Key Insights

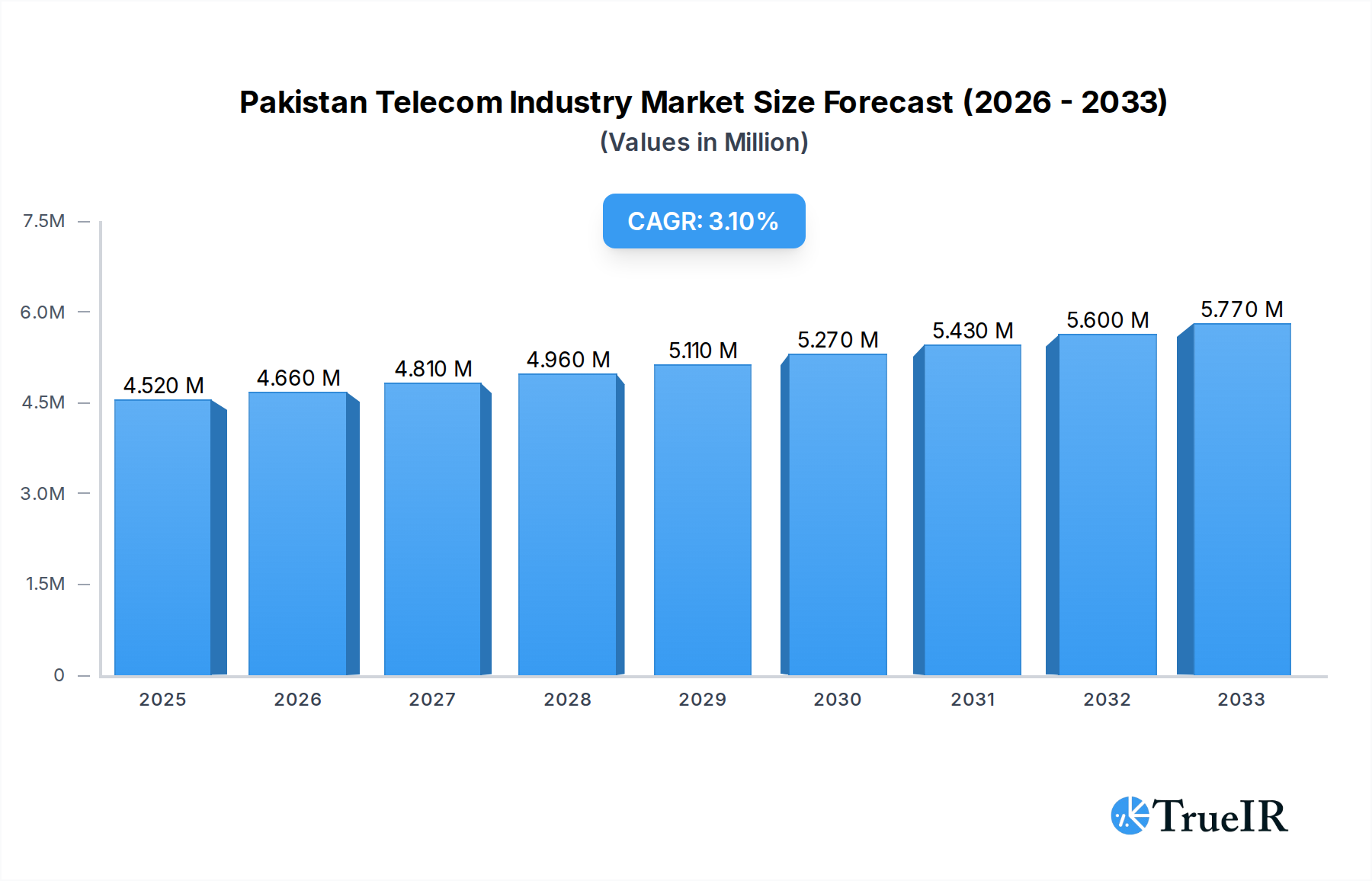

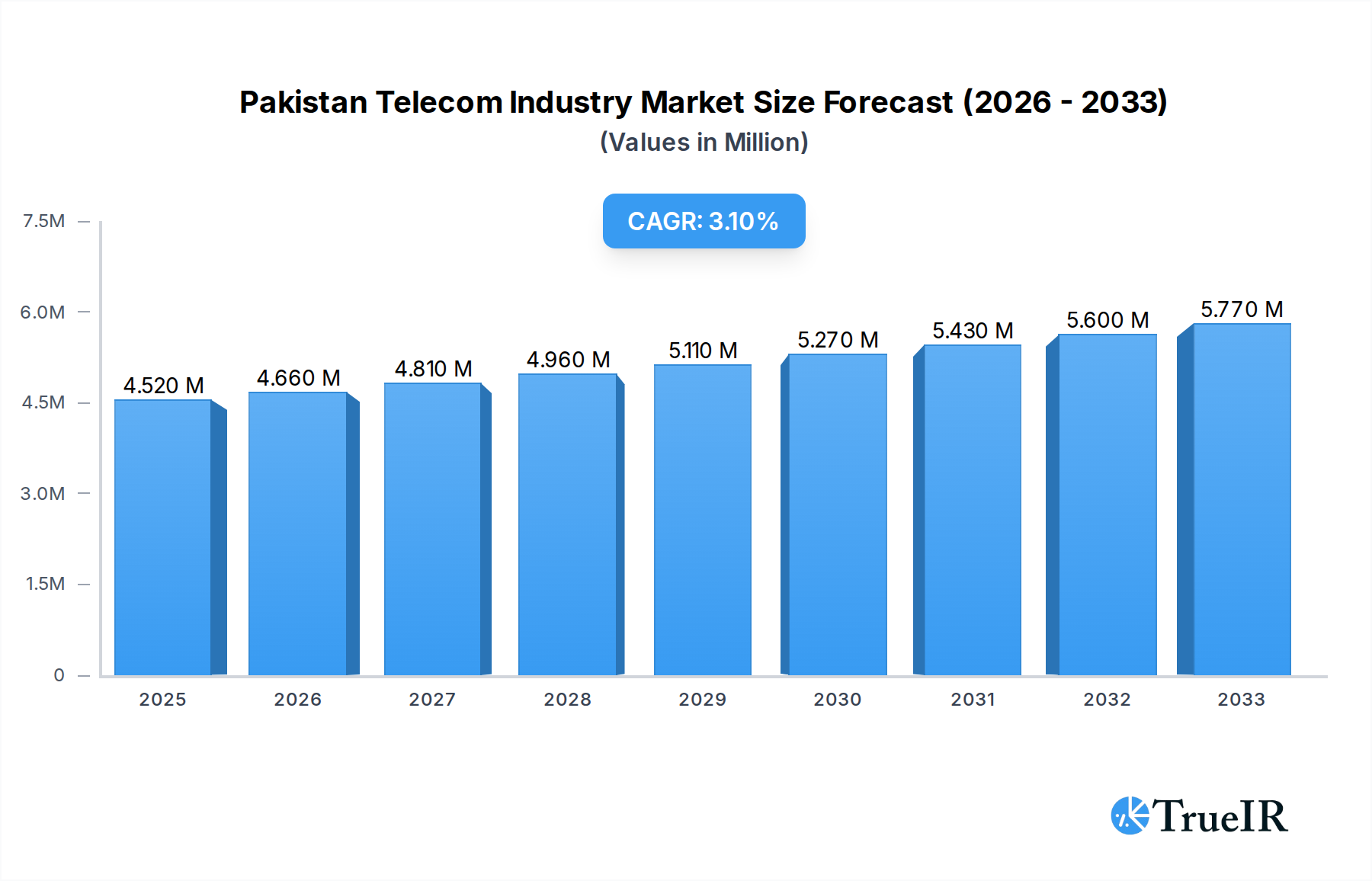

The Pakistan Telecom Industry is experiencing robust growth, currently valued at 4.52 Million and projected to expand at a Compound Annual Growth Rate (CAGR) of 3.28% from 2019 to 2033. This upward trajectory is primarily driven by increasing smartphone penetration, a burgeoning digital economy, and a growing demand for high-speed internet services across both urban and rural areas. The government's focus on digital transformation and infrastructure development, coupled with significant investments from major telecom players, are further bolstering market expansion. Key growth segments include mobile data services, fueled by the increasing adoption of mobile internet for communication, entertainment, and e-commerce. The expansion of 4G and the anticipated rollout of 5G technologies are poised to revolutionize data consumption and introduce new service avenues.

Pakistan Telecom Industry Market Size (In Million)

The industry's dynamics are further shaped by evolving consumer preferences towards Over-The-Top (OTT) and Pay-TV services, indicating a shift from traditional media consumption. While the market is propelled by these drivers, certain restraints such as the high cost of spectrum acquisition and infrastructure deployment, alongside regulatory challenges, present hurdles. However, the competitive landscape, featuring prominent players like Pakistan Telecommunication Company Ltd (PTCL), Mobilink (Jazz), and Telenor Pakistan, ensures innovation and service improvement. The continuous evolution of technology and strategic alliances among these entities are expected to mitigate these challenges and sustain the industry's growth momentum, making Pakistan a significant market in the regional telecom landscape.

Pakistan Telecom Industry Company Market Share

Pakistan Telecom Industry Market Research Report: Forecast to 2033

This comprehensive report provides an in-depth analysis of the Pakistan Telecom Industry, covering market structure, trends, opportunities, competitive landscape, and future outlook. Leveraging high-volume SEO keywords, this report is designed to engage industry professionals, investors, and stakeholders seeking detailed insights into Pakistan's rapidly evolving telecommunications sector. The study spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, building on historical data from 2019 to 2024.

Pakistan Telecom Industry Market Structure & Competitive Landscape

The Pakistan telecom industry is characterized by a highly competitive market structure, driven by significant investments in infrastructure and a growing subscriber base. Market concentration is influenced by the presence of major players, with a notable duopoly in mobile services and a consolidated fixed-line and broadband segment. Innovation drivers include the rapid adoption of 5G technology, increasing demand for high-speed data, and the expansion of Over-The-Top (OTT) services. Regulatory impacts are profound, with government policies shaping spectrum allocation, pricing, and infrastructure development, creating both opportunities and barriers to entry. Product substitutes are emerging, particularly in the form of Over-The-Top (OTT) communication and entertainment platforms, challenging traditional voice and PayTV services. End-user segmentation reveals distinct needs across consumer, enterprise, and government sectors, driving tailored service offerings. Mergers and Acquisitions (M&A) trends are observed as companies seek to consolidate market share, enhance service portfolios, and achieve economies of scale. For instance, recent M&A activities indicate a trend towards consolidation to better compete in a maturing market. The industry's competitive intensity is reflected in ongoing tariff wars and a continuous drive for customer acquisition and retention, pushing service providers to innovate and optimize their operational efficiencies. The landscape is dynamic, with continuous evolution of technology and consumer behavior.

Pakistan Telecom Industry Market Trends & Opportunities

The Pakistan telecom industry is experiencing robust market size growth, fueled by increasing internet penetration and data consumption. The market size is projected to reach an estimated value exceeding XX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). Technological shifts are paramount, with the ongoing rollout and adoption of 5G technology poised to revolutionize mobile connectivity, enabling faster speeds, lower latency, and the proliferation of new applications. This technological advancement is a significant market trend, driving demand for upgraded devices and services. Consumer preferences are increasingly shifting towards data-intensive services, including video streaming, online gaming, and social media, necessitating enhanced broadband and mobile data capabilities. The average revenue per user (ARPU) is expected to see gradual increases as subscribers migrate to higher-tier data plans and bundled services. Competitive dynamics are intensifying, with operators vying for market share through aggressive pricing strategies, innovative product bundles, and superior network quality. The rise of Over-The-Top (OTT) services presents both a challenge and an opportunity for traditional telecom operators, who are increasingly exploring partnerships or developing their own OTT platforms to capture a share of the digital content market. Furthermore, the growing digital economy in Pakistan, encompassing e-commerce, digital payments, and online education, presents substantial growth opportunities for the telecom sector to provide the underlying connectivity infrastructure. The expansion of digital financial services and the Internet of Things (IoT) are also emerging trends that will shape the future of the industry, opening up new revenue streams and market segments for telecom providers. Strategic investments in fiber optic networks and the expansion of 4G/5G coverage to underserved rural areas are critical for unlocking the full potential of these trends and ensuring inclusive digital growth across Pakistan.

Dominant Markets & Segments in Pakistan Telecom Industry

The dominant segment within the Pakistan Telecom Industry is undeniably Data and OTT services. This segment's dominance is driven by several key growth drivers:

- Rapid Digitalization: The increasing adoption of smartphones and the proliferation of internet-enabled devices have propelled data consumption to unprecedented levels. This digital transformation across various sectors, including e-commerce, education, and entertainment, directly fuels the demand for robust data services.

- Growing Middle Class and Urbanization: A burgeoning middle class with increasing disposable income and higher urbanization rates are key demographics driving the uptake of data-intensive services. These consumers are more likely to invest in higher data packages and premium digital content.

- Affordable Data Plans and Device Penetration: Telecom operators have strategically introduced more affordable data plans and bundled offers, making internet access more accessible to a wider population. The increasing penetration of smartphones, even in lower price segments, has also been a significant factor.

- Over-The-Top (OTT) Service Growth: The popularity of global and local OTT platforms for video streaming, music, and communication has created a massive demand for data. Consumers are increasingly opting for these digital alternatives to traditional broadcast and cable services.

- Government Initiatives for Digital Inclusion: While infrastructure remains a focus, government policies aimed at promoting digital literacy and providing internet access to remote areas are indirectly contributing to the growth of data services by expanding the potential user base.

While Voice Services (Wireless) also remains a significant segment, its growth is relatively slower compared to data services as Over-The-Top (OTT) communication apps gain traction. Voice Services (Wired), while foundational, is experiencing a decline in its traditional form due to the rise of mobile and digital alternatives. PayTV Services, often bundled with broadband, are also facing competition from OTT video streaming platforms. The overall market trajectory clearly indicates a strong preference and increasing expenditure on data-centric solutions and the digital content ecosystem fostered by OTT providers.

Pakistan Telecom Industry Product Analysis

Product innovation in the Pakistan telecom industry is heavily skewed towards data-centric offerings and enhanced user experience. Key innovations include the introduction of advanced hybrid packages that bundle voice, data, and sometimes entertainment services, catering to diverse consumer needs. The development of high-speed broadband solutions, including fiber optic and 4G/5G networks, is a cornerstone of product strategy, enabling seamless streaming, gaming, and enterprise applications. Furthermore, operators are actively venturing into the OTT and PayTV space, launching proprietary video streaming platforms and content aggregation services to capture a larger share of the digital entertainment market. Competitive advantages are being built on network reliability, speed, data allowances, and bundled value propositions. Technological advancements in network infrastructure are crucial for delivering these products effectively, with a focus on expanding 5G coverage and optimizing existing 4G networks.

Key Drivers, Barriers & Challenges in Pakistan Telecom Industry

Key Drivers:

- Growing Young Population & Digital Savvy Consumers: Pakistan boasts a large, young demographic eager to adopt new technologies and digital services.

- Increasing Smartphone Penetration: The widespread availability of affordable smartphones drives data consumption and adoption of digital services.

- Government Push for Digital Transformation: Initiatives promoting digital literacy and connectivity create a favorable environment.

- Demand for Data Services: Exponential growth in video streaming, social media, and online activities fuels data demand.

- Infrastructure Investments: Continuous investment in fiber optic and mobile network expansion (4G/5G) is crucial.

Barriers & Challenges:

- Regulatory Hurdles & Policy Uncertainty: Complex regulatory frameworks and inconsistent policies can impede investment and innovation.

- Infrastructure Development Costs: High capital expenditure for network expansion, particularly in remote areas, poses a challenge.

- Cybersecurity Threats: Increasing digital transactions and data usage elevate the risk of cyberattacks, requiring robust security measures.

- Affordability and Digital Divide: Ensuring affordable access for all segments of the population and bridging the digital divide remains a significant challenge.

- Intense Competition: The highly competitive market can lead to price wars, impacting profitability and return on investment.

- Spectrum Availability and Cost: Securing sufficient and affordable spectrum for advanced technologies like 5G is critical.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of essential network equipment.

Growth Drivers in the Pakistan Telecom Industry Market

Key growth drivers for the Pakistan Telecom Industry include the rapidly growing youth demographic, which is highly receptive to digital services and new technologies. The increasing penetration of smartphones across all income levels, coupled with the declining cost of data, is significantly boosting data consumption. Government initiatives aimed at promoting digital transformation and financial inclusion also act as significant catalysts. Furthermore, the expansion of 4G and the nascent rollout of 5G networks are opening up new avenues for high-speed internet services, enabling advancements in areas like IoT, cloud computing, and enhanced mobile broadband. The booming e-commerce sector and the growing demand for digital entertainment (OTT services) are also creating sustained growth opportunities.

Challenges Impacting Pakistan Telecom Industry Growth

Challenges impacting Pakistan Telecom Industry growth are multifaceted. Regulatory complexities and inconsistencies can create an unpredictable operating environment for service providers, potentially deterring investment. The high capital expenditure required for network expansion and upgrades, especially in challenging geographical terrains and to reach underserved populations, remains a substantial barrier. Intense market competition often leads to price wars, squeezing profit margins and impacting the ability to invest in future technologies. Furthermore, cybersecurity threats and the need for robust data protection are growing concerns that require continuous investment and vigilance. Bridging the digital divide and ensuring affordable access for all segments of society, particularly in rural and remote areas, is an ongoing challenge.

Key Players Shaping the Pakistan Telecom Industry Market

- Pakistan Telecommunication Company Ltd (PTCL)

- Pak Telecommunication Mobile Limited (Ufone)

- Pakistan Mobile Communications Limited (Jazz)

- Telenor Pakistan Limited

- China Mobile Pakistan (Zong)

- Multinet Pakistan (Pvt ) Limited

- WorldCall Telecom Limited

- Wateen Telecom

- Nayatel (NTL)

- Special Communications Organization

Significant Pakistan Telecom Industry Industry Milestones

- October 2022: Pakistan Telecommunication Company Ltd (PTCL) announced a collaboration with Evision to launch a new video streaming platform, aiming to offer a diverse range of Hollywood, Pakistani entertainment, and national/international news and sports channels.

- June 2022: Pakistan's leading voice and data network, Ufone, introduced the "Sab Se Bari Offer," a hybrid package designed to provide enhanced user experience through extensive and economical voice and data services.

Future Outlook for Pakistan Telecom Industry Market

The future outlook for the Pakistan Telecom Industry is overwhelmingly positive, driven by continued demand for digital services and ongoing technological advancements. The expansion of 5G technology, although in its nascent stages, is anticipated to unlock significant growth opportunities in areas like enhanced mobile broadband, fixed wireless access, and specialized enterprise solutions. Strategic investments in fiber optic infrastructure will further bolster broadband capabilities, supporting the burgeoning digital economy and the increasing consumption of high-definition content. Telecom operators are expected to focus on bundled services, digital financial inclusion, and the development of an integrated digital ecosystem to cater to evolving consumer preferences. The industry is poised to play a pivotal role in Pakistan's digital transformation journey, fostering innovation and economic growth across various sectors.

Pakistan Telecom Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Pakistan Telecom Industry Segmentation By Geography

- 1. Pakistan

Pakistan Telecom Industry Regional Market Share

Geographic Coverage of Pakistan Telecom Industry

Pakistan Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pace of Digital Transformation; Robust Mobile Penetration in the Country

- 3.3. Market Restrains

- 3.3.1. ; Lack of Infrastructure and Limited Awareness about E-learning

- 3.4. Market Trends

- 3.4.1. Accelerating Digital Transformation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Multinet Pakistan (Pvt ) Limited*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pak Telecommunication Mobile Limited (Ufone)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pakistan Mobile Communications Limited (Jazz)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WorldCall Telecom Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wateen Telecom

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nayatel (NTL)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Special Communications Organization

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pakistan Telecommunication Company Ltd (PTCL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Telenor Pakistan Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Mobile Pakistan (Zong)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Multinet Pakistan (Pvt ) Limited*List Not Exhaustive

List of Figures

- Figure 1: Pakistan Telecom Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Pakistan Telecom Industry Share (%) by Company 2025

List of Tables

- Table 1: Pakistan Telecom Industry Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 2: Pakistan Telecom Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Pakistan Telecom Industry Revenue Million Forecast, by Segmenta 2020 & 2033

- Table 4: Pakistan Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Telecom Industry?

The projected CAGR is approximately 3.28%.

2. Which companies are prominent players in the Pakistan Telecom Industry?

Key companies in the market include Multinet Pakistan (Pvt ) Limited*List Not Exhaustive, Pak Telecommunication Mobile Limited (Ufone), Pakistan Mobile Communications Limited (Jazz), WorldCall Telecom Limited, Wateen Telecom, Nayatel (NTL), Special Communications Organization, Pakistan Telecommunication Company Ltd (PTCL), Telenor Pakistan Limited, China Mobile Pakistan (Zong).

3. What are the main segments of the Pakistan Telecom Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pace of Digital Transformation; Robust Mobile Penetration in the Country.

6. What are the notable trends driving market growth?

Accelerating Digital Transformation.

7. Are there any restraints impacting market growth?

; Lack of Infrastructure and Limited Awareness about E-learning.

8. Can you provide examples of recent developments in the market?

In October 2022, Pakistan Telecommunication Company Ltd (PTCL) unveiled that it had penned to collaborate with Evision to launch a video streaming platform. According to PTCL, the new digital video over-the-top (OTT) platform would provide news and entertainment by hosting Hollywood and Pakistani entertainment material in addition to various national and international news and sports channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Telecom Industry?

To stay informed about further developments, trends, and reports in the Pakistan Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence