Key Insights

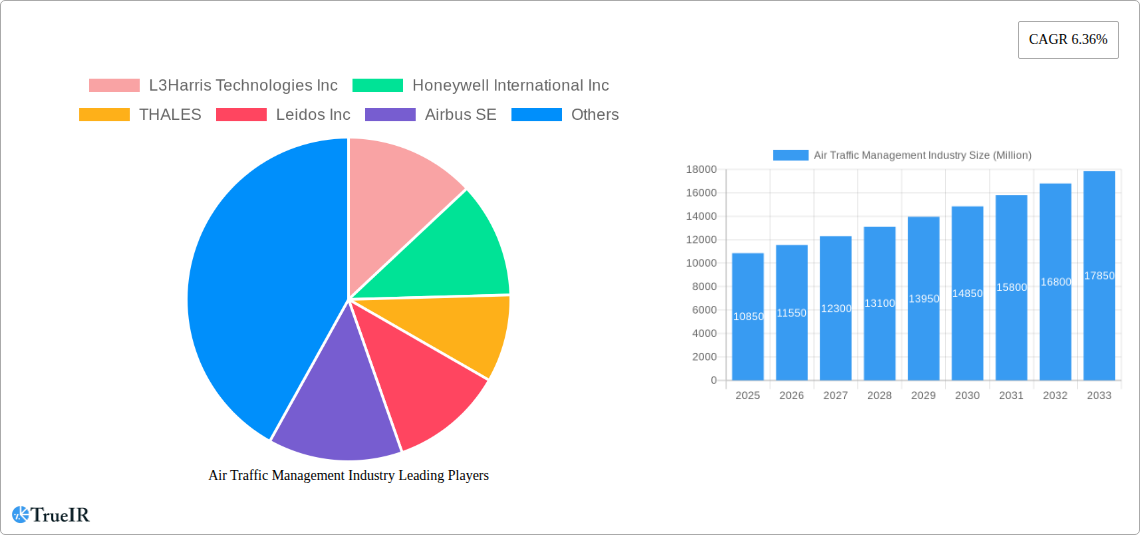

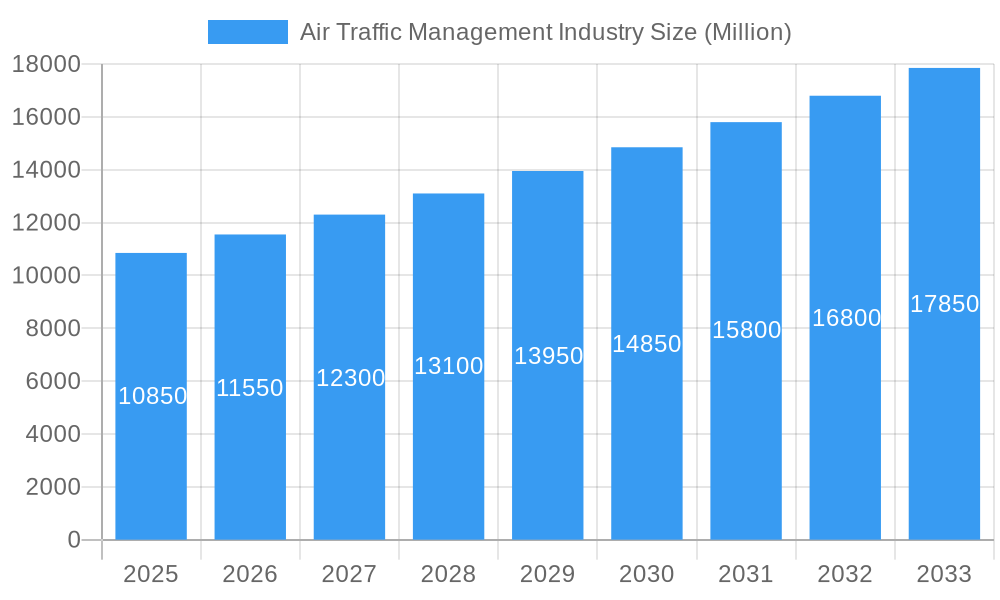

The Air Traffic Management (ATM) market, valued at $10.85 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, the expansion of air routes, and the rising adoption of advanced technologies for improved safety and efficiency. The 6.36% Compound Annual Growth Rate (CAGR) from 2025 to 2033 indicates a significant market expansion, reaching an estimated $18.6 billion by 2033. Key drivers include the urgent need for enhanced air traffic flow management systems to address increasing congestion at major airports globally, the integration of advanced data analytics for predictive maintenance and optimized resource allocation, and the growing adoption of Next Generation Air Transportation System (NextGen) technologies worldwide. Furthermore, the increasing demand for real-time data visualization and improved situational awareness among air traffic controllers is fostering growth in the software segment, which is expected to show significant growth over the forecast period. While challenges remain, such as high initial investment costs for new technologies and the need for robust cybersecurity measures, the overall outlook for the ATM market remains exceptionally positive.

Air Traffic Management Industry Market Size (In Billion)

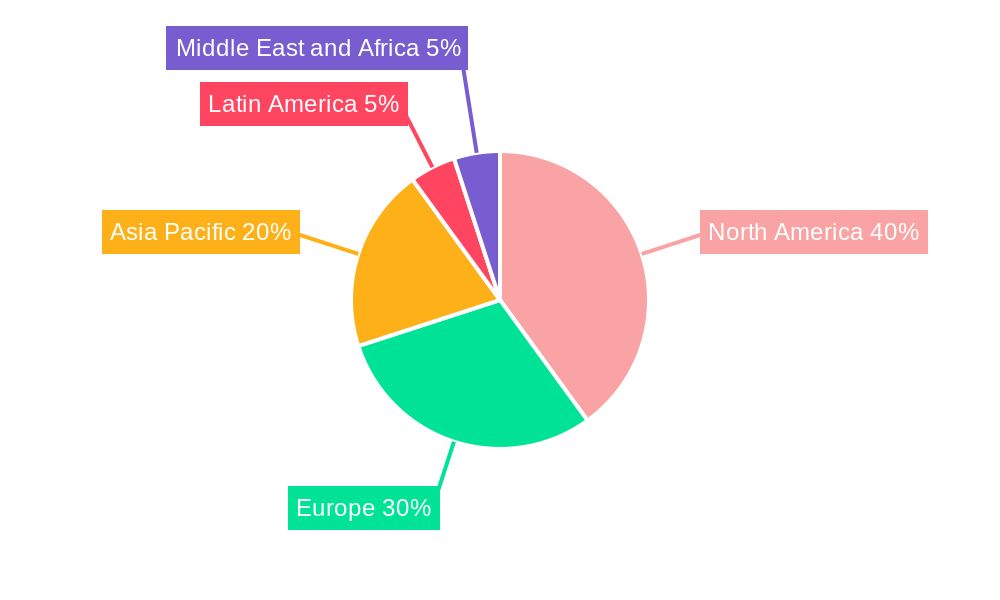

The market segmentation reveals strong growth across all components (hardware and software) and domains (Air Traffic Control, Air Traffic Flow Management, and Aeronautical Information Management). North America currently holds a significant market share, fueled by substantial investments in ATM infrastructure upgrades and technological advancements. However, the Asia-Pacific region is poised for rapid expansion due to the burgeoning air travel industry and significant infrastructure development projects across countries like India and China. Europe and the Middle East & Africa regions will also experience steady growth, driven by government initiatives to modernize their ATM systems and enhance safety standards. Competition among key players like L3Harris Technologies Inc, Honeywell International Inc, and Thales is expected to intensify as companies invest in research and development to offer innovative solutions. The market will see increased focus on solutions that enhance automation, improve data interoperability and promote sustainability in air travel.

Air Traffic Management Industry Company Market Share

Air Traffic Management (ATM) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Air Traffic Management (ATM) industry, covering the period 2019-2033. With a focus on market size, segmentation, competitive landscape, and future trends, this report is an essential resource for industry professionals, investors, and policymakers. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Air Traffic Management Industry Market Structure & Competitive Landscape

The global Air Traffic Management (ATM) market is characterized by a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters competition and innovation. Concentration ratios, calculated using the top 5 players, are estimated at xx% in 2025. Key factors influencing market structure include:

- Innovation Drivers: Advancements in technologies such as AI, machine learning, and satellite communication are driving market growth and reshaping competitive dynamics.

- Regulatory Impacts: Stringent safety regulations and evolving international standards exert a significant influence on market participants. Compliance costs and regulatory approvals can be substantial barriers to entry.

- Product Substitutes: While direct substitutes are limited, cost-effective alternatives and improvements in existing technologies continually challenge incumbent solutions.

- End-User Segmentation: The market is segmented by end-users, including airlines, airports, air navigation service providers (ANSPs), and government agencies. Growth varies significantly across these segments, with airlines driving demand for certain technologies.

- M&A Trends: The ATM industry witnesses frequent mergers and acquisitions (M&As), aimed at expanding product portfolios, gaining technological capabilities, and accessing new markets. The total value of M&A transactions in the historical period (2019-2024) is estimated to be xx Million, with an increase expected in the forecast period.

Air Traffic Management Industry Market Trends & Opportunities

The global ATM market is experiencing substantial growth, driven by increasing air traffic volume, modernization initiatives at airports, and technological advancements. The market size is projected to reach xx Million in 2025 and xx Million by 2033. Several key trends are shaping market dynamics:

The increasing adoption of advanced technologies such as AI and machine learning is revolutionizing ATM operations, improving efficiency, safety, and capacity. The growing demand for real-time data analytics and predictive modeling is driving investments in advanced software solutions. Moreover, the integration of satellite-based communication systems is enhancing the reliability and coverage of ATM networks, especially in remote areas. This is accompanied by a growing preference for cloud-based solutions, allowing for greater scalability and cost optimization. The competitive landscape is marked by continuous innovation, with established players and new entrants vying for market share. This competitive pressure is resulting in improved products and services, pushing prices down and benefiting consumers. Market penetration of new technologies is steadily growing, with estimates suggesting xx% market penetration of AI-powered solutions by 2033.

Dominant Markets & Segments in Air Traffic Management Industry

The North American region currently holds a dominant position in the global ATM market, driven by significant investments in infrastructure, regulatory support, and strong technological capabilities. However, the Asia-Pacific region is experiencing rapid growth, fueled by the expansion of air travel in developing economies. Within the ATM segments:

Air Traffic Control (ATC): This segment holds the largest market share, due to the essential nature of ATC for safe and efficient air operations. Key growth drivers include the increasing demand for automation and improved situational awareness.

Air Traffic Flow Management (ATFM): This segment is witnessing significant growth due to the increasing need for optimizing airspace utilization and managing air traffic congestion.

Aeronautical Information Management (AIM): AIM is crucial for safe and efficient air operations. Growth in this segment is driven by the need for accurate and up-to-date information.

Hardware: The hardware segment is expected to witness substantial growth due to technological advancements and the replacement of legacy systems.

Software: The software segment is witnessing strong growth due to the increasing demand for advanced functionalities like AI, Machine Learning, and automation.

Key Growth Drivers:

- Investment in modernized air navigation infrastructure.

- Implementation of new air traffic management policies and regulations.

- Technological advancements leading to improved safety and efficiency.

Air Traffic Management Industry Product Analysis

ATM technology is rapidly evolving, with a focus on integrating advanced capabilities such as AI, machine learning, and data analytics to enhance safety, efficiency, and capacity. Innovations include advanced radar systems, automated dependent surveillance-broadcast (ADS-B) technologies, and next-generation communication systems. These advancements are creating more efficient and resilient ATM systems. The market's competitive edge lies in providing solutions tailored to the needs of specific end-users, alongside providing robust customer support and ongoing maintenance services.

Key Drivers, Barriers & Challenges in Air Traffic Management Industry

Key Drivers: The primary forces propelling the ATM market include increasing air passenger traffic, government initiatives to modernize ATM infrastructure, technological advancements (like AI and automation), and the integration of new communication and surveillance technologies.

Challenges and Restraints: Key challenges include high implementation costs of new technologies, integration complexities across legacy systems, cybersecurity threats, and the need for skilled workforce to maintain and operate advanced ATM systems. Regulatory hurdles, including international standardization and compliance, further pose challenges. Supply chain disruptions and geopolitical factors can also impact the availability and pricing of components, impacting profitability. These issues could result in a xx% decrease in market growth if not addressed.

Growth Drivers in the Air Traffic Management Industry Market

The ATM market's growth is fueled by escalating air passenger numbers globally, coupled with substantial investments in airport infrastructure modernization. Advancements in AI, machine learning, and improved satellite technologies are also key contributors. Furthermore, stringent safety regulations and governmental mandates drive the adoption of advanced ATM solutions.

Challenges Impacting Air Traffic Management Industry Growth

Significant challenges include the high capital expenditure needed for infrastructure upgrades and technological implementations. Interoperability issues between various systems and legacy technologies pose integration difficulties. Lastly, cybersecurity risks and the shortage of skilled personnel hinder industry expansion.

Key Players Shaping the Air Traffic Management Industry Market

- L3Harris Technologies Inc

- Honeywell International Inc

- THALES

- Leidos Inc

- Airbus SE

- ANPC

- RTX Corporation

- SIT

- Adacel Technologies Limited

- Indra Sistemas S A

- Northrop Grumman Corporation

- Saab AB

Significant Air Traffic Management Industry Milestones

- October 2023: Biju Patnaik International Airport in Bhubaneswar, India, implemented a new air traffic management automation system, significantly enhancing operational efficiency.

- January 2024: EasyJet partnered with the ESA's Iris program and Viasat, utilizing cutting-edge satellite technologies to modernize air traffic management. This collaboration showcases the adoption of advanced satellite-based communication systems for improved efficiency and safety.

Future Outlook for Air Traffic Management Industry Market

The ATM market is poised for sustained growth, driven by continuous technological advancements, increasing air traffic, and investments in infrastructure upgrades. Strategic opportunities lie in developing and implementing AI-powered solutions, improving interoperability across systems, and enhancing cybersecurity measures. The market’s potential is significant, with ample room for expansion in emerging markets and the integration of next-generation technologies.

Air Traffic Management Industry Segmentation

-

1. Domain

- 1.1. Air Traffic Control

- 1.2. Air Traffic Flow Management

- 1.3. Aeronautical Information Management

-

2. Component

- 2.1. Hardware

- 2.2. Software

Air Traffic Management Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Air Traffic Management Industry Regional Market Share

Geographic Coverage of Air Traffic Management Industry

Air Traffic Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Air Traffic Flow Management Segment To Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Domain

- 5.1.1. Air Traffic Control

- 5.1.2. Air Traffic Flow Management

- 5.1.3. Aeronautical Information Management

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Domain

- 6. North America Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Domain

- 6.1.1. Air Traffic Control

- 6.1.2. Air Traffic Flow Management

- 6.1.3. Aeronautical Information Management

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Hardware

- 6.2.2. Software

- 6.1. Market Analysis, Insights and Forecast - by Domain

- 7. Europe Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Domain

- 7.1.1. Air Traffic Control

- 7.1.2. Air Traffic Flow Management

- 7.1.3. Aeronautical Information Management

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Hardware

- 7.2.2. Software

- 7.1. Market Analysis, Insights and Forecast - by Domain

- 8. Asia Pacific Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Domain

- 8.1.1. Air Traffic Control

- 8.1.2. Air Traffic Flow Management

- 8.1.3. Aeronautical Information Management

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Hardware

- 8.2.2. Software

- 8.1. Market Analysis, Insights and Forecast - by Domain

- 9. Latin America Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Domain

- 9.1.1. Air Traffic Control

- 9.1.2. Air Traffic Flow Management

- 9.1.3. Aeronautical Information Management

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Hardware

- 9.2.2. Software

- 9.1. Market Analysis, Insights and Forecast - by Domain

- 10. Middle East and Africa Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Domain

- 10.1.1. Air Traffic Control

- 10.1.2. Air Traffic Flow Management

- 10.1.3. Aeronautical Information Management

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Hardware

- 10.2.2. Software

- 10.1. Market Analysis, Insights and Forecast - by Domain

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leidos Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ANPC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SIT

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adacel Technologies Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indra Sistemas S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Saab AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Air Traffic Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 3: North America Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 4: North America Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 5: North America Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 9: Europe Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 10: Europe Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 15: Asia Pacific Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 16: Asia Pacific Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Pacific Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Pacific Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 21: Latin America Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 22: Latin America Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 23: Latin America Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: Latin America Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 27: Middle East and Africa Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 28: Middle East and Africa Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 29: Middle East and Africa Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 30: Middle East and Africa Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 2: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Air Traffic Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 5: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 10: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 18: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 26: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Mexico Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Brazil Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 32: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 33: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: United Arab Emirates Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Saudi Arabia Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Qatar Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Traffic Management Industry?

The projected CAGR is approximately 6.36%.

2. Which companies are prominent players in the Air Traffic Management Industry?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, THALES, Leidos Inc, Airbus SE, ANPC, RTX Corporation, SIT, Adacel Technologies Limited, Indra Sistemas S A, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the Air Traffic Management Industry?

The market segments include Domain, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.85 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Air Traffic Flow Management Segment To Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024: Easy Jet announced that they are the first airline partner of the Iris program, which is an initiative led by the European Space Agency (ESA) as well as the global communications company Viasat. Moreover, both of these organizations are now making use of the latest generation of satellite technologies to help modernize air traffic management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Traffic Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Traffic Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Traffic Management Industry?

To stay informed about further developments, trends, and reports in the Air Traffic Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence