Key Insights

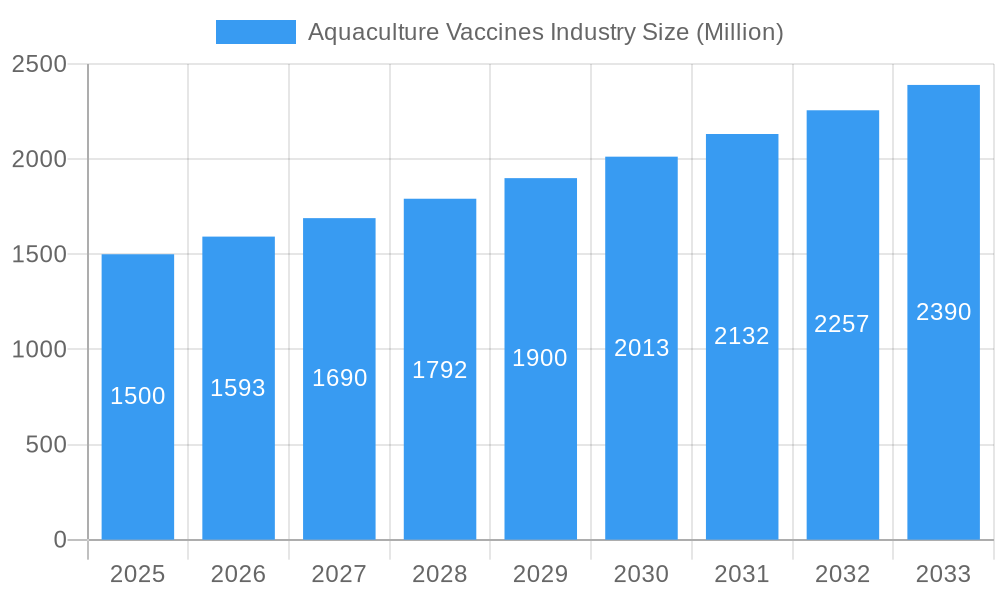

The global Aquaculture Vaccines market is projected to reach $7.34 billion by 2033, expanding at a robust Compound Annual Growth Rate (CAGR) of 15.52% from a 2025 base year. This significant growth is propelled by increasing global demand for protein, particularly fish, driven by population expansion and heightened awareness of seafood's health benefits. Proactive disease management is essential for sustainable aquaculture and minimizing economic losses, making vaccines a vital tool. Market expansion is further supported by substantial investments in research and development for advanced vaccine formulations and delivery methods, coupled with supportive regulatory frameworks for disease prevention.

Aquaculture Vaccines Industry Market Size (In Billion)

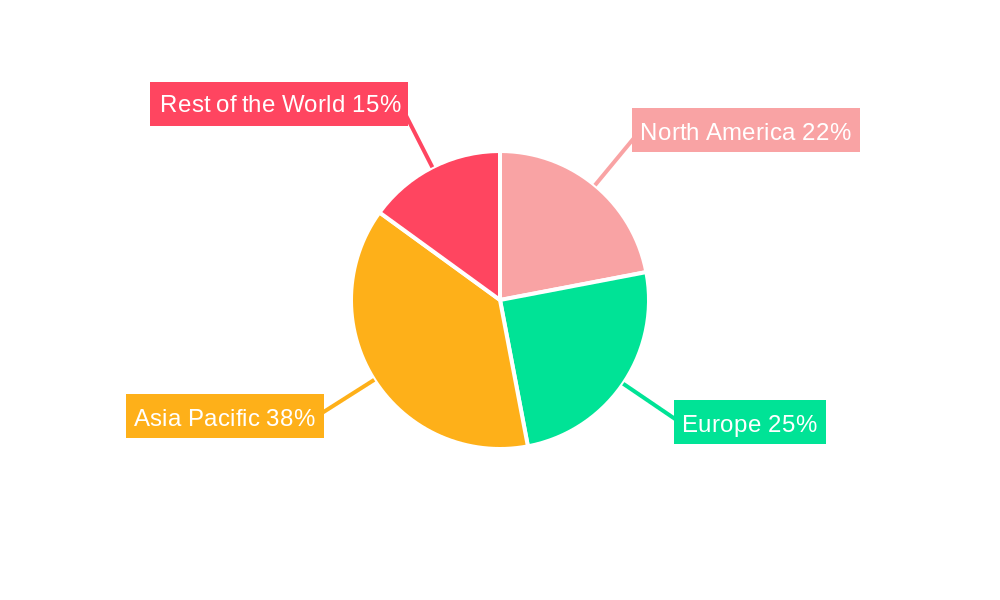

Key market segments present considerable opportunities. Within Vaccine Types, Live vaccines are anticipated to lead due to their potent and broad immune responses, while Inactivated vaccines will retain a substantial share owing to their safety and ease of administration. For Type of Administration, Oral delivery is increasingly favored for its cost-effectiveness and reduced stress in large-scale operations, complementing the continued use of Immersion and Injected methods for specific applications. Geographically, the Asia Pacific region is expected to dominate, fueled by extensive aquaculture production and the adoption of modern disease prevention techniques. North America and Europe also represent significant markets, supported by stringent regulations, advanced aquaculture practices, and higher disposable incomes. The competitive landscape includes established industry leaders and specialized aquaculture vaccine providers focused on innovation and market capture through strategic collaborations and product development.

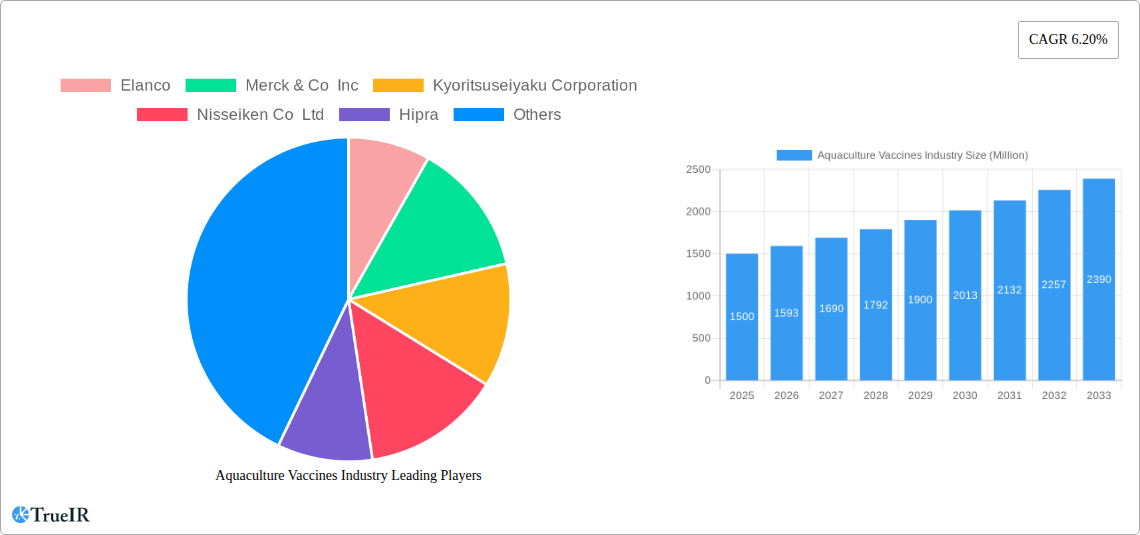

Aquaculture Vaccines Industry Company Market Share

This comprehensive report provides critical insights into the global Aquaculture Vaccines industry, analyzing market dynamics, growth drivers, competitive strategies, and future projections for the period 2025-2033. Designed with high-volume SEO keywords, this study offers actionable intelligence for strategic decision-making. It includes detailed market segmentation, product analysis, and profiling of key players, with a forecast period from 2025 to 2033.

Aquaculture Vaccines Industry Market Structure & Competitive Landscape

The Aquaculture Vaccines industry is characterized by a moderately concentrated market structure, with a few dominant players holding significant market share, while a larger number of smaller and emerging companies compete for niche segments. Innovation is a primary driver, fueled by continuous research and development into novel vaccine platforms and delivery systems to combat evolving aquatic diseases. Regulatory impacts are substantial, with stringent approval processes and quality control measures dictating market entry and product lifecycle. Product substitutes, such as antibiotics and biosecurity measures, present indirect competition, though vaccines offer a more sustainable and targeted disease prevention strategy. End-user segmentation is crucial, with farmed fish and shellfish species representing distinct market opportunities. Mergers and acquisitions (M&A) are a key trend, as larger companies seek to expand their product portfolios and geographical reach. For instance, recent M&A activities have focused on acquiring innovative technologies and gaining access to key aquaculture regions, contributing to market consolidation. The industry’s concentration ratio is estimated to be around 0.6, indicating a degree of market dominance by the top players. M&A volumes have seen a steady increase, with an estimated 25 acquisitions in the historical period (2019–2024), further shaping the competitive landscape.

Aquaculture Vaccines Industry Market Trends & Opportunities

The global Aquaculture Vaccines market is poised for substantial expansion, driven by an escalating demand for sustainable seafood production and increasing awareness of disease prevention in aquaculture operations worldwide. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025–2033). This growth is underpinned by several key trends, including the rising incidence of aquatic diseases, the growing adoption of preventative healthcare strategies in aquaculture, and advancements in vaccine technology. Consumer preferences are increasingly shifting towards responsibly sourced seafood, which directly translates to a greater emphasis on fish health and reduced reliance on antibiotics. Technologically, the market is experiencing a surge in the development of innovative vaccine types, such as DNA vaccines and mRNA vaccines, offering enhanced efficacy and reduced side effects. Oral and immersion administration methods are gaining traction due to their ease of application and reduced stress on aquatic animals, thereby increasing their market penetration rates. The growing global population and its increased protein requirements further amplify the need for efficient and healthy aquaculture practices, creating significant opportunities for vaccine manufacturers. The market penetration of vaccines in developed aquaculture regions is estimated to be around 40%, with considerable room for growth in emerging markets. The shift from therapeutic treatments to preventative measures is a pivotal trend, pushing the demand for vaccines higher. Emerging economies with expanding aquaculture sectors are presenting untapped opportunities for market players. Furthermore, the development of vaccines for a wider range of fish and shellfish species and diseases is a continuous trend, broadening the market scope.

Dominant Markets & Segments in Aquaculture Vaccines Industry

The Live vaccine segment, particularly for freshwater fish species, is currently the dominant segment within the Aquaculture Vaccines market. This dominance is attributed to their established efficacy against common pathogens and cost-effectiveness in large-scale aquaculture operations. The Oral administration route also holds a significant share, driven by its ease of use in extensive farming systems and reduced handling stress for fish. Geographically, Asia-Pacific stands as the leading market, owing to its vast aquaculture production volume, particularly in countries like China, Vietnam, and India, which are major global suppliers of farmed fish. Key growth drivers in this region include robust government support for aquaculture development, increasing investments in R&D for fish health, and the growing prevalence of fish diseases.

Dominant Vaccine Type: Live Vaccines

- Growth Drivers: Proven efficacy against prevalent bacterial and viral diseases, cost-effectiveness for large-scale farming, widespread acceptance in established aquaculture regions.

- Market Penetration: High in freshwater fish farming due to historical use and established supply chains.

Dominant Type of Administration: Oral Vaccines

- Growth Drivers: Ease of application in extensive farming systems, reduced stress on aquatic animals, cost-efficiency in mass administration, suitable for species that are difficult to handle for injection.

- Market Adoption: Increasing rapidly in both finfish and shellfish aquaculture.

Dominant Region: Asia-Pacific

- Growth Drivers: Largest global aquaculture production, significant government initiatives for aquaculture modernization, increasing awareness of fish health management, substantial R&D investments in aquatic animal health.

- Market Share: Estimated to hold over 50% of the global aquaculture vaccines market.

- Key Countries: China, India, Vietnam, Indonesia.

The Inactivated vaccine segment is steadily growing, offering improved stability and longer shelf life, making them attractive for specific pathogens and species. Immersion vaccines are also gaining traction, especially for larval stages and smaller fish, due to their non-invasive nature. The Americas and Europe represent substantial markets with a strong focus on technological innovation, high-value species cultivation, and stringent regulatory frameworks, driving the demand for advanced and specialized vaccines.

Aquaculture Vaccines Industry Product Analysis

Product innovation in the Aquaculture Vaccines industry is centered on developing vaccines with enhanced immunogenicity, broader disease coverage, and improved delivery methods. Key advancements include the development of multi-valent vaccines to protect against multiple pathogens simultaneously, and the exploration of novel platforms like subunit vaccines and viral vector vaccines for greater safety and efficacy. Applications span a wide array of farmed aquatic species, including finfish like salmon, tilapia, and catfish, as well as shellfish such as shrimp and oysters. Competitive advantages are being achieved through superior cold chain management, extended shelf life, and targeted efficacy against emerging or resistant pathogens.

Key Drivers, Barriers & Challenges in Aquaculture Vaccines Industry

Key Drivers: The Aquaculture Vaccines industry is propelled by several critical factors. The escalating global demand for seafood, coupled with increasing concerns over antibiotic resistance, drives the need for safer disease prevention methods. Technological advancements in molecular biology and immunology are enabling the development of more effective and targeted vaccines. Furthermore, growing government initiatives and investments in sustainable aquaculture practices worldwide are creating a conducive environment for vaccine adoption.

Barriers & Challenges: Despite the positive outlook, the industry faces significant challenges. Regulatory hurdles and the lengthy approval processes for new vaccines across different regions pose a considerable barrier. Supply chain complexities, particularly for temperature-sensitive vaccines, can impact accessibility and efficacy. The high cost of R&D and vaccine production can also be a restraint, especially for smaller aquaculture operations. Moreover, educating farmers about the benefits and proper usage of vaccines remains a continuous effort, and the emergence of new disease strains requires constant innovation.

Growth Drivers in the Aquaculture Vaccines Industry Market

The growth of the Aquaculture Vaccines market is significantly influenced by a confluence of technological, economic, and regulatory factors. Advances in genetic engineering and molecular biology are enabling the development of highly specific and effective vaccines, such as subunit and DNA vaccines, addressing a wider spectrum of diseases. Economically, the increasing global demand for protein-rich seafood, coupled with rising disposable incomes in emerging economies, is fueling the expansion of aquaculture operations, consequently boosting vaccine demand. Regulatory support, including government incentives for disease prevention and stricter regulations on antibiotic use in aquaculture, further accelerates market growth by promoting the adoption of vaccines. The continuous need to combat emerging infectious diseases in farmed aquatic species is a constant stimulus for vaccine development and market expansion.

Challenges Impacting Aquaculture Vaccines Industry Growth

Several challenges can impede the growth trajectory of the Aquaculture Vaccines industry. The complex and often lengthy regulatory approval processes for new vaccines across various international markets create significant delays and increase development costs. Supply chain vulnerabilities, particularly the need for a robust cold chain to maintain vaccine integrity, can lead to product spoilage and reduced efficacy, especially in remote aquaculture locations. Competitive pressures from alternative disease management strategies, such as antibiotics and improved biosecurity measures, can also influence market adoption rates. Furthermore, the high capital investment required for research, development, and manufacturing of advanced vaccines can be a barrier for smaller companies, potentially leading to market consolidation.

Key Players Shaping the Aquaculture Vaccines Industry Market

- Elanco

- Merck & Co Inc

- Kyoritsuseiyaku Corporation

- Nisseiken Co Ltd

- Hipra

- Vaxxinova International BV

- Kyoto Biken Laboratories Inc

- KBNP

- KoVax Ltd

Significant Aquaculture Vaccines Industry Industry Milestones

- November 2022: Hyderabad-based Indian Immunologicals Ltd. (IIL) partnered with the Central Institute of Fisheries Education (CIFE) for the commercial development of India's first fish vaccine, marking a significant step for domestic vaccine production and disease management in Indian aquaculture.

- January 2022: Benchmark Animal Health and Cermaq Group AS received funding of NOK 4.2 million from the Research Council of Norway to support a collaborative research project aimed at developing a vaccine against salmon diseases caused by Tenacibaculum bacteria, highlighting ongoing efforts in addressing critical disease challenges in the salmon farming sector.

Future Outlook for Aquaculture Vaccines Industry Market

The future outlook for the Aquaculture Vaccines industry is exceptionally promising, driven by persistent global demand for sustainable seafood and the imperative to reduce antibiotic reliance in aquaculture. Strategic opportunities lie in the development of innovative vaccine platforms, such as mRNA and subunit vaccines, offering enhanced specificity and safety profiles. Market expansion is expected in emerging aquaculture regions where disease management is a growing concern. Continued investment in R&D for a broader range of species and pathogens, alongside partnerships and collaborations, will be crucial for sustained growth and to address the evolving landscape of aquatic animal health, ensuring a healthier and more productive global aquaculture sector.

Aquaculture Vaccines Industry Segmentation

-

1. Vaccine Type

- 1.1. Live

- 1.2. Inactivated

- 1.3. Other Vaccine Types

-

2. Type of Administration

- 2.1. Oral

- 2.2. Immersion

- 2.3. Injected

Aquaculture Vaccines Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Aquaculture Vaccines Industry Regional Market Share

Geographic Coverage of Aquaculture Vaccines Industry

Aquaculture Vaccines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Aquaculture Farming in Developing Countries; High Prevalence of Infectious Diseases in Aquatic Animals and New Product Development; Surge in Adoption of Vaccines due to Antibiotic Resistance

- 3.3. Market Restrains

- 3.3.1. Stringent Manufacturing Regulations Associated with Vaccines

- 3.4. Market Trends

- 3.4.1. Live Vaccine Type Segment is Expected to Hold a Significant Share in the Aquaculture Vaccines Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aquaculture Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 5.1.1. Live

- 5.1.2. Inactivated

- 5.1.3. Other Vaccine Types

- 5.2. Market Analysis, Insights and Forecast - by Type of Administration

- 5.2.1. Oral

- 5.2.2. Immersion

- 5.2.3. Injected

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 6. North America Aquaculture Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 6.1.1. Live

- 6.1.2. Inactivated

- 6.1.3. Other Vaccine Types

- 6.2. Market Analysis, Insights and Forecast - by Type of Administration

- 6.2.1. Oral

- 6.2.2. Immersion

- 6.2.3. Injected

- 6.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 7. Europe Aquaculture Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 7.1.1. Live

- 7.1.2. Inactivated

- 7.1.3. Other Vaccine Types

- 7.2. Market Analysis, Insights and Forecast - by Type of Administration

- 7.2.1. Oral

- 7.2.2. Immersion

- 7.2.3. Injected

- 7.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 8. Asia Pacific Aquaculture Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 8.1.1. Live

- 8.1.2. Inactivated

- 8.1.3. Other Vaccine Types

- 8.2. Market Analysis, Insights and Forecast - by Type of Administration

- 8.2.1. Oral

- 8.2.2. Immersion

- 8.2.3. Injected

- 8.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 9. Rest of the World Aquaculture Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 9.1.1. Live

- 9.1.2. Inactivated

- 9.1.3. Other Vaccine Types

- 9.2. Market Analysis, Insights and Forecast - by Type of Administration

- 9.2.1. Oral

- 9.2.2. Immersion

- 9.2.3. Injected

- 9.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Elanco

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Merck & Co Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kyoritsuseiyaku Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nisseiken Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hipra

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vaxxinova International BV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kyoto Biken Laboratories Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KBNP

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 KoVax Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Elanco

List of Figures

- Figure 1: Global Aquaculture Vaccines Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aquaculture Vaccines Industry Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 3: North America Aquaculture Vaccines Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 4: North America Aquaculture Vaccines Industry Revenue (billion), by Type of Administration 2025 & 2033

- Figure 5: North America Aquaculture Vaccines Industry Revenue Share (%), by Type of Administration 2025 & 2033

- Figure 6: North America Aquaculture Vaccines Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Aquaculture Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aquaculture Vaccines Industry Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 9: Europe Aquaculture Vaccines Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 10: Europe Aquaculture Vaccines Industry Revenue (billion), by Type of Administration 2025 & 2033

- Figure 11: Europe Aquaculture Vaccines Industry Revenue Share (%), by Type of Administration 2025 & 2033

- Figure 12: Europe Aquaculture Vaccines Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aquaculture Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aquaculture Vaccines Industry Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 15: Asia Pacific Aquaculture Vaccines Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 16: Asia Pacific Aquaculture Vaccines Industry Revenue (billion), by Type of Administration 2025 & 2033

- Figure 17: Asia Pacific Aquaculture Vaccines Industry Revenue Share (%), by Type of Administration 2025 & 2033

- Figure 18: Asia Pacific Aquaculture Vaccines Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Aquaculture Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Aquaculture Vaccines Industry Revenue (billion), by Vaccine Type 2025 & 2033

- Figure 21: Rest of the World Aquaculture Vaccines Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 22: Rest of the World Aquaculture Vaccines Industry Revenue (billion), by Type of Administration 2025 & 2033

- Figure 23: Rest of the World Aquaculture Vaccines Industry Revenue Share (%), by Type of Administration 2025 & 2033

- Figure 24: Rest of the World Aquaculture Vaccines Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Aquaculture Vaccines Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 2: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Type of Administration 2020 & 2033

- Table 3: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 5: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Type of Administration 2020 & 2033

- Table 6: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 11: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Type of Administration 2020 & 2033

- Table 12: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 20: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Type of Administration 2020 & 2033

- Table 21: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Aquaculture Vaccines Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Vaccine Type 2020 & 2033

- Table 29: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Type of Administration 2020 & 2033

- Table 30: Global Aquaculture Vaccines Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aquaculture Vaccines Industry?

The projected CAGR is approximately 15.52%.

2. Which companies are prominent players in the Aquaculture Vaccines Industry?

Key companies in the market include Elanco, Merck & Co Inc, Kyoritsuseiyaku Corporation, Nisseiken Co Ltd, Hipra, Vaxxinova International BV, Kyoto Biken Laboratories Inc *List Not Exhaustive, KBNP, KoVax Ltd.

3. What are the main segments of the Aquaculture Vaccines Industry?

The market segments include Vaccine Type, Type of Administration.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Aquaculture Farming in Developing Countries; High Prevalence of Infectious Diseases in Aquatic Animals and New Product Development; Surge in Adoption of Vaccines due to Antibiotic Resistance.

6. What are the notable trends driving market growth?

Live Vaccine Type Segment is Expected to Hold a Significant Share in the Aquaculture Vaccines Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Manufacturing Regulations Associated with Vaccines.

8. Can you provide examples of recent developments in the market?

November 2022: Hyderabad-based Indian Immunologicals Ltd. (IIL) partnered with the Central Institute of Fisheries Education (CIFE) for the commercial development of India's first fish vaccine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aquaculture Vaccines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aquaculture Vaccines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aquaculture Vaccines Industry?

To stay informed about further developments, trends, and reports in the Aquaculture Vaccines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence