Key Insights

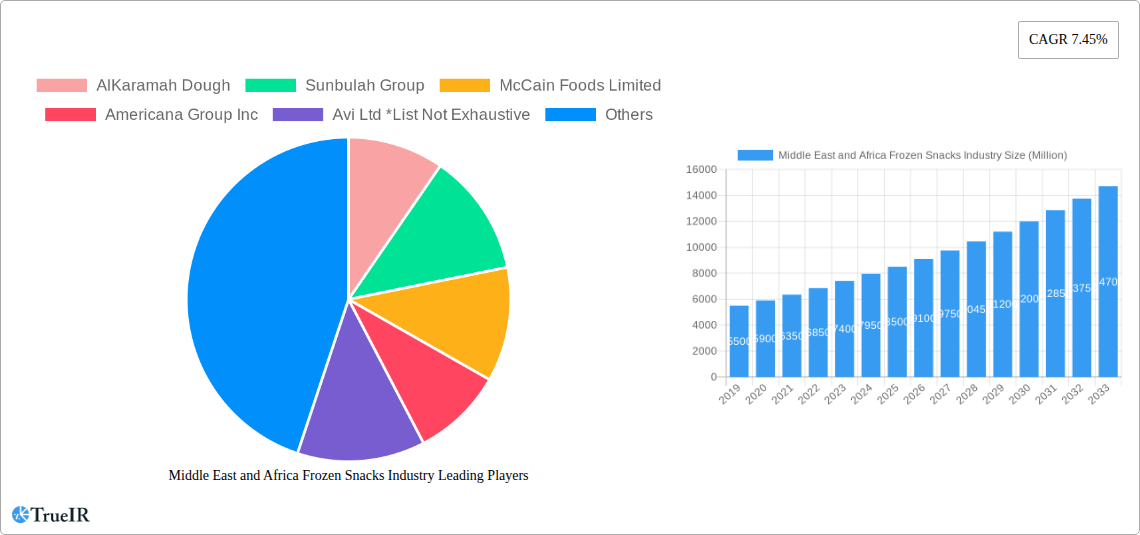

The Middle East and Africa (MEA) frozen snacks market is projected to reach approximately USD 237.05 billion by 2025, exhibiting a strong Compound Annual Growth Rate (CAGR) of 7.45% through 2033. This growth is propelled by evolving consumer lifestyles, increased disposable incomes, and a rising demand for convenient, ready-to-eat food options. A growing working population and the adoption of Westernized eating habits are increasing the appeal of frozen snacks. Enhanced accessibility through organized retail channels and the rapid expansion of online grocery platforms further fuel market expansion. Key segments like potato and fruit-based snacks are experiencing significant demand, catering to both indulgent and health-conscious preferences. The region's young demographic also represents a substantial consumer base for innovative and convenient food solutions.

Middle East and Africa Frozen Snacks Industry Market Size (In Billion)

Market growth may be moderated by perceived health concerns regarding processed foods, including high sodium and fat content. Fluctuations in raw material prices can impact manufacturing costs and retail pricing. Additionally, underdeveloped cold chain infrastructure in some MEA regions presents logistical challenges. Despite these factors, increasing urbanization, the globalization of food trends, and the sustained demand for convenience are expected to drive continued market growth. Leading companies such as Sunbulah Group, McCain Foods Limited, and Americana Group Inc. are actively innovating their product portfolios with diverse flavors and healthier alternatives to meet evolving consumer preferences.

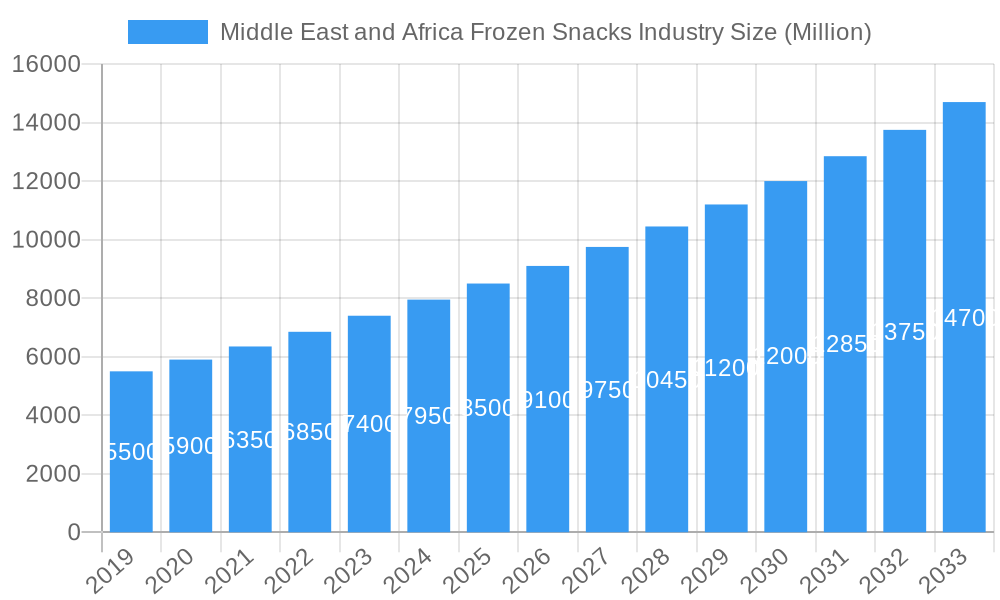

Middle East and Africa Frozen Snacks Industry Company Market Share

This comprehensive report details the Middle East and Africa Frozen Snacks Industry, including market size, growth trends, and future projections.

Middle East and Africa Frozen Snacks Industry Market Structure & Competitive Landscape

The Middle East and Africa (MEA) frozen snacks industry is characterized by a moderately concentrated market structure, driven by a blend of established global players and rapidly expanding regional manufacturers. Innovation is a key differentiator, with companies investing in novel flavor profiles, healthier formulations (e.g., reduced fat, plant-based options), and convenient packaging solutions to capture evolving consumer tastes. Regulatory frameworks, while varied across nations, are increasingly focused on food safety standards and labeling, influencing product development and market entry strategies. Product substitutes, primarily fresh snacks and ready-to-eat alternatives, present a constant competitive challenge, necessitating continuous product enhancement and aggressive marketing. End-user segmentation reveals a strong demand from households and the foodservice sector, with growing interest from convenience stores and online retail channels. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is anticipated to rise as larger entities seek to consolidate market share and expand their geographical reach. For instance, recent M&A volumes are estimated at approximately 15-20 deals annually within the broader food processing sector of the region, with frozen snacks being a growing focus. Concentration ratios, particularly in key markets like Saudi Arabia and the UAE, are expected to see an increase in the forecast period.

Middle East and Africa Frozen Snacks Industry Market Trends & Opportunities

The Middle East and Africa frozen snacks industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated market size of over $15 Million in 2025 and potentially exceeding $30 Million by 2033. This robust expansion is fueled by a confluence of evolving consumer lifestyles, increasing disposable incomes, and a burgeoning demand for convenient, high-quality food options across the region. Technological advancements in freezing and packaging are playing a pivotal role, enabling manufacturers to extend shelf life, preserve nutritional value, and introduce a wider array of products. The penetration of modern retail channels, including hypermarkets, supermarkets, and the rapidly growing online retail segment, is significantly enhancing product accessibility and driving sales volume. Furthermore, a growing health-conscious consumer base is creating significant opportunities for frozen snacks that offer healthier alternatives, such as fruit-based, vegetable-infused, and plant-based options. The foodservice sector, encompassing restaurants, cafes, and catering services, continues to be a major demand driver, adopting frozen snacks for their consistency and ease of preparation. The competitive landscape is intensifying, with both international giants and agile local players vying for market dominance. Strategic partnerships, product diversification, and targeted marketing campaigns are becoming crucial for sustained success. The rise of e-commerce platforms presents a particularly compelling opportunity for direct-to-consumer sales and reaching a broader, more diverse customer base. Addressing the unique preferences of different geographies within MEA, from the established markets of the GCC to the emerging economies of sub-Saharan Africa, will be key to unlocking the full market potential. The demand for globally recognized flavors alongside the incorporation of local tastes and ingredients offers a dual path for market penetration and brand loyalty.

Dominant Markets & Segments in Middle East and Africa Frozen Snacks Industry

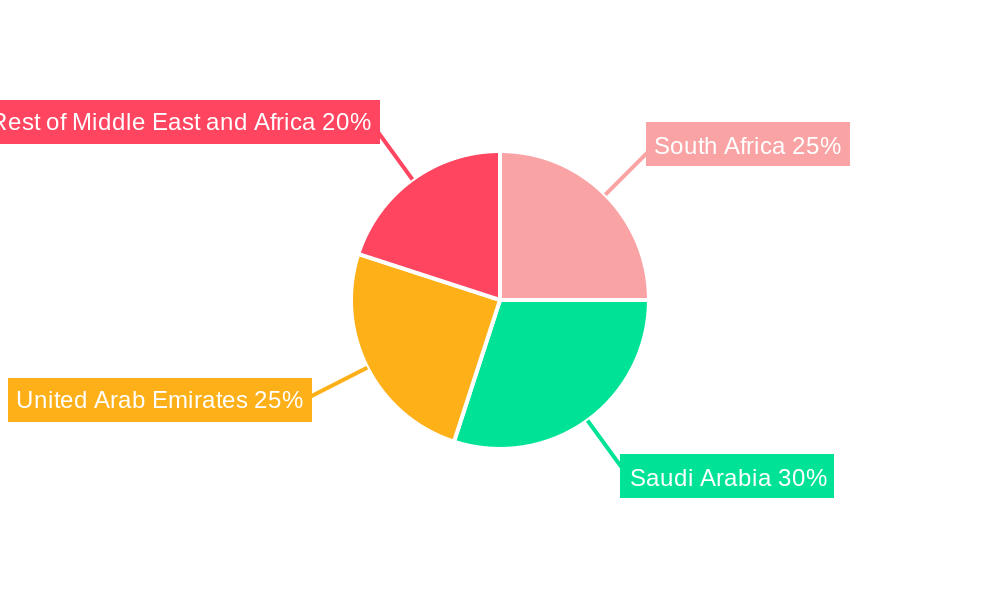

Within the Middle East and Africa frozen snacks industry, Potato-based Snacks currently command the largest market share, driven by their widespread popularity and diverse product offerings, including fries, wedges, and hash browns. This segment is projected to continue its dominance throughout the forecast period. Geographically, the United Arab Emirates and Saudi Arabia represent the most lucrative markets, owing to their high disposable incomes, well-developed retail infrastructure, and a significant expatriate population with diverse food preferences. The hypermarket/supermarket distribution channel remains the primary avenue for frozen snack sales, accounting for an estimated 60-65% of the total market revenue, due to their extensive reach and ability to cater to bulk purchases. However, Online Retail Stores are emerging as a formidable growth segment, with their market share projected to increase significantly, driven by convenience and the proliferation of online grocery platforms. Key growth drivers in these dominant markets include robust government initiatives promoting food security and investment in food processing, alongside significant infrastructure development that facilitates efficient cold chain logistics. For example, investments in modern warehousing and transportation networks in the UAE and Saudi Arabia are critical enablers. The Rest of the Middle East and Africa region, while currently representing a smaller portion of the market, holds substantial untapped potential, with countries like Egypt and Nigeria showing promising growth trajectories. Growth in these emerging markets is often propelled by increasing urbanization, a rising middle class, and a growing acceptance of Westernized food consumption patterns. The Meat- and Seafood-based Snacks segment is also witnessing steady growth, spurred by an increasing demand for protein-rich convenience foods.

Middle East and Africa Frozen Snacks Industry Product Analysis

Product innovations in the MEA frozen snacks industry are primarily focused on enhancing health benefits and catering to diverse palates. Key advancements include the development of baked rather than fried options, the incorporation of healthier ingredients like whole grains and vegetables, and the introduction of plant-based alternatives to meet growing vegan and vegetarian demand. Flavor profiles are increasingly being localized, blending international trends with regional tastes, creating unique competitive advantages. Applications range from convenient household meals and party snacks to foodservice offerings in restaurants and catering. Technological advancements in flash freezing and advanced packaging techniques are crucial for maintaining product quality, extending shelf life, and ensuring the superior taste and texture that consumers expect.

Key Drivers, Barriers & Challenges in Middle East and Africa Frozen Snacks Industry

The MEA frozen snacks industry is propelled by several key drivers. Growing urbanization and busy lifestyles are increasing the demand for convenient food options. Rising disposable incomes, particularly in the GCC nations, enable consumers to spend more on value-added convenience foods. A burgeoning young population with increasing exposure to global food trends also fuels demand. Furthermore, investments in cold chain infrastructure are crucial for market expansion.

Key challenges and restraints include high import duties on certain ingredients and finished products in some countries, impacting cost-competitiveness. Fluctuations in raw material prices, particularly for potatoes and meat, can affect profit margins. Evolving consumer preferences towards healthier options necessitate continuous product reformulation and innovation, which can be costly. Supply chain disruptions and limited cold storage facilities in some parts of the region also pose significant hurdles. Competitive pressures from both international and local players are intensifying, requiring substantial marketing investments.

Growth Drivers in the Middle East and Africa Frozen Snacks Industry Market

Growth drivers in the Middle East and Africa frozen snacks industry are multifaceted. Technological advancements in food processing and preservation, such as improved freezing techniques and intelligent packaging, are crucial enablers. Economic factors, including rising disposable incomes and a growing middle class, directly correlate with increased consumer spending on convenience foods. Favorable government policies promoting food manufacturing and investment in cold chain logistics infrastructure, particularly in key markets like Saudi Arabia and the UAE, further stimulate market expansion. Evolving consumer lifestyles, characterized by increased urbanization and busier schedules, amplify the demand for quick and easy meal solutions.

Challenges Impacting Middle East and Africa Frozen Snacks Industry Growth

Several barriers and restraints impact the growth of the Middle East and Africa frozen snacks industry. Regulatory complexities and varying food safety standards across different countries can create market entry hurdles and increase compliance costs. Supply chain inefficiencies, especially the lack of robust cold chain infrastructure in certain sub-Saharan African nations, limit product availability and increase spoilage rates. Intense competitive pressures from both multinational corporations and agile local players necessitate significant marketing expenditure and product differentiation strategies. Fluctuations in the cost of key raw materials, such as potatoes, meat, and oils, can significantly impact profit margins and pricing strategies.

Key Players Shaping the Middle East and Africa Frozen Snacks Industry Market

- AlKaramah Dough

- Sunbulah Group

- McCain Foods Limited

- Americana Group Inc

- Avi Ltd

- BRF SA

- Al Kabeer Group ME

- JBS SA

Significant Middle East and Africa Frozen Snacks Industry Industry Milestones

- 2020: Launch of a new line of plant-based frozen snacks by a leading regional player, responding to growing vegan and vegetarian demand.

- 2021: Significant investment in cold chain logistics infrastructure in Saudi Arabia, improving the distribution network for frozen foods.

- 2022: Introduction of innovative, healthier frozen snack options with reduced fat and sodium content across multiple markets.

- 2023: Expansion of online retail presence and partnerships with major e-commerce platforms by several key frozen snack manufacturers.

- 2024: Increased focus on sustainable packaging solutions and ethical sourcing of ingredients by prominent companies.

Future Outlook for Middle East and Africa Frozen Snacks Industry Market

The future outlook for the Middle East and Africa frozen snacks industry is highly optimistic, driven by sustained economic growth, evolving consumer preferences for convenience, and continued technological advancements. Strategic opportunities lie in further developing healthier product portfolios, expanding into untapped African markets with tailored offerings, and leveraging the growth of online retail channels. Investments in robust cold chain logistics and localized product innovation will be critical for capitalizing on the immense market potential. The industry is expected to witness continued consolidation and increased product diversification, catering to a wider spectrum of consumer needs and dietary habits.

Middle East and Africa Frozen Snacks Industry Segmentation

-

1. Type

- 1.1. Fruit-based Snacks

- 1.2. Potato-based Snacks

- 1.3. Meat- and Seafood-based Snacks

- 1.4. Others

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle East and Africa Frozen Snacks Industry Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East and Africa Frozen Snacks Industry Regional Market Share

Geographic Coverage of Middle East and Africa Frozen Snacks Industry

Middle East and Africa Frozen Snacks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Ready-To-Cook Meat Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Frozen Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fruit-based Snacks

- 5.1.2. Potato-based Snacks

- 5.1.3. Meat- and Seafood-based Snacks

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle East and Africa Frozen Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fruit-based Snacks

- 6.1.2. Potato-based Snacks

- 6.1.3. Meat- and Seafood-based Snacks

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarket/Supermarket

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East and Africa Frozen Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fruit-based Snacks

- 7.1.2. Potato-based Snacks

- 7.1.3. Meat- and Seafood-based Snacks

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarket/Supermarket

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Arab Emirates Middle East and Africa Frozen Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fruit-based Snacks

- 8.1.2. Potato-based Snacks

- 8.1.3. Meat- and Seafood-based Snacks

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarket/Supermarket

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle East and Africa Frozen Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fruit-based Snacks

- 9.1.2. Potato-based Snacks

- 9.1.3. Meat- and Seafood-based Snacks

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarket/Supermarket

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Saudi Arabia

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 AlKaramah Dough

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sunbulah Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 McCain Foods Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Americana Group Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Avi Ltd *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BRF SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Al Kabeer Group ME

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JBS SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 AlKaramah Dough

List of Figures

- Figure 1: Middle East and Africa Frozen Snacks Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Frozen Snacks Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Frozen Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Frozen Snacks Industry?

The projected CAGR is approximately 7.45%.

2. Which companies are prominent players in the Middle East and Africa Frozen Snacks Industry?

Key companies in the market include AlKaramah Dough, Sunbulah Group, McCain Foods Limited, Americana Group Inc, Avi Ltd *List Not Exhaustive, BRF SA, Al Kabeer Group ME, JBS SA.

3. What are the main segments of the Middle East and Africa Frozen Snacks Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 237.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increase in Demand for Ready-To-Cook Meat Products.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Frozen Snacks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Frozen Snacks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Frozen Snacks Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Frozen Snacks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence