Key Insights

The Asia-Pacific commercial aircraft cabin seating market is projected for significant expansion, driven by escalating air travel demand and increasing aircraft deliveries. With a Compound Annual Growth Rate (CAGR) of 4.01%, the market is anticipated to reach a substantial value of $28.21 billion by 2033, with a base year of 2025. Key growth catalysts include the burgeoning middle class in economies such as China, India, and Indonesia, which is stimulating both leisure and business travel. The robust expansion of the low-cost carrier (LCC) segment further necessitates the development of cost-effective yet comfortable seating solutions, fostering market innovation. Technological advancements in seat design, focusing on enhanced passenger comfort, lightweight materials for improved fuel efficiency, and integrated in-flight entertainment systems, are also propelling market growth. Potential restraints include volatile fuel prices and economic uncertainties. The market is segmented by aircraft type (narrowbody and widebody) and key geographical regions including China, India, Indonesia, Japan, Singapore, South Korea, and the Rest of Asia-Pacific. China and India, due to their large populations and dynamic economies, currently lead market share, followed by Japan and South Korea. The competitive arena features global leaders such as Safran, Recaro, and Collins Aerospace, alongside regional specialists like Jamco Corporation, highlighting a landscape of established expertise and emerging innovation. The market's future trajectory is intrinsically linked to the sustained growth of regional air travel, continued economic prosperity in key nations, and the ongoing development of pioneering and sustainable seating solutions.

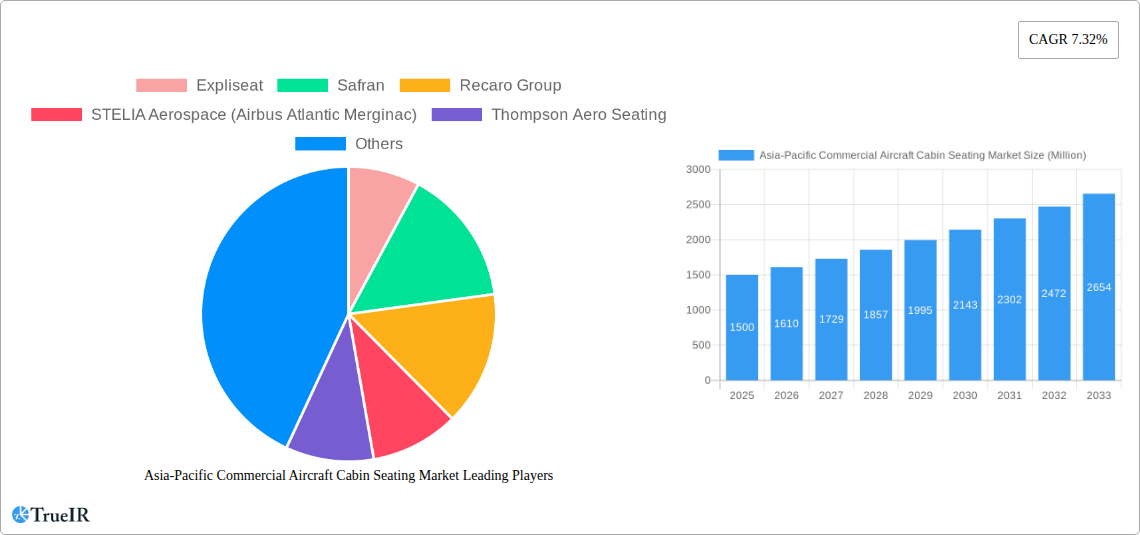

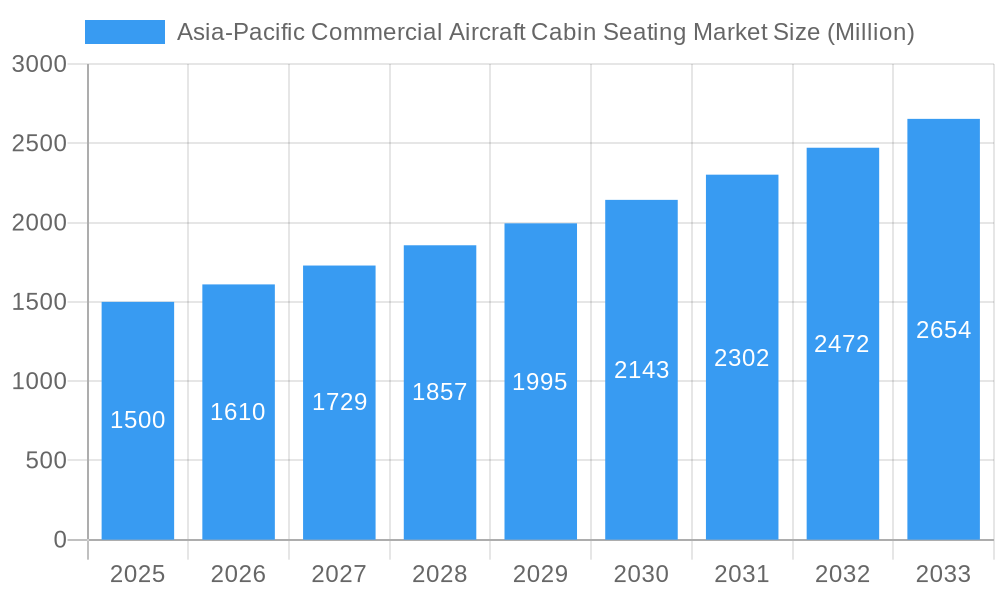

Asia-Pacific Commercial Aircraft Cabin Seating Market Market Size (In Billion)

The competitive landscape is dynamic, characterized by intense rivalry between established international manufacturers and emerging regional players. Strategic alliances, mergers, acquisitions, and continuous technological innovation are expected to define the market's future evolution. Companies are prioritizing the development of lighter, more comfortable, and technologically advanced seating solutions to meet evolving passenger expectations and diverse segment demands. This includes offering customizable options for various aircraft types and incorporating features such as improved ergonomics, seamless in-flight entertainment integration, and advanced passenger service systems. Regulatory frameworks and stringent safety standards also exert considerable influence, compelling manufacturers to innovate in materials and design for compliance. Sustained growth is forecasted, with potential for increased market consolidation driven by strategic initiatives from leading entities.

Asia-Pacific Commercial Aircraft Cabin Seating Market Company Market Share

Asia-Pacific Commercial Aircraft Cabin Seating Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Asia-Pacific commercial aircraft cabin seating market, offering invaluable insights for industry stakeholders. Leveraging extensive market research and data analysis spanning the period 2019-2033 (Historical Period: 2019-2024; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033), this report unveils key trends, growth drivers, and challenges shaping this rapidly evolving sector. Discover detailed segmentation by aircraft type (narrowbody and widebody), key countries (China, India, Indonesia, Japan, Singapore, South Korea, and Rest of Asia-Pacific), and leading players, including Expliseat, Safran, Recaro Group, STELIA Aerospace, Thompson Aero Seating, Jamco Corporation, Adient Aerospace, Collins Aerospace, and ZIM Aircraft Seating. The report's detailed analysis of market size, CAGR, and market penetration rates provides a complete picture of the current landscape and future projections, enabling informed strategic decision-making.

Asia-Pacific Commercial Aircraft Cabin Seating Market Market Structure & Competitive Landscape

The Asia-Pacific commercial aircraft cabin seating market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is characterized by intense competition, driven by continuous product innovation, evolving passenger preferences, and the increasing demand for advanced cabin technologies. The market's concentration ratio (CR4) in 2024 was estimated to be xx%, indicating a relatively consolidated market.

Key Aspects of Market Structure:

- Innovation Drivers: Ongoing advancements in lightweight materials, ergonomic design, and integrated in-flight entertainment systems are shaping the competitive landscape.

- Regulatory Impacts: Stringent safety regulations and certification processes influence product development and market entry.

- Product Substitutes: While direct substitutes are limited, the focus on enhanced passenger comfort and experience creates indirect competition from other in-flight amenities.

- End-User Segmentation: Airlines are the primary end-users, with differing requirements based on their fleet size, route network, and target passenger demographics.

- M&A Trends: The past five years have witnessed xx mergers and acquisitions (M&A) transactions, primarily driven by the need for technological advancements, expanded market reach, and enhanced product portfolios. The total value of these transactions is estimated to be around xx Million.

Asia-Pacific Commercial Aircraft Cabin Seating Market Market Trends & Opportunities

The Asia-Pacific commercial aircraft cabin seating market is experiencing robust growth, driven by a surge in air passenger traffic, rapid expansion of low-cost carriers, and increasing investments in airline infrastructure. The market size was valued at approximately xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

This significant growth is fueled by several key factors:

- Technological Advancements: Lightweight materials, improved ergonomics, and advanced cabin technologies such as interactive seatback entertainment systems are driving demand.

- Evolving Consumer Preferences: Passengers increasingly prioritize comfort, connectivity, and personalized in-flight experiences, influencing seating design and features.

- Competitive Dynamics: Intense competition among manufacturers is leading to continuous product innovations and cost-effective solutions, benefiting airlines and passengers.

- Market Penetration: The penetration rate of advanced seating technologies is steadily increasing, reflecting the growing demand for enhanced passenger comfort and in-flight services.

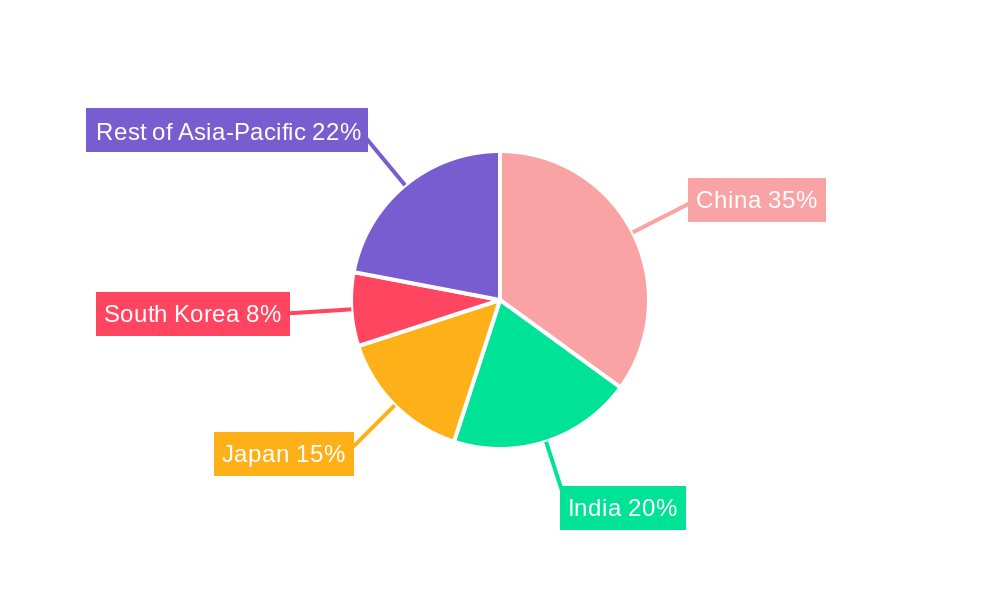

Dominant Markets & Segments in Asia-Pacific Commercial Aircraft Cabin Seating Market

China and India are currently the dominant markets in the Asia-Pacific region, driven by their robust domestic air travel growth and expansion of airline fleets.

Key Growth Drivers:

- China: Rapid economic development, increasing disposable incomes, and significant investments in airport infrastructure are fueling substantial growth.

- India: The burgeoning middle class, rising air travel demand, and government initiatives promoting air connectivity contribute to market expansion.

- Narrowbody Aircraft: This segment dominates the market due to the high demand for fuel-efficient and cost-effective aircraft among low-cost carriers.

- Widebody Aircraft: This segment is witnessing growth driven by the increasing number of long-haul flights and the preference for enhanced passenger comfort on international routes.

Detailed Analysis of Market Dominance: China's dominance stems from its vast domestic market and substantial investments in expanding air travel infrastructure. India's rapid growth is propelled by a burgeoning middle class and increasing demand for affordable air travel. The narrowbody segment holds the majority market share due to the prevalence of point-to-point travel and the significant growth of low-cost carriers in the region. However, the widebody segment is showing promising growth potential driven by expanding long-haul routes.

Asia-Pacific Commercial Aircraft Cabin Seating Market Product Analysis

Recent product innovations focus on enhancing passenger comfort, incorporating advanced technologies like integrated entertainment systems, and utilizing lightweight materials to improve fuel efficiency. Manufacturers are emphasizing designs that cater to specific passenger preferences, such as improved recline mechanisms, adjustable headrests, and increased personal space. The success of these products depends on factors such as cost-effectiveness, ease of maintenance, and ability to meet diverse airline requirements.

Key Drivers, Barriers & Challenges in Asia-Pacific Commercial Aircraft Cabin Seating Market

Key Drivers:

- Growth in Air Travel: The increasing number of air passengers in the Asia-Pacific region fuels demand for more aircraft and consequently, more seats.

- Technological Advancements: Innovations in lightweight materials, enhanced ergonomics, and integrated technology increase appeal to airlines and passengers.

- Government Policies: Favorable government policies supporting infrastructure development and aviation growth stimulate market expansion.

Challenges:

- Supply Chain Disruptions: Global supply chain constraints have led to delays and increased costs for raw materials and components, impacting production and delivery timelines. This effect is quantified by a xx% increase in production costs in 2024 compared to 2023.

- Regulatory Hurdles: Stringent safety regulations and certification processes can increase time-to-market for new products and increase development costs.

- Intense Competition: The presence of numerous established and emerging players creates intense competition, putting pressure on pricing and profitability.

Growth Drivers in the Asia-Pacific Commercial Aircraft Cabin Seating Market Market

The Asia-Pacific commercial aircraft cabin seating market's growth is significantly driven by the rapid expansion of low-cost carriers (LCCs), the increasing number of air passengers in the region, and the continual development of aircraft technology. Technological innovations, such as lighter weight and more comfortable seating designs, also play a crucial role in driving market growth. Moreover, supportive government policies towards infrastructure development further contribute to the sector's positive trajectory.

Challenges Impacting Asia-Pacific Commercial Aircraft Cabin Seating Market Growth

Several challenges hinder growth in this market, including fluctuating fuel prices influencing airline investments and the potential for supply chain disruptions. The stringent regulatory environment and increased competition from both established and emerging players add further complexity. Finally, the global economic climate can influence passenger demand and impact airlines' spending on cabin upgrades.

Key Players Shaping the Asia-Pacific Commercial Aircraft Cabin Seating Market Market

- Expliseat

- Safran

- Recaro Group

- STELIA Aerospace

- Thompson Aero Seating

- Jamco Corporation

- Adient Aerospace

- Collins Aerospace

- ZIM Aircraft Seating Gmb

Significant Asia-Pacific Commercial Aircraft Cabin Seating Market Industry Milestones

- June 2022: Recaro Aircraft Seating's BL3710 was selected for IndiGo’s new A321N and A320N aircraft. This highlights the growing preference for Recaro's products in the rapidly expanding Indian market.

- June 2022: STELIA Aerospace and AERQ collaborated on Cabin Digital Signage integration of OPERA seats for the A320neo family. This signifies the increasing integration of technology into aircraft cabin seating.

- July 2022: ZIM Aircraft Seating agreed to supply premium economy seats for Air New Zealand's Boeing 787-9 Dreamliner fleet. This showcases ZIM's success in securing contracts for premium seating on international routes.

Future Outlook for Asia-Pacific Commercial Aircraft Cabin Seating Market Market

The Asia-Pacific commercial aircraft cabin seating market is poised for sustained growth, driven by increasing air travel demand, technological advancements, and infrastructural development. Strategic opportunities exist for manufacturers to capitalize on the growing preference for enhanced passenger comfort, personalized in-flight experiences, and sustainable seating solutions. The market's potential is significant, with continued expansion expected across various segments and geographies within the Asia-Pacific region.

Asia-Pacific Commercial Aircraft Cabin Seating Market Segmentation

-

1. Aircraft Type

- 1.1. Narrowbody

- 1.2. Widebody

Asia-Pacific Commercial Aircraft Cabin Seating Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Commercial Aircraft Cabin Seating Market Regional Market Share

Geographic Coverage of Asia-Pacific Commercial Aircraft Cabin Seating Market

Asia-Pacific Commercial Aircraft Cabin Seating Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Commercial Aircraft Cabin Seating Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Narrowbody

- 5.1.2. Widebody

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Expliseat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Safran

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Recaro Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 STELIA Aerospace (Airbus Atlantic Merginac)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thompson Aero Seating

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jamco Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Adient Aerospace

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Collins Aerospace

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZIM Aircraft Seating Gmb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Expliseat

List of Figures

- Figure 1: Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Commercial Aircraft Cabin Seating Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Commercial Aircraft Cabin Seating Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Commercial Aircraft Cabin Seating Market?

The projected CAGR is approximately 4.01%.

2. Which companies are prominent players in the Asia-Pacific Commercial Aircraft Cabin Seating Market?

Key companies in the market include Expliseat, Safran, Recaro Group, STELIA Aerospace (Airbus Atlantic Merginac), Thompson Aero Seating, Jamco Corporation, Adient Aerospace, Collins Aerospace, ZIM Aircraft Seating Gmb.

3. What are the main segments of the Asia-Pacific Commercial Aircraft Cabin Seating Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: ZIM Aircraft Seating agreed to supply premium economy seats for Air New Zealand's Boeing 787-9 Dreamliner fleet.June 2022: STELIA Aerospace and AERQ to collaborate on Cabin Digital Signage integration of OPERA seats for the A320neo family.June 2022: Recaro Aircraft Seating's BL3710 was selected for IndiGo’s new A321N and A320N aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Commercial Aircraft Cabin Seating Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Commercial Aircraft Cabin Seating Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Commercial Aircraft Cabin Seating Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Commercial Aircraft Cabin Seating Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence