Key Insights

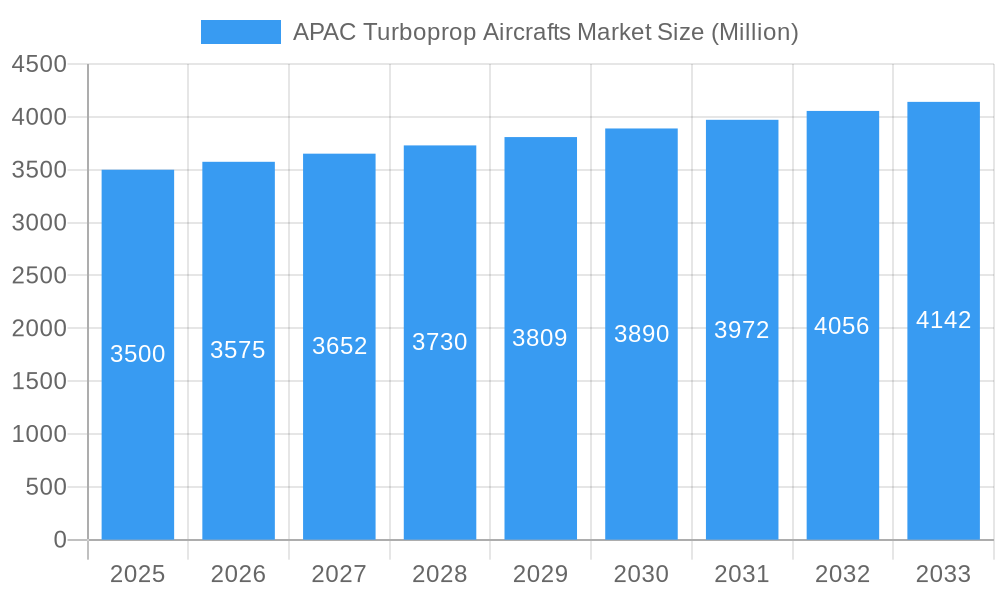

The APAC Turboprop Aircraft Market is poised for significant expansion, projected to reach a substantial market size of approximately $3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 2.00% through 2033. This growth is predominantly fueled by escalating demand across all key applications, including Commercial Aviation, Military Aviation, and General Aviation. In Commercial Aviation, the cost-efficiency and operational flexibility of turboprop aircraft make them increasingly attractive for regional routes and serving less developed infrastructure. Military aviation is witnessing a surge in interest for surveillance, reconnaissance, and troop transport missions, where turboprops offer a unique blend of endurance and survivability. The General Aviation sector continues to benefit from the versatility of turboprops for private travel, training, and specialized aerial services. These drivers are underpinned by supportive government initiatives, increasing air connectivity needs, and the inherent advantages of turboprop technology in terms of fuel efficiency and lower operating costs compared to their jet counterparts.

APAC Turboprop Aircrafts Market Market Size (In Billion)

Geographically, the Asia-Pacific region, particularly China and India, is emerging as a critical growth engine. Rapid economic development, burgeoning middle classes, and a strong emphasis on improving air travel infrastructure are compelling factors. The strategic expansion of flight networks into Tier 2 and Tier 3 cities, where turboprops excel due to their ability to operate from shorter runways, is a significant trend. While the market is robust, certain restraints such as the high initial investment for new aircraft acquisitions and the need for specialized maintenance infrastructure in remote areas could pose challenges. However, the ongoing technological advancements in engine efficiency, avionics, and cabin comfort, coupled with aggressive product development by leading companies like Textron Inc., Lockheed Martin Corporation, and Airbus SE, are expected to mitigate these restraints and further propel market growth. The strategic partnerships and collaborations among these key players will also play a crucial role in shaping the future landscape of the APAC Turboprop Aircraft Market.

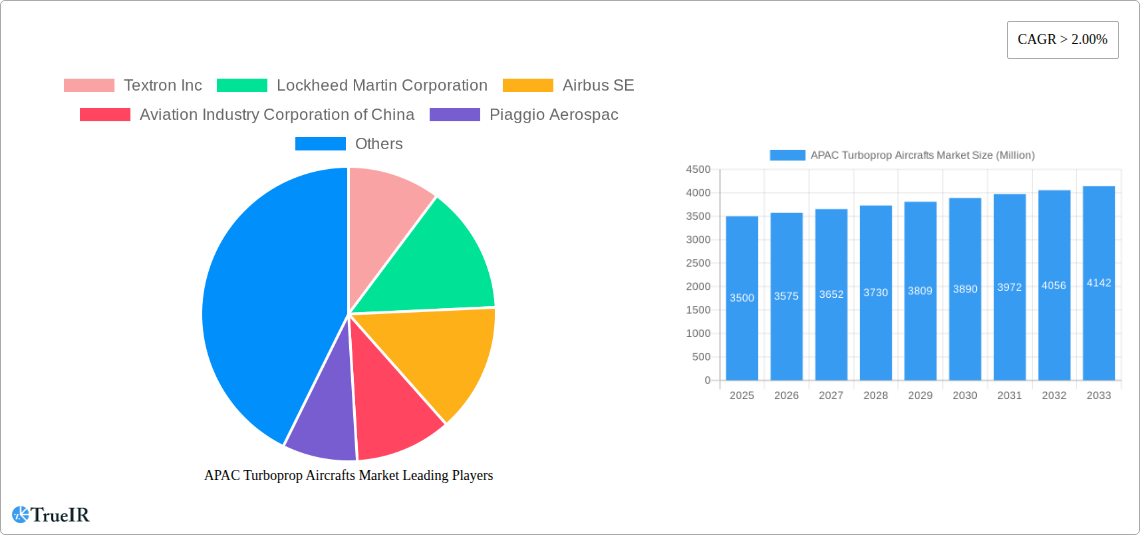

APAC Turboprop Aircrafts Market Company Market Share

Here is a dynamic, SEO-optimized report description for the APAC Turboprop Aircrafts Market, leveraging high-volume keywords and structured for clarity and insight:

APAC Turboprop Aircrafts Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report offers a definitive analysis of the Asia-Pacific (APAC) Turboprop Aircrafts Market, a vital sector experiencing rapid expansion driven by evolving aviation needs across commercial, military, and general aviation segments. With a study period spanning from 2019 to 2033, including a base year of 2025 and a detailed forecast period from 2025 to 2033, this research provides unparalleled insights into market dynamics, growth drivers, emerging opportunities, and the competitive landscape. We delve into critical segments such as Commercial Aviation, Military Aviation, and General Aviation, and analyze geographical dominance across China, India, Japan, South Korea, Australia, and the Rest of Asia-Pacific.

APAC Turboprop Aircrafts Market Market Structure & Competitive Landscape

The APAC Turboprop Aircrafts Market exhibits a moderately concentrated structure, with key players actively engaging in strategic initiatives to capture market share. Innovation drivers are primarily focused on enhanced fuel efficiency, increased payload capacity, and advanced avionics systems, catering to the growing demand for regional connectivity and specialized military operations. Regulatory impacts, while generally supportive of aviation growth, present nuanced challenges related to certifications and airworthiness standards across different APAC nations. Product substitutes, such as regional jets and advanced helicopters, exert a competitive influence, though turboprops maintain a distinct advantage in operating costs and versatility for short-haul routes and unpaved airstrips. End-user segmentation highlights strong growth in Commercial Aviation for commuter services and cargo, alongside sustained demand from Military Aviation for surveillance, transport, and training, and a resurgence in General Aviation for private charters and specialized missions. Merger and acquisition (M&A) trends are indicative of strategic consolidation and partnerships aimed at expanding product portfolios and geographical reach. Recent M&A volumes have been significant, with an estimated XX in the last fiscal year, underscoring the dynamic consolidation phase. This landscape is shaped by a few dominant entities, with a Herfindahl-Hirschman Index (HHI) estimated at XX, indicating a moderate level of market concentration.

APAC Turboprop Aircrafts Market Market Trends & Opportunities

The APAC Turboprop Aircrafts Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust expansion is fueled by a confluence of factors, including increasing air passenger traffic, the development of new regional airports, and the growing need for efficient cargo transportation solutions across the vast and geographically diverse Asia-Pacific region. Technological shifts are a major catalyst, with manufacturers investing heavily in next-generation turboprop engines offering improved fuel efficiency, reduced emissions, and quieter operations, aligning with global sustainability initiatives and stricter environmental regulations. Innovations in composite materials are leading to lighter and stronger airframes, further enhancing performance and reducing operational costs. Consumer preferences are leaning towards more accessible air travel options, making turboprop aircraft ideal for connecting smaller cities and remote areas that may not be served by larger jet aircraft. The competitive dynamics are intensifying, with established players and emerging manufacturers vying for dominance through product differentiation, strategic alliances, and aggressive market penetration strategies. Market penetration rates for turboprop aircraft in certain nascent markets are still relatively low, presenting significant untapped potential for growth. The increasing focus on regional connectivity, driven by government initiatives promoting intra-regional trade and tourism, is creating a sustained demand for aircraft capable of operating from shorter runways and in varying climatic conditions. Furthermore, the expanding e-commerce sector and the need for rapid last-mile delivery are bolstering demand for dedicated turboprop cargo aircraft. The opportunity for enhanced passenger experience through improved cabin configurations and in-flight amenities is also a growing trend, as operators seek to differentiate their services in an increasingly competitive market. The market size is estimated to reach USD XX Million by 2033, up from USD XX Million in 2025, reflecting a strong growth trajectory.

Dominant Markets & Segments in APAC Turboprop Aircrafts Market

Within the dynamic APAC Turboprop Aircrafts Market, Commercial Aviation stands out as the most dominant application segment, driven by the burgeoning demand for regional connectivity and the expansion of low-cost carrier operations. Countries like China and India are spearheading this growth, fueled by rapid economic development, increasing disposable incomes, and government initiatives to enhance air travel accessibility. The expansion of airport infrastructure in these nations, coupled with supportive aviation policies, creates a fertile ground for turboprop aircraft adoption.

- China: As the world's second-largest economy, China's continuous push for economic integration and the development of its vast interior regions necessitate efficient and cost-effective air transport solutions. Turboprop aircraft are increasingly being deployed for feeder routes, connecting major hubs to secondary cities, and supporting crucial cargo logistics. The government's focus on developing its domestic aerospace industry also contributes to the demand for turboprop platforms.

- India: India's vast population and developing infrastructure present a significant opportunity for turboprop aircraft. The Regional Connectivity Scheme (RCS) has been instrumental in promoting air travel to unserved and underserved airports, with turboprops being the ideal aircraft type for these operations due to their ability to operate from shorter runways and their lower operational costs. The burgeoning e-commerce sector also drives demand for cargo turboprops.

- Japan: While Japan has a mature aviation market, the demand for turboprops persists for inter-island transport and specialized missions. The country's focus on technological advancement also influences the adoption of modern, fuel-efficient turboprop models.

- South Korea: Similar to Japan, South Korea utilizes turboprops for regional connectivity and specialized applications. The country's advanced manufacturing capabilities contribute to the development of sophisticated turboprop components and systems.

- Australia: Australia's vast landmass and dispersed population make turboprop aircraft essential for connecting remote communities and supporting various industries like mining and agriculture. The demand for reliable and versatile aircraft for these challenging environments remains strong.

- Rest of Asia-Pacific: This diverse sub-region, encompassing Southeast Asian nations and the Pacific islands, presents significant growth potential. Developing economies are increasingly investing in aviation infrastructure, making turboprops a cost-effective solution for establishing and expanding air connectivity, thereby fostering trade, tourism, and economic development. The increasing adoption of turboprops for Special Mission roles, such as maritime surveillance and disaster relief, further bolsters the market in these regions.

APAC Turboprop Aircrafts Market Product Analysis

The APAC Turboprop Aircrafts Market is characterized by continuous product innovation focused on enhancing performance, efficiency, and sustainability. Manufacturers are introducing advanced turboprop engines that offer significant improvements in fuel burn and reduced emissions, aligning with global environmental mandates. The integration of cutting-edge avionics, fly-by-wire systems, and composite materials leads to lighter, more robust aircraft with improved maneuverability and lower maintenance requirements. These technological advancements cater to diverse applications, from efficient regional passenger transport and critical cargo logistics to specialized military roles such as surveillance, training, and light transport. The competitive advantage lies in offering versatile platforms capable of operating from short, unpaved runways, providing cost-effective solutions for connecting remote areas and facilitating last-mile delivery.

Key Drivers, Barriers & Challenges in APAC Turboprop Aircrafts Market

Key Drivers: The APAC Turboprop Aircrafts Market is propelled by several key factors. Technologically, advancements in engine efficiency and avionics are making turboprops more attractive. Economically, growing regional economies and increasing demand for air travel, especially to underserved areas, are significant drivers. Policy-driven factors include government initiatives promoting regional connectivity and investment in aviation infrastructure across the APAC region. For instance, India's UDAN scheme actively encourages the use of turboprops for regional routes. The rising middle class in emerging economies further boosts passenger demand, making turboprops a cost-effective solution for new market entry.

Barriers & Challenges: Supply chain disruptions, particularly those exacerbated by geopolitical events, can impact production timelines and costs. Regulatory hurdles, including differing airworthiness standards and import/export regulations across various APAC countries, can slow market penetration. Competitive pressures from regional jets and evolving helicopter technologies also pose a challenge. The initial capital investment for new aircraft remains a significant barrier for some operators, despite the lower operating costs of turboprops over their lifecycle. The availability of skilled maintenance personnel for advanced turboprop systems can also be a constraint in certain developing markets, requiring targeted training initiatives.

Growth Drivers in the APAC Turboprop Aircrafts Market Market

The growth of the APAC Turboprop Aircrafts Market is primarily fueled by the escalating demand for regional air connectivity, driven by economic development and expanding middle-class populations across countries like China and India. Technological advancements in engine efficiency and the use of lightweight composite materials are significantly improving operational economics and reducing environmental impact, making turboprops a more sustainable choice. Government initiatives aimed at developing regional aviation infrastructure and promoting air travel to remote and underserved areas, such as the UDAN scheme in India, are creating substantial demand. Furthermore, the increasing volume of air cargo, particularly for e-commerce and last-mile logistics, presents a significant opportunity for dedicated turboprop cargo aircraft.

Challenges Impacting APAC Turboprop Aircrafts Market Growth

Despite the positive growth trajectory, the APAC Turboprop Aircrafts Market faces several challenges. Regulatory complexities and differing certification standards across various Asia-Pacific nations can impede market entry and slow down fleet expansion. Lingering supply chain vulnerabilities, including shortages of key components and raw materials, can lead to production delays and increased costs. Intense competitive pressure from regional jets, especially for higher-density routes, and the evolving capabilities of rotorcraft also present a threat. Securing adequate financing for aircraft acquisition remains a barrier for some regional operators, and the availability of qualified maintenance and operational personnel across the vast and diverse APAC region requires continuous investment in training and development.

Key Players Shaping the APAC Turboprop Aircrafts Market Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- Aviation Industry Corporation of China

- Piaggio Aerospac

- Pilatus Aircraft Ltd

- DAHER

- ATR

- Piper Aircraft Inc

Significant APAC Turboprop Aircrafts Market Industry Milestones

- 2019: ATR launches the new Flight Attendant Trainer for its -600 series aircraft, enhancing pilot training efficiency.

- 2020: Pilatus delivers its 200th PC-12 NGX, highlighting continued demand for its versatile single-engine turboprop.

- 2021: Textron Aviation introduces upgrades to its Beechcraft King Air 260, focusing on enhanced cabin experience and avionics.

- 2022: Airbus SE, through its joint venture with Bombardier (now part of Mitsubishi Heavy Industries), continues to see strong performance from the ATR turboprop family in the APAC region.

- 2023: Aviation Industry Corporation of China (AVIC) showcases advancements in its domestic turboprop programs, signaling growing capabilities.

- 2024 (Q1): DAHER announces expanded service network in the APAC region, aiming to support its Kodiak and TBM series aircraft operators.

Future Outlook for APAC Turboprop Aircrafts Market Market

The future outlook for the APAC Turboprop Aircrafts Market is exceptionally bright, driven by sustained economic growth, increasing urbanization, and a growing emphasis on regional connectivity. Investments in new airport infrastructure and government-backed aviation development schemes will continue to create a robust demand for versatile and cost-effective turboprop solutions. The ongoing technological evolution, focusing on sustainability, reduced emissions, and enhanced operational efficiency, will further solidify the turboprop's position. Strategic opportunities lie in expanding the cargo segment, catering to the booming e-commerce market, and developing specialized mission aircraft for defense and public service applications across the region. The market is poised for continued expansion, offering significant potential for innovation and market penetration.

APAC Turboprop Aircrafts Market Segmentation

-

1. Application

- 1.1. Commercial Aviation

- 1.2. Military Aviation

- 1.3. General Aviation

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia-Pacific

APAC Turboprop Aircrafts Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

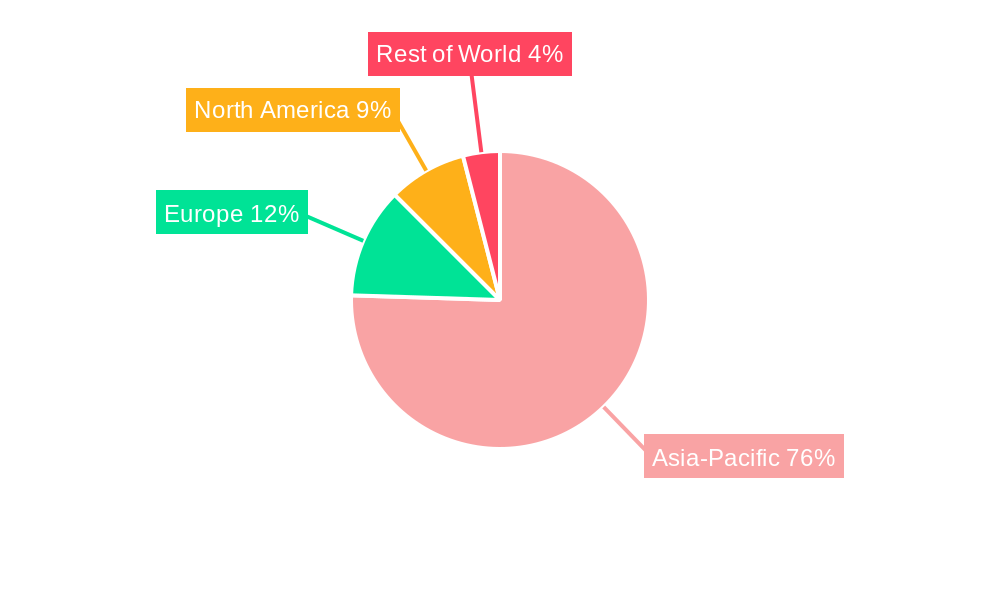

APAC Turboprop Aircrafts Market Regional Market Share

Geographic Coverage of APAC Turboprop Aircrafts Market

APAC Turboprop Aircrafts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aviation Segment Expected to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Turboprop Aircrafts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aviation

- 5.1.2. Military Aviation

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aviation Industry Corporation of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Piaggio Aerospac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pilatus Aircraft Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DAHER

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ATR

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Piper Aircraft Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Global APAC Turboprop Aircrafts Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Geography 2025 & 2033

- Figure 5: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Turboprop Aircrafts Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the APAC Turboprop Aircrafts Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Aviation Industry Corporation of China, Piaggio Aerospac, Pilatus Aircraft Ltd, DAHER, ATR, Piper Aircraft Inc.

3. What are the main segments of the APAC Turboprop Aircrafts Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aviation Segment Expected to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Turboprop Aircrafts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Turboprop Aircrafts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Turboprop Aircrafts Market?

To stay informed about further developments, trends, and reports in the APAC Turboprop Aircrafts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence