Key Insights

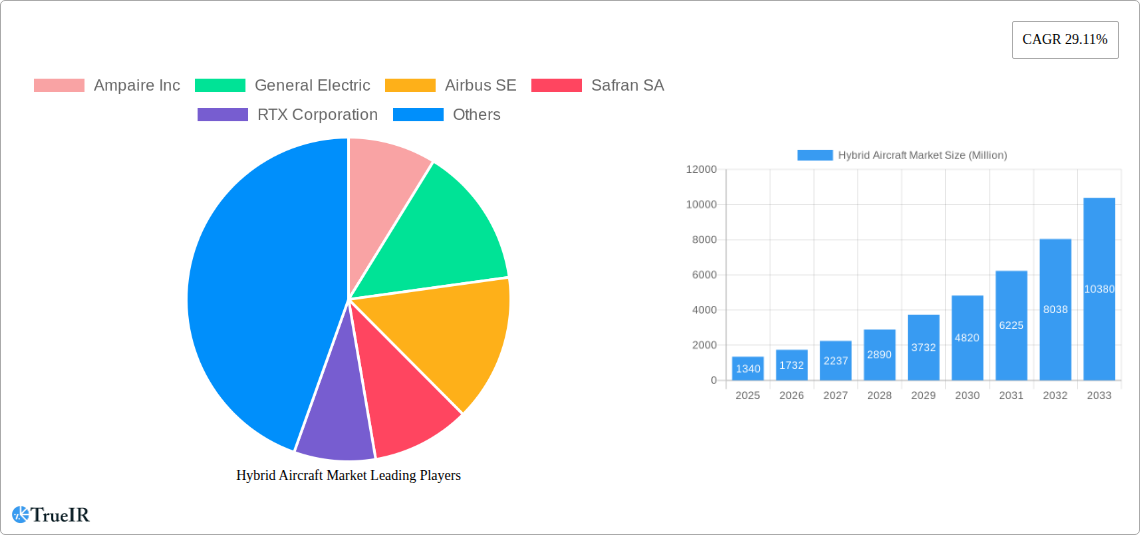

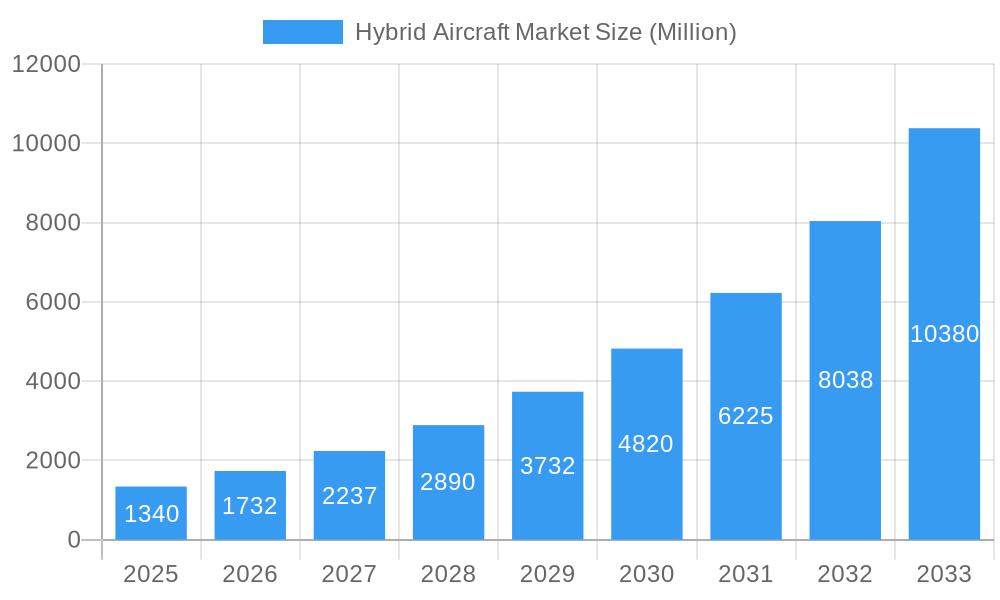

The global Hybrid Aircraft Market is poised for explosive growth, projected to reach a substantial market size of $1.34 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 29.11%. This rapid expansion is primarily driven by a confluence of factors including escalating fuel costs, increasing environmental consciousness among consumers and regulators, and significant technological advancements in battery storage and hybrid propulsion systems. The demand for more sustainable aviation solutions is a paramount driver, pushing manufacturers to invest heavily in research and development. The market is segmented by mode of operation, with "Piloted" operations currently leading but "Autonomous" operations expected to gain significant traction as the technology matures and regulatory frameworks evolve. In terms of lift technology, "Vertical Take-off and Landing" (VTOL) aircraft are emerging as a disruptive force, offering unparalleled flexibility for urban air mobility and point-to-point transportation, while "Conventional Take-off and Landing" (CTOL) and "Short Take-off and Landing" (STOL) aircraft continue to cater to established routes. Key players like Ampaire Inc., General Electric, Airbus SE, Safran SA, and Rolls-Royce plc are at the forefront of innovation, investing in next-generation hybrid powertrains and airframes.

Hybrid Aircraft Market Market Size (In Billion)

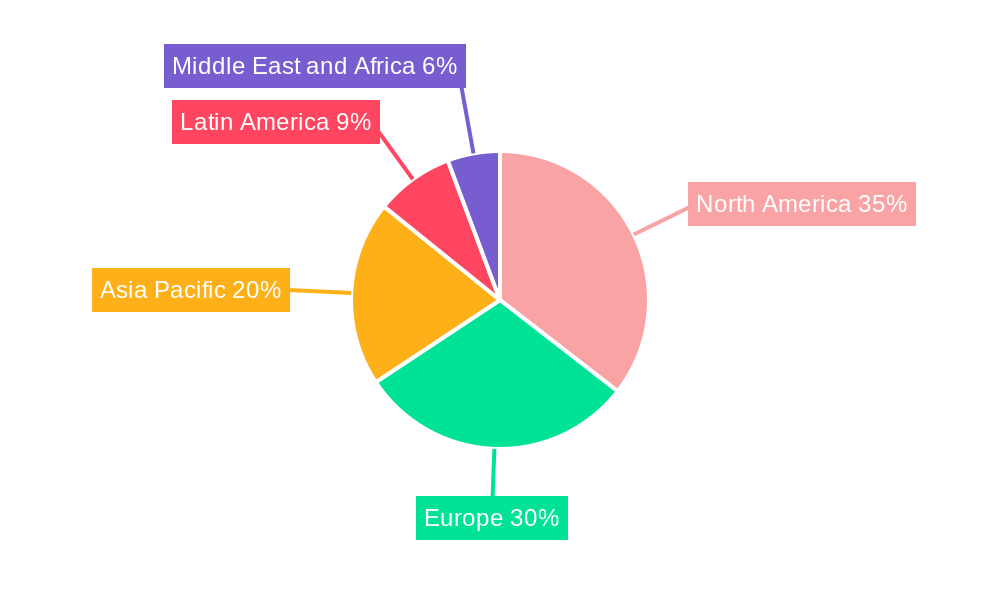

The forecast period of 2025-2033 anticipates sustained high growth, fueled by ongoing advancements in electric propulsion, lightweight materials, and aerodynamic efficiency. While the market faces restraints such as the high initial investment costs for R&D and manufacturing, along with the need for robust charging infrastructure and evolving regulatory approvals, these challenges are being actively addressed by industry stakeholders. Emerging trends include the development of hybrid-electric regional aircraft, the integration of hybrid technology into existing aircraft designs for retrofitting, and the increasing focus on hybrid solutions for cargo and logistics operations. North America and Europe are expected to lead the market in adoption, driven by stringent environmental regulations and a strong presence of leading aerospace manufacturers. However, the Asia Pacific region, with its rapidly growing aviation sector and increasing environmental awareness, is anticipated to witness the fastest growth in the coming years, presenting significant opportunities for market expansion.

Hybrid Aircraft Market Company Market Share

Unlock insights into the rapidly evolving Hybrid Aircraft Market with our comprehensive report. Delve into market size, key trends, dominant segments, competitive strategies, and future outlook from 2019-2033. This report empowers industry stakeholders, investors, and policymakers to make informed decisions in the burgeoning world of hybrid-electric aviation.

This in-depth analysis covers the hybrid aircraft market size, hybrid aircraft market trends, hybrid electric aircraft market, hybrid aircraft technology, sustainable aviation, and next-generation aircraft. Explore forecast growth, technological advancements, regulatory landscapes, and the strategic moves of major players shaping the future of air travel.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Hybrid Aircraft Market Market Structure & Competitive Landscape

The hybrid aircraft market structure is characterized by a moderate to high degree of concentration, driven by significant R&D investments and stringent certification processes. Innovation drivers are primarily focused on achieving fuel efficiency, reducing carbon emissions, and enhancing operational flexibility. Key players are channeling substantial resources into developing advanced hybrid-electric propulsion systems, lightweight materials, and aerodynamic designs. Regulatory impacts are crucial, with evolving environmental mandates and safety standards dictating development pathways. Product substitutes, while currently limited, include advancements in conventional aircraft fuel efficiency and the long-term potential of fully electric aviation. End-user segmentation spans commercial aviation, cargo, military, and personal air mobility. Merger and acquisition (M&A) trends are emerging as larger aerospace conglomerates invest in or acquire promising startups, consolidating expertise and accelerating market entry. For instance, the recent acquisition of Pipistrel by Textron Aviation signals a consolidation of capabilities in the light aircraft and electric aviation space. The competitive landscape is dynamic, with both established aerospace giants and agile startups vying for market leadership. The ongoing pursuit of certifications and partnerships further defines this evolving market.

Hybrid Aircraft Market Market Trends & Opportunities

The hybrid aircraft market size is poised for significant expansion, driven by a global imperative to decarbonize the aviation sector and achieve net-zero emissions targets. Technological shifts are central to this growth, with continuous advancements in battery technology, electric motor efficiency, and lightweight composite materials enabling more viable hybrid-electric solutions. Consumers, including airlines and passengers, are increasingly prioritizing sustainability and operational cost savings, creating a fertile ground for hybrid aircraft adoption. The market is experiencing a surge in demand for regional and short-haul flights that can benefit from the fuel efficiency and reduced noise pollution offered by hybrid powertrains.

Opportunities abound for innovative solutions that address the unique challenges of hybrid-electric flight, such as energy storage density and thermal management. The development of modular hybrid-electric powertrains offers flexibility for various aircraft configurations, catering to diverse market needs from passenger transport to cargo delivery. The integration of advanced avionics and autonomous flight capabilities further enhances the appeal and utility of hybrid aircraft, opening new avenues for air mobility services. Partnerships between engine manufacturers, airframe makers, and technology providers are crucial for overcoming complex engineering hurdles and accelerating the certification process.

The hybrid electric aircraft market is also benefiting from governmental incentives and research grants aimed at fostering sustainable aviation technologies. This financial support is critical for de-risking early-stage development and encouraging wider industry participation. As battery technology matures and charging infrastructure develops, the operational range and payload capacity of hybrid aircraft will continue to improve, making them increasingly competitive with conventional aircraft for a broader spectrum of missions. The market penetration rate for hybrid aircraft is projected to accelerate rapidly in the coming decade, particularly in segments where the benefits of reduced operating costs and environmental compliance are most pronounced.

Dominant Markets & Segments in Hybrid Aircraft Market

The hybrid aircraft market is witnessing robust growth across various segments, with the Piloted mode of operation currently dominating due to established regulatory frameworks and pilot training infrastructure. This segment benefits from the immediate applicability of hybrid technology to existing flight operations, offering a pathway to reduced emissions without a complete overhaul of air traffic control and pilot certification. The Conventional Take-off and Landing (CTOL) lift technology segment remains the most significant contributor, leveraging existing airport infrastructure and operational procedures.

However, substantial growth is anticipated in the Short Take-off and Landing (STOL) and Vertical Take-off and Landing (VTOL) segments, particularly for regional air mobility and urban air transport. The development of VTOL hybrid aircraft is driven by the potential to revolutionize short-distance travel, bypass congested ground infrastructure, and connect previously inaccessible areas. Key growth drivers for these emerging segments include:

- Infrastructure Development: Investment in vertiports and dedicated landing zones for VTOL aircraft is crucial for their widespread adoption.

- Policy Support: Favorable regulations and urban planning initiatives that integrate air mobility solutions will accelerate segment growth.

- Technological Advancements: Continuous improvements in battery density, electric propulsion, and flight control systems are essential for enhancing the performance and safety of STOL and VTOL operations.

The Autonomous mode of operation, while in its nascent stages for hybrid aircraft, presents a significant long-term opportunity. The integration of AI and advanced sensor technology promises to unlock new efficiencies and applications, particularly in cargo and logistics. The Short Take-off and Landing (STOL) segment offers a compelling balance between leveraging existing infrastructure and achieving enhanced operational flexibility compared to CTOL. This makes it an attractive proposition for airlines looking to optimize regional routes and reduce operational costs. The ongoing research and development in hybrid-electric propulsion systems are steadily increasing the viability and appeal of all lift technologies, paving the way for a diversified and sustainable future for aviation.

Hybrid Aircraft Market Product Analysis

The hybrid aircraft market is being shaped by a wave of product innovations focused on enhancing fuel efficiency, reducing emissions, and improving operational flexibility. Key advancements include the integration of sophisticated hybrid-electric powertrains that combine traditional jet engines or turboprops with electric motors and advanced battery systems. These systems are designed to optimize energy usage during different flight phases, such as take-off, climb, and cruise. The competitive advantage lies in the ability of these aircraft to offer significant reductions in fuel consumption and carbon emissions, often alongside reduced noise pollution. Applications range from regional passenger transport and air cargo to specialized military and surveillance roles. The market fit for these products is strong, addressing the growing demand for sustainable aviation solutions and the need for cost-effective operations in the face of rising fuel prices and environmental regulations.

Key Drivers, Barriers & Challenges in Hybrid Aircraft Market

Key Drivers: The hybrid aircraft market is propelled by a confluence of critical factors. Technological innovation in battery storage, electric propulsion, and advanced materials is making hybrid-electric systems increasingly feasible and efficient. Economic drivers such as escalating fuel prices and the promise of lower operating costs for airlines are significant motivators. Furthermore, policy-driven factors, including stringent environmental regulations and government incentives for sustainable aviation technologies, are accelerating adoption. The demand for sustainable aviation from passengers and corporate clients also plays a crucial role.

Barriers & Challenges: Despite the positive momentum, several challenges impede the hybrid aircraft market growth. Regulatory hurdles related to certification of novel hybrid-electric propulsion systems and battery safety standards present significant delays. Supply chain issues for specialized components, particularly advanced battery cells and high-power electric motors, can impact production timelines and costs. Competitive pressures from both incremental improvements in conventional aircraft and the long-term vision of fully electric aviation necessitate continuous innovation. The substantial capital investment required for R&D and manufacturing also acts as a barrier for smaller players.

Growth Drivers in the Hybrid Aircraft Market Market

The hybrid aircraft market is experiencing robust growth fueled by several key drivers. Technological advancements in battery energy density, electric motor efficiency, and lightweight composite materials are making hybrid-electric propulsion increasingly viable. The economic imperative to reduce fuel costs and operational expenses for airlines is a significant growth catalyst. Governmental regulations mandating emissions reductions and providing financial incentives for sustainable aviation technologies are further accelerating market development. The increasing consumer and corporate demand for environmentally friendly travel is creating a pull for hybrid aircraft solutions. The development of new air mobility concepts, such as urban air taxis, also relies heavily on hybrid-electric technology for its feasibility.

Challenges Impacting Hybrid Aircraft Market Growth

Several critical challenges are impacting the hybrid aircraft market growth. The complex and time-consuming regulatory approval process for novel hybrid-electric systems poses a significant hurdle. Supply chain constraints, particularly for advanced battery components and high-power electric motors, can lead to production delays and increased costs. Intense competitive pressures from both established aviation manufacturers and emerging technology companies necessitate continuous innovation and significant R&D investment. The high initial capital investment required for the development and production of hybrid aircraft can also be a barrier, especially for smaller companies. Furthermore, addressing public perception regarding the safety and reliability of new technologies is paramount.

Key Players Shaping the Hybrid Aircraft Market Market

- Ampaire Inc

- General Electric

- Airbus SE

- Safran SA

- RTX Corporation

- Embraer S A

- Rolls-Royce plc

- Heart Aerospace

- Pipistrel

- Faradair Aerospac

Significant Hybrid Aircraft Market Industry Milestones

- June 2023: Airbus unveiled the Eco Pulse hybrid-electric aircraft at the Paris Air Show. This innovative aircraft is a modification of the Daher TBM light aircraft, integrating a hybrid-electric powertrain and six electrically driven propellers. This milestone signifies a major step towards hybrid-electric regional aviation.

- December 2022: Embraer S.A. introduced the Energia Hybrid E19-HE in December 2022. This hybrid electric propulsion system offers a realistic and economically feasible path to achieve net-zero emissions, with the potential for up to a 90% reduction in CO2 emissions. This development highlights a strategic focus on sustainable propulsion for larger regional aircraft.

Future Outlook for Hybrid Aircraft Market Market

The future outlook for the hybrid aircraft market is exceptionally promising, characterized by accelerating innovation and increasing adoption. Strategic opportunities lie in the development of scalable hybrid-electric propulsion systems for a wide range of aircraft sizes, from small regional jets to larger commercial airliners. The market potential is amplified by the global drive towards decarbonization in aviation and the increasing demand for cost-efficient and environmentally responsible air travel. Continued advancements in battery technology, coupled with supportive regulatory frameworks, will further unlock the market's potential. Emerging applications in air cargo, advanced air mobility, and specialized military operations will also contribute significantly to the market's expansion in the coming years, solidifying hybrid aircraft as a pivotal technology in the future of flight.

Hybrid Aircraft Market Segmentation

-

1. Mode of Opertaion

- 1.1. Piloted

- 1.2. Autonomous

-

2. Lift Technology

- 2.1. Conventional Take-off and Landing

- 2.2. Short Take-off and Landing

- 2.3. Vertical Take-off and Landing

Hybrid Aircraft Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Hybrid Aircraft Market Regional Market Share

Geographic Coverage of Hybrid Aircraft Market

Hybrid Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 29.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Conventional Take off and Landing Segment to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hybrid Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Lift Technology

- 5.2.1. Conventional Take-off and Landing

- 5.2.2. Short Take-off and Landing

- 5.2.3. Vertical Take-off and Landing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 6. North America Hybrid Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.2. Market Analysis, Insights and Forecast - by Lift Technology

- 6.2.1. Conventional Take-off and Landing

- 6.2.2. Short Take-off and Landing

- 6.2.3. Vertical Take-off and Landing

- 6.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 7. Europe Hybrid Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.2. Market Analysis, Insights and Forecast - by Lift Technology

- 7.2.1. Conventional Take-off and Landing

- 7.2.2. Short Take-off and Landing

- 7.2.3. Vertical Take-off and Landing

- 7.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 8. Asia Pacific Hybrid Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.2. Market Analysis, Insights and Forecast - by Lift Technology

- 8.2.1. Conventional Take-off and Landing

- 8.2.2. Short Take-off and Landing

- 8.2.3. Vertical Take-off and Landing

- 8.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 9. Latin America Hybrid Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.2. Market Analysis, Insights and Forecast - by Lift Technology

- 9.2.1. Conventional Take-off and Landing

- 9.2.2. Short Take-off and Landing

- 9.2.3. Vertical Take-off and Landing

- 9.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 10. Middle East and Africa Hybrid Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.2. Market Analysis, Insights and Forecast - by Lift Technology

- 10.2.1. Conventional Take-off and Landing

- 10.2.2. Short Take-off and Landing

- 10.2.3. Vertical Take-off and Landing

- 10.1. Market Analysis, Insights and Forecast - by Mode of Opertaion

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ampaire Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 General Electric

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Safran SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RTX Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Embraer S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rolls-Royce plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Heart Aerospace

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pipistrel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Faradair Aerospac

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ampaire Inc

List of Figures

- Figure 1: Global Hybrid Aircraft Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hybrid Aircraft Market Revenue (Million), by Mode of Opertaion 2025 & 2033

- Figure 3: North America Hybrid Aircraft Market Revenue Share (%), by Mode of Opertaion 2025 & 2033

- Figure 4: North America Hybrid Aircraft Market Revenue (Million), by Lift Technology 2025 & 2033

- Figure 5: North America Hybrid Aircraft Market Revenue Share (%), by Lift Technology 2025 & 2033

- Figure 6: North America Hybrid Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hybrid Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hybrid Aircraft Market Revenue (Million), by Mode of Opertaion 2025 & 2033

- Figure 9: Europe Hybrid Aircraft Market Revenue Share (%), by Mode of Opertaion 2025 & 2033

- Figure 10: Europe Hybrid Aircraft Market Revenue (Million), by Lift Technology 2025 & 2033

- Figure 11: Europe Hybrid Aircraft Market Revenue Share (%), by Lift Technology 2025 & 2033

- Figure 12: Europe Hybrid Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Hybrid Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hybrid Aircraft Market Revenue (Million), by Mode of Opertaion 2025 & 2033

- Figure 15: Asia Pacific Hybrid Aircraft Market Revenue Share (%), by Mode of Opertaion 2025 & 2033

- Figure 16: Asia Pacific Hybrid Aircraft Market Revenue (Million), by Lift Technology 2025 & 2033

- Figure 17: Asia Pacific Hybrid Aircraft Market Revenue Share (%), by Lift Technology 2025 & 2033

- Figure 18: Asia Pacific Hybrid Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Hybrid Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Hybrid Aircraft Market Revenue (Million), by Mode of Opertaion 2025 & 2033

- Figure 21: Latin America Hybrid Aircraft Market Revenue Share (%), by Mode of Opertaion 2025 & 2033

- Figure 22: Latin America Hybrid Aircraft Market Revenue (Million), by Lift Technology 2025 & 2033

- Figure 23: Latin America Hybrid Aircraft Market Revenue Share (%), by Lift Technology 2025 & 2033

- Figure 24: Latin America Hybrid Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Hybrid Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Hybrid Aircraft Market Revenue (Million), by Mode of Opertaion 2025 & 2033

- Figure 27: Middle East and Africa Hybrid Aircraft Market Revenue Share (%), by Mode of Opertaion 2025 & 2033

- Figure 28: Middle East and Africa Hybrid Aircraft Market Revenue (Million), by Lift Technology 2025 & 2033

- Figure 29: Middle East and Africa Hybrid Aircraft Market Revenue Share (%), by Lift Technology 2025 & 2033

- Figure 30: Middle East and Africa Hybrid Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Hybrid Aircraft Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hybrid Aircraft Market Revenue Million Forecast, by Mode of Opertaion 2020 & 2033

- Table 2: Global Hybrid Aircraft Market Revenue Million Forecast, by Lift Technology 2020 & 2033

- Table 3: Global Hybrid Aircraft Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hybrid Aircraft Market Revenue Million Forecast, by Mode of Opertaion 2020 & 2033

- Table 5: Global Hybrid Aircraft Market Revenue Million Forecast, by Lift Technology 2020 & 2033

- Table 6: Global Hybrid Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Hybrid Aircraft Market Revenue Million Forecast, by Mode of Opertaion 2020 & 2033

- Table 10: Global Hybrid Aircraft Market Revenue Million Forecast, by Lift Technology 2020 & 2033

- Table 11: Global Hybrid Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Hybrid Aircraft Market Revenue Million Forecast, by Mode of Opertaion 2020 & 2033

- Table 18: Global Hybrid Aircraft Market Revenue Million Forecast, by Lift Technology 2020 & 2033

- Table 19: Global Hybrid Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Hybrid Aircraft Market Revenue Million Forecast, by Mode of Opertaion 2020 & 2033

- Table 26: Global Hybrid Aircraft Market Revenue Million Forecast, by Lift Technology 2020 & 2033

- Table 27: Global Hybrid Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Hybrid Aircraft Market Revenue Million Forecast, by Mode of Opertaion 2020 & 2033

- Table 31: Global Hybrid Aircraft Market Revenue Million Forecast, by Lift Technology 2020 & 2033

- Table 32: Global Hybrid Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Hybrid Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hybrid Aircraft Market?

The projected CAGR is approximately 29.11%.

2. Which companies are prominent players in the Hybrid Aircraft Market?

Key companies in the market include Ampaire Inc, General Electric, Airbus SE, Safran SA, RTX Corporation, Embraer S A, Rolls-Royce plc, Heart Aerospace, Pipistrel, Faradair Aerospac.

3. What are the main segments of the Hybrid Aircraft Market?

The market segments include Mode of Opertaion, Lift Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.34 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Conventional Take off and Landing Segment to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Airbus unveiled the Eco Pulse hybrid-electric aircraft at the Paris Air Show. This innovative aircraft is a modification of the Daher TBM light aircraft, integrating a hybrid-electric powertrain and six electrically driven propellers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hybrid Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hybrid Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hybrid Aircraft Market?

To stay informed about further developments, trends, and reports in the Hybrid Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence