Key Insights

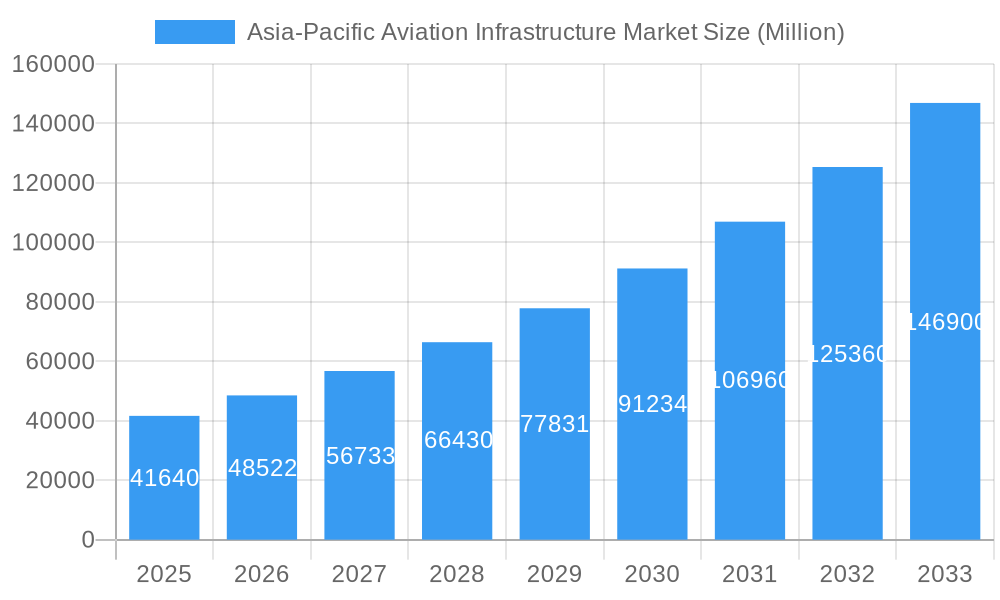

The Asia-Pacific aviation infrastructure market is experiencing robust growth, projected to reach \$41.64 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 16.61% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning air travel demand, driven by rapid economic growth and rising disposable incomes in countries like China, India, and Japan, necessitates significant investments in airport infrastructure to accommodate increased passenger and cargo traffic. Secondly, governments across the Asia-Pacific are prioritizing infrastructure development as a cornerstone of national economic strategies, leading to substantial public and private investments in airport expansions, new airport constructions, and improved air traffic management systems. Furthermore, technological advancements in airport operations, such as the implementation of advanced baggage handling systems and improved security technologies, are contributing to efficiency gains and attracting further investment. The market is segmented by airport type (commercial, military, general aviation) and infrastructure type (terminals, control towers, runways, aprons, hangars), providing diverse investment opportunities. Major players like JALUX Inc, GMR Group, and AECOM are actively shaping the market landscape through large-scale projects and technological innovations.

Asia-Pacific Aviation Infrastructure Market Market Size (In Billion)

The significant growth in the Asia-Pacific aviation infrastructure market is however, not without its challenges. While significant investments are being made, securing funding for large-scale projects can be complex, involving intricate regulatory processes and environmental considerations. Competition for skilled labor and expertise in specialized areas such as air traffic control and airport construction is also fierce. Furthermore, geopolitical factors and potential economic slowdowns could impact investment decisions and project timelines. Despite these challenges, the long-term outlook for the Asia-Pacific aviation infrastructure market remains positive, driven by strong underlying demand, supportive government policies, and continued advancements in technology. The market's continued expansion will significantly shape the region's connectivity and economic development in the coming years.

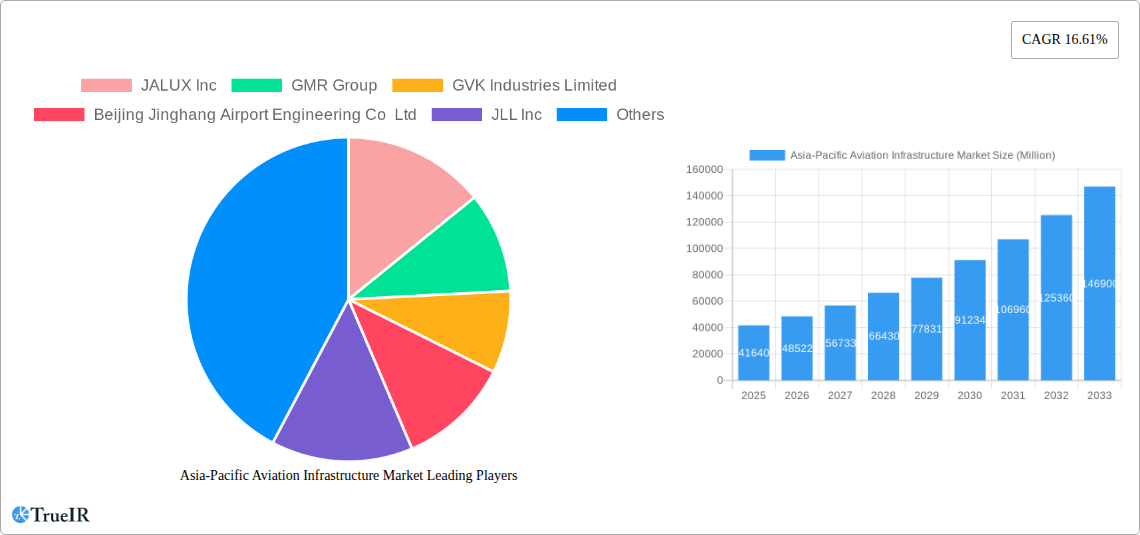

Asia-Pacific Aviation Infrastructure Market Company Market Share

Asia-Pacific Aviation Infrastructure Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Asia-Pacific aviation infrastructure market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive research and data covering the period 2019-2033 (base year 2025, forecast period 2025-2033), this report offers a comprehensive overview of market size, segmentation, growth drivers, challenges, and competitive landscape. The report includes granular data on key market segments, including airport types (commercial, military, general aviation) and infrastructure types (terminals, control towers, taxiways, runways, aprons, hangars, and other infrastructure). Key players such as JALUX Inc, GMR Group, GVK Industries Limited, Beijing Jinghang Airport Engineering Co Ltd, JLL Inc, Turner Construction Company, DLF Limite, and AECOM Limited are thoroughly examined.

Asia-Pacific Aviation Infrastructure Market Market Structure & Competitive Landscape

The Asia-Pacific aviation infrastructure market is characterized by a moderately concentrated structure, with the Herfindahl-Hirschman Index (HHI) estimated to be around 1800-2200 in 2025. This concentration is primarily due to the significant role of a few large, established players in the design, construction, and management of major international airports. However, the market is witnessing an increasing trend towards fragmentation as specialized firms emerge to cater to niche segments, including general aviation, cargo facilities, and specialized maintenance infrastructure. This evolving landscape presents both opportunities for large-scale integrated solutions and specialized service providers.

Innovation Drivers: The market is propelled by a wave of technological advancements. Key among these is the widespread adoption of smart airport technologies, encompassing AI-powered air traffic management systems for enhanced efficiency and safety, advanced passenger processing technologies, and predictive maintenance solutions. Furthermore, a strong emphasis on sustainable infrastructure is driving the development of solar-powered airports, the use of recycled and low-carbon construction materials, and water conservation systems. Innovations in modular construction and advanced materials are also contributing to faster project delivery and improved durability.

Regulatory Impacts: Government regulations are pivotal in shaping the Asia-Pacific aviation infrastructure market. They govern project approvals, enforce stringent safety standards, and dictate environmental compliance. While strict regulations, particularly those pertaining to environmental impact assessments and noise pollution, can act as a barrier by increasing project costs and extending timelines, they simultaneously serve as a catalyst for innovation by demanding greener and more efficient solutions. Evolving aviation policies and the drive towards regional integration are also influencing infrastructure development strategies.

Product Substitutes: Direct substitutes for core aviation infrastructure are limited. However, the market faces significant indirect competition from the advancement of alternative modes of transportation, most notably high-speed rail networks, which are increasingly connecting major cities and regions within Asia-Pacific, potentially diverting some passenger and cargo traffic from air travel for shorter to medium-haul journeys.

End-User Segmentation: The primary end-users of aviation infrastructure services are government agencies (responsible for national aviation policy and oversight), airport operators (managing day-to-day operations and expansion), and private investors (seeking returns on infrastructure development). The growing trend of privatization and public-private partnerships (PPPs) in airport operations and development is a significant dynamic, leading to increased private sector involvement and investment in modernizing and expanding aviation facilities.

M&A Trends: The Asia-Pacific aviation infrastructure market has observed a notable volume of mergers and acquisitions (M&A) activity during the historical period (2019-2024), with an estimated 30-45 deals. These transactions, collectively valued at approximately USD 5-8 Billion, underscore a strategic imperative for established players to consolidate market share, acquire new technologies, expand their geographic footprint, and diversify their service offerings. This trend indicates a maturing market where strategic alliances and acquisitions are key to sustained growth and competitive advantage.

Asia-Pacific Aviation Infrastructure Market Market Trends & Opportunities

The Asia-Pacific aviation infrastructure market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This expansion is fueled by several factors: rapid urbanization, rising disposable incomes leading to increased air travel demand, government initiatives to boost connectivity and tourism, and the continuous modernization of existing airports.

Technological shifts, including the adoption of automation, artificial intelligence, and big data analytics are transforming airport operations, enhancing efficiency, and improving passenger experience. Consumer preferences are shifting towards convenient, efficient, and eco-friendly airports. Competitive dynamics are shaping the market, leading to increased investments in innovative technologies and service offerings to differentiate players and cater to evolving market demands. The market penetration rate of advanced technologies in airports is anticipated to reach xx% by 2033.

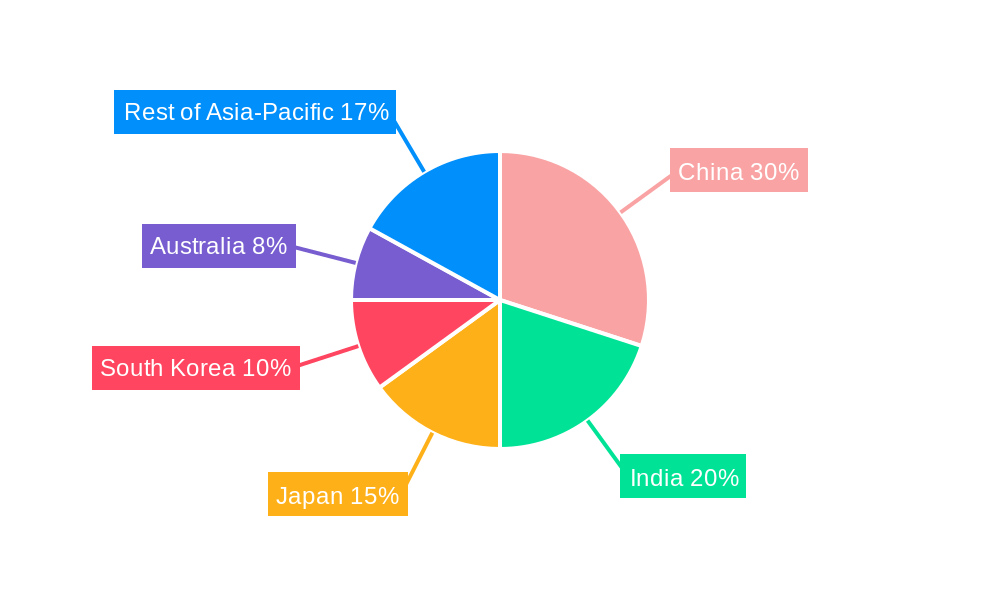

Dominant Markets & Segments in Asia-Pacific Aviation Infrastructure Market

Dominant Region/Country: China and India are projected to dominate the market due to significant investments in airport infrastructure, rising air passenger traffic, and supportive government policies. Other key markets include Japan, South Korea, Australia, and Singapore.

Dominant Segments:

- Airport Type: Commercial airports constitute the largest segment, owing to the continuous growth in air travel demand.

- Infrastructure Type: Terminals account for a significant share, followed by taxiways and runways, driven by the necessity for capacity expansion at existing airports and construction of new facilities.

Key Growth Drivers:

- Government Initiatives: Significant investments from both central and local governments in airport infrastructure development projects are driving the market.

- Infrastructure Development: Rapid infrastructure development in major metropolitan areas is creating a demand for new airports and expansion of existing ones.

- Tourism Growth: The booming tourism sector is boosting air travel demand, further driving the need for more extensive and efficient airport infrastructure.

- Rising Disposable Incomes: Growing affluence in several Asian countries is leading to greater air travel affordability, thus propelling demand for enhanced airport facilities.

Asia-Pacific Aviation Infrastructure Market Product Analysis

The Asia-Pacific aviation infrastructure market is witnessing significant product innovations, focusing on enhancing efficiency, safety, and sustainability. This includes the integration of advanced technologies like smart baggage handling systems, advanced air traffic control systems, and sustainable building materials. These innovations offer significant competitive advantages by improving operational efficiency, reducing environmental impact, and enhancing passenger experience. The market fit for these advancements is high, driven by the increasing demand for improved airport infrastructure and operational capabilities.

Key Drivers, Barriers & Challenges in Asia-Pacific Aviation Infrastructure Market

Key Drivers:

- Robust Growth in Air Passenger and Cargo Traffic: The persistent and significant rise in both leisure and business air travel, coupled with the burgeoning e-commerce sector driving air cargo demand, necessitates continuous expansion and modernization of existing airports and the development of new ones across the region.

- Proactive Government Investments and Policy Support: Governments across Asia-Pacific are actively investing in and prioritizing aviation infrastructure development as a cornerstone of economic growth, connectivity, and tourism. Supportive policies, master plans, and direct funding are crucial enablers.

- Rapid Technological Advancements and Digital Transformation: The integration of cutting-edge technologies, including AI, IoT, big data analytics, and automation, is revolutionizing airport operations, enhancing efficiency, improving passenger experience, and bolstering safety and security measures.

- Urbanization and Economic Development: Rapid urbanization and sustained economic growth in key Asia-Pacific economies are directly fueling demand for air travel, consequently driving the need for enhanced aviation infrastructure to support these dynamic centers.

- Focus on Sustainability and Green Infrastructure: A growing global and regional emphasis on environmental protection is pushing for the development of sustainable aviation infrastructure, including energy-efficient terminals, renewable energy integration, and eco-friendly construction practices.

Key Challenges:

- Substantial Initial Investment and Funding Requirements: The construction and extensive modernization of large-scale aviation infrastructure demand enormous capital outlays, posing significant financial challenges and requiring complex funding models.

- Complex Land Acquisition and Site Constraints: Identifying and acquiring suitable land for new airport development, particularly in densely populated or environmentally sensitive areas, is a protracted and challenging process, often encountering local opposition and requiring extensive feasibility studies.

- Navigating Complex Regulatory and Permitting Processes: The aviation sector is heavily regulated. Obtaining necessary approvals, adhering to diverse national and international standards, and navigating complex environmental and safety regulations can lead to significant project delays and cost overruns. An estimated 15-25% delay in project completion is commonly observed in cases involving protracted regulatory approvals.

- Supply Chain Volatility and Material Shortages: Global supply chain disruptions, exacerbated by geopolitical events and pandemics, can lead to shortages of critical construction materials, equipment, and skilled labor, driving up costs and impacting project timelines.

- Skilled Workforce Shortages: The specialized nature of aviation infrastructure projects requires a highly skilled workforce for design, engineering, construction, and maintenance. A persistent shortage of such expertise can hinder project execution.

- Environmental and Social Impact Management: Balancing the need for infrastructure development with environmental protection, noise pollution mitigation, and community engagement remains a significant challenge, requiring careful planning and stakeholder management.

Growth Drivers in the Asia-Pacific Aviation Infrastructure Market Market

The Asia-Pacific aviation infrastructure market is propelled by increasing air passenger traffic, government investments in infrastructure development, and technological advancements that improve operational efficiency and sustainability. Economic growth in the region is also a major factor, fueling demand for improved air connectivity and stimulating tourism. Supportive government policies, including tax incentives and streamlined regulatory approvals, further facilitate market growth.

Challenges Impacting Asia-Pacific Aviation Infrastructure Market Growth

Key challenges include high upfront capital expenditures for infrastructure projects, land acquisition difficulties, and complex regulatory approvals often leading to project delays. Supply chain constraints and skilled labor shortages also pose significant hurdles. Competition amongst established players and the need to balance infrastructure investments with environmental concerns further complicate growth. These challenges can lead to cost overruns and project delays, impacting market growth and profitability.

Key Players Shaping the Asia-Pacific Aviation Infrastructure Market Market

- JALUX Inc

- GMR Group

- GVK Industries Limited

- Beijing Jinghang Airport Engineering Co Ltd

- JLL Inc

- Turner Construction Company

- DLF Limite

- AECOM Limited

Significant Asia-Pacific Aviation Infrastructure Market Industry Milestones

- 2021: Several nations, including India, Indonesia, and Vietnam, unveiled ambitious, multi-year airport infrastructure development plans and initiated tenders for new terminal constructions and runway extensions.

- 2022: A notable increase in the adoption and integration of sustainable building materials, such as low-carbon concrete and recycled aggregates, in major airport construction projects across countries like Australia and South Korea.

- 2023: Significant investments and pilot programs were launched for advanced smart airport technologies, including the widespread deployment of AI-powered air traffic management systems, biometric passenger processing, and IoT-enabled airport operations management.

- 2024: The completion of several transformative airport expansion projects, most notably in cities like Bangkok, Manila, and several key hubs in China, significantly enhancing passenger capacity, cargo handling capabilities, and operational efficiency.

- Ongoing (2024-2025): Increased focus on the development of dedicated cargo hubs and the expansion of existing ones to support the booming e-commerce sector and global trade, with notable projects in Singapore, Kuala Lumpur, and Shenzhen.

- Ongoing (2024-2025): Growing emphasis on the development of "green" airports, with a rising number of projects incorporating renewable energy sources (solar, wind), advanced water management systems, and initiatives to reduce carbon footprints.

Future Outlook for Asia-Pacific Aviation Infrastructure Market Market

The Asia-Pacific aviation infrastructure market is on a robust trajectory for sustained and significant expansion in the coming years. This growth will be propelled by a confluence of powerful factors, including the relentless increase in air passenger traffic driven by a growing middle class, expanding economies, and a resurgent tourism sector. Furthermore, substantial and ongoing investments in infrastructure development by governments and private entities, coupled with continuous technological innovation, will be key enablers. Strategic partnerships, including public-private collaborations and cross-border ventures, are expected to play an increasingly vital role in financing, developing, and managing complex aviation projects. The imperative for sustainable and eco-friendly airport infrastructure will move from a niche consideration to a core requirement, driving the adoption of green technologies and practices. These trends collectively paint a highly optimistic picture for the Asia-Pacific aviation infrastructure market, promising substantial opportunities for growth, innovation, and transformation in the years ahead, solidifying its position as a critical engine for regional economic development and global connectivity.

Asia-Pacific Aviation Infrastructure Market Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangars

- 2.6. Other Infrastructure Types

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Australia

- 3.1.6. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Aviation Infrastructure Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

Asia-Pacific Aviation Infrastructure Market Regional Market Share

Geographic Coverage of Asia-Pacific Aviation Infrastructure Market

Asia-Pacific Aviation Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Airport Segment is Expected to Dominate the Market During the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Aviation Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangars

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Australia

- 5.3.1.6. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JALUX Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GMR Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GVK Industries Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beijing Jinghang Airport Engineering Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JLL Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Turner Construction Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DLF Limite

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AECOM Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 JALUX Inc

List of Figures

- Figure 1: Asia-Pacific Aviation Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Aviation Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 6: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 7: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Aviation Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Aviation Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Aviation Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia-Pacific Aviation Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Asia-Pacific Aviation Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Aviation Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Asia-Pacific Aviation Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Aviation Infrastructure Market?

The projected CAGR is approximately 16.61%.

2. Which companies are prominent players in the Asia-Pacific Aviation Infrastructure Market?

Key companies in the market include JALUX Inc, GMR Group, GVK Industries Limited, Beijing Jinghang Airport Engineering Co Ltd, JLL Inc, Turner Construction Company, DLF Limite, AECOM Limited.

3. What are the main segments of the Asia-Pacific Aviation Infrastructure Market?

The market segments include Airport Type, Infrastructure Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.64 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Airport Segment is Expected to Dominate the Market During the Forecast Period..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Aviation Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Aviation Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Aviation Infrastructure Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Aviation Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence