Key Insights

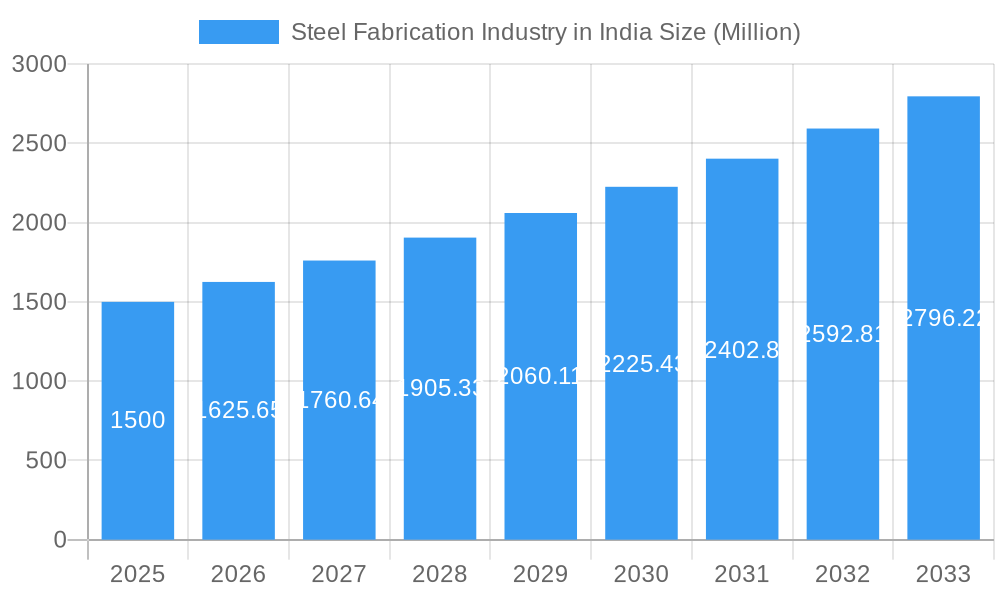

The Indian steel fabrication market is poised for significant expansion, driven by escalating infrastructure development across construction, energy, and manufacturing sectors. The market, currently valued at 3.38 billion, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.37% from 2024 to 2033. This growth is propelled by government initiatives supporting industrialization, urbanization, and domestic manufacturing under the "Make in India" campaign. Increased demand for steel in major infrastructure projects, including highways, railways, and smart cities, alongside the adoption of advanced fabrication techniques, underscores the positive market outlook.

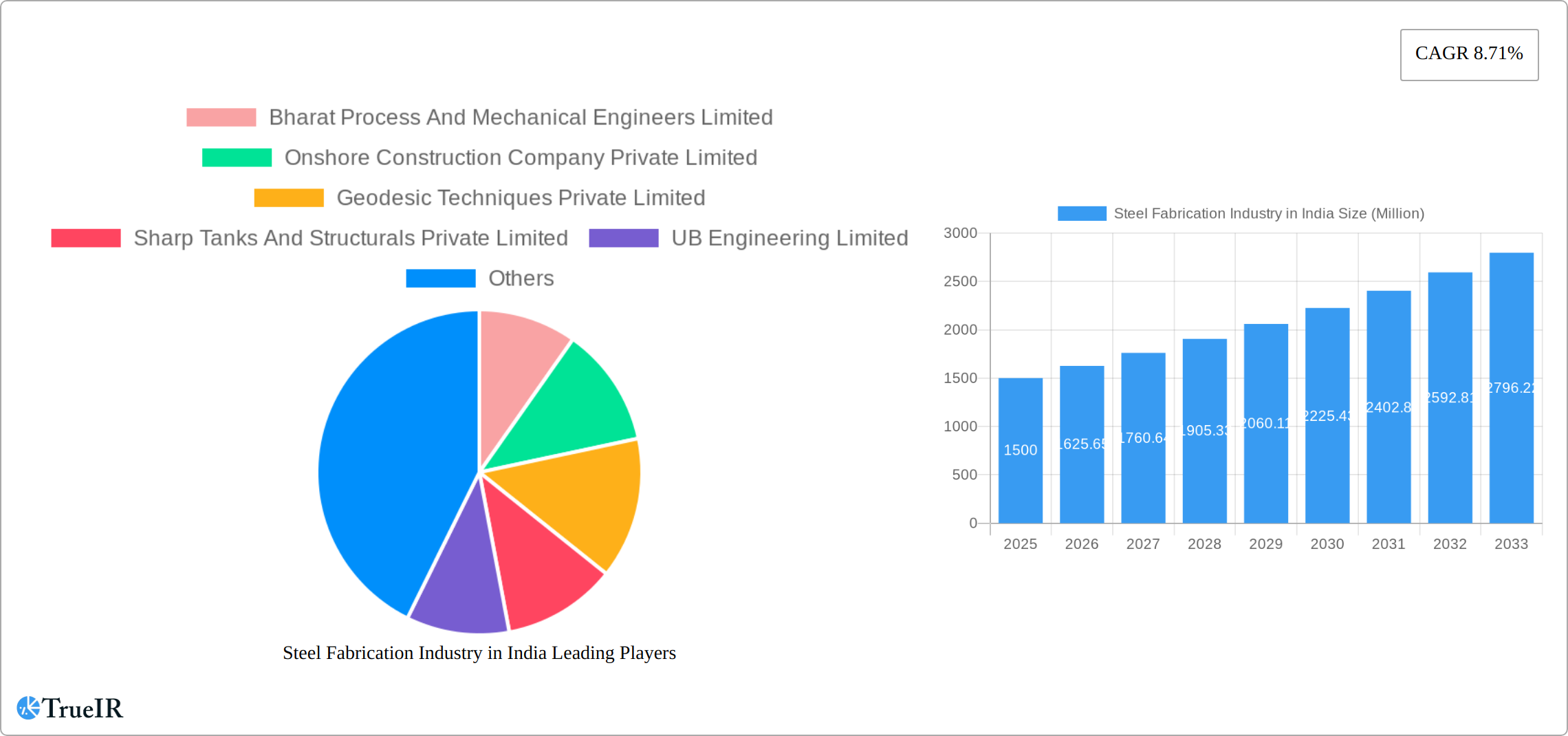

Steel Fabrication Industry in India Market Size (In Billion)

While challenges like raw material price volatility, skilled labor shortages, and environmental regulations exist, the industry demonstrates robust adaptability. Diversified applications across sectors enhance market stability. Investments in automation and technology are improving efficiency and competitiveness. Strategic partnerships and collaborations are fostering knowledge exchange and market penetration. The market comprises a dynamic mix of large and small-scale enterprises, with growth concentrated in regions experiencing high infrastructure activity and industrial concentration.

Steel Fabrication Industry in India Company Market Share

Steel Fabrication Industry in India: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the Indian steel fabrication industry, offering valuable insights into market structure, trends, opportunities, and challenges. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and researchers seeking a comprehensive understanding of this burgeoning sector. The report leverages extensive data analysis and expert insights to provide a clear picture of the current market landscape and future growth prospects. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Steel Fabrication Industry in India Market Structure & Competitive Landscape

The Indian steel fabrication industry is characterized by a moderately fragmented market structure, with a high number of small and medium-sized enterprises (SMEs) alongside larger players. Market concentration, measured by the Herfindahl-Hirschman Index (HHI), is estimated at xx in 2025, indicating a moderately competitive landscape. Innovation is primarily driven by the need to improve efficiency, enhance product quality, and reduce costs. Government regulations, including those related to safety, environmental protection, and quality standards, significantly impact the industry. Steel fabrication faces competition from alternative materials such as aluminum and composites, but steel's strength, durability, and cost-effectiveness maintain its dominance across various applications. End-user segmentation spans construction, infrastructure, automotive, manufacturing, and energy sectors.

- Market Concentration: HHI of xx in 2025, indicating moderate fragmentation.

- Innovation Drivers: Efficiency gains, quality enhancement, cost reduction.

- Regulatory Impacts: Safety, environmental, and quality standards.

- Product Substitutes: Aluminum, composites; however, steel retains market dominance.

- End-User Segmentation: Construction, infrastructure, automotive, manufacturing, energy.

- M&A Trends: Recent acquisitions, such as AM Mining India's acquisition of Uttam Galva Steels (Nov 2022), highlight strategic consolidation in the market, with an estimated xx Million in M&A activity during 2019-2024.

Steel Fabrication Industry in India Market Trends & Opportunities

The Indian steel fabrication market is experiencing robust growth, driven by factors such as increasing infrastructure development, industrialization, and urbanization. The market size is estimated at xx Million in 2025, with a projected growth to xx Million by 2033. Technological advancements such as automation, robotics, and advanced manufacturing techniques are enhancing productivity and precision. Consumer preferences are shifting towards higher-quality, customized, and sustainable steel fabrication solutions. This creates opportunities for companies to focus on niche markets and specialized products. Intense competition necessitates innovation in product design, manufacturing processes, and customer service. The market's growth is projected to continue at a significant rate, exceeding the global average due to favorable government policies and the country's robust economic growth. The CAGR during the forecast period is estimated at xx%. Market penetration rates are steadily increasing, particularly in the infrastructure and construction sectors.

Dominant Markets & Segments in Steel Fabrication Industry in India

The construction and infrastructure sectors stand as the bedrock of steel fabrication demand in India. This sustained leadership is directly attributable to substantial government outlays on critical infrastructure projects such as highways, railways, airports, and bridges, alongside the dynamic growth of the real estate market. Beyond these primary drivers, other crucial segments contributing to market activity include automotive manufacturing, the production of industrial equipment, and the rapidly expanding renewable energy infrastructure, particularly in solar and wind power installations.

-

Key Growth Drivers:

- Unprecedented scale of national infrastructure development projects, including Smart Cities Mission and dedicated freight corridors.

- Continued robust expansion of the residential, commercial, and industrial real estate sectors, fueled by urbanization and economic growth.

- Proactive government initiatives like 'Make in India' and Production Linked Incentives (PLI) schemes that encourage domestic manufacturing and industrial expansion.

- Significant and increasing investment in renewable energy infrastructure, requiring substantial fabricated steel components for solar farms, wind turbines, and associated transmission networks.

- Growing demand for specialized fabricated steel for sectors like oil and gas exploration, mining, and defence.

-

Market Dominance Analysis: The construction and infrastructure sectors collectively command an estimated 60-70% of the overall Indian steel fabrication market, dwarfing contributions from other industry segments. This underscores their pivotal role in shaping market trends and driving demand.

Steel Fabrication Industry in India Product Analysis

Product innovation in India's steel fabrication landscape is characterized by a strong focus on developing and delivering higher-strength, lighter-weight, and exceptionally corrosion-resistant steel products. The industry is increasingly venturing into specialized and niche applications, including the design and manufacture of advanced pre-engineered buildings (PEBs) for rapid construction, robust offshore structures for the oil and gas industry, and critical components for high-speed rail networks. Competitive advantages are being carved out through a combination of cost-effectiveness, adherence to stringent delivery timelines, and an unwavering commitment to superior product quality and bespoke customization to meet the unique specifications of a diverse clientele. The integration of cutting-edge technological advancements, such as additive manufacturing (3D printing) for complex geometries and high-precision laser cutting, is significantly enhancing manufacturing accuracy, boosting productivity, and elevating overall product quality. This technological infusion also provides greater design flexibility, enabling fabricators to precisely cater to an expanding spectrum of customer demands and evolving industry requirements.

Key Drivers, Barriers & Challenges in Steel Fabrication Industry in India

Key Drivers:

- Government Initiatives: Ambitious infrastructure development projects, including Bharatmala Pariyojana, Sagarmala, and the expansion of national highways and railways, serve as substantial demand generators for fabricated steel products.

- Economic Growth and Urbanization: India's sustained economic growth, coupled with rapid urbanization, translates into increased disposable incomes and a corresponding surge in demand across the construction, automotive, and consumer goods sectors, all of which rely heavily on steel fabrication.

- Technological Advancements and Automation: The adoption of automation, robotics, and advanced manufacturing processes (e.g., CNC machining, automated welding) is significantly enhancing operational efficiency, improving product precision, and reducing manufacturing lead times.

- Focus on Sustainability and Green Building: Growing environmental consciousness is driving demand for fabricated steel solutions that are energy-efficient, recyclable, and contribute to sustainable construction practices.

Challenges and Restraints:

- Raw Material Price Volatility: Significant fluctuations in the global and domestic prices of steel, a primary input, directly impact profitability margins and necessitate agile pricing strategies and robust procurement management.

- Supply Chain Disruptions: Global and domestic logistical challenges, including transportation bottlenecks, port congestion, and unforeseen events, can lead to production delays and impact the timely delivery of fabricated products, affecting project schedules and customer satisfaction.

- Intense Competition and Price Pressures: The Indian steel fabrication market is highly competitive, with numerous players vying for market share. This often leads to price pressures, compelling companies to focus on operational efficiency and value-added services to maintain profitability.

- Skilled Workforce Shortage: A persistent challenge is the availability of a skilled workforce with expertise in advanced fabrication techniques and the operation of sophisticated machinery.

- Stringent Quality and Safety Standards: Meeting increasingly rigorous international and domestic quality and safety standards requires continuous investment in training, technology, and quality control systems.

Growth Drivers in the Steel Fabrication Industry in India Market

The robust growth trajectory of the Indian steel fabrication market is primarily propelled by substantial government investments in ambitious infrastructure development programs, accelerating urbanization trends, and comprehensive industrialization initiatives aimed at boosting domestic manufacturing capabilities. Furthermore, significant technological advancements, particularly in the realms of automation, robotics, and the adoption of advanced manufacturing processes, are instrumental in driving substantial productivity improvements and elevating the quality and complexity of fabricated steel products. Favorable government policies, including those designed to streamline project approvals, promote domestic manufacturing, and incentivize infrastructure development, act as crucial catalysts, creating a conducive environment for sustained market expansion.

Challenges Impacting Steel Fabrication Industry in India Growth

The Indian steel fabrication industry faces challenges such as raw material price volatility, potential supply chain disruptions and intense competition from both domestic and international players. Regulatory complexities, including environmental and safety standards, add operational costs. These factors can significantly affect overall profitability and market growth.

Key Players Shaping the Steel Fabrication Industry in India Market

- Bharat Process And Mechanical Engineers Limited

- Onshore Construction Company Private Limited

- Geodesic Techniques Private Limited

- Sharp Tanks And Structurals Private Limited

- UB Engineering Limited

- Space Chem Engineers Private Limited

- Arun Fabricators

- Indhya Engineering Associates

- DD Erectors

- John Erectors Private Limited (List Not Exhaustive - this list includes leading companies contributing to the industry's dynamism and innovation.)

Significant Steel Fabrication Industry in India Industry Milestones

- November 2022: AM Mining India completed the acquisition of Uttam Galva Steels, consolidating market share and potentially impacting downstream operations.

- April 2023: AM Mining, a joint venture between ArcelorMittal and Nippon Steel, acquired Indian Steel Corporation for INR 897 crore, strengthening downstream capabilities and broadening product portfolios.

Future Outlook for Steel Fabrication Industry in India Market

The Indian steel fabrication industry is poised for significant growth, driven by continued government investment in infrastructure, the expansion of manufacturing, and sustained economic development. Strategic opportunities exist in specialized fabrication, sustainable solutions, and technological advancements. The market's robust growth is expected to continue, presenting promising prospects for both established players and new entrants.

Steel Fabrication Industry in India Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Energy

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

Steel Fabrication Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

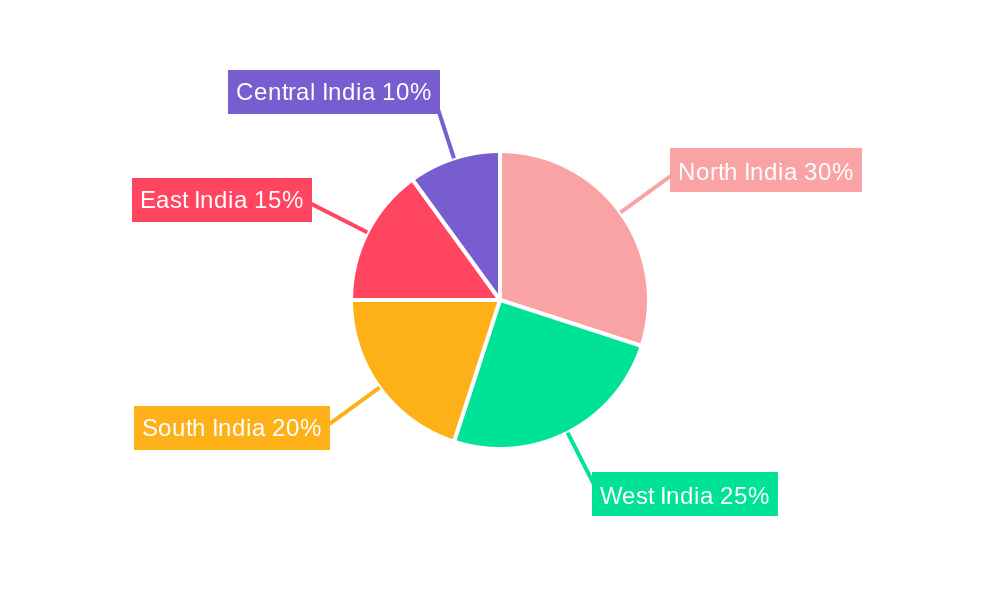

Steel Fabrication Industry in India Regional Market Share

Geographic Coverage of Steel Fabrication Industry in India

Steel Fabrication Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- 3.4. Market Trends

- 3.4.1. Rising Demand for Pre-engineered Buildings and Components

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Energy

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Manufacturing

- 6.1.2. Power and Energy

- 6.1.3. Construction

- 6.1.4. Oil and Gas

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Heavy Sectional Steel

- 6.2.2. Light Sectional Steel

- 6.2.3. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. South America Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Manufacturing

- 7.1.2. Power and Energy

- 7.1.3. Construction

- 7.1.4. Oil and Gas

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Heavy Sectional Steel

- 7.2.2. Light Sectional Steel

- 7.2.3. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Manufacturing

- 8.1.2. Power and Energy

- 8.1.3. Construction

- 8.1.4. Oil and Gas

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Heavy Sectional Steel

- 8.2.2. Light Sectional Steel

- 8.2.3. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Middle East & Africa Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Manufacturing

- 9.1.2. Power and Energy

- 9.1.3. Construction

- 9.1.4. Oil and Gas

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Heavy Sectional Steel

- 9.2.2. Light Sectional Steel

- 9.2.3. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Asia Pacific Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Manufacturing

- 10.1.2. Power and Energy

- 10.1.3. Construction

- 10.1.4. Oil and Gas

- 10.1.5. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Heavy Sectional Steel

- 10.2.2. Light Sectional Steel

- 10.2.3. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bharat Process And Mechanical Engineers Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Onshore Construction Company Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Geodesic Techniques Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sharp Tanks And Structurals Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UB Engineering Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Space Chem Engineers Private Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arun Fabricators

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Indhya Engineering Associates

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DD Erectors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 John Erectors Private Limited**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bharat Process And Mechanical Engineers Limited

List of Figures

- Figure 1: Global Steel Fabrication Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: South America Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: South America Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 27: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Steel Fabrication Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 39: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Steel Fabrication Industry in India?

The projected CAGR is approximately 4.37%.

2. Which companies are prominent players in the Steel Fabrication Industry in India?

Key companies in the market include Bharat Process And Mechanical Engineers Limited, Onshore Construction Company Private Limited, Geodesic Techniques Private Limited, Sharp Tanks And Structurals Private Limited, UB Engineering Limited, Space Chem Engineers Private Limited, Arun Fabricators, Indhya Engineering Associates, DD Erectors, John Erectors Private Limited**List Not Exhaustive.

3. What are the main segments of the Steel Fabrication Industry in India?

The market segments include End-user Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India.

6. What are the notable trends driving market growth?

Rising Demand for Pre-engineered Buildings and Components.

7. Are there any restraints impacting market growth?

Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India.

8. Can you provide examples of recent developments in the market?

April 2023: AM Mining, a joint venture between Arcelor Mittal Luxembourg and Nippon Steel Corporation, Japan to acquire Indian Steel Corpn for INR 897 crore. The acquisition of Indian Steel Corporation will likely enhance downstream capabilities and broaden its product portfolio as the company looks to capitalize on market opportunities presented by the steel industry, especially in high-value-added steel production besides capturing synergies across downstream operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Steel Fabrication Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Steel Fabrication Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Steel Fabrication Industry in India?

To stay informed about further developments, trends, and reports in the Steel Fabrication Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence