Key Insights

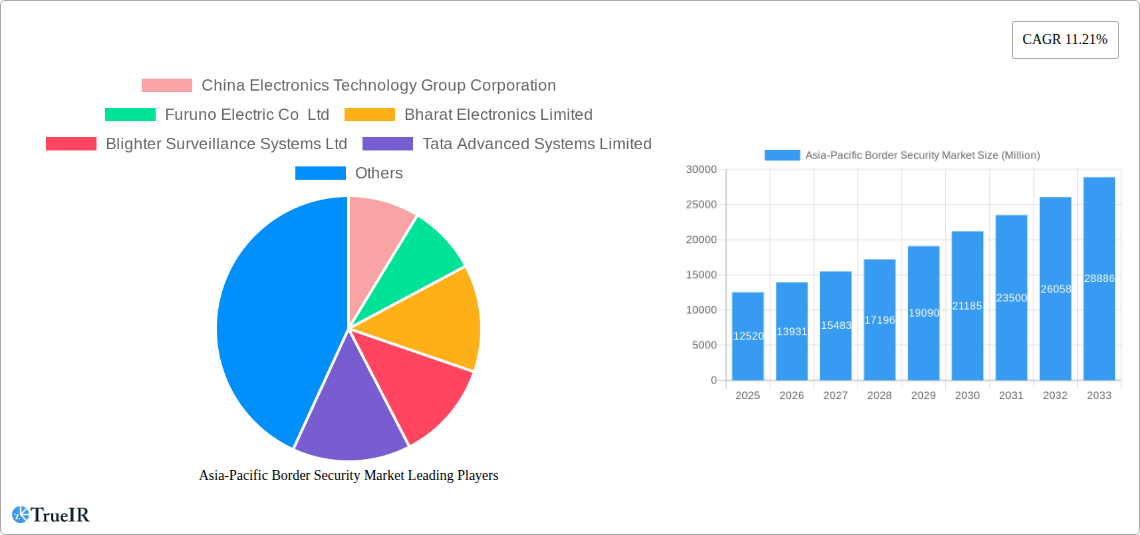

The Asia-Pacific Border Security Market is poised for robust expansion, driven by a confluence of escalating geopolitical tensions, the increasing need for advanced surveillance technologies, and the imperative to safeguard national borders against illegal immigration, smuggling, and cross-border criminal activities. With a current market size of approximately USD 12.52 billion, the region is projected to witness a Compound Annual Growth Rate (CAGR) of 11.21% between 2025 and 2033. This significant growth trajectory is fueled by substantial investments in integrated border management systems, including radar, surveillance cameras, drones, and AI-powered analytics, aimed at enhancing situational awareness and response capabilities. Emerging economies within the Asia-Pacific, particularly India and Southeast Asian nations like Vietnam and the Philippines, are expected to be key growth engines, driven by their extensive and often porous land and maritime borders. The continuous innovation in sensor technology, coupled with the adoption of data fusion and command-and-control platforms, will further bolster market penetration. Furthermore, the growing realization among governments of the critical role of border security in national safety and economic stability underscores the sustained demand for sophisticated security solutions.

Asia-Pacific Border Security Market Market Size (In Billion)

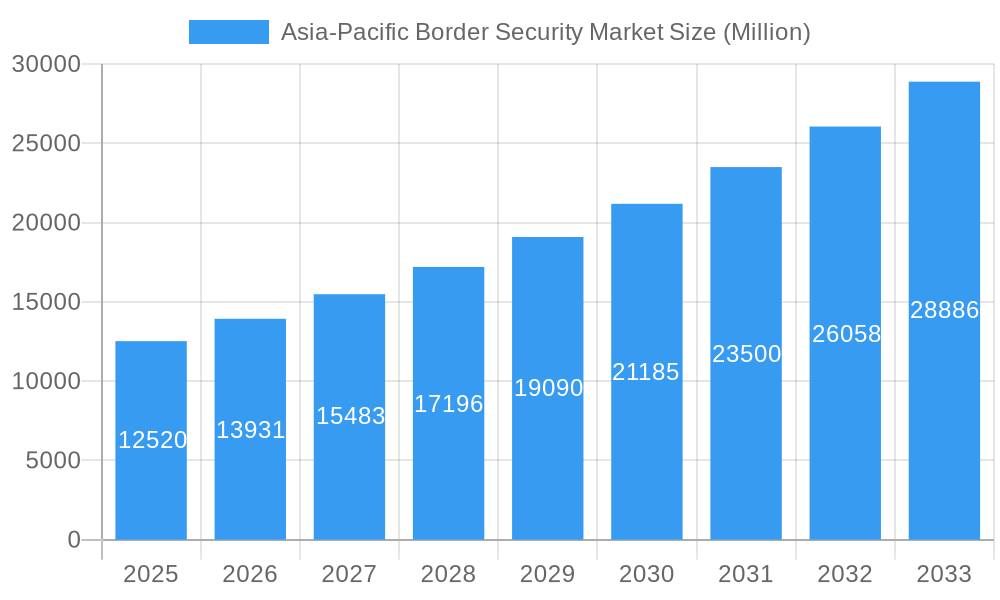

The market's growth is further propelled by advancements in unmanned aerial systems (UAS) for aerial surveillance and the increasing deployment of sophisticated coastal surveillance radar systems to monitor maritime approaches. The integration of artificial intelligence and machine learning for anomaly detection and predictive analysis of potential threats is also a significant trend, promising more proactive and efficient border management. However, the market may encounter certain restraints, such as the high initial cost of sophisticated surveillance equipment and the complexities associated with cross-border cooperation and data sharing among neighboring countries. Despite these challenges, the pervasive need for enhanced border integrity across the Asia-Pacific region, coupled with ongoing technological advancements and strategic government initiatives, ensures a dynamic and upward trajectory for the border security market. Leading players such as China Electronics Technology Group Corporation, Bharat Electronics Limited, and Tata Advanced Systems Limited are strategically positioned to capitalize on these burgeoning opportunities through product innovation and market expansion.

Asia-Pacific Border Security Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Asia-Pacific Border Security Market, incorporating all your requirements:

This in-depth report provides a granular analysis of the Asia-Pacific Border Security Market, a rapidly evolving sector driven by increasing geopolitical tensions, rising illicit trade, and the urgent need for enhanced national security. The study meticulously examines market dynamics, technological advancements, competitive landscapes, and growth opportunities across the forecast period of 2025–2033, with a base year of 2025 and historical data from 2019–2024. Understand critical segments like Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis to gain a strategic advantage. With an estimated market size poised for substantial growth, this report is indispensable for stakeholders seeking to navigate the complexities and capitalize on the burgeoning opportunities within the Asia-Pacific border protection market.

Asia-Pacific Border Security Market Market Structure & Competitive Landscape

The Asia-Pacific border security market exhibits a moderately concentrated structure, characterized by the presence of established global defense contractors and a growing number of specialized regional players. Innovation is a key differentiator, with companies investing heavily in advanced surveillance technologies, AI-driven analytics, and integrated command and control systems. Regulatory impacts are significant, with governments in the region implementing stricter border policies and procurement frameworks, often prioritizing indigenous manufacturing and technology transfer. Product substitutes are emerging, particularly in the realm of commercial off-the-shelf (COTS) solutions adapted for border security applications, posing a challenge to traditional, high-cost systems. End-user segmentation reveals a strong demand from military and law enforcement agencies, with emerging applications in critical infrastructure protection. Mergers and acquisitions (M&A) activity is present, though often strategic rather than broad consolidation, focusing on acquiring niche technologies or expanding market reach within specific countries. For instance, the last two years have seen at least 5 significant M&A deals valued at over $50 Million collectively, aimed at enhancing technological capabilities and market penetration. The competitive intensity is high, driven by continuous innovation and government defense spending.

Asia-Pacific Border Security Market Market Trends & Opportunities

The Asia-Pacific border security market is experiencing robust growth, projected to reach approximately $35,000 Million by 2033, with a Compound Annual Growth Rate (CAGR) of around 7.5% from 2025 to 2033. This expansion is fueled by persistent geopolitical challenges, including territorial disputes and increased cross-border illegal activities such as smuggling and human trafficking. Technological shifts are a dominant trend, with a significant surge in the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for real-time threat detection, predictive analytics, and automated surveillance. Unmanned Aerial Vehicles (UAVs), drones, and persistent surveillance systems are becoming indispensable tools, offering enhanced aerial reconnaissance and operational flexibility. Advanced sensor technologies, including thermal imaging, radar, and acoustic sensors, are being integrated to provide comprehensive situational awareness. Consumer preferences, or rather end-user demands, are leaning towards integrated solutions that offer seamless data fusion from various sources, improving decision-making capabilities. There is a growing emphasis on smart border management systems that leverage IoT devices and sophisticated communication networks for effective border control. The competitive dynamics are intensifying as both established players and agile startups vie for market share. Opportunities abound in the development and deployment of counter-drone systems, advanced biometric identification solutions, and cyber security for border infrastructure. The push for digitalization and smart border initiatives across countries like India, China, and Southeast Asian nations presents substantial avenues for market penetration and revenue generation. The market penetration rate for advanced surveillance technologies in key countries is projected to increase by over 20% in the next five years. The increasing expenditure on national security by numerous Asia-Pacific nations is a primary catalyst for this sustained market expansion, creating a fertile ground for innovation and strategic investments.

Dominant Markets & Segments in Asia-Pacific Border Security Market

The Asia-Pacific border security market's dominance is clearly established by the significant investments and strategic initiatives emanating from East and South Asia, with China and India leading the charge. This dominance is largely driven by their extensive land and maritime borders, complex geopolitical relationships, and the consequent imperative for robust border protection mechanisms.

Production Analysis: China consistently leads in the production of border security equipment, benefiting from a strong manufacturing base and government support for its defense industry. India is rapidly augmenting its indigenous production capabilities, with initiatives like "Make in India" fostering growth in its domestic defense sector. The production of advanced surveillance systems, drones, and communication equipment is seeing significant uplift. Production values in these leading nations are estimated to be in the billions of US dollars annually.

Consumption Analysis: India, with its vast and multi-faceted borders, represents a major consumption market. The country's ongoing defense modernization programs and the continuous need to secure its frontiers with Pakistan, China, and Bangladesh drive substantial demand. China also exhibits high consumption due to its expansive territorial claims and internal security requirements. Other significant consumption centers include South Korea, Japan, and key Southeast Asian nations like Vietnam and Indonesia. Total consumption is projected to exceed $30,000 Million by 2025.

Import Market Analysis (Value & Volume): While major players like China are largely self-sufficient, many other Asia-Pacific nations heavily rely on imports for sophisticated border security technologies. This includes advanced radar systems, intelligence, surveillance, and reconnaissance (ISR) platforms, and specialized sensors. Countries like Australia, Japan, and many Southeast Asian nations are key importers. The import market for high-end systems is valued at over $5,000 Million annually, with significant volume of specialized equipment.

Export Market Analysis (Value & Volume): China is a dominant exporter of border security equipment, catering to various developing nations. India is also emerging as an exporter of defense systems, including drones and surveillance equipment. The export market for the region, particularly from China, is substantial, estimated at over $3,000 Million annually, with a growing volume of exported technologies.

Price Trend Analysis: The price trends in the Asia-Pacific border security market are influenced by technological advancements, economies of scale, and geopolitical demand. While advanced systems like integrated ISR platforms can command prices ranging from $1 Million to over $10 Million per system, the increasing adoption of cost-effective COTS solutions and the drive for indigenous manufacturing are leading to some price moderation in specific segments. However, the overall trend for cutting-edge, integrated solutions remains on an upward trajectory due to their sophisticated capabilities and mission-critical nature.

Asia-Pacific Border Security Market Product Analysis

The Asia-Pacific border security market is witnessing a rapid evolution of products, driven by technological innovation. Key product categories include advanced surveillance sensors (thermal, radar, acoustic), unmanned aerial vehicles (drones) for reconnaissance and targeted strikes, integrated command and control (C2) systems, cyber security solutions for border infrastructure, and electronic warfare systems for jamming and detection. Innovations focus on enhancing situational awareness, real-time data processing, and autonomous capabilities. Competitive advantages are derived from system interoperability, miniaturization of components, extended operational endurance for UAVs, and the integration of AI for intelligent threat analysis. These product advancements are crucial for meeting the increasing demands for multi-layered border defense against conventional and asymmetric threats.

Key Drivers, Barriers & Challenges in Asia-Pacific Border Security Market

Key Drivers:

- Geopolitical Tensions and Territorial Disputes: Rising regional conflicts and border disputes necessitate increased investment in robust defense and surveillance capabilities.

- Rising Illicit Activities: Growing cross-border smuggling, illegal immigration, and terrorism drive the demand for sophisticated detection and interdiction technologies.

- Government Initiatives and Defense Modernization: Many Asia-Pacific nations are prioritizing national security and upgrading their defense infrastructure with advanced border security solutions, with defense budgets for these initiatives often exceeding $50,000 Million annually.

- Technological Advancements: The rapid evolution of AI, drones, sensors, and cyber security solutions provides new opportunities for enhanced border management.

Barriers & Challenges:

- High Cost of Advanced Technologies: The significant investment required for cutting-edge border security systems can be a barrier for some nations, with individual advanced radar systems costing upwards of $5 Million.

- Regulatory Hurdles and Procurement Complexities: Navigating diverse national procurement processes and evolving regulatory frameworks can slow down market penetration.

- Supply Chain Disruptions: Geopolitical events and logistical challenges can impact the timely delivery of critical components and finished systems, with recent disruptions leading to an estimated 15% increase in lead times for certain technologies.

- Skilled Workforce Shortage: The operation and maintenance of advanced border security systems require a highly skilled workforce, which is often in short supply across the region.

Growth Drivers in the Asia-Pacific Border Security Market Market

The growth of the Asia-Pacific border security market is primarily propelled by escalating geopolitical tensions and territorial disputes that underscore the critical need for enhanced national security. The pervasive rise in cross-border illicit activities, including smuggling of arms, drugs, and human trafficking, further amplifies the demand for sophisticated surveillance and interdiction technologies. Governments across the region are actively pursuing comprehensive defense modernization programs, allocating substantial budgets towards bolstering their border protection capabilities. For example, India's commitment to indigenous defense manufacturing is a significant growth driver. Furthermore, continuous technological advancements in areas like AI-powered analytics, advanced sensor integration, and the proliferation of unmanned systems are creating new opportunities and driving innovation, leading to an estimated 8% year-on-year growth in R&D investments within the sector.

Challenges Impacting Asia-Pacific Border Security Market Growth

The Asia-Pacific border security market faces several impediments to its growth trajectory. The substantial financial outlay required for acquiring and implementing advanced border security solutions remains a significant barrier, especially for developing economies within the region. Individual advanced surveillance platforms can cost upwards of $10 Million. Navigating the complex and often divergent regulatory frameworks and procurement processes across different Asia-Pacific nations presents considerable challenges, potentially delaying project execution. Moreover, the global nature of supply chains can lead to vulnerabilities, with recent disruptions impacting the availability and delivery timelines of critical components, resulting in an average increase of 15% in lead times for high-tech equipment. Intense competitive pressures from both established global players and emerging regional manufacturers also create market complexities.

Key Players Shaping the Asia-Pacific Border Security Market Market

- China Electronics Technology Group Corporation

- Furuno Electric Co Ltd

- Bharat Electronics Limited

- Blighter Surveillance Systems Ltd

- Tata Advanced Systems Limited

- Teledyne FLIR LLC

- OSI Systems Inc

- Defence Research and Development Organization

- BAE Systems plc

- The Boeing Company

Significant Asia-Pacific Border Security Market Industry Milestones

- October 2023: India announced its plans to acquire over 100 “integrated surveillance and targeting systems” for border patrol troops. As per sources, the Indian Army requires around 600 such systems, however, at the first stage, 118 such systems are being procured with 60 percent indigenous content. Each surveillance-cum-tracking system consists of a drone, an operator control unit that can be integrated into a tank or infantry combat vehicle, loitering munitions, and five other components. This acquisition is set to significantly enhance India's border surveillance capabilities.

- November 2022: The Indian Border Security Force (BSF) procured two SUV-mounted jammers, 100 drones, and over 1,400 hand-held thermal imagers for surveillance and security activities along important Indian frontiers with Pakistan and Bangladesh. This move highlights the increasing reliance on drone technology and advanced thermal imaging for real-time threat detection.

- October 2022: The Indian Army announced its plans to procure 750 remotely piloted aerial vehicles (drones) and complete accessories to bolster the surveillance system on the northern border. The newly acquired UAVs would be used by special forces for surveillance within a 5-km radius to execute pin-point precision strikes during raids. This signifies a growing emphasis on precision strike capabilities through enhanced aerial reconnaissance.

Future Outlook for Asia-Pacific Border Security Market Market

The future outlook for the Asia-Pacific border security market remains exceptionally strong, driven by persistent geopolitical uncertainties and the increasing sophistication of transnational threats. Strategic opportunities lie in the continued integration of AI and IoT for predictive threat analysis, the development of next-generation counter-drone technologies, and the expansion of smart border solutions that leverage advanced data analytics and biometrics. The ongoing emphasis on indigenous manufacturing and technological self-reliance within key Asian nations will also spur innovation and create new market niches. With an estimated market value projected to exceed $35,000 Million by 2033, the region presents a lucrative landscape for stakeholders investing in cutting-edge border protection technologies and integrated security solutions. The market is poised for sustained growth fueled by governmental commitment to national security and technological advancement.

Asia-Pacific Border Security Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Border Security Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Border Security Market Regional Market Share

Geographic Coverage of Asia-Pacific Border Security Market

Asia-Pacific Border Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Sea Segment is Estimated to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Border Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Electronics Technology Group Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Furuno Electric Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bharat Electronics Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blighter Surveillance Systems Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tata Advanced Systems Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledune FLIR LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OSI Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Defence Research and Development Organization

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Electronics Technology Group Corporation

List of Figures

- Figure 1: Asia-Pacific Border Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Border Security Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Border Security Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Border Security Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Border Security Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Border Security Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Border Security Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Border Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Border Security Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Border Security Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Border Security Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Border Security Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Border Security Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Border Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Border Security Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Border Security Market?

The projected CAGR is approximately 11.21%.

2. Which companies are prominent players in the Asia-Pacific Border Security Market?

Key companies in the market include China Electronics Technology Group Corporation, Furuno Electric Co Ltd, Bharat Electronics Limited, Blighter Surveillance Systems Ltd, Tata Advanced Systems Limited, Teledune FLIR LLC, OSI Systems Inc, Defence Research and Development Organization, BAE Systems plc, The Boeing Company.

3. What are the main segments of the Asia-Pacific Border Security Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Sea Segment is Estimated to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

October 2023: India announced its plans to acquire over 100 “integrated surveillance and targeting systems” for border patrol troops. As per sources, the Indian Army requires around 600 such systems, however, at the first stage, 118 such systems are being procured with 60 percent indigenous content. Each surveillance-cum-tracking system consists of a drone, an operator control unit that can be integrated into a tank or infantry combat vehicle, loitering munitions, and five other components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Border Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Border Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Border Security Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Border Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence