Key Insights

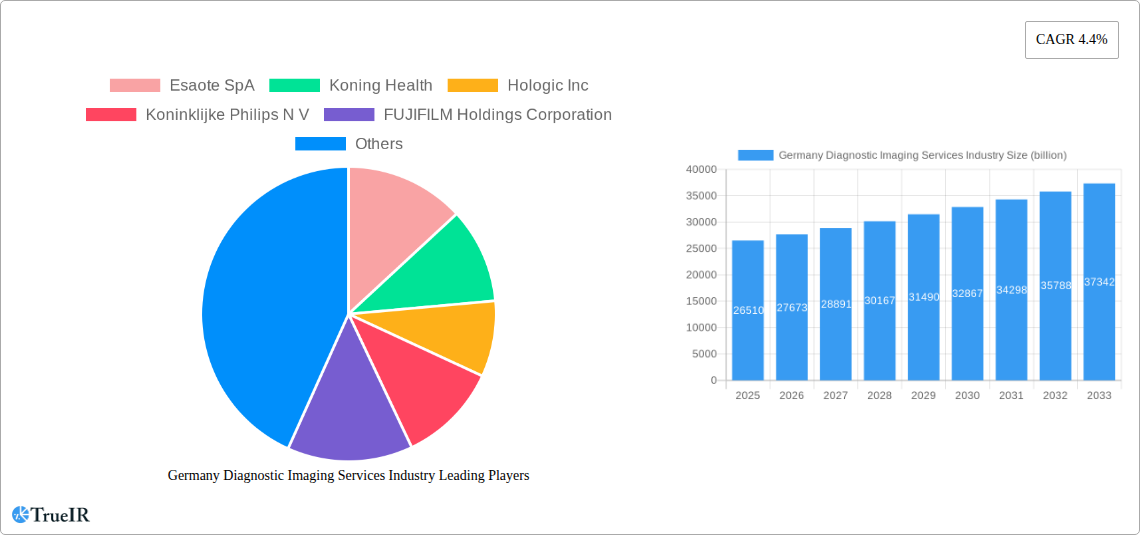

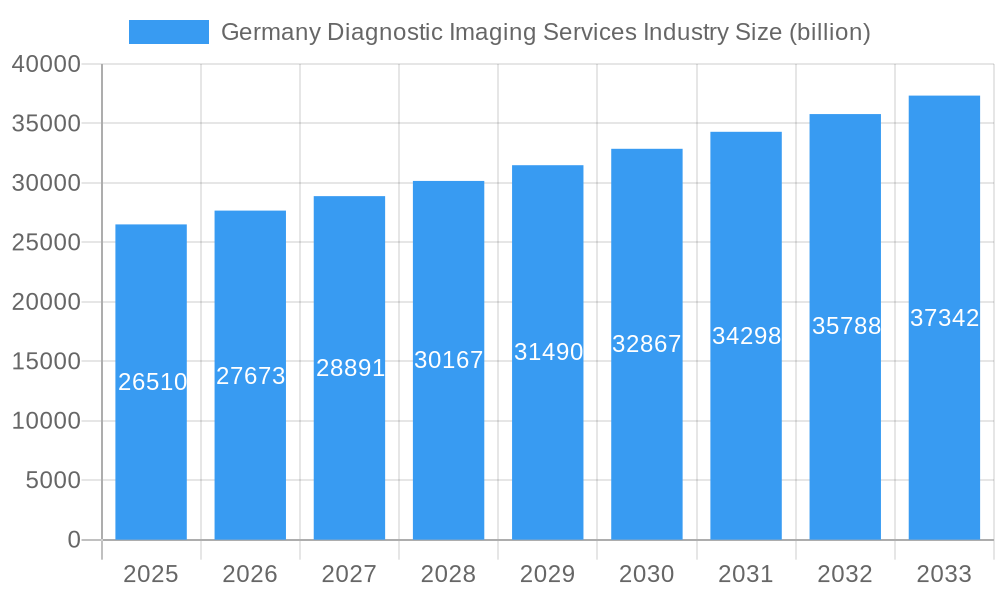

The German Diagnostic Imaging Services Industry is poised for significant expansion, with a current market size estimated at €26.51 billion in 2025. The industry is projected to experience a healthy Compound Annual Growth Rate (CAGR) of 4.4% from 2025 to 2033, indicating sustained and robust growth. This upward trajectory is primarily fueled by an increasing prevalence of chronic diseases such as cardiovascular conditions and cancer, necessitating advanced diagnostic imaging for early detection and effective treatment planning. Furthermore, the aging population in Germany is contributing to a higher demand for medical imaging services, as age-related ailments often require detailed diagnostic evaluations. Technological advancements, including the integration of Artificial Intelligence (AI) in image analysis and the development of more sophisticated imaging modalities like advanced MRI and CT scanners, are also key drivers, enhancing diagnostic accuracy and patient outcomes. The growing adoption of these cutting-edge technologies by healthcare providers is critical for maintaining competitiveness and meeting the evolving needs of the patient population.

Germany Diagnostic Imaging Services Industry Market Size (In Billion)

The market landscape is characterized by a diversified range of modalities, including MRI, Computed Tomography, Ultrasound, and X-Ray, each catering to specific diagnostic needs across various applications like Cardiology, Oncology, and Neurology. Hospitals and specialized diagnostic centers represent the primary end-users, investing in state-of-the-art imaging equipment and services. While the market benefits from strong demand and technological innovation, it also faces certain restraints. The high capital expenditure required for advanced imaging equipment, coupled with stringent regulatory frameworks governing medical device approvals and data privacy, can pose challenges to market entry and expansion for some players. However, the consistent investment in healthcare infrastructure and the strong emphasis on preventative care within Germany are expected to mitigate these restraints, ensuring continued market development and an increasing reliance on advanced diagnostic imaging services to uphold high healthcare standards.

Germany Diagnostic Imaging Services Industry Company Market Share

This comprehensive report delves into the dynamic Germany Diagnostic Imaging Services Industry, offering an in-depth analysis of market structure, key trends, dominant segments, product innovations, driving forces, and future outlook. Spanning the historical period of 2019-2024 and projecting growth through 2033 with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand the multi-billion euro landscape of diagnostic imaging in Germany.

Germany Diagnostic Imaging Services Industry Market Structure & Competitive Landscape

The Germany Diagnostic Imaging Services Industry is characterized by a moderately concentrated market structure, with a significant presence of both global conglomerates and specialized domestic players. The market's competitiveness is driven by continuous innovation, with companies investing heavily in research and development to introduce advanced imaging technologies that enhance diagnostic accuracy and patient outcomes. Regulatory frameworks, while ensuring quality and safety, also present a significant influence on market entry and product approvals. The increasing demand for minimally invasive diagnostic procedures and the growing prevalence of chronic diseases contribute to the sustained growth of this sector. Product substitutes, such as alternative diagnostic methods, exist but are often complemented rather than replaced by advanced imaging techniques. The end-user segmentation, with hospitals dominating the market share, followed by dedicated diagnostic centers, dictates strategic approaches for market players. Mergers and acquisitions (M&A) play a crucial role in shaping the competitive landscape, enabling companies to expand their product portfolios, geographical reach, and technological capabilities. The volume of M&A activities in the last five years indicates a trend towards consolidation and strategic partnerships to leverage economies of scale and drive synergistic growth, contributing to a total market value estimated to be in the billions. Key players are actively pursuing these strategies to maintain and enhance their market positions in this evolving industry.

Germany Diagnostic Imaging Services Industry Market Trends & Opportunities

The Germany Diagnostic Imaging Services Industry is poised for significant expansion, with market size growth projected to be robust throughout the forecast period. This growth is fueled by an aging population, a rising incidence of lifestyle-related diseases such as cardiovascular conditions and cancer, and an increasing awareness among the populace about the benefits of early disease detection. Technological advancements are at the forefront of market trends. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into imaging platforms is revolutionizing diagnostic capabilities, enabling faster and more accurate interpretation of medical images, and paving the way for personalized medicine. The shift towards non-invasive and minimally invasive diagnostic techniques further boosts the demand for advanced imaging modalities like MRI and CT scans.

Consumer preferences are increasingly leaning towards patient-centric care, emphasizing comfort, reduced scan times, and improved image quality. This has led to the development of advanced ultrasound systems, such as GE Healthcare's Voluson Expert 22, which offers enhanced imaging capabilities crucial for applications like prenatal diagnosis. Furthermore, the development of specialized imaging solutions, like Neoscan Solutions' MRI scanner for babies, caters to niche markets with specific needs, highlighting a growing trend of tailored product development.

The competitive dynamics within the German market are characterized by intense innovation and strategic collaborations. Companies are focused on developing integrated solutions that offer comprehensive diagnostic pathways, from imaging to treatment planning. The increasing adoption of Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHR) facilitates seamless data management and improved workflow efficiency, presenting a significant opportunity for market players offering integrated IT solutions alongside imaging hardware. The rising healthcare expenditure in Germany, coupled with favorable government initiatives promoting advanced medical technologies, further amplifies the growth prospects for the diagnostic imaging services industry. The market penetration rate for advanced imaging techniques is expected to increase substantially as healthcare providers invest in upgrading their infrastructure to meet the growing demand for high-quality diagnostic services. The total market valuation is anticipated to reach billions in the coming years, driven by these multifaceted trends and opportunities.

Dominant Markets & Segments in Germany Diagnostic Imaging Services Industry

The Germany Diagnostic Imaging Services Industry exhibits a clear dominance across specific modalities, applications, and end-user segments. In terms of Modality, Computed Tomography (CT) and Magnetic Resonance Imaging (MRI) represent the largest market shares, driven by their versatility in diagnosing a wide range of conditions. The demand for CT is propelled by its speed and efficacy in emergency care and trauma imaging, while MRI's superior soft tissue contrast makes it indispensable for neurological and musculoskeletal assessments. Ultrasound also holds a substantial and growing market share, particularly in obstetrics, gynecology, and cardiology, owing to its non-invasive nature and real-time imaging capabilities. X-Ray remains a foundational modality, especially for orthopedic and general radiography, though its growth is outpaced by more advanced technologies. The "Other Modalities" segment, encompassing PET, SPECT, and mammography, also contributes significantly, driven by specific diagnostic needs in areas like oncology and breast cancer screening.

The Application landscape is heavily influenced by the prevalence of chronic diseases. Cardiology and Oncology are the dominant application areas, accounting for a substantial portion of the market. The increasing incidence of cardiovascular diseases and the advancements in cancer detection and treatment necessitate sophisticated imaging techniques for diagnosis, staging, and monitoring. Neurology follows closely, driven by the rising diagnosis of neurodegenerative diseases and stroke. Orthopedics also represents a significant segment, with imaging playing a vital role in diagnosing fractures, joint disorders, and sports injuries.

Regarding End-User, Hospitals are the largest consumers of diagnostic imaging services and equipment in Germany, reflecting their comprehensive healthcare offerings and the high volume of patient throughput. Diagnostic Centers are the second-largest segment, specializing in providing outpatient imaging services, often with a focus on specific modalities or applications. The "Others" segment, which includes clinics, private practices, and research institutions, also contributes to the market's overall value, albeit to a lesser extent.

Key growth drivers for dominance in these segments include:

- Infrastructure Investment: Government and private sector investment in upgrading hospital infrastructure and establishing new diagnostic facilities.

- Technological Advancements: Continuous innovation in imaging hardware and software, leading to improved diagnostic accuracy and efficiency.

- Healthcare Policies: Favorable reimbursement policies and government initiatives promoting early diagnosis and preventive healthcare.

- Aging Population: An increasing elderly demographic with a higher prevalence of age-related diseases, thus driving demand for diagnostic imaging.

- Rising Healthcare Expenditure: Growing overall healthcare spending in Germany allows for greater investment in advanced medical technologies.

The market for MRI and CT is estimated to be in the billions, with cardiology and oncology applications contributing significantly to this valuation. The continuous demand from hospitals for advanced diagnostic solutions ensures their sustained dominance.

Germany Diagnostic Imaging Services Industry Product Analysis

The Germany Diagnostic Imaging Services Industry is witnessing an influx of technologically advanced products that redefine diagnostic capabilities. Innovations focus on enhancing image resolution, reducing scan times, improving patient comfort, and integrating AI for smarter diagnostics. For instance, GE Healthcare's Voluson Expert 22 exemplifies advancements in ultrasound technology, utilizing graphics-based beamforming for superior image clarity in sensitive applications like prenatal diagnosis. Similarly, Neoscan Solutions' specialized MRI scanner for infants showcases a commitment to patient-centric design, offering a more comfortable and accessible imaging experience for vulnerable populations. These product developments highlight a competitive advantage derived from technological superiority, catering to specific clinical needs and driving adoption across hospitals and diagnostic centers, contributing to a multi-billion euro market.

Key Drivers, Barriers & Challenges in Germany Diagnostic Imaging Services Industry

Key Drivers, Barriers & Challenges in Germany Diagnostic Imaging Services Industry

Key Drivers:

- Technological Advancements: Continuous innovation in imaging hardware and software, including AI integration for enhanced diagnostic accuracy and efficiency, is a primary growth catalyst.

- Aging Population & Chronic Disease Prevalence: The demographic shift towards an older population and the rising incidence of chronic diseases like cancer and cardiovascular conditions necessitate advanced diagnostic imaging.

- Increasing Healthcare Expenditure: Growing investments in healthcare infrastructure and medical technologies, supported by government initiatives, fuel market expansion.

- Focus on Preventive Healthcare: A greater emphasis on early disease detection and screening programs drives the demand for diagnostic imaging services.

Key Barriers & Challenges:

- High Equipment Costs & Maintenance: The substantial capital investment required for advanced imaging equipment and ongoing maintenance expenses pose a significant financial barrier for smaller facilities.

- Regulatory Hurdles: Stringent regulatory approval processes for new medical devices and imaging technologies can lead to lengthy market entry timelines.

- Skilled Workforce Shortage: A demand for highly trained radiologists, radiographers, and technicians to operate and interpret sophisticated imaging equipment can create workforce challenges.

- Reimbursement Policies: While generally favorable, changes or inconsistencies in reimbursement policies for specific diagnostic procedures can impact revenue streams for service providers.

- Data Security & Privacy Concerns: The increasing digitization of medical data raises concerns regarding cybersecurity and patient data privacy, requiring robust protective measures.

Growth Drivers in the Germany Diagnostic Imaging Services Industry Market

The growth of the Germany Diagnostic Imaging Services Industry is primarily propelled by rapid technological innovation, including the integration of Artificial Intelligence (AI) and machine learning into imaging devices, leading to enhanced diagnostic accuracy and workflow efficiencies. The increasing prevalence of chronic diseases such as cancer and cardiovascular ailments, coupled with an aging demographic, creates a sustained demand for advanced diagnostic solutions. Favorable government policies promoting healthcare infrastructure development and the adoption of cutting-edge medical technologies also play a crucial role. Economic factors, such as rising healthcare expenditure and disposable incomes, further empower healthcare providers and patients to invest in sophisticated imaging services, driving the multi-billion euro market forward.

Challenges Impacting Germany Diagnostic Imaging Services Industry Growth

Challenges impacting the Germany Diagnostic Imaging Services Industry primarily stem from the substantial capital investment required for advanced imaging equipment, leading to high operational costs. Stringent regulatory approvals for new medical technologies can slow down market penetration. Furthermore, a persistent shortage of skilled professionals, including radiologists and specialized technicians, can limit the capacity and efficiency of service delivery. Intense competition among established players and emerging innovators also exerts pressure on pricing and market share, while evolving reimbursement policies can create financial uncertainties for healthcare providers, potentially hindering growth in this multi-billion euro sector.

Key Players Shaping the Germany Diagnostic Imaging Services Industry Market

- Esaote SpA

- Koning Health

- Hologic Inc

- Koninklijke Philips N V

- FUJIFILM Holdings Corporation

- Siemens Healthineers AG

- General Electric Company (GE Healthcare)

- Canon Medical Systems Corporation

- Agfa-Gevaert Group

- Shimadzu Corporation

Significant Germany Diagnostic Imaging Services Industry Industry Milestones

- July 2022: GE Healthcare's Voluson Expert 22, a premium ultrasound device with graphics-based beamforming technology, was recommended by a managing director at the Center for Prenatal Diagnosis and Human Genetics in Berlin, highlighting advancements in diagnostic imaging for prenatal care.

- May 2021: Neoscan Solutions launched an MRI scanner specifically designed for babies, offering a smaller and lighter solution that can be placed directly in hospital children's wards, improving accessibility and comfort for infant diagnostics. Its subsequent installation in German hospitals demonstrated its practical application to prospective customers.

Future Outlook for Germany Diagnostic Imaging Services Industry Market

The future outlook for the Germany Diagnostic Imaging Services Industry is exceptionally promising, projected to witness sustained growth driven by continuous technological advancements and an increasing demand for advanced diagnostic solutions. The integration of AI and machine learning will further revolutionize diagnostic capabilities, enabling more precise and personalized patient care. The ongoing development of specialized imaging equipment catering to specific patient populations and medical conditions will unlock new market segments. Furthermore, a heightened focus on preventive healthcare and early disease detection, coupled with favorable government support for healthcare innovation, will act as significant catalysts for market expansion. Strategic collaborations and mergers among key players are expected to shape a more consolidated and efficient industry landscape, ensuring Germany remains at the forefront of diagnostic imaging services, contributing to a multi-billion euro market poised for robust future growth.

Germany Diagnostic Imaging Services Industry Segmentation

-

1. Modality

- 1.1. MRI

- 1.2. Computed Tomography

- 1.3. Ultrasound

- 1.4. X-Ray

- 1.5. Other Modalities

-

2. Application

- 2.1. Cardiology

- 2.2. Oncology

- 2.3. Neurology

- 2.4. Orthopedics

- 2.5. Other Applications

-

3. End-User

- 3.1. Hospital

- 3.2. Diagnostic Centers

- 3.3. Others

Germany Diagnostic Imaging Services Industry Segmentation By Geography

- 1. Germany

Germany Diagnostic Imaging Services Industry Regional Market Share

Geographic Coverage of Germany Diagnostic Imaging Services Industry

Germany Diagnostic Imaging Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic Diseases; Increased Adoption of Advanced Technologies in Medical Imaging

- 3.3. Market Restrains

- 3.3.1. Side Effects of Diagnostic Imaging

- 3.4. Market Trends

- 3.4.1. Computed Tomography is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Diagnostic Imaging Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 5.1.1. MRI

- 5.1.2. Computed Tomography

- 5.1.3. Ultrasound

- 5.1.4. X-Ray

- 5.1.5. Other Modalities

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Oncology

- 5.2.3. Neurology

- 5.2.4. Orthopedics

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospital

- 5.3.2. Diagnostic Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Esaote SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koning Health

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hologic Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FUJIFILM Holdings Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthineers AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company (GE Healthcare)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canon Medical Systems Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agfa-Gevaert Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shimadzu Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Esaote SpA

List of Figures

- Figure 1: Germany Diagnostic Imaging Services Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Diagnostic Imaging Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 2: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 3: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by Modality 2020 & 2033

- Table 10: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by Modality 2020 & 2033

- Table 11: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Germany Diagnostic Imaging Services Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Diagnostic Imaging Services Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Diagnostic Imaging Services Industry?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Germany Diagnostic Imaging Services Industry?

Key companies in the market include Esaote SpA, Koning Health, Hologic Inc, Koninklijke Philips N V, FUJIFILM Holdings Corporation, Siemens Healthineers AG, General Electric Company (GE Healthcare), Canon Medical Systems Corporation, Agfa-Gevaert Group, Shimadzu Corporation.

3. What are the main segments of the Germany Diagnostic Imaging Services Industry?

The market segments include Modality, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Diseases; Increased Adoption of Advanced Technologies in Medical Imaging.

6. What are the notable trends driving market growth?

Computed Tomography is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Side Effects of Diagnostic Imaging.

8. Can you provide examples of recent developments in the market?

In July 2022, the managing director at the Center for Prenatal Diagnosis and Human Genetics in Berlin, Germany recommended the newly launched premium ultrasound device with Voluson Expert 22 developed by GE Healthcare. This next-generation ultrasound system reportedly offers enhanced images through graphics-based beamforming technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Diagnostic Imaging Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Diagnostic Imaging Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Diagnostic Imaging Services Industry?

To stay informed about further developments, trends, and reports in the Germany Diagnostic Imaging Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence