Key Insights

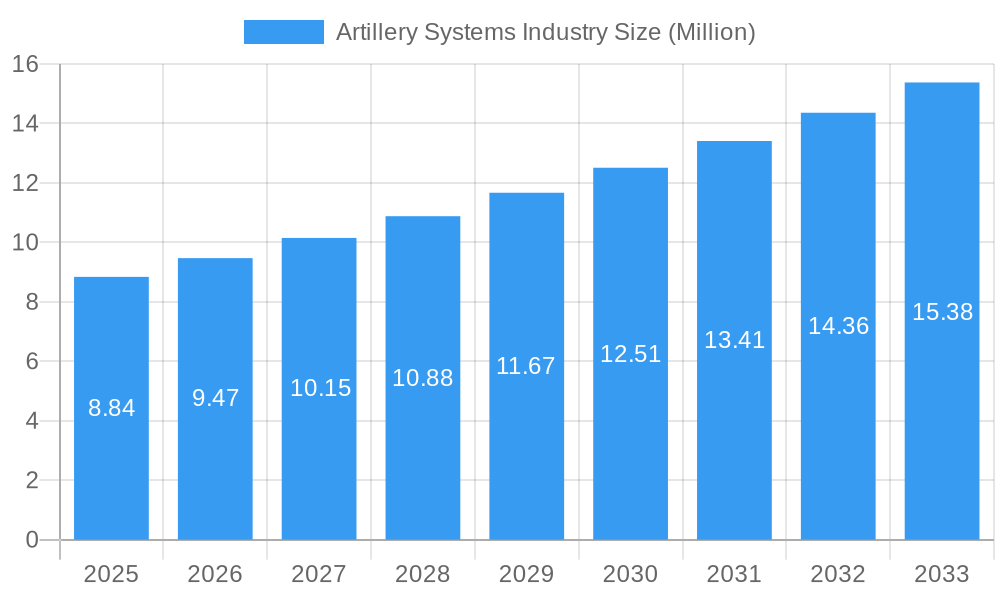

The global Artillery Systems market is poised for significant expansion, projected to reach \$8.84 million in value. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.24%, indicating a dynamic and evolving industry landscape. The escalating geopolitical tensions worldwide and the increasing emphasis on modernization of defense forces by nations are primary drivers for this expansion. Countries are investing heavily in advanced artillery systems to enhance their conventional warfare capabilities, bolster border security, and deter potential adversaries. The demand for precision-guided munitions and longer-range artillery systems is particularly on the rise, driven by the need for greater battlefield effectiveness and reduced collateral damage. Furthermore, advancements in technology, including smart artillery, networked systems, and enhanced mobility, are contributing to the adoption of next-generation artillery solutions.

Artillery Systems Industry Market Size (In Million)

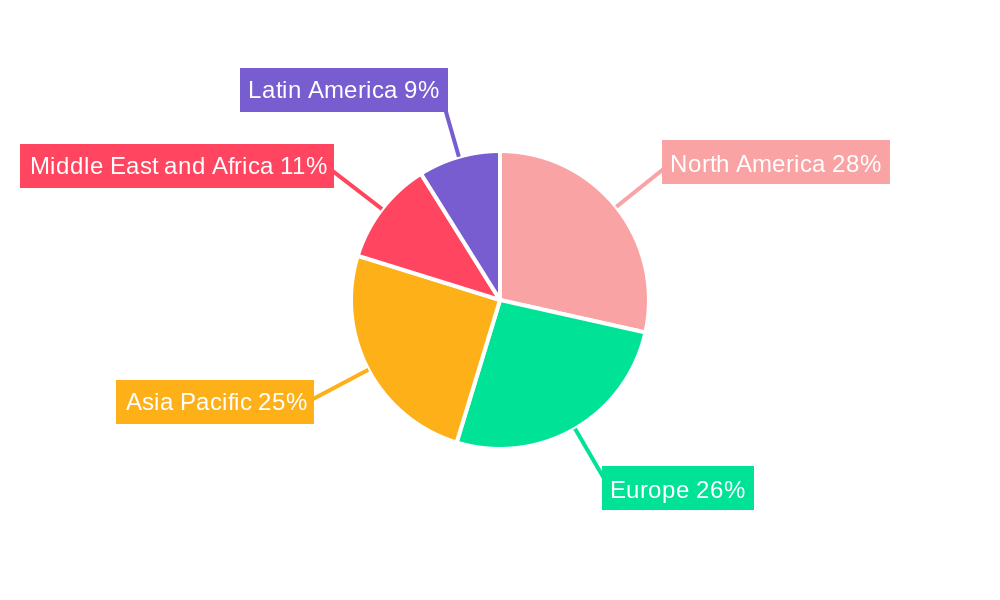

The market segmentation reveals a diverse range of artillery types catering to various tactical requirements. Howitzers and rocket artillery are expected to dominate the market due to their versatility and widespread application in both offensive and defensive operations. Short and medium-range artillery systems will likely see sustained demand for tactical deployment, while the growing interest in long-range systems, capable of striking targets at significant distances, will contribute to market growth. Regionally, North America and Europe, with their established defense industries and ongoing military modernization programs, are anticipated to hold substantial market shares. However, the Asia Pacific region, driven by countries like China and India with their rapidly expanding defense budgets and focus on indigenous manufacturing, presents a significant growth opportunity. The ongoing global arms race and the continuous need for enhanced national security are expected to sustain the positive trajectory of the Artillery Systems market throughout the forecast period.

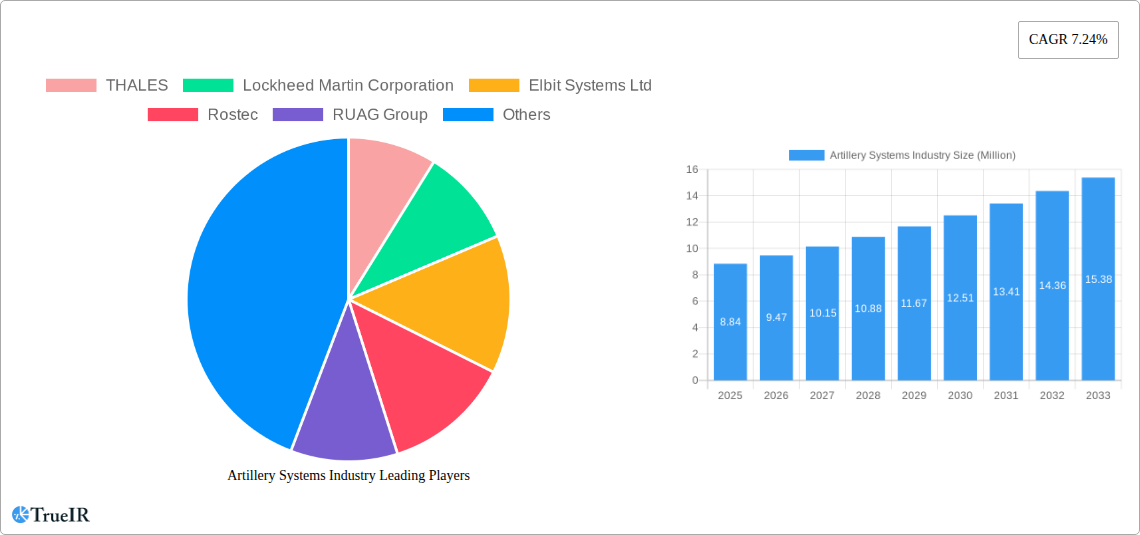

Artillery Systems Industry Company Market Share

Here's a dynamic, SEO-optimized report description for the Artillery Systems Industry, incorporating high-volume keywords and structured as requested:

Artillery Systems Industry Market Structure & Competitive Landscape

The global artillery systems market is characterized by a moderately concentrated structure, with major defense contractors dominating a significant share of the landscape. Key players like THALES, Lockheed Martin Corporation, Elbit Systems Ltd, Rostec, RUAG Group, Denel SOC Ltd, Nexter Group, Leonardo S p A, Norinco International Cooperation Ltd, Hanwha Group, Avibras Indústria Aeroespacial SA, Singapore Technologies Engineering Ltd, Rheinmetall A, and BAE Systems plc continuously drive innovation through substantial investments in research and development. The industry's competitive intensity is fueled by ongoing geopolitical tensions, increasing defense budgets, and the persistent need for advanced battlefield capabilities.

- Market Concentration: Analysis of the top 5 companies reveals a concentration ratio of approximately 65%, indicating significant market power held by leading entities.

- Innovation Drivers: Technological advancements in precision-guided munitions, enhanced mobility, networked warfare integration, and counter-battery capabilities are paramount.

- Regulatory Impacts: Stringent export controls and national defense policies significantly influence market access and procurement processes globally.

- Product Substitutes: While direct substitutes are limited, the evolution of drone warfare and missile systems presents indirect competitive pressures, compelling traditional artillery manufacturers to adapt.

- End-User Segmentation: Defense ministries and governmental agencies represent the primary end-users, with a growing emphasis on modernizing aging fleets and adopting next-generation artillery solutions.

- M&A Trends: The historical period (2019-2024) witnessed approximately 15 strategic acquisitions and mergers, primarily focused on consolidating market share, acquiring advanced technologies, and expanding product portfolios. This trend is expected to continue, driven by the pursuit of greater efficiency and global reach.

Artillery Systems Industry Market Trends & Opportunities

The global artillery systems market is poised for substantial expansion, driven by escalating geopolitical uncertainties and a widespread need for enhanced national defense capabilities. The study period from 2019 to 2033, with a base year of 2025, projects a robust Compound Annual Growth Rate (CAGR) of xx.xx% for the forecast period of 2025–2033. This growth is underpinned by increasing defense expenditures across major economies, a significant modernization drive within armed forces, and the persistent demand for both conventional and advanced indirect fire support systems. The market size is estimated to reach over USD XXX Million by 2033, a testament to the industry’s resilience and strategic importance.

Technological advancements are reshaping the artillery industry. The integration of artificial intelligence (AI) for enhanced targeting, autonomous operation, and improved battlefield awareness is a critical trend. Furthermore, the development of smart munitions and guided projectiles is significantly increasing the precision and effectiveness of artillery systems, reducing collateral damage and maximizing operational impact. The trend towards networked artillery, where systems are interconnected for real-time data sharing and coordinated fire missions, is also gaining traction. This allows for faster response times and more effective suppression of enemy forces.

Consumer preferences, or rather end-user requirements, are shifting towards lighter, more mobile, and versatile artillery platforms that can be rapidly deployed and operated in diverse terrains. The demand for longer-range capabilities, as evidenced by contracts for systems like the PULS™ rocket launchers, underscores the strategic importance of extending operational reach. Opportunities abound for manufacturers that can offer integrated solutions, including advanced command and control systems, sophisticated ammunition, and comprehensive training and support packages. The increasing adoption of modular designs and digital architectures allows for easier upgrades and customization, catering to the specific needs of different military branches and operational theaters.

Competitive dynamics are characterized by intense innovation and strategic partnerships. Companies are investing heavily in developing solutions that offer superior firepower, enhanced survivability for crews, and reduced logistical footprints. The artillery systems market is witnessing a growing emphasis on electronic warfare countermeasures and camouflage technologies to ensure the survivability of deployed units. The ongoing modernization efforts by numerous countries represent a significant opportunity for established players and emerging innovators alike to capture market share by offering state-of-the-art, cost-effective, and highly capable artillery solutions. The development of next-generation artillery systems, capable of engaging targets at extended ranges with unparalleled accuracy, will be a key differentiator in the coming years.

Dominant Markets & Segments in Artillery Systems Industry

The global artillery systems market exhibits significant regional dominance, with North America and Europe currently leading in terms of market share and technological adoption. This leadership is driven by substantial defense budgets, ongoing modernization programs, and the presence of major defense contractors. Within these regions, the United States and Germany stand out as key markets, continuously investing in advanced artillery solutions to maintain a strategic military edge. The Asia-Pacific region, particularly China and India, represents a rapidly growing segment, propelled by escalating regional tensions and ambitious military expansion plans.

The Type segment is dominated by Howitzers, which form the backbone of indirect fire support for most modern armies. Their versatility, range, and proven effectiveness in various combat scenarios ensure their continued prominence. However, Rocket Artillery is experiencing a significant surge in demand, fueled by the need for rapid, high-volume suppression and precision strikes. The July 2023 contract awarded to Elbit Systems Ltd. for PULS™ rocket launchers and precision-guided rockets highlights this growing trend, demonstrating a strategic shift towards advanced rocket artillery capabilities. Anti-air Artillery also remains a crucial segment, with continuous evolution in missile defense systems and integrated air defense solutions to counter evolving aerial threats.

Regarding Range, Long Range (Above 60 kilometers) artillery systems are gaining substantial traction. This is directly linked to the development of advanced guided munitions and the strategic imperative to engage enemy forces from safer distances. The demand for extended-range capabilities allows for greater operational flexibility and the ability to project power across wider operational theaters. Medium Range (31-60 kilometers) artillery systems also maintain a strong market presence, offering a balanced combination of reach and tactical utility. Short Range (5-30 kilometers) artillery, while foundational, is increasingly being complemented by more advanced systems for specific tactical applications.

- Dominant Region Analysis:

- North America: Driven by consistent defense spending from the US and Canada, focusing on networked warfare and precision strike capabilities.

- Europe: Characterized by robust military alliances like NATO, necessitating interoperable and advanced artillery systems to address collective security threats.

- Dominant Segment Analysis:

- Howitzer: The most widely deployed type due to its versatility and established combat effectiveness.

- Rocket Artillery: Experiencing high growth due to demand for precision strike and saturation bombardment capabilities.

- Long Range: Increasing demand driven by the need for extended operational reach and standoff capabilities.

The ongoing modernization initiatives, coupled with the development of highly accurate and mobile artillery platforms, are key growth drivers across these dominant markets and segments. The integration of advanced fire control systems and smart ammunition further enhances the capabilities and market appeal of these artillery systems.

Artillery Systems Industry Product Analysis

The artillery systems industry is witnessing rapid product innovation focused on enhancing precision, mobility, and networked warfare capabilities. Key advancements include the integration of AI-powered fire control systems for faster target acquisition and improved accuracy, as well as the development of advanced precision-guided munitions (PGMs) that significantly increase lethality and reduce collateral damage. Companies are also prioritizing lighter, more modular designs for easier transport and deployment, alongside enhanced survivability features for crews and platforms. The competitive advantage lies in offering integrated solutions that combine advanced artillery platforms with sophisticated ammunition, robust communication systems, and comprehensive battlefield management software, enabling seamless integration into modern defense networks.

Key Drivers, Barriers & Challenges in Artillery Systems Industry

The artillery systems industry is propelled by several key drivers, including escalating geopolitical tensions that necessitate enhanced defense capabilities, substantial government defense budgets across major nations, and continuous technological advancements in areas such as precision munitions and AI integration. The modernization of aging artillery fleets worldwide also presents a significant growth catalyst.

Conversely, the industry faces considerable barriers and challenges. Stringent regulatory frameworks and export controls imposed by governments can significantly impact international sales and market access. Supply chain disruptions, particularly for specialized components and raw materials, pose a constant threat to production timelines and cost management. Intense competitive pressure among established players and emerging defense contractors, coupled with the high cost of research and development, also presents significant hurdles. Furthermore, the evolving nature of warfare, with the rise of drones and asymmetric threats, requires constant adaptation and innovation, adding complexity to product development and market strategy.

Growth Drivers in the Artillery Systems Industry Market

The artillery systems industry is experiencing robust growth driven by several pivotal factors. Geopolitical instability and an increasing number of regional conflicts worldwide are compelling nations to bolster their defense infrastructures, directly impacting the demand for advanced artillery. Coupled with this is the steady increase in global defense spending, with governments prioritizing modernization of their armed forces to counter evolving threats. Technological innovation remains a critical growth engine, with advancements in guided munitions, AI-driven targeting systems, and enhanced battlefield communication transforming the capabilities of artillery. The continuous drive for precision, range, and mobility ensures a consistent demand for next-generation systems. Moreover, ongoing efforts by many countries to upgrade their existing artillery arsenals further fuel market expansion.

Challenges Impacting Artillery Systems Industry Growth

Despite its growth trajectory, the artillery systems industry faces several significant challenges that could impede its expansion. The complex and often lengthy procurement processes within government defense sectors can lead to delays and cost overruns. Stringent international regulations and export controls on defense technologies create barriers to entry for some markets and limit global sales opportunities for manufacturers. Supply chain vulnerabilities, exacerbated by global events, can lead to shortages of critical components and increased production costs, impacting timely delivery. The high research and development costs associated with cutting-edge artillery technology require substantial financial investment and carry inherent risks. Furthermore, intense competition from established players and emerging nations, along with the evolving threat landscape that necessitates continuous adaptation, adds to the market's complexity and pressure.

Key Players Shaping the Artillery Systems Industry Market

- THALES

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Rostec

- RUAG Group

- Denel SOC Ltd

- Nexter Group

- Leonardo S p A

- Norinco International Cooperation Ltd

- Hanwha Group

- Avibras Indústria Aeroespacial SA

- Singapore Technologies Engineering Ltd

- Rheinmetall A

- BAE Systems plc

Significant Artillery Systems Industry Industry Milestones

- July 2023: Elbit Systems Ltd. secured a USD 150 Million contract to supply PULS™ (Precise and Universal Launching Systems) rocket launchers and precision-guided long-range rockets, significantly enhancing its market position in advanced rocket artillery.

- July 2023: The UK Ministry of Defence awarded BAE Systems Bofors AB a USD 4.5 Million contract for the support of the Archer Artillery System, highlighting ongoing investment in the maintenance, training, and configuration management of critical artillery platforms.

Future Outlook for Artillery Systems Industry Market

The artillery systems industry is projected to experience continued growth, driven by persistent geopolitical tensions and the ongoing global imperative for robust national defense. Strategic opportunities lie in the development and integration of autonomous and AI-enabled artillery systems, as well as advanced precision-guided munitions that offer enhanced standoff capabilities and reduced operational risks. The market potential is further amplified by the increasing adoption of networked artillery, enabling seamless battlefield integration and coordinated fire support. Companies that can offer modular, upgradeable, and cost-effective solutions, coupled with comprehensive lifecycle support, will be best positioned to capitalize on the evolving demands of modern military forces and secure a significant share of the expanding global market.

Artillery Systems Industry Segmentation

-

1. Type

- 1.1. Howitzer

- 1.2. Mortar

- 1.3. Anti-air Artillery

- 1.4. Rocket Artillery

- 1.5. Other Types (Naval and Coastal Artillery)

-

2. Range

- 2.1. Short Range (5-30 kilometers)

- 2.2. Medium Range (31-60 kilometers)

- 2.3. Long Range (Above 60 kilometers)

Artillery Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Artillery Systems Industry Regional Market Share

Geographic Coverage of Artillery Systems Industry

Artillery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Defense Expenditure Supporting the Growth of the Artillery Systems Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Howitzer

- 5.1.2. Mortar

- 5.1.3. Anti-air Artillery

- 5.1.4. Rocket Artillery

- 5.1.5. Other Types (Naval and Coastal Artillery)

- 5.2. Market Analysis, Insights and Forecast - by Range

- 5.2.1. Short Range (5-30 kilometers)

- 5.2.2. Medium Range (31-60 kilometers)

- 5.2.3. Long Range (Above 60 kilometers)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Howitzer

- 6.1.2. Mortar

- 6.1.3. Anti-air Artillery

- 6.1.4. Rocket Artillery

- 6.1.5. Other Types (Naval and Coastal Artillery)

- 6.2. Market Analysis, Insights and Forecast - by Range

- 6.2.1. Short Range (5-30 kilometers)

- 6.2.2. Medium Range (31-60 kilometers)

- 6.2.3. Long Range (Above 60 kilometers)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Howitzer

- 7.1.2. Mortar

- 7.1.3. Anti-air Artillery

- 7.1.4. Rocket Artillery

- 7.1.5. Other Types (Naval and Coastal Artillery)

- 7.2. Market Analysis, Insights and Forecast - by Range

- 7.2.1. Short Range (5-30 kilometers)

- 7.2.2. Medium Range (31-60 kilometers)

- 7.2.3. Long Range (Above 60 kilometers)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Howitzer

- 8.1.2. Mortar

- 8.1.3. Anti-air Artillery

- 8.1.4. Rocket Artillery

- 8.1.5. Other Types (Naval and Coastal Artillery)

- 8.2. Market Analysis, Insights and Forecast - by Range

- 8.2.1. Short Range (5-30 kilometers)

- 8.2.2. Medium Range (31-60 kilometers)

- 8.2.3. Long Range (Above 60 kilometers)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Howitzer

- 9.1.2. Mortar

- 9.1.3. Anti-air Artillery

- 9.1.4. Rocket Artillery

- 9.1.5. Other Types (Naval and Coastal Artillery)

- 9.2. Market Analysis, Insights and Forecast - by Range

- 9.2.1. Short Range (5-30 kilometers)

- 9.2.2. Medium Range (31-60 kilometers)

- 9.2.3. Long Range (Above 60 kilometers)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Artillery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Howitzer

- 10.1.2. Mortar

- 10.1.3. Anti-air Artillery

- 10.1.4. Rocket Artillery

- 10.1.5. Other Types (Naval and Coastal Artillery)

- 10.2. Market Analysis, Insights and Forecast - by Range

- 10.2.1. Short Range (5-30 kilometers)

- 10.2.2. Medium Range (31-60 kilometers)

- 10.2.3. Long Range (Above 60 kilometers)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elbit Systems Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rostec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RUAG Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Denel SOC Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nexter Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leonardo S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Norinco International Cooperation Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hanwha Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avibras Indústria Aeroespacial SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Singapore Technologies Engineering Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rheinmetall A

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BAE Systems plc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Global Artillery Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 5: North America Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 6: North America Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 11: Europe Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 12: Europe Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 17: Asia Pacific Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 18: Asia Pacific Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 23: Latin America Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 24: Latin America Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Artillery Systems Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Artillery Systems Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Artillery Systems Industry Revenue (Million), by Range 2025 & 2033

- Figure 29: Middle East and Africa Artillery Systems Industry Revenue Share (%), by Range 2025 & 2033

- Figure 30: Middle East and Africa Artillery Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Artillery Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 3: Global Artillery Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 6: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 11: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 20: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 29: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Mexico Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Artillery Systems Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Artillery Systems Industry Revenue Million Forecast, by Range 2020 & 2033

- Table 35: Global Artillery Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Israel Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Artillery Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artillery Systems Industry?

The projected CAGR is approximately 7.24%.

2. Which companies are prominent players in the Artillery Systems Industry?

Key companies in the market include THALES, Lockheed Martin Corporation, Elbit Systems Ltd, Rostec, RUAG Group, Denel SOC Ltd, Nexter Group, Leonardo S p A, Norinco International Cooperation Ltd, Hanwha Group, Avibras Indústria Aeroespacial SA, Singapore Technologies Engineering Ltd, Rheinmetall A, BAE Systems plc.

3. What are the main segments of the Artillery Systems Industry?

The market segments include Type, Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.84 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Defense Expenditure Supporting the Growth of the Artillery Systems Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: Elbit Systems Ltd. announced it was awarded a USD 150 million contract to supply PULS™ (Precise and Universal Launching Systems) rocket launchers and a package of precision-guided long-range rockets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artillery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artillery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artillery Systems Industry?

To stay informed about further developments, trends, and reports in the Artillery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence