Key Insights

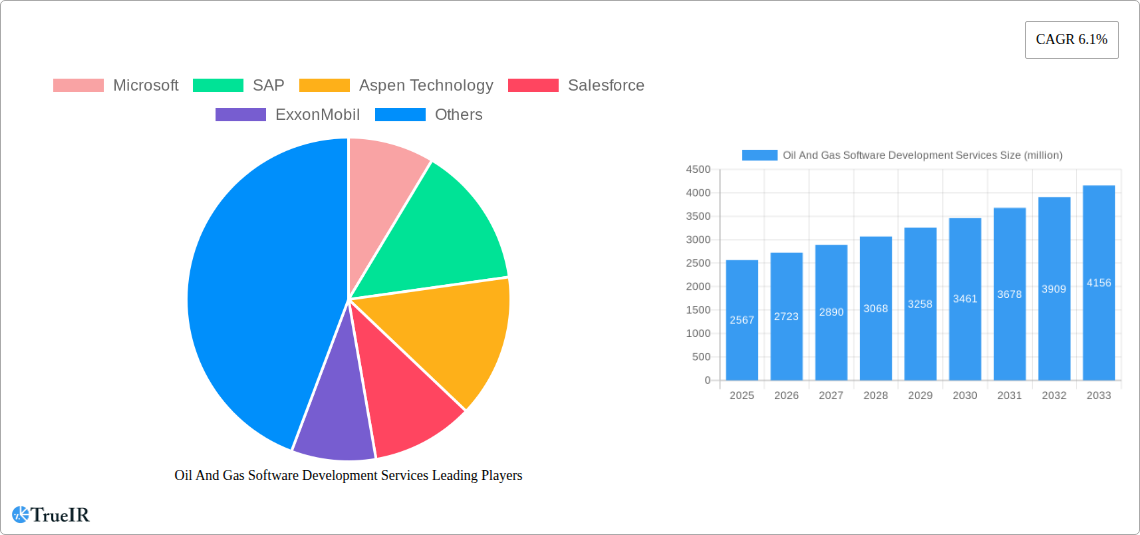

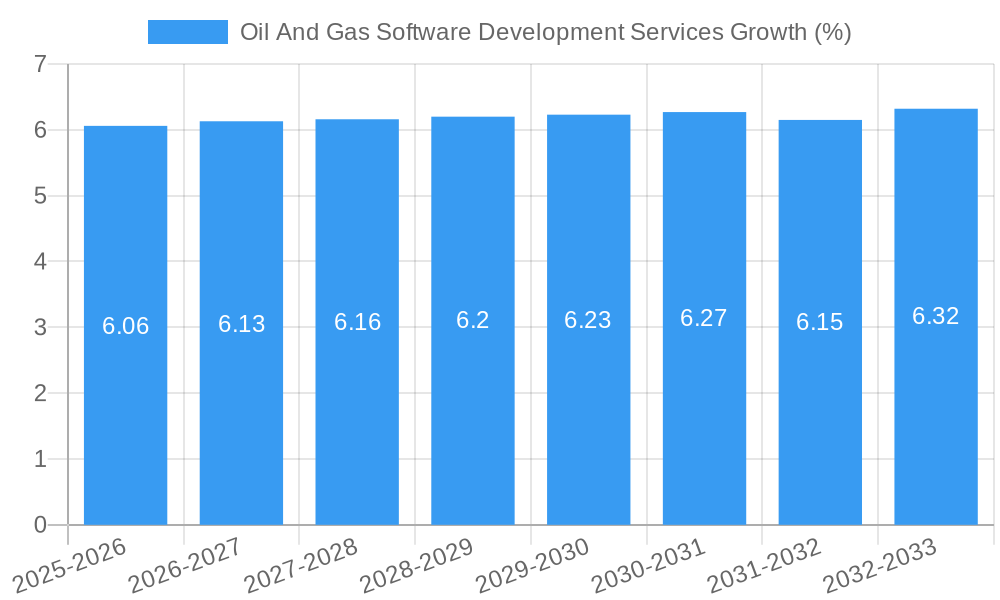

The global Oil and Gas Software Development Services market is poised for robust growth, projected to reach a substantial size by 2033, driven by a Compound Annual Growth Rate (CAGR) of 6.1%. This expansion is fundamentally fueled by the industry's relentless pursuit of operational efficiency, cost reduction, and enhanced safety through digital transformation. Key drivers include the increasing adoption of cloud-based solutions for scalability and data accessibility, alongside the growing demand for sophisticated analytics and AI-driven insights to optimize exploration, extraction, and production processes. The imperative to manage complex assets effectively, coupled with stringent environmental regulations, further propels the need for specialized software development services that can streamline workflows, improve decision-making, and ensure compliance. Engineering applications, in particular, are witnessing significant investment as companies leverage advanced simulation and modeling tools to design and manage complex projects more effectively.

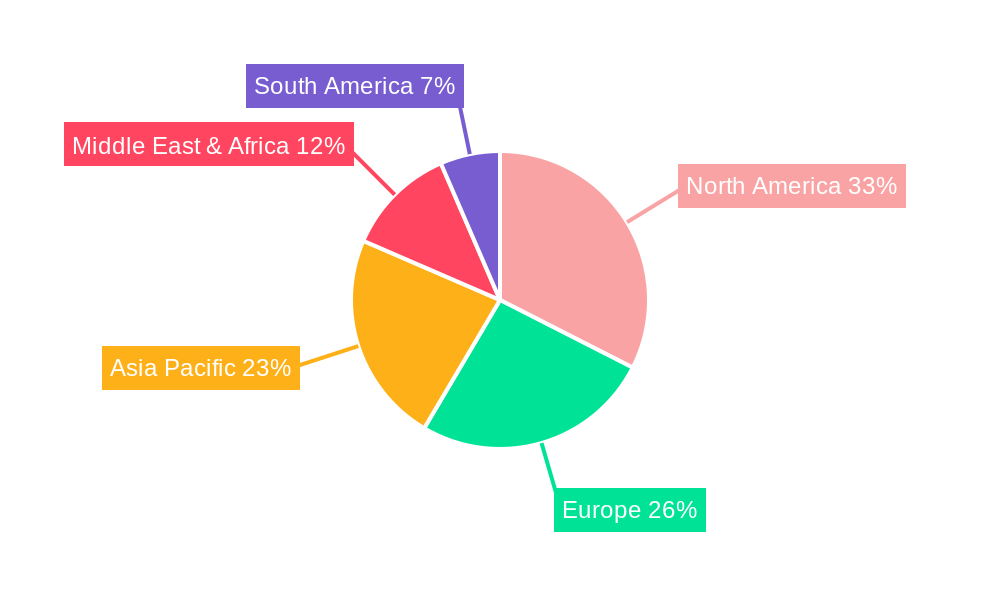

The market's trajectory is also shaped by evolving trends such as the integration of the Internet of Things (IoT) for real-time data collection from remote assets, the rise of blockchain for secure data management and supply chain transparency, and the increasing focus on predictive maintenance to minimize downtime and extend asset life. While the industry faces challenges like cybersecurity threats and the need for skilled talent, the overwhelming benefits of digital solutions in navigating market volatility and optimizing resource utilization ensure sustained demand for specialized software development. Cloud-based software development is expected to dominate the market due to its flexibility, cost-effectiveness, and ease of deployment, though on-premise solutions will continue to cater to specific security and regulatory needs. Geographically, North America and Asia Pacific are anticipated to lead the market growth, owing to significant investments in technology and the presence of major oil and gas players.

Here's a dynamic, SEO-optimized report description for Oil and Gas Software Development Services, incorporating your specified details and adhering to all constraints.

Oil and Gas Software Development Services Market Structure & Competitive Landscape

The Oil and Gas software development services market, projected to reach over XX million by 2025, is characterized by a moderately concentrated landscape driven by innovation and strategic collaborations. Leading players like Microsoft, SAP, Aspen Technology, and Salesforce exert significant influence, alongside specialized providers such as P2 Energy Solutions, Aveva, and Field Squared. The market's innovation is fueled by the escalating demand for advanced digital solutions in exploration, extraction, engineering, production, calculation, and asset management. Regulatory impacts, though varying by region, increasingly favor the adoption of digital transformation initiatives aimed at enhancing safety, efficiency, and environmental compliance. Product substitutes, while present in the form of legacy systems, are rapidly losing ground to sophisticated cloud-based and on-premise software solutions. End-user segmentation clearly delineates demand across upstream (exploration and extraction), midstream (transportation and storage), and downstream (refining and marketing) operations. Mergers and acquisition (M&A) trends are actively reshaping the competitive arena, with an estimated XX million worth of deals observed historically (2019-2024), indicating a drive towards consolidation and expanded service offerings. For instance, the acquisition of smaller niche providers by larger enterprises aims to broaden their digital transformation portfolios for clients like ExxonMobil. Acropolium and LeewayHertz are notable for their contributions to custom software solutions.

- Market Concentration: Moderate, with dominance by a few large technology providers and a growing number of specialized players.

- Innovation Drivers: Digitalization of operations, AI/ML integration, IoT adoption, predictive analytics, and automation.

- Regulatory Impacts: Increased focus on safety, environmental reporting, and data security driving demand for compliant software.

- Product Substitutes: Legacy systems are being phased out in favor of modern, integrated software platforms.

- End-User Segmentation: Upstream, Midstream, and Downstream sectors are key consumers.

- M&A Trends: Strategic acquisitions to expand service portfolios and market reach, with an estimated XX million in historical M&A volume.

Oil and Gas Software Development Services Market Trends & Opportunities

The global Oil and Gas software development services market is poised for substantial expansion, driven by a confluence of technological advancements, evolving industry needs, and the relentless pursuit of operational excellence. The market size is projected to surge, reaching an estimated XX million by 2025 and continuing on an upward trajectory throughout the forecast period of 2025–2033. This robust growth is underpinned by a significant compound annual growth rate (CAGR) of approximately XX% observed during the historical period (2019–2024) and expected to continue. Key technological shifts are transforming the industry, with cloud-based software development services gaining unprecedented traction. This migration to the cloud offers unparalleled scalability, flexibility, and cost-efficiency, enabling companies to manage vast datasets from exploration through production with greater agility. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing predictive maintenance, reservoir simulation, and supply chain optimization, leading to enhanced resource recovery and reduced operational downtime. Consumer preferences are increasingly leaning towards integrated, user-friendly platforms that provide real-time insights and support data-driven decision-making across all operational segments, including exploration, extraction, engineering, production, calculation, and asset management. Companies like Chetu and Miracle Devs are at the forefront of delivering bespoke solutions tailored to these evolving demands. The competitive dynamics are intensifying, with established giants such as SAP and Aspen Technology constantly innovating, while agile firms like Boosty Labs and WebSpace are carving out niches with specialized offerings. The increasing adoption of digital twins and the Internet of Things (IoT) further fuels the demand for sophisticated software that can harness and analyze real-time data streams, thereby optimizing every facet of the oil and gas value chain. The drive for decarbonization and sustainable practices is also a significant trend, spurring the development of software solutions for emissions monitoring, carbon capture, and alternative energy integration. This presents a vast opportunity for software developers to create intelligent systems that not only enhance traditional operations but also support the industry's transition towards a greener future. The market penetration rate for advanced software solutions is steadily increasing, indicating a strong market appetite for digital transformation.

Dominant Markets & Segments in Oil And Gas Software Development Services

The Oil and Gas Software Development Services market exhibits distinct dominance across various regions and segments, driven by strategic investments, regulatory frameworks, and operational imperatives. North America, particularly the United States, stands as a leading region, fueled by its mature oil and gas industry, significant exploration and extraction activities, and a proactive embrace of technological innovation. Countries like Canada also contribute substantially to this dominance. In terms of Application segments, Exploration and Extraction are currently the largest revenue generators, owing to the continuous need for advanced geophysical data analysis, seismic imaging, and drilling optimization software. However, Production and Asset Management are witnessing rapid growth, as companies prioritize maximizing output from existing reserves and ensuring the longevity and efficiency of their infrastructure, which includes pipelines, refineries, and drilling equipment. The shift towards Cloud-based Software Development is a defining trend, outstripping on-premise solutions due to its inherent scalability, cost-effectiveness, and accessibility for remote operations. This allows for seamless data integration and real-time analytics, critical for complex global operations.

- Leading Region: North America (particularly the United States), followed by the Middle East and Asia-Pacific.

- Key Growth Drivers in North America: Extensive upstream operations, advanced technological adoption, supportive regulatory environment for digital transformation, and a high concentration of major oil and gas companies.

- Dominant Application Segments:

- Exploration & Extraction: Driven by the need for sophisticated seismic interpretation, reservoir modeling, and drilling automation. Companies like P2 Energy Solutions and Aveva play a crucial role.

- Production: Growing demand for real-time monitoring, optimization, and efficiency enhancement in ongoing extraction processes.

- Asset Management: Increasing focus on predictive maintenance, integrity management, and lifecycle costing for critical infrastructure.

- Dominant Type of Software Development:

- Cloud-based Software Development: Favored for its flexibility, scalability, cost-efficiency, and ability to support remote operations and data analytics. Key providers include Microsoft Azure and SAP cloud solutions.

- On-premise Software Development: Still relevant for highly sensitive data and specific legacy system integrations, but with a declining market share compared to cloud.

- Key Growth Drivers in Other Regions:

- Middle East: Significant investments in new exploration projects and infrastructure development.

- Asia-Pacific: Rapidly expanding energy demand driving investment in both upstream and downstream sectors, with a growing interest in digital solutions.

- Detailed Analysis of Market Dominance: The dominance in North America is reinforced by the presence of major industry players and research institutions that foster innovation. The application segment dominance is directly linked to the core operational stages of the oil and gas lifecycle. Cloud-based development’s ascendancy is a global phenomenon, mirroring broader digital transformation trends across industries, offering tangible benefits in terms of agility and data-driven insights, which are paramount in the volatile oil and gas sector. For example, the integration of AI in exploration software by companies like Aspen Technology enhances discovery rates, while solutions from Field Squared and DocVue streamline field operations.

Oil And Gas Software Development Services Product Analysis

The oil and gas software development services market is characterized by a wave of innovative products focused on enhancing operational efficiency, safety, and data intelligence. These solutions range from advanced exploration and seismic interpretation tools leveraging AI for subsurface analysis, to sophisticated production optimization platforms that integrate real-time sensor data with predictive algorithms. Asset management software is increasingly incorporating digital twin technology and IoT capabilities for proactive maintenance and lifecycle monitoring. Competitive advantages lie in the ability of these products to offer seamless integration across the value chain, robust cybersecurity features, and intuitive user interfaces. Companies like Petro Suite and Aquad are at the forefront of developing comprehensive suites that address specific operational challenges, while firms such as BinaryFolks and WebCreek provide specialized solutions. The market's technological advancements are driven by the demand for greater accuracy in resource estimation, reduced downtime, and improved compliance with environmental regulations.

Key Drivers, Barriers & Challenges in Oil And Gas Software Development Services

The oil and gas software development services market is propelled by several key drivers:

- Technological Advancements: The integration of AI, ML, IoT, and cloud computing is revolutionizing operations, leading to enhanced efficiency and cost savings.

- Digital Transformation Imperative: Companies are increasingly adopting digital strategies to remain competitive and optimize complex processes.

- Need for Enhanced Safety & Compliance: Stringent regulations and the inherent risks in the industry necessitate advanced software for monitoring and reporting.

- Data Analytics & Insights: The ability to process vast amounts of data for better decision-making is crucial for resource management and operational optimization.

Key challenges and restraints impacting growth include:

- High Implementation Costs: The initial investment for sophisticated software solutions can be substantial.

- Cybersecurity Threats: Protecting sensitive operational data from cyberattacks remains a significant concern.

- Legacy System Integration: Integrating new software with existing, often outdated, infrastructure can be complex and time-consuming.

- Skilled Workforce Shortage: A lack of professionals with expertise in both oil and gas operations and advanced software development can hinder adoption.

- Regulatory Hurdles: Navigating diverse and evolving international regulations can pose challenges for global software providers.

Growth Drivers in the Oil And Gas Software Development Services Market

Several factors are driving the growth of the Oil and Gas software development services market. Technologically, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics in exploration and production is a significant catalyst. Economic drivers include the ongoing need to optimize operational costs and maximize resource recovery in an ever-fluctuating commodity market. Regulatory tailwinds, such as stricter environmental compliance mandates, are also pushing companies to invest in sophisticated monitoring and reporting software. The global push for digital transformation across all industries, including oil and gas, further amplifies this growth. For instance, the development of cloud-based platforms by companies like Microsoft and SAP facilitates scalability and accessibility, enabling smaller players to leverage advanced solutions. The demand for enhanced asset management and predictive maintenance solutions, exemplified by offerings from Aveva and P2 Energy Solutions, directly contributes to sustained growth.

Challenges Impacting Oil And Gas Software Development Services Growth

Despite the strong growth trajectory, the Oil and Gas Software Development Services market faces significant challenges. Regulatory complexities and varying compliance standards across different jurisdictions can slow down adoption and increase development costs. Supply chain disruptions, while less direct for software, can impact the availability of hardware infrastructure on which software solutions depend. Competitive pressures are intensifying, with numerous players vying for market share, leading to pricing challenges and the need for continuous innovation. The high upfront investment required for implementing advanced software solutions remains a barrier for some organizations, particularly smaller independent operators. Furthermore, the risk of cybersecurity threats is a constant concern, necessitating robust security protocols and continuous vigilance. The industry's inherent resistance to change and the need for extensive training to adapt to new digital tools also present hurdles.

Key Players Shaping the Oil And Gas Software Development Services Market

- Microsoft

- SAP

- Aspen Technology

- Salesforce

- ExxonMobil

- P2 Energy Solutions

- Aveva

- Field Squared

- DocVue

- Acropolium

- LeewayHertz

- Chetu

- Miracle Devs

- Boosty Labs

- WebSpace

- KeyUA

- GDS Ware

- Focus ERP

- PaleBlue

- Petro Suite

- Aquad

- Planet PCI

- BinaryFolks

- WebCreek

- DEV.co

- Contata

- Dev Technosys

Significant Oil And Gas Software Development Services Industry Milestones

- 2019/01: Increased investment in AI-driven exploration technologies by major E&P companies.

- 2020/03: Expansion of cloud-based solutions for upstream operations by leading software providers.

- 2021/07: Growing adoption of IoT for real-time production monitoring and predictive maintenance.

- 2022/02: Focus on digital twin technology for asset management and lifecycle optimization.

- 2023/05: Emergence of blockchain solutions for supply chain transparency and security.

- 2024/01: Strategic partnerships between oilfield service companies and technology providers to offer integrated digital solutions.

Future Outlook for Oil And Gas Software Development Services Market

The future outlook for Oil and Gas Software Development Services is exceptionally bright, driven by an unwavering demand for enhanced operational efficiency, safety, and sustainability. The continued integration of AI, ML, and IoT will unlock unprecedented capabilities in predictive analytics, autonomous operations, and real-time data insights across exploration, extraction, and production. The expansion of cloud-based solutions will democratize access to sophisticated technologies, fostering innovation and collaboration. Strategic opportunities lie in developing solutions that support the energy transition, including software for carbon capture, utilization, and storage (CCUS), renewable energy integration, and emissions monitoring. Market potential is substantial as companies increasingly recognize digital transformation not as an option, but a necessity for resilience and competitiveness in the evolving energy landscape. The ongoing advancements, coupled with strategic investments from companies like Acropolium and LeewayHertz, ensure a dynamic and growing market.

Oil And Gas Software Development Services Segmentation

-

1. Application

- 1.1. Exploration

- 1.2. Extraction

- 1.3. Engineering

- 1.4. Production

- 1.5. Calculation

- 1.6. Asset Management

-

2. Type

- 2.1. Cloud-based Software Development

- 2.2. On-premise Software Development

Oil And Gas Software Development Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil And Gas Software Development Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil And Gas Software Development Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Exploration

- 5.1.2. Extraction

- 5.1.3. Engineering

- 5.1.4. Production

- 5.1.5. Calculation

- 5.1.6. Asset Management

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-based Software Development

- 5.2.2. On-premise Software Development

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oil And Gas Software Development Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Exploration

- 6.1.2. Extraction

- 6.1.3. Engineering

- 6.1.4. Production

- 6.1.5. Calculation

- 6.1.6. Asset Management

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-based Software Development

- 6.2.2. On-premise Software Development

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Oil And Gas Software Development Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Exploration

- 7.1.2. Extraction

- 7.1.3. Engineering

- 7.1.4. Production

- 7.1.5. Calculation

- 7.1.6. Asset Management

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-based Software Development

- 7.2.2. On-premise Software Development

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Oil And Gas Software Development Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Exploration

- 8.1.2. Extraction

- 8.1.3. Engineering

- 8.1.4. Production

- 8.1.5. Calculation

- 8.1.6. Asset Management

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-based Software Development

- 8.2.2. On-premise Software Development

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Oil And Gas Software Development Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Exploration

- 9.1.2. Extraction

- 9.1.3. Engineering

- 9.1.4. Production

- 9.1.5. Calculation

- 9.1.6. Asset Management

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-based Software Development

- 9.2.2. On-premise Software Development

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Oil And Gas Software Development Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Exploration

- 10.1.2. Extraction

- 10.1.3. Engineering

- 10.1.4. Production

- 10.1.5. Calculation

- 10.1.6. Asset Management

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-based Software Development

- 10.2.2. On-premise Software Development

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Microsoft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SAP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aspen Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Salesforce

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ExxonMobil

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 P2 Energy Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aveva

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Field Squared

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DocVue

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Acropolium

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LeewayHertz

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chetu

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Miracle Devs

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Boosty Labs

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 WebSpace

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 KeyUA

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 GDS Ware

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Focus ERP

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 PaleBlue

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Petro Suite

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Aquad

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Planet PCI

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 BinaryFolks

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 WebCreek

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 DEV.co

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Contata

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Dev Technosys

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Microsoft

List of Figures

- Figure 1: Global Oil And Gas Software Development Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Oil And Gas Software Development Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Oil And Gas Software Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Oil And Gas Software Development Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Oil And Gas Software Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Oil And Gas Software Development Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Oil And Gas Software Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oil And Gas Software Development Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Oil And Gas Software Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Oil And Gas Software Development Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Oil And Gas Software Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Oil And Gas Software Development Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Oil And Gas Software Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Oil And Gas Software Development Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Oil And Gas Software Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Oil And Gas Software Development Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Oil And Gas Software Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Oil And Gas Software Development Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Oil And Gas Software Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Oil And Gas Software Development Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Oil And Gas Software Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Oil And Gas Software Development Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Oil And Gas Software Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Oil And Gas Software Development Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Oil And Gas Software Development Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Oil And Gas Software Development Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Oil And Gas Software Development Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Oil And Gas Software Development Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Oil And Gas Software Development Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Oil And Gas Software Development Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Oil And Gas Software Development Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oil And Gas Software Development Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Oil And Gas Software Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Oil And Gas Software Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Oil And Gas Software Development Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Oil And Gas Software Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Oil And Gas Software Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Oil And Gas Software Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Oil And Gas Software Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Oil And Gas Software Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Oil And Gas Software Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Oil And Gas Software Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Oil And Gas Software Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Oil And Gas Software Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Oil And Gas Software Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Oil And Gas Software Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Oil And Gas Software Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Oil And Gas Software Development Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Oil And Gas Software Development Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Oil And Gas Software Development Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Oil And Gas Software Development Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil And Gas Software Development Services?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Oil And Gas Software Development Services?

Key companies in the market include Microsoft, SAP, Aspen Technology, Salesforce, ExxonMobil, P2 Energy Solutions, Aveva, Field Squared, DocVue, Acropolium, LeewayHertz, Chetu, Miracle Devs, Boosty Labs, WebSpace, KeyUA, GDS Ware, Focus ERP, PaleBlue, Petro Suite, Aquad, Planet PCI, BinaryFolks, WebCreek, DEV.co, Contata, Dev Technosys.

3. What are the main segments of the Oil And Gas Software Development Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2567 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil And Gas Software Development Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil And Gas Software Development Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil And Gas Software Development Services?

To stay informed about further developments, trends, and reports in the Oil And Gas Software Development Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence