Key Insights

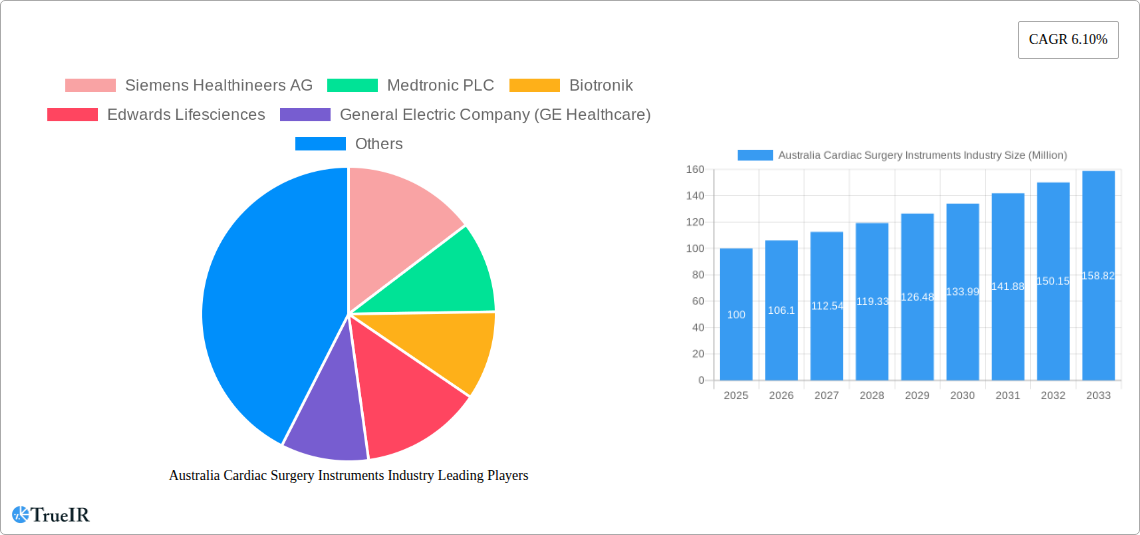

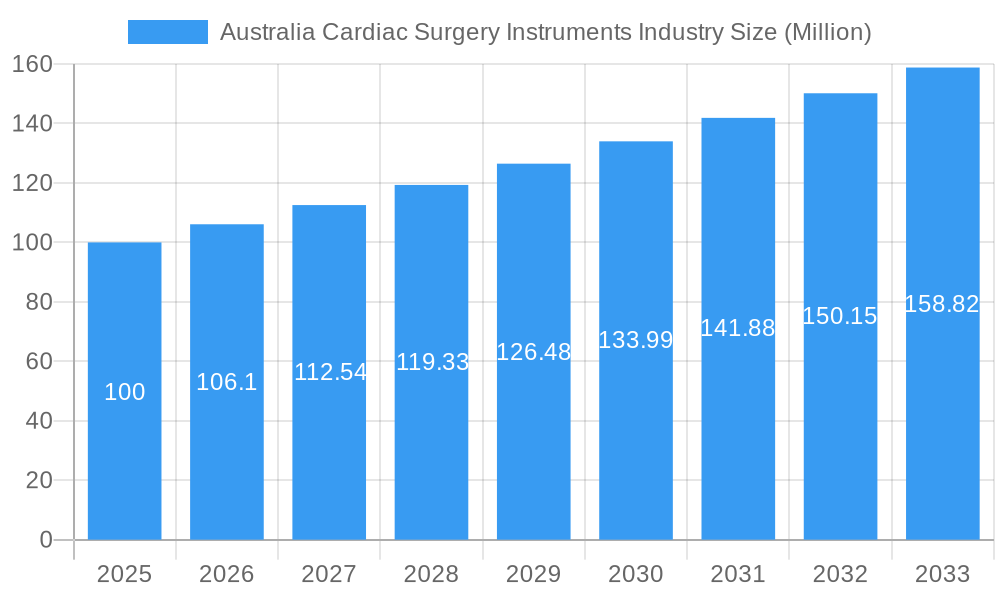

The Australian cardiac surgery instruments market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is fueled by several key drivers. An aging population, coupled with increasing prevalence of cardiovascular diseases like coronary artery disease and valvular heart disease, is significantly boosting demand for advanced cardiac surgery procedures. Technological advancements, including the development of minimally invasive surgical techniques and sophisticated instruments, are enhancing surgical outcomes and contributing to market growth. Furthermore, rising healthcare expenditure and improved healthcare infrastructure within Australia are facilitating greater access to specialized cardiac care, further fueling market expansion. The market is segmented by device type into diagnostic and monitoring devices and therapeutic and surgical devices, with the latter segment anticipated to hold a larger market share due to the higher complexity and cost of procedures requiring these instruments. Leading players such as Siemens Healthineers AG, Medtronic PLC, and Boston Scientific Corporation are shaping the market landscape through continuous innovation and strategic partnerships. Despite these positive factors, market growth may face some constraints such as high costs associated with advanced instruments, stringent regulatory approvals for new devices, and potential reimbursement challenges impacting accessibility for some patients.

Australia Cardiac Surgery Instruments Industry Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, driven by ongoing technological advancements focusing on enhanced precision, minimally invasive procedures, and improved patient outcomes. The market will likely witness increased competition among established players and the emergence of new entrants offering innovative products and solutions. Strategic acquisitions and mergers are expected to reshape the competitive landscape further. Government initiatives promoting preventative healthcare and early disease detection could positively influence market growth by reducing the incidence of advanced cardiovascular conditions requiring complex surgical interventions. However, careful monitoring of cost-effectiveness and accessibility of advanced technologies will remain crucial for sustainable market expansion.

Australia Cardiac Surgery Instruments Industry Company Market Share

Australia Cardiac Surgery Instruments Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Australia Cardiac Surgery Instruments market, offering crucial insights for industry stakeholders, investors, and strategists. Covering the period 2019-2033, with a base year of 2025, this report unveils the market's structure, competitive dynamics, growth drivers, challenges, and future outlook. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Australia Cardiac Surgery Instruments Industry Market Structure & Competitive Landscape

The Australian cardiac surgery instruments market exhibits a moderately consolidated structure. Major players like Siemens Healthineers AG, Medtronic PLC, Biotronik, Edwards Lifesciences, General Electric Company (GE Healthcare), Canon Medical Systems Corporation, Boston Scientific Corporation, B Braun SE, Abbott Laboratories, W L Gore & Associates Inc, and Cardinal Health Inc dominate the market, holding a combined market share of approximately xx%.

Innovation, driven by the need for minimally invasive procedures and improved patient outcomes, is a key market driver. Stringent regulatory frameworks, particularly those set by the Therapeutic Goods Administration (TGA), heavily influence market dynamics. The presence of substitute technologies (e.g., less invasive procedures) and the increasing adoption of advanced imaging technologies create both opportunities and challenges for existing players.

The market exhibits a clear segmentation by end-user (hospitals, cardiac surgery centers, etc.) and by device type (Diagnostic and Monitoring Devices, Therapeutic and Surgical Devices). Mergers and acquisitions (M&A) activity within the sector has been moderate in recent years, with xx major M&A deals recorded between 2019 and 2024, indicating a strategic focus on expanding product portfolios and geographical reach. The concentration ratio (CR4) for the market is estimated at xx%, reflecting the influence of the major players.

Australia Cardiac Surgery Instruments Industry Market Trends & Opportunities

The Australian cardiac surgery instruments market is poised for significant growth, driven by factors such as the rising prevalence of cardiovascular diseases, an aging population, and increasing government initiatives to improve healthcare infrastructure. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, representing a robust CAGR of xx%. Technological advancements, such as the integration of robotics and artificial intelligence in surgical procedures, are significantly impacting market dynamics. The growing preference for minimally invasive surgeries and improved patient outcomes is further accelerating market growth. Competitive intensity remains high, with companies focusing on product differentiation, strategic partnerships, and technological innovations to gain a competitive edge. Market penetration rates for advanced technologies are steadily increasing, particularly in major metropolitan areas.

Dominant Markets & Segments in Australia Cardiac Surgery Instruments Industry

The Australian cardiac surgery instruments market is geographically concentrated in major metropolitan areas such as Sydney, Melbourne, and Brisbane, reflecting higher healthcare infrastructure and concentration of specialized hospitals and clinics.

- Key Growth Drivers:

- Rising prevalence of cardiovascular diseases.

- Growing geriatric population.

- Government investments in healthcare infrastructure.

- Increasing adoption of minimally invasive surgical techniques.

The Therapeutic and Surgical Devices segment currently dominates the market, accounting for approximately xx% of the total market share in 2025. This segment is expected to witness higher growth compared to the Diagnostic and Monitoring Devices segment due to the increasing demand for advanced surgical instruments. This dominance is attributed to the growing preference for advanced surgical techniques and the continuous development of innovative devices. The Diagnostic and Monitoring Devices segment is expected to experience moderate growth owing to technological advancements in cardiac monitoring and diagnostic tools.

Australia Cardiac Surgery Instruments Industry Product Analysis

The market features a diverse range of instruments, including catheters, stents, valves, surgical tools, and monitoring devices. Recent innovations focus on miniaturization, improved precision, and enhanced functionalities. Companies are emphasizing the development of instruments with superior biocompatibility, reduced trauma, and faster recovery times to improve patient outcomes and reduce hospital stay duration. These advancements contribute to a more efficient and less invasive surgical experience, enhancing the market appeal of these products.

Key Drivers, Barriers & Challenges in Australia Cardiac Surgery Instruments Industry

Key Drivers: Technological advancements, such as the development of robotic-assisted surgery and minimally invasive techniques, are driving market growth. The aging population and increasing prevalence of cardiovascular diseases necessitate a growing demand for cardiac surgical instruments. Government initiatives to enhance healthcare infrastructure also play a significant role.

Challenges: Regulatory hurdles (TGA approvals), high manufacturing costs, and intense competition from both domestic and international players represent significant barriers to market entry and growth. Supply chain disruptions can lead to delays in product delivery and affect market stability. Price sensitivity in the Australian healthcare system, coupled with the reimbursement policies, can also impact profitability.

Growth Drivers in the Australia Cardiac Surgery Instruments Industry Market

The market is propelled by factors such as an aging population, increased prevalence of cardiovascular diseases, and rising demand for minimally invasive surgeries. Technological advancements leading to enhanced product features and functionality also serve as significant drivers. Government investments in healthcare infrastructure and supportive policies further fuel market expansion.

Challenges Impacting Australia Cardiac Surgery Instruments Industry Growth

The market faces challenges from stringent regulatory approvals, high manufacturing costs, supply chain disruptions, and intense competition. Price sensitivity within the healthcare system and reimbursement policies also impact market growth.

Key Players Shaping the Australia Cardiac Surgery Instruments Industry Market

- Siemens Healthineers AG

- Medtronic PLC

- Biotronik

- Edwards Lifesciences

- General Electric Company (GE Healthcare)

- Canon Medical Systems Corporation

- Boston Scientific Corporation

- B Braun SE

- Abbott Laboratories

- W L Gore & Associates Inc

- Cardinal Health Inc

Significant Australia Cardiac Surgery Instruments Industry Industry Milestones

- June 2022: Teleflex Incorporated launched its Arrow Pressure Injectable Midline Catheter in Australia, enhancing patient safety and addressing catheter identification confusion.

- March 2022: The Australian government allocated USD 17.2 Million for mobile health clinics, including cardiology services in Queensland, improving access to diagnosis and treatment.

Future Outlook for Australia Cardiac Surgery Instruments Industry Market

The Australian cardiac surgery instruments market is expected to experience continued growth, driven by technological advancements, the increasing prevalence of cardiovascular diseases, and government initiatives. Strategic partnerships, product diversification, and a focus on minimally invasive solutions will be key success factors for companies operating within this market. The potential for growth is significant, particularly in regional areas with limited access to specialized cardiac care.

Australia Cardiac Surgery Instruments Industry Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

Australia Cardiac Surgery Instruments Industry Segmentation By Geography

- 1. Australia

Australia Cardiac Surgery Instruments Industry Regional Market Share

Geographic Coverage of Australia Cardiac Surgery Instruments Industry

Australia Cardiac Surgery Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures and Technological Advancements in Cardiovascular Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Product Recalls

- 3.4. Market Trends

- 3.4.1. Electrocardiogram (ECG) Segment is Expected to Witness Growth Over The Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Cardiac Surgery Instruments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens Healthineers AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biotronik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Edwards Lifesciences

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Canon Medical Systems Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 B Braun SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abbott Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cardinal Health Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthineers AG

List of Figures

- Figure 1: Australia Cardiac Surgery Instruments Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Cardiac Surgery Instruments Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 2: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 6: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Cardiac Surgery Instruments Industry?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Australia Cardiac Surgery Instruments Industry?

Key companies in the market include Siemens Healthineers AG, Medtronic PLC, Biotronik, Edwards Lifesciences, General Electric Company (GE Healthcare), Canon Medical Systems Corporation, Boston Scientific Corporation, B Braun SE, Abbott Laboratories, W L Gore & Associates Inc, Cardinal Health Inc.

3. What are the main segments of the Australia Cardiac Surgery Instruments Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures and Technological Advancements in Cardiovascular Devices.

6. What are the notable trends driving market growth?

Electrocardiogram (ECG) Segment is Expected to Witness Growth Over The Forecast period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Product Recalls.

8. Can you provide examples of recent developments in the market?

June 2022: Teleflex Incorporated, a leading global provider of medical technologies, launched its Arrow Pressure Injectable Midline Catheter in Australia. The addition of the pressure injectable catheter further enhances the Midline portfolio to meet the expanded needs of clinicians and is designed to improve patient safety. The new 20 cm Arrow Pressure Injectable Midline with brightly colored yellow hubs and labeling will help clinicians overcome catheter identification confusion, which can lead to infusion mistakes that can harm patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Cardiac Surgery Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Cardiac Surgery Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Cardiac Surgery Instruments Industry?

To stay informed about further developments, trends, and reports in the Australia Cardiac Surgery Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence