Key Insights

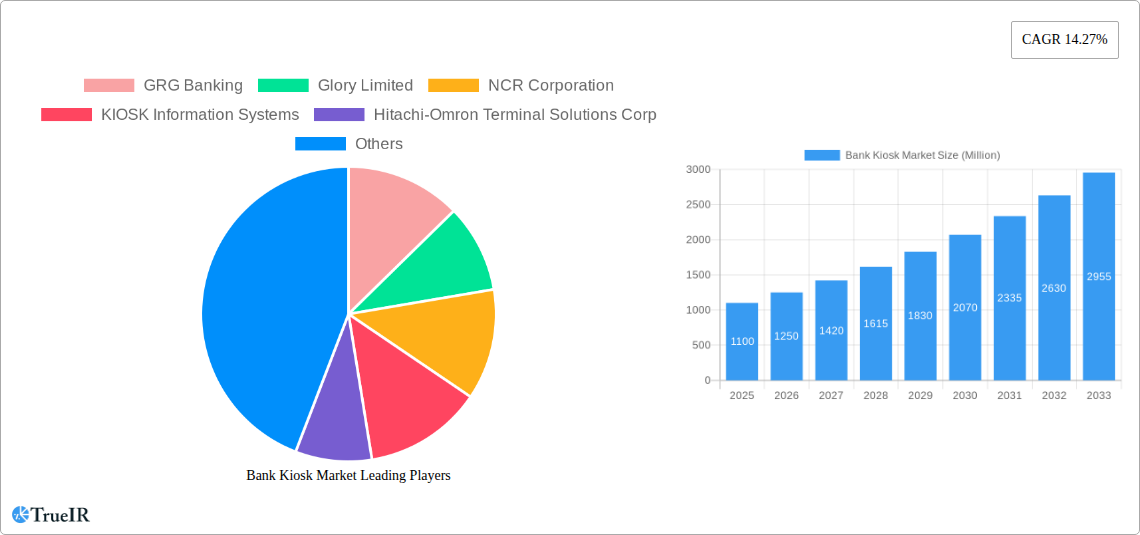

The global Bank Kiosk Market is poised for significant expansion, projected to reach $1.10 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 14.27% over the forecast period of 2025-2033. This robust growth trajectory is primarily propelled by the escalating demand for enhanced customer convenience and the increasing adoption of self-service banking solutions across developed and emerging economies. Key drivers include the need to optimize operational costs for financial institutions, the continuous innovation in kiosk technology leading to more sophisticated functionalities, and the growing preference among consumers for quick and accessible banking transactions. The market is witnessing a strong shift towards multi-function kiosks and virtual/video teller machines, which offer a wider range of services beyond basic cash dispensing, thereby improving customer engagement and loyalty. Furthermore, the expanding digital payment ecosystem and government initiatives promoting financial inclusion in rural and semi-urban areas are creating substantial opportunities for market players.

Bank Kiosk Market Market Size (In Billion)

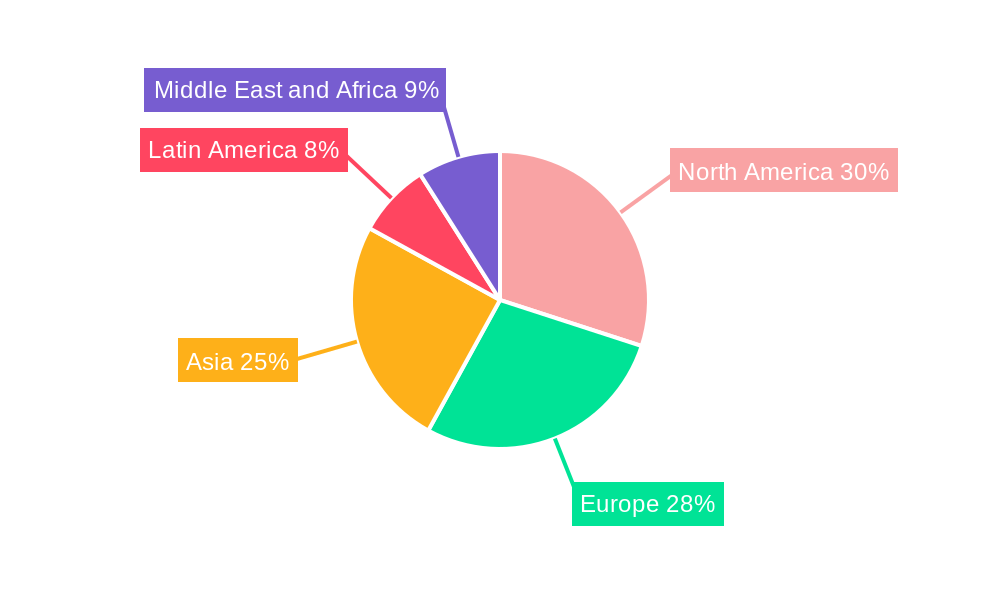

The competitive landscape is characterized by the presence of established global players and emerging regional manufacturers, all vying for market share through product innovation and strategic partnerships. The market segmentation reveals a balanced demand across hardware, software, and services, with each segment contributing to the overall growth of the bank kiosk ecosystem. Geographically, North America and Europe currently lead the market, driven by advanced technological infrastructure and high adoption rates of self-service banking. However, the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth due to rapid urbanization, a burgeoning middle class, and a strong push towards digital banking transformation. Challenges such as cybersecurity concerns and the initial high investment cost for deploying advanced kiosk systems remain, but these are being mitigated by advancements in security protocols and the long-term cost-saving benefits that kiosks provide.

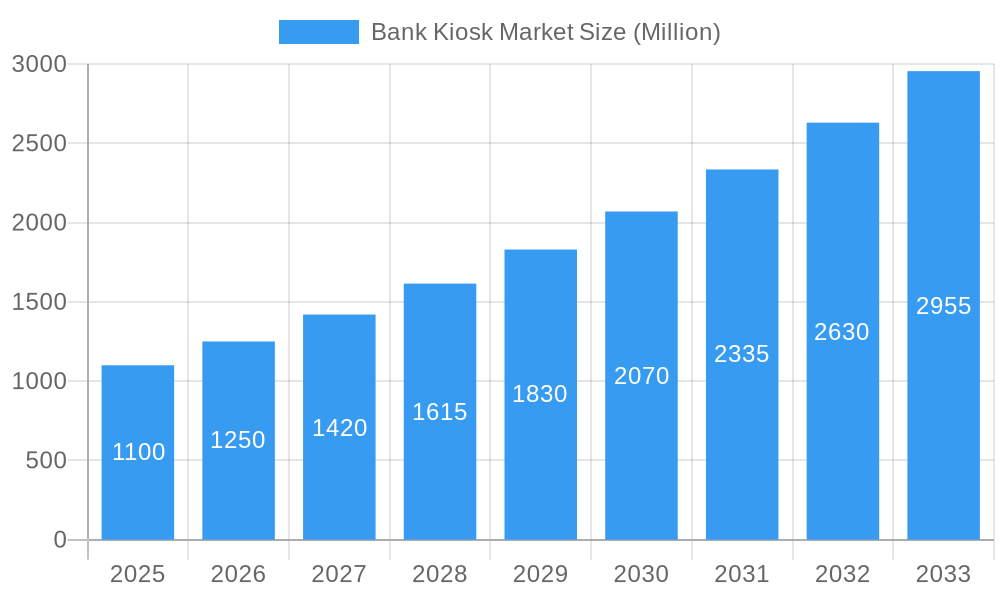

Bank Kiosk Market Company Market Share

Unveiling the Future of Banking: The Bank Kiosk Market Report 2024-2033

This comprehensive Bank Kiosk Market report offers an in-depth analysis of the global banking self-service technology landscape. Covering the historical period 2019–2024, base year 2025, and an extensive forecast period 2025–2033, this report is your definitive guide to understanding market dynamics, growth opportunities in banking technology, and digital banking kiosk trends. Discover the latest innovations, strategic initiatives, and competitive intelligence shaping the future of financial access. With a focus on high-volume keywords such as banking automation, self-service banking solutions, and financial inclusion technology, this report is optimized for maximum SEO impact and designed for industry professionals seeking actionable insights.

Bank Kiosk Market Market Structure & Competitive Landscape

The Bank Kiosk Market is characterized by a moderately consolidated structure, with a few dominant players holding significant market share. Innovation is a key differentiator, driven by the continuous demand for enhanced customer experience and operational efficiency. Regulatory frameworks, while evolving to support digital banking, can also present implementation challenges. The market witnesses ongoing competition from product substitutes, including traditional branch services and advanced mobile banking applications. End-user segmentation is crucial, with varying needs across different demographic and geographic profiles. Mergers and acquisitions (M&A) activity plays a role in consolidating market power and expanding technological capabilities. For instance, the past few years have seen several strategic partnerships and acquisitions aimed at bolstering software and service offerings in the ATM and kiosk industry. The competitive intensity is expected to rise as new entrants leverage disruptive technologies, further shaping the future of banking kiosks. Key M&A trends indicate a focus on acquiring companies with strong software development and cybersecurity expertise to support the growing demand for secure banking kiosks.

Bank Kiosk Market Market Trends & Opportunities

The global Bank Kiosk Market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and a strong push towards financial inclusion. The market size is projected to reach an estimated $xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period 2025–2033. This expansion is fueled by the increasing adoption of self-service banking solutions across both urban and rural landscapes, offering unparalleled convenience and accessibility. Key technological shifts include the integration of artificial intelligence (AI) for personalized customer interactions, enhanced biometric security features, and the proliferation of Virtual/Video Teller Machines (VTMs) that bridge the gap between digital convenience and human interaction. Consumer preferences are increasingly leaning towards 24/7 access to banking services, reduced waiting times, and the ability to perform a wider range of transactions outside traditional banking hours. This shift is compelling financial institutions to invest in advanced banking automation and deploy more sophisticated kiosk networks. The competitive dynamics are intensifying, with established players and innovative startups vying for market share by offering differentiated products and services. Opportunities abound in underserved markets, where financial inclusion technology can significantly improve access to essential banking services. The integration of VTMs is a particularly significant trend, enabling remote teller assistance and expanding the scope of services available at kiosk locations, thus driving demand for advanced banking terminals. The ongoing digital transformation in the banking sector, coupled with government initiatives promoting digital payments and financial literacy, will further accelerate market penetration rates for modern banking kiosks. The market is also witnessing a growing demand for customizable kiosk solutions tailored to specific banking needs and customer demographics.

Dominant Markets & Segments in Bank Kiosk Market

The Bank Kiosk Market demonstrates significant regional variations and segment dominance, driven by differing economic development, regulatory landscapes, and consumer adoption rates.

Dominant Regions & Countries:

- Asia Pacific: Currently leads the market and is projected to maintain its dominance throughout the forecast period.

- Key Growth Drivers: Rapid urbanization, increasing disposable incomes, strong government initiatives promoting digital banking and financial inclusion, and a vast unbanked and underbanked population. Countries like China and India are major contributors due to their large populations and aggressive adoption of technology.

- North America: Remains a mature yet significant market, driven by high technological penetration and a focus on customer experience.

- Key Growth Drivers: Advanced banking infrastructure, strong regulatory support for digital innovation, and consumer demand for seamless self-service options. The United States is the primary market within this region.

- Europe: Exhibits steady growth, with a focus on enhanced security features and integration of advanced technologies.

- Key Growth Drivers: Stringent data privacy regulations (e.g., GDPR), a mature banking sector, and a growing demand for multi-functional kiosks offering a comprehensive suite of services.

Dominant Segments:

- Type: Multi-Function Kiosk

- Detailed Analysis: Multi-Function Kiosks are capturing significant market share due to their ability to offer a wide array of services, from basic transactions to more complex operations like loan applications and account management. This versatility appeals to both banks seeking to optimize branch operations and customers desiring a one-stop self-service solution.

- Key Growth Drivers: Enhanced customer convenience, reduced operational costs for banks, ability to handle diverse transaction types, and integration capabilities with core banking systems.

- Type: Virtual/Video Teller Machine (VTM)

- Detailed Analysis: VTMs are a rapidly growing segment, offering a hybrid approach that combines the efficiency of self-service with the personal touch of a live teller. This segment is particularly attractive for expanding banking reach into remote areas and providing extended service hours.

- Key Growth Drivers: Bridging the digital divide, personalized customer support, cost-effectiveness compared to traditional branch staffing, and enabling remote banking operations.

- Offering: Hardware

- Detailed Analysis: While software and services are crucial, the underlying hardware remains a foundational element of the market. Demand for robust, secure, and technologically advanced hardware components is consistently high.

- Key Growth Drivers: Technological advancements in components, need for durable and secure physical units, and the ongoing replacement cycle of older ATM and kiosk hardware.

- Offering: Software

- Detailed Analysis: Sophisticated software is the brain of modern banking kiosks, enabling advanced functionalities, secure transactions, and seamless integration with banking ecosystems.

- Key Growth Drivers: Demand for user-friendly interfaces, robust security protocols, AI-powered features, and integration with omnichannel banking strategies.

- Offering: Services

- Detailed Analysis: Installation, maintenance, repair, and ongoing support services are critical for the efficient operation of banking kiosks. This segment is vital for ensuring uptime and customer satisfaction.

- Key Growth Drivers: Need for reliable maintenance, remote monitoring and management, cybersecurity services, and specialized technical support.

- Distribution: Metropolitan

- Detailed Analysis: Metropolitan areas are the largest distribution channel due to the high population density and concentration of financial institutions.

- Key Growth Drivers: High customer traffic, established banking infrastructure, and strong demand for convenient banking solutions in busy urban environments.

- Distribution: Rural

- Detailed Analysis: The rural segment presents a significant growth opportunity, driven by initiatives aimed at improving financial inclusion and extending banking services to remote populations.

- Key Growth Drivers: Government push for financial inclusion, limited traditional branch access, and the growing adoption of mobile banking technologies that can be supported by localized kiosk access.

Bank Kiosk Market Product Analysis

The Bank Kiosk Market is witnessing a surge in product innovations focused on enhancing user experience, security, and transactional capabilities. Advanced hardware, including high-resolution touchscreens, secure card readers, and sophisticated cash recyclers, forms the backbone of these solutions. Software development is increasingly incorporating AI for personalized customer engagement, biometric authentication for heightened security, and intuitive interfaces for ease of use. Applications range from routine cash withdrawals and deposits to more complex services like new account opening, loan origination, and remote assistance through video tellers. Competitive advantages lie in the seamless integration of these components, the robustness of cybersecurity measures, and the ability of kiosks to provide a personalized and efficient banking experience, thereby increasing customer satisfaction and reducing reliance on traditional branch networks.

Key Drivers, Barriers & Challenges in Bank Kiosk Market

Key Drivers:

- Digital Transformation in Banking: The overarching trend of banks moving towards digital-first strategies is a primary driver, pushing for self-service solutions.

- Demand for Convenience and Accessibility: Consumers increasingly expect 24/7 access to banking services, a demand that kiosks effectively meet.

- Financial Inclusion Initiatives: Governments and financial institutions are actively promoting kiosk deployment in underserved rural and semi-urban areas to increase access to financial services.

- Cost Optimization for Banks: Kiosks help reduce operational costs associated with staffing and managing physical branches.

- Technological Advancements: Innovations in AI, biometrics, and IoT are enabling more sophisticated and secure kiosk functionalities.

Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of deploying advanced kiosk hardware and software can be substantial.

- Cybersecurity Threats: Protecting sensitive customer data from evolving cyber threats remains a significant challenge.

- Regulatory Compliance: Adhering to diverse and evolving financial regulations across different jurisdictions can be complex.

- Maintenance and Servicing: Ensuring the uptime and functionality of a widespread kiosk network requires robust maintenance and servicing infrastructure.

- Customer Adoption and Digital Literacy: While growing, there are still segments of the population that may require education and support to fully adopt self-service banking technologies, particularly in rural areas.

Growth Drivers in the Bank Kiosk Market Market

The Bank Kiosk Market is propelled by several key factors. The relentless drive for digital transformation in banking is a paramount driver, compelling financial institutions to embrace self-service technologies for enhanced efficiency and customer engagement. The escalating consumer demand for convenience and accessibility, including 24/7 banking services, directly fuels the adoption of kiosks. Furthermore, global financial inclusion initiatives are a significant catalyst, promoting the deployment of banking kiosks in rural and semi-urban regions to extend financial services to previously unbanked or underbanked populations. Banks are also leveraging cost optimization strategies, recognizing that kiosks can significantly reduce operational expenses compared to traditional brick-and-mortar branches. Finally, continuous technological advancements, such as the integration of AI, advanced biometrics, and IoT capabilities, are enabling the development of more sophisticated, secure, and user-friendly kiosk solutions, further expanding their appeal and functionality.

Challenges Impacting Bank Kiosk Market Growth

Despite robust growth drivers, the Bank Kiosk Market faces several challenges. The high initial investment costs associated with deploying advanced kiosk hardware and software can be a significant barrier, especially for smaller financial institutions. Cybersecurity threats remain a persistent concern, as protecting sensitive customer data from an ever-evolving landscape of cyberattacks is paramount and requires continuous investment in security measures. Regulatory compliance across various geographic regions, with differing and often evolving financial regulations, adds complexity and potential cost to deployment and operation. The maintenance and servicing of a widespread kiosk network also presents logistical and financial hurdles, necessitating a robust and efficient support infrastructure to ensure consistent uptime and functionality. Lastly, customer adoption and digital literacy can impact growth, particularly in certain demographics and regions where greater education and support are required for individuals to feel comfortable and proficient using self-service banking technologies.

Key Players Shaping the Bank Kiosk Market Market

- GRG Banking

- Glory Limited

- NCR Corporation

- KIOSK Information Systems

- Hitachi-Omron Terminal Solutions Corp

- Cisco Systems Inc

- Shenzhen Yi of Computer Co Ltd*List Not Exhaustive

- OKI Electric Industry Co Ltd

- Diebold Inc

- Korala Associates Limited (Kal Atm Software)

- Nautilus Hyosung Corporation

Significant Bank Kiosk Market Industry Milestones

- October 2023: The State Bank of India (SBI) introduced a 'Mobile Handheld Device' to offer banking services to its financially inclusive customers. This initiative aims to improve accessibility and convenience by providing bank kiosks at customers' homes, significantly enhancing banking accessibility by bringing kiosk banking directly to the customer's doorstep. This offers greater flexibility to Customer Service Point (CSP) agents, allowing them to reach out to customers wherever they may be, particularly benefiting those who face difficulty accessing CSP outlets.

- August 2023: Northwest Bank region management announced plans to build a new digital banking kiosk at 1081 Million Dollar Highway in St. Marys. This kiosk provides customers with two efficient banking options: a 24/7 drive-up ATM for easy access to account withdrawals, fund transfers, deposits, and more, and an advanced video teller machine (VTM) for live interactions with a teller, allowing customers to comfortably address inquiries or carry out routine transactions like check cashing or loan payments.

Future Outlook for Bank Kiosk Market Market

The Bank Kiosk Market is set for a promising future, driven by continuous technological innovation and a growing demand for accessible, efficient, and personalized financial services. Strategic opportunities lie in the further integration of AI and machine learning for predictive analytics and hyper-personalized customer experiences, the expansion of VTM functionalities to handle increasingly complex transactions, and the development of more sustainable and energy-efficient kiosk designs. The increasing focus on financial inclusion worldwide will create significant market potential in emerging economies. As financial institutions continue to prioritize customer-centric strategies and cost-efficiency, the adoption of advanced banking kiosks is expected to accelerate, solidifying their role as integral components of the modern banking ecosystem. The market is also likely to witness further consolidation and strategic partnerships aimed at offering end-to-end solutions.

Bank Kiosk Market Segmentation

-

1. Type

- 1.1. Single-Function Kiosk

- 1.2. Multi-Function Kiosk

- 1.3. Virtual/Video Teller Machine

-

2. Offering

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Distribution

- 3.1. Rural

- 3.2. Semi-Urban

- 3.3. Metropolitan

Bank Kiosk Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

Bank Kiosk Market Regional Market Share

Geographic Coverage of Bank Kiosk Market

Bank Kiosk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Self-Service Multi Function Kiosk through out the Globe to drive the Market; Magnified Customer Services Offered by Interactive Kiosks; Minimizing Overall Operation Cost

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation; Increasing Use of Mobile Devices Decreasing the Usage of Self-Service Banking Kiosks

- 3.4. Market Trends

- 3.4.1. Multi Function Segment is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bank Kiosk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-Function Kiosk

- 5.1.2. Multi-Function Kiosk

- 5.1.3. Virtual/Video Teller Machine

- 5.2. Market Analysis, Insights and Forecast - by Offering

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Distribution

- 5.3.1. Rural

- 5.3.2. Semi-Urban

- 5.3.3. Metropolitan

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Bank Kiosk Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Single-Function Kiosk

- 6.1.2. Multi-Function Kiosk

- 6.1.3. Virtual/Video Teller Machine

- 6.2. Market Analysis, Insights and Forecast - by Offering

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.3. Market Analysis, Insights and Forecast - by Distribution

- 6.3.1. Rural

- 6.3.2. Semi-Urban

- 6.3.3. Metropolitan

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Bank Kiosk Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Single-Function Kiosk

- 7.1.2. Multi-Function Kiosk

- 7.1.3. Virtual/Video Teller Machine

- 7.2. Market Analysis, Insights and Forecast - by Offering

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.3. Market Analysis, Insights and Forecast - by Distribution

- 7.3.1. Rural

- 7.3.2. Semi-Urban

- 7.3.3. Metropolitan

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Bank Kiosk Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Single-Function Kiosk

- 8.1.2. Multi-Function Kiosk

- 8.1.3. Virtual/Video Teller Machine

- 8.2. Market Analysis, Insights and Forecast - by Offering

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.3. Market Analysis, Insights and Forecast - by Distribution

- 8.3.1. Rural

- 8.3.2. Semi-Urban

- 8.3.3. Metropolitan

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Bank Kiosk Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Single-Function Kiosk

- 9.1.2. Multi-Function Kiosk

- 9.1.3. Virtual/Video Teller Machine

- 9.2. Market Analysis, Insights and Forecast - by Offering

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.3. Market Analysis, Insights and Forecast - by Distribution

- 9.3.1. Rural

- 9.3.2. Semi-Urban

- 9.3.3. Metropolitan

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Bank Kiosk Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Single-Function Kiosk

- 10.1.2. Multi-Function Kiosk

- 10.1.3. Virtual/Video Teller Machine

- 10.2. Market Analysis, Insights and Forecast - by Offering

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Services

- 10.3. Market Analysis, Insights and Forecast - by Distribution

- 10.3.1. Rural

- 10.3.2. Semi-Urban

- 10.3.3. Metropolitan

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GRG Banking

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Glory Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NCR Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KIOSK Information Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi-Omron Terminal Solutions Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shenzhen Yi of Computer Co Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OKI Electric Industry Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Diebold Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Korala Associates Limited (Kal Atm Software)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nautilus Hyosung Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 GRG Banking

List of Figures

- Figure 1: Global Bank Kiosk Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bank Kiosk Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Bank Kiosk Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Bank Kiosk Market Revenue (Million), by Offering 2025 & 2033

- Figure 5: North America Bank Kiosk Market Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Bank Kiosk Market Revenue (Million), by Distribution 2025 & 2033

- Figure 7: North America Bank Kiosk Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 8: North America Bank Kiosk Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Bank Kiosk Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bank Kiosk Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Bank Kiosk Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Bank Kiosk Market Revenue (Million), by Offering 2025 & 2033

- Figure 13: Europe Bank Kiosk Market Revenue Share (%), by Offering 2025 & 2033

- Figure 14: Europe Bank Kiosk Market Revenue (Million), by Distribution 2025 & 2033

- Figure 15: Europe Bank Kiosk Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 16: Europe Bank Kiosk Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Bank Kiosk Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Bank Kiosk Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Bank Kiosk Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Bank Kiosk Market Revenue (Million), by Offering 2025 & 2033

- Figure 21: Asia Bank Kiosk Market Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Asia Bank Kiosk Market Revenue (Million), by Distribution 2025 & 2033

- Figure 23: Asia Bank Kiosk Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 24: Asia Bank Kiosk Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Bank Kiosk Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Bank Kiosk Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Bank Kiosk Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Bank Kiosk Market Revenue (Million), by Offering 2025 & 2033

- Figure 29: Latin America Bank Kiosk Market Revenue Share (%), by Offering 2025 & 2033

- Figure 30: Latin America Bank Kiosk Market Revenue (Million), by Distribution 2025 & 2033

- Figure 31: Latin America Bank Kiosk Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 32: Latin America Bank Kiosk Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Bank Kiosk Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Bank Kiosk Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Bank Kiosk Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Bank Kiosk Market Revenue (Million), by Offering 2025 & 2033

- Figure 37: Middle East and Africa Bank Kiosk Market Revenue Share (%), by Offering 2025 & 2033

- Figure 38: Middle East and Africa Bank Kiosk Market Revenue (Million), by Distribution 2025 & 2033

- Figure 39: Middle East and Africa Bank Kiosk Market Revenue Share (%), by Distribution 2025 & 2033

- Figure 40: Middle East and Africa Bank Kiosk Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Bank Kiosk Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bank Kiosk Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Bank Kiosk Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 3: Global Bank Kiosk Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 4: Global Bank Kiosk Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Bank Kiosk Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Bank Kiosk Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Global Bank Kiosk Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 8: Global Bank Kiosk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Bank Kiosk Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Bank Kiosk Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 13: Global Bank Kiosk Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 14: Global Bank Kiosk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Bank Kiosk Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Bank Kiosk Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 21: Global Bank Kiosk Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 22: Global Bank Kiosk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Bank Kiosk Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Bank Kiosk Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 29: Global Bank Kiosk Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 30: Global Bank Kiosk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Mexico Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Bank Kiosk Market Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Bank Kiosk Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 36: Global Bank Kiosk Market Revenue Million Forecast, by Distribution 2020 & 2033

- Table 37: Global Bank Kiosk Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: UAE Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Bank Kiosk Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bank Kiosk Market?

The projected CAGR is approximately 14.27%.

2. Which companies are prominent players in the Bank Kiosk Market?

Key companies in the market include GRG Banking, Glory Limited, NCR Corporation, KIOSK Information Systems, Hitachi-Omron Terminal Solutions Corp, Cisco Systems Inc, Shenzhen Yi of Computer Co Ltd*List Not Exhaustive, OKI Electric Industry Co Ltd, Diebold Inc, Korala Associates Limited (Kal Atm Software), Nautilus Hyosung Corporation.

3. What are the main segments of the Bank Kiosk Market?

The market segments include Type, Offering, Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Self-Service Multi Function Kiosk through out the Globe to drive the Market; Magnified Customer Services Offered by Interactive Kiosks; Minimizing Overall Operation Cost.

6. What are the notable trends driving market growth?

Multi Function Segment is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation; Increasing Use of Mobile Devices Decreasing the Usage of Self-Service Banking Kiosks.

8. Can you provide examples of recent developments in the market?

October 2023: The State Bank of India (SBI) has introduced a 'Mobile Handheld Device' to offer banking services to its financially inclusive customers. This step aims to improve accessibility and convenience for customers in availing banking services and providing bank kiosks at customershome. This device will significantly enhance banking accessibility by bringing kiosk banking directly to the customer's doorstep. It will provide greater flexibility to customer service point (CSP) agents, allowing them to reach out to customers wherever they may be. This initiative will particularly benefit customers who face difficulty accessing CSP outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bank Kiosk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bank Kiosk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bank Kiosk Market?

To stay informed about further developments, trends, and reports in the Bank Kiosk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence