Key Insights

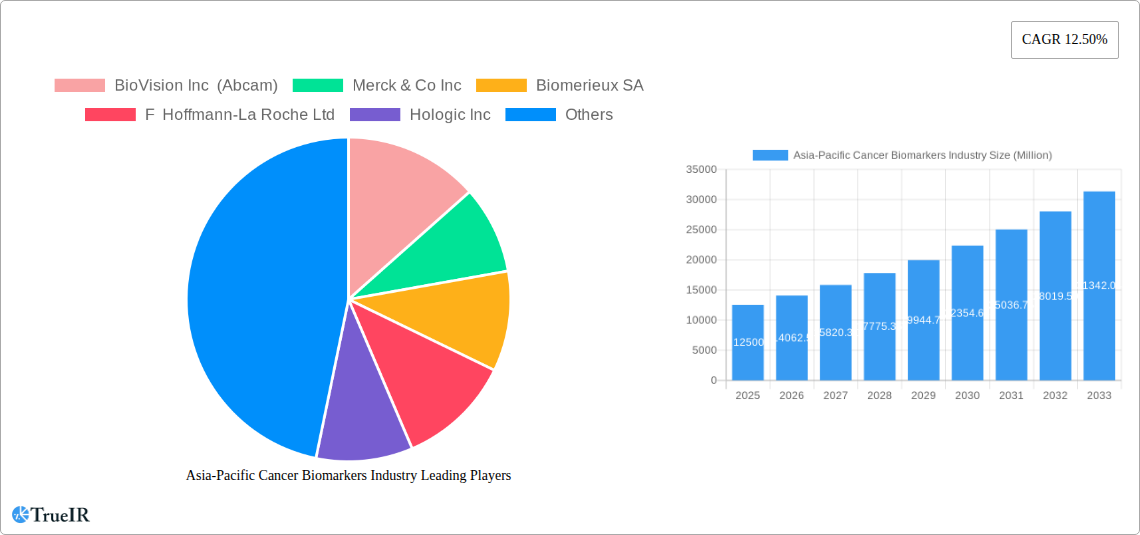

The Asia-Pacific Cancer Biomarkers Market is projected for significant expansion, anticipated to reach $30.7 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 12.4%. This growth is propelled by increasing cancer incidence, advancements in diagnostic technologies, and the rising adoption of personalized medicine. Precision oncology strategies, heavily reliant on biomarkers for treatment guidance, are a key driver. Enhanced healthcare expenditure, greater awareness of early cancer detection, and government initiatives supporting cancer research further contribute to market growth. Leading segments by cancer type include Prostate, Breast, and Lung Cancer, with Protein and Genetic Biomarkers dominating the biomarker types due to the shift towards molecular diagnostics.

Asia-Pacific Cancer Biomarkers Industry Market Size (In Billion)

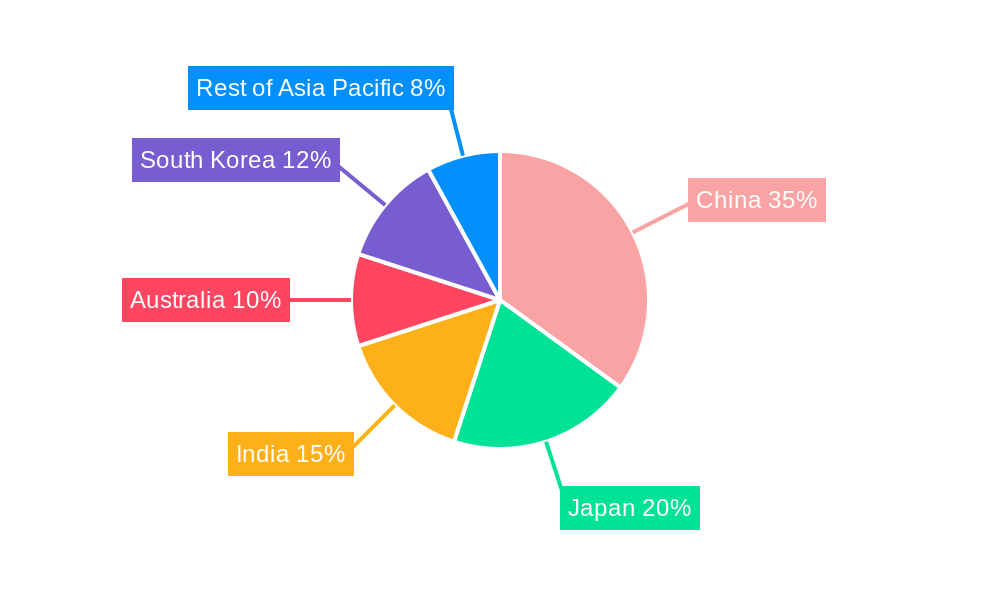

Within profiling technologies, OMICS Technologies lead, offering comprehensive molecular profiling. Imaging Technologies and Immunoassays also hold substantial market share, providing complementary diagnostic insights. Geographically, China is expected to lead market size and growth, driven by its large population, expanding healthcare infrastructure, and government focus on disease management. Japan and India are also significant contributors, fueled by their growing healthcare sectors and demand for advanced diagnostics. While high test costs and evolving regulatory frameworks in some developing economies present challenges, technological innovations and policy reforms are improving accessibility and affordability. The competitive landscape features major global players actively pursuing research and development for novel biomarker solutions.

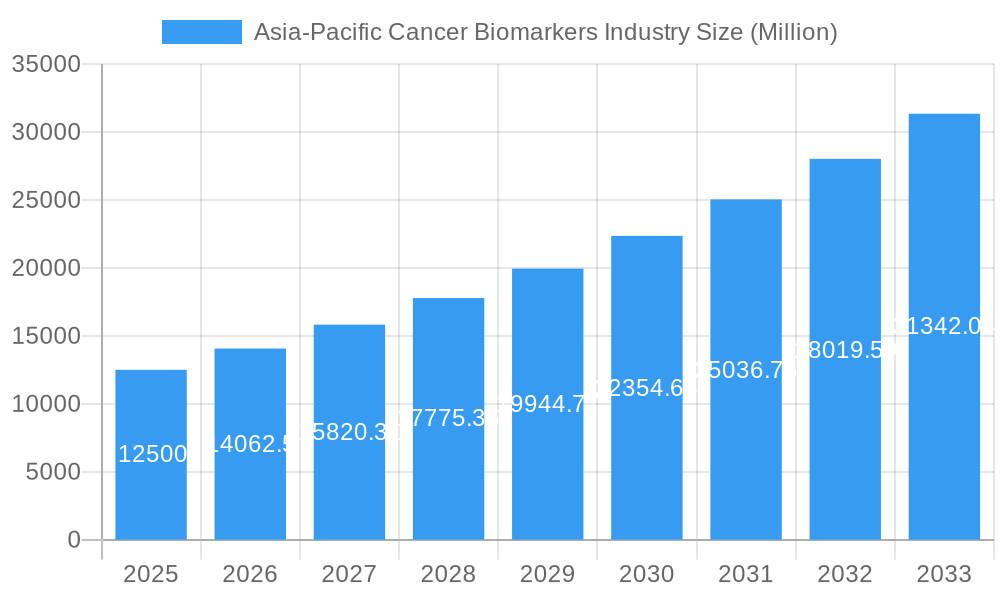

Asia-Pacific Cancer Biomarkers Industry Company Market Share

This report provides an in-depth analysis of the Asia-Pacific Cancer Biomarkers Market, covering the period 2019-2033, with a base year of 2025. It examines market structure, key trends, dominant segments, product innovations, growth drivers, challenges, and future outlook, offering strategic insights for stakeholders in cancer diagnostics and personalized medicine.

Asia-Pacific Cancer Biomarkers Industry Market Structure & Competitive Landscape

The Asia-Pacific cancer biomarkers market exhibits a moderately consolidated structure, with a blend of established global players and emerging regional innovators. Key market concentration drivers include the high cost of R&D for novel biomarker discovery, stringent regulatory approval processes, and the need for substantial investment in advanced profiling technologies. Innovation is heavily driven by advancements in genomic sequencing, proteomic analysis, and AI-powered data interpretation, leading to the development of more precise and sensitive diagnostic tools.

Regulatory frameworks across countries like China, Japan, and South Korea are evolving, influencing market entry and product approvals. While FDA and EMA standards often serve as benchmarks, local adaptations are becoming increasingly significant. Product substitutes are primarily other diagnostic modalities, but the superior specificity and early detection capabilities of biomarkers are creating a distinct market segment. End-user segmentation is driven by healthcare providers, research institutions, and pharmaceutical companies, with an increasing focus on personalized treatment strategies. Merger and acquisition (M&A) activities are anticipated to grow, as larger companies seek to integrate innovative technologies and expand their geographic reach. Notable M&A trends include acquisitions of smaller biotech firms with promising biomarker pipelines, aiming to enhance competitive advantage and market share. The competitive landscape is characterized by intense R&D efforts, strategic partnerships, and a growing emphasis on companion diagnostics.

Asia-Pacific Cancer Biomarkers Industry Market Trends & Opportunities

The Asia-Pacific cancer biomarkers market is poised for substantial growth, projected to reach several billion USD by the end of the forecast period. This expansion is fueled by a confluence of factors including a rising incidence of various cancers, increasing healthcare expenditure, and a growing awareness among both healthcare professionals and patients regarding the benefits of early detection and personalized treatment. The aging population across the region is a significant demographic trend contributing to the increased demand for advanced cancer diagnostics.

Technological shifts are profoundly reshaping the market. The widespread adoption of next-generation sequencing (NGS), advanced proteomics, and liquid biopsy techniques are enabling the identification of novel biomarkers with unprecedented accuracy. These technologies are moving cancer diagnosis and treatment from a "one-size-fits-all" approach to highly personalized strategies, optimizing therapeutic efficacy and minimizing adverse effects. Consumer preferences are increasingly leaning towards non-invasive diagnostic methods, with liquid biopsies emerging as a key area of innovation and adoption. This trend is particularly strong in countries with a high digital penetration and a demand for patient convenience.

Competitive dynamics are intensifying, with companies focusing on developing comprehensive biomarker panels for various cancer types and investing in companion diagnostic development to support targeted therapies. The market presents significant opportunities for companies that can offer cost-effective and clinically validated biomarker solutions, particularly for prevalent cancers like breast, lung, and colorectal cancer. Strategic collaborations between diagnostic companies, pharmaceutical firms, and academic research institutions are becoming crucial for accelerating biomarker discovery and clinical translation. Furthermore, the growing emphasis on preventive healthcare and early screening programs across Asia-Pacific nations is creating a sustained demand for reliable cancer biomarkers. The market penetration rate of advanced biomarker testing is expected to see a significant upward trajectory, driven by supportive government initiatives and advancements in healthcare infrastructure.

Dominant Markets & Segments in Asia-Pacific Cancer Biomarkers Industry

China stands as a dominant market within the Asia-Pacific cancer biomarkers industry, driven by its massive population, increasing healthcare investments, and a growing focus on advanced diagnostics. The country’s rapid economic development has led to a substantial rise in disposable income, enabling greater access to sophisticated medical technologies. Supportive government policies aimed at improving healthcare infrastructure and promoting innovation in the life sciences sector further bolster China’s market leadership.

Key Growth Drivers in China:

- Government Initiatives: Strong policy support for R&D and the commercialization of new diagnostic technologies.

- Healthcare Infrastructure Expansion: Significant investments in hospitals, diagnostic centers, and research facilities.

- Rising Cancer Incidence: High prevalence of various cancers necessitating advanced detection methods.

- Growing Middle Class: Increased affordability and demand for premium healthcare services.

Within cancer types, Breast Cancer and Lung Cancer are major growth drivers due to their high incidence rates across the region. Breast cancer, in particular, benefits from widespread awareness campaigns and the availability of established protein biomarkers like HER2 and hormone receptors. Lung cancer diagnosis is increasingly reliant on genetic biomarkers for targeted therapy selection.

Type of Biomarker analysis: Genetic Biomarkers are experiencing rapid growth, propelled by the advancements in genomic sequencing technologies such as NGS. These biomarkers offer high specificity for identifying actionable mutations and are crucial for personalized medicine strategies, especially in lung and colorectal cancers. Protein Biomarkers, while established, continue to play a vital role, particularly in areas like prostate and breast cancer screening and prognosis.

Profiling Technology analysis: OMICS Technologies, encompassing genomics, proteomics, and metabolomics, are at the forefront of innovation, enabling the discovery of novel and complex biomarker signatures. Immunoassays remain a cornerstone for the detection of protein biomarkers, offering reliable and cost-effective solutions for routine diagnostics. The penetration of OMICS technologies is expected to surge, driving the discovery of new therapeutic targets and diagnostic markers.

Geography analysis: Beyond China, Japan and South Korea are significant contributors, characterized by advanced technological adoption, well-established healthcare systems, and a proactive approach to personalized medicine. India presents a rapidly growing market with a large unmet need and increasing investment in healthcare. Australia is a mature market with a strong research base and early adoption of innovative diagnostic solutions. The Rest of Asia-Pacific region, while diverse, shows promising growth potential due to expanding healthcare access and increasing awareness of cancer diagnostics.

Asia-Pacific Cancer Biomarkers Industry Product Analysis

The Asia-Pacific cancer biomarkers industry is characterized by a surge in product innovations focused on enhanced diagnostic accuracy, early disease detection, and personalized treatment selection. Key advancements include the development of multiplex assays capable of detecting multiple biomarkers simultaneously, leading to more comprehensive patient profiling. Innovations in liquid biopsy technologies are enabling non-invasive cancer detection and monitoring, significantly improving patient convenience and compliance. Furthermore, the integration of AI and machine learning algorithms with biomarker data is facilitating the identification of complex predictive and prognostic signatures, thereby optimizing therapeutic strategies for conditions like breast, lung, and prostate cancer. Competitive advantages are increasingly derived from clinical validation studies, regulatory approvals, and strategic partnerships with pharmaceutical companies developing targeted therapies.

Key Drivers, Barriers & Challenges in Asia-Pacific Cancer Biomarkers Industry

Key Drivers:

- Technological Advancements: Rapid progress in genomic sequencing, proteomics, and AI-driven data analysis.

- Increasing Cancer Incidence: Growing prevalence of various cancer types across the region.

- Growing Healthcare Expenditure: Increased investment in diagnostics and personalized medicine.

- Supportive Government Policies: Initiatives promoting R&D and market access for innovative diagnostics.

- Demand for Personalized Medicine: A shift towards tailored treatment strategies based on individual patient profiles.

Barriers & Challenges:

- Regulatory Hurdles: Complex and varying approval processes across different Asian countries.

- Cost of Advanced Technologies: High initial investment and ongoing operational costs for sophisticated biomarker platforms.

- Lack of Skilled Workforce: Shortage of trained professionals in bioinformatics and molecular diagnostics.

- Reimbursement Policies: Inconsistent and often limited reimbursement for novel biomarker tests.

- Data Standardization and Sharing: Challenges in establishing universal data formats and enabling seamless data exchange for research and clinical applications.

Growth Drivers in the Asia-Pacific Cancer Biomarkers Industry Market

The Asia-Pacific cancer biomarkers industry is experiencing robust growth driven by several key factors. Technological innovation, particularly in areas like next-generation sequencing (NGS) and liquid biopsies, is enabling the discovery and validation of novel biomarkers for early detection and personalized treatment. Increasing cancer incidence rates across the region, coupled with a growing aging population, are creating a sustained demand for effective diagnostic solutions. Furthermore, rising healthcare expenditure and government initiatives aimed at improving cancer care infrastructure and promoting R&D are providing a conducive environment for market expansion. The shift towards personalized medicine is a significant catalyst, empowering clinicians to select optimal therapies based on individual patient genetic profiles, thereby enhancing treatment efficacy and patient outcomes.

Challenges Impacting Asia-Pacific Cancer Biomarkers Industry Growth

Despite its promising trajectory, the Asia-Pacific cancer biomarkers industry faces several significant challenges. Regulatory complexities and the varying approval pathways across different countries can hinder rapid market penetration and increase compliance costs. The high cost of advanced diagnostic technologies and biomarker assays can also be a barrier, especially in developing economies, limiting accessibility for a broader patient population. Reimbursement policies often lag behind technological advancements, creating a gap between the availability of innovative tests and their widespread adoption by healthcare systems. Supply chain disruptions, although less prevalent for software-based diagnostics, can impact the availability of consumables for assay kits. Lastly, intense competitive pressures necessitate continuous innovation and strategic pricing to maintain market share.

Key Players Shaping the Asia-Pacific Cancer Biomarkers Industry Market

- BioVision Inc (Abcam)

- Merck & Co Inc

- Biomerieux SA

- F Hoffmann-La Roche Ltd

- Hologic Inc

- Celera Corporation (Quest Diagnostics)

- ASURAGEN INC

- Qiagen NV

- Illumina Inc

- Abbott Laboratories Inc

- Thermo Fisher Scientific

- Agilent Technologies

Significant Asia-Pacific Cancer Biomarkers Industry Industry Milestones

- October 2022: The Garvan Institute of Medical Research in Australia discovered a new biomarker for prostate cancer that could lead to better diagnosis and treatment for men with the aggressive form of this disease.

- February 2022: The University of South Australia used novel biomarkers to decode metastatic breast cancer. They found a connection between aggressive breast cancer cells and the dual CXCR4-CCR7 cell surface protein complexes.

Future Outlook for Asia-Pacific Cancer Biomarkers Industry Market

The future outlook for the Asia-Pacific cancer biomarkers industry is exceptionally bright, driven by ongoing technological advancements and increasing healthcare investments. The expansion of liquid biopsy technology is expected to revolutionize cancer screening and monitoring, offering non-invasive and highly accurate detection. The growing adoption of AI and machine learning in biomarker discovery and data analysis will further enhance diagnostic precision and accelerate the development of personalized therapies. Strategic collaborations and partnerships will continue to be crucial for navigating the complex regulatory landscapes and fostering innovation. As cancer awareness rises and healthcare systems prioritize early detection and targeted treatments, the demand for advanced cancer biomarkers in the Asia-Pacific region is projected to witness exponential growth, presenting significant opportunities for market players and ultimately improving patient outcomes across the continent.

Asia-Pacific Cancer Biomarkers Industry Segmentation

-

1. Cancer Type

- 1.1. Prostate Cancer

- 1.2. Breast Cancer

- 1.3. Lung Cancer

- 1.4. Colorectal Cancer

- 1.5. Cervical Cancer

- 1.6. Other Cancer Type

-

2. Type of Biomarker

- 2.1. Protein Biomarkers

- 2.2. Genetic Biomarkers

- 2.3. Other Types of Biomarkers

-

3. Profiling Technology

- 3.1. OMICS Technologies

- 3.2. Imaging Technologies

- 3.3. Immunoassays

- 3.4. Cytogenetics

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

Asia-Pacific Cancer Biomarkers Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Cancer Biomarkers Industry Regional Market Share

Geographic Coverage of Asia-Pacific Cancer Biomarkers Industry

Asia-Pacific Cancer Biomarkers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer; Increasing Research Activities and Growing Usage of Biomarkers in Drug Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Diagnosis; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Breast Cancer is Expected to Grow with a Significant CAGR in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 5.1.1. Prostate Cancer

- 5.1.2. Breast Cancer

- 5.1.3. Lung Cancer

- 5.1.4. Colorectal Cancer

- 5.1.5. Cervical Cancer

- 5.1.6. Other Cancer Type

- 5.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 5.2.1. Protein Biomarkers

- 5.2.2. Genetic Biomarkers

- 5.2.3. Other Types of Biomarkers

- 5.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 5.3.1. OMICS Technologies

- 5.3.2. Imaging Technologies

- 5.3.3. Immunoassays

- 5.3.4. Cytogenetics

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6. China Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6.1.1. Prostate Cancer

- 6.1.2. Breast Cancer

- 6.1.3. Lung Cancer

- 6.1.4. Colorectal Cancer

- 6.1.5. Cervical Cancer

- 6.1.6. Other Cancer Type

- 6.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 6.2.1. Protein Biomarkers

- 6.2.2. Genetic Biomarkers

- 6.2.3. Other Types of Biomarkers

- 6.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 6.3.1. OMICS Technologies

- 6.3.2. Imaging Technologies

- 6.3.3. Immunoassays

- 6.3.4. Cytogenetics

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7. Japan Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7.1.1. Prostate Cancer

- 7.1.2. Breast Cancer

- 7.1.3. Lung Cancer

- 7.1.4. Colorectal Cancer

- 7.1.5. Cervical Cancer

- 7.1.6. Other Cancer Type

- 7.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 7.2.1. Protein Biomarkers

- 7.2.2. Genetic Biomarkers

- 7.2.3. Other Types of Biomarkers

- 7.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 7.3.1. OMICS Technologies

- 7.3.2. Imaging Technologies

- 7.3.3. Immunoassays

- 7.3.4. Cytogenetics

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8. India Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8.1.1. Prostate Cancer

- 8.1.2. Breast Cancer

- 8.1.3. Lung Cancer

- 8.1.4. Colorectal Cancer

- 8.1.5. Cervical Cancer

- 8.1.6. Other Cancer Type

- 8.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 8.2.1. Protein Biomarkers

- 8.2.2. Genetic Biomarkers

- 8.2.3. Other Types of Biomarkers

- 8.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 8.3.1. OMICS Technologies

- 8.3.2. Imaging Technologies

- 8.3.3. Immunoassays

- 8.3.4. Cytogenetics

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9. Australia Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9.1.1. Prostate Cancer

- 9.1.2. Breast Cancer

- 9.1.3. Lung Cancer

- 9.1.4. Colorectal Cancer

- 9.1.5. Cervical Cancer

- 9.1.6. Other Cancer Type

- 9.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 9.2.1. Protein Biomarkers

- 9.2.2. Genetic Biomarkers

- 9.2.3. Other Types of Biomarkers

- 9.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 9.3.1. OMICS Technologies

- 9.3.2. Imaging Technologies

- 9.3.3. Immunoassays

- 9.3.4. Cytogenetics

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10. South Korea Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10.1.1. Prostate Cancer

- 10.1.2. Breast Cancer

- 10.1.3. Lung Cancer

- 10.1.4. Colorectal Cancer

- 10.1.5. Cervical Cancer

- 10.1.6. Other Cancer Type

- 10.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 10.2.1. Protein Biomarkers

- 10.2.2. Genetic Biomarkers

- 10.2.3. Other Types of Biomarkers

- 10.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 10.3.1. OMICS Technologies

- 10.3.2. Imaging Technologies

- 10.3.3. Immunoassays

- 10.3.4. Cytogenetics

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11. Rest of Asia Pacific Asia-Pacific Cancer Biomarkers Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11.1.1. Prostate Cancer

- 11.1.2. Breast Cancer

- 11.1.3. Lung Cancer

- 11.1.4. Colorectal Cancer

- 11.1.5. Cervical Cancer

- 11.1.6. Other Cancer Type

- 11.2. Market Analysis, Insights and Forecast - by Type of Biomarker

- 11.2.1. Protein Biomarkers

- 11.2.2. Genetic Biomarkers

- 11.2.3. Other Types of Biomarkers

- 11.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 11.3.1. OMICS Technologies

- 11.3.2. Imaging Technologies

- 11.3.3. Immunoassays

- 11.3.4. Cytogenetics

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Cancer Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BioVision Inc (Abcam)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Merck & Co Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Biomerieux SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 F Hoffmann-La Roche Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hologic Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Celera Corporation (Quest Diagnostics)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ASURAGEN INC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Qiagen NV

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Illumina Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Abbott Laboratories Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Thermo Fisher Scientific

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Agilent Technologies

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 BioVision Inc (Abcam)

List of Figures

- Figure 1: Asia-Pacific Cancer Biomarkers Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Cancer Biomarkers Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 2: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 3: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 4: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 5: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 6: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 7: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 12: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 13: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 14: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 15: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 16: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 17: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 22: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 23: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 24: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 25: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 26: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 27: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 32: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 33: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 34: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 35: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 36: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 37: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 42: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 43: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 44: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 45: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 46: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 47: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 52: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 53: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 54: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 55: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 56: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 57: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Cancer Type 2020 & 2033

- Table 62: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Cancer Type 2020 & 2033

- Table 63: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Type of Biomarker 2020 & 2033

- Table 64: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Type of Biomarker 2020 & 2033

- Table 65: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Profiling Technology 2020 & 2033

- Table 66: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Profiling Technology 2020 & 2033

- Table 67: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 68: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Asia-Pacific Cancer Biomarkers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Asia-Pacific Cancer Biomarkers Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Cancer Biomarkers Industry?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Asia-Pacific Cancer Biomarkers Industry?

Key companies in the market include BioVision Inc (Abcam), Merck & Co Inc, Biomerieux SA, F Hoffmann-La Roche Ltd, Hologic Inc, Celera Corporation (Quest Diagnostics), ASURAGEN INC, Qiagen NV, Illumina Inc, Abbott Laboratories Inc, Thermo Fisher Scientific, Agilent Technologies.

3. What are the main segments of the Asia-Pacific Cancer Biomarkers Industry?

The market segments include Cancer Type, Type of Biomarker, Profiling Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer; Increasing Research Activities and Growing Usage of Biomarkers in Drug Development.

6. What are the notable trends driving market growth?

Breast Cancer is Expected to Grow with a Significant CAGR in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Diagnosis; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

October 2022: The Garvan Institute of Medical Research in Australia discovered a new biomarker for prostate cancer that could lead to better diagnosis and treatment for men with the aggressive form of this disease.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Cancer Biomarkers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Cancer Biomarkers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Cancer Biomarkers Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Cancer Biomarkers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence