Key Insights

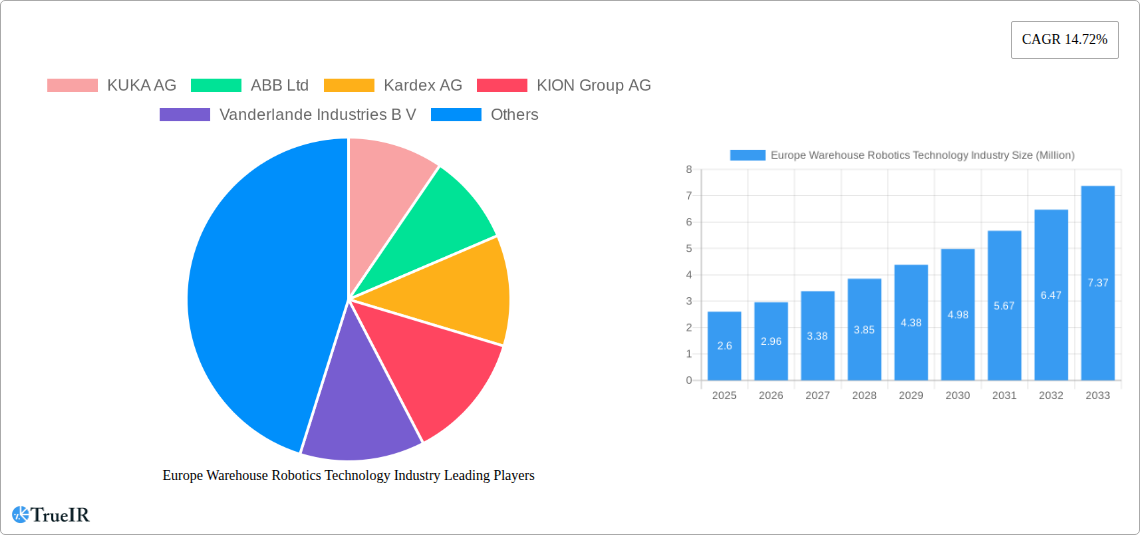

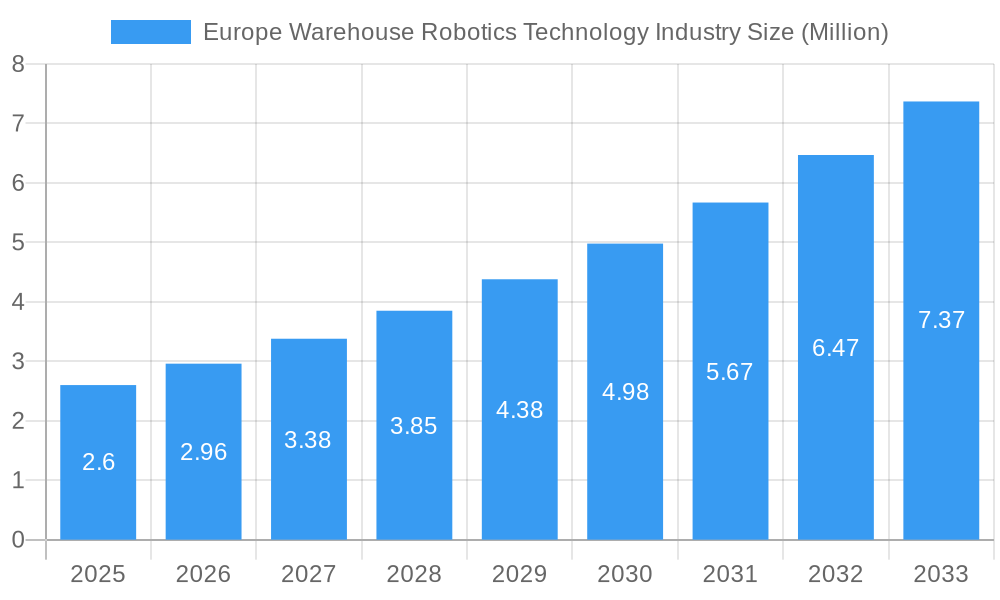

The European warehouse robotics technology market is poised for significant expansion, projected to reach $2.60 million in 2025 and witness a robust Compound Annual Growth Rate (CAGR) of 14.72% through 2033. This dynamic growth is propelled by an escalating demand for enhanced operational efficiency, reduced labor costs, and improved accuracy in warehousing and logistics operations across the continent. Key drivers include the burgeoning e-commerce sector, necessitating faster order fulfillment and sophisticated inventory management, and the increasing adoption of automation in traditional industries to remain competitive. Furthermore, technological advancements in artificial intelligence, machine learning, and sensor technology are enabling more sophisticated and versatile robotic solutions, further fueling market penetration. The industry is witnessing a notable shift towards flexible and scalable automation, with a particular surge in the adoption of mobile robots (AGVs and AMRs) for their adaptability and ease of integration, alongside established technologies like Automated Storage and Retrieval Systems (ASRS) and industrial robots.

Europe Warehouse Robotics Technology Industry Market Size (In Million)

Several key trends are shaping the European warehouse robotics landscape. The integration of AI and machine learning is empowering robots with greater autonomy, predictive maintenance capabilities, and optimized pathfinding, thereby enhancing overall warehouse productivity. The rise of Industry 4.0 principles emphasizes interconnectedness, with robots seamlessly integrating into broader supply chain ecosystems. While the market is experiencing substantial growth, certain restraints, such as the high initial investment cost for advanced robotic systems and the need for skilled labor to operate and maintain them, present challenges. However, the long-term benefits of increased throughput, reduced operational errors, and improved worker safety are increasingly outweighing these initial hurdles. The Food and Beverage, Automotive, and Retail sectors are leading the charge in adopting these technologies, driven by their specific operational demands for efficient storage, packaging, and trans-shipment processes. This pervasive adoption across diverse end-user applications underscores the transformative impact of warehouse robotics on the European industrial landscape.

Europe Warehouse Robotics Technology Industry Company Market Share

Europe Warehouse Robotics Technology Industry: Market Dynamics, Trends, and Future Outlook

This comprehensive report offers an in-depth analysis of the Europe Warehouse Robotics Technology Industry, providing critical insights for stakeholders, investors, and industry professionals. Leveraging high-volume keywords and a data-driven approach, this report details market structure, competitive landscape, key trends, dominant segments, product innovations, growth drivers, challenges, and a forward-looking outlook for the period 2019–2033.

Europe Warehouse Robotics Technology Industry Market Structure & Competitive Landscape

The Europe Warehouse Robotics Technology Industry is characterized by a moderately consolidated market structure, driven by significant investments in automation and a growing need for enhanced operational efficiency. Innovation is a primary driver, with companies continuously developing advanced robotics, AI integration, and intelligent software solutions to meet the evolving demands of e-commerce and manufacturing sectors. Regulatory frameworks, while generally supportive of technological advancement, are increasingly focused on safety standards and data security, influencing product development and market entry strategies. The threat of product substitutes, such as advanced manual labor or less sophisticated automation, is diminishing as the ROI for robotic solutions becomes more compelling. End-user segmentation highlights the strong adoption across Food and Beverage, Automotive, and Retail sectors, each with unique automation requirements. Mergers and acquisitions (M&A) are a notable trend, with larger players acquiring innovative startups or complementary technology providers to expand their portfolios and market reach. For instance, the period saw [XX] M&A deals with a combined valuation of over [XX] Million Euros, indicative of the ongoing consolidation. Concentration ratios in key segments like Automated Storage and Retrieval Systems (ASRS) are estimated to be around [XX]%, suggesting the presence of a few dominant players.

Europe Warehouse Robotics Technology Industry Market Trends & Opportunities

The Europe Warehouse Robotics Technology Industry is experiencing robust growth, projected to reach a market size of [XX] Million Euros by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of [XX]% during the forecast period (2025–2033). This expansion is fueled by the relentless surge in e-commerce, necessitating faster order fulfillment and reduced operational costs. Technological shifts are paramount, with advancements in Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) enabling more intelligent and adaptable robotic systems. Mobile robots, including Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs), are witnessing accelerated adoption due to their flexibility in navigating dynamic warehouse environments and their ability to work alongside human operators. Consumer preferences are increasingly driving demand for faster delivery times and personalized shopping experiences, directly translating into a need for highly efficient and scalable warehouse automation solutions. Competitive dynamics are intensifying, with a focus on developing integrated automation ecosystems that offer end-to-end solutions, from goods receiving to dispatch. Companies are investing heavily in R&D to enhance robot dexterity, collaborative capabilities, and predictive maintenance features, thereby reducing downtime and maximizing throughput. The penetration rate of warehouse robotics, particularly in advanced economies like Germany and the UK, is projected to exceed [XX]% by 2033. Emerging opportunities lie in the adoption of robotics in less traditional sectors, the development of sustainable and energy-efficient robotic solutions, and the integration of robotics with digital twin technologies for enhanced simulation and optimization of warehouse operations. The market is also ripe for solutions addressing labor shortages and the increasing demand for ergonomic and safe working environments for warehouse personnel.

Dominant Markets & Segments in Europe Warehouse Robotics Technology Industry

The dominance in the Europe Warehouse Robotics Technology Industry is clearly defined by key segments and geographic regions, driven by specific industry needs and infrastructure development. Within the Type segment, Mobile Robots (AGVs and AMRs) are exhibiting the most significant growth momentum. This is largely attributed to their inherent flexibility, lower integration costs compared to fixed systems, and their crucial role in optimizing intralogistics and last-mile delivery processes within distribution centers. The Automated Storage and Retrieval System (ASRS) segment also holds a substantial market share, particularly in large-scale operations where maximizing space utilization and inventory accuracy is paramount.

In terms of Function, Storage and Trans-shipments represent the largest application areas. The sheer volume of goods processed through distribution centers necessitates efficient storage solutions and rapid movement of inventory. E-commerce growth has amplified the demand for robotics in these functions, enabling businesses to handle peak season demands with greater agility.

Geographically, Germany continues to be a dominant market, owing to its strong manufacturing base, high adoption rate of industrial automation, and supportive government initiatives for Industry 4.0. The United Kingdom and France follow closely, with significant investments in warehouse automation driven by a burgeoning e-commerce sector and a focus on supply chain resilience.

Key Growth Drivers for Mobile Robots (AGVs and AMRs):

- Flexibility and Scalability: Easily adaptable to changing warehouse layouts and production volumes.

- Reduced Infrastructure Costs: Lower upfront investment compared to complex fixed automation.

- Labor Shortage Mitigation: Addressing the growing deficit of skilled warehouse personnel.

- E-commerce Boom: Essential for rapid order picking and fulfillment in high-volume distribution centers.

Detailed Analysis of ASRS Market Dominance:

- ASRS systems are crucial for industries requiring high-density storage and precise inventory management, such as Food and Beverage and Pharmaceuticals. The consistent demand for efficient and safe storage of temperature-sensitive goods fuels ASRS adoption.

- The Automotive sector also relies heavily on ASRS for managing the vast array of parts and components required for assembly lines, ensuring just-in-time delivery and minimizing production delays.

- Government incentives promoting advanced manufacturing and logistics infrastructure in countries like the Netherlands and Belgium further bolster the ASRS market.

The Retail end-user application is also a major contributor to market growth, particularly in segments like fashion and electronics, where rapid inventory turnover and diverse product SKUs necessitate advanced automation for efficient replenishment and order picking.

Europe Warehouse Robotics Technology Industry Product Analysis

Product innovation in the Europe Warehouse Robotics Technology Industry centers on enhanced intelligence, adaptability, and human-robot collaboration. Companies are investing in AI-powered vision systems for improved object recognition and manipulation, leading to more versatile robotic arms for picking and packing. The development of modular and scalable robotic solutions, particularly in the AGV and AMR space, allows businesses to customize automation to their specific needs and expand capabilities as their operations grow. Competitive advantages are increasingly derived from integrated software platforms that enable seamless coordination of multiple robotic units, real-time data analytics, and predictive maintenance, thereby minimizing downtime and optimizing throughput. The focus is on creating solutions that not only automate tasks but also improve workplace safety and ergonomics.

Key Drivers, Barriers & Challenges in Europe Warehouse Robotics Technology Industry

Key Drivers: The Europe Warehouse Robotics Technology Industry is propelled by several critical factors. The exponential growth of e-commerce and the demand for faster, more reliable delivery services are primary catalysts. Technological advancements, including AI, ML, and improved sensor technologies, are enabling more sophisticated and cost-effective robotic solutions. Furthermore, increasing labor costs and shortages in many European countries are forcing businesses to seek automation alternatives. Government initiatives promoting Industry 4.0 and smart manufacturing also play a significant role.

Barriers & Challenges: Despite the strong growth trajectory, the industry faces notable challenges. High upfront investment costs for advanced robotic systems can be a barrier for small and medium-sized enterprises (SMEs). Integrating new robotic systems with existing legacy infrastructure can also be complex and time-consuming, requiring specialized expertise. Supply chain disruptions, particularly concerning the availability of essential components, can impact production timelines. Regulatory hurdles related to safety standards and data privacy also need careful navigation. Competitive pressures, both from established players and new entrants, necessitate continuous innovation and cost optimization. The estimated impact of these challenges on market growth is approximately [XX]% reduction in potential expansion.

Growth Drivers in the Europe Warehouse Robotics Technology Industry Market

Key growth drivers for the Europe Warehouse Robotics Technology Industry are multifaceted. The accelerating adoption of automation in response to labor shortages and rising labor costs is a significant economic driver. Technological advancements in areas such as artificial intelligence and machine learning are enabling more intelligent and adaptable robotic systems, improving efficiency and accuracy in warehouse operations. Favorable government policies and incentives aimed at promoting industrial automation and Industry 4.0 adoption, particularly in countries like Germany and France, further accelerate market expansion. The ever-increasing demand for faster and more accurate order fulfillment in the e-commerce sector is a critical market-driven factor, pushing businesses to invest in robotics for improved throughput and customer satisfaction.

Challenges Impacting Europe Warehouse Robotics Technology Industry Growth

Several barriers and restraints are impacting the growth of the Europe Warehouse Robotics Technology Industry. The substantial initial capital investment required for implementing advanced robotic solutions poses a significant challenge for small and medium-sized enterprises (SMEs), potentially limiting market penetration. The complexity of integrating new robotic systems with existing warehouse infrastructure and IT systems can lead to implementation delays and increased operational risks. Furthermore, ongoing supply chain vulnerabilities, particularly in the semiconductor and specialized component markets, can disrupt production schedules and increase lead times. Stringent regulatory frameworks concerning safety standards and data security, while crucial for responsible implementation, can also add to the compliance burden and necessitate considerable development effort. Competitive pressures from both established players and emerging technologies constantly demand innovation and cost-effectiveness, creating a dynamic and challenging landscape for market participants.

Key Players Shaping the Europe Warehouse Robotics Technology Industry Market

- KUKA AG

- ABB Ltd

- Kardex AG

- KION Group AG

- Vanderlande Industries B V

- KNAPP AG

- BEUMER Group GmbH & Co KG

- Siemens AG

- Viastore Systems GmbH (Toyota Industries Corporation)

- Mecalux SA

- SSI Schaefer AG

Significant Europe Warehouse Robotics Technology Industry Industry Milestones

- August 2022: ABB Limited announced joining the technology alliance program with Berkshire Grey Inc. to provide more customers with robotics and artificial intelligence that improve e-commerce fulfillment throughput and warehouse efficiency. Through this collaboration, the company aimed to provide flexible, cost-effective warehouse automation solutions and optimize customers' operations.

- September 2022: Yanmar America Corporation introduced an advanced automated guided vehicle (AGV) solution to its Adairsville, GA, manufacturing facility. The addition of the modular AGV system to Yanmar's Powerpack series generator production line boosted production capacity tenfold and increased the quality of products delivered to customers.

Future Outlook for Europe Warehouse Robotics Technology Industry Market

The future outlook for the Europe Warehouse Robotics Technology Industry is exceptionally promising, driven by sustained demand for automation across various sectors. Strategic opportunities lie in the development and deployment of more intelligent, collaborative, and sustainable robotic solutions that can adapt to evolving supply chain dynamics. The increasing focus on Industry 5.0 principles, emphasizing human-robot collaboration and enhanced worker well-being, will shape future product development. Market potential will be further unlocked by the expansion of robotics into niche applications and the integration of advanced AI for predictive analytics and autonomous decision-making. The continued growth of e-commerce, coupled with efforts to enhance supply chain resilience and efficiency, will ensure a robust demand for warehouse robotics, positioning the industry for significant expansion in the coming years.

Europe Warehouse Robotics Technology Industry Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

-

2. Function

- 2.1. Storage

- 2.2. Packaging

- 2.3. Trans-shipments

- 2.4. Other Functions

-

3. End-user Application

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End User Applications

Europe Warehouse Robotics Technology Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Warehouse Robotics Technology Industry Regional Market Share

Geographic Coverage of Europe Warehouse Robotics Technology Industry

Europe Warehouse Robotics Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of SKUs; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Warehouse Automation by E-Commerce Industry to Drive the Studied Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Packaging

- 5.2.3. Trans-shipments

- 5.2.4. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Application

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End User Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KUKA AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kardex AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KION Group AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vanderlande Industries B V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KNAPP AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BEUMER Group GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Viastore Systems GmbH (Toyota Industries Corporation)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mecalux SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SSI Schaefer AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 KUKA AG

List of Figures

- Figure 1: Europe Warehouse Robotics Technology Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Warehouse Robotics Technology Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 3: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 4: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 7: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 8: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Warehouse Robotics Technology Industry?

The projected CAGR is approximately 14.72%.

2. Which companies are prominent players in the Europe Warehouse Robotics Technology Industry?

Key companies in the market include KUKA AG, ABB Ltd, Kardex AG, KION Group AG, Vanderlande Industries B V, KNAPP AG, BEUMER Group GmbH & Co KG, Siemens A, Viastore Systems GmbH (Toyota Industries Corporation), Mecalux SA, SSI Schaefer AG.

3. What are the main segments of the Europe Warehouse Robotics Technology Industry?

The market segments include Type, Function, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of SKUs; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

Increasing Investment in Warehouse Automation by E-Commerce Industry to Drive the Studied Market's Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

August 2022: ABB Limited announced joining the technology alliance program with Berkshire Grey Inc. to provide more customers with robotics and artificial intelligence that improve e-commerce fulfillment throughput and warehouse efficiency. Through this collaboration, the company aimed to provide flexible, cost-effective warehouse automation solutions and optimize customers' operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Warehouse Robotics Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Warehouse Robotics Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Warehouse Robotics Technology Industry?

To stay informed about further developments, trends, and reports in the Europe Warehouse Robotics Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence