Key Insights

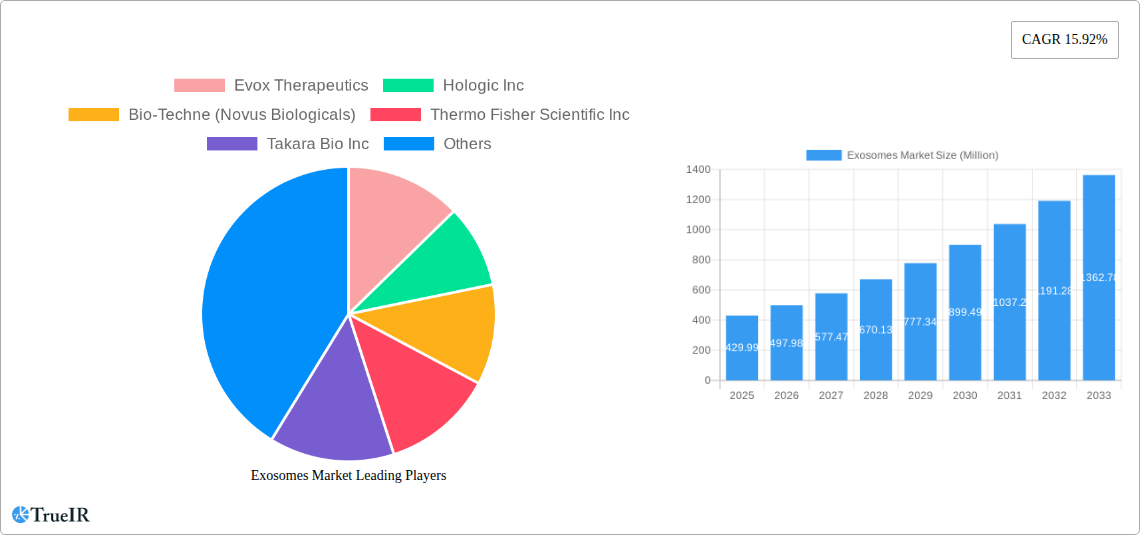

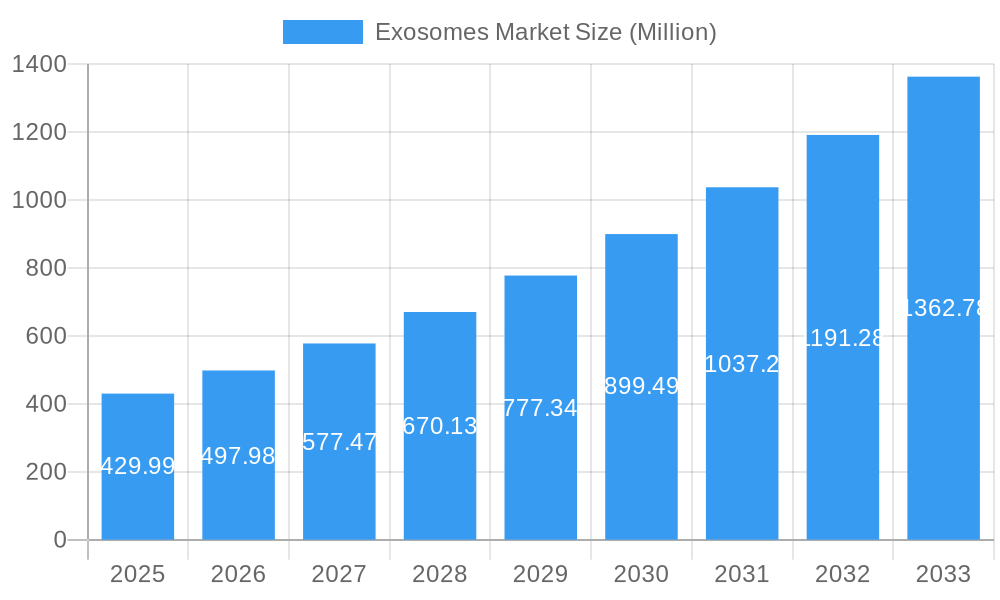

The global Exosomes Market is poised for substantial growth, projected to reach an estimated $429.99 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 15.92% during the forecast period of 2025-2033. This robust expansion is driven by the increasing recognition of exosomes as potent biomarkers for early disease detection and as versatile therapeutic delivery vehicles. Advances in exosome isolation and characterization technologies are further fueling market penetration, enabling more precise and reliable applications across diagnostics and therapeutics. The growing investment in exosome-based research and development by leading pharmaceutical and biotechnology companies, coupled with a rising prevalence of chronic diseases, underscores the significant potential of this market. Key players are actively engaged in strategic collaborations and product development to capitalize on these emerging opportunities.

Exosomes Market Market Size (In Million)

The market's trajectory is shaped by key trends including the development of standardized exosome isolation protocols and the exploration of novel applications in areas like regenerative medicine and oncology. The increasing demand for personalized medicine and the ability of exosomes to efficiently deliver therapeutic payloads to target sites are significant growth catalysts. While the market presents a promising outlook, challenges such as the complexity of exosome purification and the need for regulatory clarity for exosome-based therapies could influence the pace of adoption in certain segments. Nevertheless, the inherent therapeutic and diagnostic capabilities of exosomes, supported by ongoing technological innovations and increasing clinical validation, are expected to overcome these hurdles, solidifying their position as a transformative force in healthcare.

Exosomes Market Company Market Share

This comprehensive Exosomes Market report delves into the burgeoning field of extracellular vesicles, offering a detailed analysis of market dynamics, technological advancements, and strategic opportunities. Driven by the immense potential of exosomes as diagnostic biomarkers and therapeutic delivery vehicles, the global exosomes market is poised for exponential growth. This report leverages high-volume keywords such as "exosome therapeutics," "exosome diagnostics," "extracellular vesicles," "biomarker discovery," and "drug delivery systems" to provide actionable insights for stakeholders. The study encompasses a detailed examination of the exosomes market from 2019 to 2033, with a base year of 2025 and a robust forecast period of 2025–2033.

Exosomes Market Market Structure & Competitive Landscape

The global exosomes market exhibits a moderately fragmented structure, with a blend of established biotechnology giants and innovative startups vying for market share. Key innovation drivers include the ongoing research into exosome biogenesis, cargo analysis, and targeted delivery mechanisms. Regulatory bodies are progressively developing frameworks for exosome-based therapeutics and diagnostics, influencing market entry and product development. The threat of product substitutes is relatively low given the unique biological properties of exosomes, but competition intensifies through advancements in isolation techniques and therapeutic applications. End-user segmentation primarily comprises research institutions, pharmaceutical and biotechnology companies, and hospitals. Mergers and acquisitions (M&A) are emerging as a significant trend, as larger players seek to acquire specialized exosome technologies and expand their product portfolios. For instance, the acquisition of an exosome manufacturing facility by Lonza in November 2021 highlights the strategic consolidation occurring within the industry. The market concentration is influenced by the patent landscape and the increasing investment in exosome-related R&D, creating a dynamic competitive environment.

Exosomes Market Market Trends & Opportunities

The exosomes market is experiencing a significant upward trajectory, driven by a convergence of groundbreaking research, technological innovation, and expanding therapeutic applications. The market size is projected to witness substantial growth, fueled by an increasing understanding of exosomes' roles in intercellular communication and disease pathogenesis. Technological shifts are centered around more efficient and scalable exosome isolation, characterization, and therapeutic formulation techniques. Advancements in microfluidics, ultracentrifugation, and precipitation methods are improving the purity and yield of exosomes, making them more viable for clinical translation. Consumer preferences, particularly in the diagnostics sector, are leaning towards non-invasive liquid biopsy methods, where exosomes play a crucial role as biomarkers for early disease detection and monitoring. The competitive dynamics are characterized by intense R&D efforts focused on developing exosome-based drugs for oncology, neurodegenerative diseases, and regenerative medicine. The market penetration rate for exosome-based therapies is still nascent but growing rapidly, offering immense opportunities for early movers. The projected Compound Annual Growth Rate (CAGR) for the exosomes market is robust, underscoring its potential as a transformative area within the biotechnology and pharmaceutical industries. This growth is further augmented by the increasing prevalence of chronic diseases and the continuous demand for novel treatment modalities.

Dominant Markets & Segments in Exosomes Market

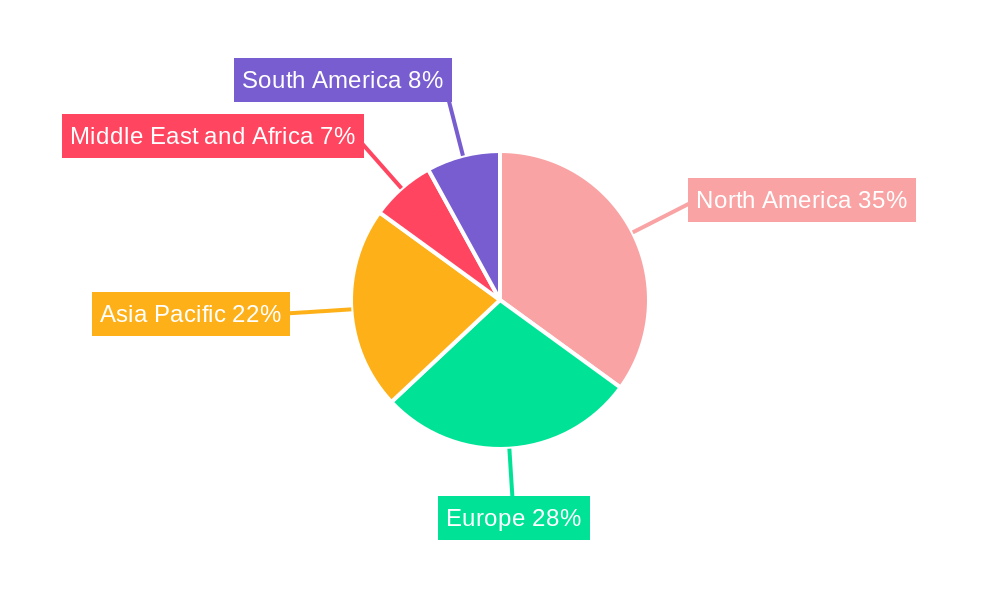

Within the exosomes market, the Therapeutics application segment is emerging as a dominant force, propelled by extensive research and clinical trials investigating exosome-based treatments for a wide range of diseases, particularly cancer and neurological disorders. The Kits and Reagents product segment also holds a significant share, catering to the extensive research and development activities across academic and commercial laboratories focused on exosome isolation, characterization, and analysis. North America, particularly the United States, stands out as the leading region in the exosomes market. This dominance is attributed to robust government funding for life sciences research, a high concentration of leading pharmaceutical and biotechnology companies, and a well-established ecosystem for clinical trials and drug development. Favorable regulatory pathways and a strong emphasis on innovation further bolster its leading position. Key growth drivers in this region include:

- Advanced Research Infrastructure: Presence of world-class research institutions and universities actively engaged in exosome research.

- Significant Investment: Substantial venture capital and government funding allocated to exosome-based R&D.

- Regulatory Support: Evolving regulatory frameworks that facilitate the development and approval of exosome-based products.

Asia Pacific is also a rapidly growing market, driven by increasing healthcare expenditure, a rising focus on biomarker discovery, and a growing number of research initiatives in countries like China and Japan. The Diagnostics application segment is also witnessing considerable growth, with exosome-derived biomarkers showing promise for early detection and prognosis of diseases. The Instruments segment, essential for exosome research and production, is expected to grow in tandem with the expansion of the overall market.

Exosomes Market Product Analysis

Exosome products are rapidly evolving, with innovations focused on enhancing isolation efficiency, purity, and scalability. Kits and reagents, including isolation kits utilizing precipitation or affinity-based methods, are crucial for researchers. Advanced instruments, such as flow cytometers and nanoparticle tracking analysis (NTA) systems, are essential for exosome characterization. The "Other Products" category encompasses engineered exosomes for targeted drug delivery, diagnostic assay components, and exosome-based vaccines, showcasing the diverse applications and competitive advantages emerging from technological advancements.

Key Drivers, Barriers & Challenges in Exosomes Market

Key Drivers:

- Therapeutic Potential: Exosomes' inherent biocompatibility and ability to deliver therapeutic payloads to specific cells drive their use in drug development.

- Biomarker Discovery: Their role in disease signaling makes them invaluable for non-invasive diagnostics and prognosis.

- Technological Advancements: Improved isolation and characterization techniques enhance their clinical viability.

- Growing Investment: Increased funding from both public and private sectors fuels research and development.

Barriers & Challenges:

- Standardization: Lack of standardized protocols for exosome isolation and characterization hinders reproducibility.

- Regulatory Hurdles: Navigating complex regulatory pathways for exosome-based therapies and diagnostics remains a challenge.

- Scalability: Efficient and cost-effective large-scale production for therapeutic applications is still developing.

- Understanding Biology: Further research is needed to fully elucidate exosome mechanisms and optimize their therapeutic efficacy.

Growth Drivers in the Exosomes Market Market

The exosomes market is experiencing significant growth driven by several key factors. Technological advancements in exosome isolation and characterization techniques, such as advanced ultracentrifugation and microfluidic devices, are making exosomes more accessible and reproducible for research and clinical applications. The inherent therapeutic potential of exosomes as natural drug delivery systems, coupled with their ability to cross biological barriers, is attracting substantial investment in exosome therapeutics, particularly for oncology and regenerative medicine. Furthermore, the growing recognition of exosomes as potent biomarkers for early disease detection and monitoring through liquid biopsies is fueling the demand for exosome diagnostics. Increased funding from government agencies and venture capital firms, alongside a growing number of academic research collaborations, further accelerates innovation and market expansion.

Challenges Impacting Exosomes Market Growth

Despite the promising outlook, the exosomes market faces several challenges. The lack of universally standardized protocols for exosome isolation, purification, and characterization remains a significant hurdle, impacting the reproducibility and comparability of research findings. Regulatory complexities surrounding the approval of exosome-based therapies and diagnostic tools pose another substantial restraint, requiring extensive clinical validation and adherence to stringent guidelines. Supply chain issues related to the consistent and scalable production of high-quality exosomes for therapeutic purposes are also a concern. Competitive pressures from established cell-based therapies and traditional diagnostic methods necessitate continuous innovation and demonstration of superior efficacy and cost-effectiveness.

Key Players Shaping the Exosomes Market Market

- Evox Therapeutics

- Hologic Inc

- Bio-Techne (Novus Biologicals)

- Thermo Fisher Scientific Inc

- Takara Bio Inc

- Abcam PLC

- Malvern Instruments Ltd

- Miltenyi Biotec

- JSR Corporation (MBL International)

- Lonza Group Ltd

- Qiagen

- Capricor Therapeutics Inc

- Illumina Inc

- Danaher Corporation (Beckman Coulter Inc)

- Fujifilm Holdings Corporation

Significant Exosomes Market Industry Milestones

- July 2022: Cells for Cells announced a 6-month follow-up of groundbreaking clinical data from the first patient dosed with an exosome-produced therapy for osteoarthritis, underscoring advancements in exosome therapeutics for chronic diseases.

- April 2022: Global Stem Cells Group (GSCG) launched its new product line featuring innovative lyophilized exosome technology for cell regeneration and anti-aging, highlighting advancements in exosome product formulation and application.

- November 2021: Lonza acquired an exosome manufacturing facility from Codiak BioSciences, signaling strategic consolidation and expansion in exosome manufacturing capabilities to support clinical-stage biopharmaceutical companies.

Future Outlook for Exosomes Market Market

The exosomes market is poised for remarkable growth, driven by ongoing breakthroughs in understanding exosome biology and their multifaceted applications. Strategic opportunities lie in the development of standardized isolation and characterization platforms, the acceleration of clinical trials for exosome-based therapeutics across diverse disease indications, and the expansion of exosome-based diagnostic solutions for early disease detection. The increasing demand for targeted drug delivery systems and personalized medicine further fuels market potential. Continued investment in R&D, coupled with supportive regulatory frameworks, will be crucial in unlocking the full therapeutic and diagnostic promise of exosomes, transforming healthcare paradigms.

Exosomes Market Segmentation

-

1. Product

- 1.1. Kits and Reagents

- 1.2. Instruments

- 1.3. Other Products

-

2. Application

- 2.1. Diagnostics

- 2.2. Therapeutics

Exosomes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Exosomes Market Regional Market Share

Geographic Coverage of Exosomes Market

Exosomes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer; Technological Advancements in Exosome Isolation and Analytical Procedures; Increasing Advanced Applications of Exosomes

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Requirements for Approval and Commercialization of Exosome Products; Technical Difficulties with the Implementation and Usage of Exosomes

- 3.4. Market Trends

- 3.4.1. The Therapeutic Application Segment is Expected to Hold the Largest Market Share in the Exosomes Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Exosomes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Kits and Reagents

- 5.1.2. Instruments

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diagnostics

- 5.2.2. Therapeutics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Exosomes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Kits and Reagents

- 6.1.2. Instruments

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diagnostics

- 6.2.2. Therapeutics

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Exosomes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Kits and Reagents

- 7.1.2. Instruments

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diagnostics

- 7.2.2. Therapeutics

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Exosomes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Kits and Reagents

- 8.1.2. Instruments

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diagnostics

- 8.2.2. Therapeutics

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Exosomes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Kits and Reagents

- 9.1.2. Instruments

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diagnostics

- 9.2.2. Therapeutics

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Exosomes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Kits and Reagents

- 10.1.2. Instruments

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diagnostics

- 10.2.2. Therapeutics

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Evox Therapeutics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hologic Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Techne (Novus Biologicals)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Takara Bio Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abcam PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Malvern Instruments Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Miltenyi Biotec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 JSR Corporation (MBL International)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lonza Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Qiagen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Capricor Therapeutics Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Illumina Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Danaher Corporation (Beckman Coulter Inc )

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Fujifilm Holdings Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Evox Therapeutics

List of Figures

- Figure 1: Global Exosomes Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Exosomes Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Exosomes Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Exosomes Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Exosomes Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Exosomes Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Exosomes Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Exosomes Market Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Exosomes Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Exosomes Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Exosomes Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Exosomes Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Exosomes Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Exosomes Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Pacific Exosomes Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Exosomes Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Exosomes Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Exosomes Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Exosomes Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Exosomes Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East and Africa Exosomes Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Exosomes Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Exosomes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Exosomes Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Exosomes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Exosomes Market Revenue (Million), by Product 2025 & 2033

- Figure 27: South America Exosomes Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Exosomes Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Exosomes Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Exosomes Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Exosomes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Exosomes Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Exosomes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Exosomes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Exosomes Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Exosomes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Exosomes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Exosomes Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Exosomes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Exosomes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Exosomes Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Exosomes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Exosomes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Exosomes Market Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Exosomes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Exosomes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Exosomes Market Revenue Million Forecast, by Product 2020 & 2033

- Table 35: Global Exosomes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Exosomes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Exosomes Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Exosomes Market?

The projected CAGR is approximately 15.92%.

2. Which companies are prominent players in the Exosomes Market?

Key companies in the market include Evox Therapeutics, Hologic Inc, Bio-Techne (Novus Biologicals), Thermo Fisher Scientific Inc, Takara Bio Inc, Abcam PLC, Malvern Instruments Ltd, Miltenyi Biotec, JSR Corporation (MBL International), Lonza Group Ltd, Qiagen, Capricor Therapeutics Inc, Illumina Inc, Danaher Corporation (Beckman Coulter Inc ), Fujifilm Holdings Corporation.

3. What are the main segments of the Exosomes Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 429.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer; Technological Advancements in Exosome Isolation and Analytical Procedures; Increasing Advanced Applications of Exosomes.

6. What are the notable trends driving market growth?

The Therapeutic Application Segment is Expected to Hold the Largest Market Share in the Exosomes Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Requirements for Approval and Commercialization of Exosome Products; Technical Difficulties with the Implementation and Usage of Exosomes.

8. Can you provide examples of recent developments in the market?

July 2022: Cells for Cells, a clinical-stage biotech pioneering allogeneic stem cell and stem-cell-derived therapeutics for high-impact chronic diseases, announced a 6-month follow-up of the groundbreaking clinical data from the first-ever patient dosed with an exosome-produced therapy for osteoarthritis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Exosomes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Exosomes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Exosomes Market?

To stay informed about further developments, trends, and reports in the Exosomes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence