Key Insights

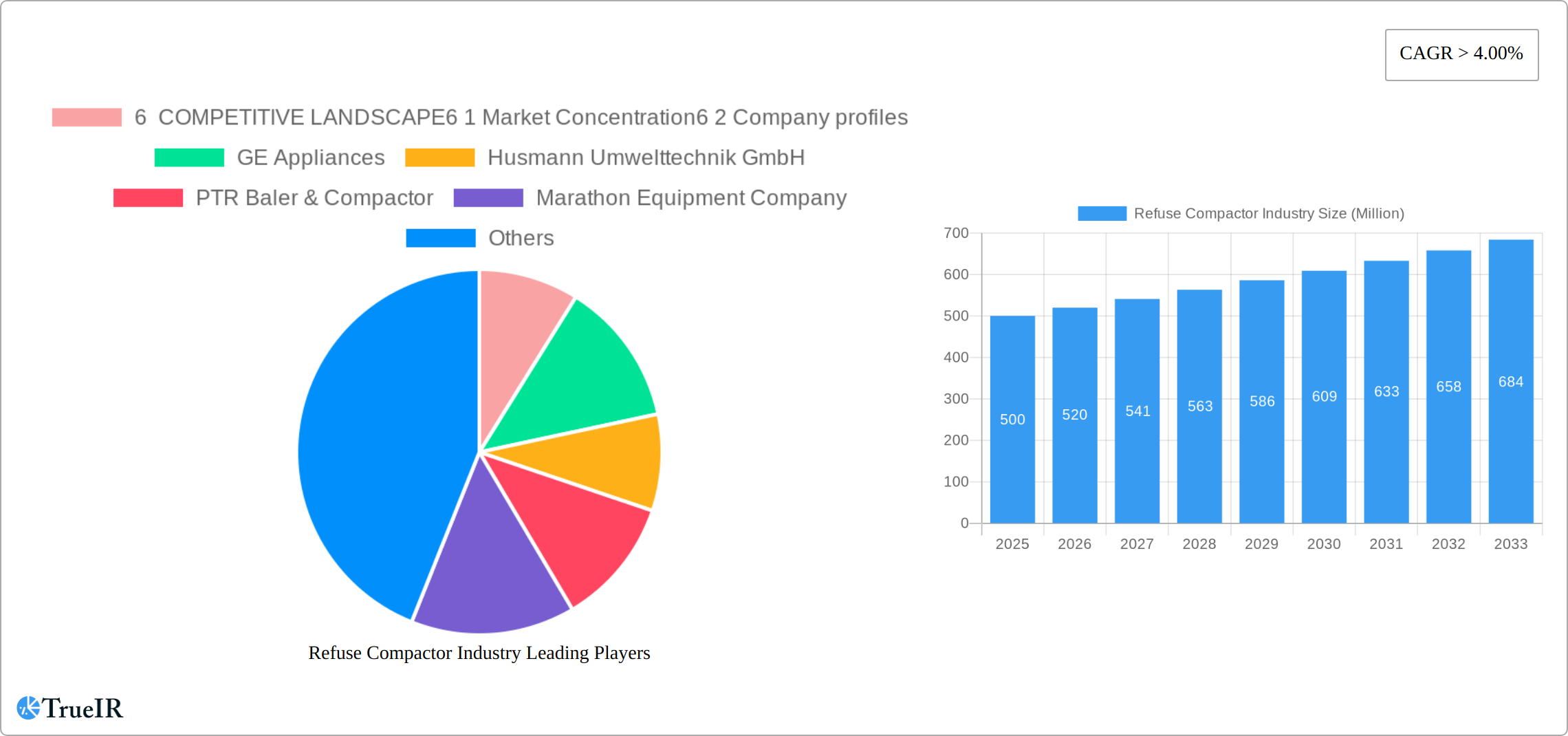

The global refuse compactor market is poised for significant expansion, propelled by escalating urbanization, increasing waste generation, and stringent environmental regulations mandating efficient waste management solutions. The market exhibits a Compound Annual Growth Rate (CAGR) of 3.4%, with a projected market size of 280 million in the base year 2024. This growth is attributed to the widespread adoption of compactors across residential, commercial, and industrial sectors. Innovations in automated systems and advanced compaction technologies, enhancing density and reducing storage requirements, are key growth enablers. The market likely encompasses various compactor types, including stationary, mobile, and self-contained units, catering to diverse waste streams such as recyclables, general waste, and hazardous materials.

Refuse Compactor Industry Market Size (In Million)

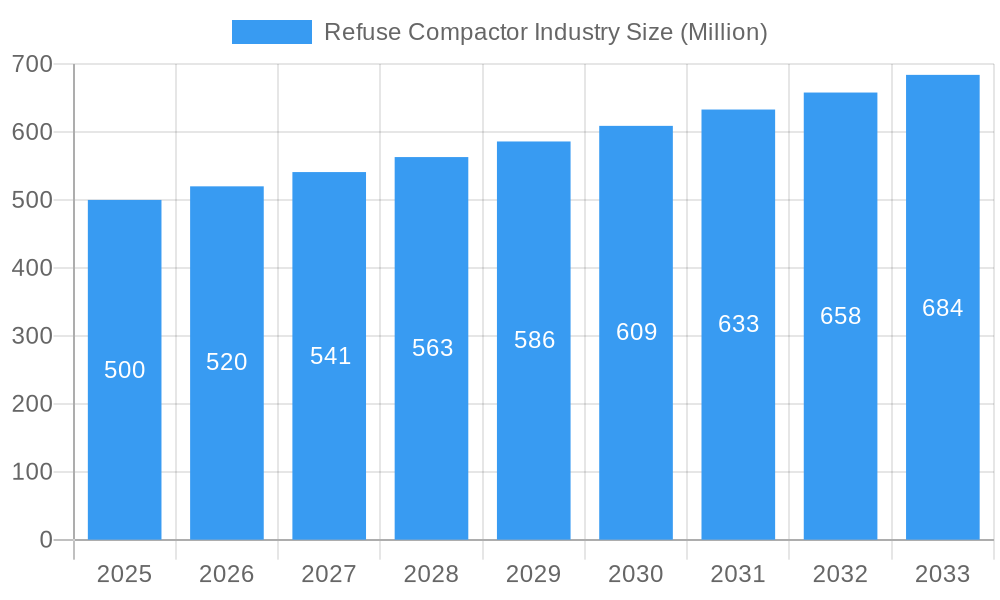

The competitive landscape is characterized by the presence of major players including GE Appliances, Husmann Umwelttechnik GmbH, PTR Baler & Compactor, Marathon Equipment Company, Capital Compactors Ltd, Compactor Management Company, Genesis Waste Handling Private Limited, Precision Machinery Systems, ACE Equipment Company, and Wastequip LLC. Competition centers on technological innovation, service capabilities, and global presence. While initial investment costs and ongoing maintenance can present market restraints, the long-term advantages of reduced disposal expenses and environmental compliance ensure sustained market development. The industry's outlook remains robust, underscoring the global commitment to sustainable waste management.

Refuse Compactor Industry Company Market Share

Refuse Compactor Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Refuse Compactor Industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to project a robust market outlook. The global market size is estimated at $XX Million in 2025, poised for significant growth in the coming years.

Refuse Compactor Industry Market Structure & Competitive Landscape

The Refuse Compactor Industry exhibits a moderately concentrated market structure, with a few key players holding significant market share. The Herfindahl-Hirschman Index (HHI) for the industry is estimated at XX, indicating a moderate level of competition. Innovation in compaction technology, particularly in automation and smart waste management systems, is a key driver. Stringent environmental regulations regarding waste management significantly impact industry players, pushing adoption of more efficient and environmentally friendly compactors. The industry also faces competition from alternative waste disposal methods, including incineration and anaerobic digestion. The market is segmented by end-user (residential, commercial, industrial, municipal), with the municipal segment being the largest. M&A activity has been relatively moderate in recent years, with approximately XX deals recorded between 2019 and 2024, predominantly involving smaller players.

- Market Concentration: Moderately concentrated (HHI: XX)

- Innovation Drivers: Automation, smart waste management systems

- Regulatory Impacts: Stringent environmental regulations driving adoption of efficient compactors

- Product Substitutes: Incineration, anaerobic digestion

- End-User Segmentation: Residential, Commercial, Industrial, Municipal (Municipal being the largest)

- M&A Trends: Moderate activity (XX deals 2019-2024), primarily involving smaller players

Refuse Compactor Industry Market Trends & Opportunities

The Refuse Compactor Industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This growth is fueled by increasing urbanization, rising waste generation, and the growing emphasis on efficient waste management practices. Technological advancements, including the integration of IoT sensors and data analytics, are transforming the industry, enabling real-time monitoring and optimized waste collection routes. Consumer preferences are shifting towards environmentally friendly and technologically advanced compactors. Competitive dynamics are characterized by a combination of established players and emerging technology companies vying for market share. Market penetration rates for smart compactors are currently at XX% and expected to increase significantly to XX% by 2033.

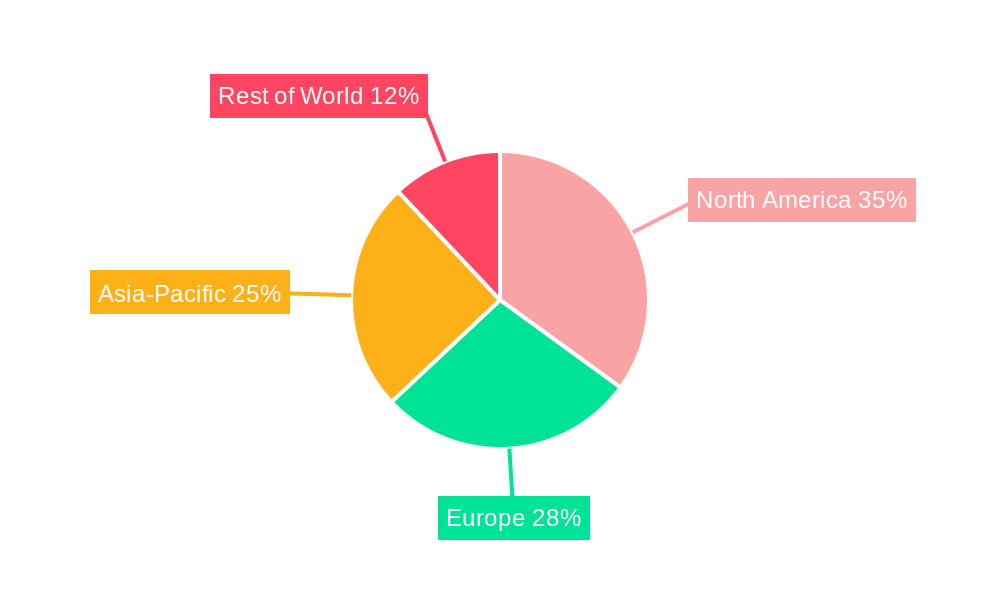

Dominant Markets & Segments in Refuse Compactor Industry

The Refuse Compactor Industry is a dynamic market experiencing significant growth, driven by escalating urbanization, stringent environmental regulations, and the increasing need for efficient waste management solutions. While North America currently holds a substantial market share (estimated at XX% in 2025), fueled by robust infrastructure, high per capita waste generation, and substantial private investment in waste management technologies, other regions are rapidly catching up.

Regional Dynamics:

- North America: Continues to lead due to its advanced infrastructure, stringent environmental regulations, and high waste generation rates. The focus is shifting towards sustainable and technologically advanced compaction solutions.

- Europe: Experiencing steady growth driven by EU environmental policies promoting waste reduction and recycling. Emphasis is placed on energy-efficient and environmentally friendly compactors.

- Asia-Pacific: Shows significant potential due to rapid urbanization and increasing government initiatives aimed at improving waste management infrastructure. Growth is largely concentrated in rapidly developing economies.

Market Segmentation: The industry caters to diverse segments, with the municipal sector currently dominating due to the large volumes of waste generated by cities and towns. The commercial and industrial sectors are also experiencing substantial growth, driven by the need for efficient waste handling in businesses of all sizes.

Refuse Compactor Industry Product Analysis

The Refuse Compactor Industry offers a wide array of solutions tailored to various waste types, volumes, and application needs. This spans from basic manual compactors suitable for smaller businesses to sophisticated automated systems designed for large-scale waste management operations. Key product differentiators include:

- Compaction Efficiency: Advancements focus on maximizing compaction ratios to minimize landfill space requirements.

- Energy Consumption: Manufacturers are prioritizing energy-efficient designs to lower operational costs and reduce environmental impact.

- Automation and Smart Features: Integration of IoT (Internet of Things) technologies allows for real-time monitoring, predictive maintenance, and data-driven optimization.

- Waste Type Specialization: Products are designed to handle various waste streams, including recyclables, organics, and general waste, often with tailored features for each material type.

- Safety and Ergonomics: Modern compactors incorporate safety features and ergonomic designs to enhance operator safety and productivity.

Competitive advantages are derived from a combination of technological innovation, robust build quality, user-friendly interfaces, cost-effectiveness, and strong after-sales service and support.

Key Drivers, Barriers & Challenges in Refuse Compactor Industry

Key Drivers:

- Increasing Urbanization: Rapid urbanization leads to increased waste generation.

- Stringent Environmental Regulations: Governments are implementing stricter regulations on waste management.

- Technological Advancements: Innovations in compaction technology offer improved efficiency and sustainability.

Challenges:

- High Initial Investment Costs: The cost of advanced compaction systems can be a barrier for some municipalities.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components.

- Intense Competition: The market is competitive, with both established and emerging players vying for market share. This competition puts pressure on pricing and profit margins. The estimated impact on revenue is a reduction of approximately $XX million annually.

Growth Drivers in the Refuse Compactor Industry Market

The Refuse Compactor Industry’s growth is significantly driven by increasing urbanization and the subsequent rise in waste generation, stringent environmental regulations enforcing efficient waste management, and continuous technological advancements in compaction technology, offering enhanced efficiency and sustainability.

Challenges Impacting Refuse Compactor Industry Growth

Despite the considerable growth potential, the Refuse Compactor Industry faces several challenges that could impact its trajectory. These include:

- High Initial Investment Costs: Advanced automated systems can represent a significant upfront investment, potentially hindering adoption by smaller businesses or municipalities with limited budgets.

- Supply Chain Volatility: Global supply chain disruptions can affect the availability and pricing of key components, leading to production delays and increased costs.

- Intense Competition: The market is characterized by a substantial number of players, leading to intense competition on price and features, which can compress profit margins.

- Technological Advancements: The rapid pace of technological innovation necessitates continuous investment in R&D to remain competitive and meet evolving market demands.

Key Players Shaping the Refuse Compactor Industry Market

- GE Appliances

- Husmann Umwelttechnik GmbH

- PTR Baler & Compactor

- Marathon Equipment Company

- Capital Compactors Ltd

- Compactor Management Company

- Genesis Waste Handling Private Limited

- Precision Machinery Systems

- ACE Equipment Company

- Wastequip LLC

Significant Refuse Compactor Industry Milestones

- September 2021: Wastequip launched Wasteware, a cloud-based solution for waste and recycling management, enhancing data-driven decision-making in the industry.

- February 2022: The New Town Kolkata Development Authority planned the construction of 15 compactor stations, significantly boosting waste management infrastructure in the region.

Future Outlook for Refuse Compactor Industry Market

The Refuse Compactor Industry is poised for continued growth, driven by urbanization, stringent regulations, and technological innovations. Strategic opportunities lie in developing sustainable and smart compaction solutions, focusing on data-driven optimization, and expanding into emerging markets. The market holds significant potential for further expansion and diversification, particularly in developing countries with rapidly growing waste management needs.

Refuse Compactor Industry Segmentation

-

1. Product Type

- 1.1. Portable

- 1.2. Stationary

-

2. Waste Type

- 2.1. Dry Waste

- 2.2. Wet Waste

-

3. Application

- 3.1. Residential

- 3.2. Agricultural

- 3.3. Municipal

- 3.4. Commercial

- 3.5. Industrial

Refuse Compactor Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Europe

- 6. Rest of the World

Refuse Compactor Industry Regional Market Share

Geographic Coverage of Refuse Compactor Industry

Refuse Compactor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asia-Pacific to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.2. Market Analysis, Insights and Forecast - by Waste Type

- 5.2.1. Dry Waste

- 5.2.2. Wet Waste

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Agricultural

- 5.3.3. Municipal

- 5.3.4. Commercial

- 5.3.5. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Europe

- 5.4.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.2. Market Analysis, Insights and Forecast - by Waste Type

- 6.2.1. Dry Waste

- 6.2.2. Wet Waste

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Residential

- 6.3.2. Agricultural

- 6.3.3. Municipal

- 6.3.4. Commercial

- 6.3.5. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Latin America Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.2. Market Analysis, Insights and Forecast - by Waste Type

- 7.2.1. Dry Waste

- 7.2.2. Wet Waste

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Residential

- 7.3.2. Agricultural

- 7.3.3. Municipal

- 7.3.4. Commercial

- 7.3.5. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.2. Market Analysis, Insights and Forecast - by Waste Type

- 8.2.1. Dry Waste

- 8.2.2. Wet Waste

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Residential

- 8.3.2. Agricultural

- 8.3.3. Municipal

- 8.3.4. Commercial

- 8.3.5. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.2. Market Analysis, Insights and Forecast - by Waste Type

- 9.2.1. Dry Waste

- 9.2.2. Wet Waste

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Residential

- 9.3.2. Agricultural

- 9.3.3. Municipal

- 9.3.4. Commercial

- 9.3.5. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Europe Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.2. Market Analysis, Insights and Forecast - by Waste Type

- 10.2.1. Dry Waste

- 10.2.2. Wet Waste

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Residential

- 10.3.2. Agricultural

- 10.3.3. Municipal

- 10.3.4. Commercial

- 10.3.5. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of the World Refuse Compactor Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.2. Market Analysis, Insights and Forecast - by Waste Type

- 11.2.1. Dry Waste

- 11.2.2. Wet Waste

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Residential

- 11.3.2. Agricultural

- 11.3.3. Municipal

- 11.3.4. Commercial

- 11.3.5. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GE Appliances

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Husmann Umwelttechnik GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PTR Baler & Compactor

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Marathon Equipment Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Capital Compactors Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Compactor Management Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Genesis Waste Handling Private Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Precision Machinery Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ACE Equipment Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Wastequip LLC **List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

List of Figures

- Figure 1: Global Refuse Compactor Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 5: North America Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 7: North America Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 11: Latin America Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Latin America Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 13: Latin America Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 14: Latin America Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Latin America Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Latin America Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 21: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 22: Asia Pacific Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 23: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 29: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 30: Middle East and Africa Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 31: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 35: Europe Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Europe Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 37: Europe Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 38: Europe Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 39: Europe Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Europe Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Europe Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of the World Refuse Compactor Industry Revenue (million), by Product Type 2025 & 2033

- Figure 43: Rest of the World Refuse Compactor Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of the World Refuse Compactor Industry Revenue (million), by Waste Type 2025 & 2033

- Figure 45: Rest of the World Refuse Compactor Industry Revenue Share (%), by Waste Type 2025 & 2033

- Figure 46: Rest of the World Refuse Compactor Industry Revenue (million), by Application 2025 & 2033

- Figure 47: Rest of the World Refuse Compactor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: Rest of the World Refuse Compactor Industry Revenue (million), by Country 2025 & 2033

- Figure 49: Rest of the World Refuse Compactor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 3: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Refuse Compactor Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 7: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 11: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 15: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 19: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 23: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

- Table 25: Global Refuse Compactor Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 26: Global Refuse Compactor Industry Revenue million Forecast, by Waste Type 2020 & 2033

- Table 27: Global Refuse Compactor Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Refuse Compactor Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refuse Compactor Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Refuse Compactor Industry?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, GE Appliances, Husmann Umwelttechnik GmbH, PTR Baler & Compactor, Marathon Equipment Company, Capital Compactors Ltd, Compactor Management Company, Genesis Waste Handling Private Limited, Precision Machinery Systems, ACE Equipment Company, Wastequip LLC **List Not Exhaustive.

3. What are the main segments of the Refuse Compactor Industry?

The market segments include Product Type, Waste Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 280 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asia-Pacific to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: The New Town Kolkata Development Authority has planned to set up 15 compactor stations in different locations across New Town to facilitate a daily waste collection and disposal system. The compactor stations will be constructed at an estimated cost of about Rs 4.1 crore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refuse Compactor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refuse Compactor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refuse Compactor Industry?

To stay informed about further developments, trends, and reports in the Refuse Compactor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence