Key Insights

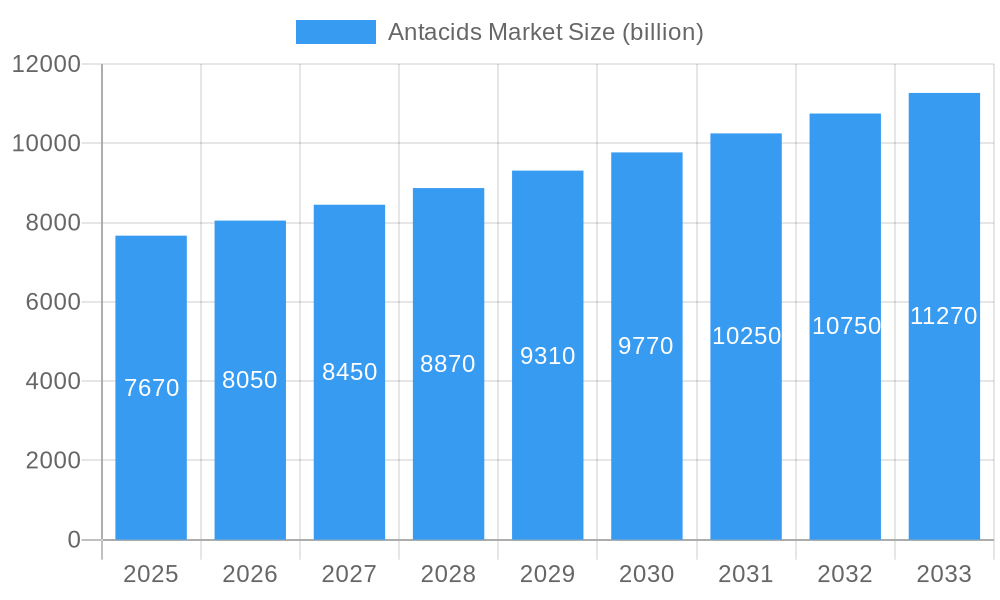

The global Antacids Market is poised for significant expansion, projected to reach an estimated USD 7.67 billion in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.9%, indicating a steady and consistent upward trajectory. The market is being propelled by an increasing prevalence of gastrointestinal issues, such as heartburn, indigestion, and acid reflux, driven by evolving dietary habits, sedentary lifestyles, and rising stress levels worldwide. Consumers are increasingly seeking accessible and effective over-the-counter (OTC) remedies, fueling demand for antacid products. Furthermore, advancements in formulation technologies, leading to more palatable and faster-acting antacids, are contributing to market dynamism. The rising awareness about digestive health and the accessibility of these products through various distribution channels, including pharmacies and a burgeoning e-commerce presence, are also key growth drivers.

Antacids Market Market Size (In Billion)

Looking ahead, the Antacids Market is expected to continue its upward climb, reflecting sustained consumer demand and market innovation. The projected growth rate suggests the market will reach approximately USD 9.9 billion by 2033. Key trends shaping this market include the development of novel antacid formulations with added benefits, such as probiotic integration for gut health, and an increasing preference for natural and organic ingredients. The convenience and widespread availability of e-commerce platforms are further democratizing access to antacid products, particularly in emerging economies. While the market benefits from strong demand, potential restraints such as intense competition among established players and the development of alternative treatment therapies for chronic digestive disorders could influence its pace of growth. Nevertheless, the fundamental need for relief from common digestive discomforts ensures a resilient and expanding market.

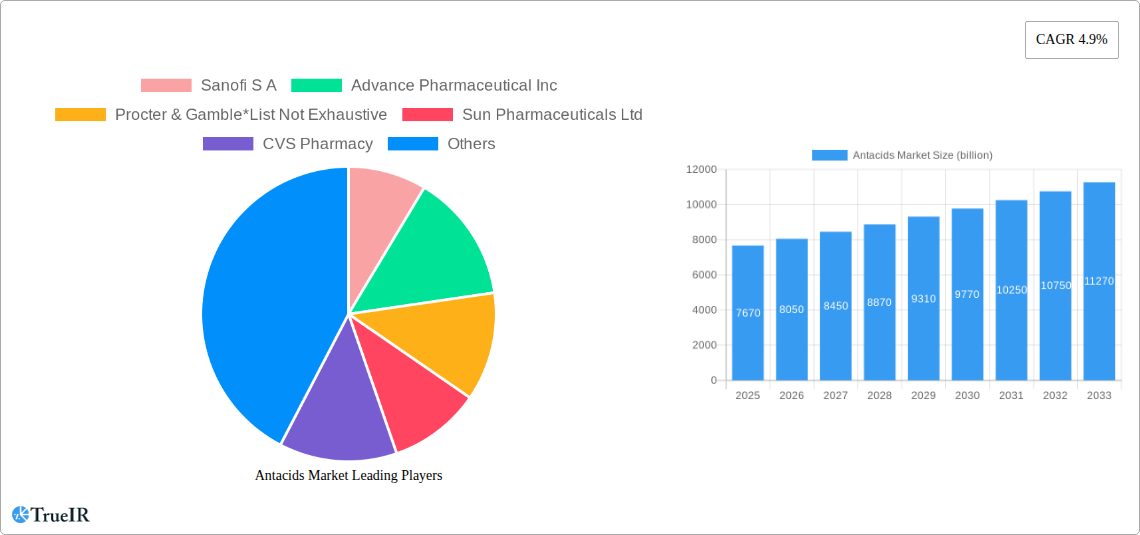

Antacids Market Company Market Share

Antacids Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report offers a dynamic and SEO-optimized analysis of the global Antacids Market, covering historical trends, current dynamics, and future projections from 2019 to 2033. Leveraging high-volume keywords and detailed segmentation, this report is an indispensable resource for industry stakeholders seeking to understand market concentration, innovation drivers, regulatory impacts, and competitive strategies. With an estimated market size of USD xx billion in 2025, the Antacids Market is poised for substantial growth, driven by increasing prevalence of digestive disorders and rising consumer awareness.

The study encompasses a comprehensive examination of market structure, trends, opportunities, dominant segments, product analysis, key drivers, barriers, challenges, leading players, significant industry milestones, and the future outlook. Utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report provides actionable insights for strategic decision-making.

Antacids Market Market Structure & Competitive Landscape

The Antacids Market exhibits a moderately concentrated structure, with a blend of multinational pharmaceutical giants and smaller, specialized players. Innovation is a key differentiator, with companies actively investing in research and development to introduce novel formulations, improved efficacy, and enhanced consumer experiences. Regulatory frameworks, particularly stringent approvals from bodies like the FDA, play a significant role in market entry and product development. The threat of product substitutes, such as proton pump inhibitors (PPIs) and H2 blockers, necessitates continuous product improvement and differentiation within the antacid segment. End-user segmentation reveals a strong demand from the general consumer populace, driven by over-the-counter accessibility and self-treatment of common gastrointestinal discomfort. Merger and acquisition (M&A) trends are observed, albeit at a moderate pace, as larger entities seek to expand their product portfolios and market reach. The market's concentration ratio is estimated at XX%, indicating a competitive yet consolidated landscape. M&A activities have seen an average of X transactions per year over the historical period.

- Market Concentration: Moderate to high, with key players holding substantial market share.

- Innovation Drivers: Development of novel formulations, improved efficacy, and enhanced consumer convenience.

- Regulatory Impacts: Strict FDA and other regional regulatory approvals influence product launches and market access.

- Product Substitutes: Proton Pump Inhibitors (PPIs) and H2 blockers pose a competitive threat.

- End-User Segmentation: Primarily retail consumers seeking relief from heartburn and indigestion.

- M&A Trends: Strategic acquisitions aimed at portfolio expansion and market consolidation.

Antacids Market Market Trends & Opportunities

The Antacids Market is experiencing robust growth, projected to reach an impressive USD xx billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025. This expansion is fueled by a confluence of factors, including the escalating prevalence of lifestyle-induced digestive disorders, such as acid reflux and heartburn, driven by poor dietary habits and sedentary lifestyles. The increasing aging population globally also contributes significantly to market demand, as older individuals are more prone to gastrointestinal issues. Technological advancements are paving the way for more sophisticated and targeted antacid formulations, including chewable tablets with faster absorption rates and powders offering customizable dosage. Consumer preferences are shifting towards more natural and ingredient-conscious products, presenting an opportunity for manufacturers to innovate with plant-based or naturally derived antacids. E-commerce channels are emerging as a crucial distribution avenue, offering consumers convenience and accessibility, thereby expanding market penetration. The competitive landscape is characterized by continuous product launches and aggressive marketing campaigns by both established pharmaceutical companies and emerging players. Strategic collaborations and partnerships are also on the rise, aimed at leveraging combined expertise and resources to tap into new markets and consumer segments. The market penetration rate for over-the-counter antacids is estimated to be XX% globally, with significant room for growth. Opportunities lie in developing specialized antacids for specific conditions, such as pregnancy-related heartburn or stress-induced indigestion, and in expanding reach in emerging economies with growing disposable incomes and increasing awareness of gastrointestinal health. The rise of personalized medicine also presents a long-term opportunity for tailored antacid solutions.

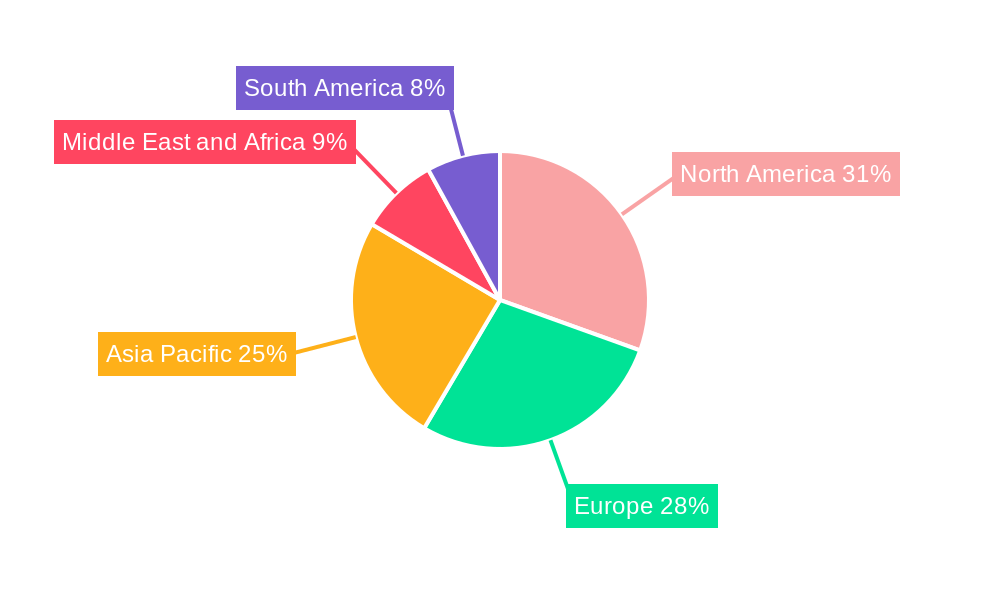

Dominant Markets & Segments in Antacids Market

The global Antacids Market is characterized by significant regional dominance, with North America currently leading in market share, largely attributed to high healthcare expenditure, established distribution networks, and a high prevalence of lifestyle-related digestive issues. Within this region, the United States, with its substantial population and robust pharmaceutical industry, plays a pivotal role. Asia Pacific, however, is emerging as the fastest-growing market, driven by increasing disposable incomes, rising awareness of digestive health, and a growing preference for over-the-counter remedies.

In terms of Formulation Type, the Tablet segment holds the largest market share. This dominance is driven by their convenience, portability, ease of administration, and widespread consumer familiarity. Tablet formulations are often perceived as more accurate in dosage and more stable compared to other forms. The Powder segment, while smaller, is witnessing steady growth due to its rapid dissolution and absorption rates, making it a preferred choice for individuals seeking immediate relief. Other Formulation Types, including liquids and gels, cater to specific consumer needs, such as those with swallowing difficulties or requiring specialized formulations.

Regarding Distribution Channel, E-Commerce is rapidly gaining traction and is projected to become a dominant force. The convenience of online purchasing, coupled with wider product availability and competitive pricing, is fueling this trend. Hospital Pharmacies remain a significant channel, particularly for prescription-strength antacids or when recommended by healthcare professionals, contributing to a steady revenue stream. Other Distribution Channels, encompassing retail pharmacies, supermarkets, and convenience stores, continue to hold substantial market share due to their accessibility and impulse purchase appeal. Growth drivers in these dominant segments include:

- North America: High healthcare spending, strong brand presence, and consumer demand for accessible digestive health solutions.

- Asia Pacific: Rapidly growing middle class, increasing health consciousness, and expanding e-commerce infrastructure.

- Tablet Formulations: Consumer preference for convenience, accurate dosing, and established familiarity.

- E-Commerce Channel: Growing online retail penetration, increased digital literacy, and demand for home delivery services.

Antacids Market Product Analysis

Product innovation in the Antacids Market centers on enhancing efficacy, improving palatability, and offering convenient delivery methods. Manufacturers are focusing on developing combination antacids that address multiple symptoms simultaneously and introducing sustained-release formulations for prolonged relief. Technological advancements are leading to more rapid absorption and targeted action, minimizing systemic side effects. Competitive advantages are being carved out through unique flavor profiles, sugar-free options, and the incorporation of natural ingredients, appealing to a health-conscious consumer base. The market fit is optimized by catering to diverse needs, from instant relief for occasional heartburn to long-term management of chronic digestive issues.

Key Drivers, Barriers & Challenges in Antacids Market

Key Drivers: The Antacids Market is propelled by several key drivers. The escalating prevalence of gastrointestinal disorders, attributed to changing dietary habits, stress, and sedentary lifestyles, is a primary growth catalyst. Increasing consumer awareness regarding the availability and efficacy of OTC antacids for managing heartburn and indigestion further fuels demand. Technological advancements in formulation, leading to faster acting and more palatable products, are also significant drivers. The growing elderly population, more susceptible to digestive ailments, contributes consistently to market expansion.

Barriers & Challenges: Despite robust growth, the market faces several barriers and challenges. Intense competition from established players and the threat of product substitutes like PPIs and H2 blockers can impact pricing power and market share. Evolving regulatory landscapes and the need for stringent product approvals can pose hurdles for new entrants and product launches, with compliance costs being substantial. Supply chain disruptions, particularly for raw material procurement and distribution, can affect product availability and increase operational expenses. Furthermore, price sensitivity among a segment of consumers can limit the adoption of premium or innovative antacid products. The market faces an estimated XX% impact on growth due to regulatory hurdles.

Growth Drivers in the Antacids Market Market

The Antacids Market is experiencing significant growth, underpinned by a range of critical factors. Technologically, the development of novel drug delivery systems and advanced formulations, such as chewable tablets with improved taste profiles and faster-dissolving powders, is enhancing product appeal and efficacy. Economically, rising disposable incomes in emerging economies are enabling greater consumer spending on healthcare and self-medication for digestive discomfort. Policy-driven factors, including the growing emphasis on public health and the accessibility of Over-the-Counter (OTC) medications, further contribute to market expansion. The increasing understanding of the link between gut health and overall well-being is also driving consumer interest in digestive health products, including antacids.

Challenges Impacting Antacids Market Growth

Several challenges can impede the growth trajectory of the Antacids Market. Regulatory complexities and the stringent approval processes required by health authorities worldwide can lead to extended timelines and increased costs for product launches. Supply chain disruptions, exacerbated by geopolitical events or unforeseen logistical issues, can impact the consistent availability of raw materials and finished goods, leading to stockouts and lost sales opportunities. Fierce competitive pressures from both established multinational corporations and agile local players necessitate continuous innovation and aggressive marketing strategies, which can strain profit margins. Moreover, the potential for price wars and the increasing demand for cost-effective solutions can limit the market's ability to fully capitalize on premium product offerings.

Key Players Shaping the Antacids Market Market

- Sanofi S A

- Advance Pharmaceutical Inc

- Procter & Gamble

- Sun Pharmaceuticals Ltd

- CVS Pharmacy

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Haleon

- Safetec of America Inc

- Reckitt Benckiser Group plc

- WellSpring Pharmaceutical Corporation

- Johnson & Johnson

Significant Antacids Market Industry Milestones

- March 2023: Wonderbelly, a digestive medicine company, launched three antacid flavors, one of which, Fruity Cereal, at select Target stores, being exclusive to the retailer. This move signifies innovative product diversification and strategic retail partnerships.

- June 2022: Zydus Lifesciences received final approval from the United States Food and Drug Administration (FDA) to market Famotidine tablets in 20 and 40 mg. Famotidine is a histamine H2 receptor blocker. It works by reducing the amount of acid in the stomach. This development highlights regulatory approvals for key generic antacid ingredients, enhancing market accessibility.

Future Outlook for Antacids Market Market

The future outlook for the Antacids Market is exceptionally promising, characterized by sustained growth and evolving consumer demands. Growth catalysts include the continued rise in lifestyle-related digestive issues, an aging global population, and increasing disposable incomes in developing nations, all of which will drive demand for effective and accessible relief. Strategic opportunities lie in the development of specialized antacids catering to niche markets, such as those for pregnancy-induced heartburn or pediatric digestive discomfort, and in the expansion of e-commerce channels to reach a wider consumer base. Furthermore, advancements in personalized medicine and a growing consumer focus on holistic wellness will create avenues for innovative, science-backed digestive health solutions. The market is projected to witness an estimated growth of XX% over the next decade.

Antacids Market Segmentation

-

1. Formulation Type

- 1.1. Tablet

- 1.2. Powder

- 1.3. Other Formulation Types

-

2. Distribution Channel

- 2.1. Hospital Pharmacies

- 2.2. E-Commerce

- 2.3. Other Distribution Channels

Antacids Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Antacids Market Regional Market Share

Geographic Coverage of Antacids Market

Antacids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Geriatric Population Suffering from Gastroesophageal Reflux Disease (GERD); Poor Lifestyle Choices Leading to Higher Incidences of Acidity; Side Effects of Drugs like Non-Steroidal Anti-Inflammatory Drugs

- 3.3. Market Restrains

- 3.3.1. Ignorance of People towards Symptoms of Acidity; Growing Number of Alternatives in the Market for Antacids

- 3.4. Market Trends

- 3.4.1. Tablet Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antacids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Formulation Type

- 5.1.1. Tablet

- 5.1.2. Powder

- 5.1.3. Other Formulation Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacies

- 5.2.2. E-Commerce

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Formulation Type

- 6. North America Antacids Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Formulation Type

- 6.1.1. Tablet

- 6.1.2. Powder

- 6.1.3. Other Formulation Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hospital Pharmacies

- 6.2.2. E-Commerce

- 6.2.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Formulation Type

- 7. Europe Antacids Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Formulation Type

- 7.1.1. Tablet

- 7.1.2. Powder

- 7.1.3. Other Formulation Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hospital Pharmacies

- 7.2.2. E-Commerce

- 7.2.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Formulation Type

- 8. Asia Pacific Antacids Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Formulation Type

- 8.1.1. Tablet

- 8.1.2. Powder

- 8.1.3. Other Formulation Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hospital Pharmacies

- 8.2.2. E-Commerce

- 8.2.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Formulation Type

- 9. Middle East and Africa Antacids Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Formulation Type

- 9.1.1. Tablet

- 9.1.2. Powder

- 9.1.3. Other Formulation Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hospital Pharmacies

- 9.2.2. E-Commerce

- 9.2.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Formulation Type

- 10. South America Antacids Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Formulation Type

- 10.1.1. Tablet

- 10.1.2. Powder

- 10.1.3. Other Formulation Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hospital Pharmacies

- 10.2.2. E-Commerce

- 10.2.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Formulation Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sanofi S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Advance Pharmaceutical Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Procter & Gamble*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sun Pharmaceuticals Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CVS Pharmacy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bayer AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Takeda Pharmaceutical Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Haleon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Safetec of America Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Reckitt Benckiser Group plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 WellSpring Pharmaceutical Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Johnson & Johnson

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Sanofi S A

List of Figures

- Figure 1: Global Antacids Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Antacids Market Revenue (billion), by Formulation Type 2025 & 2033

- Figure 3: North America Antacids Market Revenue Share (%), by Formulation Type 2025 & 2033

- Figure 4: North America Antacids Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Antacids Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Antacids Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Antacids Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Antacids Market Revenue (billion), by Formulation Type 2025 & 2033

- Figure 9: Europe Antacids Market Revenue Share (%), by Formulation Type 2025 & 2033

- Figure 10: Europe Antacids Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Antacids Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Antacids Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Antacids Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Antacids Market Revenue (billion), by Formulation Type 2025 & 2033

- Figure 15: Asia Pacific Antacids Market Revenue Share (%), by Formulation Type 2025 & 2033

- Figure 16: Asia Pacific Antacids Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Antacids Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Antacids Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Antacids Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Antacids Market Revenue (billion), by Formulation Type 2025 & 2033

- Figure 21: Middle East and Africa Antacids Market Revenue Share (%), by Formulation Type 2025 & 2033

- Figure 22: Middle East and Africa Antacids Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East and Africa Antacids Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East and Africa Antacids Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Antacids Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Antacids Market Revenue (billion), by Formulation Type 2025 & 2033

- Figure 27: South America Antacids Market Revenue Share (%), by Formulation Type 2025 & 2033

- Figure 28: South America Antacids Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: South America Antacids Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Antacids Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Antacids Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Antacids Market Revenue billion Forecast, by Formulation Type 2020 & 2033

- Table 2: Global Antacids Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Antacids Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Antacids Market Revenue billion Forecast, by Formulation Type 2020 & 2033

- Table 5: Global Antacids Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Antacids Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Antacids Market Revenue billion Forecast, by Formulation Type 2020 & 2033

- Table 11: Global Antacids Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Antacids Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Antacids Market Revenue billion Forecast, by Formulation Type 2020 & 2033

- Table 20: Global Antacids Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Antacids Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Antacids Market Revenue billion Forecast, by Formulation Type 2020 & 2033

- Table 29: Global Antacids Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Antacids Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Antacids Market Revenue billion Forecast, by Formulation Type 2020 & 2033

- Table 35: Global Antacids Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Antacids Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Antacids Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antacids Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Antacids Market?

Key companies in the market include Sanofi S A, Advance Pharmaceutical Inc, Procter & Gamble*List Not Exhaustive, Sun Pharmaceuticals Ltd, CVS Pharmacy, Bayer AG, Takeda Pharmaceutical Company Limited, Haleon, Safetec of America Inc, Reckitt Benckiser Group plc, WellSpring Pharmaceutical Corporation, Johnson & Johnson.

3. What are the main segments of the Antacids Market?

The market segments include Formulation Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population Suffering from Gastroesophageal Reflux Disease (GERD); Poor Lifestyle Choices Leading to Higher Incidences of Acidity; Side Effects of Drugs like Non-Steroidal Anti-Inflammatory Drugs.

6. What are the notable trends driving market growth?

Tablet Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Ignorance of People towards Symptoms of Acidity; Growing Number of Alternatives in the Market for Antacids.

8. Can you provide examples of recent developments in the market?

March 2023: Wonderbelly, a digestive medicine company, launched three antacid flavors, one of which, Fruity Cereal, at select Target stores, being exclusive to the retailer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antacids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antacids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antacids Market?

To stay informed about further developments, trends, and reports in the Antacids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence