Key Insights

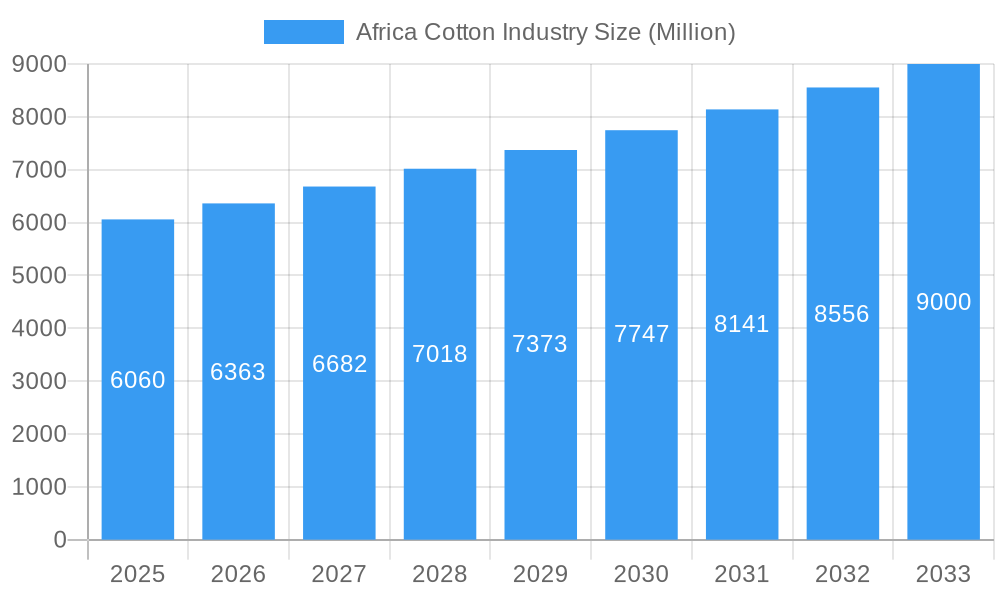

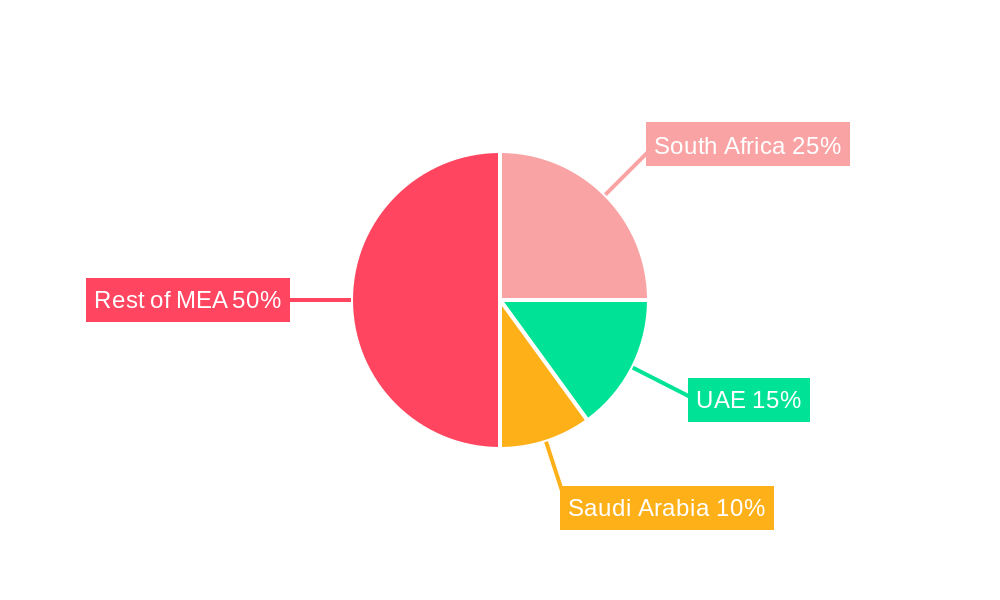

The African cotton industry, valued at $6.06 billion in 2025, is projected to experience steady growth, driven by increasing demand for textiles and apparel, particularly from a burgeoning African middle class and global fast fashion brands sourcing sustainable materials. Key growth drivers include supportive government policies aimed at boosting agricultural production, investments in improved farming techniques and technology leading to higher yields and better quality cotton, and a rising focus on sustainable and ethically sourced cotton. While challenges remain, such as climate change impacting yields and competition from synthetic fibers, the industry is adapting. The diversification of end-use applications beyond traditional textiles, into areas like home furnishings and industrial uses, is also contributing to market expansion. Significant investment in infrastructure, including improved processing and ginning facilities, will be crucial for maximizing the value captured within the region. Leading players such as Louis Dreyfus Company, Cargill, and ADM, are strategically positioned to benefit from these trends, either through direct production, trade, or processing activities. The Middle East and Africa region, particularly countries like South Africa, UAE, and Saudi Arabia, represent significant market segments due to robust domestic consumption and strategic trade corridors.

Africa Cotton Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 4.91%, indicating a substantial increase in market value. However, realizing this growth potential requires addressing critical restraints. These include improving farmer access to finance and training, enhancing the efficiency of supply chains to minimize post-harvest losses, and promoting sustainable cotton farming practices to mitigate environmental impacts. The focus on value addition within Africa, moving beyond raw cotton export to include yarn and fabric production, represents a key strategic priority for long-term sustainable growth. Successful implementation of these strategies will solidify Africa's position as a significant player in the global cotton market.

Africa Cotton Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the African cotton industry, encompassing market structure, competitive dynamics, growth drivers, challenges, and future outlook. With a detailed study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report provides crucial insights for stakeholders across the value chain. Expect detailed analysis of market size, CAGR, production volumes (raw cotton, cotton yarn, cotton seed), and end-use segments (textiles, apparel, home furnishings), all presented in Millions.

Africa Cotton Industry Market Structure & Competitive Landscape

The African cotton industry exhibits a moderately concentrated market structure, with key players like Louis Dreyfus Company, Bunge Limited, Cargill, and Archer Daniels Midland Company (ADM) commanding significant market share. However, a diverse range of smaller, regional players, including TELA (Togo) and SIAT (Cote d'Ivoire), contributes to the overall production and trade.

- Market Concentration: The four-firm concentration ratio is estimated at xx%, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in cotton farming, ginning, and textile processing are driving efficiency gains and product diversification.

- Regulatory Impacts: Government policies on subsidies, export regulations, and trade agreements significantly influence the industry's performance. Varying regulations across African nations create complexities for cross-border operations.

- Product Substitutes: Synthetic fibers like polyester and nylon pose a competitive threat to cotton, particularly in price-sensitive segments. The rise of sustainable and recycled materials also impacts market share.

- End-User Segmentation: The apparel segment accounts for the largest share of cotton consumption, followed by home furnishings and industrial textiles. Changing fashion trends and consumer preferences significantly impact demand.

- M&A Trends: The past five years have seen xx M&A transactions in the African cotton industry, primarily focused on consolidating processing and trading operations. The number is projected to increase to xx in the forecast period due to increased industry consolidation.

Africa Cotton Industry Market Trends & Opportunities

The African cotton industry is poised for significant growth, driven by rising demand for textiles and apparel, especially in emerging markets. Market size is estimated at xx Million USD in 2025, projected to reach xx Million USD by 2033, exhibiting a CAGR of xx%. Technological advancements like precision agriculture, improved ginning technologies, and automation in textile manufacturing are enhancing efficiency and productivity. Consumer preferences are shifting towards sustainable and ethically sourced cotton, creating opportunities for companies implementing environmentally friendly practices. Increased investment in infrastructure and supportive government policies are fostering the industry’s growth. Competitive dynamics are shaped by factors such as pricing strategies, product differentiation, and access to global markets. Market penetration rates for organic and sustainably produced cotton are increasing, driven by both consumer and brand initiatives.

Dominant Markets & Segments in Africa Cotton Industry

While many African countries contribute to cotton production, several stand out. Specific regional dominance varies across value chain segments.

Production:

- Raw Cotton: xx Million tons (2025) with significant production in countries like Burkina Faso, Mali, and Benin.

- Cotton Yarn: xx Million tons (2025) with leading capacity in countries like Egypt and South Africa.

- Cotton Seed: xx Million tons (2025). Nigeria and Sudan emerge as dominant producers.

End-Use:

- Textiles: Nigeria and Egypt are leading consumers. Growth is driven by a burgeoning domestic textile industry and rising population.

- Apparel: South Africa and Kenya are major markets, fueled by their developed apparel manufacturing sectors.

- Home Furnishings: The demand for home textiles is rising across Africa, with notable consumption in urban areas.

Key Growth Drivers:

- Improved Infrastructure: Investments in irrigation systems, transportation networks, and storage facilities improve efficiency.

- Supportive Government Policies: Subsidies, tax incentives, and investments in research and development stimulate growth.

- Growing Domestic Demand: Rising populations and increased disposable income drive consumption of cotton products.

Africa Cotton Industry Product Analysis

The African cotton industry is seeing innovation in both the production and processing of cotton. High-quality extra-long staple cotton is increasingly sought for premium textile applications. Advancements in ginning and spinning technologies are improving fiber quality and reducing production costs. The rise of organic and sustainably produced cotton is capturing significant market share, meeting the growing demand for environmentally friendly products. These innovations are enhancing the competitiveness of African cotton in the global market.

Key Drivers, Barriers & Challenges in Africa Cotton Industry

Key Drivers: Rising global demand for cotton, technological advancements in cultivation and processing, and government support for the sector are key drivers. The rise of sustainable and ethical sourcing is also creating new opportunities.

Challenges and Restraints: Erratic weather patterns leading to crop failures, outdated farming techniques, inadequate infrastructure (storage, transportation), and access to finance significantly impact production. Competition from cheaper synthetic fibers and high production costs also limit growth. The lack of integration across the value chain and the limited capacity of domestic textile industries further challenge industry development. These factors impact supply chain efficiency and production volume, resulting in reduced competitiveness and profitability.

Growth Drivers in the Africa Cotton Industry Market

Technological advancements in farming and processing, rising global demand, and government support through policies and investments are major growth drivers. The increasing focus on sustainable cotton production, driven by consumer preferences and brand initiatives, adds further momentum to the market's expansion. Improved infrastructure and access to finance will also contribute to accelerated growth.

Challenges Impacting Africa Cotton Industry Growth

Climate change leading to erratic weather patterns, limited access to credit and technology among farmers, inadequate infrastructure for transport and storage, and low levels of value addition are key challenges. Competition from synthetic fibers and low global cotton prices add to the complexities faced by the industry. These challenges result in lower yields and reduce the industry's competitiveness.

Key Players Shaping the Africa Cotton Industry Market

- Louis Dreyfus Company

- TELA (Togo)

- International Cotton Advisory Committee (ICAC)

- Cotton Development International (CDI)

- AGT Foods

- SIAT (Cote d'Ivoire)

- Bunge Limited

- GIZ

- Cargill

- Archer Daniels Midland Company (ADM)

Significant Africa Cotton Industry Industry Milestones

- April 2021: France pledged USD 83.04 Million to boost sustainable cotton production in Ivory Coast, targeting 120,000 farmers.

- January 2022: LPP, a Polish clothing company, partnered with Cotton made in Africa (CmiA), committing to using CmiA cotton for the production of 60 Million products.

- October 2022: The CmiA program received German Green Button and Cradle to Cradle Certified recognitions, boosting its sustainability credentials and market appeal.

Future Outlook for Africa Cotton Industry Market

The African cotton industry is expected to experience continued growth, driven by rising domestic demand, increased investment in sustainable practices, and the potential for greater value addition within the region. Strategic partnerships, technological advancements, and supportive government policies will play crucial roles in shaping the industry's future. The focus on sustainability and traceability will be critical in securing a larger share of the global market.

Africa Cotton Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Cotton Industry Segmentation By Geography

- 1. Benin

- 2. Mali

- 3. Burkina Faso

- 4. C

- 5. Cameroon

- 6. Nigeria

- 7. Tanzania

Africa Cotton Industry Regional Market Share

Geographic Coverage of Africa Cotton Industry

Africa Cotton Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Climatic Conditions; Blooming Export Opportunities

- 3.3. Market Restrains

- 3.3.1. High Adoption Cost of Modern Technology; Increasing Insect Infestations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for African Cotton in Textile Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Benin

- 5.6.2. Mali

- 5.6.3. Burkina Faso

- 5.6.4. C

- 5.6.5. Cameroon

- 5.6.6. Nigeria

- 5.6.7. Tanzania

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Benin Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Mali Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Burkina Faso Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. C Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Cameroon Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Nigeria Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 11.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 11.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 11.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12. Tanzania Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 12.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 12.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 12.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Louis Dreyfus Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TELA (Togo)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 International Cotton Advisory Committee (ICAC)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cotton Development International (CDI)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 AGT Foods

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SIAT (Cote d'Ivoire)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bunge Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 GIZ

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cargill

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Archer Daniels Midland Company (ADM)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Louis Dreyfus Company

List of Figures

- Figure 1: Africa Cotton Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Cotton Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Africa Cotton Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Africa Cotton Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 51: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 52: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 53: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 54: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 57: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 58: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 59: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 61: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 63: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 64: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 65: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 66: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 67: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 68: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 69: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 70: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 71: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 73: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 74: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 75: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 76: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 77: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 78: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 79: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 80: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 81: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 82: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 83: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 85: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 86: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 87: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 88: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 89: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 90: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 91: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 92: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 93: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 94: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 95: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 96: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Cotton Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Africa Cotton Industry?

Key companies in the market include Louis Dreyfus Company, TELA (Togo) , International Cotton Advisory Committee (ICAC) , Cotton Development International (CDI) , AGT Foods, SIAT (Cote d'Ivoire) , Bunge Limited , GIZ , Cargill , Archer Daniels Midland Company (ADM) .

3. What are the main segments of the Africa Cotton Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Climatic Conditions; Blooming Export Opportunities.

6. What are the notable trends driving market growth?

Increasing Demand for African Cotton in Textile Industry.

7. Are there any restraints impacting market growth?

High Adoption Cost of Modern Technology; Increasing Insect Infestations.

8. Can you provide examples of recent developments in the market?

October 2022: The Cotton made in Africa (CmiA) program run by the Aid by Trade Foundation received official recognition by the German Green Button standard as a sustainable natural fiber,' and was confirmed as an accredited source of raw materials by Cradle to Cradle Certified. It is likely to further boost CmiA uptake volumes through demand from existing and new program partners and apparel brands and retailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Cotton Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Cotton Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Cotton Industry?

To stay informed about further developments, trends, and reports in the Africa Cotton Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence