Key Insights

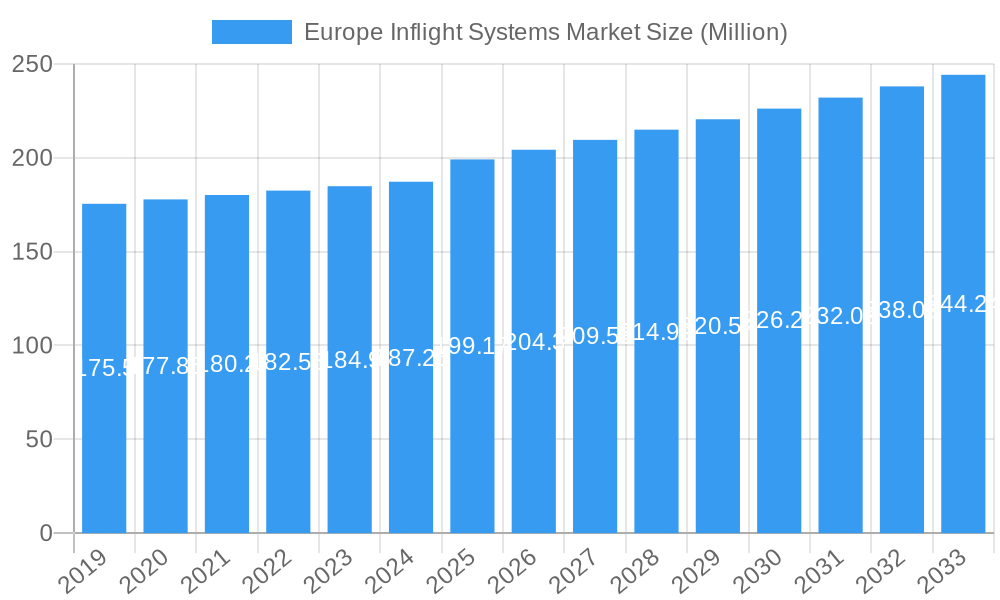

The European Inflight Systems Market is poised for steady growth, projected to reach an estimated value of $199.17 million by 2025. This expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of 2.67% throughout the forecast period of 2025-2033. A significant factor fueling this growth is the increasing demand for enhanced passenger experience, encompassing advanced in-flight entertainment (IFE) and connectivity solutions. Airlines are continuously investing in modernizing their fleets with cutting-edge IFE systems and high-speed internet to attract and retain customers in a competitive landscape. Furthermore, the growing adoption of digital solutions in aviation, aimed at improving operational efficiency and safety, also contributes to the market's upward trajectory. The integration of next-generation connectivity, including 5G capabilities, and the evolution of personalized entertainment offerings are expected to be key enablers of this expansion.

Europe Inflight Systems Market Market Size (In Million)

While the market is experiencing robust demand, certain factors present challenges. The high initial cost of implementing sophisticated inflight systems and the ongoing need for regular upgrades to keep pace with technological advancements can pose a significant financial burden for airlines. Additionally, regulatory hurdles and the complexity of integrating new systems with existing airline infrastructure can slow down adoption rates. Despite these restraints, the market is actively addressing these concerns through innovative leasing models and phased implementation strategies. The production and consumption analysis indicate a balanced market, with strong domestic production and consumption in key European countries like the United Kingdom, Germany, and France. Import and export activities also play a crucial role in shaping the market dynamics, with Europe being a significant player in both. The price trend analysis suggests a gradual stabilization of prices as technological maturity and economies of scale are achieved. Key players like Honeywell International Inc., Safran, and Thales SA are at the forefront of innovation, offering a diverse range of solutions catering to the evolving needs of the European aviation sector.

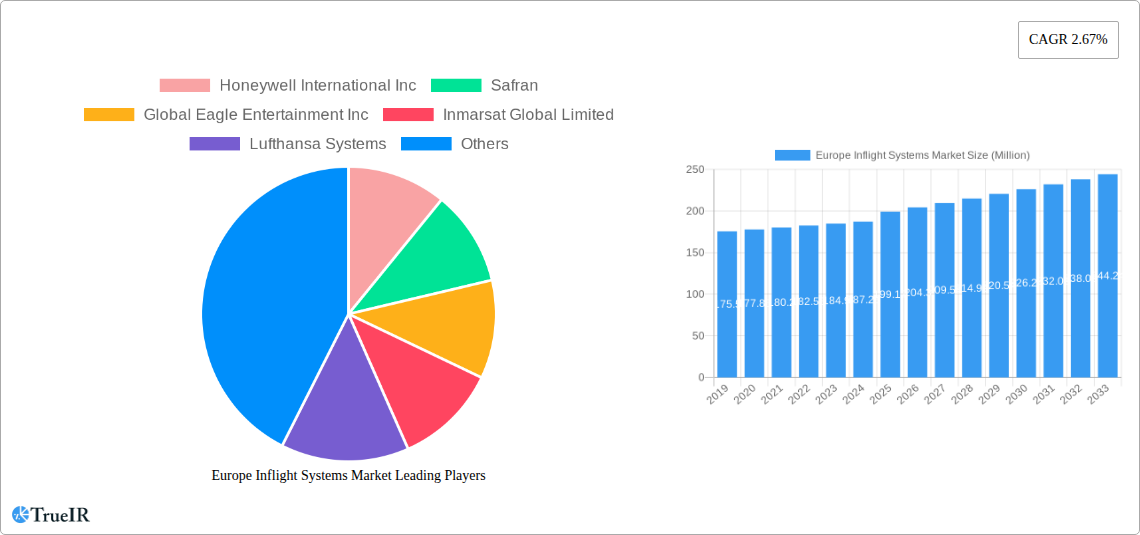

Europe Inflight Systems Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Europe Inflight Systems Market, designed for immediate use without modification.

This in-depth report offers a thorough examination of the Europe Inflight Systems Market, a critical sector within the aviation industry experiencing rapid technological advancement and evolving passenger demands. Covering the historical period from 2019 to 2024, the base year of 2025, and extending through a comprehensive forecast period of 2025–2033, this study provides unparalleled insights into market dynamics, key players, and future trajectory. Leverage high-volume keywords such as "inflight connectivity," "IFE systems," "aviation technology Europe," "airline passenger experience," and "digital cabin solutions" to enhance your search visibility and reach key industry stakeholders. The report meticulously analyzes production, consumption, import/export values and volumes, and price trends, offering a holistic view of the European inflight systems landscape.

Europe Inflight Systems Market Market Structure & Competitive Landscape

The Europe Inflight Systems Market is characterized by a moderately concentrated structure, with key players like Honeywell International Inc, Safran, and Panasonic Corporation holding significant market share. Innovation is a primary driver, fueled by increasing demand for enhanced passenger connectivity and entertainment. Regulatory frameworks, particularly those concerning data privacy and cybersecurity, play a crucial role in shaping product development and market entry. Product substitutes, while limited in core functionality, include a growing array of portable electronic devices and evolving airline-provided services. End-user segmentation primarily revolves around airline fleet type (narrow-body vs. wide-body) and service class (economy, premium economy, business, first class). Mergers and acquisitions (M&A) are a notable trend, with an estimated xx M&A volumes observed in the historical period, aimed at consolidating market position and expanding technological portfolios. Key consolidation activities are expected to continue as companies seek to offer integrated solutions. Concentration ratios are estimated to be around xx% for the top 3 players and xx% for the top 5 players in the base year.

Europe Inflight Systems Market Market Trends & Opportunities

The Europe Inflight Systems Market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This expansion is driven by a confluence of technological advancements, shifting consumer preferences, and evolving competitive dynamics. The relentless pursuit of enhanced passenger experience is at the forefront, with airlines investing heavily in inflight connectivity solutions, including high-speed Wi-Fi and robust IFE (Inflight Entertainment) systems. The increasing adoption of 5G technology and the development of satellite-based communication networks are revolutionizing the speed and reliability of inflight internet access, enabling a richer digital experience for passengers. This includes seamless streaming of high-definition content, real-time communication, and the availability of a wider range of onboard digital services.

Furthermore, the market is witnessing a surge in demand for personalized entertainment and services. Passengers expect a tailored experience that mirrors their at-home digital environment. This translates into opportunities for IFE systems that offer extensive content libraries, personalized recommendations, and integration with passengers' own devices. The rise of "bring your own device" (BYOD) trends further necessitates flexible and adaptable inflight entertainment solutions. Airlines are increasingly viewing inflight systems not just as a cost center but as a revenue-generating opportunity through advertising, e-commerce, and premium service offerings.

The competitive landscape is intensifying, with established players like Gogo LLC, ViaSat Inc., and Inmarsat Global Limited facing competition from emerging technology providers and system integrators. Strategic partnerships and collaborations are becoming essential for addressing complex integration challenges and for developing innovative solutions. The drive towards sustainability is also influencing the market, with a growing focus on energy-efficient inflight systems and lighter-weight components. This trend presents opportunities for manufacturers to develop eco-friendly solutions that contribute to reduced fuel consumption.

The increasing demand for operational efficiency for airlines also fuels the adoption of advanced inflight systems. Data analytics and predictive maintenance capabilities integrated within these systems can help airlines optimize operations, reduce downtime, and improve overall fleet management. The burgeoning aviation technology Europe sector is actively developing solutions that cater to these evolving needs, creating a fertile ground for innovation and market penetration. Opportunities also lie in retrofitting older aircraft with advanced inflight connectivity and IFE systems, a segment expected to contribute significantly to market growth in the coming years. The focus on creating a connected cabin experience is no longer a luxury but a necessity for airlines seeking to remain competitive in the global aviation market.

Dominant Markets & Segments in Europe Inflight Systems Market

The Europe Inflight Systems Market exhibits distinct patterns of dominance across various segments, driven by a combination of robust aviation infrastructure, supportive policies, and evolving passenger expectations.

Production Analysis: The production of inflight systems is concentrated in regions with strong aerospace manufacturing capabilities. Germany, France, and the United Kingdom are key manufacturing hubs, benefiting from established supply chains and a skilled workforce. Production analysis reveals a growing emphasis on inflight connectivity hardware and software development.

Consumption Analysis: Western Europe, particularly countries with major airline hubs like Germany, France, the UK, and Spain, represents the dominant region for consumption. This is directly linked to the high volume of air travel and the proactive adoption of advanced inflight entertainment (IFE) systems and inflight Wi-Fi by leading European airlines. Passenger demand for seamless connectivity and enhanced entertainment options is a primary growth driver.

- Key Growth Drivers in Consumption:

- High disposable income and a strong propensity for air travel among European populations.

- The presence of major global airlines that prioritize passenger experience and technology upgrades.

- A competitive airline market that necessitates differentiation through advanced onboard services.

Import Market Analysis (Value & Volume): The import market is significant, with Europe importing advanced technological components and integrated systems from global manufacturers. The value of imports is driven by high-end IFE systems, advanced communication modules, and specialized software solutions. Volume is influenced by the sheer number of aircraft being equipped or retrofitted.

- Dominant Import Categories:

- High-bandwidth satellite communication equipment.

- Advanced touchscreen IFE displays and control units.

- Integrated cabin management systems.

Export Market Analysis (Value & Volume): Europe is also a significant exporter of inflight systems, particularly from specialized companies focusing on niche solutions and integrated services. Exports are driven by innovation in areas like cabin lighting, passenger-centric software, and certain connectivity hardware.

- Key Export Strengths:

- Innovative software solutions for passenger engagement and personalization.

- Specialized components for lightweight and energy-efficient systems.

- Aftermarket support and upgrade services for existing fleets.

Price Trend Analysis: Price trends are influenced by technological advancements, competitive pressures, and economies of scale. The introduction of new technologies, such as faster inflight Wi-Fi solutions and more immersive IFE systems, initially commands premium pricing. However, as these technologies mature and production volumes increase, prices tend to stabilize or decline. Government incentives and airline fleet modernization programs can also impact price trends. The cost of raw materials and supply chain disruptions, as seen in recent years, can lead to upward price pressures.

Europe Inflight Systems Market Product Analysis

The Europe Inflight Systems Market is characterized by a constant stream of product innovations focused on enhancing passenger experience and operational efficiency. Key product categories include inflight connectivity hardware (e.g., satellite antennas, modems), IFE systems (e.g., displays, content servers, control units), and cabin management systems. Technological advancements are driving the integration of high-speed internet, personalized entertainment streaming, and seamless device connectivity. Competitive advantages stem from superior bandwidth, intuitive user interfaces, comprehensive content offerings, and robust cybersecurity features. The focus is shifting towards lighter, more energy-efficient solutions that minimize aircraft weight and reduce fuel consumption.

Key Drivers, Barriers & Challenges in Europe Inflight Systems Market

Key Drivers: The Europe Inflight Systems Market is primarily propelled by increasing passenger demand for seamless inflight connectivity and engaging IFE systems. Airlines are investing to enhance the passenger experience and differentiate themselves in a competitive market. Technological advancements, particularly in satellite communications and high-speed Wi-Fi, are enabling richer digital experiences. Furthermore, the potential for ancillary revenue generation through onboard e-commerce and advertising is a significant economic driver. Supportive aviation policies and the trend towards fleet modernization further fuel market growth.

Barriers & Challenges: Key challenges include the high cost of system implementation and upgrades, particularly for older aircraft. Regulatory complexities related to data privacy, cybersecurity, and spectrum allocation can pose hurdles. Supply chain disruptions and component shortages, as experienced recently, can impact production timelines and costs. Intense competition among established players and emerging technology providers also presents a challenge, driving down margins. The long lifecycle of aircraft and the significant capital investment required for retrofitting can slow down the adoption of the latest technologies.

Growth Drivers in the Europe Inflight Systems Market Market

Growth in the Europe Inflight Systems Market is propelled by several key factors. Technologically, the evolution of inflight Wi-Fi towards high-speed, reliable connectivity via advanced satellite and cellular networks is a primary catalyst. Economically, airlines are recognizing the significant revenue potential from ancillary services, including e-commerce, targeted advertising, and premium content access delivered through IFE systems. Regulatory initiatives promoting aviation innovation and passenger welfare also contribute. The increasing passenger expectation for a connected and entertaining journey, mirroring ground-based experiences, is a powerful market driver, pushing airlines to invest in sophisticated inflight entertainment and communication solutions.

Challenges Impacting Europe Inflight Systems Market Growth

Several significant challenges impact the growth of the Europe Inflight Systems Market. Regulatory complexities surrounding data privacy, cybersecurity mandates, and spectrum allocation can delay product deployment and increase compliance costs. Supply chain issues, including the availability of critical components and rising raw material prices, can lead to production delays and escalated costs for inflight connectivity hardware and IFE systems. Competitive pressures from both established players and new entrants necessitate continuous innovation and can lead to price erosion, impacting profit margins for inflight systems providers. The substantial capital investment required for aircraft retrofitting and the long lead times associated with aviation certifications also present considerable barriers to rapid market expansion.

Key Players Shaping the Europe Inflight Systems Market Market

- Honeywell International Inc

- Safran

- Global Eagle Entertainment Inc

- Inmarsat Global Limited

- Lufthansa Systems

- Raytheon Technologies Corporations

- Thales SA

- Burrana

- Gogo LLC

- ViaSat Inc

- Panasonic Corporation

- Immfly

Significant Europe Inflight Systems Market Industry Milestones

- 2020: Launch of new generation high-throughput satellite constellations, significantly improving inflight connectivity speeds.

- 2021: Increased focus on personalized IFE systems with advanced content management and BYOD integration.

- 2022: Significant investments in cybersecurity solutions for inflight networks due to rising cyber threats.

- 2023: Major European airlines announce ambitious plans for fleet-wide retrofitting of advanced inflight Wi-Fi and entertainment systems.

- 2024: Introduction of 5G-enabled inflight communication solutions, promising near-ground speeds.

Future Outlook for Europe Inflight Systems Market Market

The future outlook for the Europe Inflight Systems Market is exceptionally promising, driven by an insatiable passenger appetite for seamless inflight connectivity and personalized IFE systems. Strategic opportunities lie in the development of integrated solutions that combine communication, entertainment, and operational data analytics. The ongoing fleet modernization programs across Europe, coupled with the increasing adoption of advanced technologies like 5G and improved satellite networks, will continue to fuel market expansion. The shift towards a "connected cabin" will empower airlines to generate substantial ancillary revenues, further solidifying the importance of sophisticated aviation technology Europe in the years to come.

Europe Inflight Systems Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Inflight Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

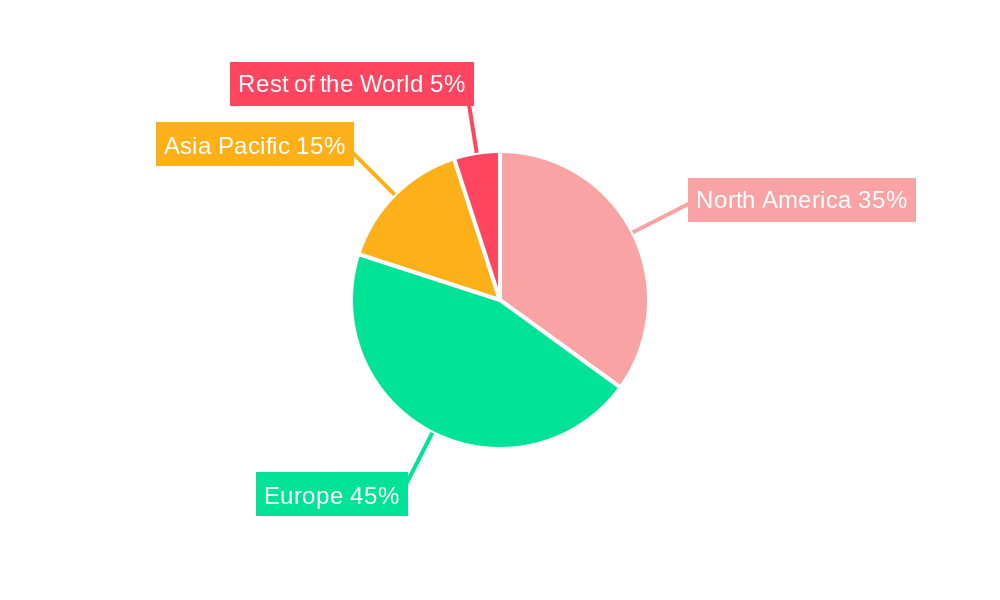

Europe Inflight Systems Market Regional Market Share

Geographic Coverage of Europe Inflight Systems Market

Europe Inflight Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 By Product Type

- 3.4.2 The Connectivity Segment Is Expected To Witness Significant Growth During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Inflight Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Safran

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Global Eagle Entertainment Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inmarsat Global Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lufthansa Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Raytheon Technologies Corporations

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Burrana

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gogo LL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ViaSat Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Immfly

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Inflight Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Inflight Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Inflight Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Inflight Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Inflight Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Inflight Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Inflight Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Inflight Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Inflight Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Inflight Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Inflight Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Inflight Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Inflight Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Inflight Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Inflight Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Inflight Systems Market?

The projected CAGR is approximately 2.67%.

2. Which companies are prominent players in the Europe Inflight Systems Market?

Key companies in the market include Honeywell International Inc, Safran, Global Eagle Entertainment Inc, Inmarsat Global Limited, Lufthansa Systems, Raytheon Technologies Corporations, Thales SA, Burrana, Gogo LL, ViaSat Inc, Panasonic Corporation, Immfly.

3. What are the main segments of the Europe Inflight Systems Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 199.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

By Product Type. The Connectivity Segment Is Expected To Witness Significant Growth During The Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Inflight Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Inflight Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Inflight Systems Market?

To stay informed about further developments, trends, and reports in the Europe Inflight Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence