Key Insights

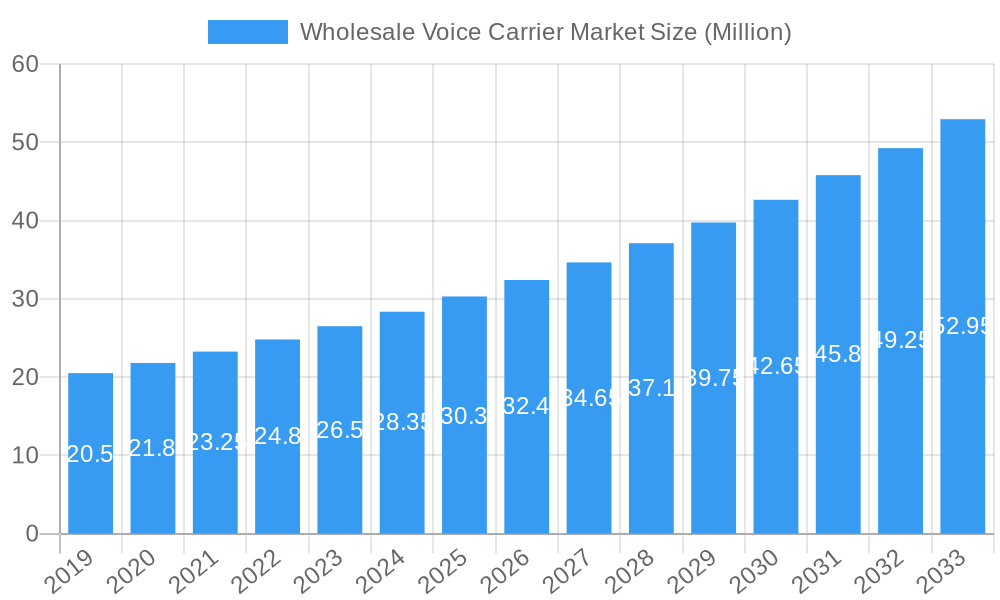

The global Wholesale Voice Carrier Market is poised for substantial expansion, projected to reach 36.19 Million by the end of 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 11.25% over the forecast period of 2025-2033. The market's dynamism is driven by several key factors. The increasing demand for cost-effective communication solutions, particularly from emerging economies, acts as a primary driver. Furthermore, advancements in Voice over Internet Protocol (VoIP) technology are continually enhancing the quality and reducing the cost of voice transmission, making wholesale voice services more attractive to a wider range of businesses. The ongoing digital transformation across industries is also contributing significantly, as organizations rely more heavily on robust and scalable communication infrastructure to support their operations and customer interactions. The market segments of Voice Termination and Interconnect Billing are expected to witness considerable activity, driven by the need for efficient routing and settlement of voice traffic.

Wholesale Voice Carrier Market Market Size (In Million)

However, the market is not without its challenges. While the increasing adoption of IP-based technologies like VoIP presents opportunities, the ongoing transition from traditional switching infrastructure to newer IP networks may pose integration challenges and require significant investment for some legacy providers. Furthermore, intense competition among established players and the emergence of new entrants can lead to price pressures, potentially impacting profit margins. Fraud management remains a critical concern, necessitating continuous innovation in security protocols and detection mechanisms to safeguard revenue streams and maintain service integrity. Despite these restraints, the overarching trend towards globalization and the ever-increasing need for seamless international communication are expected to propel the Wholesale Voice Carrier Market forward, with key players like Vodafone, Orange, AT&T, and Tata Communications at the forefront of this evolving landscape.

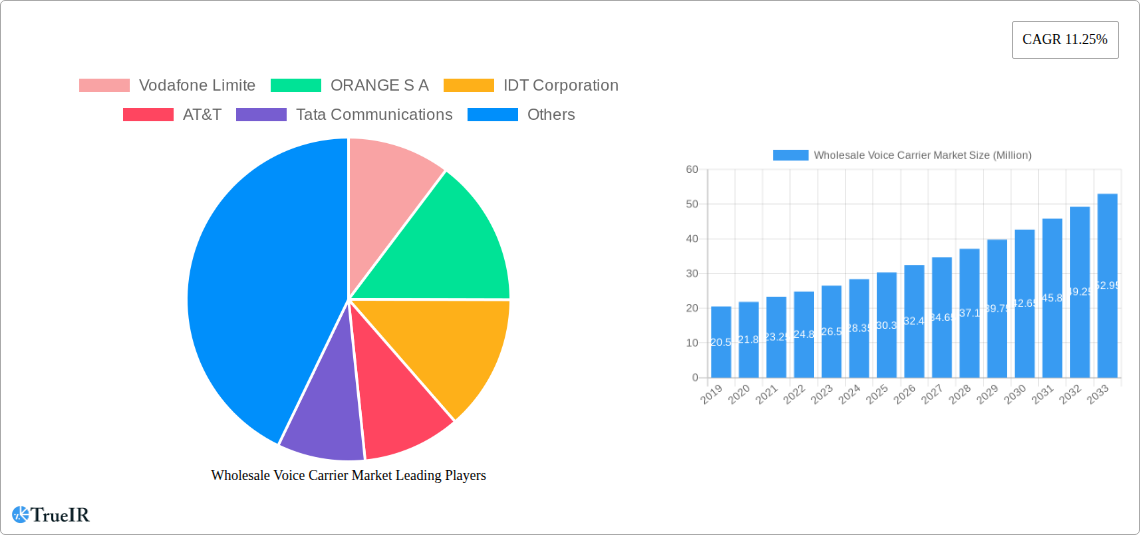

Wholesale Voice Carrier Market Company Market Share

This in-depth report provides a meticulous examination of the global Wholesale Voice Carrier Market, offering critical insights into its structure, trends, and future trajectory. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033, this analysis is designed for industry leaders, strategists, and investors seeking to navigate the evolving landscape of international voice services.

Wholesale Voice Carrier Market Market Structure & Competitive Landscape

The Wholesale Voice Carrier Market is characterized by a moderate to high concentration, with a few key players dominating global traffic. Leading entities like AT&T, Vodafone Limited, ORANGE S.A., and Tata Communications collectively hold a significant market share. Innovation remains a critical differentiator, driven by the constant need for cost optimization, enhanced quality of service (QoS), and the adoption of new technologies like VoIP. Regulatory impacts, while diverse across regions, are increasingly focused on aspects like data privacy, security, and fair competition, influencing operational strategies. Product substitutes, though evolving, primarily center around over-the-top (OTT) communication services, creating a competitive pressure. End-user segmentation reveals a strong reliance on business-to-business (B2B) relationships, with major telecommunication operators, mobile virtual network operators (MVNOs), and large enterprises forming the core customer base. Merger and acquisition (M&A) trends are ongoing, aimed at consolidating market presence, expanding service portfolios, and achieving economies of scale. For instance, significant M&A activity in recent years has seen the consolidation of smaller regional players into larger international entities, increasing the market concentration. The Herfindahl-Hirschman Index (HHI) is estimated to be between 1500 and 2000, indicating a moderately concentrated market. Key M&A volumes have averaged approximately $500 Million annually over the historical period.

Wholesale Voice Carrier Market Market Trends & Opportunities

The Wholesale Voice Carrier Market is experiencing robust growth, driven by an insatiable global demand for seamless and cost-effective voice communication. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period, reaching an estimated $XXX Million by 2033. This expansion is significantly fueled by the ongoing digital transformation across industries, which necessitates reliable international voice connectivity for businesses of all sizes. The shift towards VoIP technology continues to be a dominant trend, offering substantial cost savings and enhanced features compared to traditional circuit-switched networks. This technological evolution presents a major opportunity for carriers to invest in next-generation infrastructure and offer value-added services. Consumer preferences are increasingly leaning towards integrated communication solutions, pushing wholesale carriers to develop more sophisticated offerings that can be white-labeled or bundled by their clients. Competitive dynamics are intensifying, with players focusing on network optimization, route diversification, and superior customer support to gain market share. The increasing penetration of mobile devices globally, coupled with the growing demand for international calling from emerging economies, further underpins market expansion. Emerging markets, in particular, represent a significant growth frontier, with a rapidly expanding subscriber base and a growing appetite for international voice services. Furthermore, the rise of IoT and M2M communications is creating new avenues for wholesale voice carriers to explore, by offering specialized connectivity solutions. The market penetration rate for wholesale voice services among large enterprises is estimated to be around 75%, with significant room for growth in the SME sector. The average revenue per minute (ARPM) for international wholesale voice traffic is projected to see a marginal decline due to increased competition and efficiency gains in VoIP, estimated at a rate of -1.5% annually.

Dominant Markets & Segments in Wholesale Voice Carrier Market

The Voice Termination segment is the undisputed leader within the Wholesale Voice Carrier Market, commanding an estimated 60% of the total market revenue. This dominance is attributed to its foundational role in enabling international voice calls, connecting disparate networks, and ensuring global reach for telecommunication providers. The VoIP technology segment is also a significant growth driver, holding approximately 70% of the market share in terms of technology adoption and projected to grow at a CAGR of 8% over the forecast period. This rapid adoption is driven by its cost-effectiveness, scalability, and superior functionality.

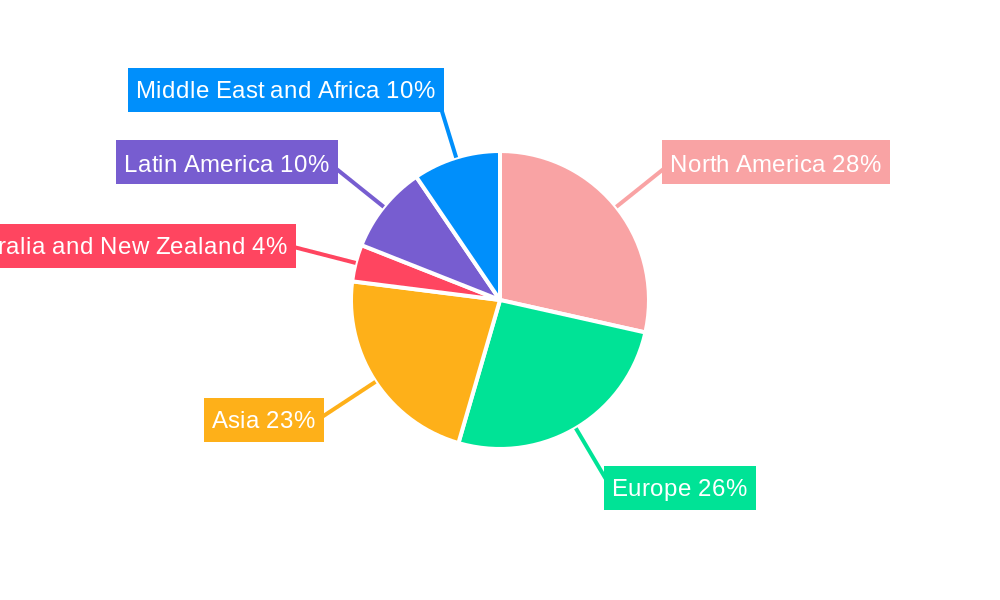

Dominant Region: North America and Europe

- Key Growth Drivers: Mature telecommunication infrastructure, high smartphone penetration, extensive business networks, and established regulatory frameworks fostering competition and innovation.

- Detailed Analysis: These regions have long been at the forefront of telecommunications development. Extensive fiber optic networks, widespread adoption of cloud-based services, and a strong presence of multinational corporations requiring robust international voice solutions solidify their dominance. Regulatory environments, while complex, generally promote market liberalization and technological advancement. The high concentration of major carriers in these regions also contributes to the dominance.

Dominant Segment: Voice Termination

- Key Growth Drivers: Essential for global connectivity, continuous demand from mobile and fixed-line operators, and the need for high-quality termination services.

- Detailed Analysis: Voice termination remains the bedrock of the wholesale voice market. The sheer volume of international calls necessitates reliable and efficient termination points. Major carriers invest heavily in their Points of Presence (PoPs) and interconnect agreements to ensure high-quality, low-latency voice delivery, which is critical for customer satisfaction and churn reduction.

Dominant Technology: VoIP

- Key Growth Drivers: Cost efficiency, scalability, advanced features (e.g., HD voice, call routing), and seamless integration with other IP-based services.

- Detailed Analysis: The transition from traditional circuit-switched networks to IP-based communication has been a transformative trend. VoIP offers significant operational cost reductions for carriers and their clients, enabling them to offer more competitive pricing. The ability to integrate voice with data and other digital services further enhances its appeal and drives its market dominance.

Growing Segment: Fraud Management

- Key Growth Drivers: Increasing sophistication of voice fraud (e.g., SIM boxing, IRSF), growing financial losses for carriers, and regulatory pressures to enhance security.

- Detailed Analysis: As the wholesale voice market grows, so does the risk and impact of fraudulent activities. Carriers are increasingly investing in advanced fraud detection and prevention systems to safeguard their revenues and protect their customers. This segment, though smaller in revenue compared to voice termination, is experiencing rapid growth due to the escalating threat of fraud.

Wholesale Voice Carrier Market Product Analysis

Product innovation in the Wholesale Voice Carrier Market revolves around enhancing the efficiency, security, and intelligence of voice routing and management. Key advancements include sophisticated Overload Bypass Routing (OBR) and scoring mechanisms to optimize traffic flow and minimize service disruptions, as seen in the Odine Nebula platform. Integration of AI and machine learning for advanced fraud management solutions offers predictive capabilities to combat evolving threats. The development of secure and resilient "Protected" packages ensures reliable international voice operations, as demonstrated by Deutsche Telekom Global Carrier. Competitive advantages are derived from superior network quality, competitive pricing, comprehensive fraud mitigation, and tailored service offerings that cater to the specific needs of telecommunications operators worldwide.

Key Drivers, Barriers & Challenges in Wholesale Voice Carrier Market

Key Drivers:

- Globalization and increasing international trade necessitating continuous cross-border communication.

- Advancements in IP-based technologies (VoIP), offering cost efficiencies and enhanced service capabilities.

- Growth of emerging economies with expanding mobile and internet penetration.

- Digital transformation initiatives across various industries demanding robust voice connectivity.

- Demand for value-added services such as unified communications and IoT connectivity.

Barriers & Challenges:

- Intense price competition leading to declining Average Revenue Per Minute (ARPM).

- Evolving regulatory landscapes and compliance complexities across different jurisdictions.

- Increasing threat of voice fraud leading to significant financial losses.

- Infrastructure investment costs for maintaining and upgrading global networks.

- Cybersecurity threats impacting network integrity and data privacy.

- Supply chain disruptions affecting hardware and equipment availability.

Growth Drivers in the Wholesale Voice Carrier Market Market

The Wholesale Voice Carrier Market is propelled by several key growth drivers. The relentless march of globalization continues to fuel demand for seamless international voice communication, connecting businesses and individuals across continents. Technological evolution, particularly the widespread adoption of VoIP, is a significant catalyst, offering unprecedented cost efficiencies and enabling the development of advanced features. Emerging economies, with their burgeoning populations and increasing digital adoption, represent a vast untapped market. Furthermore, the overarching trend of digital transformation across all sectors necessitates reliable and scalable voice solutions, pushing wholesale carriers to innovate and expand their service portfolios. The increasing integration of voice services with other digital platforms, such as cloud-based contact centers and unified communications, also presents substantial growth opportunities.

Challenges Impacting Wholesale Voice Carrier Market Growth

Despite the robust growth trajectory, the Wholesale Voice Carrier Market faces several significant challenges. Intense price competition among a multitude of players has led to a continuous pressure on profit margins, with ARPMs steadily declining. Navigating the complex and often disparate regulatory environments across different countries poses a considerable hurdle, demanding substantial compliance efforts and resources. The ever-evolving nature of voice fraud, from SIM boxing to International Revenue Share Fraud (IRSF), presents a persistent threat, leading to substantial revenue losses and requiring continuous investment in sophisticated detection and prevention technologies. Furthermore, the ongoing need to invest in and upgrade global network infrastructure to maintain quality of service (QoS) and capacity is a capital-intensive undertaking. Cybersecurity threats also remain a major concern, with the potential to disrupt services, compromise data, and erode customer trust.

Key Players Shaping the Wholesale Voice Carrier Market Market

- Vodafone Limited

- ORANGE S.A.

- IDT Corporation

- AT&T

- Tata Communications

- BT

- TELEFÓNICA S.A.

- Deutsche Telekom AG

- Verizon

- Lumen Technologies

Significant Wholesale Voice Carrier Market Industry Milestones

- March 2023: Odine announced that Xicomm will expand its international voice service growth plans and migrate them to the Odine Nebula platform. The primary focus of this collaboration is to enhance advanced controls for OBR (Overload Bypass Routing), scoring, and overload routing, catering to the needs of leading international wholesale telecommunications companies. The Nebula solution extends these capabilities to Xicomm, providing a comprehensive solution that can be customized and deployed at any time, in any location, on demand.

- August 2022: Deutsche Telekom Global Carrier and Swedish telecommunications operator Tele2 formalized a cooperation agreement encompassing the international voice operations of the Tele2 Group. Within this strategic partnership, Deutsche Telekom Global Carrier assumes the role of Tele2's exclusive gateway for all outgoing and incoming international voice traffic. This is facilitated by the implementation of the "United Voice" speech synthesis solution and the utilization of the "Protected" package to ensure secure and efficient communication.

Future Outlook for Wholesale Voice Carrier Market Market

The future outlook for the Wholesale Voice Carrier Market remains exceptionally positive, driven by sustained global connectivity needs and ongoing technological advancements. Strategic opportunities lie in the expansion of services beyond basic voice termination to include more sophisticated offerings like IoT connectivity, secure enterprise communication solutions, and enhanced fraud prevention tools. The increasing demand for high-definition voice and real-time communication services will further fuel market growth. As emerging markets continue to develop their telecommunication infrastructures, they will present significant untapped potential for wholesale carriers. The ongoing consolidation and strategic partnerships among key players are expected to create more robust and efficient global networks, enabling carriers to offer competitive pricing and superior service quality. The market is poised for continued innovation, particularly in areas leveraging AI and machine learning to optimize network performance and enhance security.

Wholesale Voice Carrier Market Segmentation

-

1. Service

- 1.1. Voice Termination

- 1.2. Interconnect Billing

- 1.3. Fraud Management

-

2. Technology

- 2.1. VoIP

- 2.2. Traditional Switching

Wholesale Voice Carrier Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Wholesale Voice Carrier Market Regional Market Share

Geographic Coverage of Wholesale Voice Carrier Market

Wholesale Voice Carrier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of VoIP Call Services; Increasing Adoption of Cloud-Based Communication Platforms

- 3.3. Market Restrains

- 3.3.1. High Implementation Costs

- 3.4. Market Trends

- 3.4.1. VoIP Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Voice Termination

- 5.1.2. Interconnect Billing

- 5.1.3. Fraud Management

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. VoIP

- 5.2.2. Traditional Switching

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Voice Termination

- 6.1.2. Interconnect Billing

- 6.1.3. Fraud Management

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. VoIP

- 6.2.2. Traditional Switching

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Voice Termination

- 7.1.2. Interconnect Billing

- 7.1.3. Fraud Management

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. VoIP

- 7.2.2. Traditional Switching

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Voice Termination

- 8.1.2. Interconnect Billing

- 8.1.3. Fraud Management

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. VoIP

- 8.2.2. Traditional Switching

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Australia and New Zealand Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Voice Termination

- 9.1.2. Interconnect Billing

- 9.1.3. Fraud Management

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. VoIP

- 9.2.2. Traditional Switching

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Latin America Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Voice Termination

- 10.1.2. Interconnect Billing

- 10.1.3. Fraud Management

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. VoIP

- 10.2.2. Traditional Switching

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Middle East and Africa Wholesale Voice Carrier Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Voice Termination

- 11.1.2. Interconnect Billing

- 11.1.3. Fraud Management

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. VoIP

- 11.2.2. Traditional Switching

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vodafone Limite

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ORANGE S A

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IDT Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AT&T

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Tata Communications

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BT

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 TELEFÓNICA S A

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Deutsche Telekom AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Verizon

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Lumen Technologies

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Vodafone Limite

List of Figures

- Figure 1: Global Wholesale Voice Carrier Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wholesale Voice Carrier Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Wholesale Voice Carrier Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Wholesale Voice Carrier Market Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Wholesale Voice Carrier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Wholesale Voice Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wholesale Voice Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wholesale Voice Carrier Market Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe Wholesale Voice Carrier Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Wholesale Voice Carrier Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Wholesale Voice Carrier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Wholesale Voice Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wholesale Voice Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Wholesale Voice Carrier Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Wholesale Voice Carrier Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Wholesale Voice Carrier Market Revenue (Million), by Technology 2025 & 2033

- Figure 17: Asia Wholesale Voice Carrier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Wholesale Voice Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Wholesale Voice Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Wholesale Voice Carrier Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Australia and New Zealand Wholesale Voice Carrier Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Australia and New Zealand Wholesale Voice Carrier Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: Australia and New Zealand Wholesale Voice Carrier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Australia and New Zealand Wholesale Voice Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Wholesale Voice Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Wholesale Voice Carrier Market Revenue (Million), by Service 2025 & 2033

- Figure 27: Latin America Wholesale Voice Carrier Market Revenue Share (%), by Service 2025 & 2033

- Figure 28: Latin America Wholesale Voice Carrier Market Revenue (Million), by Technology 2025 & 2033

- Figure 29: Latin America Wholesale Voice Carrier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Wholesale Voice Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Wholesale Voice Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Wholesale Voice Carrier Market Revenue (Million), by Service 2025 & 2033

- Figure 33: Middle East and Africa Wholesale Voice Carrier Market Revenue Share (%), by Service 2025 & 2033

- Figure 34: Middle East and Africa Wholesale Voice Carrier Market Revenue (Million), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Wholesale Voice Carrier Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Wholesale Voice Carrier Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Wholesale Voice Carrier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global Wholesale Voice Carrier Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wholesale Voice Carrier Market?

The projected CAGR is approximately 11.25%.

2. Which companies are prominent players in the Wholesale Voice Carrier Market?

Key companies in the market include Vodafone Limite, ORANGE S A, IDT Corporation, AT&T, Tata Communications, BT, TELEFÓNICA S A, Deutsche Telekom AG, Verizon, Lumen Technologies.

3. What are the main segments of the Wholesale Voice Carrier Market?

The market segments include Service, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of VoIP Call Services; Increasing Adoption of Cloud-Based Communication Platforms.

6. What are the notable trends driving market growth?

VoIP Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Implementation Costs.

8. Can you provide examples of recent developments in the market?

March 2023: Odine announced that Xicomm will expand its international voice service growth plans and migrate them to the Odine Nebula platform. The primary focus of this collaboration is to enhance advanced controls for OBR (Overload Bypass Routing), scoring, and overload routing, catering to the needs of leading international wholesale telecommunications companies. The Nebula solution extends these capabilities to Xicomm, providing a comprehensive solution that can be customized and deployed at any time, in any location, on demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wholesale Voice Carrier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wholesale Voice Carrier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wholesale Voice Carrier Market?

To stay informed about further developments, trends, and reports in the Wholesale Voice Carrier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence