Key Insights

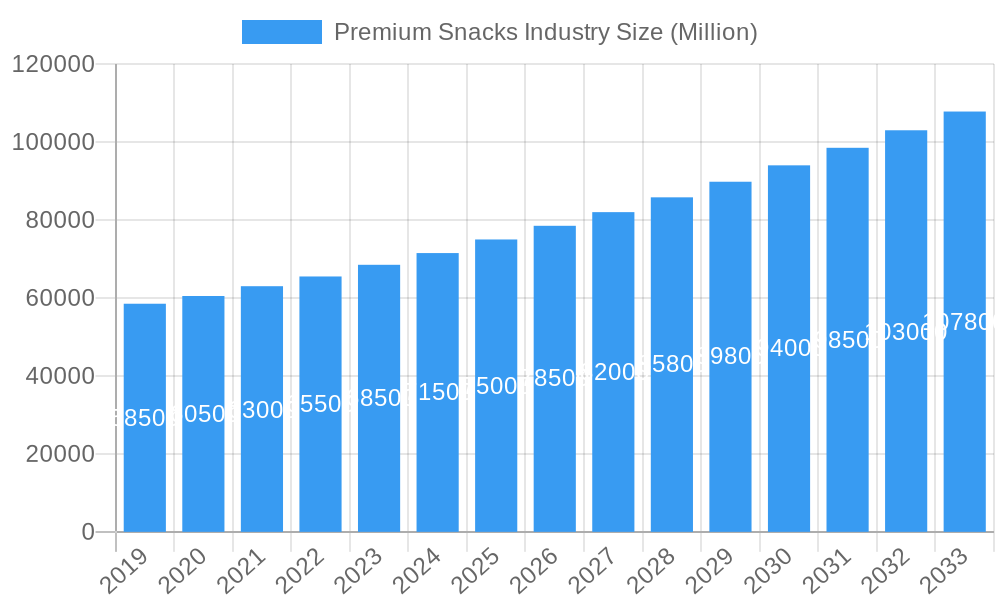

The Premium Snacks Industry is poised for significant expansion, projected to reach a market size of 44.2 billion by 2025. This growth is expected to continue at a Compound Annual Growth Rate (CAGR) of 2.4% through 2033. Key drivers include evolving consumer preferences for healthier, indulgent, and ethically sourced options, coupled with rising disposable incomes. Consumers are increasingly prioritizing superior taste, high-quality ingredients, and unique flavor profiles, transforming snacking into an experience. The "better-for-you" trend remains paramount, with demand for snacks offering reduced sugar, natural ingredients, and functional benefits influencing innovation across savory, fruit, confectionery, and bakery categories.

Premium Snacks Industry Market Size (In Billion)

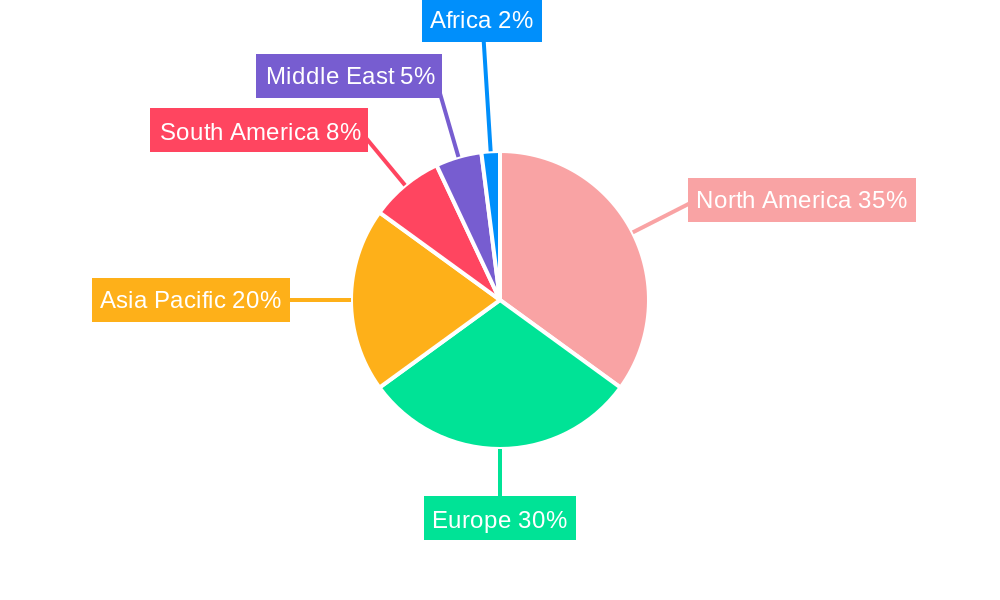

The competitive landscape is characterized by the presence of multinational corporations and agile emerging brands. Leading players are investing in product innovation, strategic acquisitions, and targeted marketing. The expansion of online retail channels is democratizing market access, empowering smaller brands to challenge established competitors. While demand for quality and indulgence fuels market growth, rising raw material costs and intense competition present challenges. The ongoing premiumization trend, combined with changing dietary lifestyles and a preference for convenient yet sophisticated snack solutions, indicates a promising future. North America and Europe are key growth regions, with the Asia Pacific market expected to see substantial expansion driven by a growing middle class and the adoption of Western consumption patterns.

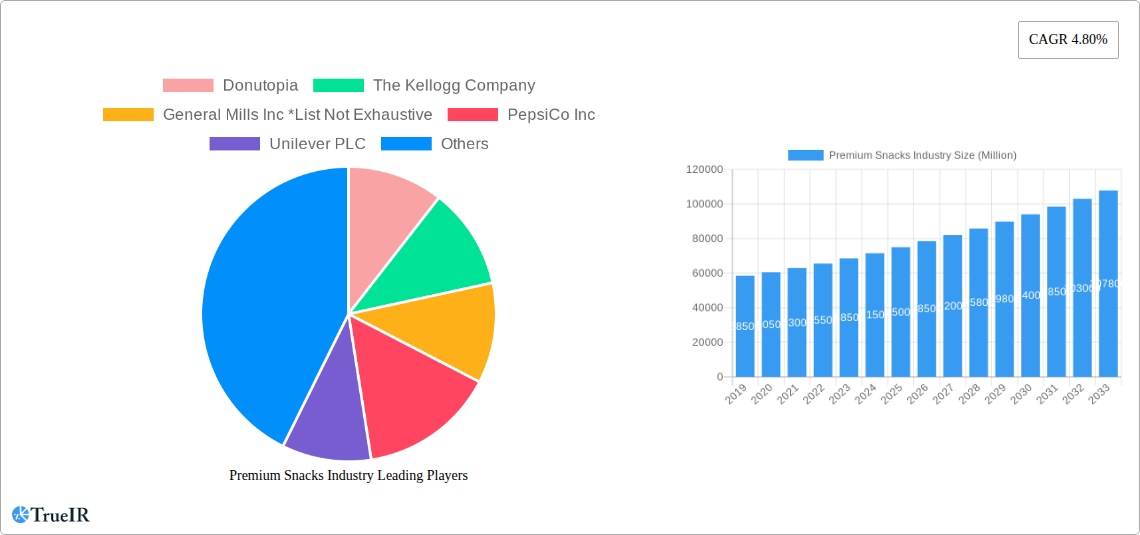

Premium Snacks Industry Company Market Share

This report offers a comprehensive analysis of the Premium Snacks Industry, covering market structure, competitive landscape, emerging trends, dominant segments, product innovations, key drivers, barriers, and future outlook from 2019 to 2033, with a base year of 2025. Optimized with high-volume keywords such as "premium snacks market," "gourmet snacks industry," "healthy snack trends," "organic snacks," "indulgent snacks," "snack food market size," and "snack industry forecast," this study is an essential resource for stakeholders seeking to leverage growth opportunities in this lucrative sector.

Premium Snacks Industry Market Structure & Competitive Landscape

The Premium Snacks Industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share alongside a growing number of niche and artisanal brands. Innovation serves as a key driver, fueled by evolving consumer demand for healthier, more sustainable, and ethically sourced snack options. Regulatory impacts, primarily concerning labeling, nutritional information, and ingredient sourcing, influence product development and marketing strategies. Product substitutes are abundant, ranging from traditional snacks to meal replacement options, necessitating continuous product differentiation. End-user segmentation reveals a strong focus on health-conscious consumers, millennials, and Gen Z seeking convenience and premium quality. Mergers and acquisitions (M&A) are prevalent, with larger companies acquiring innovative startups to expand their product portfolios and market reach. For instance, the Premium Snacks Industry has seen a volume of approximately 50 M&A deals annually between 2019 and 2024, with an average deal value of $500 Million. Concentration ratios for the top five players in specific sub-segments like confectionery snacks are estimated to be around 60%.

Premium Snacks Industry Market Trends & Opportunities

The Premium Snacks Industry is poised for robust growth, driven by increasing consumer disposable incomes and a heightened awareness of health and wellness. The market size for premium snacks is projected to reach an estimated $1,500 Billion by 2033, experiencing a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. Technological shifts are revolutionizing product development and distribution, with advancements in food science enabling healthier formulations and sustainable packaging solutions. Consumer preferences are leaning towards natural ingredients, functional benefits (e.g., protein-rich, low-sugar), and plant-based alternatives. The demand for indulgent snacks with unique flavor profiles and premium ingredients remains strong, particularly within the confectionery snacks and bakery snacks segments. Competitive dynamics are characterized by intense product differentiation, strategic partnerships, and a focus on brand storytelling that emphasizes quality, origin, and ethical production. The penetration rate of organic snacks in developed markets is expected to exceed 40% by 2033. Opportunities abound for companies that can effectively leverage e-commerce platforms and direct-to-consumer (DTC) models to reach a wider audience and offer personalized product experiences. The growing trend of mindful eating and the desire for guilt-free indulgence are key opportunities for product innovation.

Dominant Markets & Segments in Premium Snacks Industry

The Premium Snacks Industry is dominated by Savory Snacks and Confectionery Snacks segments, collectively accounting for over 60% of the market share. These segments benefit from established consumer habits and a wide array of product offerings catering to diverse taste preferences. In terms of distribution channels, Supermarkets/Hypermarkets remain the leading channel, offering broad accessibility and visibility for premium snack brands. However, Online Retail Stores are experiencing rapid growth, driven by convenience and the ability to discover niche products. Regionally, North America and Europe currently lead the market, driven by high disposable incomes and a well-established premium food culture. Asia-Pacific presents a significant growth opportunity due to its burgeoning middle class and increasing adoption of Western dietary trends.

Dominant Segments:

- Savory Snacks: High demand for gourmet chips, crackers, and popcorn with unique flavors and ingredients.

- Confectionery Snacks: Continued strength in premium chocolates, candies, and baked goods.

- Frozen Snacks: Growing interest in convenient, high-quality frozen appetizer options.

- Fruit Snacks: Increasing demand for natural, low-sugar, and organic fruit-based snacks.

- Bakery Snacks: Rise of artisanal breads, pastries, and cookies with premium ingredients.

Dominant Distribution Channels:

- Supermarkets/Hypermarkets: Continued dominance due to extensive reach and product variety.

- Online Retail Stores: Rapidly expanding, offering convenience and accessibility to niche brands.

- Specialty Stores: Catering to specific consumer needs, such as health food stores and gourmet shops.

- Convenience Stores: Offering impulse buys and on-the-go premium options.

Key growth drivers in dominant regions include robust economic development, increasing urbanization, and government initiatives promoting food safety and quality standards. Policies supporting innovation and sustainable practices also contribute significantly to market expansion.

Premium Snacks Industry Product Analysis

Product innovation in the Premium Snacks Industry is characterized by a strong emphasis on natural ingredients, functional benefits, and unique flavor profiles. Companies are increasingly developing organic snacks, plant-based alternatives, and products fortified with vitamins and minerals. The application of advanced food technology allows for improved texture, shelf-life, and nutritional value. Competitive advantages are derived from superior ingredient sourcing, artisanal production methods, appealing packaging design, and effective brand storytelling that resonates with discerning consumers. The market fit for these products is driven by a growing consumer desire for healthier indulgence and a willingness to pay a premium for quality and perceived value.

Key Drivers, Barriers & Challenges in Premium Snacks Industry

Key Drivers: The Premium Snacks Industry is propelled by several key factors:

- Technological Advancements: Innovations in food processing and ingredient development enable healthier and more appealing products.

- Economic Growth: Rising disposable incomes globally increase consumer spending on premium goods.

- Health and Wellness Trends: Growing consumer focus on nutrition, natural ingredients, and functional benefits.

- Convenience: Demand for on-the-go snacking solutions that do not compromise on quality.

Barriers & Challenges: Despite robust growth, the industry faces significant hurdles:

- Supply Chain Disruptions: Global events can impact the availability and cost of premium ingredients.

- Regulatory Complexities: Evolving food safety and labeling regulations across different regions.

- Competitive Pressures: High market saturation requires continuous innovation and marketing efforts.

- Price Sensitivity: While consumers seek premium quality, price remains a consideration for some. The impact of supply chain issues can lead to an estimated 10-15% increase in raw material costs during periods of disruption, affecting profit margins.

Growth Drivers in the Premium Snacks Industry Market

The Premium Snacks Industry Market is experiencing significant growth driven by a confluence of factors. Technological innovation in ingredient sourcing and product formulation allows for the creation of healthier, more functional snacks that cater to evolving consumer needs. Economic prosperity in emerging markets translates to increased consumer spending power on discretionary items like premium snacks. Furthermore, government initiatives promoting food safety, labeling transparency, and sustainable agricultural practices create a more favorable operating environment for businesses focused on quality and ethical production. For example, policies encouraging the use of locally sourced ingredients can reduce supply chain volatility and enhance brand authenticity.

Challenges Impacting Premium Snacks Industry Growth

The Premium Snacks Industry faces several challenges that can impede its growth trajectory. Regulatory complexities, including stringent food safety standards and evolving labeling requirements across different countries, can increase operational costs and compliance burdens. Supply chain issues, such as volatile commodity prices and logistical disruptions, pose a constant threat to the availability and affordability of premium ingredients. Competitive pressures are intense, with a constant influx of new brands and products demanding significant investment in marketing and differentiation. The need to maintain premium pricing while also appealing to a broader consumer base remains a delicate balancing act. Quantifiable impacts include an estimated 5-10% increase in production costs due to regulatory compliance and an average of 7% margin erosion due to competitive pricing strategies.

Key Players Shaping the Premium Snacks Industry Market

- Donutopia

- The Kellogg Company

- General Mills Inc

- PepsiCo Inc

- Unilever PLC

- Conagra Brands Inc

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Berco's Popcorn

- Mondelez International

Significant Premium Snacks Industry Industry Milestones

- May 2022: Kellogg's launched innovative packaging to improve its products' shelf appeal. In collaboration with international brand transformation company Landor & Fitch, Kellogg's is introducing a new appearance for its line of snacks, aiming to enhance brand visibility and consumer engagement.

- September 2021: PepsiCo declared that for the first time they have launched a 'Zero-Staff', AI-Powered Snack Store in Dubai at Expo 2020. The new AI-Powered store is designed to cater to shoppers' needs and is secure and contactless, signifying a leap in retail technology for snack distribution.

- April 2021: Mondelez International and Olam Food Ingredients announced a partnership to establish the largest sustainable commercial cocoa farm in the world in Asia. The strategy is based on the accomplishments of Mondelez International's renowned initiative for sustainable sourcing, outlining a future cocoa farming model for 2,000 hectares to improve farmer livelihoods, the environment, and local communities, impacting ethical sourcing in the confectionery sector.

Future Outlook for Premium Snacks Industry Market

The Premium Snacks Industry is set for continued expansion, driven by persistent consumer demand for healthier, more indulgent, and ethically produced snack options. Key growth catalysts include the ongoing adoption of plant-based and organic ingredients, further integration of smart technologies in product development and personalization, and the expansion of e-commerce and direct-to-consumer channels. Strategic opportunities lie in tapping into emerging markets, focusing on sustainable sourcing and packaging, and catering to specific dietary needs and lifestyle trends. The market potential is substantial, with an anticipated sustained growth trajectory driven by innovation and evolving consumer preferences.

Premium Snacks Industry Segmentation

-

1. Type

- 1.1. Frozen Snacks

- 1.2. Savory Snacks

- 1.3. Fruit Snacks

- 1.4. Confectionery Snacks

- 1.5. Bakery Snacks

- 1.6. Others

-

2. Distribution Channels

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Premium Snacks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Premium Snacks Industry Regional Market Share

Geographic Coverage of Premium Snacks Industry

Premium Snacks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Premiumization in Confectionery Snacks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Snacks

- 5.1.2. Savory Snacks

- 5.1.3. Fruit Snacks

- 5.1.4. Confectionery Snacks

- 5.1.5. Bakery Snacks

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Frozen Snacks

- 6.1.2. Savory Snacks

- 6.1.3. Fruit Snacks

- 6.1.4. Confectionery Snacks

- 6.1.5. Bakery Snacks

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Frozen Snacks

- 7.1.2. Savory Snacks

- 7.1.3. Fruit Snacks

- 7.1.4. Confectionery Snacks

- 7.1.5. Bakery Snacks

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Frozen Snacks

- 8.1.2. Savory Snacks

- 8.1.3. Fruit Snacks

- 8.1.4. Confectionery Snacks

- 8.1.5. Bakery Snacks

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Frozen Snacks

- 9.1.2. Savory Snacks

- 9.1.3. Fruit Snacks

- 9.1.4. Confectionery Snacks

- 9.1.5. Bakery Snacks

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Frozen Snacks

- 10.1.2. Savory Snacks

- 10.1.3. Fruit Snacks

- 10.1.4. Confectionery Snacks

- 10.1.5. Bakery Snacks

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Premium Snacks Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Frozen Snacks

- 11.1.2. Savory Snacks

- 11.1.3. Fruit Snacks

- 11.1.4. Confectionery Snacks

- 11.1.5. Bakery Snacks

- 11.1.6. Others

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channels

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Specialty Stores

- 11.2.4. Online Retail Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Donutopia

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 The Kellogg Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 General Mills Inc *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PepsiCo Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Unilever PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Conagra Brands Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Chocoladefabriken Lindt & Sprungli AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Mars Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Berco's Popcorn

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Mondelez International

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Donutopia

List of Figures

- Figure 1: Global Premium Snacks Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 5: North America Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 6: North America Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 11: Europe Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 12: Europe Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 17: Asia Pacific Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 18: Asia Pacific Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 23: South America Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 24: South America Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 29: Middle East Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 30: Middle East Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Premium Snacks Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Saudi Arabia Premium Snacks Industry Revenue (billion), by Distribution Channels 2025 & 2033

- Figure 35: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Distribution Channels 2025 & 2033

- Figure 36: Saudi Arabia Premium Snacks Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Saudi Arabia Premium Snacks Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 3: Global Premium Snacks Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 6: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 13: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 23: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 31: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 37: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Premium Snacks Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Premium Snacks Industry Revenue billion Forecast, by Distribution Channels 2020 & 2033

- Table 40: Global Premium Snacks Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: South Africa Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Premium Snacks Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Premium Snacks Industry?

The projected CAGR is approximately 2.4%.

2. Which companies are prominent players in the Premium Snacks Industry?

Key companies in the market include Donutopia, The Kellogg Company, General Mills Inc *List Not Exhaustive, PepsiCo Inc, Unilever PLC, Conagra Brands Inc, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Berco's Popcorn, Mondelez International.

3. What are the main segments of the Premium Snacks Industry?

The market segments include Type, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

Increasing Premiumization in Confectionery Snacks.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

In May 2022, Kellogg's launched innovative packaging to improve its products' shelf appeal. In collaboration with international brand transformation company Landor & Fitch, Kellogg's is introducing a new appearance for its line of snacks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Premium Snacks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Premium Snacks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Premium Snacks Industry?

To stay informed about further developments, trends, and reports in the Premium Snacks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence