Key Insights

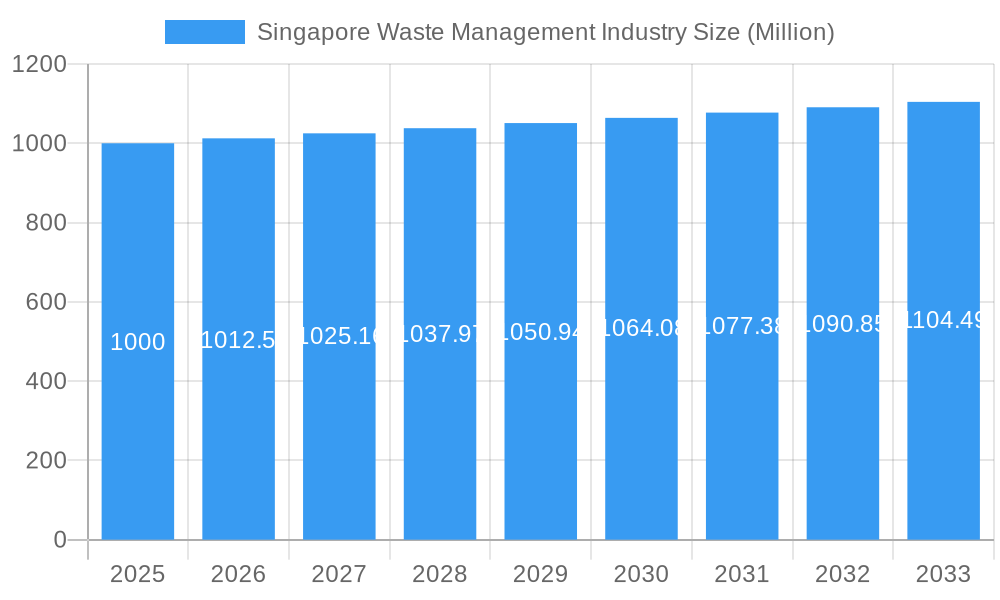

The Singapore waste management market, estimated at $819.26 billion in the base year 2025, is forecast to expand at a Compound Annual Growth Rate (CAGR) of 6.9% from 2025 to 2033. This growth is underpinned by robust environmental regulations, a strong commitment to sustainability, and the imperative for resource recovery, all of which are driving demand for efficient waste management solutions. Increasing urbanization and population growth in Singapore directly correlate with escalating waste generation, further stimulating market expansion. Heightened environmental awareness among both citizens and businesses is also accelerating the adoption of advanced recycling and waste-to-energy technologies, positively influencing industry trajectory. Leading entities such as Sembcorp Environmental Management, Veolia, and Colex Holdings are pivotal in shaping the market through innovation and strategic alliances.

Singapore Waste Management Industry Market Size (In Billion)

Despite a positive outlook, the sector confronts challenges. Limited land availability in Singapore restricts landfill capacity, necessitating innovative waste reduction and advanced management strategies. Volatility in commodity prices for recycled materials can affect the financial viability of recycling operations. Additionally, substantial capital investment for state-of-the-art waste management infrastructure may pose an entry barrier for smaller enterprises. Nevertheless, government initiatives promoting circular economy principles and ongoing advancements in sustainable waste management solutions ensure a promising future. The market will likely witness a shift towards technological innovations in waste-to-energy conversion, sophisticated recycling methodologies, and smart waste management systems to overcome these obstacles and sustain growth.

Singapore Waste Management Industry Company Market Share

Singapore Waste Management Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Singapore Waste Management Industry, offering invaluable insights for investors, industry professionals, and strategic planners. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report leverages rigorous data analysis and expert insights to paint a vivid picture of this crucial sector. The market size is projected to reach xx Million by 2033, presenting substantial growth opportunities.

Singapore Waste Management Industry Market Structure & Competitive Landscape

Singapore's waste management market exhibits a moderately concentrated structure, with key players like Sembcorp Environmental Management Pte Ltd, Veolia Environmental S.A., and Colex Holdings Limited commanding substantial market share. While precise figures fluctuate, the market concentration ratio (CR4) is significant, reflecting a landscape where a few major players dominate. This structure is influenced by stringent government regulations promoting innovative recycling and waste-to-energy solutions. The emergence of alternative waste processing methods, such as composting and anaerobic digestion, is impacting market dynamics, introducing competition and driving innovation. The market caters to residential, commercial, and industrial sectors, with the industrial segment demonstrating the most substantial growth potential due to its high waste generation volume and specific regulatory requirements. Mergers and acquisitions (M&A) activity, while modest in recent years (e.g., approximately XX Million in transaction value between 2019-2024), is projected to increase driven by the need for consolidation and the integration of advanced technologies.

- High regulatory pressure: Stringent environmental regulations drive innovation, investment, and a focus on sustainability.

- Technological advancements: Significant investment in advanced waste treatment technologies, including AI-powered sorting and automated systems, is reshaping the industry.

- Growing environmental awareness: Rising consumer awareness of sustainable practices fuels demand for eco-friendly waste management solutions and transparency in operations.

- Limited land availability: Singapore's limited land area necessitates highly efficient waste management solutions prioritizing resource recovery and minimization of landfill use.

- Government Initiatives: Active government support through funding, policy frameworks, and incentives further fosters innovation and sustainable practices within the sector.

Singapore Waste Management Industry Market Trends & Opportunities

The Singapore waste management market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: increasing urbanization, rising environmental awareness among consumers, and supportive government policies promoting sustainable waste management practices. Technological advancements, such as AI-powered waste sorting and advanced recycling technologies, are transforming the industry landscape. Market penetration rates for innovative waste management solutions are expected to rise significantly, reaching xx% by 2033. However, challenges remain, including managing the increasing volume of electronic waste and ensuring the efficient integration of new technologies. Competitive dynamics are intensifying, with established players facing competition from emerging technology providers and international firms.

Dominant Markets & Segments in Singapore Waste Management Industry

The industrial segment remains a dominant force in Singapore's waste management market, holding a substantial share (e.g., XX% in 2025) of the total market value. This dominance stems from the significant volume of industrial waste generated and the strict regulations governing its disposal. Singapore's geographical limitations act as a catalyst for innovation, particularly in waste-to-energy and resource recovery technologies. The high concentration of industrial activities within specific zones further contributes to this segment's market share.

- Key Growth Drivers in the Industrial Segment:

- Stringent government regulations on industrial waste disposal, including penalties for non-compliance.

- High concentration of industrial activity in designated zones, leading to economies of scale for waste management services.

- Growing adoption of sustainable practices and corporate social responsibility initiatives by industries.

- Increasing demand for efficient, cost-effective, and technologically advanced waste management solutions to improve operational efficiency and reduce environmental impact.

- Government incentives for adopting innovative and sustainable waste management practices in the industrial sector.

- Market Dominance Analysis: The spatial clustering of industrial activities within Singapore directly contributes to the prominence of the industrial waste management segment, creating opportunities for large-scale waste processing facilities and optimized logistics.

Singapore Waste Management Industry Product Analysis

Technological advancements are driving innovation in waste management products and services. Advanced waste-to-energy technologies, automated waste sorting systems, and innovative recycling processes are gaining prominence. These solutions are gaining market acceptance due to their efficiency, environmental benefits, and compliance with stringent regulations. The market is seeing a shift towards integrated waste management solutions offering comprehensive services, from collection and sorting to processing and disposal.

Key Drivers, Barriers & Challenges in Singapore Waste Management Industry

Key Drivers: Stringent government regulations promoting recycling and waste reduction, increasing environmental awareness among citizens, and technological advancements like AI-powered waste sorting and advanced recycling techniques are driving market growth. Furthermore, the limited land availability in Singapore necessitates efficient waste management solutions.

Challenges: High upfront investment costs for advanced technologies, complexities in managing diverse waste streams, and competition from established and emerging players pose significant challenges. Supply chain disruptions can also impact the smooth functioning of the waste management ecosystem. Regulatory hurdles and the need to address public perception around waste management facilities require careful consideration. For example, securing land for new waste treatment facilities can be challenging.

Growth Drivers in the Singapore Waste Management Industry Market

Technological innovation, supportive government policies, and a burgeoning environmental consciousness among citizens are key growth drivers. Specifically, investments in advanced recycling technologies (e.g., AI-powered sorting, chemical recycling), waste-to-energy plants utilizing innovative conversion methods, and smart waste management solutions (e.g., smart bins, real-time monitoring systems) are accelerating market expansion. Stringent regulations, coupled with incentives for sustainable practices, are further incentivizing the adoption of environmentally responsible waste management techniques.

Challenges Impacting Singapore Waste Management Industry Growth

High capital expenditures for advanced technologies, the complexity of managing diverse waste streams, persistent land scarcity, and competition from established players present significant challenges. Navigating complex regulatory compliance, addressing public perceptions regarding waste management facilities, and mitigating supply chain disruptions (especially for specialized equipment) remain crucial considerations. The cost-effectiveness of advanced technologies, their scalability, and achieving a sufficient return on investment are also significant factors in determining market expansion.

Key Players Shaping the Singapore Waste Management Industry Market

- Sembcorp Environmental Management Pte Ltd (Singapore)

- Veolia Environmental S A

- Colex Holdings Limited

- ECO Industrial Environmental Engineering Pte Ltd

- Envipure

- RICTEC PTE LTD

- Industrial Wastes Auction

- Recycling Partners Pte Ltd

- CH E-Recycling

- CITIC Envirotech Ltd

- [Add other relevant key players here]

Significant Singapore Waste Management Industry Industry Milestones

- 2021: Launch of the National Recycling Blueprint, outlining ambitious recycling targets for Singapore.

- 2022: Several significant investments in new waste-to-energy facilities were announced.

- 2023: Introduction of stricter regulations on plastic waste disposal and import.

Future Outlook for Singapore Waste Management Industry Market

The Singapore waste management market is poised for continued growth, driven by technological advancements, supportive government policies, and heightened environmental awareness. Strategic opportunities exist in developing advanced recycling technologies, optimizing waste-to-energy solutions, and implementing smart waste management systems. The market potential is significant, with a focus on achieving sustainable waste management practices in line with national sustainability goals.

Singapore Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Bio-medical waste

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Recycling

Singapore Waste Management Industry Segmentation By Geography

- 1. Singapore

Singapore Waste Management Industry Regional Market Share

Geographic Coverage of Singapore Waste Management Industry

Singapore Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Recycling is a key trend in the Singaporean waste management industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Singapore Waste Management Industry

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Environmental Management Pte Ltd (Singapore)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environmental S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colex Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ECO Industrial Environmental Engineering Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envipure

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RICTEC PTE LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Indsutrial Wastes Auction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Recycling Partners Pte Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CH E-Recycling

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CITIC Envirotech Ltd**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Singapore Waste Management Industry

List of Figures

- Figure 1: Singapore Waste Management Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 2: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 3: Singapore Waste Management Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Waste Management Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 5: Singapore Waste Management Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 6: Singapore Waste Management Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Waste Management Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Singapore Waste Management Industry?

Key companies in the market include Singapore Waste Management Industry, Sembcorp Environmental Management Pte Ltd (Singapore), Veolia Environmental S A, Colex Holdings Limited, ECO Industrial Environmental Engineering Pte Ltd, Envipure, RICTEC PTE LTD, Indsutrial Wastes Auction, Recycling Partners Pte Ltd, CH E-Recycling, CITIC Envirotech Ltd**List Not Exhaustive.

3. What are the main segments of the Singapore Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 819.26 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Recycling is a key trend in the Singaporean waste management industry.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Waste Management Industry?

To stay informed about further developments, trends, and reports in the Singapore Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence