Key Insights

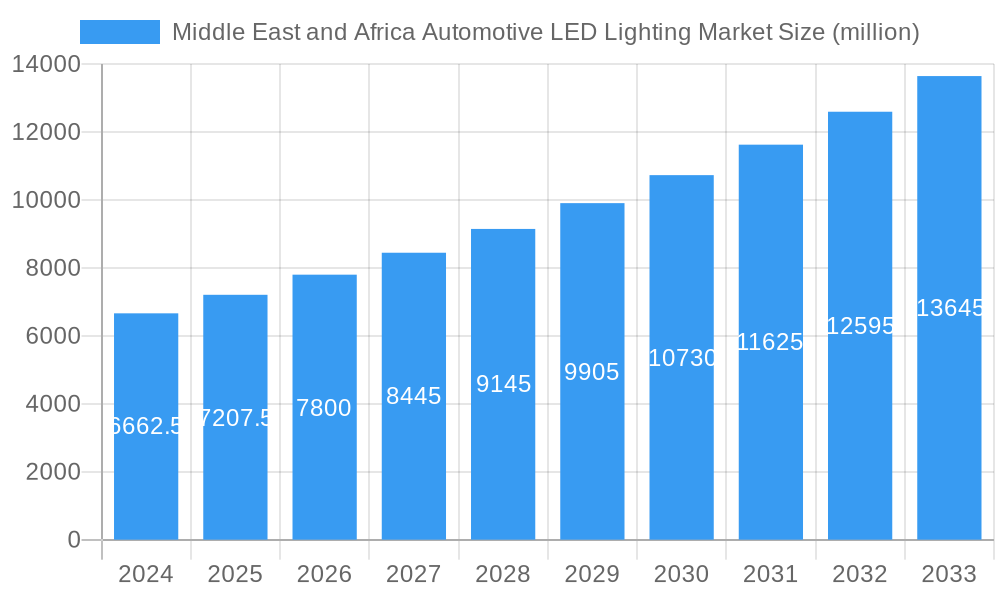

The Middle East and Africa automotive LED lighting market is poised for robust expansion, projected to reach a substantial USD 6662.5 million in 2024. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.1% throughout the forecast period, signaling a dynamic and evolving landscape. A primary driver for this surge is the increasing adoption of advanced automotive technologies, with LED lighting systems offering superior illumination, energy efficiency, and enhanced safety features. Government initiatives promoting road safety and stricter regulations on vehicle lighting standards are also compelling automakers to integrate sophisticated LED solutions. The growing consumer demand for premium vehicle features, coupled with rising disposable incomes in key Middle Eastern economies, further fuels the market. Furthermore, the expansion of the automotive manufacturing and assembly sector across the region, particularly in countries like Saudi Arabia and the UAE, necessitates a consistent supply of high-quality automotive LED lighting components. The market is witnessing a significant shift towards LED for its longevity and reduced maintenance, making it a preferred choice over traditional lighting technologies.

Middle East and Africa Automotive LED Lighting Market Market Size (In Billion)

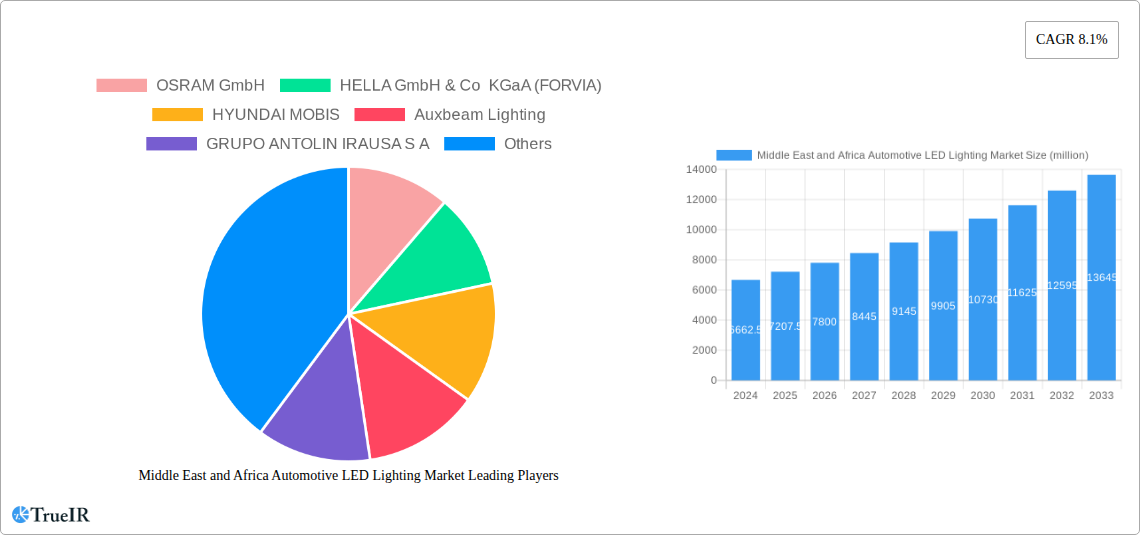

The market segmentation reveals a broad spectrum of applications, with Automotive Utility Lighting, encompassing essential components like Daytime Running Lights (DRL), Directional Signal Lights, Headlights, and Stop Lights, expected to dominate. Simultaneously, the Automotive Vehicle Lighting segment, covering two-wheelers, commercial vehicles, and passenger cars, will also experience considerable growth, driven by fleet upgrades and new vehicle sales. Key players like OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), and HYUNDAI MOBIS are at the forefront, investing in research and development to introduce innovative LED solutions that cater to the evolving needs of the automotive industry. The Middle East, with countries like Saudi Arabia and the United Arab Emirates leading the charge, represents a significant growth pocket. While the market exhibits strong positive momentum, potential challenges such as the initial cost of advanced LED systems and the availability of skilled labor for installation and maintenance could pose minor headwinds. However, the overwhelming benefits of LED technology in terms of performance, safety, and aesthetics are expected to overshadow these constraints, paving the way for sustained market prosperity.

Middle East and Africa Automotive LED Lighting Market Company Market Share

Middle East and Africa Automotive LED Lighting Market Market Structure & Competitive Landscape

The Middle East and Africa automotive LED lighting market is characterized by a moderate level of concentration, with a few key global players holding significant market share. Innovation drivers are primarily fueled by the increasing demand for enhanced vehicle safety features, improved aesthetics, and energy efficiency. Regulatory impacts are becoming more pronounced, with governments in the region progressively adopting stricter safety and emissions standards that favor LED lighting technologies. Product substitutes, such as traditional halogen and HID lighting, are gradually being phased out due to their lower efficiency and performance. End-user segmentation reveals a strong preference for LED lighting in passenger cars, driven by consumer demand for advanced features and customization. Commercial vehicles and two-wheelers also present growing segments, as manufacturers increasingly integrate LED solutions for cost-effectiveness and durability. Mergers and acquisitions (M&A) are notable trends, with companies strategically acquiring smaller players or forging partnerships to expand their product portfolios and geographical reach. For instance, the past decade has witnessed over 50 M&A activities within the broader automotive lighting sector in MEA, indicating a consolidated effort to strengthen market positions.

- Market Concentration: Moderate to high among top global players.

- Innovation Drivers:

- Enhanced vehicle safety (e.g., adaptive headlights, advanced DRLs).

- Aesthetic appeal and customization options.

- Energy efficiency and reduced power consumption.

- Technological advancements in LED chips and control systems.

- Regulatory Impacts:

- Increasingly stringent vehicle safety standards across MEA.

- Government initiatives promoting energy-efficient automotive components.

- Phase-out of non-LED lighting in new vehicle regulations in select nations.

- Product Substitutes: Gradual displacement by LEDs from Halogen and HID lighting.

- End-User Segmentation:

- Passenger Cars: Dominant segment due to consumer demand for advanced features.

- Commercial Vehicles: Growing adoption driven by durability and operational cost savings.

- Two-Wheelers: Emerging segment with increasing integration of LED lighting for safety and style.

- M&A Trends: Strategic acquisitions and partnerships to expand market share and technological capabilities.

Middle East and Africa Automotive LED Lighting Market Market Trends & Opportunities

The Middle East and Africa automotive LED lighting market is poised for substantial growth, driven by a confluence of factors including increasing vehicle production, evolving consumer preferences, and supportive government policies. The market size for automotive LED lighting in the MEA region is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033, reaching an estimated value of over $8,000 million by 2033. This impressive growth trajectory is underpinned by the rapid adoption of LED technology across all vehicle segments, from passenger cars and commercial vehicles to two-wheelers. Technological shifts are a significant catalyst, with continuous advancements in LED chip technology leading to brighter, more energy-efficient, and more compact lighting solutions. The integration of smart lighting features, such as adaptive front-lighting systems (AFS) and dynamic turn signals, is becoming a key differentiator, catering to the growing demand for enhanced safety and a premium driving experience.

Consumer preferences are increasingly aligning with the benefits offered by LED lighting. The desire for modern aesthetics, improved visibility for nighttime driving, and a more sophisticated vehicle appearance are pushing consumers to opt for vehicles equipped with LED lighting systems. This shift in demand, in turn, influences automotive manufacturers to prioritize LED integration in their new models. Furthermore, the growing emphasis on vehicle safety across the MEA region, with several countries implementing stricter regulations regarding lighting performance, directly benefits the LED lighting market. For instance, the mandatory inclusion of Daytime Running Lights (DRLs) in many new vehicle regulations across key markets like South Africa and the UAE has significantly boosted demand for LED DRLs.

The competitive dynamics within the market are intensifying, with established global players like OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), and HYUNDAI MOBIS fiercely competing with emerging regional players and specialized LED manufacturers. Opportunities abound for companies that can offer innovative, cost-effective, and compliant LED lighting solutions. The expansion of automotive manufacturing hubs in countries like Egypt and Morocco, coupled with increasing vehicle parc growth in nations such as Nigeria and Saudi Arabia, presents a fertile ground for market penetration. The development of localized manufacturing and supply chains for LED automotive components could further unlock opportunities, reducing lead times and costs. The rising disposable incomes and a growing middle class in many African nations are also contributing to the increased demand for passenger vehicles, consequently driving the demand for advanced LED lighting. The push towards electric vehicles (EVs) in the region also presents a significant opportunity, as EVs often integrate more advanced and power-efficient lighting solutions, with LEDs being the preferred choice. The market penetration of LED lighting in new vehicles is expected to surpass 70% by 2033, indicating a substantial shift from traditional lighting technologies.

Dominant Markets & Segments in Middle East and Africa Automotive LED Lighting Market

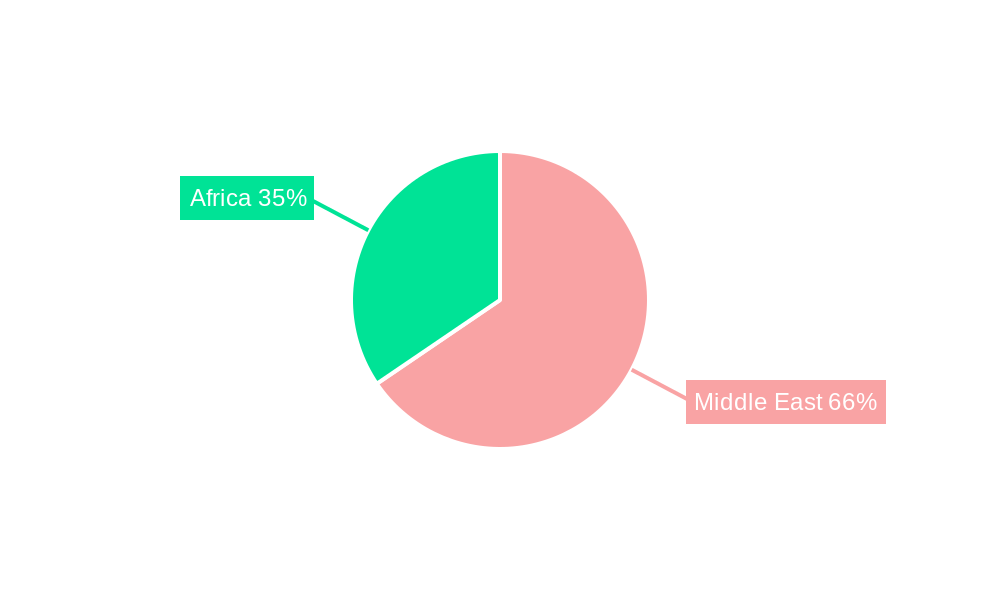

The Middle East and Africa automotive LED lighting market exhibits distinct patterns of dominance across various regions and segments, driven by a mix of economic development, regulatory frameworks, and consumer adoption rates. In terms of regional dominance, the Middle East region, particularly countries like Saudi Arabia, the UAE, and Turkey, currently holds the largest share in the automotive LED lighting market. This is attributed to their higher per capita income, a substantial luxury and premium vehicle segment, and proactive adoption of advanced automotive technologies. The region benefits from significant investments in automotive infrastructure and a strong consumer appetite for features that enhance vehicle aesthetics and safety. The Passenger Cars segment within Automotive Vehicle Lighting is the most dominant, accounting for an estimated 65% of the total market revenue in 2025. This dominance is fueled by a growing middle class, increasing urbanization, and a strong demand for personal mobility.

Within Automotive Utility Lighting, Headlights are the most significant segment, representing over 30% of the utility lighting market share. The increasing adoption of advanced headlight technologies, including LED and matrix LED systems, driven by safety regulations and consumer demand for improved visibility, propels this segment's growth. Daytime Running Lights (DRLs) also represent a substantial and rapidly growing segment, with mandatory regulations in several key MEA markets acting as a primary growth driver.

On the African continent, South Africa stands out as a leading market, owing to its relatively mature automotive industry, established manufacturing base, and stringent vehicle safety standards. While the overall penetration of LED lighting is still evolving, the Commercial Vehicles segment is showing promising growth in key African nations as fleet operators seek to reduce operational costs through energy-efficient and durable lighting solutions. The Two-Wheelers segment, particularly in countries like India (though a significant portion of the MEA region for this report context) and some parts of North Africa, is a rapidly expanding niche, driven by the affordability and ubiquity of motorcycles and scooters as primary modes of transportation, with increasing integration of LED lighting for enhanced safety and style.

Key growth drivers for market dominance include:

- Infrastructure Development: Expanding road networks and urban development in emerging economies stimulate new vehicle sales, increasing the demand for automotive lighting.

- Government Policies and Regulations: Mandates for safety features like DRLs and emissions standards that favor energy-efficient lighting solutions.

- Economic Growth and Disposable Income: Rising incomes lead to increased purchasing power for new vehicles and demand for premium features like LED lighting.

- Automotive Manufacturing Hubs: The presence of established or growing automotive manufacturing bases in countries like Turkey, Egypt, and South Africa directly impacts the adoption and localized production of LED lighting.

- Consumer Awareness and Preference: Growing awareness of the benefits of LED lighting, such as improved visibility, energy efficiency, and modern aesthetics.

The Automotive Vehicle Lighting segment, particularly Passenger Cars, is projected to maintain its leading position throughout the forecast period, with a CAGR of approximately 13% from 2025 to 2033. The Headlights and DRLs within the Automotive Utility Lighting segment are expected to experience the fastest growth rates, driven by regulatory mandates and technological advancements.

Middle East and Africa Automotive LED Lighting Market Product Analysis

The Middle East and Africa automotive LED lighting market is witnessing a significant surge in product innovation, with a focus on enhanced performance, energy efficiency, and aesthetic integration. LED technology offers superior brightness, durability, and lower power consumption compared to traditional lighting. Product innovations include advanced headlight systems with adaptive capabilities that adjust beam patterns based on driving conditions and steering input, significantly improving nighttime visibility and safety. Daytime Running Lights (DRLs) have become a standard feature, often integrated into sleek, customizable designs that enhance vehicle aesthetics. The market also sees a rise in sophisticated rear lighting solutions, including dynamic turn signals and 3D tail light designs, contributing to both safety and brand identity. The competitive advantage lies in the ability of manufacturers to deliver high-quality, reliable, and cost-effective LED lighting modules that meet stringent automotive standards and evolving consumer expectations for advanced lighting functionalities.

Key Drivers, Barriers & Challenges in Middle East and Africa Automotive LED Lighting Market

Key Drivers:

The Middle East and Africa automotive LED lighting market is propelled by several key drivers. Technologically, the inherent superiority of LEDs in terms of brightness, energy efficiency, and lifespan is a primary advantage, aligning with global trends towards sustainable automotive solutions. Economically, increasing vehicle production and sales across the MEA region, coupled with rising disposable incomes in many nations, directly fuels demand for new vehicles equipped with advanced lighting. Policy-driven factors, such as stricter vehicle safety regulations mandating features like Daytime Running Lights (DRLs), are also significant catalysts. For instance, the adoption of UN R121 standards in several key African markets is a major push factor for LED DRLs.

Key Barriers & Challenges:

Despite the growth, the market faces significant challenges. Regulatory complexities and differing standards across various MEA countries can hinder widespread adoption and necessitate product customization. Supply chain disruptions, particularly for specialized electronic components, can impact production timelines and costs. Competitive pressures from established global players and emerging local manufacturers, often competing on price, also pose a challenge. Furthermore, the initial higher cost of LED lighting systems compared to traditional halogen bulbs can be a barrier in price-sensitive markets, especially for entry-level vehicles and in less developed regions. The need for specialized manufacturing and assembly expertise also presents an entry hurdle for new players.

Growth Drivers in the Middle East and Africa Automotive LED Lighting Market Market

Several factors are driving the growth of the automotive LED lighting market in the Middle East and Africa. Technologically, the continuous evolution of LED chip efficiency and performance, along with the integration of smart features like adaptive lighting, is a key driver. Economically, the robust growth in vehicle production and sales across key MEA nations, spurred by expanding economies and a growing middle class, directly translates to increased demand for automotive lighting. Regulatory advancements, such as the increasing adoption of global safety standards that mandate advanced lighting features like DRLs and improved headlight performance, are also significant growth catalysts. For example, the mandatory implementation of DRLs in South Africa and the UAE has substantially boosted the demand for LED DRLs.

Challenges Impacting Middle East and Africa Automotive LED Lighting Market Growth

The growth of the Middle East and Africa automotive LED lighting market is being impacted by several barriers and restraints. Regulatory complexities and inconsistencies across the diverse markets within the MEA region can create hurdles for market entry and product standardization. Supply chain vulnerabilities, particularly concerning the availability and cost of specialized semiconductor components for LED manufacturing, can lead to production delays and increased costs. Intense competitive pressures from both global giants and emerging local players, often engaging in price-based competition, also challenge profit margins. Furthermore, the upfront cost of LED lighting systems, while decreasing, can still be a limiting factor for mass adoption in price-sensitive segments and less affluent markets within the region.

Key Players Shaping the Middle East and Africa Automotive LED Lighting Market Market

- OSRAM GmbH

- HELLA GmbH & Co KGaA (FORVIA)

- HYUNDAI MOBIS

- Auxbeam Lighting

- GRUPO ANTOLIN IRAUSA S A

- Marelli Holdings Co Ltd

- Vale

- Signify (Philips)

Significant Middle East and Africa Automotive LED Lighting Market Industry Milestones

- 2019: HELLA GmbH & Co KGaA (FORVIA) announces expansion plans for its lighting division, targeting increased production capacity in North Africa to serve growing vehicle demand.

- 2020: OSRAM GmbH launches a new generation of automotive LED modules with enhanced energy efficiency and longer lifespan, specifically for emerging markets in MEA.

- 2021: HYUNDAI MOBIS secures a significant supply contract for advanced LED lighting systems with a major automotive OEM operating in South Africa.

- 2022: Vale introduces innovative LED lighting solutions for commercial vehicles in the Middle East, focusing on durability and reduced maintenance costs.

- 2023: Signify (Philips) partners with a regional automotive aftermarket distributor to expand its LED retrofit lighting solutions for passenger cars across key MEA countries.

- 2024: GRUPO ANTOLIN IRAUSA S A announces the development of smart LED lighting systems with integrated sensors for enhanced vehicle safety, targeting the premium segment in the Middle East.

Future Outlook for Middle East and Africa Automotive LED Lighting Market Market

The future outlook for the Middle East and Africa automotive LED lighting market is exceptionally bright, driven by a sustained demand for advanced vehicle features, increasingly stringent safety regulations, and the inherent technological advantages of LED illumination. Strategic opportunities lie in the expansion of manufacturing capabilities within the region to reduce costs and lead times, catering to both original equipment manufacturers (OEMs) and the aftermarket. The growing adoption of electric vehicles will further accelerate the demand for efficient and sophisticated LED lighting. Companies that focus on delivering innovative, cost-effective, and compliant solutions, while also adapting to regional market specificities, are poised for significant growth. The anticipated increase in vehicle parc and the ongoing urbanization trend across Africa will continue to fuel the demand for automotive LED lighting, solidifying its position as a critical component in the evolving automotive landscape of the MEA region.

Middle East and Africa Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

Middle East and Africa Automotive LED Lighting Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Automotive LED Lighting Market Regional Market Share

Geographic Coverage of Middle East and Africa Automotive LED Lighting Market

Middle East and Africa Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Operational Efficiency; Cost-cutting Across Industries

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Personnel

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Automotive LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OSRAM GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HELLA GmbH & Co KGaA (FORVIA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HYUNDAI MOBIS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Auxbeam Lighting

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GRUPO ANTOLIN IRAUSA S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marelli Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vale

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Signify (Philips)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 OSRAM GmbH

List of Figures

- Figure 1: Middle East and Africa Automotive LED Lighting Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Automotive LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Automotive LED Lighting Market Revenue million Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 2: Middle East and Africa Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 3: Middle East and Africa Automotive LED Lighting Market Revenue million Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 4: Middle East and Africa Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 5: Middle East and Africa Automotive LED Lighting Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Automotive LED Lighting Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Middle East and Africa Automotive LED Lighting Market Revenue million Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 8: Middle East and Africa Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 9: Middle East and Africa Automotive LED Lighting Market Revenue million Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 10: Middle East and Africa Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 11: Middle East and Africa Automotive LED Lighting Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Middle East and Africa Automotive LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East and Africa Automotive LED Lighting Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East and Africa Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Automotive LED Lighting Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Middle East and Africa Automotive LED Lighting Market?

Key companies in the market include OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), HYUNDAI MOBIS, Auxbeam Lighting, GRUPO ANTOLIN IRAUSA S A, Marelli Holdings Co Ltd, Vale, Signify (Philips).

3. What are the main segments of the Middle East and Africa Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 6662.5 million as of 2022.

5. What are some drivers contributing to market growth?

Need for Operational Efficiency; Cost-cutting Across Industries.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of Skilled Personnel.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence