Key Insights

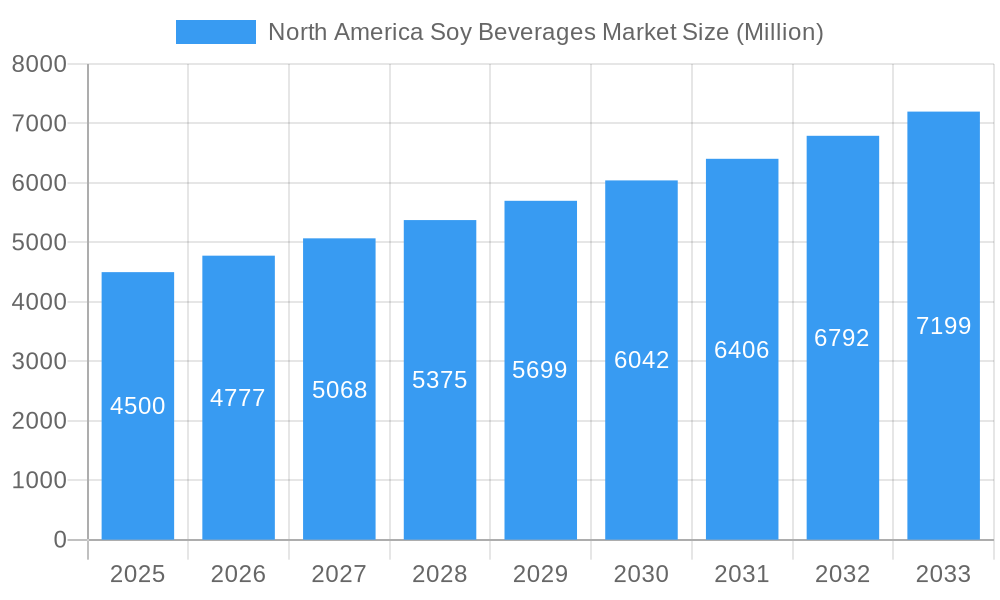

The North American soy beverage market is projected for robust expansion, forecasted to reach approximately $5 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 7.9%. This significant growth is propelled by escalating consumer demand for plant-based alternatives, driven by heightened health awareness, increased lactose intolerance, and growing environmental consciousness. Soy beverages, recognized for their substantial protein content and established nutritional value, are a preferred dairy-free option. The market is witnessing substantial innovation, with an expanded range of flavored soy beverages addressing diverse consumer preferences beyond traditional plain varieties. Product development also emphasizes improved textures and added functional benefits, enhancing appeal to a wider demographic. Key distribution channels include supermarkets/hypermarkets and convenience stores, ensuring broad accessibility, with continued presence in pharmacies/drug stores and specialty retail outlets.

North America Soy Beverages Market Market Size (In Billion)

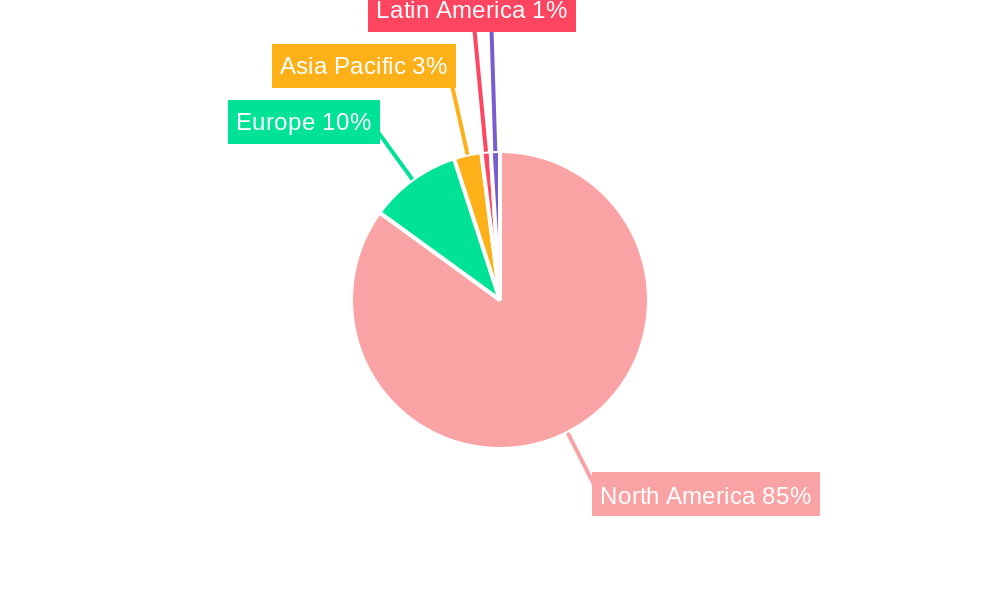

Competitive pressures arise from the increasing popularity of other plant-based milk alternatives such as almond, oat, and coconut milk. Some consumers also voice concerns regarding potential allergens or the taste of soy. Nevertheless, the market is expected to surmount these challenges through continuous product differentiation, strategic marketing highlighting health advantages and sustainability, and key collaborations. The burgeoning demand for drinkable soy-based yogurts is also emerging as a notable segment, offering a convenient and nutritious choice. Geographically, North America, comprising the United States, Canada, and Mexico, constitutes a significant market share, with sustained demand and evolving consumer preferences dictating its future trajectory.

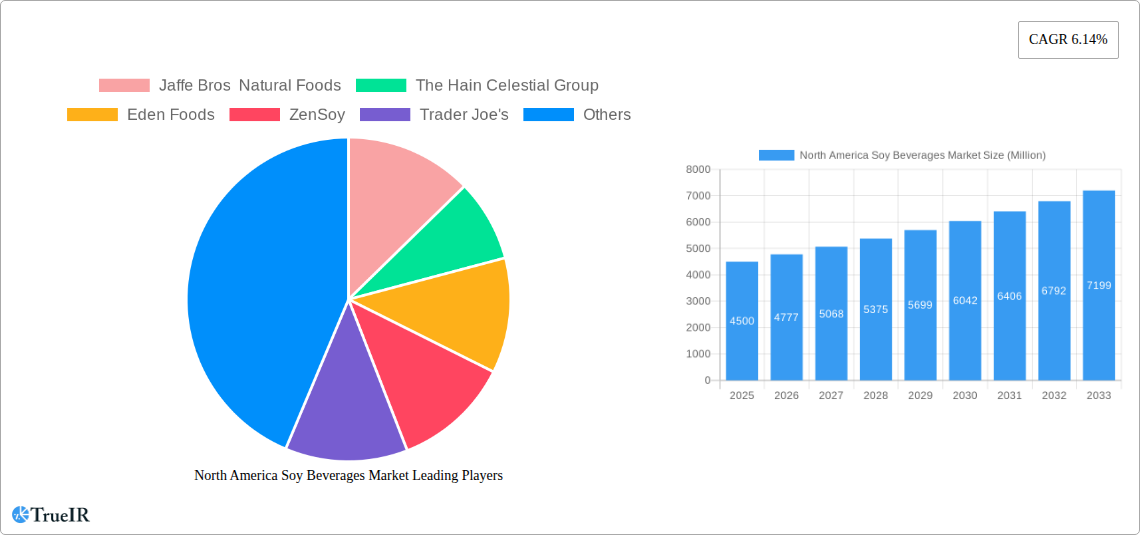

North America Soy Beverages Market Company Market Share

This report offers a comprehensive analysis of the North America Soy Beverages Market, detailing market size, growth trends, and future projections.

North America Soy Beverages Market Market Structure & Competitive Landscape

The North America soy beverages market is characterized by a moderate to high concentration, with a few key players dominating the landscape. Leading companies like The Hain Celestial Group, Danone, and Kikkoman Pearl Soy Milk hold significant market share. Innovation is a critical driver, focusing on enhanced nutritional profiles, improved taste and texture, and the development of plant-based alternatives to cater to evolving consumer demands. Regulatory impacts, primarily related to food labeling laws and health claims, continue to shape product development and marketing strategies.

Product Substitutes such as almond milk, oat milk, and other dairy-free beverages present a competitive challenge, necessitating continuous product differentiation and value proposition enhancement for soy beverage manufacturers. End-user segmentation reveals a strong demand from health-conscious consumers, vegans, lactose-intolerant individuals, and those seeking sustainable food options. Mergers & Acquisitions (M&A) are also a notable trend, with strategic consolidations aiming to expand product portfolios, enhance distribution networks, and gain a larger market footprint. While specific M&A volumes for the soy beverage segment are proprietary, the broader plant-based beverage industry has witnessed numerous strategic acquisitions over the past five years, indicating consolidation potential. Industry reports suggest a concentration ratio of approximately 60-70% for the top five players in the North American soy beverage market.

North America Soy Beverages Market Market Trends & Opportunities

The North America soy beverages market is poised for significant growth, driven by a confluence of evolving consumer preferences, technological advancements, and expanding distribution channels. Market size is projected to reach an estimated US$ 5.5 Billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.8% projected from 2025 to 2033. This expansion is fueled by a rising awareness of the health benefits associated with soy protein, including its role in heart health and bone density. Consumers are increasingly seeking plant-based alternatives to dairy, driven by concerns about lactose intolerance, ethical considerations, and environmental sustainability. The market penetration rate for plant-based beverages in North America is already substantial and continues to grow, with soy beverages holding a significant portion of this market.

Technological shifts are contributing to improved product quality and variety. Innovations in processing techniques have led to soy beverages with a smoother texture, reduced "beany" taste, and enhanced shelf stability. Furthermore, advancements in flavor encapsulation and natural ingredient utilization allow manufacturers to offer a wider array of appealing Flavored Soy Beverages, from classic vanilla and chocolate to more exotic fruit and spice combinations. The demand for plain soy beverages remains strong, serving as a versatile base for consumers and food manufacturers alike.

The competitive dynamics are intensifying, with established players investing heavily in marketing and product development to maintain market share. Simultaneously, emerging brands are disrupting the market with niche offerings and innovative branding strategies. Opportunities lie in tapping into emerging demographics, such as the growing Gen Z and Millennial populations who are more open to plant-based diets. The expansion of e-commerce platforms and direct-to-consumer models also presents a significant avenue for reaching a broader customer base and fostering brand loyalty. The market's trajectory is also influenced by governmental initiatives promoting healthy eating and sustainable agriculture, further bolstering the appeal of soy-based products.

Dominant Markets & Segments in North America Soy Beverages Market

The North America soy beverages market exhibits distinct dominance across various segments, driven by demographic, economic, and consumer preference factors.

Geography

- United States: The United States stands as the undisputed dominant market within North America. Its sheer population size, coupled with a high prevalence of health-conscious consumers, a well-established plant-based food culture, and robust retail infrastructure, positions it as the primary growth engine.

- Canada: Canada follows as the second-largest market, benefiting from similar consumer trends and a growing acceptance of plant-based alternatives.

- Mexico: Mexico represents a burgeoning market with significant untapped potential. While traditionally a dairy-dominant market, increasing awareness of health benefits and the availability of diverse product options are driving growth.

- Rest of North America: This segment, comprising smaller nations and territories, contributes a smaller but steadily growing share to the overall market.

Product Type

- Soy Milk: Soy milk is the cornerstone of the North America soy beverages market, commanding the largest market share. Its versatility as a direct beverage, ingredient in cooking and baking, and base for smoothies makes it a staple for a wide consumer base.

- Soy-Based Drinkable Yogurt: This segment is experiencing rapid growth, appealing to consumers seeking convenient, on-the-go, and probiotic-rich plant-based options. Its growth is fueled by the increasing demand for functional foods and beverages.

Flavor

- Plain Soy Beverages: Plain soy beverages maintain a substantial market share due to their versatility and suitability for a wide range of applications, including as a neutral base for various culinary uses.

- Flavored Soy Beverages: This segment is a key growth driver, with a diverse range of flavors catering to evolving consumer palates. Innovations in natural flavorings and unique combinations are expanding its appeal, particularly among younger demographics.

Distribution Channel

- Supermarkets/Hypermarkets: These channels are the dominant distribution points, offering wide accessibility and product variety to a broad consumer base. Their extensive reach and promotional capabilities are crucial for market penetration.

- Retail Stores (including specialty health food stores): These outlets cater to a niche but highly engaged segment of consumers actively seeking plant-based and health-focused products.

- Convenience Stores: Growing in importance for on-the-go consumption, convenience stores are increasingly stocking soy beverages to meet demand from busy consumers.

- Pharmacies/Drug Stores: These channels are gaining traction, particularly for products with perceived health benefits or fortified nutritional profiles.

- Others (including E-commerce and Foodservice): The e-commerce segment is experiencing exponential growth, offering convenience and wider product selection. The foodservice industry also plays a role, with soy beverages being incorporated into coffee shops and restaurants.

North America Soy Beverages Market Product Analysis

Product innovations in the North America soy beverages market are primarily focused on enhancing nutritional value and sensory appeal. Companies are developing fortified soy milks with added vitamins and minerals like Vitamin D, calcium, and B12, addressing specific dietary needs. Advances in processing technology have led to smoother textures and a reduction in the characteristic "beany" flavor, improving palatability for a wider audience. Plant-based drinkable yogurts are gaining traction, offering probiotic benefits and a convenient, on-the-go option. Competitive advantages are derived from unique flavor profiles, organic and non-GMO certifications, and sustainable sourcing practices. The market fit is strong among health-conscious consumers, vegans, and those with lactose intolerance seeking dairy alternatives.

Key Drivers, Barriers & Challenges in North America Soy Beverages Market

Key Drivers:

- Growing Health Consciousness: Increasing consumer awareness of soy's health benefits, including protein content, heart health support, and bone density improvement, is a primary growth driver.

- Rising Demand for Plant-Based Alternatives: The global shift towards plant-based diets, fueled by ethical, environmental, and health concerns, significantly boosts soy beverage consumption.

- Lactose Intolerance and Dairy Allergies: A growing number of individuals seeking dairy-free options find soy beverages to be a suitable and accessible alternative.

- Product Innovation and Variety: Continuous development of new flavors, textures, and fortified options expands consumer appeal and caters to diverse preferences.

Key Barriers & Challenges:

- Competition from Other Plant-Based Milks: Intense competition from almond, oat, coconut, and other plant-based milk alternatives creates market saturation and pricing pressures.

- Allergen Concerns and Perceptions: While soy is a common allergen, negative perceptions or concerns about its potential health impacts (though often unfounded for moderate consumption) can deter some consumers.

- Price Sensitivity: Soy beverages can sometimes be priced higher than conventional dairy milk, impacting adoption among price-sensitive consumers.

- Supply Chain Volatility: Fluctuations in soybean prices and agricultural yields can impact production costs and product availability.

Growth Drivers in the North America Soy Beverages Market Market

The North America soy beverages market is propelled by several key growth drivers. Technologically, advancements in processing have led to improved taste, texture, and shelf-life, making soy beverages more appealing to a wider consumer base. Economically, the rising disposable incomes in certain demographics coupled with the increasing preference for perceived healthier food options contribute significantly. Regulatory factors, such as the push for clearer labeling and the support for plant-based diets through health guidelines, also act as catalysts. For instance, the increased availability of fortified soy milk options addressing common nutrient deficiencies further enhances its market positioning.

Challenges Impacting North America Soy Beverages Market Growth

Several challenges impact the growth of the North America soy beverages market. Regulatory complexities, particularly around health claims and labeling standards, can create hurdles for new product introductions. Supply chain issues, including the volatility of soybean commodity prices and potential disruptions due to climate or geopolitical events, can affect profitability and product availability. Competitive pressures are immense, with a crowded market of plant-based alternatives like almond, oat, and cashew milk constantly vying for consumer attention. For example, intense promotional activities and pricing strategies by competitors can limit market share expansion for soy beverage manufacturers.

Key Players Shaping the North America Soy Beverages Market Market

- Jaffe Bros Natural Foods

- The Hain Celestial Group

- Eden Foods

- ZenSoy

- Trader Joe's

- Organic Valley

- Kikkoman Pearl Soy Milk

- Stremicks Heritage Foods

- Danone

Significant North America Soy Beverages Market Industry Milestones

- 2019: Increased investment in research and development for allergen-friendly and plant-based protein sources.

- 2020: Surge in demand for plant-based beverages driven by health and wellness trends accelerated by the global pandemic.

- 2021: Launch of new fortified soy milk varieties with enhanced nutritional profiles and natural sweeteners.

- 2022: Growing emphasis on sustainable sourcing and packaging initiatives by leading soy beverage manufacturers.

- 2023: Expansion of e-commerce channels and direct-to-consumer sales for soy beverage brands.

- 2024: Increased innovation in savory soy beverage applications and functional ingredient integration.

Future Outlook for North America Soy Beverages Market Market

The future outlook for the North America soy beverages market is exceptionally promising, driven by sustained consumer interest in plant-based diets and the ongoing pursuit of healthier lifestyles. Strategic opportunities lie in further innovation of functional benefits, such as enhanced gut health or cognitive function, and the development of novel flavor profiles catering to diverse palates. Market potential will be realized through expanded distribution in foodservice and emerging retail channels, alongside a continued focus on sustainable production and transparent labeling. The integration of advanced technologies in production and supply chain management will also play a crucial role in meeting growing demand and maintaining competitive advantage.

North America Soy Beverages Market Segmentation

-

1. Product Type

- 1.1. Soy Milk

- 1.2. Soy-Based Drinkable Yogurt

-

2. Flavor

- 2.1. Plain Soy Beverages

- 2.2. Flavored Soy Beverages

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Pharmacies/Drug Stores

- 3.3. Retail Stores

- 3.4. Convenience Stores

- 3.5. Others

-

4. Geography

-

4.1. North America

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Mexico

- 4.1.4. Rest of North America

-

4.1. North America

North America Soy Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

North America Soy Beverages Market Regional Market Share

Geographic Coverage of North America Soy Beverages Market

North America Soy Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Growing Consumption of Processed Foods and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Soy Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Soy Milk

- 5.1.2. Soy-Based Drinkable Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Flavor

- 5.2.1. Plain Soy Beverages

- 5.2.2. Flavored Soy Beverages

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Pharmacies/Drug Stores

- 5.3.3. Retail Stores

- 5.3.4. Convenience Stores

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North America

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Mexico

- 5.4.1.4. Rest of North America

- 5.4.1. North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jaffe Bros Natural Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hain Celestial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eden Foods

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZenSoy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trader Joe's

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Organic Valley

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kikkoman Pearl Soy Milk

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stremicks Heritage Foods*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danone

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Jaffe Bros Natural Foods

List of Figures

- Figure 1: North America Soy Beverages Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Soy Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: North America Soy Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Soy Beverages Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 3: North America Soy Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Soy Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Soy Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Soy Beverages Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: North America Soy Beverages Market Revenue billion Forecast, by Flavor 2020 & 2033

- Table 8: North America Soy Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Soy Beverages Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Soy Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Soy Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Soy Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Soy Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America North America Soy Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Soy Beverages Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the North America Soy Beverages Market?

Key companies in the market include Jaffe Bros Natural Foods, The Hain Celestial Group, Eden Foods, ZenSoy, Trader Joe's, Organic Valley, Kikkoman Pearl Soy Milk, Stremicks Heritage Foods*List Not Exhaustive, Danone.

3. What are the main segments of the North America Soy Beverages Market?

The market segments include Product Type, Flavor, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Growing Consumption of Processed Foods and Beverages.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Soy Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Soy Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Soy Beverages Market?

To stay informed about further developments, trends, and reports in the North America Soy Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence