Key Insights

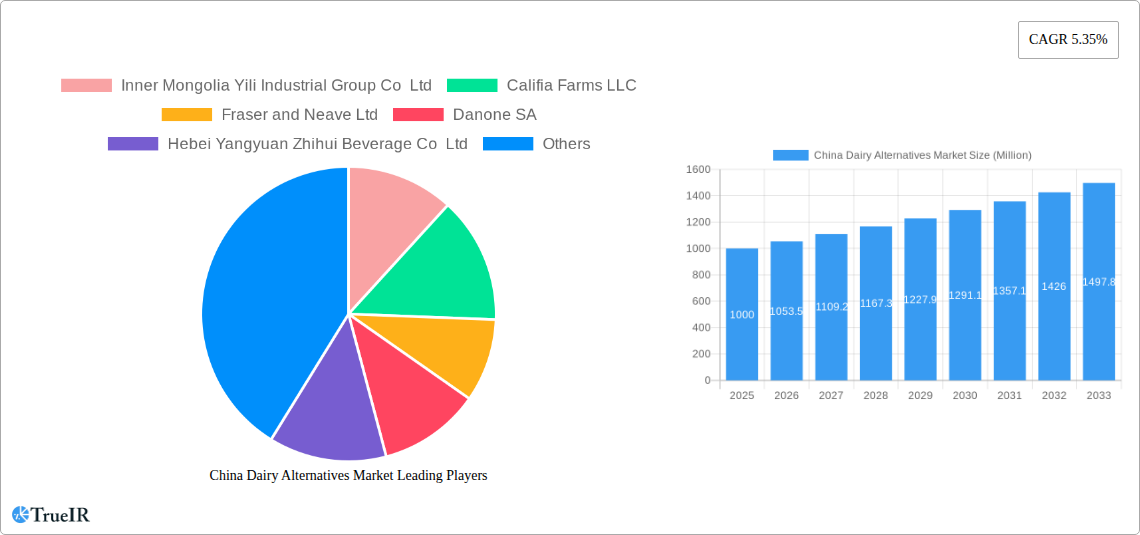

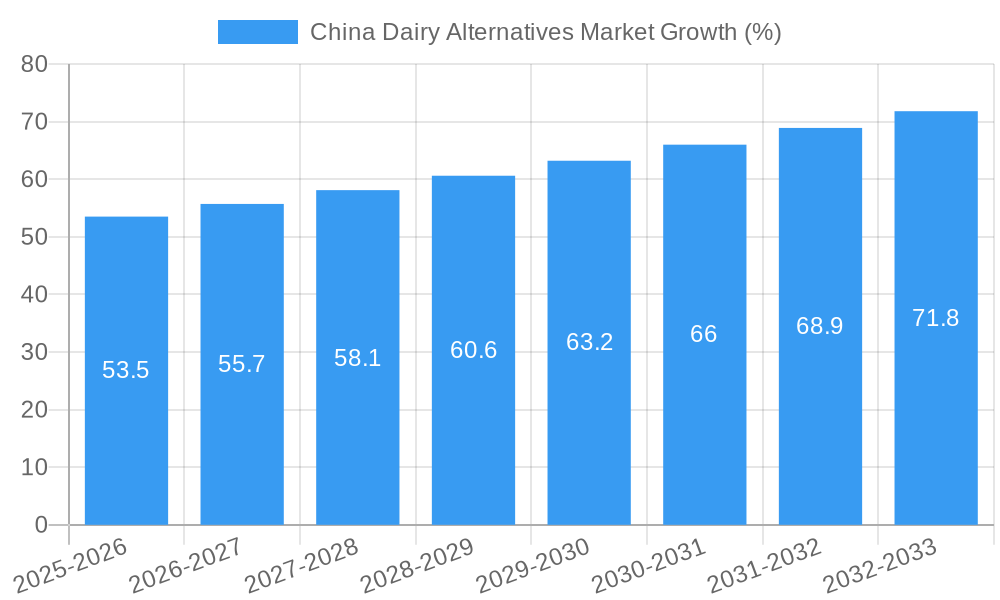

The China dairy alternatives market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and market size data), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2033. This surge is primarily driven by increasing health consciousness among Chinese consumers, a growing preference for plant-based diets, and rising lactose intolerance rates. The market is segmented into Non-Dairy Butter and Non-Dairy Milk, with distribution channels including Off-Trade (supermarkets, retail stores) and On-Trade (restaurants, cafes, and other foodservice outlets). Key players such as Yili, Califia Farms, and Oatly are fiercely competing to capture market share, leveraging innovation in product development and expanding distribution networks to cater to the evolving consumer preferences. The growth is further fueled by the rising disposable incomes and the increasing urbanization within China, leading to a higher adoption of convenient and readily available dairy alternatives.

The market faces certain restraints, including potential price fluctuations in raw materials and consumer perceptions regarding the taste and nutritional value of dairy alternatives compared to traditional dairy products. However, ongoing research and development in product formulation, focusing on improving taste and texture, are mitigating these challenges. The dominance of established players like Yili and the entry of international brands present a dynamic competitive landscape. The strategic focus on product diversification, innovative marketing campaigns, and targeted distribution strategies will be crucial for success within this rapidly expanding market. Further segmentation analysis, perhaps by product type (almond milk, soy milk, etc.), would provide a more granular understanding of market dynamics and inform targeted marketing initiatives. The forecast period of 2025-2033 indicates a promising future for the China dairy alternatives market, driven by sustained consumer demand and continued industry innovation.

China Dairy Alternatives Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic China Dairy Alternatives Market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive market research to forecast future trends and opportunities within this rapidly expanding sector. The market is segmented by category (Non-Dairy Butter, Non-Dairy Milk), distribution channel (Off-Trade, On-Trade), and key players including Inner Mongolia Yili Industrial Group Co Ltd, Califia Farms LLC, Fraser and Neave Ltd, Danone SA, Hebei Yangyuan Zhihui Beverage Co Ltd, Blue Diamond Growers, Oatly Group AB, Coconut Palm Group Co Ltd, Vitasoy International Holdings Ltd, and Dali Foods Group Co Ltd. The report projects a market value exceeding XX Million by 2033.

China Dairy Alternatives Market Market Structure & Competitive Landscape

The China dairy alternatives market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, the market is experiencing increasing competition from both established multinational corporations and emerging domestic brands. Innovation is a key driver, with companies continually developing new products to cater to evolving consumer preferences and health concerns. Stringent regulatory frameworks surrounding food safety and labeling significantly impact market dynamics. The presence of numerous substitutes, including traditional dairy products, poses a challenge to market growth. The market is segmented by end-users, primarily consumers seeking healthier alternatives, and food service establishments incorporating plant-based options into their menus.

Mergers and acquisitions (M&A) activity is relatively high, reflecting the strategic importance of the market. The estimated M&A volume between 2019 and 2024 was approximately XX Million, with a significant portion involving foreign companies seeking to tap into the growing Chinese market. The concentration ratio (CR4), representing the market share of the top four players, is estimated to be around xx% in 2025, indicating a moderately consolidated market. Further consolidation is expected in the forecast period, driven by ongoing M&A activity and the entrance of new players. This trend indicates increasing competition among established and emerging players for market share.

China Dairy Alternatives Market Market Trends & Opportunities

The China dairy alternatives market is experiencing robust growth, driven by increasing consumer awareness of health benefits, rising disposable incomes, and shifting dietary preferences towards plant-based products. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated value of XX Million by 2033. This growth is fueled by technological advancements in product development, leading to improved taste, texture, and nutritional profiles of dairy alternatives. Consumer preferences are increasingly shifting towards products that are organic, sustainably sourced, and free from artificial additives. Market penetration rates for dairy alternatives are relatively high in urban areas compared to rural areas, indicating potential for further expansion in less developed regions. The competitive dynamics are characterized by a mix of established players and emerging companies, resulting in intense innovation and product diversification.

Dominant Markets & Segments in China Dairy Alternatives Market

Leading Segment: Non-Dairy Milk dominates the market, driven by the wide range of available products and the established preference among consumers.

Leading Distribution Channel: Off-trade channels (supermarkets, hypermarkets, convenience stores) hold the largest share due to their widespread accessibility and established distribution networks.

Key Growth Drivers:

- Rising disposable incomes: Increased purchasing power among consumers fuels the demand for premium dairy alternatives.

- Growing health consciousness: The increasing awareness of health benefits associated with plant-based diets is a major driver.

- Government support for sustainable agriculture: Policies promoting sustainable agriculture contribute to the growth of the industry.

- Technological advancements: Continuous innovations in product development lead to improved product quality and affordability.

The dominance of Non-Dairy Milk and Off-trade channels is primarily attributed to consumer preference for readily available and convenient products. The expansion of supermarket chains and increasing access to online retail platforms further support the dominance of this segment and channel. The growth drivers work synergistically to propel the expansion of the China Dairy Alternatives market.

China Dairy Alternatives Market Product Analysis

The market showcases a diverse range of products, including innovative soy, almond, oat, and coconut-based milk alternatives, and increasingly sophisticated non-dairy butter substitutes. Technological advancements, such as improved processing techniques and the use of novel ingredients, have led to products with enhanced taste, texture, and nutritional value, better mimicking traditional dairy products. These innovations contribute to increased market acceptance and expansion, appealing to a broader consumer base. The competitive advantage often lies in product differentiation through unique flavors, health benefits, or sustainable sourcing practices.

Key Drivers, Barriers & Challenges in China Dairy Alternatives Market

Key Drivers:

- Technological advancements in production resulting in lower costs and improved product quality.

- Increasing consumer awareness of health and environmental benefits.

- Government policies supporting sustainable agriculture and plant-based food.

Challenges:

- Supply chain complexities and the need for reliable and sustainable sourcing of raw materials.

- Regulatory hurdles and stringent food safety standards potentially impeding product launch and market access.

- Intense competition from both domestic and international players, necessitating continuous innovation and marketing efforts.

Growth Drivers in the China Dairy Alternatives Market Market

The China dairy alternatives market thrives due to increased consumer health awareness, preference for plant-based diets, and advancements in product technology leading to enhanced quality and affordability. Government support for sustainable agriculture also plays a crucial role.

Challenges Impacting China Dairy Alternatives Market Growth

Challenges include maintaining consistent supply chains, navigating complex regulations, and competing with established dairy producers. These factors could potentially restrain market growth if not addressed effectively.

Key Players Shaping the China Dairy Alternatives Market Market

- Inner Mongolia Yili Industrial Group Co Ltd

- Califia Farms LLC

- Fraser and Neave Ltd

- Danone SA

- Hebei Yangyuan Zhihui Beverage Co Ltd

- Blue Diamond Growers

- Oatly Group AB

- Coconut Palm Group Co Ltd

- Vitasoy International Holdings Ltd

- Dali Foods Group Co Ltd

Significant China Dairy Alternatives Market Industry Milestones

- August 2022: Califia Farms expanded its Barista Blend line, strengthening its presence in the coffee market.

- September 2022: Vitasoy launched its Vitasoy Plant+ line, expanding its plant milk offerings.

- October 2022: Vitasoy planned to expand its dairy alternative business through an acquisition.

Future Outlook for China Dairy Alternatives Market Market

The China dairy alternatives market is poised for continued robust growth, driven by sustained consumer demand, ongoing product innovation, and supportive government policies. Strategic partnerships, expansion into new regions, and further diversification of product offerings will be key to unlocking the market's full potential and driving further growth in the coming years.

China Dairy Alternatives Market Segmentation

-

1. Category

- 1.1. Non-Dairy Butter

-

1.2. Non-Dairy Milk

-

1.2.1. By Product Type

- 1.2.1.1. Almond Milk

- 1.2.1.2. Coconut Milk

- 1.2.1.3. Oat Milk

- 1.2.1.4. Soy Milk

-

1.2.1. By Product Type

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

China Dairy Alternatives Market Segmentation By Geography

- 1. China

China Dairy Alternatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Dairy Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Non-Dairy Butter

- 5.1.2. Non-Dairy Milk

- 5.1.2.1. By Product Type

- 5.1.2.1.1. Almond Milk

- 5.1.2.1.2. Coconut Milk

- 5.1.2.1.3. Oat Milk

- 5.1.2.1.4. Soy Milk

- 5.1.2.1. By Product Type

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Inner Mongolia Yili Industrial Group Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Califia Farms LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fraser and Neave Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hebei Yangyuan Zhihui Beverage Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blue Diamond Growers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oatly Group AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Coconut Palm Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vitasoy International Holdings Lt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dali Foods Group Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Inner Mongolia Yili Industrial Group Co Ltd

List of Figures

- Figure 1: China Dairy Alternatives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Dairy Alternatives Market Share (%) by Company 2024

List of Tables

- Table 1: China Dairy Alternatives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Dairy Alternatives Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: China Dairy Alternatives Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: China Dairy Alternatives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Dairy Alternatives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Dairy Alternatives Market Revenue Million Forecast, by Category 2019 & 2032

- Table 7: China Dairy Alternatives Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: China Dairy Alternatives Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Dairy Alternatives Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the China Dairy Alternatives Market?

Key companies in the market include Inner Mongolia Yili Industrial Group Co Ltd, Califia Farms LLC, Fraser and Neave Ltd, Danone SA, Hebei Yangyuan Zhihui Beverage Co Ltd, Blue Diamond Growers, Oatly Group AB, Coconut Palm Group Co Ltd, Vitasoy International Holdings Lt, Dali Foods Group Co Ltd.

3. What are the main segments of the China Dairy Alternatives Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: Vitasoy International Holdings Ltd planned to expand its dairy alternative business by acquiring the shares from its joint venture Bega Cheese subsidiary National Food Holdings Ltd.September 2022: Vitasoy introduced a new product line, Vitasoy Plant+, to its plant milk portfolio. The new product line comprises almond milk and oat milk made from 100% almonds and oats, respectively.August 2022: The addition of the new Oat Barista Blend to Califia Farms' already well-liked Original and Unsweetened Almondmilk Barista Blends demonstrated the company's commitment to quality coffee while bolstering its relationships with both old and new coffee shops.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Dairy Alternatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Dairy Alternatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Dairy Alternatives Market?

To stay informed about further developments, trends, and reports in the China Dairy Alternatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence