Key Insights

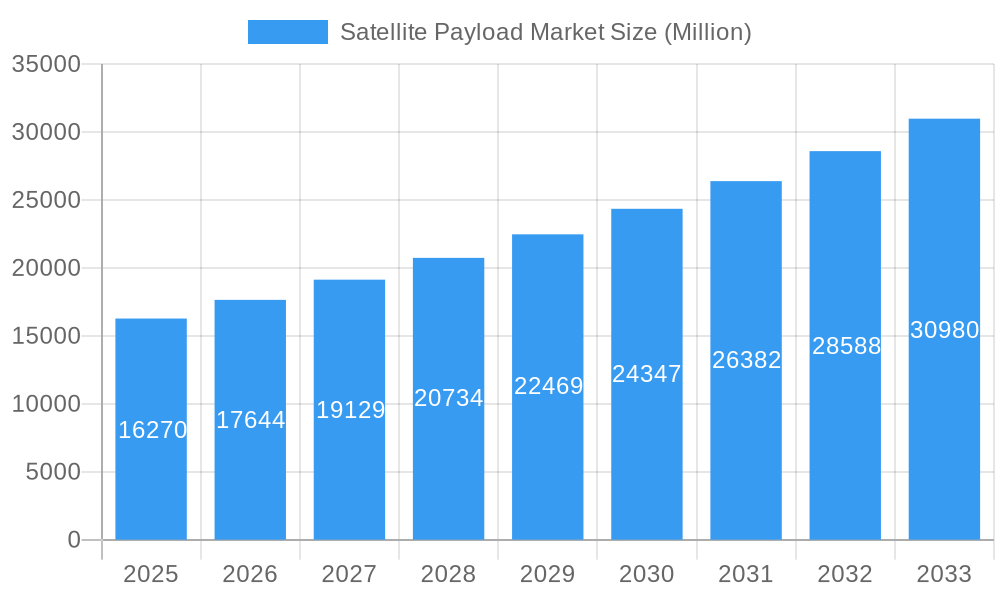

The global Satellite Payload Market is poised for significant expansion, projected to reach an estimated market size of $16.27 billion by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.54% anticipated over the forecast period from 2025 to 2033. A primary driver for this surge is the escalating demand for advanced satellite applications across diverse sectors, including telecommunications, Earth observation, defense, and scientific research. The increasing deployment of small satellites and constellations, coupled with advancements in payload miniaturization and technological sophistication, is further fueling market expansion. Furthermore, growing government investments in space exploration and national security initiatives are creating substantial opportunities for payload manufacturers. The market's trajectory is also influenced by the continuous innovation in areas such as artificial intelligence for on-board data processing, enhanced sensor technologies, and more efficient power systems, all contributing to improved satellite capabilities and mission effectiveness.

Satellite Payload Market Market Size (In Billion)

Despite the overwhelmingly positive growth outlook, the Satellite Payload Market faces certain restraints that warrant strategic consideration. High research and development costs associated with cutting-edge payload technologies, alongside the stringent regulatory frameworks governing space operations, can present barriers to entry and slow down the adoption of new innovations. Additionally, the inherent risks associated with space missions, including launch failures and orbital debris, can impact market confidence and investment. However, these challenges are increasingly being mitigated by advancements in launch reliability, ongoing efforts in space debris management, and the development of more resilient payload designs. The market is characterized by intense competition among major players, driving innovation and cost optimization. Emerging trends such as the commercialization of space, the rise of satellite constellations for global internet coverage, and the growing use of satellite data for climate monitoring and disaster management are expected to shape the market's future landscape, ensuring sustained growth and technological evolution.

Satellite Payload Market Company Market Share

Satellite Payload Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report delivers a granular analysis of the global Satellite Payload Market, encompassing production, consumption, trade, pricing, and emerging trends. With a comprehensive study period from 2019 to 2033, and a base year of 2025, this report offers robust insights into market dynamics, competitive landscapes, and future growth trajectories. Leveraging high-volume SEO keywords like "satellite payload market," "space industry," "payload systems," "satellite technology," and "aerospace market," this report is optimized for maximum visibility and engagement with industry professionals, investors, and stakeholders.

Satellite Payload Market Market Structure & Competitive Landscape

The Satellite Payload Market is characterized by a moderately concentrated competitive landscape, with a few key players holding significant market share. Innovation remains a primary driver, fueled by the relentless pursuit of enhanced functionality, miniaturization, and cost-efficiency in satellite payloads. The market is influenced by stringent regulatory frameworks governing space activities, including spectrum allocation, orbital debris mitigation, and national security considerations, which can act as both barriers to entry and drivers for specialized solutions. Product substitutes are limited due to the unique demands of space-based applications, but advancements in alternative technologies like High-Altitude Platform Systems (HAPS) could present future competition. End-user segmentation is diverse, spanning defense, telecommunications, Earth observation, navigation, and scientific research, each with distinct payload requirements. Mergers and Acquisitions (M&A) activity is a notable trend, with an estimated 50+ M&A deals observed during the historical period (2019-2024) as larger entities seek to consolidate capabilities and expand their portfolios. This consolidation aims to achieve economies of scale, acquire cutting-edge technologies, and secure market dominance. The market concentration ratio for the top 5 players is estimated to be around 65-70%.

Satellite Payload Market Market Trends & Opportunities

The global Satellite Payload Market is poised for substantial expansion, driven by an escalating demand for satellite-derived data and services across various sectors. Market size is projected to grow from an estimated $15 Billion in 2025 to over $35 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 10.5% during the forecast period. This robust growth is underpinned by several transformative technological shifts. The increasing adoption of SmallSats and CubeSats, enabled by advancements in miniaturization and cost-effective launch services, is democratizing access to space and creating new markets for specialized payloads. These smaller platforms require highly efficient, compact, and versatile payloads for applications ranging from IoT connectivity to scientific data collection. Furthermore, the proliferation of constellations for broadband internet services, exemplified by projects like Starlink and OneWeb, is a significant demand driver, necessitating the mass production of standardized yet high-performance payloads. Earth observation capabilities are also being revolutionized by the deployment of sophisticated optical, radar, and hyperspectral payloads, providing unprecedented resolution and analytical power for environmental monitoring, disaster management, and agricultural insights. The rise of AI and machine learning integrated directly into payloads for on-orbit processing is another key trend, enabling faster data analysis and reducing downlink bandwidth requirements.

Consumer preferences are evolving towards more integrated, reliable, and cost-effective payload solutions. This includes a growing demand for payloads that can offer multi-functionality and adaptability to changing mission requirements. The competitive dynamics are intensifying, with established aerospace giants competing alongside nimble startups and national space agencies. Opportunities lie in developing payloads for emerging applications such as space-based artificial intelligence, quantum communication, and in-orbit servicing, assembly, and manufacturing (ISAM). The continuous innovation in sensor technology, including advanced imaging sensors, radio frequency (RF) transponders, and navigation payloads, coupled with miniaturized processing units, is creating a fertile ground for new product development. The increasing focus on national security and defense applications, including intelligence, surveillance, and reconnaissance (ISR), is also a significant market driver, leading to the development of more sophisticated and resilient payloads. The market penetration rate for advanced payload technologies is steadily increasing, particularly in the telecommunications and Earth observation segments.

Dominant Markets & Segments in Satellite Payload Market

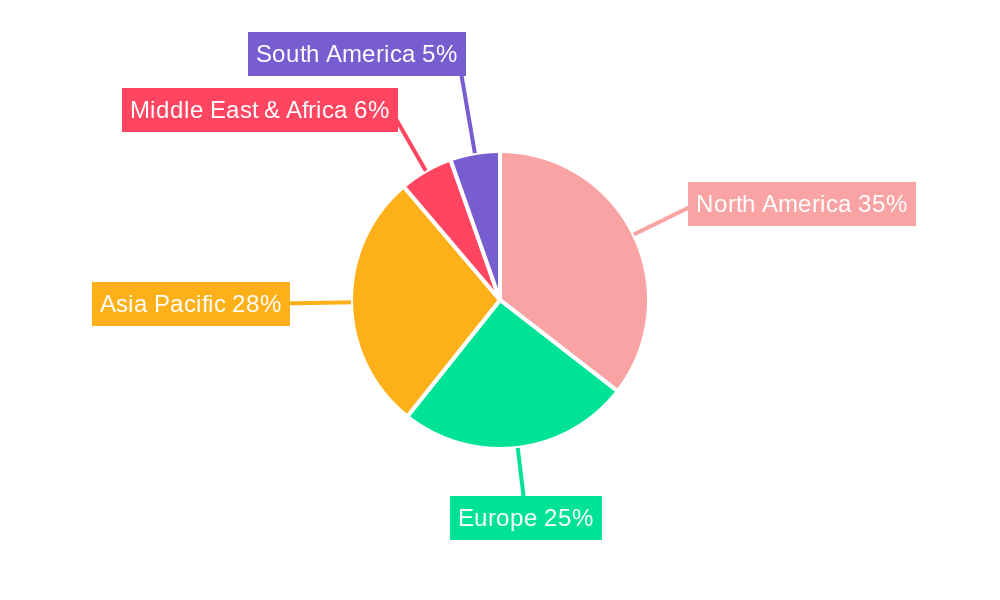

The North America region stands out as the dominant market for satellite payloads, driven by substantial government investments in defense, intelligence, and commercial space initiatives. Within North America, the United States is the leading country, consistently allocating significant budgets towards the development and procurement of advanced satellite payloads. The dominance is further amplified by the presence of major space companies and a robust ecosystem of research and development institutions.

Production Analysis: The production of satellite payloads is heavily concentrated in regions with advanced manufacturing capabilities and strong aerospace industries. North America and Europe lead in production volume and value. Key growth drivers include government defense contracts, commercial satellite constellation deployments, and the growing demand for specialized payloads for scientific missions. Production of payloads for telecommunications and Earth observation segments is particularly robust.

Consumption Analysis: Consumption of satellite payloads is driven by the demand for satellite-based services. The telecommunications sector, including broadband internet constellations and mobile communications, represents the largest segment of consumption. Earth observation for various applications (e.g., agriculture, climate monitoring, urban planning) and defense/intelligence applications are also major consumption drivers. The increasing number of satellite launches globally directly translates to higher payload consumption.

Import Market Analysis (Value & Volume): While North America and Europe are major producers, they also engage in significant imports of specialized payloads or components to supplement domestic capabilities or to leverage cost advantages. Countries with developing space programs, such as those in Asia and the Middle East, are increasingly importing payloads to accelerate their space capabilities. The value of import markets is projected to grow, with an estimated import value of $8 Billion in 2025 and a projected increase to $18 Billion by 2033. Import volume will also see a steady rise, driven by the expansion of small satellite constellations.

Export Market Analysis (Value & Volume): Leading space nations like the United States, European countries, and increasingly China and Russia, are significant exporters of satellite payloads. These exports cater to the global demand for advanced satellite technology, particularly for telecommunications, navigation, and Earth observation. The export market value is estimated at $10 Billion in 2025, expected to reach $22 Billion by 2033. The volume of exports is directly correlated with the global increase in satellite deployments.

Price Trend Analysis: The price trend for satellite payloads is characterized by a gradual decrease in cost per unit for mass-produced payloads, especially for small satellites, due to economies of scale and technological advancements in manufacturing. However, for highly specialized, custom-designed, or advanced scientific payloads, prices remain high due to the complexity of development and stringent performance requirements. The average price of a payload is expected to see a 5-7% annual decrease for standardized payloads while specialty payloads may see stable to modest increases driven by technological sophistication.

Satellite Payload Market Product Analysis

The Satellite Payload Market is witnessing a surge in product innovation, focusing on miniaturization, enhanced functionality, and increased efficiency. Key product advancements include the development of highly integrated RF payloads for broadband constellations, sophisticated multi-spectral and hyperspectral imagers for Earth observation, and advanced sensors for navigation and signal intelligence. These innovations aim to deliver higher data throughput, greater resolution, and improved on-orbit processing capabilities. Competitive advantages are being gained through the development of modular and adaptable payload designs that can be readily integrated into various satellite platforms. Applications are expanding beyond traditional uses, with emerging demands in space-based AI, quantum communications, and debris monitoring.

Key Drivers, Barriers & Challenges in Satellite Payload Market

Key Drivers: The Satellite Payload Market is primarily propelled by the exponential growth in demand for satellite-derived data and services, especially in telecommunications and Earth observation. Technological advancements in miniaturization and cost-effective launch services are democratizing space access, fueling the growth of small satellite constellations. Increased government spending on defense and national security, coupled with a growing number of commercial ventures like broadband internet constellations, are significant economic drivers. Favorable regulatory environments for commercial space activities and international collaborations in space research also act as crucial growth catalysts.

Barriers & Challenges: Despite the robust growth, the market faces several significant barriers and challenges. The high upfront cost of research, development, and manufacturing remains a substantial hurdle for new entrants. Stringent regulatory compliance and licensing procedures, particularly for dual-use payloads, can lead to lengthy development cycles and increased costs. Supply chain vulnerabilities and the reliance on specialized components from a limited number of suppliers pose risks to production timelines and costs. Intensifying competition from both established players and new agile startups necessitates continuous innovation and cost optimization. Furthermore, geopolitical instability and the increasing militarization of space can create uncertainty and impact global market dynamics. The ever-evolving technological landscape requires continuous adaptation and investment in R&D to stay competitive.

Growth Drivers in the Satellite Payload Market Market

The Satellite Payload Market is experiencing significant growth driven by several key factors. Technologically, advancements in miniaturization and integration are enabling smaller, more capable payloads, reducing satellite size and launch costs. The increasing demand for high-bandwidth satellite internet services, exemplified by mega-constellations, is a major economic driver. From a regulatory perspective, supportive government policies and funding initiatives for space exploration and commercialization in various nations are accelerating market expansion. The growing adoption of Earth observation data for climate monitoring, precision agriculture, and urban planning highlights the increasing application diversity. Furthermore, a rising number of defense and security applications, including intelligence, surveillance, and reconnaissance (ISR), are spurring the development of advanced payload technologies.

Challenges Impacting Satellite Payload Market Growth

Several challenges are impacting the growth of the Satellite Payload Market. Regulatory complexities and spectrum allocation issues can lead to delays and increased operational costs. Supply chain disruptions, particularly for critical electronic components, pose significant risks to production schedules and cost management. Intense competitive pressure from both established giants and emerging players necessitates continuous innovation and cost optimization to maintain market share. The high capital expenditure required for R&D and manufacturing infrastructure can be a barrier for smaller companies. Cybersecurity threats targeting satellite systems and ground infrastructure also present a growing concern, requiring robust security solutions. Geopolitical tensions and export control regulations can also limit market access and international collaboration.

Key Players Shaping the Satellite Payload Market Market

- Sierra Nevada Corporation

- Space Exploration Technologies Corp

- L3Harris Technologies Inc

- Honeywell International Inc

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- Airbus SE

- RTX Corporation

- ISRO

- Northrop Grumman Corporation

- The Boeing Company

Significant Satellite Payload Market Industry Milestones

- 2019: Launch of multiple commercial satellite constellations for broadband internet, significantly increasing demand for standardized payloads.

- 2020: Increased investment in Earth observation payloads with advanced hyperspectral imaging capabilities for environmental monitoring.

- 2021: Significant advancements in AI and machine learning integration within satellite payloads for on-orbit data processing.

- 2022: Growing number of mergers and acquisitions as larger companies consolidate their positions in the burgeoning satellite payload market.

- 2023: Introduction of more modular and software-defined payloads, offering greater flexibility and adaptability to evolving mission requirements.

- 2024: Continued focus on payload miniaturization for CubeSats and small satellites, enabling broader access to space-based applications.

Future Outlook for Satellite Payload Market Market

The future outlook for the Satellite Payload Market is exceptionally bright, fueled by a confluence of technological innovation and expanding application frontiers. The market is expected to witness continued growth driven by the ongoing deployment of large satellite constellations for global broadband internet and the increasing demand for high-resolution Earth observation data. Emerging opportunities lie in the development of payloads for space-based artificial intelligence, quantum communication, and in-orbit servicing. The trend towards miniaturization and standardization will likely drive down costs for certain payload types, opening up new market segments. Strategic opportunities for key players will involve focusing on specialized, high-value payloads, fostering strategic partnerships for technology development, and adapting to evolving regulatory landscapes to capitalize on the vast potential of space-based technologies.

Satellite Payload Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Satellite Payload Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Satellite Payload Market Regional Market Share

Geographic Coverage of Satellite Payload Market

Satellite Payload Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Commercial Segment is Expected to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Payload Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Satellite Payload Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Satellite Payload Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Satellite Payload Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Satellite Payload Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Satellite Payload Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sierra Nevada Corporatio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Space Exploration Technologies Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 L3Harris Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 THALES

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 General Dynamics Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lockheed Martin Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Airbus SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RTX Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ISRO

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Sierra Nevada Corporatio

List of Figures

- Figure 1: Global Satellite Payload Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Satellite Payload Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Satellite Payload Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Satellite Payload Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Satellite Payload Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Satellite Payload Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Satellite Payload Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Satellite Payload Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Satellite Payload Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Satellite Payload Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Satellite Payload Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Satellite Payload Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Satellite Payload Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Satellite Payload Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Satellite Payload Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Satellite Payload Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Satellite Payload Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Satellite Payload Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Satellite Payload Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Satellite Payload Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Satellite Payload Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Satellite Payload Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Satellite Payload Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Satellite Payload Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Satellite Payload Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Satellite Payload Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Satellite Payload Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Satellite Payload Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Satellite Payload Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Satellite Payload Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Satellite Payload Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Satellite Payload Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Satellite Payload Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Satellite Payload Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Satellite Payload Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Satellite Payload Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Satellite Payload Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Satellite Payload Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Satellite Payload Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Satellite Payload Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Satellite Payload Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Satellite Payload Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Satellite Payload Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Satellite Payload Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Satellite Payload Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Satellite Payload Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Satellite Payload Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Satellite Payload Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Satellite Payload Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Satellite Payload Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Satellite Payload Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Satellite Payload Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Satellite Payload Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Satellite Payload Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Satellite Payload Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Satellite Payload Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Satellite Payload Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Satellite Payload Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Satellite Payload Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Satellite Payload Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Satellite Payload Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Payload Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Satellite Payload Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Satellite Payload Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Satellite Payload Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Satellite Payload Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Satellite Payload Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Satellite Payload Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Satellite Payload Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Satellite Payload Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Satellite Payload Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Satellite Payload Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Satellite Payload Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Satellite Payload Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Satellite Payload Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Satellite Payload Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Satellite Payload Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Satellite Payload Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Satellite Payload Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Satellite Payload Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Satellite Payload Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Satellite Payload Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Satellite Payload Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Satellite Payload Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Satellite Payload Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Satellite Payload Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Satellite Payload Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Satellite Payload Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Satellite Payload Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Satellite Payload Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Satellite Payload Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Satellite Payload Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Satellite Payload Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Satellite Payload Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Satellite Payload Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Satellite Payload Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Satellite Payload Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Satellite Payload Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Payload Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the Satellite Payload Market?

Key companies in the market include Sierra Nevada Corporatio, Space Exploration Technologies Corp, L3Harris Technologies Inc, Honeywell International Inc, THALES, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, RTX Corporation, ISRO, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Satellite Payload Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.27 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Commercial Segment is Expected to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Payload Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Payload Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Payload Market?

To stay informed about further developments, trends, and reports in the Satellite Payload Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence