentiation, offering unique flavor profiles, and ensuring supply chain transparency and traceability. The market increasingly favors products with clean labels, free from artificial additives and preservatives, reflecting consumer demand for healthier and more natural food ingredients.

Key Drivers, Barriers & Challenges in North American Seasonings & Spices Market

Key Drivers:

- Growing Demand for Convenience Foods: The accelerated adoption of ready-to-eat meals and snacks fuels the need for pre-mixed seasonings and flavorings.

- Consumer Interest in Global Flavors: Increasing exposure to international cuisines drives demand for authentic and diverse spice blends.

- Health and Wellness Trends: The perceived health benefits of spices and the demand for natural, organic, and low-sodium options are significant growth catalysts.

- Technological Advancements: Innovations in flavor encapsulation and extraction enhance product quality, shelf-life, and application versatility.

Key Barriers & Challenges:

- Supply Chain Volatility: Geopolitical events, climate change, and trade policies can impact the availability and pricing of raw ingredients, leading to supply chain disruptions.

- Regulatory Compliance: Stringent food safety regulations and evolving labeling requirements across different North American countries can pose challenges for manufacturers.

- Intense Competition: The presence of both large multinational corporations and numerous smaller players leads to price pressures and the need for continuous product differentiation.

- Consumer Price Sensitivity: While demand for premium and organic products is rising, price remains a significant factor for a large segment of consumers.

Growth Drivers in the North American Seasonings & Spices Market Market

The North American seasonings and spices market is propelled by several key growth drivers. Technologically, advancements in flavor encapsulation and spray-drying techniques are enabling the creation of more stable and potent seasoning products, enhancing their appeal for diverse food applications. Economically, rising disposable incomes and an increasing demand for value-added food products are contributing to market expansion. Policy-driven factors, such as government initiatives promoting local sourcing and sustainable agriculture, are also influencing the market, encouraging the development of traceable and ethically produced ingredients. The expanding food service sector and the growing popularity of home cooking, amplified by social media culinary trends, further fuel the demand for a wider variety of seasonings and spices.

Challenges Impacting North American Seasonings & Spices Market Growth

Several challenges impact the growth of the North American seasonings and spices market. Regulatory complexities, including evolving food safety standards and labeling mandates for allergens and origin, require significant investment in compliance. Supply chain issues, such as the vulnerability of agricultural production to climate change and the volatility in global commodity prices for raw spices, can lead to price fluctuations and availability concerns. Competitive pressures from both established players and emerging artisanal brands necessitate continuous innovation and cost management. Furthermore, the increasing demand for premium and organic products can lead to higher production costs, potentially impacting price competitiveness in certain market segments.

Key Players Shaping the North American Seasonings & Spices Market Market

- Newly Weds Foods Inc

- Cargill Incorporated

- Döhler GmbH

- Horton Spice Mills Limited

- Ajinomoto Co Inc

- Olam International

- Kerry Group PLC

- Associated British Foods PLC

- McCormick & Company Incorporated

- All Seasonings Ingredients Inc

Significant North American Seasonings & Spices Market Industry Milestones

- June 2021: Kerry opened a new taste facility in Mexico, enhancing its capacity for producing innovative seasonings and supporting customers with local and sustainable taste solutions in the region.

- April 2021: Olam Food Ingredients (OFI) acquired US-based private-label spices and seasonings manufacturer Olde Thompson for USD 950 million, expanding OFI's private label capabilities and its offering of authentic, natural tastes and flavors with end-to-end traceability.

- January 2021: Cargill launched a purified sea salt flour, an ultra-fine cut, powder-like sodium chloride ingredient suitable for blending in dry mixes like soups, cereals, flour, and spice blends, and for topping snack foods.

Future Outlook for North American Seasonings & Spices Market Market

The future outlook for the North American seasonings and spices market remains exceptionally positive, driven by sustained consumer interest in diverse flavors, health-conscious choices, and the convenience of processed foods. Strategic opportunities lie in expanding the portfolio of plant-based and vegan-friendly seasonings, catering to the growing demand for sustainable and ethically sourced ingredients, and leveraging digital platforms for personalized flavor recommendations and direct-to-consumer sales. The market will likely witness continued consolidation through M&A activities as companies seek to broaden their offerings and market reach. Innovations in functional ingredients, such as those with probiotic or prebiotic properties, are also expected to gain significant traction, further diversifying the market landscape and offering substantial growth potential.

North American Seasonings & Spices Market Segmentation

-

1. Product Type

- 1.1. Salt and Salt Substitutes

-

1.2. Herbs and Seasonings

- 1.2.1. Thyme

- 1.2.2. Basil

- 1.2.3. Oregano

- 1.2.4. Parsley

- 1.2.5. Other Herbs and Seasonings

-

1.3. Spices

- 1.3.1. Pepper

- 1.3.2. Cardamom

- 1.3.3. Cinnamon

- 1.3.4. Clove

- 1.3.5. Nutmeg

- 1.3.6. Turmeric

- 1.3.7. Other Spices

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Soup, Noodles, and Pasta

- 2.3. Meat and Seafood

- 2.4. Sauces, Salads, and Dressing

- 2.5. Savory Snacks

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North American Seasonings & Spices Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North American Seasonings & Spices Market Regional Market Share

Geographic Coverage of North American Seasonings & Spices Market

North American Seasonings & Spices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus On Health and Wellness; Surge in Product Innovation

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes

- 3.4. Market Trends

- 3.4.1. Increased Demand for Spice Blends in the Food Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Salt and Salt Substitutes

- 5.1.2. Herbs and Seasonings

- 5.1.2.1. Thyme

- 5.1.2.2. Basil

- 5.1.2.3. Oregano

- 5.1.2.4. Parsley

- 5.1.2.5. Other Herbs and Seasonings

- 5.1.3. Spices

- 5.1.3.1. Pepper

- 5.1.3.2. Cardamom

- 5.1.3.3. Cinnamon

- 5.1.3.4. Clove

- 5.1.3.5. Nutmeg

- 5.1.3.6. Turmeric

- 5.1.3.7. Other Spices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Soup, Noodles, and Pasta

- 5.2.3. Meat and Seafood

- 5.2.4. Sauces, Salads, and Dressing

- 5.2.5. Savory Snacks

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Salt and Salt Substitutes

- 6.1.2. Herbs and Seasonings

- 6.1.2.1. Thyme

- 6.1.2.2. Basil

- 6.1.2.3. Oregano

- 6.1.2.4. Parsley

- 6.1.2.5. Other Herbs and Seasonings

- 6.1.3. Spices

- 6.1.3.1. Pepper

- 6.1.3.2. Cardamom

- 6.1.3.3. Cinnamon

- 6.1.3.4. Clove

- 6.1.3.5. Nutmeg

- 6.1.3.6. Turmeric

- 6.1.3.7. Other Spices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery and Confectionery

- 6.2.2. Soup, Noodles, and Pasta

- 6.2.3. Meat and Seafood

- 6.2.4. Sauces, Salads, and Dressing

- 6.2.5. Savory Snacks

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Salt and Salt Substitutes

- 7.1.2. Herbs and Seasonings

- 7.1.2.1. Thyme

- 7.1.2.2. Basil

- 7.1.2.3. Oregano

- 7.1.2.4. Parsley

- 7.1.2.5. Other Herbs and Seasonings

- 7.1.3. Spices

- 7.1.3.1. Pepper

- 7.1.3.2. Cardamom

- 7.1.3.3. Cinnamon

- 7.1.3.4. Clove

- 7.1.3.5. Nutmeg

- 7.1.3.6. Turmeric

- 7.1.3.7. Other Spices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery and Confectionery

- 7.2.2. Soup, Noodles, and Pasta

- 7.2.3. Meat and Seafood

- 7.2.4. Sauces, Salads, and Dressing

- 7.2.5. Savory Snacks

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Salt and Salt Substitutes

- 8.1.2. Herbs and Seasonings

- 8.1.2.1. Thyme

- 8.1.2.2. Basil

- 8.1.2.3. Oregano

- 8.1.2.4. Parsley

- 8.1.2.5. Other Herbs and Seasonings

- 8.1.3. Spices

- 8.1.3.1. Pepper

- 8.1.3.2. Cardamom

- 8.1.3.3. Cinnamon

- 8.1.3.4. Clove

- 8.1.3.5. Nutmeg

- 8.1.3.6. Turmeric

- 8.1.3.7. Other Spices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery and Confectionery

- 8.2.2. Soup, Noodles, and Pasta

- 8.2.3. Meat and Seafood

- 8.2.4. Sauces, Salads, and Dressing

- 8.2.5. Savory Snacks

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Salt and Salt Substitutes

- 9.1.2. Herbs and Seasonings

- 9.1.2.1. Thyme

- 9.1.2.2. Basil

- 9.1.2.3. Oregano

- 9.1.2.4. Parsley

- 9.1.2.5. Other Herbs and Seasonings

- 9.1.3. Spices

- 9.1.3.1. Pepper

- 9.1.3.2. Cardamom

- 9.1.3.3. Cinnamon

- 9.1.3.4. Clove

- 9.1.3.5. Nutmeg

- 9.1.3.6. Turmeric

- 9.1.3.7. Other Spices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery and Confectionery

- 9.2.2. Soup, Noodles, and Pasta

- 9.2.3. Meat and Seafood

- 9.2.4. Sauces, Salads, and Dressing

- 9.2.5. Savory Snacks

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 11. Canada North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 12. Mexico North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 13. Rest of North America North American Seasonings & Spices Market Analysis, Insights and Forecast, 2020-2032

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Newly Weds Foods Inc *List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Cargill Incorporated

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Döhler GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Horton Spice Mills Limited (Canada)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ajinomoto Co Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Olam International

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Kerry Group PLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Associated British Foods PLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 McCormick & Company Incorporated

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 All Seasonings Ingredients Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Newly Weds Foods Inc *List Not Exhaustive

List of Figures

- Figure 1: North American Seasonings & Spices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North American Seasonings & Spices Market Share (%) by Company 2025

List of Tables

- Table 1: North American Seasonings & Spices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North American Seasonings & Spices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America North American Seasonings & Spices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: North American Seasonings & Spices Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: North American Seasonings & Spices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: North American Seasonings & Spices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 26: North American Seasonings & Spices Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Seasonings & Spices Market?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the North American Seasonings & Spices Market?

Key companies in the market include Newly Weds Foods Inc *List Not Exhaustive, Cargill Incorporated, Döhler GmbH, Horton Spice Mills Limited (Canada), Ajinomoto Co Inc, Olam International, Kerry Group PLC, Associated British Foods PLC, McCormick & Company Incorporated, All Seasonings Ingredients Inc.

3. What are the main segments of the North American Seasonings & Spices Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus On Health and Wellness; Surge in Product Innovation.

6. What are the notable trends driving market growth?

Increased Demand for Spice Blends in the Food Industry.

7. Are there any restraints impacting market growth?

Presence of Substitutes.

8. Can you provide examples of recent developments in the market?

June 2021: Kerry opened a new taste facility in Mexico. Located in Irapuato, Mexico, the new state-of-the-art facility will significantly increase Kerry's capacity in the region and further support customers in delivering local and sustainable taste solutions, which also include the production of innovative seasonings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Seasonings & Spices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Seasonings & Spices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Seasonings & Spices Market?

To stay informed about further developments, trends, and reports in the North American Seasonings & Spices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence