Key Insights

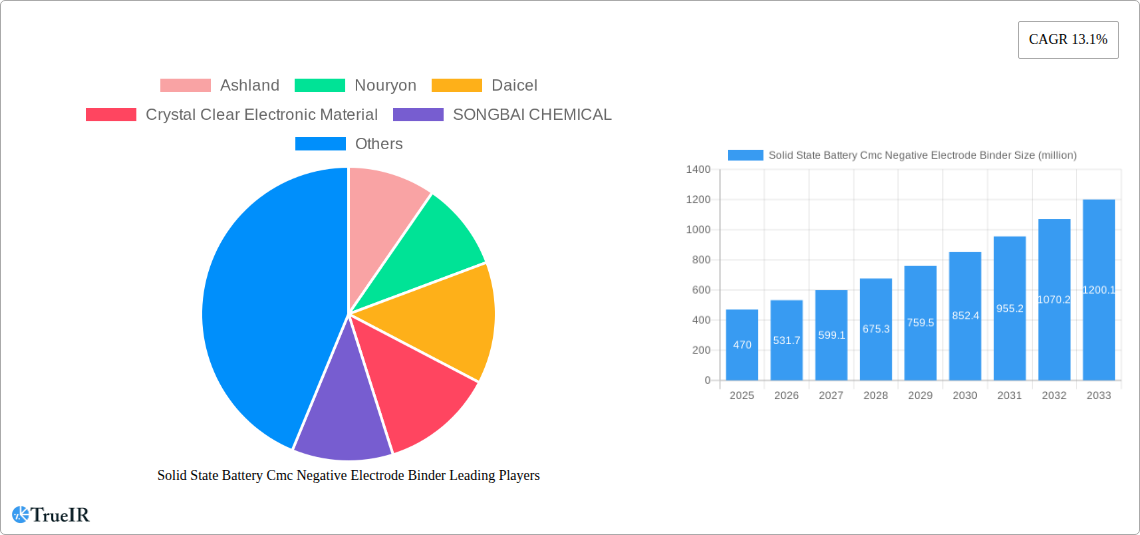

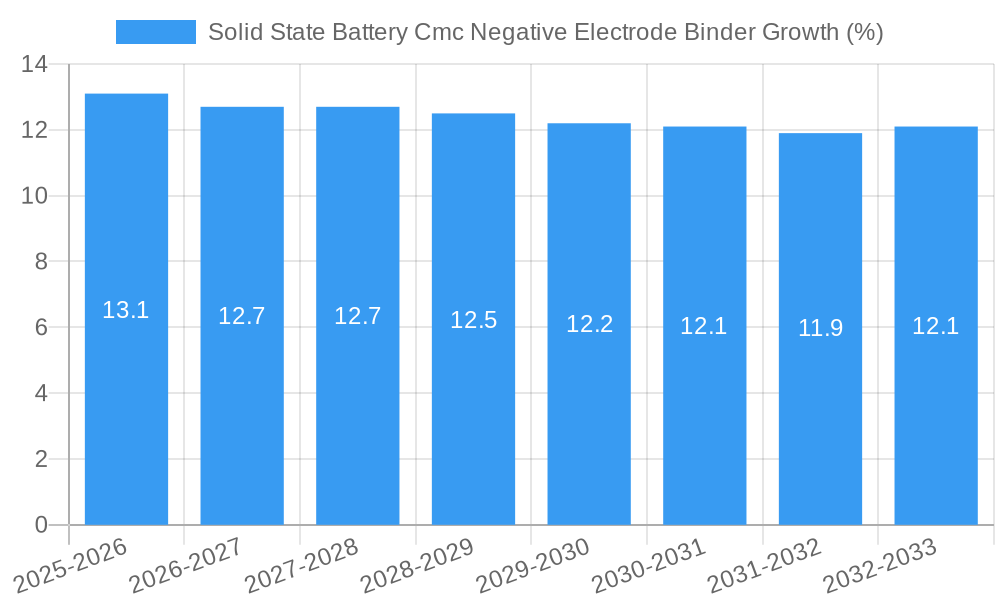

The Solid State Battery CMC Negative Electrode Binder market is poised for substantial expansion, projected to reach a significant valuation of $470 million in 2025. This robust growth is driven by a compelling Compound Annual Growth Rate (CAGR) of 13.1% throughout the forecast period (2025-2033). A primary catalyst for this surge is the escalating demand for advanced battery technologies in the electric vehicle (EV) sector, where solid-state batteries offer superior safety, energy density, and faster charging capabilities compared to traditional lithium-ion batteries. The ongoing global transition towards electrification and stringent emission regulations further amplify the need for high-performance battery components like CMC binders, crucial for enhancing the electrochemical stability and cycle life of negative electrodes in these next-generation batteries. Innovations in material science, particularly in optimizing the performance and scalability of CMC binders with varying degrees of substitution (DS), are also instrumental in meeting the evolving requirements of power batteries.

The market landscape is further shaped by significant trends in the broader battery industry. The increasing adoption of solid-state batteries across consumer electronics and grid-scale energy storage solutions, beyond just automotive applications, will create diversified revenue streams. While the market enjoys strong growth drivers, potential restraints include the high cost of materials and manufacturing processes associated with solid-state battery production, which can impact widespread adoption rates initially. Furthermore, the complex supply chain for specialized chemical binders like CMC necessitates strategic partnerships and technological advancements to ensure consistent quality and availability. Key players such as Ashland, Nouryon, and Daicel are at the forefront of developing and supplying these critical materials, focusing on research and development to overcome these challenges and capitalize on the burgeoning market opportunities, especially in technologically advanced regions like Asia Pacific, North America, and Europe.

Solid State Battery CMC Negative Electrode Binder Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report provides an in-depth analysis of the global Solid State Battery CMC Negative Electrode Binder market, a critical component for advancing next-generation battery technologies. Leveraging high-volume keywords and structured for optimal SEO performance, this report offers invaluable insights for industry stakeholders, researchers, and investors. The study period encompasses historical data from 2019 to 2024, with a base year of 2025 and a comprehensive forecast period extending to 2033.

Solid State Battery Cmc Negative Electrode Binder Market Structure & Competitive Landscape

The Solid State Battery CMC Negative Electrode Binder market is characterized by a dynamic and evolving competitive landscape. Market concentration varies across different geographical regions and specific product segments. Innovation drivers are primarily focused on enhancing binder performance, including improved ionic conductivity, electrochemical stability, and adhesion properties essential for solid-state electrolytes. Regulatory impacts, while still nascent in some regions, are beginning to shape market entry and product development, particularly concerning safety and environmental standards for battery materials. Product substitutes, such as other polymer binders or inorganic binders, are under continuous development, posing a competitive challenge. End-user segmentation reveals a strong demand from the Power Battery sector, driven by the burgeoning electric vehicle (EV) market and grid-scale energy storage solutions. Consumer Battery applications also contribute significantly, albeit with different performance requirements. Mergers and acquisitions (M&A) activity is on the rise as key players seek to consolidate market share, acquire critical technologies, and expand their product portfolios. For instance, estimated M&A volumes in the advanced battery materials sector have reached in the tens of millions of dollars annually in recent years, reflecting strategic investments and consolidation efforts to capture market share. Concentration ratios in specific high-purity CMC binder segments are estimated to be in the range of 40-60%, indicating a moderately concentrated market.

Solid State Battery Cmc Negative Electrode Binder Market Trends & Opportunities

The Solid State Battery CMC Negative Electrode Binder market is poised for substantial growth, driven by the relentless pursuit of higher energy density, improved safety, and longer cycle life in battery technologies. The projected market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 25% over the forecast period, reaching tens of billions of dollars by 2033. This robust growth is fueled by significant technological shifts towards solid-state electrolytes, which necessitate advanced binder solutions like Carboxymethyl Cellulose (CMC) to ensure proper electrode integrity and ion transport. Consumer preferences are increasingly leaning towards batteries with faster charging capabilities, enhanced safety features, and extended lifespans, all of which are key benefits offered by solid-state battery technology and its associated binders. Competitive dynamics are intensifying, with established chemical manufacturers and emerging specialty material providers investing heavily in research and development to secure a competitive edge. The market penetration rate for CMC binders in solid-state batteries is rapidly increasing, moving from niche applications to mainstream adoption as solid-state battery manufacturing scales up. Emerging opportunities lie in developing tailored CMC grades with specific degrees of substitution (DS) to optimize performance for diverse solid-state electrolyte chemistries, including sulfide-based, oxide-based, and polymer-based electrolytes. Furthermore, the development of cost-effective and scalable manufacturing processes for high-purity CMC binders will be crucial for widespread market adoption. The demand for enhanced thermal stability and mechanical strength in binders is another key trend, directly influencing product development and innovation. As the automotive industry continues its aggressive push towards electrification, the demand for high-performance CMC binders for power batteries is expected to surge, representing a multi-billion dollar opportunity. Similarly, the growing adoption of renewable energy sources is driving the need for advanced energy storage solutions, further bolstering the demand for solid-state batteries and their key components. The market is also witnessing a growing interest in binders that can facilitate easier manufacturing processes for solid-state battery electrodes, reducing production costs and improving scalability. The increasing focus on battery recycling and sustainability is also creating opportunities for the development of bio-based or easily recyclable CMC binders.

Dominant Markets & Segments in Solid State Battery Cmc Negative Electrode Binder

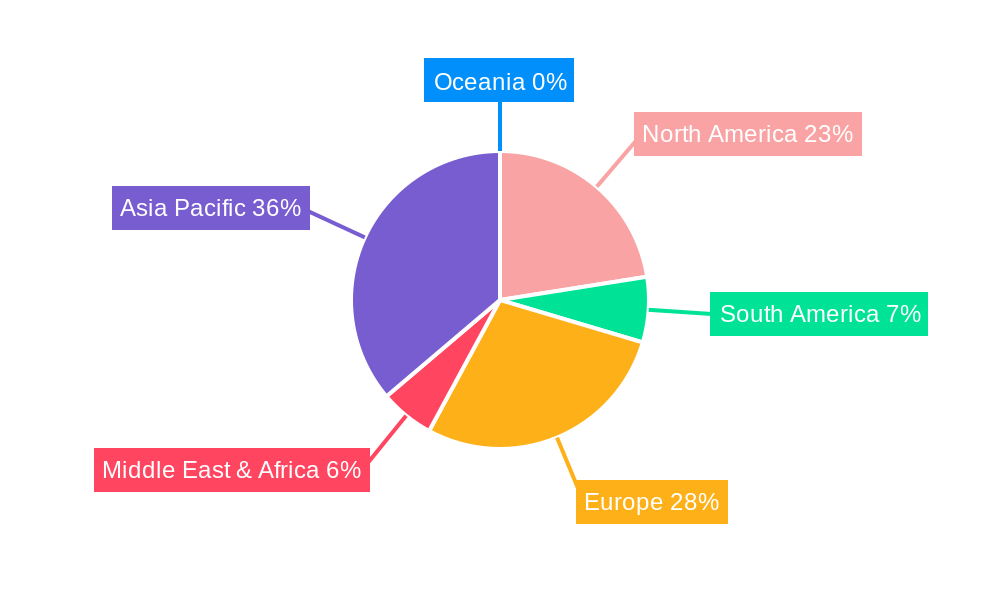

The global Solid State Battery CMC Negative Electrode Binder market exhibits distinct regional and segmental dominance, driven by a confluence of technological advancements, policy support, and end-user demand.

Dominant Region

North America and Asia Pacific are emerging as the leading regions in the Solid State Battery CMC Negative Electrode Binder market.

- Asia Pacific: This region, particularly China, South Korea, and Japan, is at the forefront of solid-state battery research, development, and manufacturing. Extensive government incentives for electric vehicles (EVs) and renewable energy infrastructure, coupled with a robust existing battery manufacturing ecosystem, are significant growth drivers. The sheer volume of battery production for consumer electronics and power applications in this region creates a massive demand for advanced battery materials. Policies promoting the adoption of solid-state batteries for grid-scale energy storage further bolster market growth. The presence of major battery manufacturers and material suppliers in this region fosters innovation and rapid market penetration.

- North America: The United States is experiencing a surge in solid-state battery research and manufacturing investments, supported by federal initiatives aimed at achieving battery supply chain independence and accelerating EV adoption. State-level policies and private sector funding for battery technology startups are also contributing to market expansion. The growing demand for advanced battery solutions in consumer electronics and emerging aerospace applications also fuels market growth.

Dominant Application Segments

- Power Battery: This segment holds the largest market share and is projected to witness the highest growth rate. The burgeoning electric vehicle (EV) market is the primary driver, with automakers investing billions of dollars in solid-state battery technology to achieve longer ranges, faster charging, and improved safety. The demand for high-performance CMC binders with superior adhesion and ionic conductivity is paramount for power batteries to meet these stringent requirements.

- Energy Storage Battery: The expansion of renewable energy sources like solar and wind power necessitates efficient and reliable energy storage solutions. Solid-state batteries offer a safer and more durable alternative to conventional lithium-ion batteries for grid-scale energy storage. CMC binders play a crucial role in ensuring the longevity and performance of these large-scale battery systems.

- Consumer Battery: While not as dominant as power batteries, the consumer battery segment is also a significant contributor. Solid-state batteries are being explored for premium consumer electronics, wearable devices, and medical implants where safety, miniaturization, and long operational life are critical.

Dominant Type Segments (Degree of Substitution - DS)

The performance of CMC binders is highly dependent on their degree of substitution (DS), which influences their solubility, viscosity, and electrochemical properties.

- Degree of Substitution (DS) at 1% Content: 0.6-0.8: Binders with a DS in this range offer a good balance of solubility and viscosity, making them suitable for a wide range of general-purpose applications in solid-state battery electrodes. They are often used in applications where a moderate level of binder strength and ionic conductivity is sufficient.

- Degree of Substitution (DS) at 1% Content: 0.8-1: This DS range is critical for high-performance applications where enhanced ionic conductivity and improved binding strength are required. These binders are preferred for power batteries and advanced energy storage systems demanding superior electrochemical performance and cycle life. Their precise molecular structure allows for better integration with solid-state electrolytes.

- Degree of Substitution (DS) at 1% Content: Above 1: Binders with a DS above 1 are typically designed for specialized, high-end applications requiring exceptional performance characteristics. These might include ultra-high energy density batteries or extreme temperature operating conditions. Their unique properties offer advanced solutions for cutting-edge solid-state battery designs.

The interplay of these regional, application, and type segments creates a complex yet opportunity-rich market landscape for Solid State Battery CMC Negative Electrode Binders.

Solid State Battery Cmc Negative Electrode Binder Product Analysis

Solid State Battery CMC Negative Electrode Binders represent a significant advancement in battery material science. These binders are specifically engineered to address the unique challenges of solid-state electrolytes, offering superior adhesion between the electrolyte and active materials, enhanced ionic conductivity, and improved mechanical stability. Innovations focus on developing CMC derivatives with tailored degrees of substitution (DS) and molecular weights to optimize performance for different solid-state battery chemistries. Key competitive advantages include their ability to form robust electrode structures, their electrochemical inertness within the solid-state environment, and their contribution to increased battery energy density and cycle life. The market fit for these binders is primarily within next-generation solid-state batteries for power, consumer, and energy storage applications.

Key Drivers, Barriers & Challenges in Solid State Battery Cmc Negative Electrode Binder

Key Drivers:

The Solid State Battery CMC Negative Electrode Binder market is propelled by several key forces. Technological advancements in solid-state battery chemistries, such as sulfide-based and oxide-based electrolytes, necessitate specialized binder solutions that can withstand aggressive electrochemical environments. The escalating demand for electric vehicles (EVs) with longer ranges and faster charging capabilities is a primary economic driver, creating a multi-billion dollar market opportunity for advanced battery materials. Government initiatives and favorable policies promoting EV adoption and renewable energy integration further incentivize the development and adoption of solid-state batteries, thereby driving the demand for high-performance CMC binders. The continuous pursuit of enhanced battery safety and energy density by device manufacturers also acts as a significant catalyst.

Barriers & Challenges:

Despite the promising outlook, several challenges impact the growth of the Solid State Battery CMC Negative Electrode Binder market. High production costs associated with specialized, high-purity CMC binders remain a significant restraint, limiting their widespread adoption in cost-sensitive applications. Supply chain issues related to the sourcing of high-quality raw materials and consistent production capacity can create bottlenecks. Regulatory complexities in different regions regarding battery safety standards and material certifications can slow down market entry and product approvals. Intense competitive pressures from alternative binder technologies and established lithium-ion battery solutions also pose a challenge. Overcoming these barriers will require continued innovation in manufacturing processes, strategic partnerships, and a harmonized regulatory framework. For instance, achieving cost parity with conventional binders is estimated to require a 30-50% reduction in manufacturing costs for specialized CMC grades.

Growth Drivers in the Solid State Battery Cmc Negative Electrode Binder Market

The Solid State Battery CMC Negative Electrode Binder market is experiencing robust growth driven by several critical factors. The technological advancements in solid-state electrolyte formulations, demanding binders with enhanced ionic conductivity and electrochemical stability, are key technical drivers. Economically, the exponential growth of the electric vehicle (EV) industry, coupled with the increasing adoption of renewable energy storage systems, creates a massive demand for next-generation batteries. Government policies and incentives supporting battery research, development, and manufacturing globally are also significant growth catalysts. Furthermore, the growing consumer demand for safer, more energy-dense, and longer-lasting batteries is pushing manufacturers to adopt solid-state technologies, directly benefiting the CMC binder market.

Challenges Impacting Solid State Battery Cmc Negative Electrode Binder Growth

The growth of the Solid State Battery CMC Negative Electrode Binder market is not without its obstacles. The high cost of producing specialized, high-purity CMC binders remains a significant barrier to widespread adoption, particularly in price-sensitive consumer electronics. Ensuring a consistent and reliable supply chain for raw materials and finished products can be challenging, leading to potential production delays. Navigating diverse and evolving regulatory landscapes across different regions regarding battery safety and material composition adds complexity. The intense competitive pressure from established binder technologies and alternative solid-state materials necessitates continuous innovation and cost optimization. Quantifiable impacts include potential delays in large-scale battery production of up to 10-15% due to supply chain disruptions.

Key Players Shaping the Solid State Battery Cmc Negative Electrode Binder Market

- Ashland

- Nouryon

- Daicel

- Crystal Clear Electronic Material

- SONGBAI CHEMICAL

- JinBang Power Source Technology

- Chongqing Lihong Fine Chemicals

Significant Solid State Battery Cmc Negative Electrode Binder Industry Milestones

- 2020 Jan: Introduction of novel CMC formulations with improved ionic conductivity by leading chemical manufacturers.

- 2021 Feb: Significant increase in R&D investments from major automotive companies into solid-state battery technology.

- 2022 Apr: Development of scalable pilot production lines for high-purity CMC binders for solid-state applications.

- 2023 Jun: Announcement of strategic partnerships between binder suppliers and solid-state battery developers to accelerate commercialization.

- 2024 Mar: Growing number of successful prototype solid-state battery integrations in consumer electronics and EVs.

Future Outlook for Solid State Battery Cmc Negative Electrode Binder Market

The future outlook for the Solid State Battery CMC Negative Electrode Binder market is exceptionally bright, driven by the accelerating transition to advanced battery technologies. Strategic opportunities lie in developing highly customized CMC binders tailored to specific solid-state electrolyte chemistries and cell designs, aiming to maximize performance and minimize cost. The expansion of the electric vehicle market, coupled with the critical need for robust energy storage solutions for renewable energy grids, will continue to fuel demand. Innovations in binder processing and manufacturing techniques are expected to lead to significant cost reductions, thereby increasing market accessibility. The market potential is estimated to grow into tens of billions of dollars by 2033, with continued investment in research and development being paramount for players to capture a substantial share of this rapidly expanding sector.

Solid State Battery Cmc Negative Electrode Binder Segmentation

-

1. Application

- 1.1. Power Battery

- 1.2. Consumer Battery

- 1.3. Energy Storage Battery

-

2. Type

- 2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 2.3. Degree of Substitution (DS) at 1% Content: Above 1

Solid State Battery Cmc Negative Electrode Binder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Solid State Battery Cmc Negative Electrode Binder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solid State Battery Cmc Negative Electrode Binder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Battery

- 5.1.2. Consumer Battery

- 5.1.3. Energy Storage Battery

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 5.2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 5.2.3. Degree of Substitution (DS) at 1% Content: Above 1

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Solid State Battery Cmc Negative Electrode Binder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Battery

- 6.1.2. Consumer Battery

- 6.1.3. Energy Storage Battery

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 6.2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 6.2.3. Degree of Substitution (DS) at 1% Content: Above 1

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Solid State Battery Cmc Negative Electrode Binder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Battery

- 7.1.2. Consumer Battery

- 7.1.3. Energy Storage Battery

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 7.2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 7.2.3. Degree of Substitution (DS) at 1% Content: Above 1

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Solid State Battery Cmc Negative Electrode Binder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Battery

- 8.1.2. Consumer Battery

- 8.1.3. Energy Storage Battery

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 8.2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 8.2.3. Degree of Substitution (DS) at 1% Content: Above 1

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power Battery

- 9.1.2. Consumer Battery

- 9.1.3. Energy Storage Battery

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 9.2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 9.2.3. Degree of Substitution (DS) at 1% Content: Above 1

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Solid State Battery Cmc Negative Electrode Binder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power Battery

- 10.1.2. Consumer Battery

- 10.1.3. Energy Storage Battery

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Degree of Substitution (DS) at 1% Content: 0.6-0.8

- 10.2.2. Degree of Substitution (DS) at 1% Content: 0.8-1

- 10.2.3. Degree of Substitution (DS) at 1% Content: Above 1

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ashland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daicel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crystal Clear Electronic Material

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SONGBAI CHEMICAL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JinBang Power Source Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chongqing Lihong Fine Chemicals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Ashland

List of Figures

- Figure 1: Global Solid State Battery Cmc Negative Electrode Binder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Application 2024 & 2032

- Figure 3: North America Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Type 2024 & 2032

- Figure 5: North America Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Country 2024 & 2032

- Figure 7: North America Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Application 2024 & 2032

- Figure 9: South America Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Type 2024 & 2032

- Figure 11: South America Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Country 2024 & 2032

- Figure 13: South America Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Solid State Battery Cmc Negative Electrode Binder Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Solid State Battery Cmc Negative Electrode Binder Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solid State Battery Cmc Negative Electrode Binder?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the Solid State Battery Cmc Negative Electrode Binder?

Key companies in the market include Ashland, Nouryon, Daicel, Crystal Clear Electronic Material, SONGBAI CHEMICAL, JinBang Power Source Technology, Chongqing Lihong Fine Chemicals.

3. What are the main segments of the Solid State Battery Cmc Negative Electrode Binder?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 470 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solid State Battery Cmc Negative Electrode Binder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solid State Battery Cmc Negative Electrode Binder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solid State Battery Cmc Negative Electrode Binder?

To stay informed about further developments, trends, and reports in the Solid State Battery Cmc Negative Electrode Binder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence