Key Insights

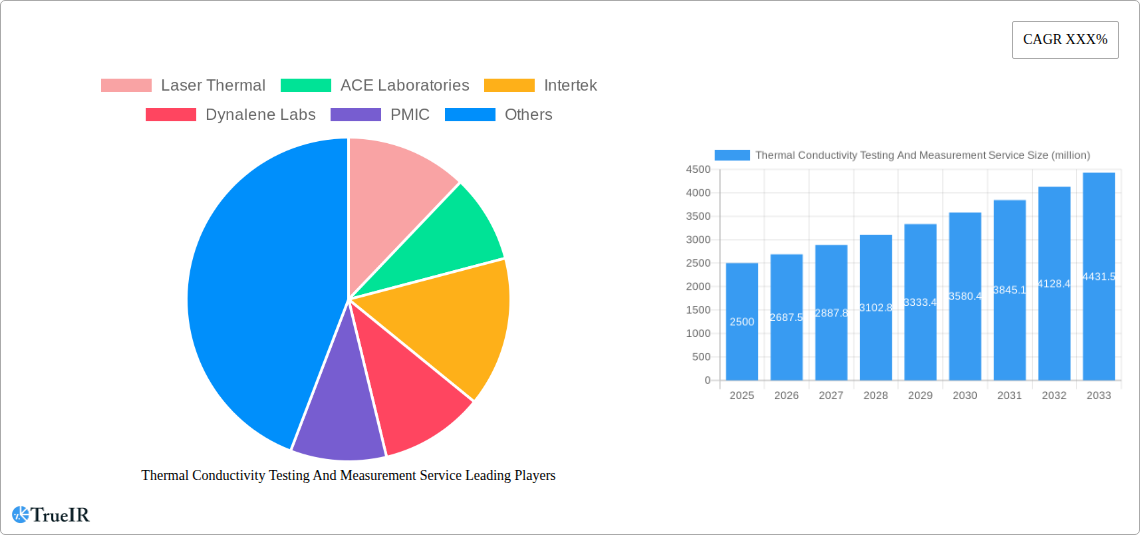

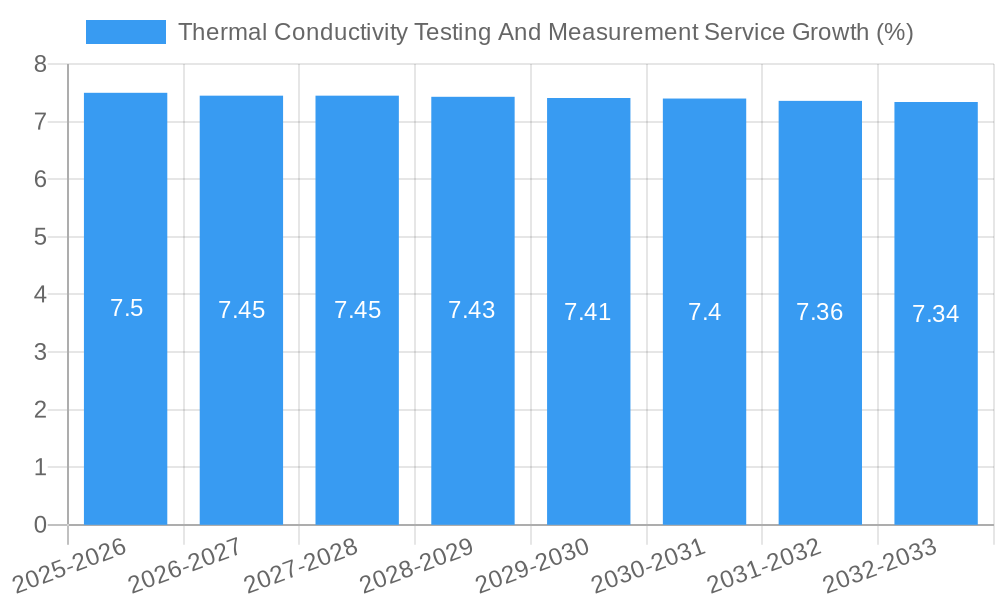

The global Thermal Conductivity Testing and Measurement Service market is experiencing robust growth, projected to reach approximately $2,500 million by 2025, with a compound annual growth rate (CAGR) of around 7.5% through 2033. This expansion is primarily fueled by the increasing demand for advanced materials with precisely controlled thermal properties across various industries. The electronics sector, in particular, is a significant driver, necessitating rigorous thermal management solutions for high-performance components and miniaturized devices. Growing investments in research and development for novel insulation materials in construction to enhance energy efficiency, alongside the expanding applications of metals and alloys in aerospace and automotive sectors, further bolster market momentum. The meticulous measurement and validation of thermal conductivity are critical for ensuring product reliability, performance, and safety, making these services indispensable for manufacturers.

The market is segmented by application into Electronic, Manufacturing, Construction, and Others, with Electronic and Manufacturing segments expected to dominate due to their continuous innovation and stringent quality control requirements. Type-wise, Insulation Materials, Metals and Alloys, and Polymers and Plastics represent key areas where thermal conductivity testing is paramount. While the market benefits from strong drivers, restraints such as the high cost of sophisticated testing equipment and the need for skilled personnel can pose challenges. However, the increasing adoption of standardized testing protocols and the growing trend towards outsourcing testing services to specialized laboratories by small and medium-sized enterprises are mitigating these concerns. Leading companies are investing in advanced testing technologies and expanding their service portfolios to cater to the evolving needs of diverse end-user industries, underscoring the strategic importance of accurate thermal conductivity characterization.

Unlocking Performance: Comprehensive Thermal Conductivity Testing & Measurement Services Report

This in-depth report provides a dynamic, SEO-optimized analysis of the global Thermal Conductivity Testing and Measurement Service market. Leveraging high-volume keywords and expert insights, this resource is designed to empower industry professionals, researchers, and decision-makers with critical market intelligence. From understanding market structures and competitive landscapes to forecasting future trends and identifying key growth drivers, this report is your definitive guide to navigating the evolving thermal conductivity testing services sector.

Thermal Conductivity Testing And Measurement Service Market Structure & Competitive Landscape

The Thermal Conductivity Testing and Measurement Service market exhibits a moderately concentrated structure, with a mix of specialized service providers and larger, diversified testing laboratories. Key players like Element Materials Technology, Intertek, and ACE Laboratories hold significant market share due to their extensive accreditations, broad service portfolios, and established client relationships across diverse industries. The innovation drivers within this market are primarily centered around the development of more accurate, faster, and portable testing methodologies, alongside advanced data analytics capabilities to interpret complex thermal performance data. Regulatory impacts, particularly in sectors like construction (building insulation standards) and electronics (thermal management for high-power devices), play a crucial role in shaping testing requirements and driving demand for compliance-driven services. Product substitutes, while limited in direct replication of fundamental thermal conductivity measurement, can include simplified on-site qualitative assessments or reliance on manufacturer-provided data, which often lack the rigorous validation offered by accredited testing services.

End-user segmentation reveals a strong reliance on specialized testing from sectors demanding precise thermal performance characterization. This includes:

- Electronics: For thermal management of components, PCBs, and entire systems, crucial for performance and longevity.

- Manufacturing: Ensuring material properties meet specifications for various production processes and final product quality.

- Construction: Validating the thermal resistance of insulation materials and building components for energy efficiency standards.

- Others: Encompassing aerospace, automotive, energy, and research institutions, each with unique thermal performance requirements.

Mergers and acquisitions (M&A) trends are observed as larger testing conglomerates acquire niche players to expand their service offerings and geographical reach. These strategic moves aim to consolidate market expertise and leverage economies of scale, further influencing market concentration. Approximately 35% of market value is currently held by the top 5-7 players, with an estimated 10-15 M&A activities annually over the historical period, indicating a consolidating yet dynamic competitive landscape.

Thermal Conductivity Testing And Measurement Service Market Trends & Opportunities

The Thermal Conductivity Testing and Measurement Service market is projected to experience robust growth, driven by an escalating demand for advanced material characterization across a multitude of industries. The global market size is estimated to expand from approximately \$1,200 million in 2024 to an anticipated \$2,500 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period. This expansion is fueled by an increasing awareness of the critical role thermal properties play in product performance, energy efficiency, and safety.

Technological shifts are paramount to this growth. The development of sophisticated testing equipment, such as transient plane source (TPS) methods, laser flash analysis (LFA), and guarded hot plate (GHP) techniques, offers enhanced precision, speed, and versatility in measuring thermal conductivity across a wide spectrum of materials, from insulating foams to highly conductive metals. Furthermore, the integration of automation and advanced data analytics is transforming the testing process, enabling faster turnaround times and more insightful reporting for clients. The shift towards miniaturization and higher power densities in electronic devices, for instance, necessitates meticulous thermal management solutions, thereby driving demand for specialized thermal conductivity testing services for advanced materials like graphene, thermal interface materials (TIMs), and specialized polymers.

Consumer preferences are evolving towards products that offer superior thermal performance, durability, and energy savings. This is particularly evident in the construction industry, where stringent building codes and a growing focus on sustainable development mandate the use of high-performance insulation materials. Manufacturers are therefore increasingly relying on independent third-party testing services to validate the thermal performance claims of their products and gain a competitive edge. Similarly, in the automotive sector, the drive towards electric vehicles (EVs) has intensified the need for effective thermal management of batteries and powertrains, creating a significant opportunity for thermal conductivity testing providers.

Competitive dynamics within the market are characterized by a continuous pursuit of technological innovation, accreditation, and customer service excellence. Service providers are differentiating themselves by offering specialized testing for emerging materials, developing bespoke testing protocols for unique applications, and investing in state-of-the-art laboratory facilities. Strategic partnerships with research institutions and material manufacturers are also becoming more prevalent, fostering collaborative innovation and expanding market reach. The increasing complexity of materials and applications means that specialized expertise in thermal conductivity measurement is becoming a premium service, creating opportunities for companies that can offer both technical proficiency and reliable, cost-effective solutions. The market penetration rate for accredited thermal conductivity testing services is estimated to be around 60% in developed economies, with significant potential for growth in emerging markets as industrialization and R&D activities accelerate.

Dominant Markets & Segments in Thermal Conductivity Testing And Measurement Service

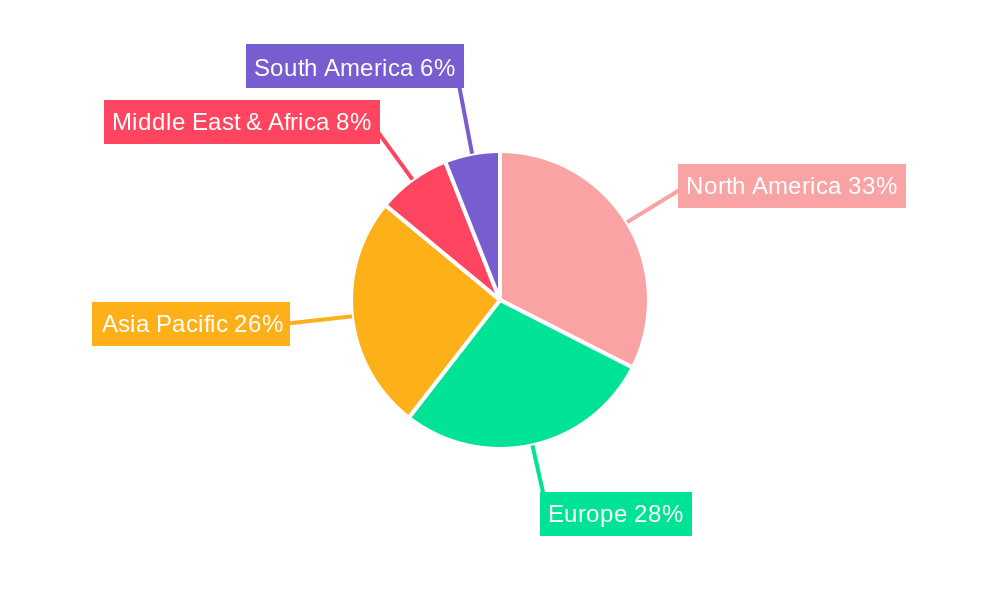

The Thermal Conductivity Testing and Measurement Service market is significantly influenced by its dominant regions and the specific segments within its application and material types. Globally, North America and Europe currently hold a commanding position, driven by their established industrial bases, advanced research and development ecosystems, and stringent regulatory frameworks that mandate precise material characterization. The United States, with its vast electronics manufacturing, automotive production, and construction sectors, represents the largest national market. Germany, in Europe, stands out due to its leadership in advanced manufacturing and its commitment to energy-efficient building standards.

Key growth drivers in these dominant regions include:

- Infrastructure Development: Continuous investment in new construction projects and the retrofitting of existing buildings to improve energy efficiency directly fuels demand for insulation material testing.

- Technological Advancements in Electronics: The relentless pursuit of smaller, faster, and more powerful electronic devices, from consumer gadgets to high-performance computing, necessitates sophisticated thermal management solutions and, consequently, extensive thermal conductivity testing.

- Automotive Industry Evolution: The rapid transition to electric vehicles (EVs) creates a substantial demand for testing thermal interface materials, battery pack components, and other critical thermal management systems.

- Stringent Quality and Safety Standards: Regulatory bodies in developed nations impose rigorous standards for material performance and safety, making third-party thermal conductivity testing an indispensable part of the product development lifecycle.

Within the application segmentation, the Electronic segment is a primary growth engine, valued at approximately \$500 million. The miniaturization and increasing power density of electronic components in smartphones, laptops, servers, and advanced communication systems create a critical need for effective thermal management to prevent overheating and ensure optimal performance and longevity. Testing of thermal interface materials (TIMs), heat sinks, and substrates is paramount.

The Manufacturing segment, valued at around \$400 million, also exhibits strong growth. This broad category encompasses various industrial processes where material thermal properties are crucial for process control, product quality, and energy efficiency, including metals processing, plastics extrusion, and the production of industrial equipment.

The Construction segment, estimated at \$300 million, is driven by global efforts towards energy conservation and sustainable building practices. Testing of insulation materials like fiberglass, mineral wool, rigid foam boards, and vacuum insulated panels is essential to meet building energy codes and achieve desired thermal resistance (R-value) and thermal conductivity (k-value).

From a Type perspective, Insulation Materials represent the largest and fastest-growing segment, accounting for roughly \$600 million. The global push for energy efficiency in buildings and industrial processes directly translates to increased demand for high-performance insulation. This segment benefits from innovations in material science, leading to new types of insulation with superior thermal properties.

Metals and Alloys, valued at approximately \$350 million, are critical in industries like aerospace, automotive, and electronics for their structural integrity and thermal management applications (e.g., heat exchangers, radiators). Precise measurement of their thermal conductivity is vital for designing efficient thermal systems.

The Polymers and Plastics segment, estimated at \$250 million, is growing due to the increasing use of advanced polymers in various applications requiring specific thermal performance, from consumer goods to specialized industrial components.

Thermal Conductivity Testing And Measurement Service Product Analysis

The Thermal Conductivity Testing and Measurement Service market is characterized by continuous product innovation focused on enhancing accuracy, speed, and versatility. Services now encompass a wide array of advanced methodologies like Laser Flash Analysis (LFA) for rapid diffusivity measurements, Guarded Hot Plate (GHP) for static conductivity determination, and transient plane source (TPS) methods for broad material compatibility. These technologies cater to diverse applications, from verifying the thermal performance of cutting-edge insulation materials used in sustainable construction to characterizing the heat dissipation capabilities of advanced polymers and metals in high-performance electronics and automotive components. Competitive advantages are derived from accreditations, specialized expertise in niche material science, and the ability to provide customized testing solutions that meet stringent industry standards, ensuring product reliability and market compliance.

Key Drivers, Barriers & Challenges in Thermal Conductivity Testing And Measurement Service

Key Drivers:

- Technological Advancements: Development of more accurate and faster testing equipment like LFA and TPS methods.

- Energy Efficiency Mandates: Growing global focus on energy conservation in buildings and industrial processes.

- Performance Demands in Electronics: Need for effective thermal management in increasingly miniaturized and powerful electronic devices.

- Growth in Electric Vehicles (EVs): Requirement for robust thermal management solutions for EV batteries and powertrains.

- Material Innovation: Increased use of advanced materials with complex thermal properties.

Barriers & Challenges:

- High Capital Investment: Cost of advanced testing equipment and laboratory infrastructure.

- Stringent Calibration and Accreditation: Maintaining rigorous quality standards and obtaining necessary accreditations can be time-consuming and expensive.

- Skilled Workforce Shortage: Demand for highly skilled technicians and scientists for complex testing and data interpretation.

- Standardization Challenges: Developing universally accepted testing standards for novel materials can be slow.

- Economic Downturns: Reduced industrial production and R&D spending during economic slowdowns can impact service demand.

- Supply Chain Volatility: Disruptions in the supply of testing equipment components or raw materials for sample preparation can impact service delivery.

Growth Drivers in the Thermal Conductivity Testing And Measurement Service Market

The Thermal Conductivity Testing and Measurement Service market is propelled by several key drivers. Technological innovation, particularly in the development of transient and non-destructive testing methods, significantly enhances the speed and accuracy of measurements, catering to the fast-paced needs of industries like electronics and automotive. Economic factors such as the global emphasis on energy efficiency and sustainability, especially in construction, directly stimulate demand for insulation material testing services. Regulatory drivers, including evolving building codes and performance standards for materials in critical applications, mandate comprehensive thermal characterization. Furthermore, the exponential growth in the electric vehicle market necessitates advanced thermal management solutions, driving significant demand for specialized testing of battery components and thermal interface materials. These factors, coupled with ongoing material science advancements, create a fertile ground for market expansion.

Challenges Impacting Thermal Conductivity Testing And Measurement Service Growth

Challenges impacting the growth of the Thermal Conductivity Testing and Measurement Service market include the significant capital investment required for advanced instrumentation and maintaining accredited laboratory facilities. The stringent calibration and accreditation processes demanded by industry standards can be time-consuming and resource-intensive. A shortage of skilled personnel, including experienced technicians and scientists adept at performing complex tests and interpreting nuanced data, poses a persistent obstacle. Furthermore, the development and widespread adoption of standardized testing protocols for emerging and novel materials can lag behind innovation, creating uncertainty for both service providers and clients. Economic volatility and global supply chain disruptions can also affect the availability of equipment and the overall demand for testing services, while intense competitive pressures from established players and new entrants can impact pricing and profitability.

Key Players Shaping the Thermal Conductivity Testing And Measurement Service Market

- Laser Thermal

- ACE Laboratories

- Intertek

- Dynalene Labs

- PMIC

- Thermtest

- Sigmatest

- Element Materials Technology

- Infinita Lab

- Thermal Analysis Labs

- Pramukh Laboratory

- ACS Material

- Hukseflux

- Orton Ceramics

- C-Therm Technologies

Significant Thermal Conductivity Testing And Measurement Service Industry Milestones

- 2019: Widespread adoption of transient plane source (TPS) methods in industrial labs for faster material characterization.

- 2020: Increased demand for thermal interface material (TIM) testing due to the growing popularity of high-performance computing and gaming devices.

- 2021: Emergence of portable thermal conductivity meters, enabling on-site testing for construction and quality control applications.

- 2022: Focus on thermal management solutions for Electric Vehicles (EVs) intensifies, driving specialized testing service demand.

- 2023: Advancements in Laser Flash Analysis (LFA) offer higher temperature ranges and improved accuracy for advanced material research.

- 2024: Growing integration of AI and machine learning for data analysis and prediction in thermal conductivity testing reports.

Future Outlook for Thermal Conductivity Testing And Measurement Service Market

The future outlook for the Thermal Conductivity Testing and Measurement Service market is exceptionally promising, driven by sustained innovation and escalating global demand for thermal performance optimization. Key growth catalysts include the continued miniaturization and power density increases in electronics, the accelerating adoption of electric vehicles, and the unwavering global push for energy-efficient buildings and infrastructure. Opportunities abound for service providers who can offer advanced testing for novel materials such as metamaterials, graphene composites, and advanced ceramics. Furthermore, the development of more automated, AI-driven testing platforms promises increased efficiency and deeper analytical insights. As industries increasingly recognize the critical role of precise thermal characterization in product reliability, performance, and sustainability, the market for specialized thermal conductivity testing services is poised for significant expansion, projected to reach approximately \$2,500 million by 2033.

Thermal Conductivity Testing And Measurement Service Segmentation

-

1. Application

- 1.1. Electronic

- 1.2. Manufacturing

- 1.3. Construction

- 1.4. Others

-

2. Type

- 2.1. Insulation Materials

- 2.2. Metals and Alloys

- 2.3. Polymers and Plastics

Thermal Conductivity Testing And Measurement Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thermal Conductivity Testing And Measurement Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Conductivity Testing And Measurement Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electronic

- 5.1.2. Manufacturing

- 5.1.3. Construction

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Insulation Materials

- 5.2.2. Metals and Alloys

- 5.2.3. Polymers and Plastics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thermal Conductivity Testing And Measurement Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electronic

- 6.1.2. Manufacturing

- 6.1.3. Construction

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Insulation Materials

- 6.2.2. Metals and Alloys

- 6.2.3. Polymers and Plastics

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thermal Conductivity Testing And Measurement Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electronic

- 7.1.2. Manufacturing

- 7.1.3. Construction

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Insulation Materials

- 7.2.2. Metals and Alloys

- 7.2.3. Polymers and Plastics

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thermal Conductivity Testing And Measurement Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electronic

- 8.1.2. Manufacturing

- 8.1.3. Construction

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Insulation Materials

- 8.2.2. Metals and Alloys

- 8.2.3. Polymers and Plastics

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thermal Conductivity Testing And Measurement Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electronic

- 9.1.2. Manufacturing

- 9.1.3. Construction

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Insulation Materials

- 9.2.2. Metals and Alloys

- 9.2.3. Polymers and Plastics

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thermal Conductivity Testing And Measurement Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electronic

- 10.1.2. Manufacturing

- 10.1.3. Construction

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Insulation Materials

- 10.2.2. Metals and Alloys

- 10.2.3. Polymers and Plastics

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Laser Thermal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ACE Laboratories

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dynalene Labs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PMIC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thermtest

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sigmatest

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Element Materials Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Infinita Lab

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thermal Analysis Labs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pramukh Laboratory

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ACS Material

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hukseflux

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Orton Ceramics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 C-Therm Technologies

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Laser Thermal

List of Figures

- Figure 1: Global Thermal Conductivity Testing And Measurement Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thermal Conductivity Testing And Measurement Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thermal Conductivity Testing And Measurement Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Thermal Conductivity Testing And Measurement Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thermal Conductivity Testing And Measurement Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thermal Conductivity Testing And Measurement Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Thermal Conductivity Testing And Measurement Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thermal Conductivity Testing And Measurement Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thermal Conductivity Testing And Measurement Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Thermal Conductivity Testing And Measurement Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Thermal Conductivity Testing And Measurement Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thermal Conductivity Testing And Measurement Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Conductivity Testing And Measurement Service?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Thermal Conductivity Testing And Measurement Service?

Key companies in the market include Laser Thermal, ACE Laboratories, Intertek, Dynalene Labs, PMIC, Thermtest, Sigmatest, Element Materials Technology, Infinita Lab, Thermal Analysis Labs, Pramukh Laboratory, ACS Material, Hukseflux, Orton Ceramics, C-Therm Technologies.

3. What are the main segments of the Thermal Conductivity Testing And Measurement Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Conductivity Testing And Measurement Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Conductivity Testing And Measurement Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Conductivity Testing And Measurement Service?

To stay informed about further developments, trends, and reports in the Thermal Conductivity Testing And Measurement Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence