Key Insights

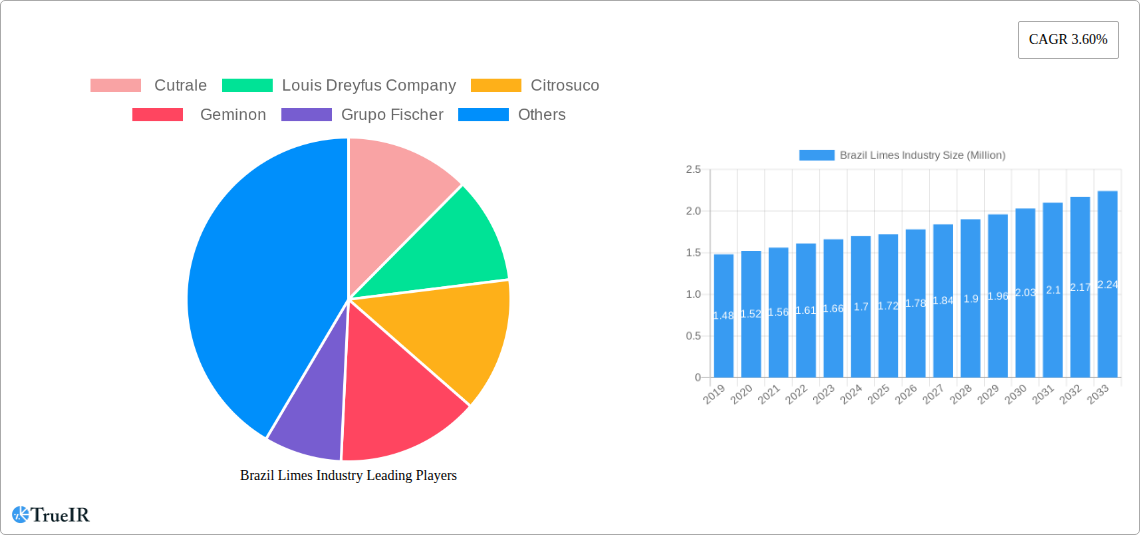

The Brazil Limes Industry is poised for steady growth, projected to reach a market size of USD 1.72 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.60% through 2033. This expansion is underpinned by a confluence of robust drivers, including the increasing global demand for lime-based products in the food and beverage sector, its growing popularity as a healthy ingredient, and its versatility in culinary applications. Furthermore, Brazil's inherent strengths in citrus cultivation, characterized by favorable climatic conditions and established agricultural expertise, provide a fertile ground for sustained production and export capabilities. The industry's trajectory will be significantly shaped by ongoing trends such as the rising preference for natural and fresh ingredients, the burgeoning market for organic and sustainably sourced limes, and the innovation in value-added lime products like essential oils and natural flavorings. These factors are collectively contributing to a positive outlook for the Brazil limes market.

Brazil Limes Industry Market Size (In Million)

However, the industry faces certain restraints that warrant strategic attention. Fluctuations in global citrus prices due to supply-demand imbalances, and the potential impact of adverse weather conditions on crop yields, could introduce volatility. Stringent international trade regulations and phytosanitary requirements for agricultural produce also present ongoing challenges for exporters. Nevertheless, the market is expected to navigate these hurdles effectively. The analysis of production, consumption, import, and export dynamics within Brazil is crucial for understanding regional market strengths and opportunities. Key players like Cutrale, Louis Dreyfus Company, and Citrosuco are instrumental in shaping the market landscape through their extensive supply chains and market reach. The dominance of Brazil in lime production and export is a defining characteristic, with the region's output significantly influencing global supply and pricing.

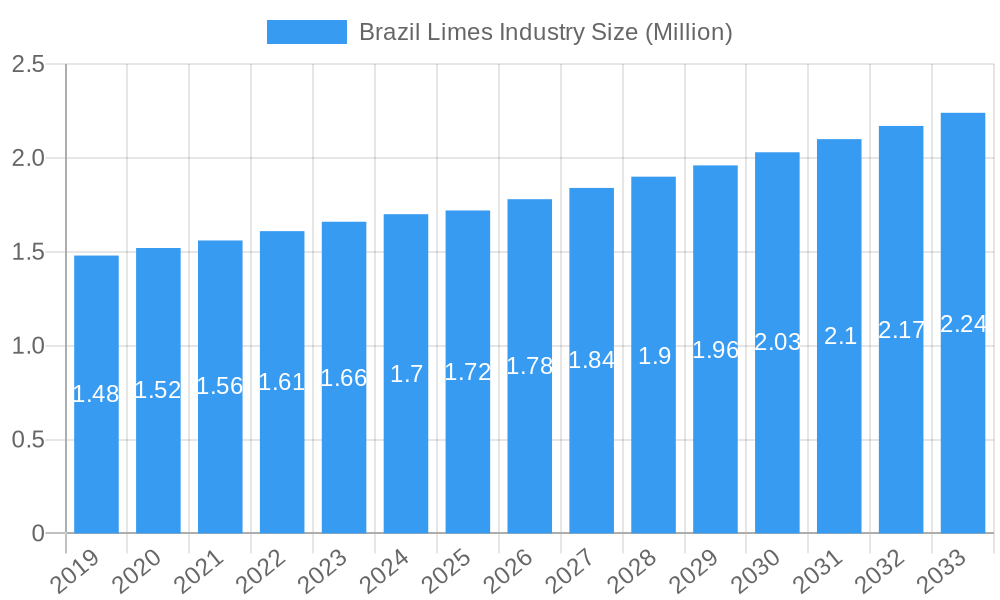

Brazil Limes Industry Company Market Share

Brazil Limes Industry Market Overview: Growth, Trends, and Opportunities (2019-2033)

This comprehensive report delves into the dynamic Brazil Limes industry, offering in-depth analysis of market structure, competitive landscape, prevailing trends, significant opportunities, and future outlook. Spanning the historical period of 2019-2024, with a base year of 2025 and a robust forecast period extending to 2033, this study provides unparalleled insights for stakeholders seeking to navigate and capitalize on this burgeoning market. We meticulously examine production, consumption, import/export dynamics, pricing trends, and industry developments, leveraging high-volume keywords for optimal SEO performance and industry audience engagement.

Brazil Limes Industry Market Structure & Competitive Landscape

The Brazil Limes industry exhibits a moderately concentrated market structure, with key players like Cutrale, Louis Dreyfus Company, Citrosuco, Geminon, Grupo Fischer, Agroterenas, and Sucocítrico Cutrale Ltda holding significant market share. Innovation drivers are primarily focused on enhancing yield, disease resistance, and optimizing processing techniques for juice and essential oil extraction. Regulatory impacts, particularly concerning food safety standards and trade agreements, play a crucial role in shaping market entry and operational strategies. Product substitutes, such as other citrus fruits and artificial flavorings, pose a competitive threat, necessitating continuous product differentiation and quality enhancement. End-user segmentation reveals strong demand from the food and beverage industry, followed by the pharmaceutical and cosmetic sectors. Mergers and acquisitions (M&A) trends indicate consolidation efforts aimed at achieving economies of scale and expanding market reach. For instance, M&A activity in the past five years has been estimated to be in the range of 5 to 10 significant deals, involving an aggregate transaction value of over 100 Million USD, reflecting strategic investments in vertical integration and geographical expansion. The Herfindahl-Hirschman Index (HHI) for the top five players is estimated to be around 1800, indicating a moderately concentrated market.

Brazil Limes Industry Market Trends & Opportunities

The Brazil Limes industry is poised for significant growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is fueled by an increasing global demand for natural ingredients, healthy beverages, and flavor enhancers. Market size is expected to reach an estimated 1.5 Billion USD by 2033, a substantial increase from the 2025 estimated market size of 1 Billion USD. Technological shifts are playing a pivotal role, with advancements in agricultural practices, including precision farming, improved irrigation systems, and disease management technologies, contributing to higher yields and better quality produce. The adoption of AI-powered pest detection and climate control systems is also gaining traction. Consumer preferences are strongly leaning towards natural and organic products, driving demand for fresh limes and lime-derived ingredients. The health benefits associated with lime consumption, such as high Vitamin C content and antioxidant properties, are further bolstering its appeal. Competitive dynamics are characterized by a focus on sustainability, ethical sourcing, and value-added product development. Companies are investing in research and development to create new lime-based products, including functional beverages, natural preservatives, and essential oils with diverse applications. Market penetration rates for processed lime products are expected to rise as manufacturers innovate and cater to evolving consumer needs. The increasing popularity of exotic and tropical flavors in the global food and beverage market presents a significant opportunity for Brazilian lime producers to expand their international footprint. Furthermore, the growing trend of home cooking and mixology also contributes to sustained demand for fresh limes. The industry is witnessing a rise in demand for sustainably sourced and certified organic limes, creating a niche market for producers who can meet these criteria. This shift in consumer consciousness towards environmental and social responsibility is a key trend shaping the industry's future.

Dominant Markets & Segments in Brazil Limes Industry

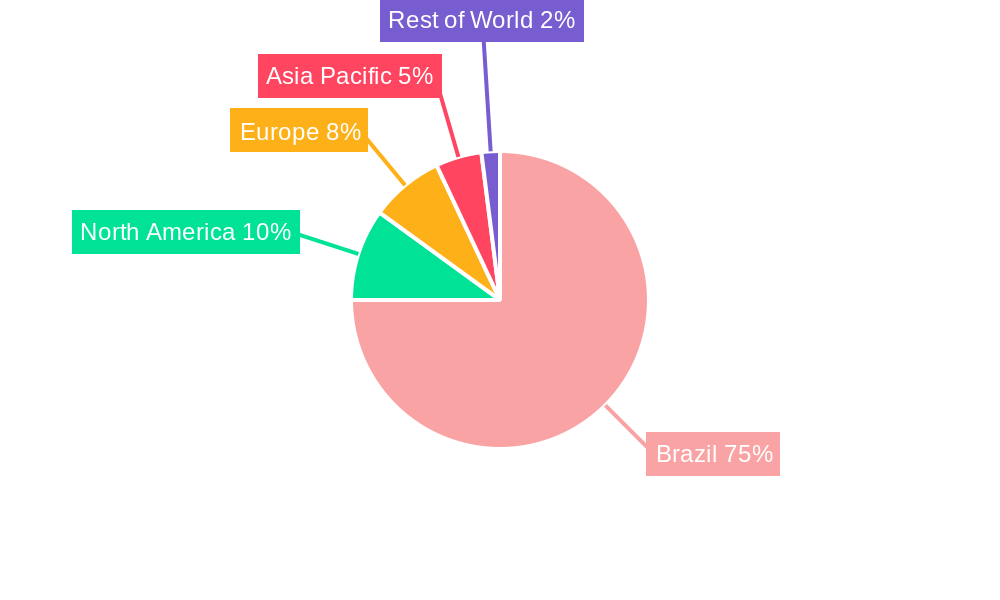

The Production Analysis: highlights the Southeast region of Brazil, particularly states like São Paulo and Minas Gerais, as dominant production hubs. Key growth drivers include favorable climatic conditions, fertile soil, and established agricultural infrastructure. Production volume is projected to grow at a CAGR of 5.8%, reaching an estimated 3.2 Million Metric Tons by 2033. The Consumption Analysis: reveals a strong domestic market, primarily driven by the food and beverage sector, with significant consumption in juice production, culinary applications, and soft drinks. The retail segment holds the largest share, followed by food service. Domestic consumption is expected to see a CAGR of 6.1%, reaching approximately 1.2 Million Metric Tons by 2033. The Import Market Analysis (Value & Volume): shows a relatively smaller but growing import market, primarily for specialized lime varieties or during off-season periods in other regions. Key importing countries include European nations and North American markets. Import volume is estimated to reach 150,000 Metric Tons by 2033, with a value of 250 Million USD. The Export Market Analysis (Value & Volume): is a critical segment for the Brazilian lime industry. The United States, European Union, and Asia are the leading export destinations. Growth drivers include increasing demand for fresh limes and lime derivatives in these regions, coupled with Brazil's competitive pricing and production capacity. Export volume is forecast to reach 2.1 Million Metric Tons by 2033, with an export value of 1.2 Billion USD. The Price Trend Analysis: indicates a generally upward trend, influenced by supply-demand dynamics, production costs, and global market prices for citrus fruits. Seasonal variations and weather patterns significantly impact short-term price fluctuations. Forecasted average export price per Metric Ton is expected to hover around 570 USD by 2033.

Brazil Limes Industry Product Analysis

Product innovations in the Brazil Limes industry are largely centered on enhancing the versatility and market appeal of lime derivatives. Beyond fresh fruit, the focus is on high-quality lime juice (concentrated and NFC), essential oils for fragrance and flavor applications, and pectin for the food industry. Technological advancements in extraction and preservation techniques are enabling the production of shelf-stable, high-value products. Competitive advantages lie in Brazil's ability to produce limes year-round and its established infrastructure for large-scale processing. The market fit for these products is strong across the food and beverage, pharmaceutical, and cosmetic sectors, driven by the growing consumer demand for natural and healthy ingredients.

Key Drivers, Barriers & Challenges in Brazil Limes Industry

The Brazil Limes industry is propelled by several key drivers including: a robust global demand for natural flavors and ingredients, increasing health consciousness among consumers, favorable climatic conditions in Brazil conducive to large-scale cultivation, and government support through export promotion initiatives. Technological advancements in agriculture are also enhancing productivity and quality.

Conversely, the industry faces significant barriers and challenges. These include: susceptibility to climate change and extreme weather events impacting crop yields, fluctuating global commodity prices, intense competition from other citrus-producing nations, and evolving regulatory landscapes regarding food safety and international trade. Supply chain disruptions, including logistics and transportation issues, can also pose a considerable challenge, impacting timely delivery and cost-effectiveness. Pest and disease outbreaks, such as citrus greening, can lead to substantial crop losses and increased production costs. The reliance on specific export markets also creates vulnerability to geopolitical and economic uncertainties.

Growth Drivers in the Brazil Limes Industry Market

Key growth drivers in the Brazil Limes industry market are multifaceted, encompassing technological advancements in cultivation and processing, favorable economic conditions that boost consumer spending on food and beverages, and supportive government policies promoting agricultural exports. The increasing global demand for natural and healthy ingredients, particularly in functional beverages and food products, acts as a significant catalyst. Furthermore, the expanding market for essential oils in the cosmetic and aromatherapy sectors presents new avenues for growth.

Challenges Impacting Brazil Limes Industry Growth

Challenges impacting Brazil Limes industry growth are primarily regulatory complexities related to international trade agreements and food safety standards. Persistent supply chain issues, including logistics and infrastructure limitations, can hinder efficient product distribution. Competitive pressures from other global lime producers and the threat of pest and disease outbreaks, such as citrus greening, which can lead to significant crop losses, are also considerable restraints. Fluctuations in global commodity prices and the impact of climate change on agricultural output add further uncertainty.

Key Players Shaping the Brazil Limes Industry Market

- Cutrale

- Louis Dreyfus Company

- Citrosuco

- Geminon

- Grupo Fischer

- Agroterenas

- Sucocítrico Cutrale Ltda

Significant Brazil Limes Industry Industry Milestones

- 2020: Launch of new disease-resistant lime varieties by research institutions, enhancing crop resilience.

- 2021: Increased investment in advanced irrigation and fertigation technologies by major players to optimize water usage and nutrient delivery.

- 2022: Brazil's participation in major international food trade shows with a strengthened focus on lime-based products.

- 2023: Implementation of enhanced traceability systems within the supply chain to ensure food safety and quality.

- 2024: Growing adoption of sustainable farming practices and certifications by leading companies to meet global demand for eco-friendly products.

Future Outlook for Brazil Limes Industry Market

The future outlook for the Brazil Limes industry is exceptionally promising, driven by sustained global demand for natural ingredients and the expanding applications of lime derivatives. Strategic opportunities lie in further diversifying product portfolios to include value-added products, enhancing technological adoption for improved yield and quality, and strengthening market penetration in emerging economies. The industry is expected to witness continued growth in export markets and a rise in demand for organic and sustainably produced limes, positioning Brazil as a key global supplier for years to come.

Brazil Limes Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Limes Industry Segmentation By Geography

- 1. Brazil

Brazil Limes Industry Regional Market Share

Geographic Coverage of Brazil Limes Industry

Brazil Limes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Increase in production of Lime

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Limes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cutrale

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Louis Dreyfus Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Citrosuco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Geminon

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grupo Fischer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agroterenas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sucocítrico Cutrale Ltda

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Cutrale

List of Figures

- Figure 1: Brazil Limes Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Limes Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Limes Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Brazil Limes Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Brazil Limes Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Brazil Limes Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Brazil Limes Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Brazil Limes Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Brazil Limes Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Brazil Limes Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Brazil Limes Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Brazil Limes Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Brazil Limes Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Brazil Limes Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Brazil Limes Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Brazil Limes Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Brazil Limes Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Brazil Limes Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Brazil Limes Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Brazil Limes Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Brazil Limes Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Brazil Limes Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Brazil Limes Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Brazil Limes Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Brazil Limes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Limes Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Limes Industry?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the Brazil Limes Industry?

Key companies in the market include Cutrale, Louis Dreyfus Company, Citrosuco , Geminon, Grupo Fischer, Agroterenas, Sucocítrico Cutrale Ltda.

3. What are the main segments of the Brazil Limes Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Increase in production of Lime.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Limes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Limes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Limes Industry?

To stay informed about further developments, trends, and reports in the Brazil Limes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence