Key Insights

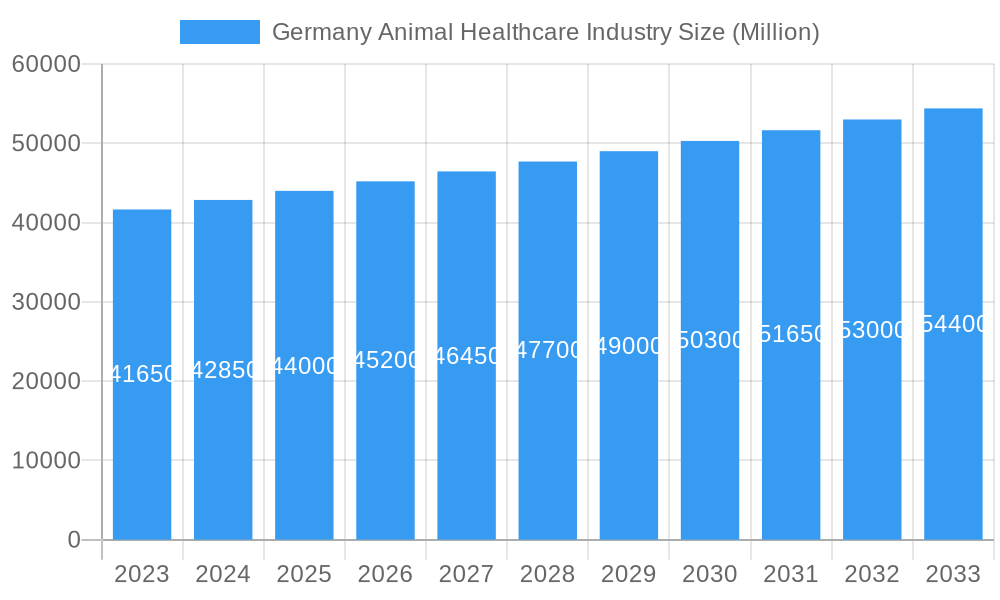

The German animal healthcare industry is poised for substantial growth, currently valued at approximately $41.65 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This robust expansion is fueled by several interconnected drivers. A primary catalyst is the increasing pet ownership trend across Germany, where companion animals are increasingly viewed as integral family members, leading to higher spending on their well-being. This heightened emotional connection translates directly into greater demand for advanced veterinary services, pharmaceuticals, and diagnostic tools. Furthermore, growing awareness among animal owners regarding zoonotic diseases and the importance of animal health for public health security is a significant driver. The prevalence of diseases like ASF in swine and avian influenza in poultry also necessitates proactive and advanced healthcare solutions, further stimulating market activity.

Germany Animal Healthcare Industry Market Size (In Billion)

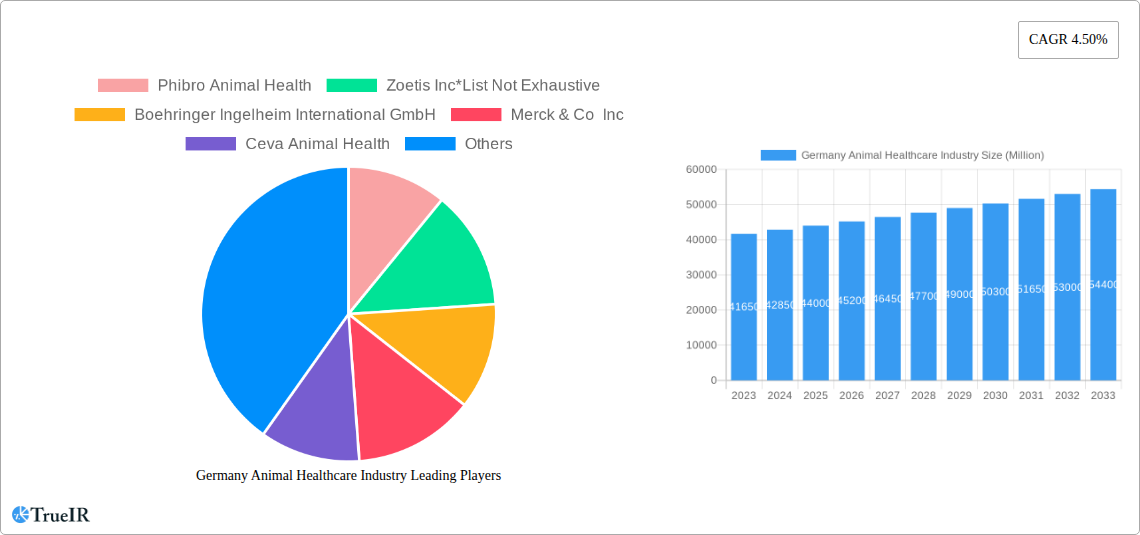

The market's trajectory is further shaped by evolving industry trends and a dynamic segment landscape. The therapeutics segment is experiencing robust demand, particularly for vaccines and anti-infectives, driven by the need to prevent and treat common animal ailments and emerging infectious diseases. Diagnostic advancements, including immunodiagnostic tests and molecular diagnostics, are also critical, enabling earlier and more accurate disease detection, thereby improving treatment outcomes. The "Dogs and Cats" segment continues to dominate due to widespread pet ownership. However, segments like "Poultry" and "Swine" are also showing significant growth, influenced by the scale of commercial operations and the need for disease management in food production. Key players like Zoetis Inc., Merck & Co. Inc., and Boehringer Ingelheim International GmbH are actively investing in research and development, launching innovative products and solutions to capture market share. While the market is expanding, potential restraints include the rising costs of veterinary services and the complexity of regulatory frameworks for animal health products.

Germany Animal Healthcare Industry Company Market Share

Germany Animal Healthcare Industry Market Analysis 2019-2033: Comprehensive Insights & Future Outlook

Unlock in-depth insights into the dynamic Germany animal healthcare market. This comprehensive report analyzes the German veterinary medicine market, animal health products in Germany, and pet care industry Germany from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033. Leveraging high-volume keywords such as animal diagnostics Germany, veterinary pharmaceuticals Germany, and animal nutrition Germany, this report is meticulously crafted for industry professionals, investors, and stakeholders seeking a competitive edge.

Germany Animal Healthcare Industry Market Structure & Competitive Landscape

The Germany animal healthcare industry exhibits a moderately concentrated market structure, with a few key players holding significant market share. Innovation remains a primary driver, fueled by substantial investments in research and development by leading companies. Regulatory frameworks, though robust, are adapting to foster growth in areas like companion animal health and sustainable livestock farming. Product substitutes, while present, are increasingly differentiated by efficacy, application, and technological integration. The end-user segmentation is dominated by companion animals, followed by livestock, reflecting evolving pet ownership trends and agricultural demands. Mergers and acquisitions (M&A) activity has been a consistent feature, signaling consolidation and strategic expansion by major entities. For instance, the German veterinary diagnostics market is seeing increased M&A as companies seek to broaden their service offerings. We anticipate a continued trend of strategic partnerships and acquisitions to enhance market penetration and technological capabilities, with an estimated XX billion in M&A volume during the historical period. Concentration ratios are estimated to be around XX% for the top 5 players in key segments.

Germany Animal Healthcare Industry Market Trends & Opportunities

The Germany animal healthcare market is projected for significant growth, estimated to reach a market size of XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is propelled by a confluence of technological advancements, evolving consumer preferences, and a growing emphasis on animal welfare. The rising pet humanization trend in Germany translates to increased spending on premium pet food, advanced veterinary diagnostics, and sophisticated therapeutic treatments, particularly for companion animals like dogs and cats. Simultaneously, the livestock sector, driven by demands for food safety and sustainable farming practices, is witnessing an uptake in vaccines, anti-infectives, and medical feed additives to enhance herd health and productivity. Digitalization is transforming veterinary services, with the emergence of telemedicine, advanced diagnostic tools, and data analytics offering new opportunities for efficiency and personalized care. The German veterinary services market is poised for innovation, with a projected market penetration rate for digital health solutions reaching XX% by 2033. Opportunities lie in the development of novel biologics, personalized medicine for pets, and smart farming solutions for livestock, all contributing to a robust and expanding market. The increasing prevalence of zoonotic diseases also underscores the importance of proactive animal health management.

Dominant Markets & Segments in Germany Animal Healthcare Industry

The Germany animal healthcare industry is characterized by the dominance of specific segments and animal types.

Product Segmentation:

- Therapeutics: The vaccines segment is a leading revenue generator, driven by routine immunization programs for both companion and livestock animals to prevent endemic and emerging diseases. Anti-infectives also hold substantial market share due to their critical role in treating bacterial and viral infections. Medical feed additives are gaining traction in the livestock sector, promoting growth and preventing diseases, aligning with sustainable agricultural practices.

- Diagnostics: The immunodiagnostic tests segment is experiencing robust growth, offering rapid and accurate disease detection. Diagnostic imaging and clinical chemistry are increasingly adopted in advanced veterinary practices, facilitating precise diagnosis and treatment planning. The demand for molecular diagnostics is on the rise for early disease detection and genetic analysis.

Animal Type Segmentation:

- Dogs and Cats: This segment represents the largest and fastest-growing market due to high pet ownership rates, increasing pet humanization, and a willingness to spend on premium healthcare solutions. The companion animal healthcare Germany market is a significant contributor.

- Ruminants (Cattle and Sheep): This segment is crucial for the agricultural economy, with a strong demand for preventative medicines, parasiticides, and reproductive health products. Government initiatives promoting animal welfare and food safety further bolster this segment.

- Poultry: Driven by the demand for meat and eggs, the poultry sector requires effective disease prevention and management strategies, leading to significant demand for vaccines and anti-infectives.

- Swine: This sector is vital for German exports, necessitating advanced disease control measures and performance-enhancing solutions.

Key growth drivers include government support for livestock health, increasing disposable incomes dedicated to pet care, and the continuous innovation in diagnostic and therapeutic technologies. Infrastructure development in rural areas for veterinary services and the integration of digital technologies further support market expansion.

Germany Animal Healthcare Industry Product Analysis

Product innovation in the Germany animal healthcare industry is primarily focused on developing advanced biologics, targeted therapeutics, and sophisticated diagnostic tools. Companies are emphasizing the creation of vaccines with broader spectrum efficacy and longer-lasting immunity. In diagnostics, there's a surge in the development of rapid, point-of-care tests and advanced molecular diagnostic platforms for early and precise disease identification. The market fit for these innovations is strong, driven by the demand for improved animal welfare, enhanced farm productivity, and the prevention of zoonotic diseases. Competitive advantages are being forged through patented technologies, superior efficacy, and user-friendly application.

Key Drivers, Barriers & Challenges in Germany Animal Healthcare Industry

Key Drivers: The Germany animal healthcare industry is propelled by several key drivers, including the growing trend of pet humanization, leading to increased expenditure on companion animal well-being. Technological advancements in diagnostics and therapeutics are enhancing treatment efficacy and accessibility. Supportive government policies promoting animal health and food safety, coupled with a robust research and development ecosystem, further fuel market growth. The increasing awareness of zoonotic diseases also necessitates proactive animal health management.

Key Barriers & Challenges: Despite strong growth, the industry faces challenges such as stringent regulatory approval processes for new veterinary drugs, which can be time-consuming and costly. Supply chain disruptions, particularly for specialized raw materials and finished products, pose a continuous risk, impacting market availability. Intense competition among established and emerging players necessitates continuous innovation and strategic pricing. The rising cost of veterinary care can also be a barrier for some pet owners, impacting market accessibility. We estimate supply chain disruptions to have impacted market growth by approximately XX% in the historical period.

Growth Drivers in the Germany Animal Healthcare Industry Market

Key growth drivers in the Germany animal healthcare industry market include the escalating pet ownership and the trend of pet humanization, leading to a substantial increase in spending on companion animal healthcare. Technological advancements are continuously introducing more effective and less invasive diagnostic and therapeutic solutions. Economic factors, such as rising disposable incomes, enable greater investment in animal health. Furthermore, government initiatives and favorable regulations aimed at ensuring animal welfare and food safety create a conducive environment for market expansion. The increasing focus on preventative care and disease management strategies in both companion and livestock sectors is a significant catalyst.

Challenges Impacting Germany Animal Healthcare Industry Growth

Challenges impacting Germany animal healthcare industry growth encompass the rigorous and lengthy regulatory approval pathways for veterinary pharmaceuticals and vaccines, which can stifle innovation and market entry. Supply chain vulnerabilities, including geopolitical factors and raw material sourcing issues, can lead to product shortages and price volatility, impacting market stability. Intense competitive pressures from both domestic and international players necessitate significant investment in R&D and marketing to maintain market share. Additionally, the rising cost of advanced veterinary treatments and diagnostics can pose accessibility challenges for a segment of the pet owner population and livestock producers.

Key Players Shaping the Germany Animal Healthcare Industry Market

- Phibro Animal Health

- Zoetis Inc

- Boehringer Ingelheim International GmbH

- Merck & Co Inc

- Ceva Animal Health

- Vetoquinol

- Virbac SA

- Elanco Animal Health

- Idexx Laboratories

Significant Germany Animal Healthcare Industry Industry Milestones

- July 2022: Berlin-based Rex raised USD 5.27 million (EUR 5 million) to build veterinary clinics in the upcoming years. With an emphasis on customer experience, digitized processes, and top-notch treatment, the pet tech startup is bringing the digital world to veterinary care, highlighting innovation in veterinary service delivery.

- January 2022: Idexx Laboratories Inc. launched a series of product and service enhancements, such as IDEXX 4Dx Plus Test, VetConnect PLUS Mobile App, SediVue Dx Urine Sediment Analyzer, and New Catalyst SDMA Test, that enable veterinary practices to be more efficient while managing increasing patient volumes. The enhancements provide deeper, actionable insights and personalized support to facilitate faster, more confident clinical decisions, showcasing advancements in diagnostic technology and digital integration.

Future Outlook for Germany Animal Healthcare Industry Market

The future outlook for the Germany animal healthcare industry is exceptionally promising, driven by persistent trends in pet humanization, continuous technological innovation, and an increasing emphasis on preventative healthcare and sustainability in livestock management. Strategic opportunities lie in the expansion of tele-veterinary services, the development of personalized medicine for pets, and the integration of AI and data analytics for predictive diagnostics and herd management. The market is poised for further consolidation through strategic partnerships and acquisitions, as key players seek to broaden their portfolios and geographical reach. Investment in novel biologics, antimicrobial stewardship solutions, and advanced animal nutrition will remain critical growth catalysts. The market is expected to reach XX billion by 2033.

Germany Animal Healthcare Industry Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

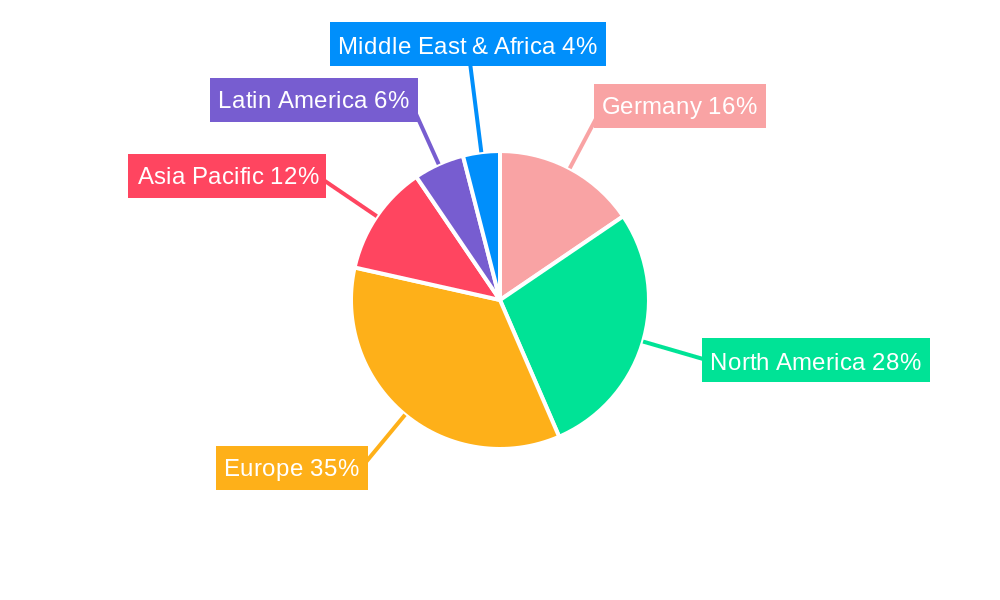

Germany Animal Healthcare Industry Segmentation By Geography

- 1. Germany

Germany Animal Healthcare Industry Regional Market Share

Geographic Coverage of Germany Animal Healthcare Industry

Germany Animal Healthcare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advanced Technology Leading to Innovations in Animal Healthcare; Rising Awareness and Initiatives by the Government; Increasing Prevalence of Zoonotic Diseases

- 3.3. Market Restrains

- 3.3.1. Increasing Cost of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. Vaccine Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Animal Healthcare Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Phibro Animal Health

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zoetis Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Boehringer Ingelheim International GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck & Co Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ceva Animal Health

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vetoquinol

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Virbac SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Elanco Animal Health

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Idexx Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Phibro Animal Health

List of Figures

- Figure 1: Germany Animal Healthcare Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Animal Healthcare Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Germany Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Germany Animal Healthcare Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Germany Animal Healthcare Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Germany Animal Healthcare Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Germany Animal Healthcare Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Animal Healthcare Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Germany Animal Healthcare Industry?

Key companies in the market include Phibro Animal Health, Zoetis Inc*List Not Exhaustive, Boehringer Ingelheim International GmbH, Merck & Co Inc, Ceva Animal Health, Vetoquinol, Virbac SA, Elanco Animal Health, Idexx Laboratories.

3. What are the main segments of the Germany Animal Healthcare Industry?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Advanced Technology Leading to Innovations in Animal Healthcare; Rising Awareness and Initiatives by the Government; Increasing Prevalence of Zoonotic Diseases.

6. What are the notable trends driving market growth?

Vaccine Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Cost of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

July 2022- Berlin-based Rex raised USD 5.27 million (EUR 5 million) to build veterinary clinics in the upcoming years. With an emphasis on customer experience, digitized processes, and top-notch treatment, the pet tech startup is bringing the digital world to veterinary care.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Animal Healthcare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Animal Healthcare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Animal Healthcare Industry?

To stay informed about further developments, trends, and reports in the Germany Animal Healthcare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence