Key Insights

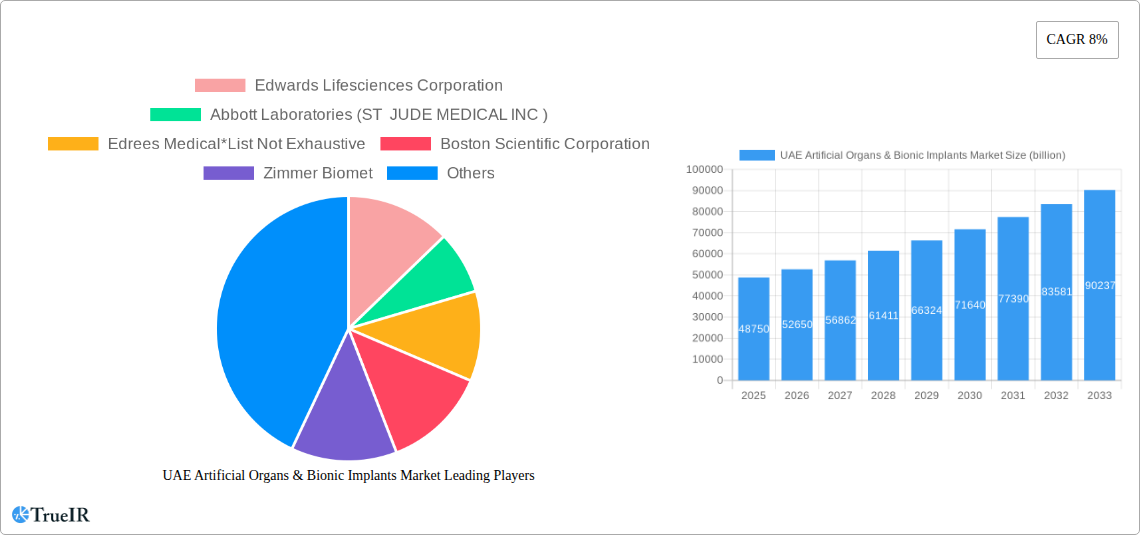

The UAE Artificial Organs & Bionic Implants Market is poised for significant expansion, with a projected market size of USD 48.75 billion in 2025, driven by increasing demand for advanced medical solutions and a growing elderly population. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 8% during the forecast period of 2025-2033. This robust growth is fueled by several key factors, including the rising prevalence of chronic diseases like kidney failure and cardiovascular conditions, which directly necessitate artificial organ replacements. Furthermore, advancements in bionic technologies, offering improved functionality and quality of life for individuals with disabilities, are acting as powerful catalysts. The UAE's commitment to healthcare infrastructure development, coupled with favorable government initiatives and a growing awareness among the populace regarding sophisticated medical treatments, further underpins this optimistic market outlook. Key segments contributing to this growth include artificial organs, with artificial kidneys and cochlear implants showing particular promise, and bionics, where orthopedic and vision bionics are experiencing elevated demand.

UAE Artificial Organs & Bionic Implants Market Market Size (In Billion)

The market landscape is characterized by a dynamic interplay of innovation and strategic partnerships among leading global players such as Edwards Lifesciences Corporation, Abbott Laboratories, and Medtronic plc. These companies are actively investing in research and development to introduce next-generation artificial organs and bionic implants that offer enhanced efficacy and patient comfort. While the market benefits from strong demand drivers, certain restraints such as the high cost of advanced implants and the need for extensive surgical procedures could temper rapid adoption in specific demographics. However, the increasing healthcare spending power in the UAE and the continuous efforts to make these life-changing technologies more accessible are expected to mitigate these challenges. The market is segmented across product types, including artificial organs and bionics, with further subdivisions within each category, catering to a diverse range of medical needs and patient profiles. The strategic focus on technological innovation and market penetration by key players will shape the trajectory of the UAE Artificial Organs & Bionic Implants Market in the coming years.

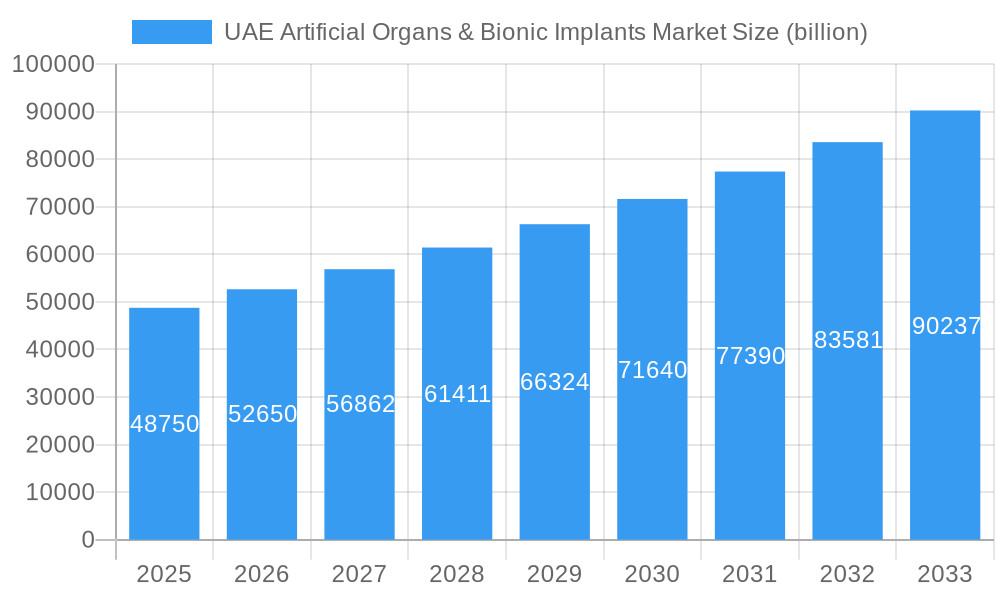

UAE Artificial Organs & Bionic Implants Market Company Market Share

Here is a dynamic, SEO-optimized report description for the UAE Artificial Organs & Bionic Implants Market, incorporating your specified details and structure.

This in-depth report provides a strategic analysis of the rapidly evolving UAE Artificial Organs & Bionic Implants Market. With a study period spanning from 2019 to 2033, including a base year of 2025, estimated year of 2025, and a detailed forecast period of 2025–2033, this research delves into the critical factors shaping this lucrative sector. Leveraging high-volume keywords such as "UAE artificial organs," "bionic implants UAE," "organ replacement technology," "prosthetic devices UAE," and "medical device innovation Dubai," this report is designed to attract industry professionals, investors, and policymakers seeking actionable insights into market growth, competitive dynamics, and emerging opportunities. The report meticulously examines product segments including Artificial Organs (Artificial Heart, Artificial Kidney, Cochlear Implants, Others) and Bionics (Vision Bionics, Ear Bionics, Orthopedic Bionic, Cardiac Bionics), alongside key industry developments that are influencing the trajectory of advanced medical solutions in the United Arab Emirates.

UAE Artificial Organs & Bionic Implants Market Market Structure & Competitive Landscape

The UAE Artificial Organs & Bionic Implants Market is characterized by a dynamic and evolving competitive landscape, marked by significant innovation drivers and a growing emphasis on advanced healthcare solutions. Market concentration is influenced by the presence of both global leaders and emerging local players, with technological innovation serving as a primary differentiator. Regulatory impacts from governing bodies like the Dubai Health Authority and Abu Dhabi Health Services Company (Seha) are shaping market entry and product approvals, fostering an environment of stringent quality and safety standards. Product substitutes, while present in the form of traditional treatments, are increasingly being overshadowed by the efficacy and longevity of artificial organs and bionic implants. The end-user segmentation highlights a growing demand across diverse patient demographics, driven by an aging population and an increasing prevalence of chronic diseases. Mergers and acquisition (M&A) trends, though currently at a nascent stage, are anticipated to accelerate as companies seek to consolidate market share, acquire advanced technologies, and expand their product portfolios. With an estimated market size projected to reach several billion in the coming years, strategic partnerships and investments are poised to become pivotal in navigating this competitive arena. The focus on patient-centric solutions and the integration of artificial intelligence and advanced materials are key areas of competitive advantage.

UAE Artificial Organs & Bionic Implants Market Market Trends & Opportunities

The UAE Artificial Organs & Bionic Implants Market is poised for significant expansion, driven by a confluence of technological advancements, increasing healthcare expenditure, and a growing patient awareness of sophisticated treatment options. The market size is projected to witness robust growth, with a compound annual growth rate (CAGR) of approximately XX% from 2025 to 2033, potentially reaching several billion in value by the end of the forecast period. Technological shifts are at the forefront, with innovations in areas like bio-integrated prosthetics, regenerative medicine, and miniaturized implantable devices revolutionizing patient care. The development of artificial organs with enhanced biocompatibility and longevity, coupled with bionic implants offering superior functionality and user experience, are key trends. Consumer preferences are increasingly leaning towards minimally invasive procedures and personalized treatment plans, further stimulating demand for advanced bionic solutions. The competitive dynamics are intensifying, with companies investing heavily in research and development to gain a competitive edge. Opportunities abound in addressing unmet medical needs, such as the growing demand for artificial kidneys and advanced cardiac bionics. The UAE's strategic vision for a robust healthcare sector, coupled with supportive government initiatives, creates a fertile ground for market penetration and growth. Emerging trends also include the integration of AI for personalized implant calibration and remote patient monitoring, as well as the development of more affordable and accessible bionic technologies to broaden market reach. The increasing prevalence of chronic diseases and the demand for improved quality of life for patients with organ failure are fundamental drivers fueling market penetration rates across various segments.

Dominant Markets & Segments in UAE Artificial Organs & Bionic Implants Market

The UAE Artificial Organs & Bionic Implants Market exhibits distinct dominance across specific product segments and regions, driven by varying levels of technological adoption, healthcare infrastructure, and unmet medical needs. Within the Artificial Organs segment, Artificial Kidneys are emerging as a dominant area of growth, fueled by the high prevalence of kidney diseases in the region and the significant burden on dialysis services. The increasing demand for advanced dialysis technologies and the long-term aspiration for artificial kidney replacements position this sub-segment for substantial market penetration. Cochlear Implants also represent a significant market, driven by advancements in audiology and a growing awareness of restorative hearing solutions for individuals with hearing loss, particularly among the pediatric and geriatric populations. The Bionics segment showcases particular strength in Orthopedic Bionics, owing to the increasing incidence of mobility-limiting conditions such as arthritis and fractures, coupled with a rising adoption of advanced prosthetic limbs and joint replacements offering enhanced mobility and functionality.

Key growth drivers for this dominance include:

- Robust Healthcare Infrastructure: The UAE boasts world-class healthcare facilities and a growing network of specialized clinics equipped to handle complex implant procedures.

- Government Initiatives & Investment: Proactive government policies promoting medical innovation and substantial investments in the healthcare sector are creating a conducive environment for the adoption of advanced bionic technologies. For example, initiatives aimed at reducing the burden of chronic diseases like diabetes, which is a precursor to kidney failure, indirectly support the demand for artificial kidney solutions.

- Increasing Disposable Income & Healthcare Awareness: A population with high disposable income and a growing awareness of the benefits of advanced medical interventions are more likely to opt for sophisticated bionic solutions.

- Technological Advancements: Continuous innovation in materials science, robotics, and AI is leading to more sophisticated and patient-friendly bionic devices.

The market dominance is further amplified by strategic partnerships between global manufacturers and local healthcare providers, facilitating wider accessibility and localized support for these advanced medical devices. The focus on improving quality of life and restoring functionality for patients is a central theme driving the demand and adoption across these dominant segments.

UAE Artificial Organs & Bionic Implants Market Product Analysis

Product innovations in the UAE Artificial Organs & Bionic Implants Market are primarily centered on enhancing biocompatibility, functionality, and longevity. The development of artificial organs like artificial hearts and kidneys is moving towards more integrated, bio-friendly materials and sophisticated control systems to mimic natural organ functions more closely. In the bionics sphere, advancements in orthopedic bionic limbs are focusing on intuitive control, sensory feedback, and lighter, more durable designs. Cochlear implants are benefiting from miniaturization and improved sound processing algorithms, offering a more natural hearing experience. The competitive advantage lies in the ability of these products to significantly improve patient outcomes, reduce reliance on continuous medical interventions, and restore a higher quality of life, making them increasingly sought after by healthcare providers and patients alike.

Key Drivers, Barriers & Challenges in UAE Artificial Organs & Bionic Implants Market

Key Drivers:

The UAE Artificial Organs & Bionic Implants Market is propelled by several key drivers. Technologically, advancements in AI-powered diagnostics and sophisticated implantable devices are enhancing efficacy. Economically, increasing per capita healthcare spending and a growing affluent population are driving demand for high-value medical treatments. Policy-driven factors, such as the UAE's vision for advanced healthcare and government support for medical innovation, are creating a favorable regulatory and investment climate. For instance, the emphasis on preventive healthcare and the management of chronic diseases indirectly boosts the need for organ replacement and bionic solutions.

Barriers & Challenges:

Significant challenges include high initial costs associated with advanced artificial organs and bionic implants, which can pose a barrier to widespread adoption, especially for certain patient segments. Regulatory hurdles, while ensuring quality, can also lead to extended approval timelines for new technologies. Supply chain complexities, particularly for specialized components and materials, can impact availability and lead times. Furthermore, the need for specialized surgical expertise and extensive post-operative rehabilitation presents logistical and economic challenges. Competitive pressures from established global players and the ongoing need for significant R&D investment to maintain a technological edge are also crucial considerations.

Growth Drivers in the UAE Artificial Organs & Bionic Implants Market Market

The growth drivers within the UAE Artificial Organs & Bionic Implants Market are multifaceted, encompassing technological, economic, and regulatory factors. Technologically, continuous innovation in areas such as regenerative medicine, advanced robotics, and AI-driven personalized implant design is creating more effective and less invasive solutions. Economically, the UAE's commitment to developing a world-class healthcare ecosystem, coupled with a growing emphasis on medical tourism, is attracting substantial investment and driving demand for cutting-edge medical devices. The increasing prevalence of lifestyle-related diseases, leading to organ failure and limb loss, further fuels the need for artificial organs and bionic prosthetics. Regulatory bodies are actively promoting the adoption of advanced medical technologies, streamlining approval processes for innovative products, and encouraging research and development through various incentives, thereby fostering a robust growth environment.

Challenges Impacting UAE Artificial Organs & Bionic Implants Market Growth

Several challenges impact the growth trajectory of the UAE Artificial Organs & Bionic Implants Market. The high cost of these sophisticated medical devices remains a primary barrier, potentially limiting accessibility for a broader patient demographic. Regulatory complexities, while ensuring safety and efficacy, can also lead to prolonged approval processes for new technologies and products entering the market. Supply chain vulnerabilities, including the availability of specialized components and the logistical intricacies of distributing advanced medical equipment, can affect market responsiveness. Furthermore, the need for highly specialized medical professionals for implantation and ongoing patient management, alongside the competitive pressure from established global manufacturers, presents ongoing challenges that require strategic mitigation efforts to ensure sustained market expansion.

Key Players Shaping the UAE Artificial Organs & Bionic Implants Market Market

- Edwards Lifesciences Corporation

- Abbott Laboratories (ST JUDE MEDICAL INC)

- Edrees Medical

- Boston Scientific Corporation

- Zimmer Biomet

- Medtronic plc

- Otto Bock Holding GmbH & Co KG

Significant UAE Artificial Organs & Bionic Implants Market Industry Milestones

- Mar 2022: The Dubai Health Authority launched an awareness campaign on World Kidney Day to encourage people to voluntarily register their organ donation decision and raise awareness about how organ donation can dramatically improve the health of patients with organ failure and, in some instances, save their lives.

- Jan 2022: The Abu Dhabi Health Services Company (Seha) implanted an Implantable Cardioverter Defibrillator (ICD) in a seven-year-old boy.

Future Outlook for UAE Artificial Organs & Bionic Implants Market Market

The future outlook for the UAE Artificial Organs & Bionic Implants Market is exceptionally promising, driven by a sustained commitment to innovation and patient well-being. Strategic opportunities lie in the continued development of personalized bionic solutions, integration of advanced AI for predictive diagnostics and treatment optimization, and the expansion of regenerative medicine approaches to complement or replace existing artificial organ technologies. The market is expected to witness increased adoption of advanced cardiac bionics, addressing the rising incidence of cardiovascular diseases, and further advancements in artificial kidney technologies aiming for greater autonomy and reduced patient burden. With ongoing government support, increasing private sector investment, and a growing demand for high-quality healthcare, the UAE is set to solidify its position as a leading hub for artificial organs and bionic implants in the region.

UAE Artificial Organs & Bionic Implants Market Segmentation

-

1. Product

-

1.1. Artificial Organs

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Others

-

1.2. Bionics

- 1.2.1. Vision Bionics

- 1.2.2. Ear Bionics

- 1.2.3. Orthopedic Bionic

- 1.2.4. Cardiac Bionics

-

1.1. Artificial Organs

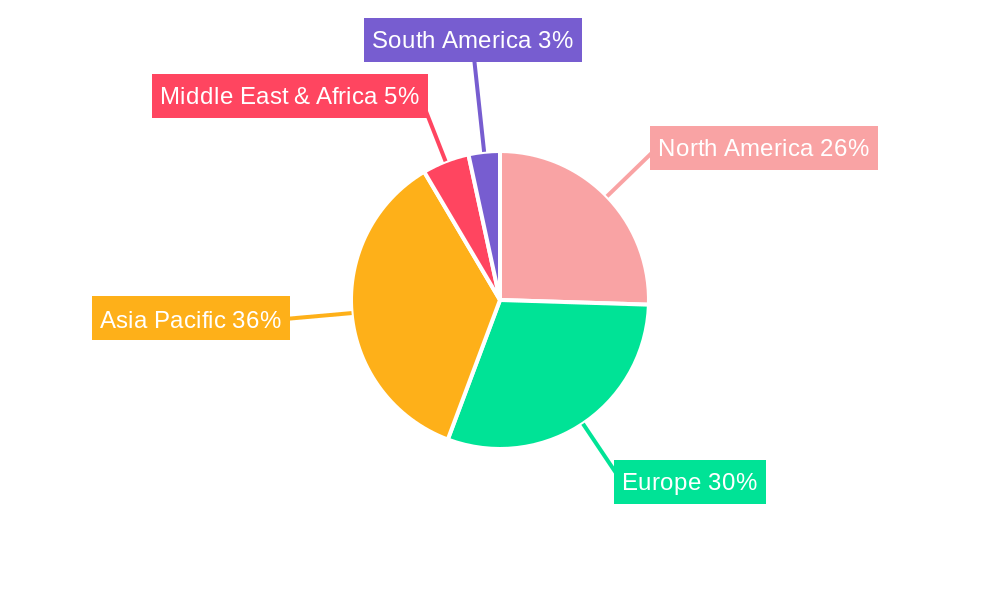

UAE Artificial Organs & Bionic Implants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Artificial Organs & Bionic Implants Market Regional Market Share

Geographic Coverage of UAE Artificial Organs & Bionic Implants Market

UAE Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Number of People Suffering from Organ Failures and Rising Incidents of Motor Accidents and Injuries; Rapid Technological Advancements in the Bionics Sector

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures Coupled with Fear of Malfunction or Failure of Device

- 3.4. Market Trends

- 3.4.1. Artificial Kidney Segment is Expected to Have a Highest Growth Rate in the UAE Artificial Organs and Bionic Implants Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Artificial Organs

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Others

- 5.1.2. Bionics

- 5.1.2.1. Vision Bionics

- 5.1.2.2. Ear Bionics

- 5.1.2.3. Orthopedic Bionic

- 5.1.2.4. Cardiac Bionics

- 5.1.1. Artificial Organs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America UAE Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Artificial Organs

- 6.1.1.1. Artificial Heart

- 6.1.1.2. Artificial Kidney

- 6.1.1.3. Cochlear Implants

- 6.1.1.4. Others

- 6.1.2. Bionics

- 6.1.2.1. Vision Bionics

- 6.1.2.2. Ear Bionics

- 6.1.2.3. Orthopedic Bionic

- 6.1.2.4. Cardiac Bionics

- 6.1.1. Artificial Organs

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America UAE Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Artificial Organs

- 7.1.1.1. Artificial Heart

- 7.1.1.2. Artificial Kidney

- 7.1.1.3. Cochlear Implants

- 7.1.1.4. Others

- 7.1.2. Bionics

- 7.1.2.1. Vision Bionics

- 7.1.2.2. Ear Bionics

- 7.1.2.3. Orthopedic Bionic

- 7.1.2.4. Cardiac Bionics

- 7.1.1. Artificial Organs

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe UAE Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Artificial Organs

- 8.1.1.1. Artificial Heart

- 8.1.1.2. Artificial Kidney

- 8.1.1.3. Cochlear Implants

- 8.1.1.4. Others

- 8.1.2. Bionics

- 8.1.2.1. Vision Bionics

- 8.1.2.2. Ear Bionics

- 8.1.2.3. Orthopedic Bionic

- 8.1.2.4. Cardiac Bionics

- 8.1.1. Artificial Organs

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa UAE Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Artificial Organs

- 9.1.1.1. Artificial Heart

- 9.1.1.2. Artificial Kidney

- 9.1.1.3. Cochlear Implants

- 9.1.1.4. Others

- 9.1.2. Bionics

- 9.1.2.1. Vision Bionics

- 9.1.2.2. Ear Bionics

- 9.1.2.3. Orthopedic Bionic

- 9.1.2.4. Cardiac Bionics

- 9.1.1. Artificial Organs

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific UAE Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Artificial Organs

- 10.1.1.1. Artificial Heart

- 10.1.1.2. Artificial Kidney

- 10.1.1.3. Cochlear Implants

- 10.1.1.4. Others

- 10.1.2. Bionics

- 10.1.2.1. Vision Bionics

- 10.1.2.2. Ear Bionics

- 10.1.2.3. Orthopedic Bionic

- 10.1.2.4. Cardiac Bionics

- 10.1.1. Artificial Organs

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Edwards Lifesciences Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abbott Laboratories (ST JUDE MEDICAL INC )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Edrees Medical*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Boston Scientific Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zimmer Biomet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medtronic plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Otto Bock Holding GmbH & Co KG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Edwards Lifesciences Corporation

List of Figures

- Figure 1: Global UAE Artificial Organs & Bionic Implants Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Product 2025 & 2033

- Figure 7: South America UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Product 2025 & 2033

- Figure 8: South America UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Product 2025 & 2033

- Figure 11: Europe UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Middle East & Africa UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Middle East & Africa UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Product 2025 & 2033

- Figure 19: Asia Pacific UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific UAE Artificial Organs & Bionic Implants Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UAE Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Product 2020 & 2033

- Table 9: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Product 2020 & 2033

- Table 25: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Product 2020 & 2033

- Table 33: Global UAE Artificial Organs & Bionic Implants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UAE Artificial Organs & Bionic Implants Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the UAE Artificial Organs & Bionic Implants Market?

Key companies in the market include Edwards Lifesciences Corporation, Abbott Laboratories (ST JUDE MEDICAL INC ), Edrees Medical*List Not Exhaustive, Boston Scientific Corporation, Zimmer Biomet, Medtronic plc, Otto Bock Holding GmbH & Co KG.

3. What are the main segments of the UAE Artificial Organs & Bionic Implants Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Number of People Suffering from Organ Failures and Rising Incidents of Motor Accidents and Injuries; Rapid Technological Advancements in the Bionics Sector.

6. What are the notable trends driving market growth?

Artificial Kidney Segment is Expected to Have a Highest Growth Rate in the UAE Artificial Organs and Bionic Implants Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Procedures Coupled with Fear of Malfunction or Failure of Device.

8. Can you provide examples of recent developments in the market?

Mar 2022: The Dubai Health Authority launched an awareness campaign on World Kidney Day to encourage people to voluntarily register their organ donation decision and raise awareness about how organ donation can dramatically improve the health of patients with organ failure and, in some instances, save their lives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the UAE Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence