Key Insights

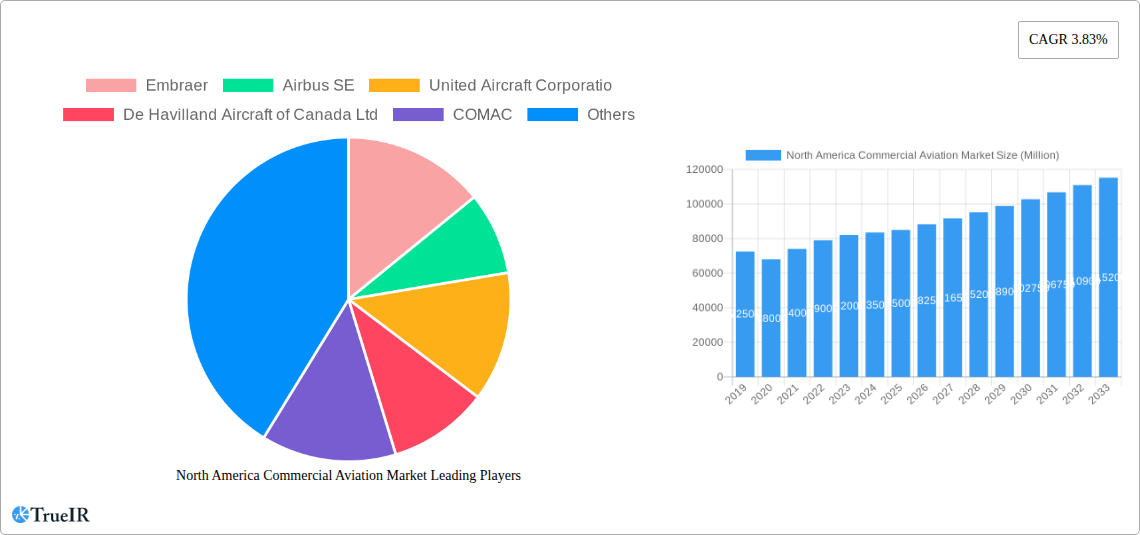

The North American commercial aviation market is poised for robust expansion, projected to reach a market size of approximately USD 85,000 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 3.83% anticipated through 2033. This growth is primarily fueled by a rebound in air travel demand post-pandemic, increasing passenger traffic, and the need for fleet modernization. The region's established aviation infrastructure, coupled with significant investments in new aircraft technologies and sustainable aviation solutions, further supports this upward trajectory. The market encompasses a diverse range of aircraft types, including essential Freighter Aircraft critical for cargo logistics and Passenger Aircraft segmented into Narrowbody and Widebody categories, each catering to different route demands and operational efficiencies. Key industry players such as Embraer, Airbus SE, The Boeing Company, and others are actively engaged in research and development, seeking to enhance fuel efficiency, reduce emissions, and improve passenger experience, all contributing to market vitality.

North America Commercial Aviation Market Market Size (In Billion)

The market's expansion is underpinned by several dynamic drivers, including an increasing disposable income and a growing middle class in North America, leading to a higher propensity for air travel for both leisure and business purposes. Furthermore, government initiatives aimed at supporting the aviation sector, such as infrastructure upgrades and incentives for greener aviation technologies, are playing a crucial role. The increasing adoption of advanced navigation systems and the continuous demand for both passenger and cargo transportation are also significant contributors. However, the market faces certain restraints, including fluctuating fuel prices, stringent environmental regulations, and the high capital expenditure required for aircraft acquisition and maintenance. Despite these challenges, the trend towards more efficient and environmentally friendly aircraft, coupled with the continuous need to replace aging fleets, is expected to drive sustained growth and innovation within the North American commercial aviation landscape throughout the forecast period.

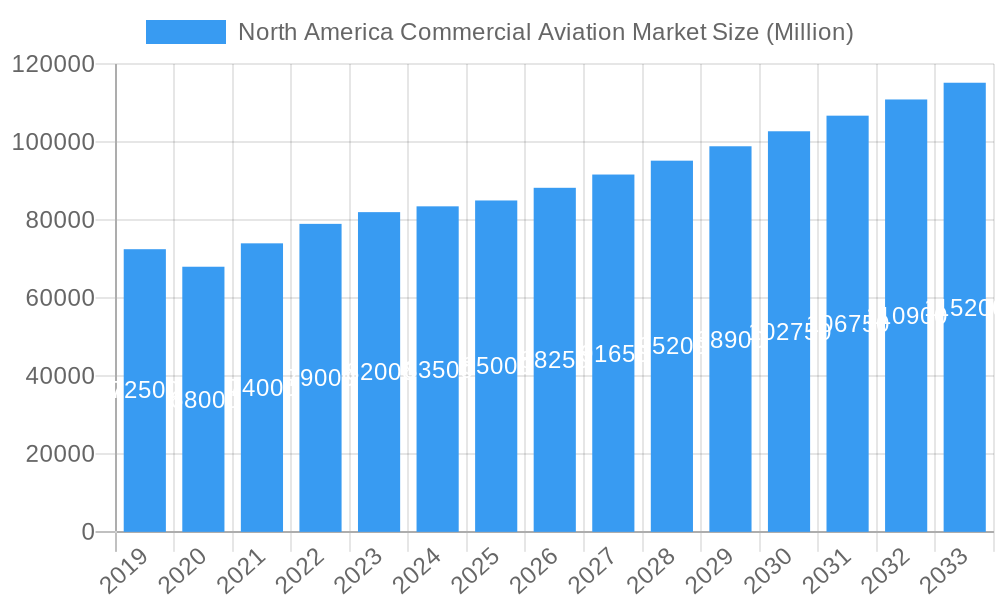

North America Commercial Aviation Market Company Market Share

North America Commercial Aviation Market: Unveiling Growth & Dynamics (2019-2033)

This comprehensive report delves into the North America Commercial Aviation Market, providing in-depth analysis and actionable insights. From 2019 to 2033, we meticulously examine market evolution, base year 2025, and project future trajectories through 2025-2033. Our historical period spans 2019-2024, capturing crucial past trends. This report is engineered for industry stakeholders, investors, and analysts seeking to navigate the complexities of this vital sector. Leveraging high-volume keywords such as "commercial aviation market," "aircraft orders," "passenger aircraft," and "freighter aircraft," this analysis is optimized for search engines, ensuring maximum visibility for critical industry intelligence. We cover the competitive landscape, market trends, dominant segments, product innovations, key drivers, barriers, and future outlook, offering a 360-degree view of the North American aviation ecosystem.

North America Commercial Aviation Market Market Structure & Competitive Landscape

The North America Commercial Aviation Market exhibits a moderately concentrated structure, with a few dominant players like The Boeing Company and Airbus SE holding significant market share. Innovation remains a primary driver, fueled by advancements in fuel efficiency, composite materials, and digital technologies that reduce operational costs and enhance passenger experience. Regulatory impacts, particularly those related to emissions standards and air traffic management, continue to shape market dynamics and necessitate continuous investment in sustainable aviation solutions. While product substitutes are limited in the core commercial aviation segment, the emergence of advanced drone technology for cargo delivery and emerging electric vertical takeoff and landing (eVTOL) aircraft for short-haul regional transport present nascent substitution possibilities for specific niche applications. End-user segmentation is predominantly driven by airline operational needs, with distinctions between passenger (narrowbody, widebody) and freighter aircraft. Mergers and acquisitions (M&A) trends have been less pronounced in recent years due to the high capital expenditure and regulatory scrutiny, but strategic partnerships and joint ventures are common to share R&D costs and expand market reach. The overall concentration ratio for the top 3 players in the commercial aircraft manufacturing segment is estimated to be around 75-80%. M&A volumes in related MRO (Maintenance, Repair, and Overhaul) and component supply sectors have remained steady, indicating consolidation and efficiency drives within the broader ecosystem.

North America Commercial Aviation Market Market Trends & Opportunities

The North America Commercial Aviation Market is poised for substantial growth driven by a confluence of factors, including resilient air travel demand, fleet modernization initiatives, and the increasing importance of air cargo. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. Technological shifts are paramount, with a strong emphasis on developing more fuel-efficient aircraft. The push towards sustainability is compelling airlines to retire older, less efficient models and invest in next-generation aircraft like the Boeing 737 MAX and Airbus A320neo family, which offer significant fuel savings and reduced emissions. This trend creates a robust demand for narrowbody aircraft. The expansion of e-commerce and global trade continues to fuel the demand for freighter aircraft, with dedicated cargo planes and converted passenger aircraft playing crucial roles. Opportunities lie in the development and adoption of sustainable aviation fuels (SAFs), advancements in electric and hybrid-electric propulsion systems, and the integration of AI and data analytics for optimized flight operations and predictive maintenance. Consumer preferences are evolving, with a growing demand for comfortable, connected, and environmentally conscious travel. Airlines are responding by investing in cabin modernization and offering improved in-flight amenities. The competitive dynamics are characterized by fierce competition between established manufacturers, with a constant drive for innovation and cost leadership. The market penetration rate for advanced avionics and connectivity solutions is steadily increasing across all aircraft types, enhancing operational efficiency and passenger experience. Emerging markets within North America, particularly those with growing middle classes and expanding trade routes, present significant untapped potential. The increasing emphasis on regional connectivity also opens doors for smaller, more efficient aircraft catering to underserved routes.

Dominant Markets & Segments in North America Commercial Aviation Market

Within the North America Commercial Aviation Market, Passenger Aircraft represent the dominant segment, further bifurcated into Narrowbody Aircraft and Widebody Aircraft. The United States, with its extensive domestic and international route networks, stands as the leading country, driving the majority of market demand and activity. This dominance is underpinned by a robust economic environment, a large population base with significant disposable income for travel, and a highly developed aviation infrastructure. The continuous need for fleet renewal among major US carriers, such as Delta Air Lines Inc. and United Airlines, fuels consistent demand for both narrowbody and widebody aircraft.

Key growth drivers for the passenger aircraft segment include:

- Rebounding Air Travel Demand: Post-pandemic recovery has seen a strong resurgence in passenger traffic, necessitating increased capacity.

- Fleet Modernization: Airlines are actively replacing older aircraft with newer, more fuel-efficient models to reduce operational costs and meet environmental regulations.

- Network Expansion: Carriers are expanding their route networks to cater to growing demand for both domestic and international travel.

- Economic Growth: A healthy economy in North America translates to higher consumer spending on travel.

The Narrowbody Aircraft sub-segment, in particular, is experiencing robust growth due to its versatility for short to medium-haul flights, which constitute the bulk of air traffic in North America. Aircraft like the Boeing 737 MAX and Airbus A320neo family are central to this demand.

The Widebody Aircraft sub-segment, while smaller in volume, is crucial for long-haul international routes and premium leisure travel. The recent interest from airlines like Air Algérie and discussions by Delta Air Lines Inc. with Airbus for A350 and A330neo orders highlight the ongoing importance of this segment for global connectivity and strategic route development.

The Freighter Aircraft segment is also witnessing significant expansion, driven by the e-commerce boom and the need for efficient global supply chain logistics. While dedicated freighter aircraft remain essential, the conversion of passenger aircraft into freighters is a notable trend, adding flexibility and capacity to the cargo market. This segment is crucial for supporting international trade and the timely delivery of goods across the continent and beyond.

North America Commercial Aviation Market Product Analysis

The North America Commercial Aviation Market is characterized by continuous product innovation focused on enhancing efficiency, sustainability, and passenger experience. Key advancements include the development of lighter composite materials, more fuel-efficient engine technologies, and advanced avionics systems. Manufacturers like Embraer, Airbus SE, and The Boeing Company are investing heavily in next-generation aircraft that offer reduced fuel burn and lower emissions, aligning with global environmental targets. Applications range from short-haul regional flights served by Embraer's E-Jets to long-haul international routes serviced by widebody aircraft such as the Boeing 777 and Airbus A350. The competitive advantage lies in offering aircraft that meet stringent performance, safety, and economic criteria, while also catering to evolving airline operational needs and passenger expectations for comfort and connectivity.

Key Drivers, Barriers & Challenges in North America Commercial Aviation Market

Key Drivers:

The North America Commercial Aviation Market is propelled by several key forces. Technologically, the ongoing development of more fuel-efficient engines and the increasing use of lightweight composite materials are critical for reducing operational costs and environmental impact. Economically, the sustained demand for air travel, driven by business and leisure, alongside the growth of e-commerce boosting air cargo, are fundamental growth catalysts. Policy-driven factors, such as government support for aviation infrastructure development and evolving environmental regulations that incentivize cleaner aircraft, also play a significant role. For instance, the Boeing 737 MAX orders from Avolon demonstrate airlines' confidence in new-generation aircraft.

Barriers & Challenges:

Despite robust growth prospects, the market faces significant challenges. Supply chain issues, particularly those related to the availability of raw materials and components, can lead to production delays and increased costs, impacting aircraft delivery timelines. Regulatory hurdles, including evolving safety standards and noise regulations, require continuous adaptation and investment. Competitive pressures from established manufacturers and the high capital intensity of developing new aircraft models pose ongoing challenges. The cost of new aircraft, coupled with the fluctuating price of fuel, can also impact airline purchasing decisions, potentially slowing down fleet modernization. For example, the need for airlines to invest in sustainable aviation fuels (SAFs) represents an additional financial and logistical challenge.

Growth Drivers in the North America Commercial Aviation Market Market

Key growth drivers for the North America Commercial Aviation Market are multifaceted. Technologically, the relentless pursuit of fuel efficiency through advanced engine designs and aerodynamic improvements remains a cornerstone. The increasing integration of digital technologies, such as AI for predictive maintenance and route optimization, is enhancing operational efficiency. Economically, the continued recovery and expansion of air passenger traffic, supported by a growing middle class and a strong business travel sector, are significant. The booming e-commerce sector directly fuels demand for air cargo services, driving the need for both dedicated freighters and the conversion of passenger aircraft. Regulatory support, including government initiatives aimed at modernizing aviation infrastructure and promoting sustainable aviation practices, further bolsters growth. The substantial order placed by Avolon for Boeing 737 MAX aircraft exemplifies airline confidence in the future of air travel and new technology.

Challenges Impacting North America Commercial Aviation Market Growth

Several challenges significantly impact the growth of the North America Commercial Aviation Market. Regulatory complexities surrounding emissions standards and air traffic control modernization can create operational hurdles and require substantial investment. Persistent supply chain disruptions, from raw material shortages to labor constraints, continue to affect aircraft production and delivery schedules, leading to extended lead times. Intense competitive pressures among aircraft manufacturers and a highly price-sensitive airline industry can limit profit margins. Furthermore, the high capital expenditure required for new aircraft acquisition and the volatility of fuel prices present ongoing financial risks for airlines, potentially moderating their fleet expansion plans. The ongoing need to invest in the development and infrastructure for sustainable aviation fuels (SAFs) adds another layer of financial and operational complexity.

Key Players Shaping the North America Commercial Aviation Market Market

- Embraer

- Airbus SE

- United Aircraft Corporation

- De Havilland Aircraft of Canada Ltd

- COMAC

- ATR

- The Boeing Company

Significant North America Commercial Aviation Market Industry Milestones

- June 2023: Boeing received solid 40 737 Max 8s orders from Irish aircraft leasing company Avolon.

- June 2023: Air Algérie, the national airline of Algeria, signed a contract to purchase seven wide-body aircraft to support commercial development.

- June 2023: Delta Air Lines Inc. is in talks with Airbus SE (AIR.PA) for a jumbo jet order. Orders include both A350 and A330neo dual-aisle.

Future Outlook for North America Commercial Aviation Market Market

The future outlook for the North America Commercial Aviation Market is exceptionally strong, driven by persistent demand for air travel and cargo services. Strategic opportunities lie in the continued advancement and adoption of sustainable aviation technologies, including SAFs and potentially hybrid-electric propulsion for regional routes. The market will witness ongoing fleet modernization as airlines prioritize fuel efficiency and environmental compliance. The expansion of air cargo capabilities to support the growing e-commerce landscape presents a significant growth catalyst. Furthermore, government investments in air traffic management modernization and airport infrastructure will facilitate smoother operations and increased capacity, paving the way for sustained market expansion and innovation.

North America Commercial Aviation Market Segmentation

-

1. Sub Aircraft Type

- 1.1. Freighter Aircraft

-

1.2. Passenger Aircraft

- 1.2.1. Narrowbody Aircraft

- 1.2.2. Widebody Aircraft

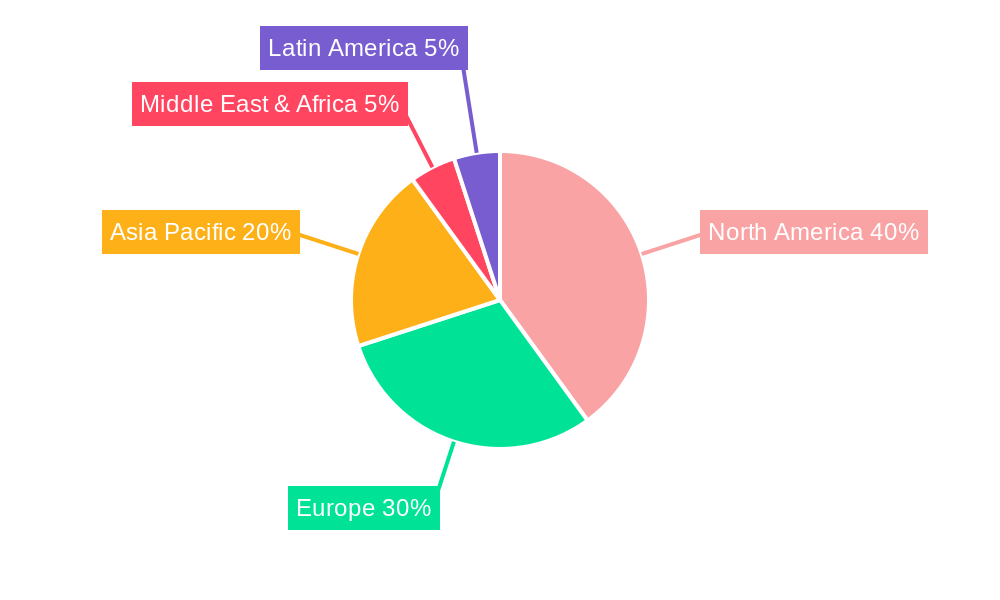

North America Commercial Aviation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Aviation Market Regional Market Share

Geographic Coverage of North America Commercial Aviation Market

North America Commercial Aviation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Aviation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 5.1.1. Freighter Aircraft

- 5.1.2. Passenger Aircraft

- 5.1.2.1. Narrowbody Aircraft

- 5.1.2.2. Widebody Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Embraer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Aircraft Corporatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 De Havilland Aircraft of Canada Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 COMAC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATR

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Boeing Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Embraer

List of Figures

- Figure 1: North America Commercial Aviation Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Commercial Aviation Market Share (%) by Company 2025

List of Tables

- Table 1: North America Commercial Aviation Market Revenue undefined Forecast, by Sub Aircraft Type 2020 & 2033

- Table 2: North America Commercial Aviation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: North America Commercial Aviation Market Revenue undefined Forecast, by Sub Aircraft Type 2020 & 2033

- Table 4: North America Commercial Aviation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States North America Commercial Aviation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Commercial Aviation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Commercial Aviation Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Aviation Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the North America Commercial Aviation Market?

Key companies in the market include Embraer, Airbus SE, United Aircraft Corporatio, De Havilland Aircraft of Canada Ltd, COMAC, ATR, The Boeing Company.

3. What are the main segments of the North America Commercial Aviation Market?

The market segments include Sub Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Boeing received solid 40 737 Max 8s orders from Irish aircraft leasing company Avolon.June 2023: Air Algérie, the national airline of Algeria, signed a contract to purchase seven wide-body aircraft to support commercial development.June 2023: Delta Air Lines Inc. is in talks with Airbus SE (AIR.PA) for a jumbo jet order. Orders include both A350 and A330neo dual-aisle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Aviation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Aviation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Aviation Market?

To stay informed about further developments, trends, and reports in the North America Commercial Aviation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence