Key Insights

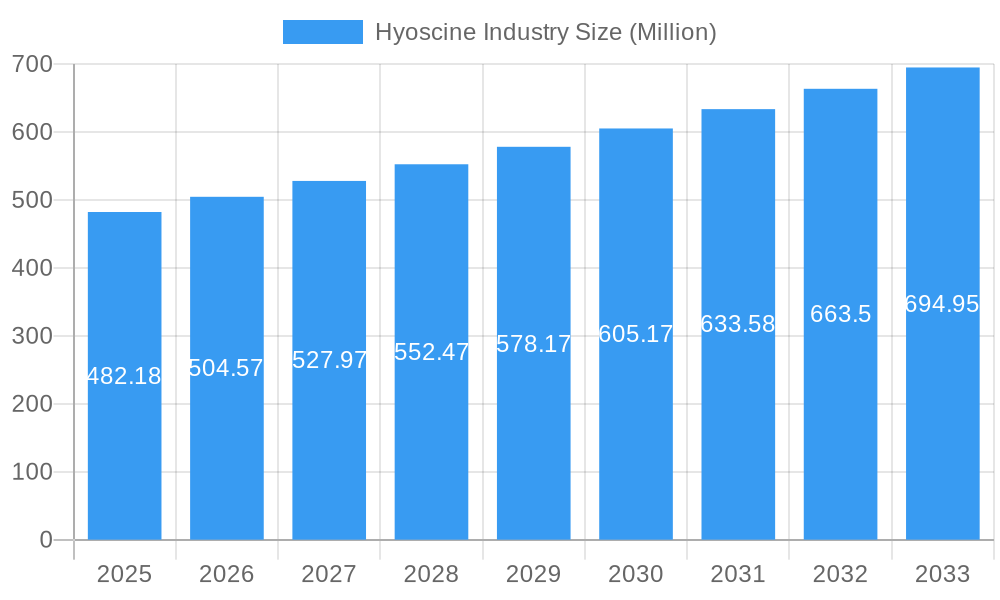

The global Hyoscine market is poised for steady expansion, with a market size of USD 482.18 million projected for 2025. This growth is underpinned by a CAGR of 4.7% over the forecast period of 2025-2033, indicating a sustained upward trajectory. A primary driver for this market's expansion is the increasing prevalence of gastrointestinal disorders, motion sickness, and irritable bowel syndrome, conditions that often necessitate the use of hyoscine-based medications for symptom relief. Furthermore, the growing demand for effective antispasmodic drugs, coupled with advancements in drug delivery systems, particularly patches and injections offering faster and more targeted relief, is contributing significantly to market penetration. The pharmaceutical industry's continuous investment in research and development to explore new therapeutic applications for hyoscine derivatives also presents a substantial growth opportunity. Key players are actively engaged in strategic collaborations and product launches to cater to the evolving needs of healthcare providers and patients, further propelling market dynamics.

Hyoscine Industry Market Size (In Million)

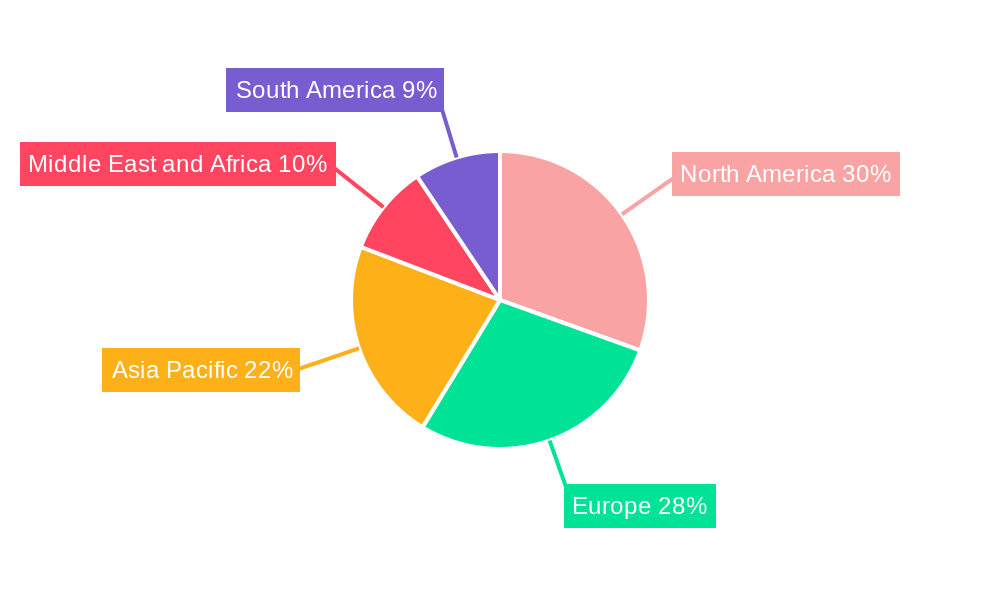

The market is characterized by diverse segments, with both Hyoscine Butylbromide and Hyoscine Hydrobromide holding significant shares, driven by their distinct therapeutic profiles. In terms of administration, while oral formulations remain prevalent, the increasing preference for rapid-acting and convenient delivery methods like patches and injections is a notable trend. Geographically, North America and Europe are expected to lead the market due to established healthcare infrastructures and high healthcare expenditure. However, the Asia Pacific region presents considerable growth potential, fueled by a rising patient pool, improving healthcare access, and increasing awareness of available treatment options. Restraints, such as stringent regulatory approvals for new drug formulations and the emergence of alternative treatments, are factors that market participants need to strategically navigate. Despite these challenges, the overall outlook for the hyoscine market remains positive, driven by its established efficacy and expanding applications in managing a range of debilitating conditions.

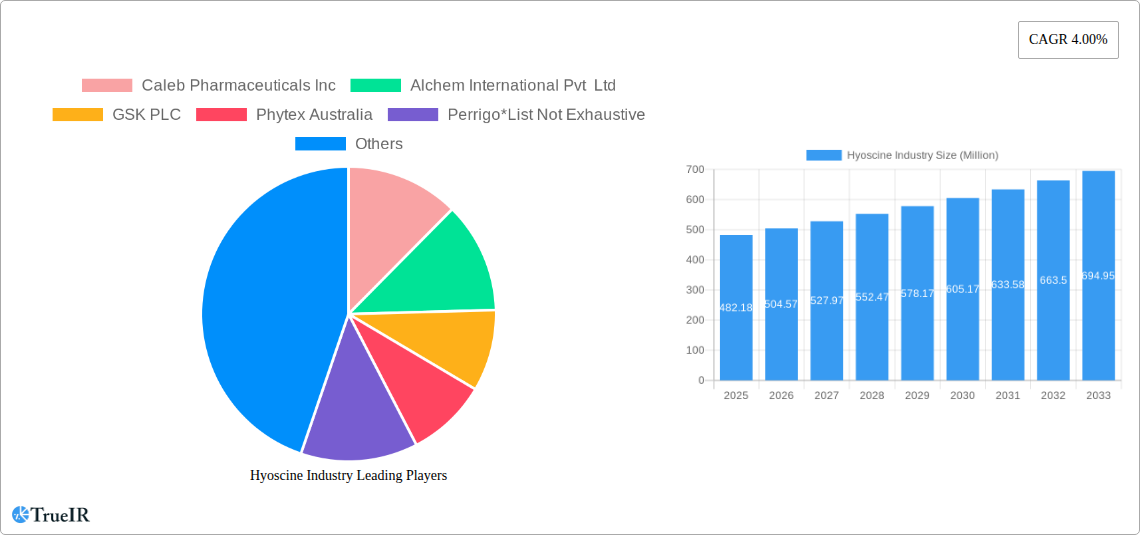

Hyoscine Industry Company Market Share

Unveiling the Hyoscine Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report delivers a dynamic and SEO-optimized analysis of the global Hyoscine industry, meticulously forecasting market trajectory from 2019 to 2033. Leveraging high-volume keywords and comprehensive data, this report provides unparalleled insights for stakeholders seeking to navigate the complexities of the hyoscine market. With a base year of 2025 and a forecast period spanning 2025–2033, this report delves into market structure, key trends, dominant segments, product innovations, critical drivers, significant challenges, and the pivotal players shaping this vital pharmaceutical sector. Expect an estimated market value of over one million dollars by 2025, with significant growth projected.

Hyoscine Industry Market Structure & Competitive Landscape

The Hyoscine industry exhibits a moderately concentrated market structure, characterized by a blend of large multinational pharmaceutical corporations and agile niche players. Innovation drivers are primarily fueled by advancements in drug delivery systems, increased research into hyoscine's therapeutic applications beyond its traditional uses in gastrointestinal and antispasmodic treatments, and a growing emphasis on cost-effectiveness in healthcare. Regulatory impacts are significant, with stringent approval processes for new formulations and a continuous need to adhere to pharmacopoeia standards. Product substitutes, while present in some applications like pain management, are generally less effective for specific antispasmodic indications. End-user segmentation is broad, encompassing hospitals, clinics, pharmacies, and research institutions. Merger and acquisition (M&A) trends in the historical period (2019-2024) indicate strategic consolidations aimed at expanding product portfolios, enhancing manufacturing capabilities, and securing market share, with an estimated volume of over ten M&A transactions annually.

- Market Concentration: Moderate, with key players holding substantial market share.

- Innovation Drivers: Novel drug delivery, expanded therapeutic research, cost optimization.

- Regulatory Landscape: Strict approval pathways, pharmacopoeia compliance.

- Product Substitutes: Limited for core antispasmodic applications.

- End-User Segmentation: Hospitals, clinics, pharmacies, research institutions.

- M&A Trends: Strategic consolidations for portfolio expansion and market access.

Hyoscine Industry Market Trends & Opportunities

The global Hyoscine industry is poised for robust growth, projected to expand significantly beyond its current valuation of several hundred million dollars to exceed one million dollars by the estimated year of 2025 and continue its upward trajectory through 2033. This growth is propelled by an increasing prevalence of gastrointestinal disorders, a growing awareness and adoption of antispasmodic medications for symptomatic relief, and the expanding application of hyoscine in managing motion sickness and surgical procedures. Technological shifts are evident in the development of more sophisticated drug delivery mechanisms, such as long-acting injections and transdermal patches, offering improved patient compliance and efficacy. Consumer preferences are leaning towards less invasive and more convenient administration routes, driving demand for patch and oral formulations. The competitive dynamics are intensifying, with established players focusing on product differentiation and market penetration, while emerging companies are exploring novel applications and emerging markets. The compound annual growth rate (CAGR) is estimated to be between 5% and 7% over the forecast period. Market penetration rates for hyoscine-based treatments are steadily increasing, particularly in developed economies, and are expected to see substantial gains in emerging markets due to improving healthcare infrastructure and increasing disposable incomes. The increasing global elderly population, prone to gastrointestinal issues, will further bolster demand. Furthermore, ongoing research into hyoscine's potential in areas like Parkinson's disease management and as an adjunct in palliative care is opening new avenues for market expansion. The strategic importance of hyoscine in essential medicine lists across numerous countries also underpins its consistent demand. The expansion of generic drug manufacturing capabilities in developing nations is also a key trend, leading to more accessible and affordable hyoscine treatments, thereby widening the market reach.

Dominant Markets & Segments in Hyoscine Industry

The Hyoscine industry is characterized by distinct regional dominance and segment preferences, with North America and Europe currently leading in market value and consumption. The United States, Germany, and the United Kingdom are at the forefront of hyoscine market adoption, driven by advanced healthcare systems, high disposable incomes, and a strong emphasis on patient comfort and efficient treatment of gastrointestinal ailments. Within the segments, Hyoscine Butylbromide is the dominant type, owing to its primary application as an antispasmodic for smooth muscle relaxation, widely prescribed for conditions like irritable bowel syndrome and renal colic. The oral mode of administration currently holds the largest market share due to its convenience and widespread availability, followed by injections, which are preferred for rapid and potent action in acute cases. However, the patches segment is witnessing a significant growth spurt, driven by the demand for sustained drug release and improved patient compliance, particularly for chronic conditions.

- Leading Regions: North America, Europe.

- Key Dominant Countries: United States, Germany, United Kingdom.

- Dominant Segment (Type): Hyoscine Butylbromide.

- Growth Drivers: Extensive use in treating common gastrointestinal disorders, effective antispasmodic properties.

- Dominant Segment (Mode of Administration): Oral.

- Growth Drivers: High convenience, broad accessibility, patient preference for non-invasive routes.

- Emerging Growth Segment (Mode of Administration): Patches.

- Growth Drivers: Sustained drug release, enhanced patient compliance, preference for long-term management.

Hyoscine Industry Product Analysis

Product innovation in the Hyoscine industry is focusing on enhancing efficacy, improving patient compliance, and expanding therapeutic applications. Advancements in formulation technologies, such as the development of novel extended-release oral dosage forms and advanced transdermal patch designs, are creating competitive advantages by offering more convenient and consistent drug delivery. These innovations aim to reduce the frequency of dosing and minimize side effects. Furthermore, research into combination therapies and novel indications for hyoscine, particularly in areas like pain management and as an adjunct in anesthesia, is expanding its market fit and strengthening its competitive positioning. The market is witnessing a trend towards higher purity grades of hyoscine for pharmaceutical use.

Key Drivers, Barriers & Challenges in Hyoscine Industry

The Hyoscine industry is propelled by several key drivers, including the rising global incidence of gastrointestinal disorders, an aging population prone to such conditions, and increasing healthcare expenditure in developing nations. Technological advancements in drug delivery systems, such as more efficient transdermal patches and improved oral formulations, are also significant growth catalysts. Regulatory support, evidenced by hyoscine’s inclusion in essential medicine lists, further underpins market stability.

However, the industry faces significant barriers and challenges. Stringent regulatory approval processes for new hyoscine-based products and formulations can delay market entry. Supply chain disruptions, particularly for raw materials, and price volatility can impact manufacturing costs and product availability. Intense competition from generic manufacturers and the availability of alternative treatments in certain therapeutic areas also pose challenges.

Growth Drivers in the Hyoscine Industry Market

The Hyoscine industry market is experiencing substantial growth driven by a confluence of factors. The escalating global burden of gastrointestinal disorders, coupled with a burgeoning elderly population, creates a consistent and growing demand for effective antispasmodic treatments. Advancements in pharmaceutical technology are yielding innovative drug delivery systems, such as enhanced transdermal patches and improved oral formulations, offering superior patient compliance and therapeutic outcomes. Furthermore, the inclusion of hyoscine butylbromide on national essential medicines lists in many countries provides a stable regulatory environment and predictable demand. Economic growth in emerging markets is also a significant driver, increasing healthcare access and affordability for hyoscine-based medications.

Challenges Impacting Hyoscine Industry Growth

Despite its growth trajectory, the Hyoscine industry confronts several critical challenges. The complex and time-consuming regulatory approval pathways for novel hyoscine formulations can significantly impede market penetration and product launches, leading to increased development costs. Vulnerabilities in the global supply chain for key raw materials and active pharmaceutical ingredients (APIs) can result in production delays and price fluctuations, impacting profitability. Intense competition from established generic manufacturers and the availability of alternative treatment options for certain indications, such as pain management, exert downward pressure on pricing and necessitate continuous innovation. Stringent quality control and adherence to pharmacopoeial standards add to manufacturing complexities and costs.

Key Players Shaping the Hyoscine Industry Market

- Caleb Pharmaceuticals Inc

- Alchem International Pvt Ltd

- GSK PLC

- Phytex Australia

- Perrigo Company plc

- Baxter International Inc

- MYUNGMOON PHARM CO LTD

Significant Hyoscine Industry Industry Milestones

- September 2022: Union Health and Family Welfare Minister of India, Dr. Mansukh Mandaviya, released the National List of Essential Medicines 2022, comprising 384 medicines, including hyoscine butylbromide, across 27 categories, underscoring its importance in public health.

- February 2022: Alex Ekwueme Federal University Teaching Hospital sponsored a clinical trial under the title "Metoclopramide Versus Hyoscine Butylbromide in Shortening Duration of First Stage of Labour," aiming to compare the effectiveness of metoclopramide versus hyoscine butyl bromide in shortening the duration of the first stage of labor in Abakaliki, potentially opening new therapeutic insights.

Future Outlook for Hyoscine Industry Market

The future outlook for the Hyoscine industry market is exceptionally promising, driven by sustained demand for effective gastrointestinal treatments and ongoing product innovation. Strategic opportunities lie in the expansion of hyoscine's application in managing chronic pain conditions and its potential role in palliative care. The increasing focus on patient-centric solutions will further fuel the demand for advanced drug delivery systems like transdermal patches and extended-release formulations. Emerging economies, with their growing healthcare infrastructure and increasing disposable incomes, represent significant untapped markets for hyoscine-based pharmaceuticals. Continued investment in research and development to explore novel therapeutic avenues for hyoscine will be crucial for long-term market growth and sustained competitive advantage. The market is projected to witness consistent growth, exceeding expectations and reaching a valuation of several million dollars in the coming years.

Hyoscine Industry Segmentation

-

1. Type

- 1.1. Hyoscine Butylbromide

- 1.2. Hyoscine Hydrobromide

-

2. Mode of Administration

- 2.1. Oral

- 2.2. Patches

- 2.3. Injections

Hyoscine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hyoscine Industry Regional Market Share

Geographic Coverage of Hyoscine Industry

Hyoscine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Consumer Awareness Towards Hyoscine; Increase in Travelling

- 3.3. Market Restrains

- 3.3.1. Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Oral Hyoscine is Expected to Hold a Significant Market Share in the Hyoscine Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hyoscine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hyoscine Butylbromide

- 5.1.2. Hyoscine Hydrobromide

- 5.2. Market Analysis, Insights and Forecast - by Mode of Administration

- 5.2.1. Oral

- 5.2.2. Patches

- 5.2.3. Injections

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hyoscine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hyoscine Butylbromide

- 6.1.2. Hyoscine Hydrobromide

- 6.2. Market Analysis, Insights and Forecast - by Mode of Administration

- 6.2.1. Oral

- 6.2.2. Patches

- 6.2.3. Injections

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Hyoscine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hyoscine Butylbromide

- 7.1.2. Hyoscine Hydrobromide

- 7.2. Market Analysis, Insights and Forecast - by Mode of Administration

- 7.2.1. Oral

- 7.2.2. Patches

- 7.2.3. Injections

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Hyoscine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hyoscine Butylbromide

- 8.1.2. Hyoscine Hydrobromide

- 8.2. Market Analysis, Insights and Forecast - by Mode of Administration

- 8.2.1. Oral

- 8.2.2. Patches

- 8.2.3. Injections

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Hyoscine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hyoscine Butylbromide

- 9.1.2. Hyoscine Hydrobromide

- 9.2. Market Analysis, Insights and Forecast - by Mode of Administration

- 9.2.1. Oral

- 9.2.2. Patches

- 9.2.3. Injections

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Hyoscine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hyoscine Butylbromide

- 10.1.2. Hyoscine Hydrobromide

- 10.2. Market Analysis, Insights and Forecast - by Mode of Administration

- 10.2.1. Oral

- 10.2.2. Patches

- 10.2.3. Injections

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caleb Pharmaceuticals Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alchem International Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GSK PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Phytex Australia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Perrigo*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baxter International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MYUNGMOON PHARM CO LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Caleb Pharmaceuticals Inc

List of Figures

- Figure 1: Global Hyoscine Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Hyoscine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Hyoscine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hyoscine Industry Revenue (undefined), by Mode of Administration 2025 & 2033

- Figure 5: North America Hyoscine Industry Revenue Share (%), by Mode of Administration 2025 & 2033

- Figure 6: North America Hyoscine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Hyoscine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hyoscine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Hyoscine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Hyoscine Industry Revenue (undefined), by Mode of Administration 2025 & 2033

- Figure 11: Europe Hyoscine Industry Revenue Share (%), by Mode of Administration 2025 & 2033

- Figure 12: Europe Hyoscine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Hyoscine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hyoscine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Hyoscine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Hyoscine Industry Revenue (undefined), by Mode of Administration 2025 & 2033

- Figure 17: Asia Pacific Hyoscine Industry Revenue Share (%), by Mode of Administration 2025 & 2033

- Figure 18: Asia Pacific Hyoscine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Hyoscine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Hyoscine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East and Africa Hyoscine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Hyoscine Industry Revenue (undefined), by Mode of Administration 2025 & 2033

- Figure 23: Middle East and Africa Hyoscine Industry Revenue Share (%), by Mode of Administration 2025 & 2033

- Figure 24: Middle East and Africa Hyoscine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Hyoscine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Hyoscine Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Hyoscine Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Hyoscine Industry Revenue (undefined), by Mode of Administration 2025 & 2033

- Figure 29: South America Hyoscine Industry Revenue Share (%), by Mode of Administration 2025 & 2033

- Figure 30: South America Hyoscine Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Hyoscine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hyoscine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Hyoscine Industry Revenue undefined Forecast, by Mode of Administration 2020 & 2033

- Table 3: Global Hyoscine Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Hyoscine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Hyoscine Industry Revenue undefined Forecast, by Mode of Administration 2020 & 2033

- Table 6: Global Hyoscine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Hyoscine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Hyoscine Industry Revenue undefined Forecast, by Mode of Administration 2020 & 2033

- Table 12: Global Hyoscine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Hyoscine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Hyoscine Industry Revenue undefined Forecast, by Mode of Administration 2020 & 2033

- Table 21: Global Hyoscine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Hyoscine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Hyoscine Industry Revenue undefined Forecast, by Mode of Administration 2020 & 2033

- Table 30: Global Hyoscine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Hyoscine Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Hyoscine Industry Revenue undefined Forecast, by Mode of Administration 2020 & 2033

- Table 36: Global Hyoscine Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Hyoscine Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hyoscine Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Hyoscine Industry?

Key companies in the market include Caleb Pharmaceuticals Inc, Alchem International Pvt Ltd, GSK PLC, Phytex Australia, Perrigo*List Not Exhaustive, Baxter International, MYUNGMOON PHARM CO LTD.

3. What are the main segments of the Hyoscine Industry?

The market segments include Type, Mode of Administration.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Consumer Awareness Towards Hyoscine; Increase in Travelling.

6. What are the notable trends driving market growth?

Oral Hyoscine is Expected to Hold a Significant Market Share in the Hyoscine Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Regulatory Framework.

8. Can you provide examples of recent developments in the market?

September 2022: Union Health and Family Welfare Minister of India, Dr. Mansukh Mandaviya, released the National List of Essential Medicines 2022, comprising 384 medicines, including hyoscine butylbromide, across 27 categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hyoscine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hyoscine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hyoscine Industry?

To stay informed about further developments, trends, and reports in the Hyoscine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence