Key Insights

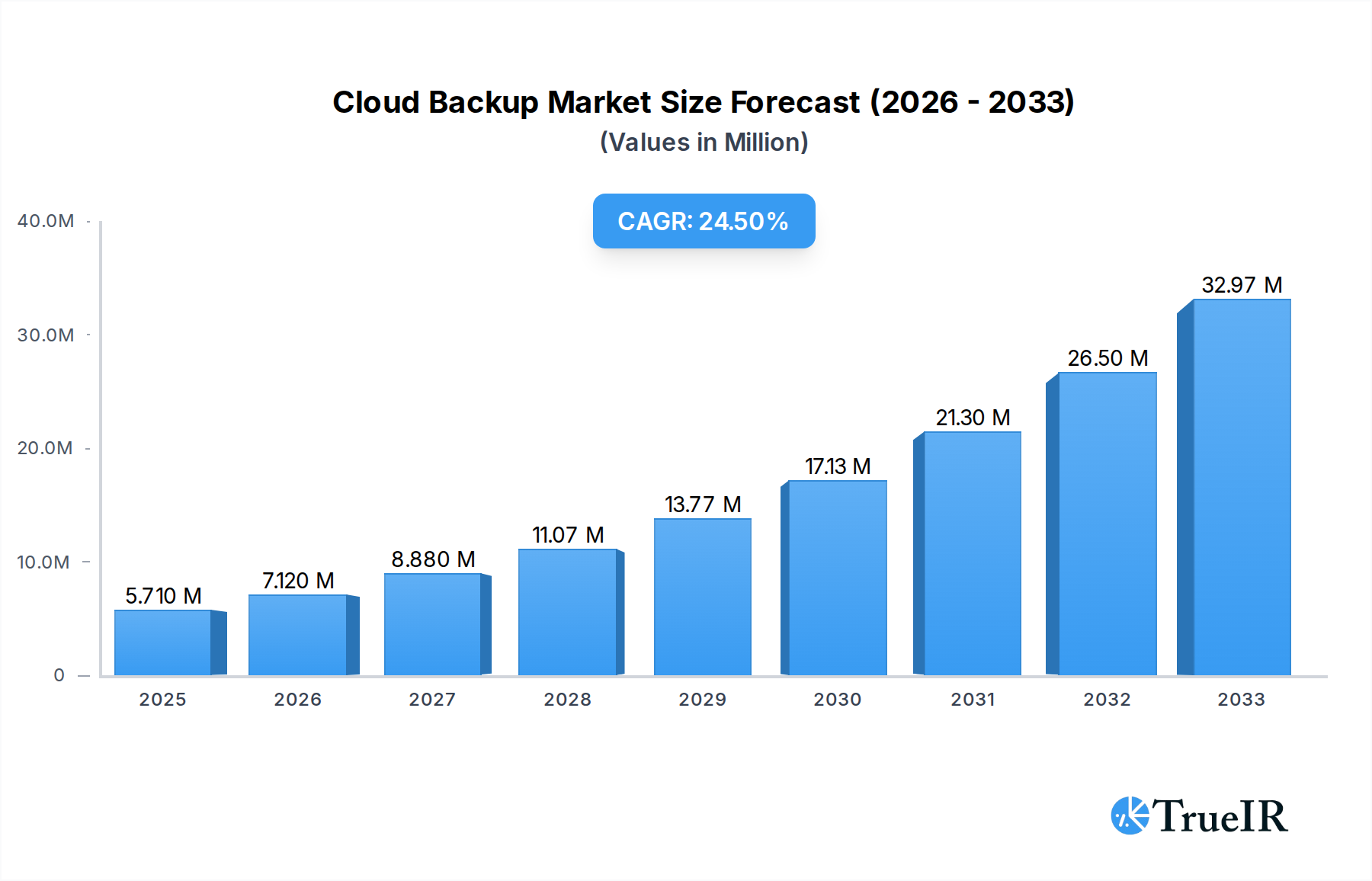

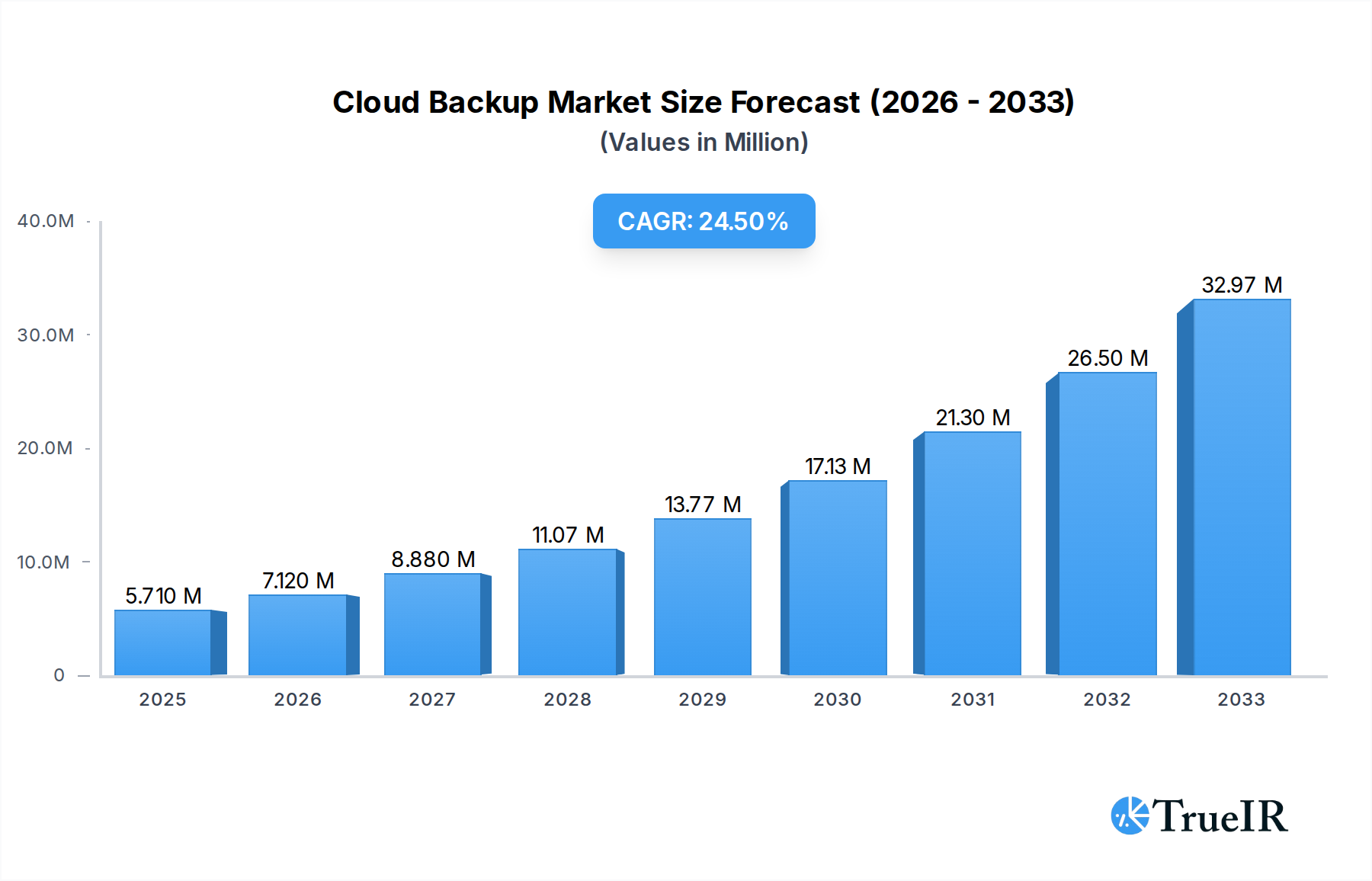

The global Cloud Backup Market is poised for remarkable expansion, with a current market size estimated at 5.71 Million and a projected Compound Annual Growth Rate (CAGR) of 24.84% during the forecast period of 2025-2033. This significant growth is propelled by an increasing volume of data generated across industries, the escalating need for robust data protection and disaster recovery solutions, and the inherent scalability and cost-effectiveness offered by cloud-based backup services. Organizations are actively migrating their data infrastructure to the cloud, driven by the imperative to safeguard against data loss, ensure business continuity, and comply with stringent data regulations. The market is segmented across various components, including solutions and services, with deployment modes encompassing public, private, and hybrid cloud environments. Key end-user industries such as BFSI, IT and Telecom, Media and Entertainment, Retail, and Healthcare are leading the adoption of cloud backup, recognizing its critical role in maintaining operational resilience and competitive advantage.

Cloud Backup Market Market Size (In Million)

The competitive landscape is characterized by the presence of major players like IBM Corporation, Dell EMC, Cohesity Inc., and Rubrik, who are continuously innovating with advanced features and integrated offerings. Emerging trends such as the adoption of AI and machine learning for automated backup management, ransomware protection capabilities, and the growing demand for SaaS backup solutions are shaping the market's trajectory. While the market demonstrates strong growth potential, some restraints may include initial implementation costs for certain organizations, concerns around data privacy and security in multi-tenant cloud environments, and the complexity of managing hybrid cloud deployments. However, the overwhelming benefits of cloud backup in terms of accessibility, reduced infrastructure overhead, and enhanced data security are expected to outweigh these challenges, driving sustained market penetration and innovation.

Cloud Backup Market Company Market Share

This in-depth report provides a definitive analysis of the global cloud backup market, a rapidly expanding sector driven by the escalating need for robust data protection, disaster recovery, and business continuity solutions. Leveraging high-volume keywords such as "cloud backup solutions," "data protection," "disaster recovery," "hybrid cloud backup," and "SaaS backup," this report is meticulously crafted for industry professionals, IT decision-makers, and investors seeking unparalleled insights. Our study period spans from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, offering a comprehensive view of historical performance and future trajectory.

Cloud Backup Market Market Structure & Competitive Landscape

The cloud backup market exhibits a moderately concentrated structure, with a blend of established enterprise players and agile disruptors vying for market share. Innovation drivers are primarily fueled by advancements in data deduplication, encryption technologies, automation, and the growing demand for SaaS backup solutions. Regulatory impacts, particularly stringent data privacy laws like GDPR and CCPA, are compelling organizations to adopt more secure and compliant cloud backup services. Product substitutes include on-premises backup solutions and traditional tape backups, though their limitations in scalability and accessibility are increasingly apparent.

The competitive landscape is shaped by:

- Key Players: Backblaze Inc, Barracuda Networks Inc, Veritas Technologies, IBM Corporation, Cohesity Inc, Rubrik, Dell EMC, Arcserve LLC, Acronis International GmbH, Commvault Systems Inc, Carbonite Inc.

- Mergers & Acquisitions (M&A): The cloud backup market has witnessed a steady stream of M&A activities as larger entities acquire innovative startups to expand their portfolios and technological capabilities. Over the past few years, an estimated over 20 M&A deals have been recorded, significantly impacting market consolidation.

- End-User Segmentation: The market is segmented across various end-user industries, with BFSI and IT & Telecom currently demonstrating the highest adoption rates, driven by sensitive data and critical infrastructure needs.

Cloud Backup Market Market Trends & Opportunities

The cloud backup market is poised for exceptional growth, projected to reach an estimated $XX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of over 18% during the forecast period. This expansion is fueled by the pervasive digital transformation across industries, leading to exponential data generation and an increased reliance on cloud-based infrastructure. Organizations are increasingly recognizing cloud backup not just as a cost-effective alternative to traditional methods but as a critical component for ensuring business resilience and minimizing downtime. The shift towards hybrid cloud backup strategies, offering a balance between on-premises control and cloud scalability, represents a significant trend. Furthermore, the proliferation of remote work and decentralized IT environments necessitates more flexible and accessible data backup solutions.

The growing adoption of SaaS backup solutions is a major trend, addressing the challenges of protecting data residing in cloud-based applications like Microsoft 365 and Google Workspace. The increasing sophistication of cyber threats, including ransomware, also amplifies the demand for secure, immutable, and readily restorable cloud backup capabilities. Opportunities abound for providers offering advanced features such as artificial intelligence-driven threat detection, automated backup orchestration, and granular recovery options. The rise of edge computing and the Internet of Things (IoT) presents a nascent but rapidly growing opportunity for specialized cloud backup strategies to manage and protect the vast volumes of data generated by these devices. The increasing regulatory focus on data sovereignty and compliance further propels the need for localized and secure cloud backup options.

Dominant Markets & Segments in Cloud Backup Market

The Cloud Backup Market is experiencing significant growth across various segments, with the Public Cloud deployment mode currently dominating, accounting for an estimated over 55% market share. This dominance is attributed to its inherent scalability, cost-effectiveness, and ease of deployment, making it an attractive option for small to medium-sized businesses as well as large enterprises seeking to offload infrastructure management. The IT and Telecom industry is a leading end-user segment, driven by the massive data volumes and the critical need for uninterrupted service availability. This sector represents an estimated over 25% of the total market revenue.

Key growth drivers within these dominant segments include:

Public Cloud:

- Scalability and Flexibility: The ability to scale backup storage up or down based on demand, without significant upfront hardware investments.

- Cost Efficiency: Pay-as-you-go models and reduced operational overhead compared to on-premises solutions.

- Accessibility: Remote access to backup data from any location with an internet connection.

- Managed Services: Availability of comprehensive cloud backup services that handle infrastructure and maintenance.

IT and Telecom Industry:

- Massive Data Generation: The constant influx of data from network operations, customer interactions, and service delivery.

- Regulatory Compliance: Strict mandates for data retention and recovery for telecommunications providers.

- Business Continuity: The imperative to minimize downtime and ensure service continuity for end-users.

- Cybersecurity Threats: The high-risk environment necessitates robust protection against data loss and breaches.

The BFSI sector also represents a substantial and growing segment, driven by stringent regulatory requirements for data protection and disaster recovery, particularly for financial transactions and sensitive customer information. The hybrid cloud deployment mode is gaining considerable traction as organizations seek to leverage the benefits of both public and private clouds, offering a balanced approach to security, control, and cost. The "Other End-user Industries" category, encompassing sectors like manufacturing, education, and government, is also showing robust growth as digital transformation accelerates across the board.

Cloud Backup Market Product Analysis

The cloud backup market is characterized by continuous product innovation focused on enhancing data security, accelerating recovery times, and simplifying management. Key advancements include the development of immutable backups, offering protection against ransomware by creating unalterable copies of data. Advanced encryption algorithms, both in transit and at rest, are standard features, ensuring data confidentiality. Intelligent deduplication and compression technologies optimize storage utilization and reduce backup windows. Furthermore, the integration of AI and machine learning is enabling proactive threat detection and automated recovery processes, significantly improving resilience and reducing the burden on IT staff. The market is witnessing a surge in SaaS backup solutions tailored for specific cloud applications, providing seamless protection for data residing within these platforms.

Key Drivers, Barriers & Challenges in Cloud Backup Market

Key Drivers:

- Escalating Data Growth: The exponential increase in data volume across all industries is the primary catalyst, necessitating scalable and efficient cloud backup solutions.

- Cybersecurity Threats: The pervasive threat of ransomware and other cyberattacks makes robust data protection and disaster recovery a paramount concern.

- Digital Transformation: The widespread adoption of cloud computing, IoT, and AI drives the need for comprehensive cloud backup strategies.

- Regulatory Compliance: Increasingly stringent data privacy and retention regulations globally mandate secure and reliable data backup services.

- Cost-Effectiveness: Cloud backup offers a more economical alternative to traditional on-premises solutions, especially for SMBs.

Barriers & Challenges:

- Security Concerns: Despite advancements, some organizations still harbor concerns about the security of data stored in the cloud, particularly for highly sensitive information.

- Vendor Lock-in: The potential for vendor lock-in with proprietary cloud backup platforms can be a deterrent for some businesses.

- Complexity of Hybrid Environments: Managing hybrid cloud backup solutions can be complex, requiring specialized expertise.

- Internet Bandwidth Limitations: For very large data sets, initial backups and full restores can be constrained by internet bandwidth.

- Data Sovereignty and Compliance: Navigating different regional data residency laws and compliance requirements can be challenging.

Growth Drivers in the Cloud Backup Market Market

The cloud backup market is propelled by several interconnected growth drivers. Technologically, advancements in data deduplication, compression, and encryption are making cloud backup solutions more efficient and secure, directly addressing scalability and data protection concerns. Economically, the pay-as-you-go model and the reduction in capital expenditure on on-premises hardware make cloud backup services a highly attractive and cost-effective option, especially for small and medium-sized businesses. Policy-driven factors, such as the increasing global emphasis on data privacy and sovereignty through regulations like GDPR and CCPA, are forcing organizations to adopt robust data protection strategies, with cloud backup being a key component. The continuous rise in data generation, fueled by digital transformation and emerging technologies like IoT, further fuels demand for scalable and accessible disaster recovery solutions.

Challenges Impacting Cloud Backup Market Growth

Despite strong growth prospects, the cloud backup market faces several challenges. Regulatory complexities, particularly concerning data sovereignty and cross-border data transfers, can create hurdles for global organizations seeking seamless cloud backup services. Supply chain issues, while less direct for software-centric services, can impact the availability of underlying cloud infrastructure and hardware components for hybrid deployments. Competitive pressures are intense, with numerous vendors vying for market share, leading to price sensitivity and the need for continuous innovation. Furthermore, the inherent concern regarding the security of sensitive data in a shared cloud environment, despite robust security measures, remains a persistent restraint for some enterprise segments. The transition from legacy backup systems to modern cloud backup solutions can also present significant integration challenges for established organizations.

Key Players Shaping the Cloud Backup Market Market

- Backblaze Inc

- Barracuda Networks Inc

- Veritas Technologies

- IBM Corporation

- Cohesity Inc

- Rubrik

- Dell EMC

- Arcserve LLC

- Acronis International GmbH

- Commvault Systems Inc

- Carbonite Inc

Significant Cloud Backup Market Industry Milestones

- August 2023: Oracle announced the new Oracle Cloud for Australian Government and Defense in Canberra to meet rapidly growing global demand from public sector organizations. Offering over 100 services, the new region is a complete and highly secure hyperscale cloud platform that permits consumers to build and run applications. It is physically separated from Oracle’s other government and public cloud regions. It shares no backbone connections, including the existing Sydney and Melbourne general regions available to all Oracle Cloud customers. The completed IRAP assessment at the PROTECTED level assures Australian public sector institutions that Oracle Cloud for the Australian Government and Defense adheres to appropriate security controls.

- June 2023: Impossible Cloud, the revolutionary cloud platform that offers decentralized, multi-service cloud solutions, reported the launch of its Partner Program, designed to enable partners and resellers to seamlessly implement, demo, and integrate Impossible Cloud’s efficient, performance-driven solutions into enterprise environments. The firm also reported global backup solutions providers as alliance partners. These include Comet Backup, an inaugural partner, as well as Acronis. Customers can now seamlessly utilize these companies’ fast, secure backup software with Impossible Cloud’s S3-compatible storage to safeguard data, ensure business continuity, and prepare for emergencies.

Future Outlook for Cloud Backup Market Market

The future outlook for the cloud backup market is exceptionally promising, driven by continued digital transformation and the ever-increasing criticality of data protection. Strategic opportunities lie in the expansion of SaaS backup offerings to cover a wider range of cloud applications and the development of specialized cloud backup solutions for emerging technologies like edge computing and AI-driven data streams. Market growth will be further catalyzed by advancements in ransomware recovery capabilities, including immutable backups and rapid, granular restoration. The increasing demand for hybrid cloud backup and multi-cloud strategies will create opportunities for vendors offering interoperable and unified management platforms. As organizations prioritize resilience and business continuity, the cloud backup market is set to witness sustained innovation and market expansion, solidifying its position as a foundational element of modern IT infrastructure.

Cloud Backup Market Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Services

-

2. Deployment Mode

- 2.1. Public Cloud

- 2.2. Private Cloud

- 2.3. Hybrid Cloud

-

3. End-user Industry

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Media and Entertainment

- 3.4. Retail

- 3.5. Healthcare

- 3.6. Other End-user Industries

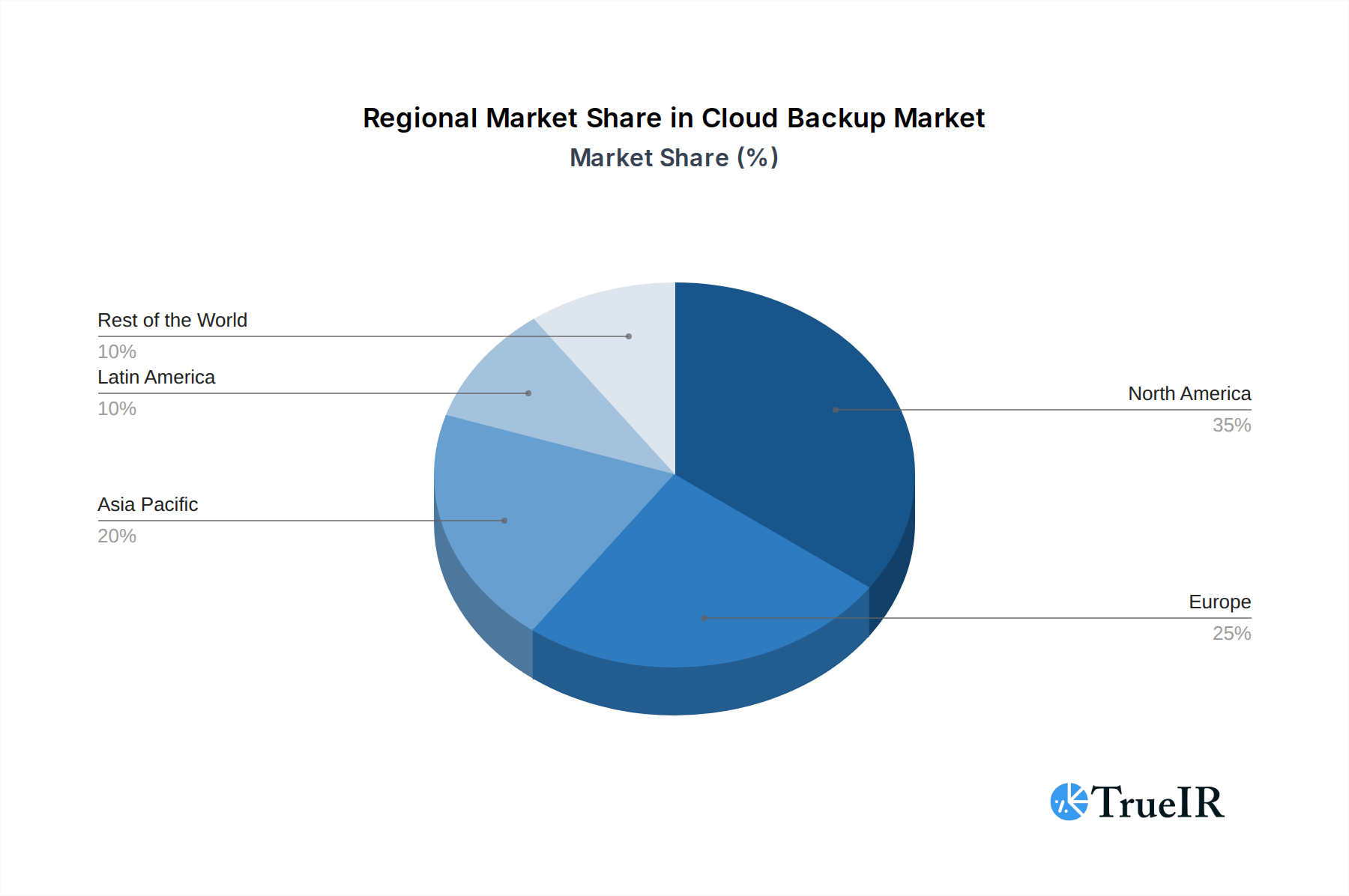

Cloud Backup Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Rest of the World

Cloud Backup Market Regional Market Share

Geographic Coverage of Cloud Backup Market

Cloud Backup Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Massive Growth in Data Generation Stimulating the Demand for Larger Storage Space at Low Cost; Increasing Adoption of SaaS and Other Similar Solutions; Increasing Adoption of Cloud Computing Amongst Enterprises

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. BFSI Expected to Exhibit Maximum Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Backup Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. Public Cloud

- 5.2.2. Private Cloud

- 5.2.3. Hybrid Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Media and Entertainment

- 5.3.4. Retail

- 5.3.5. Healthcare

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Cloud Backup Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. Public Cloud

- 6.2.2. Private Cloud

- 6.2.3. Hybrid Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. IT and Telecom

- 6.3.3. Media and Entertainment

- 6.3.4. Retail

- 6.3.5. Healthcare

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Cloud Backup Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. Public Cloud

- 7.2.2. Private Cloud

- 7.2.3. Hybrid Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. IT and Telecom

- 7.3.3. Media and Entertainment

- 7.3.4. Retail

- 7.3.5. Healthcare

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Cloud Backup Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. Public Cloud

- 8.2.2. Private Cloud

- 8.2.3. Hybrid Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. IT and Telecom

- 8.3.3. Media and Entertainment

- 8.3.4. Retail

- 8.3.5. Healthcare

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Cloud Backup Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. Public Cloud

- 9.2.2. Private Cloud

- 9.2.3. Hybrid Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. IT and Telecom

- 9.3.3. Media and Entertainment

- 9.3.4. Retail

- 9.3.5. Healthcare

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Rest of the World Cloud Backup Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solution

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.2.1. Public Cloud

- 10.2.2. Private Cloud

- 10.2.3. Hybrid Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. IT and Telecom

- 10.3.3. Media and Entertainment

- 10.3.4. Retail

- 10.3.5. Healthcare

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Backblaze Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Barracuda Networks Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Veritas Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cohesity Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rubrik

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dell EMC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arcserve LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Acronis International GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Commvault Systems Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Carbonite Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Backblaze Inc

List of Figures

- Figure 1: Global Cloud Backup Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cloud Backup Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Cloud Backup Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Cloud Backup Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 5: North America Cloud Backup Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 6: North America Cloud Backup Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Cloud Backup Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Cloud Backup Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cloud Backup Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cloud Backup Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Cloud Backup Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Cloud Backup Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 13: Europe Cloud Backup Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 14: Europe Cloud Backup Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Cloud Backup Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Cloud Backup Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Cloud Backup Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cloud Backup Market Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Pacific Cloud Backup Market Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Cloud Backup Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 21: Asia Pacific Cloud Backup Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 22: Asia Pacific Cloud Backup Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Cloud Backup Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Cloud Backup Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Cloud Backup Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Cloud Backup Market Revenue (Million), by Component 2025 & 2033

- Figure 27: Latin America Cloud Backup Market Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Cloud Backup Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 29: Latin America Cloud Backup Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 30: Latin America Cloud Backup Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Cloud Backup Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Cloud Backup Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Cloud Backup Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Cloud Backup Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Rest of the World Cloud Backup Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Rest of the World Cloud Backup Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 37: Rest of the World Cloud Backup Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 38: Rest of the World Cloud Backup Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Rest of the World Cloud Backup Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of the World Cloud Backup Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Cloud Backup Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Backup Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Cloud Backup Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 3: Global Cloud Backup Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Cloud Backup Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cloud Backup Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Cloud Backup Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 7: Global Cloud Backup Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Cloud Backup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Cloud Backup Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Cloud Backup Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 11: Global Cloud Backup Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Cloud Backup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Cloud Backup Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Cloud Backup Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 15: Global Cloud Backup Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Cloud Backup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Cloud Backup Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Cloud Backup Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 19: Global Cloud Backup Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Cloud Backup Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Cloud Backup Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Cloud Backup Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 23: Global Cloud Backup Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Cloud Backup Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Backup Market?

The projected CAGR is approximately 24.84%.

2. Which companies are prominent players in the Cloud Backup Market?

Key companies in the market include Backblaze Inc, Barracuda Networks Inc, Veritas Technologies, IBM Corporation, Cohesity Inc, Rubrik, Dell EMC, Arcserve LLC, Acronis International GmbH, Commvault Systems Inc, Carbonite Inc.

3. What are the main segments of the Cloud Backup Market?

The market segments include Component, Deployment Mode, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Massive Growth in Data Generation Stimulating the Demand for Larger Storage Space at Low Cost; Increasing Adoption of SaaS and Other Similar Solutions; Increasing Adoption of Cloud Computing Amongst Enterprises.

6. What are the notable trends driving market growth?

BFSI Expected to Exhibit Maximum Adoption.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

August 2023: Oracle announced the new Oracle Cloud for Australian Government and Defense in Canberra to meet rapidly growing global demand from public sector organizations. Offering over 100 services, the new region is a complete and highly secure hyperscale cloud platform that permits consumers to build and run applications. It is physically separated from Oracle’s other government and public cloud regions. It shares no backbone connections, including the existing Sydney and Melbourne general regions available to all Oracle Cloud customers. The completed IRAP assessment at the PROTECTED level assures Australian public sector institutions that Oracle Cloud for the Australian Government and Defense adheres to appropriate security controls

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Backup Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Backup Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Backup Market?

To stay informed about further developments, trends, and reports in the Cloud Backup Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence