Key Insights

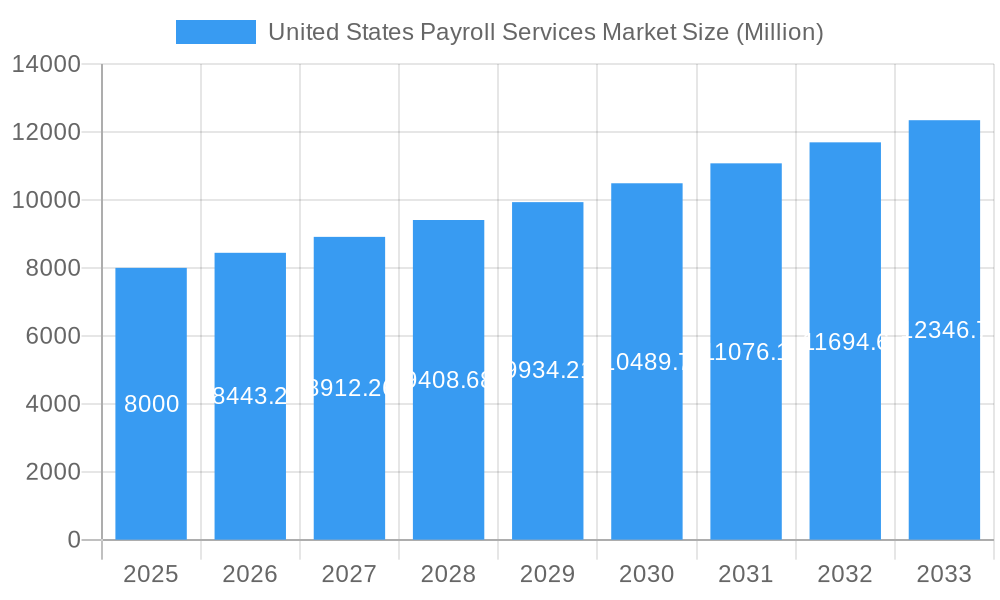

The United States payroll services market, currently valued at approximately $8 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.54% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud-based payroll solutions offers businesses enhanced efficiency, scalability, and cost-effectiveness compared to traditional on-premise systems. Furthermore, the rising complexity of payroll regulations and tax laws necessitates the use of specialized software and services, fueling market demand. Small and medium-sized enterprises (SMEs), in particular, are increasingly outsourcing payroll functions to streamline operations and focus on core business activities. Automation in payroll processing, including features like direct deposit and automated tax calculations, contributes significantly to improved accuracy and reduced processing times, further propelling market growth. Competitive pressures among established players like ADP, Paychex, and Intuit (QuickBooks), alongside the emergence of innovative solutions from companies such as Gusto and OnPay, fosters market innovation and accessibility.

United States Payroll Services Market Market Size (In Billion)

While the market enjoys considerable growth potential, certain challenges persist. Integration complexities with existing HR and accounting systems can hinder adoption for some businesses. Data security concerns surrounding sensitive employee information also remain a significant consideration. Moreover, the ongoing evolution of labor laws and tax regulations necessitates continuous software updates and compliance efforts, presenting a potential barrier to market entry for smaller providers. Despite these restraints, the long-term outlook for the US payroll services market remains positive, driven by increasing digitization, a focus on operational efficiency, and the unwavering need for accurate and compliant payroll processing across all business sizes. The market is expected to reach approximately $12.5 billion by 2033, showcasing considerable potential for investment and innovation.

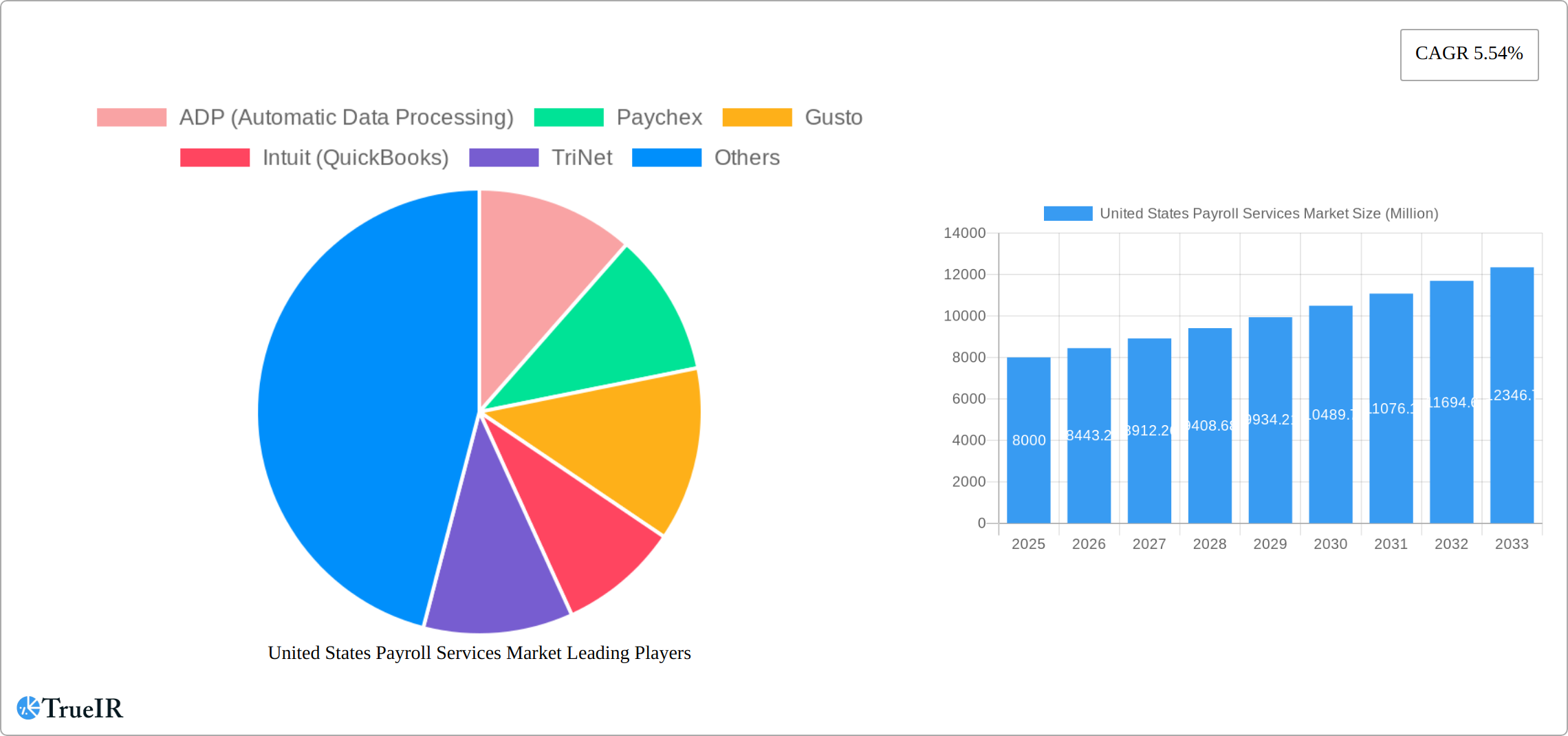

United States Payroll Services Market Company Market Share

United States Payroll Services Market: A Comprehensive Report (2019-2033)

This dynamic report offers an in-depth analysis of the United States Payroll Services Market, providing critical insights for businesses, investors, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver a comprehensive overview of market size, growth trajectories, competitive dynamics, and future trends. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

United States Payroll Services Market Structure & Competitive Landscape

The US payroll services market is characterized by a blend of large established players and emerging innovative companies. Market concentration is moderately high, with a few dominant players controlling a significant share. However, the market also exhibits substantial fragmentation, particularly within niche segments. The Herfindahl-Hirschman Index (HHI) for the market in 2024 was estimated at xx, indicating a moderately concentrated market.

Key aspects analyzed:

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2024.

- Innovation Drivers: Technological advancements like cloud computing, AI-powered automation, and mobile accessibility are driving market innovation.

- Regulatory Impacts: Compliance with evolving federal and state labor laws significantly impacts operational costs and service offerings.

- Product Substitutes: Limited direct substitutes exist, but internal payroll management systems represent a potential alternative for larger companies.

- End-User Segmentation: The market caters to diverse end-users, including small businesses, large enterprises, and various industry verticals.

- M&A Trends: Consolidation is a noticeable trend, with several large acquisitions observed in recent years, resulting in xx acquisitions in the period 2019-2024. This trend is expected to continue.

United States Payroll Services Market Trends & Opportunities

The US payroll services market is experiencing robust growth driven by several factors. The increasing adoption of cloud-based payroll solutions, the rising demand for integrated HR and payroll systems, and the growing need for accurate and efficient payroll processing are key contributors to this growth. Furthermore, technological advancements are streamlining operations, improving accuracy, and enabling real-time data analysis.

- Market Size Growth: The market is expanding at a considerable rate, primarily due to the increasing number of businesses and the growing adoption of automated payroll solutions.

- Technological Shifts: The migration from on-premise to cloud-based solutions is accelerating, driving scalability, cost efficiency, and enhanced data security. The integration of AI and machine learning is also transforming payroll processes.

- Consumer Preferences: Businesses increasingly prefer user-friendly, flexible, and secure payroll solutions that integrate seamlessly with other HR systems.

- Competitive Dynamics: The market features both intense competition among established players and the emergence of new entrants offering innovative solutions. This dynamic landscape fosters continuous improvement and innovation.

Dominant Markets & Segments in United States Payroll Services Market

The United States payroll services market is a dynamic landscape, with the small and medium-sized business (SMB) sector representing the largest and most rapidly growing segment. This dominance stems from the sheer number of SMBs across the country and their increasing reliance on efficient, cost-effective payroll solutions to manage their workforce effectively. The market is further segmented by industry, company size (categorized by employee count), and geographic location.

- Key Growth Drivers for the SMB Segment:

- Ease of Use and Accessibility: Intuitive software interfaces and mobile accessibility are crucial for SMBs, many of which lack dedicated HR or payroll personnel. Cloud-based solutions offer anytime, anywhere access, improving efficiency and reducing administrative burden.

- Cost-Effectiveness and Scalability: Affordable, tiered pricing plans allow SMBs to select solutions that fit their budget and scale as their business grows. This avoids the significant upfront investment associated with traditional on-premise systems.

- Compliance and Risk Mitigation: Payroll services providers often incorporate features designed to ensure compliance with complex federal, state, and local labor regulations, reducing the risk of penalties and legal issues.

- Integration with other Business Systems: Seamless integration with accounting software, HR platforms, and other business applications streamlines workflows and reduces data entry errors.

- Geographic Distribution: While the market is national in scope, significant concentrations of payroll service users are found in densely populated regions like the East and West Coasts, reflecting the high concentration of businesses in these areas. However, growth is also evident in other regions as businesses of all sizes increasingly adopt automated payroll solutions.

Beyond SMBs, larger enterprises also utilize payroll services, often opting for solutions that offer advanced features such as global payroll capabilities, robust reporting and analytics, and sophisticated workforce management tools.

United States Payroll Services Market Product Analysis

The market offers a wide range of products, from basic payroll processing software to integrated HR and payroll platforms. Technological advancements, particularly in cloud computing and AI, have led to the development of sophisticated solutions with features like automated tax calculations, direct deposit, and employee self-service portals. The market is moving toward comprehensive platforms that integrate with other business applications, improving workflow efficiency and data accuracy. Competition is largely focused on user experience, integration capabilities, pricing, and security features.

Key Drivers, Barriers & Challenges in United States Payroll Services Market

Key Drivers:

- Technological Advancements: Automation, AI-driven insights, and cloud-based solutions improve efficiency and accuracy.

- Government Regulations: Stringent labor laws increase demand for compliant payroll solutions.

- Economic Growth: A thriving economy fuels business expansion and demand for payroll services.

Challenges:

- Regulatory Complexity: Evolving labor laws and tax regulations pose compliance challenges and increase operational costs.

- Cybersecurity Threats: Data breaches and security vulnerabilities are a significant risk, demanding robust security measures.

- Competition: Intense competition among existing players and new entrants puts pressure on pricing and innovation. The market share lost due to competition is estimated at xx% in 2024.

Growth Drivers in the United States Payroll Services Market Market

The key growth drivers are the increasing number of businesses, rising adoption of cloud-based solutions, enhanced integration capabilities, and a growing need for compliance. The demand for real-time data analysis, improved accuracy, and flexible payroll solutions are also driving market growth. The increasing preference for mobile-based payroll solutions further fuels market expansion.

Challenges Impacting United States Payroll Services Market Growth

Challenges include the complexity of labor laws and tax regulations, cybersecurity risks, and stiff competition. Maintaining data security, navigating frequent regulatory changes, and keeping pace with technological advancements pose ongoing hurdles. Supply chain disruptions and workforce skills gaps add to the operational challenges.

Key Players Shaping the United States Payroll Services Market Market

- ADP (Automatic Data Processing)

- Paychex

- Gusto

- Intuit (QuickBooks)

- TriNet

- Paycor

- Zenefits

- SurePayroll

- OnPay

- Square Payroll

- List Not Exhaustive

Significant United States Payroll Services Market Industry Milestones

- June 2023: UKG Inc. acquired Immedis, expanding its global payroll capabilities.

- April 2024: Everee partnered with NextCrew to enhance payroll processes for staffing firms and temporary employees.

Future Outlook for United States Payroll Services Market Market

The US payroll services market is poised for continued growth, driven by ongoing technological innovation, increasing demand for integrated solutions, and the persistent need for efficient and compliant payroll processing. Strategic opportunities exist in expanding into niche markets, offering specialized services, and leveraging AI and machine learning to enhance automation and data analysis capabilities. The market's future is bright, characterized by growth, innovation, and increasing competition.

United States Payroll Services Market Segmentation

-

1. Type

- 1.1. Small-size Company

- 1.2. Mid-size Company

- 1.3. Large Enterprises

-

2. End User

- 2.1. Healthcare

- 2.2. Manufacturing

- 2.3. Retail

- 2.4. IT

- 2.5. Finance

- 2.6. Professional Services

United States Payroll Services Market Segmentation By Geography

- 1. United States

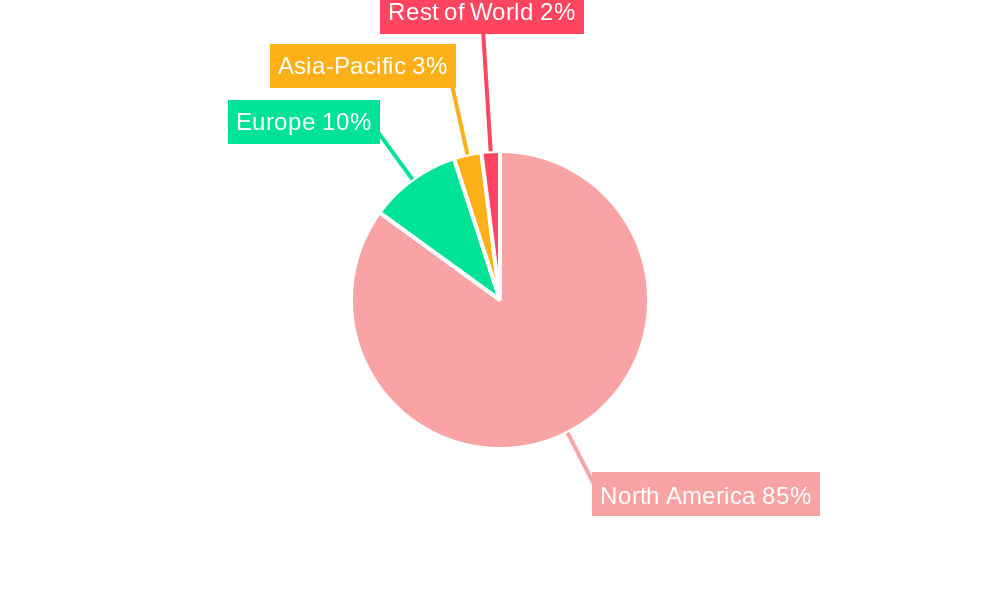

United States Payroll Services Market Regional Market Share

Geographic Coverage of United States Payroll Services Market

United States Payroll Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Complexity of Payroll Regulations; Rise of Gig Economy

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Payroll Regulations; Rise of Gig Economy

- 3.4. Market Trends

- 3.4.1. Rise of Gig Economy Influencing US Payroll Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Payroll Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Small-size Company

- 5.1.2. Mid-size Company

- 5.1.3. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Healthcare

- 5.2.2. Manufacturing

- 5.2.3. Retail

- 5.2.4. IT

- 5.2.5. Finance

- 5.2.6. Professional Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP (Automatic Data Processing)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paychex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gusto

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuit (QuickBooks)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TriNet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paycor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zenefits

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SurePayroll

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OnPay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Square Payroll**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP (Automatic Data Processing)

List of Figures

- Figure 1: United States Payroll Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Payroll Services Market Share (%) by Company 2025

List of Tables

- Table 1: United States Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United States Payroll Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Payroll Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: United States Payroll Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Payroll Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United States Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United States Payroll Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: United States Payroll Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: United States Payroll Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Payroll Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Payroll Services Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the United States Payroll Services Market?

Key companies in the market include ADP (Automatic Data Processing), Paychex, Gusto, Intuit (QuickBooks), TriNet, Paycor, Zenefits, SurePayroll, OnPay, Square Payroll**List Not Exhaustive.

3. What are the main segments of the United States Payroll Services Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Complexity of Payroll Regulations; Rise of Gig Economy.

6. What are the notable trends driving market growth?

Rise of Gig Economy Influencing US Payroll Services.

7. Are there any restraints impacting market growth?

Increasing Complexity of Payroll Regulations; Rise of Gig Economy.

8. Can you provide examples of recent developments in the market?

April 2024: Everee, a prominent payroll firm known for its instant payment solutions, joined forces with NextCrew. This collaboration aims to revolutionize payroll processes, ensuring swift and seamless payments for workers. By integrating Everee's cutting-edge payroll tech with NextCrew's comprehensive staffing platform, the partnership promises to elevate the payroll experience for both staffing firms and their temporary employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Payroll Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Payroll Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Payroll Services Market?

To stay informed about further developments, trends, and reports in the United States Payroll Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence