Key Insights

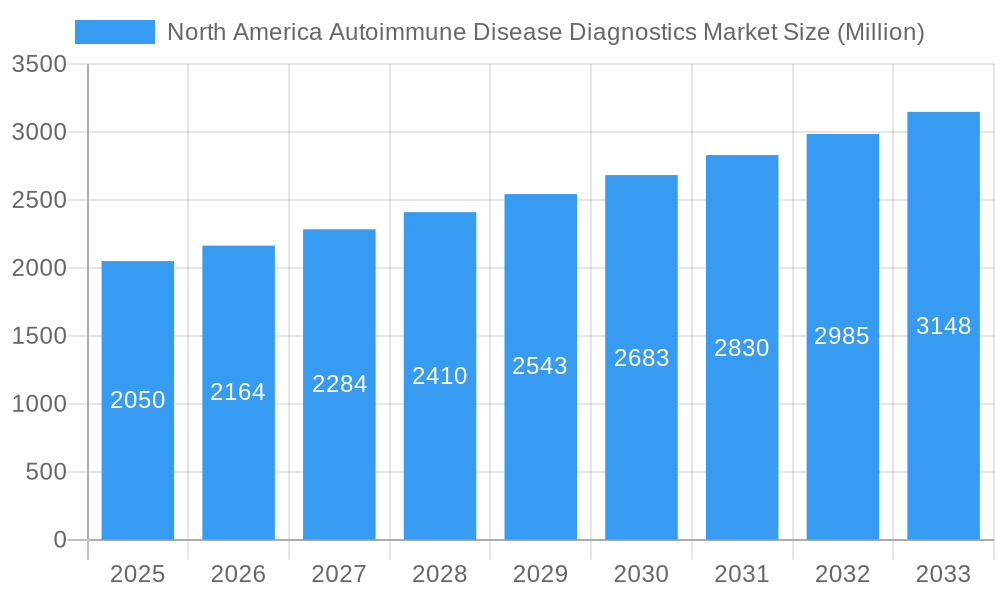

The North America Autoimmune Disease Diagnostics Market is poised for significant expansion, driven by increasing disease prevalence and advancements in diagnostic technologies. The market was valued at approximately 2.05 Million in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.53% from 2025 to 2033. This robust growth is fueled by a rising incidence of chronic autoimmune conditions like Rheumatoid Arthritis, Psoriasis, and Systemic Lupus Erythematosus (SLE), necessitating earlier and more accurate diagnostic interventions. Furthermore, the continuous development of novel immunologic assays and antibody tests, coupled with growing patient awareness and physician emphasis on early diagnosis, are key factors propelling the market forward. The integration of advanced laboratory techniques and the availability of specialized diagnostic panels are enhancing the precision and efficiency of autoimmune disease detection across North America.

North America Autoimmune Disease Diagnostics Market Market Size (In Billion)

Several key drivers are shaping the trajectory of the autoimmune disease diagnostics market. An escalating global burden of autoimmune disorders, influenced by factors such as genetic predisposition, environmental triggers, and lifestyle changes, directly translates to a higher demand for diagnostic solutions. Technological innovations in diagnostic testing, including the development of more sensitive and specific biomarkers and the adoption of automated platforms, are improving diagnostic accuracy and speed. The growing emphasis on personalized medicine and the need for early intervention to manage chronic autoimmune conditions effectively also contribute to market growth. While the market benefits from these positive trends, it faces certain restraints, including the high cost of advanced diagnostic tests and the limited availability of skilled healthcare professionals in certain regions, which could potentially impede widespread adoption. However, the sustained focus on research and development, along with strategic collaborations among market players, is expected to mitigate these challenges and foster continued market development.

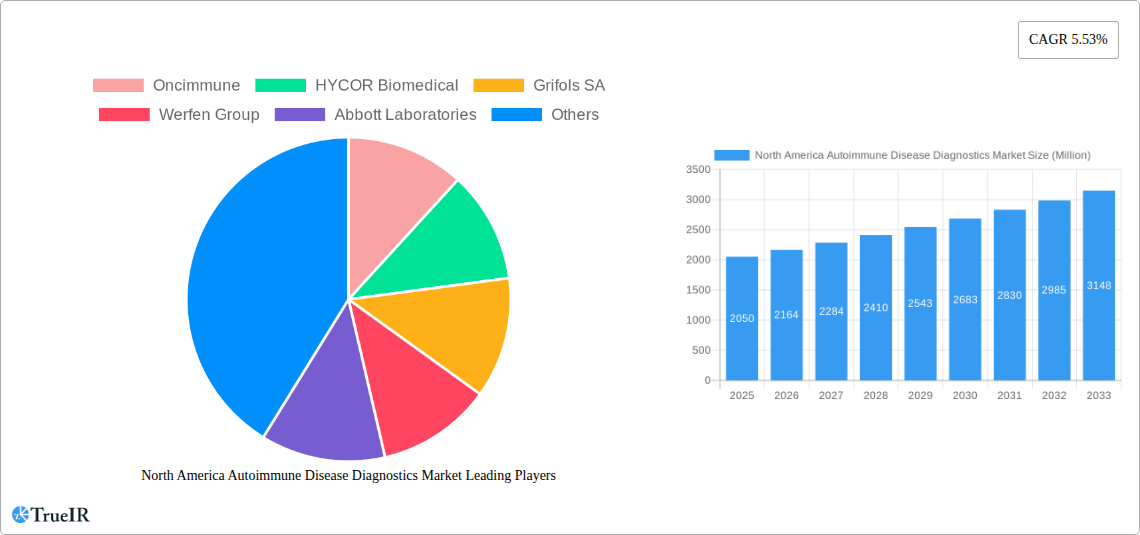

North America Autoimmune Disease Diagnostics Market Company Market Share

North America Autoimmune Disease Diagnostics Market: Comprehensive Analysis and Future Projections (2019–2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the North America Autoimmune Disease Diagnostics Market. Leveraging high-volume keywords relevant to autoimmune disease testing, diagnostic assays, lupus diagnostics, rheumatoid arthritis diagnosis, multiple sclerosis testing, diabetes diagnostics, and thyroid disease testing, this report is designed to engage and inform industry professionals, researchers, and investors. The study covers a comprehensive period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, offering insights into historical trends and future growth trajectories.

North America Autoimmune Disease Diagnostics Market Market Structure & Competitive Landscape

The North America autoimmune disease diagnostics market is characterized by a moderately consolidated structure, driven by continuous innovation in diagnostic technologies and an increasing prevalence of autoimmune disorders. Leading players like Abbott Laboratories, Siemens Healthineers Inc., Thermo Fisher Scientific, and F. Hoffmann-La Roche dominate the landscape, investing heavily in research and development to introduce advanced autoimmune antibody tests and immunologic assays. Regulatory bodies, such as the FDA in the United States and Health Canada, play a crucial role in shaping the market through stringent approval processes, influencing the pace of new product introductions. The threat of product substitutes is relatively low due to the specificity and complexity of autoimmune disease diagnosis, though advancements in point-of-care testing are beginning to offer alternative approaches. End-user segmentation is broad, encompassing hospitals, diagnostic laboratories, and academic research institutions, each with distinct purchasing patterns and technology adoption rates. Mergers and acquisitions (M&A) remain a significant strategy for market expansion and portfolio diversification, with recent activities focusing on acquiring novel diagnostic platforms and expanding market reach for rheumatoid arthritis diagnostic tests and multiple sclerosis diagnostic solutions. The market concentration is estimated to be around 35-45% among the top five players.

North America Autoimmune Disease Diagnostics Market Market Trends & Opportunities

The North America autoimmune disease diagnostics market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is fueled by a confluence of factors, including the rising global incidence of autoimmune conditions, increasing patient awareness, and significant advancements in diagnostic methodologies. Technological shifts are a primary driver, with a growing emphasis on the development and adoption of highly sensitive and specific antibody tests and multiplex assays that can simultaneously detect multiple autoantibodies. This allows for earlier and more accurate diagnosis of complex conditions like Systemic Lupus Erythematosus (SLE) and rheumatoid arthritis. Consumer preferences are increasingly leaning towards personalized medicine approaches, demanding diagnostic tools that can stratify patients and predict disease progression or treatment response. The competitive dynamics within the market are intensifying, with companies striving to differentiate themselves through innovation, strategic partnerships, and expanded product portfolios. Opportunities abound in the development of novel biomarkers, liquid biopsy techniques for less invasive diagnostics, and the integration of artificial intelligence and machine learning to enhance diagnostic accuracy and efficiency. The market penetration rate for advanced diagnostic solutions is steadily increasing, particularly in the United States, where a higher healthcare expenditure and a greater focus on early disease detection contribute to market expansion for autoimmune disease detection kits. The increasing demand for efficient and rapid diagnostic solutions for inflammatory bowel disease diagnostics and type 1 diabetes diagnostics further underscores the market’s growth potential.

Dominant Markets & Segments in North America Autoimmune Disease Diagnostics Market

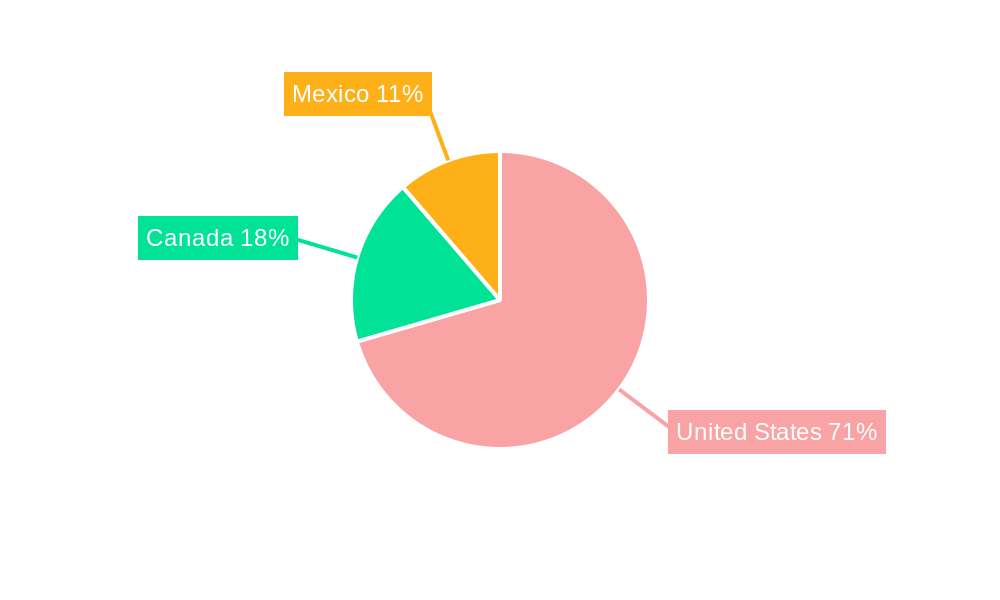

The United States stands as the dominant market within North America for autoimmune disease diagnostics, accounting for an estimated 70-75% of the total market value. This dominance is attributed to a high prevalence of autoimmune diseases, advanced healthcare infrastructure, substantial investment in R&D, and a favorable regulatory environment that supports the adoption of innovative diagnostic technologies. The country’s healthcare system’s emphasis on early diagnosis and personalized treatment further propels the demand for sophisticated autoimmune disease diagnostic tests.

Within the Disease Type segment, Systemic Autoimmune Disease continues to be the largest revenue generator.

- Rheumatoid Arthritis: The high prevalence and the availability of specific diagnostic markers make this a significant segment.

- Systemic Lupus Erythematosus (SLE): Increasing awareness and the development of more accurate antibody detection methods are driving growth.

- Multiple Sclerosis: Advances in neuro-immunological diagnostics and the growing need for early intervention contribute to its market share.

- Psoriasis and Other Disease Types also represent substantial, albeit smaller, segments.

The Localized Autoimmune Disease segment is also witnessing considerable growth, particularly:

- Inflammatory Bowel Disease (IBD): The rising incidence of Crohn's disease and ulcerative colitis fuels demand for diagnostic solutions.

- Type 1 Diabetes: Early detection and monitoring are critical, leading to consistent demand for diagnostic tests.

- Thyroid related autoimmune conditions, such as Hashimoto's thyroiditis and Graves' disease, are also significant contributors.

In terms of Diagnostic Test types, Antibody Tests represent the most crucial and rapidly growing segment.

- Immunologic Assays are fundamental for detecting autoantibodies and other immunological markers.

- Inflammatory Markers, such as C-reactive protein (CRP) and erythrocyte sedimentation rate (ESR), are vital for monitoring inflammation associated with autoimmune diseases.

- Regular Laboratory Tests remain a foundational diagnostic tool.

- Other Tests, including genetic testing and advanced molecular diagnostics, are emerging as key growth drivers.

Canada and Mexico are also significant contributors to the North America market, with growing healthcare expenditures and increasing awareness of autoimmune diseases. Policies aimed at improving access to healthcare and diagnostics in these regions are expected to foster market expansion for autoimmune disease screening and autoimmune panel tests.

North America Autoimmune Disease Diagnostics Market Product Analysis

The North America autoimmune disease diagnostics market is marked by continuous product innovation focused on enhancing sensitivity, specificity, and speed. Key advancements include the development of multiplex immunoassay platforms capable of detecting multiple autoantibodies simultaneously, significantly reducing diagnostic time and cost for complex autoimmune conditions. Applications range from the early detection of rheumatoid arthritis and SLE to the precise diagnosis of multiple sclerosis and inflammatory bowel disease. Competitive advantages are being established through proprietary antibody targets, novel assay chemistries, and integrated data analysis software that aids clinicians in interpreting results. The introduction of automated diagnostic systems and point-of-care testing devices further strengthens the market's product landscape, catering to evolving healthcare delivery models.

Key Drivers, Barriers & Challenges in North America Autoimmune Disease Diagnostics Market

Key Drivers: The North America autoimmune disease diagnostics market is propelled by a rising prevalence of autoimmune disorders, increasing healthcare expenditure, and a growing emphasis on early and accurate diagnosis. Technological advancements in immunologic assays and antibody tests, alongside supportive government initiatives for healthcare access, are significant growth catalysts.

Barriers & Challenges: Despite robust growth, the market faces challenges including the high cost of advanced diagnostic technologies, complex regulatory approval pathways, and the need for skilled laboratory professionals. Reimbursement policies and the potential for diagnostic errors also pose significant hurdles to market expansion. Supply chain disruptions for critical reagents and components can also impact market accessibility.

Growth Drivers in the North America Autoimmune Disease Diagnostics Market Market

Key growth drivers in the North America autoimmune disease diagnostics market include the escalating incidence of autoimmune diseases, such as rheumatoid arthritis, lupus, and multiple sclerosis, coupled with increasing patient awareness and demand for early intervention. Technological advancements in autoimmune diagnostics are paramount, with innovations in immunologic assays, antibody tests, and multiplex platforms enabling more accurate and efficient disease detection. Supportive government policies aimed at improving healthcare access and diagnostic capabilities, particularly in the United States, also contribute significantly. Furthermore, substantial investments in R&D by leading companies are fostering the development of novel diagnostic solutions and biomarkers, creating a dynamic and expanding market.

Challenges Impacting North America Autoimmune Disease Diagnostics Market Growth

Challenges impacting North America autoimmune disease diagnostics market growth include the high cost associated with advanced diagnostic technologies and specialized reagents, which can limit accessibility, especially in certain regions or for specific patient populations. Regulatory complexities and the protracted approval processes for new diagnostic tests can hinder timely market entry. Supply chain vulnerabilities, as demonstrated by recent global events, can disrupt the availability of essential components and reagents. Furthermore, the competitive pressure among market players, while fostering innovation, can also lead to pricing pressures. The need for highly skilled personnel to operate and interpret results from sophisticated diagnostic equipment presents another operational challenge.

Key Players Shaping the North America Autoimmune Disease Diagnostics Market Market

- Abbott Laboratories

- Siemens Healthineers Inc.

- Thermo Fisher Scientific

- F. Hoffmann-La Roche

- Bio-rad Laboratories

- Grifols SA

- Werfen Group

- Myriad Genetics

- Euroimmun AG (Perkinelmer Inc.)

- Oncimmune

- HYCOR Biomedical

- Trinity Biotech

Significant North America Autoimmune Disease Diagnostics Market Industry Milestones

- February 2023: Edesa Biotech received approval from Health Canada for a phase II clinical trial of its EB06 monoclonal antibody candidate to treat vitiligo, a life-altering autoimmune disease, highlighting advancements in therapeutic and diagnostic avenues.

- June 2022: Thermo Scientific received United States FDA clearance for the EliA RNA Pol III and EliA Rib-P tests for aiding in the diagnosis of systemic sclerosis and systemic lupus erythematosus (SLE), underscoring the continuous introduction of sophisticated diagnostic tools.

Future Outlook for North America Autoimmune Disease Diagnostics Market Market

The future outlook for the North America autoimmune disease diagnostics market is highly promising, driven by persistent growth catalysts. Continued innovation in autoimmune disease testing, particularly in areas like genetic diagnostics, predictive biomarkers, and point-of-care solutions, will shape the market. The increasing adoption of AI and machine learning in diagnostic interpretation offers significant potential for enhanced accuracy and efficiency. Strategic collaborations, mergers, and acquisitions are expected to continue, leading to further market consolidation and portfolio expansion. The rising healthcare expenditure across North America, coupled with a growing understanding of the long-term economic and health impacts of untreated autoimmune diseases, will sustain the demand for advanced diagnostic solutions, including thyroid autoimmune diagnostics and inflammatory bowel disease diagnostics. This dynamic landscape presents substantial opportunities for market players to innovate and capture market share.

North America Autoimmune Disease Diagnostics Market Segmentation

-

1. Disease Type

-

1.1. Systemic Autoimmune Disease

- 1.1.1. Rheumatoid Arthritis

- 1.1.2. Psoriasis

- 1.1.3. Systemic Lupus Erythematosus (SLE)

- 1.1.4. Multiple Sclerosis

- 1.1.5. Other Disease Types

-

1.2. Localized Autoimmune Disease

- 1.2.1. Inflammatory Bowel disease

- 1.2.2. Type 1 Diabetes

- 1.2.3. Thyroid

- 1.2.4. Other Localized Autoimmune Diseases

-

1.1. Systemic Autoimmune Disease

-

2. Diagnostic Test

- 2.1. Regular Laboratory Tests

- 2.2. Inflammatory Markers

- 2.3. Immunologic Assays

- 2.4. Antibody Tests

- 2.5. Other Tests

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Autoimmune Disease Diagnostics Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Autoimmune Disease Diagnostics Market Regional Market Share

Geographic Coverage of North America Autoimmune Disease Diagnostics Market

North America Autoimmune Disease Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence and Growing Public Awareness of Autoimmune Diseases; Technological Advancements in Autoimmune Disease Diagnostics

- 3.3. Market Restrains

- 3.3.1. Slow Turnaround Time for Autoimmune Disease Diagnostic Test Results; High Frequency of False Positive Result

- 3.4. Market Trends

- 3.4.1. Immunologic Assays Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Systemic Autoimmune Disease

- 5.1.1.1. Rheumatoid Arthritis

- 5.1.1.2. Psoriasis

- 5.1.1.3. Systemic Lupus Erythematosus (SLE)

- 5.1.1.4. Multiple Sclerosis

- 5.1.1.5. Other Disease Types

- 5.1.2. Localized Autoimmune Disease

- 5.1.2.1. Inflammatory Bowel disease

- 5.1.2.2. Type 1 Diabetes

- 5.1.2.3. Thyroid

- 5.1.2.4. Other Localized Autoimmune Diseases

- 5.1.1. Systemic Autoimmune Disease

- 5.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 5.2.1. Regular Laboratory Tests

- 5.2.2. Inflammatory Markers

- 5.2.3. Immunologic Assays

- 5.2.4. Antibody Tests

- 5.2.5. Other Tests

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. United States North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Systemic Autoimmune Disease

- 6.1.1.1. Rheumatoid Arthritis

- 6.1.1.2. Psoriasis

- 6.1.1.3. Systemic Lupus Erythematosus (SLE)

- 6.1.1.4. Multiple Sclerosis

- 6.1.1.5. Other Disease Types

- 6.1.2. Localized Autoimmune Disease

- 6.1.2.1. Inflammatory Bowel disease

- 6.1.2.2. Type 1 Diabetes

- 6.1.2.3. Thyroid

- 6.1.2.4. Other Localized Autoimmune Diseases

- 6.1.1. Systemic Autoimmune Disease

- 6.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 6.2.1. Regular Laboratory Tests

- 6.2.2. Inflammatory Markers

- 6.2.3. Immunologic Assays

- 6.2.4. Antibody Tests

- 6.2.5. Other Tests

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Canada North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Systemic Autoimmune Disease

- 7.1.1.1. Rheumatoid Arthritis

- 7.1.1.2. Psoriasis

- 7.1.1.3. Systemic Lupus Erythematosus (SLE)

- 7.1.1.4. Multiple Sclerosis

- 7.1.1.5. Other Disease Types

- 7.1.2. Localized Autoimmune Disease

- 7.1.2.1. Inflammatory Bowel disease

- 7.1.2.2. Type 1 Diabetes

- 7.1.2.3. Thyroid

- 7.1.2.4. Other Localized Autoimmune Diseases

- 7.1.1. Systemic Autoimmune Disease

- 7.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 7.2.1. Regular Laboratory Tests

- 7.2.2. Inflammatory Markers

- 7.2.3. Immunologic Assays

- 7.2.4. Antibody Tests

- 7.2.5. Other Tests

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Mexico North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Systemic Autoimmune Disease

- 8.1.1.1. Rheumatoid Arthritis

- 8.1.1.2. Psoriasis

- 8.1.1.3. Systemic Lupus Erythematosus (SLE)

- 8.1.1.4. Multiple Sclerosis

- 8.1.1.5. Other Disease Types

- 8.1.2. Localized Autoimmune Disease

- 8.1.2.1. Inflammatory Bowel disease

- 8.1.2.2. Type 1 Diabetes

- 8.1.2.3. Thyroid

- 8.1.2.4. Other Localized Autoimmune Diseases

- 8.1.1. Systemic Autoimmune Disease

- 8.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 8.2.1. Regular Laboratory Tests

- 8.2.2. Inflammatory Markers

- 8.2.3. Immunologic Assays

- 8.2.4. Antibody Tests

- 8.2.5. Other Tests

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Oncimmune

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 HYCOR Biomedical

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Grifols SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Werfen Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Abbott Laboratories

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Siemens Healthineers Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Bio-rad Laboratories

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Myriad Genetics

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Euroimmun AG (Perkinelmer Inc )

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 F Hoffmann-la Roche

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Thermo Fisher Scientific

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Trinity Biotech

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Oncimmune

List of Figures

- Figure 1: North America Autoimmune Disease Diagnostics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Autoimmune Disease Diagnostics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 2: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 3: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2020 & 2033

- Table 4: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2020 & 2033

- Table 5: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 10: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 11: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2020 & 2033

- Table 12: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2020 & 2033

- Table 13: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 18: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 19: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2020 & 2033

- Table 20: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2020 & 2033

- Table 21: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 26: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 27: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2020 & 2033

- Table 28: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2020 & 2033

- Table 29: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Autoimmune Disease Diagnostics Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the North America Autoimmune Disease Diagnostics Market?

Key companies in the market include Oncimmune, HYCOR Biomedical, Grifols SA, Werfen Group, Abbott Laboratories, Siemens Healthineers Inc, Bio-rad Laboratories, Myriad Genetics, Euroimmun AG (Perkinelmer Inc ), F Hoffmann-la Roche, Thermo Fisher Scientific, Trinity Biotech.

3. What are the main segments of the North America Autoimmune Disease Diagnostics Market?

The market segments include Disease Type, Diagnostic Test, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence and Growing Public Awareness of Autoimmune Diseases; Technological Advancements in Autoimmune Disease Diagnostics.

6. What are the notable trends driving market growth?

Immunologic Assays Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Slow Turnaround Time for Autoimmune Disease Diagnostic Test Results; High Frequency of False Positive Result.

8. Can you provide examples of recent developments in the market?

February 2023: Edesa Biotech received approval from Health Canada for a phase II clinical trial of its EB06 monoclonal antibody candidate to treat vitiligo, a life-altering autoimmune disease.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Autoimmune Disease Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Autoimmune Disease Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Autoimmune Disease Diagnostics Market?

To stay informed about further developments, trends, and reports in the North America Autoimmune Disease Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence