Key Insights

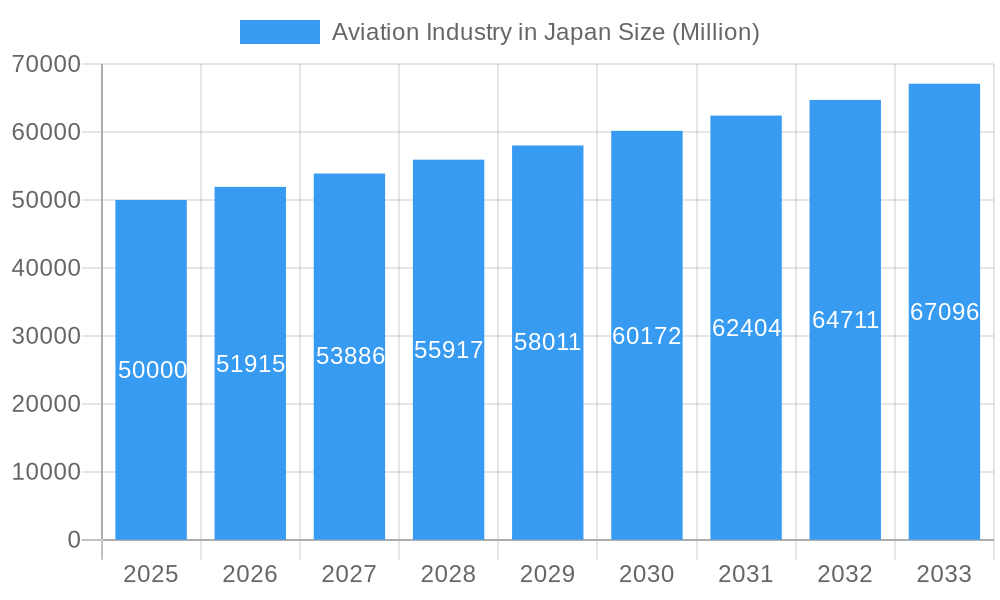

The Japanese aviation market, encompassing commercial and other aviation sectors, is poised for significant expansion. Projected to reach a market size of 16.9 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.7%, the industry is driven by substantial infrastructure investments, particularly in Kanto and Kansai regions, alongside robust domestic tourism and enhanced international connectivity. Factors contributing to this growth include rising disposable incomes, increased air travel demand, and government support for sustainable aviation. The expanding presence of low-cost carriers and advancements in aircraft manufacturing and air traffic management further bolster market expansion and operational efficiency.

Aviation Industry in Japan Market Size (In Billion)

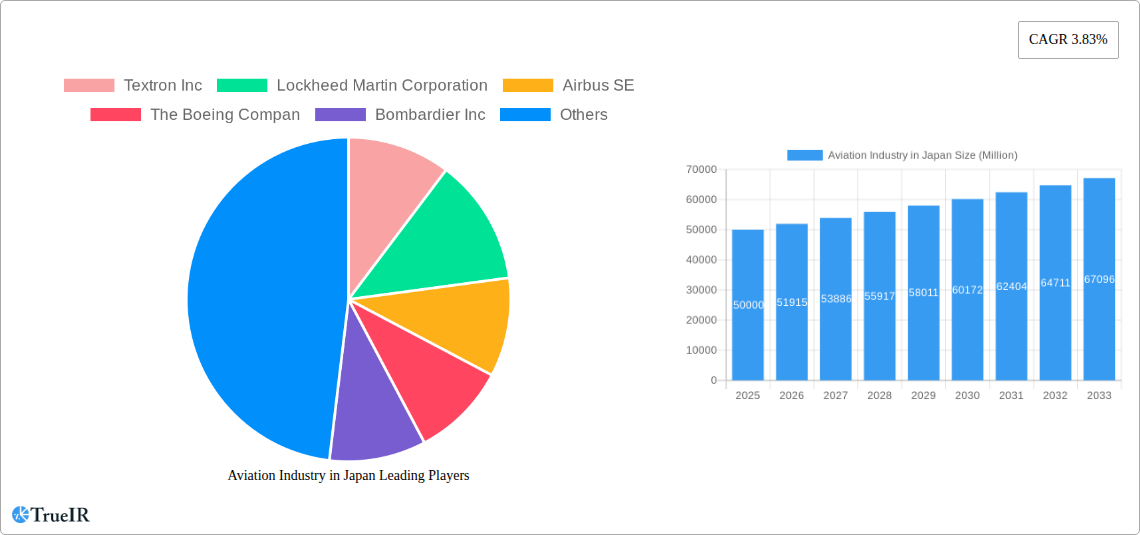

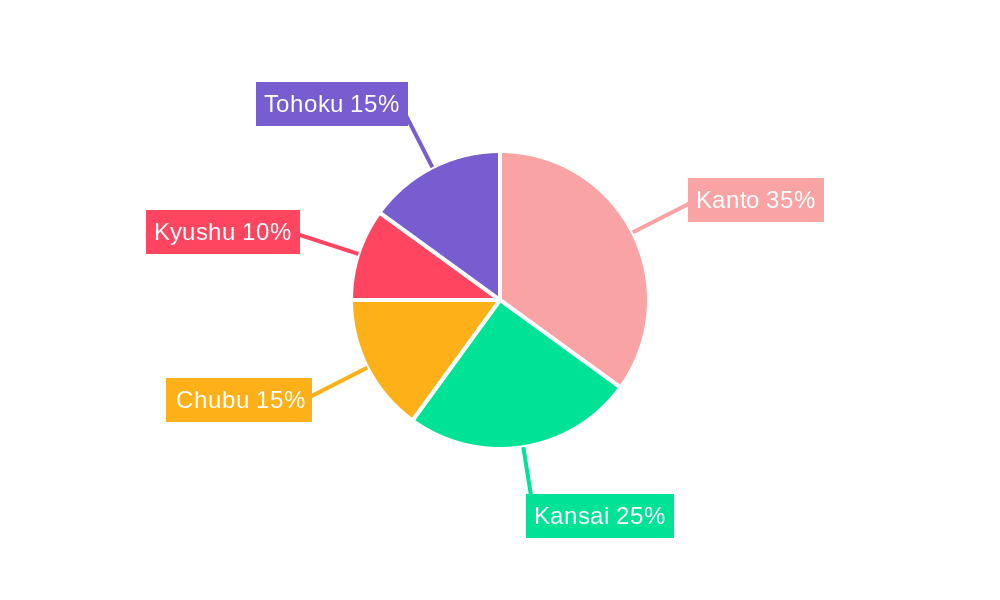

Despite a positive outlook, the industry confronts challenges such as economic volatility, escalating fuel costs, and environmental concerns related to carbon emissions. Market segmentation into commercial aviation and other aviation segments requires granular regional analysis to fully grasp market dynamics. Regional variations in growth are anticipated across Kanto, Kansai, Chubu, Kyushu, and Tohoku, influenced by local economic conditions and airport infrastructure. Key industry players, including Textron Inc., Lockheed Martin Corporation, Airbus SE, Boeing, Bombardier Inc., ATR, and Kawasaki Heavy Industries Ltd., engage in intense competition, fostering innovation. Future growth will be contingent on adapting to evolving sustainability regulations and mitigating economic uncertainties.

Aviation Industry in Japan Company Market Share

Aviation Industry in Japan: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the Japanese aviation industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a comprehensive analysis spanning the period 2019-2033, including a detailed forecast from 2025-2033 and a focus on the key year 2025, this report leverages extensive data and expert analysis to illuminate the current landscape and future trajectory of this vital sector. Explore key market trends, competitive dynamics, significant industry milestones, and growth opportunities within the Japanese aviation market, valued at xx Million.

Aviation Industry in Japan Market Structure & Competitive Landscape

The Japanese aviation industry exhibits a complex market structure characterized by a blend of domestic and international players. Market concentration is moderately high, with a few dominant players commanding significant market share, particularly in the commercial aviation segment. However, the presence of several smaller, specialized firms, particularly in the maintenance, repair, and overhaul (MRO) sector, indicates a dynamic competitive landscape. Innovation is driven by ongoing technological advancements in aircraft design, manufacturing processes, and air traffic management systems. Stringent regulatory oversight by the Japanese government significantly impacts industry operations, requiring substantial investments in compliance and safety measures. Product substitutes, such as high-speed rail for shorter distances, exert some competitive pressure, particularly on domestic air travel. End-user segmentation is predominantly driven by commercial airlines, military forces, and general aviation operators. The M&A activity in the Japanese aviation sector has been moderate in recent years, with xx Million in total deal value recorded between 2019 and 2024, indicating a strategic focus on organic growth rather than large-scale acquisitions.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the commercial aviation segment is estimated at xx, suggesting a moderately concentrated market.

- Innovation Drivers: Technological advancements in aircraft design, fuel efficiency, and flight operations.

- Regulatory Impacts: Stringent safety regulations and environmental standards imposed by the Japanese Civil Aviation Bureau (JCAB).

- Product Substitutes: High-speed rail networks and alternative modes of transportation.

- End-User Segmentation: Commercial airlines (xx%), General aviation (xx%), Military (xx%).

- M&A Trends: Moderate M&A activity with xx Million in total deal value between 2019 and 2024.

Aviation Industry in Japan Market Trends & Opportunities

The Japanese aviation market demonstrates steady growth, driven by increasing passenger traffic, robust economic activity, and government investments in infrastructure development. The market size is projected to reach xx Million by 2025 and is expected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements such as the introduction of more fuel-efficient aircraft and the integration of advanced technologies into air traffic management systems. Changing consumer preferences toward enhanced travel experiences and greater connectivity are also playing a crucial role. The competitive landscape is dynamic, with both established international players and domestic companies vying for market share. The market penetration rate for commercial aviation services is currently estimated at xx%, leaving significant room for expansion, particularly in regional connectivity.

Dominant Markets & Segments in Aviation Industry in Japan

The commercial aviation segment dominates the Japanese aviation market, accounting for the largest share of revenue and growth. This segment's dominance is primarily driven by the increasing number of domestic and international air travelers. The other segment, encompassing general aviation and related services (MRO, etc.), also exhibits steady growth, albeit at a slower pace than commercial aviation.

- Key Growth Drivers in Commercial Aviation:

- Expanding air travel demand, both domestic and international.

- Investments in airport infrastructure and expansion.

- Government support for the aviation industry.

- Increasing tourism and business travel.

- Key Growth Drivers in Other Segments:

- Rising demand for maintenance, repair, and overhaul services (MRO).

- Growth in general aviation activities, including private and corporate flights.

- Expansion of air cargo and logistics operations.

The Kanto region, including Tokyo, remains the dominant market, concentrating a significant portion of passenger traffic and aviation-related businesses.

Aviation Industry in Japan Product Analysis

Technological advancements are transforming the aviation industry in Japan, with a focus on enhancing fuel efficiency, improving safety features, and optimizing operational performance. New aircraft models incorporating advanced materials and technologies are being introduced, while innovative maintenance and repair techniques are improving operational efficiency. These advancements contribute to increased competitiveness and improved market fit, catering to the evolving needs of airlines and other operators.

Key Drivers, Barriers & Challenges in Aviation Industry in Japan

Key Drivers: Technological advancements in aircraft design and manufacturing, increasing air travel demand fueled by economic growth, and supportive government policies promoting aviation infrastructure development.

Challenges: Intense competition from established international players, rising fuel costs, and stringent environmental regulations. Supply chain disruptions can have a quantifiable impact, potentially delaying projects and increasing costs by xx Million annually. Regulatory hurdles and compliance requirements also add complexity and costs to operations.

Growth Drivers in the Aviation Industry in Japan Market

Strong economic growth, supportive government policies, and investments in infrastructure are key growth catalysts. Technological advancements such as fuel-efficient aircraft and improved air traffic management systems contribute significantly to market expansion. The rising number of international and domestic air travelers further fuels market expansion.

Challenges Impacting Aviation Industry in Japan Growth

High operating costs, stringent regulations, and global economic uncertainties pose significant challenges. Supply chain vulnerabilities and competition from other modes of transport also impact growth trajectory.

Key Players Shaping the Aviation Industry in Japan Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Bombardier Inc

- ATR

- Kawasaki Heavy Industries Ltd

Significant Aviation Industry in Japan Industry Milestones

- November 2022: Boeing awarded a contract to deliver two additional KC-46A Pegasus tankers to the Japan Air Self-Defense Force (JASDF), increasing Japan's total to six. This signifies continued reliance on Boeing for military aviation needs and contributes to Boeing's market share.

- November 2022: Bell Textron Inc. agreed to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force. While not directly impacting the Japanese market, it showcases Bell's product competitiveness and global market presence, which indirectly benefits Textron's overall image and potential future Japanese contracts.

- December 2022: The US Army awarded Textron Inc.'s Bell unit a contract for next-generation helicopters. This significant win strengthens Bell's position in the global helicopter market, potentially influencing future technology transfer or collaborative ventures in Japan.

Future Outlook for Aviation Industry in Japan Market

The Japanese aviation industry is poised for continued growth, driven by technological advancements, supportive government policies, and expanding air travel demand. Strategic partnerships and investments in sustainable aviation technologies will shape the future landscape, creating significant opportunities for industry players. The market's potential for innovation and expansion remains substantial.

Aviation Industry in Japan Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Aviation Industry in Japan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in Japan Regional Market Share

Geographic Coverage of Aviation Industry in Japan

Aviation Industry in Japan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Boeing Compan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bombardier Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ATR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kawasaki Heavy Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Aviation Industry in Japan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 3: North America Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 7: South America Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: South America Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 11: Europe Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Aviation Industry in Japan Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 9: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in Japan?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Aviation Industry in Japan?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Bombardier Inc, ATR, Kawasaki Heavy Industries Ltd.

3. What are the main segments of the Aviation Industry in Japan?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.November 2022: Boeing was awarded a contract to deliver two additional KC-46A Pegasus tankers to the Japan Air Self-Defense Force (JASDF), bringing the total on contract for Japan to six.November 2022: Bell Textron Inc., a company of Textron Inc., forged an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF) at the Forces Exhibition and Conference. Combat Air Force (SOFEX) in Aqaba, Jordan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in Japan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in Japan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in Japan?

To stay informed about further developments, trends, and reports in the Aviation Industry in Japan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence