Key Insights

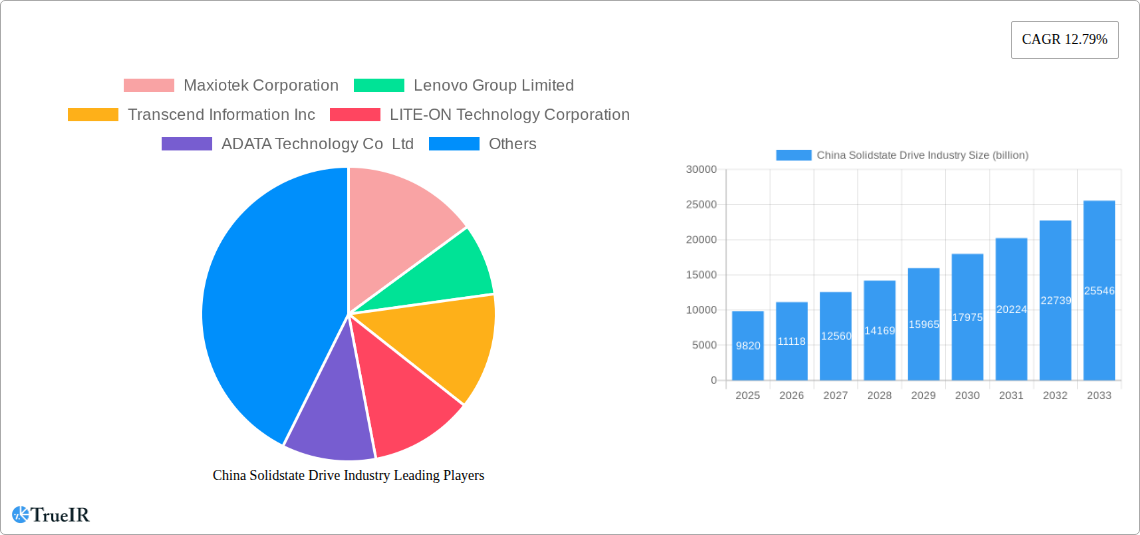

The China Solid State Drive (SSD) industry is poised for substantial expansion, projecting a market size of USD 9.82 billion in 2025. This growth is propelled by a robust CAGR of 12.79%, indicating a dynamic and rapidly evolving market landscape. The widespread adoption of SSDs across enterprise, client, and emerging applications is a primary driver, fueled by the increasing demand for faster data access, improved performance, and enhanced energy efficiency in computing devices. Government initiatives supporting the development of domestic semiconductor manufacturing and the "Made in China 2025" strategy are further bolstering local production and innovation. Furthermore, the burgeoning digital transformation across various sectors, including cloud computing, artificial intelligence, and big data analytics, necessitates higher storage capacities and speeds, directly benefiting the SSD market. The interface technologies, predominantly Serial Advanced Technology Attachment (SATA) and Peripheral Component Interconnect (PCI) Express, are witnessing continuous upgrades, with PCI Express gaining significant traction due to its superior bandwidth and performance capabilities, essential for high-demand applications.

China Solidstate Drive Industry Market Size (In Billion)

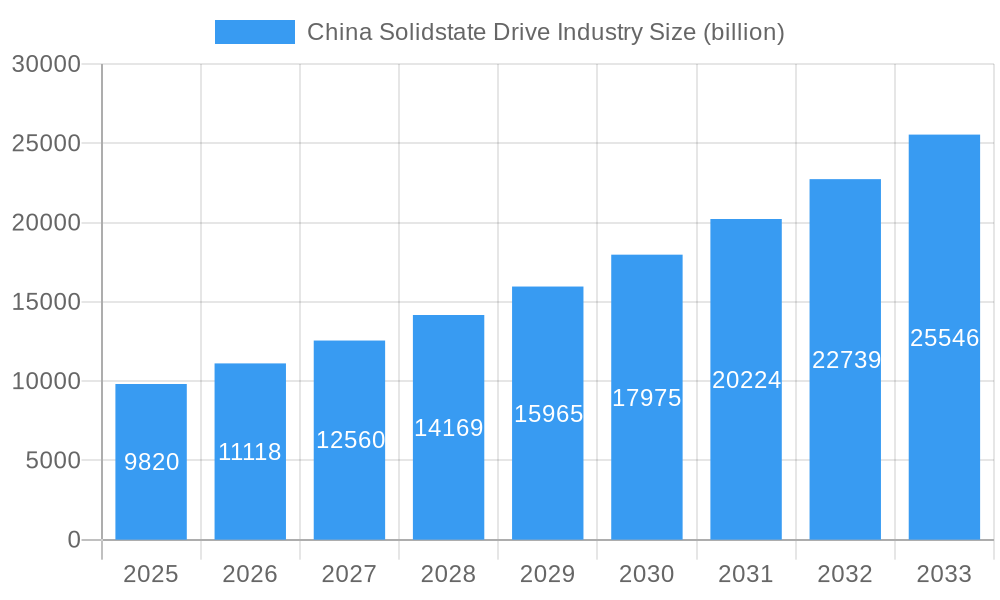

Several key players, including Maxiotek Corporation, Lenovo Group Limited, Transcend Information Inc, LITE-ON Technology Corporation, ADATA Technology Co Ltd, Teclast Electronics Co Ltd, Huawei Technologies Co Ltd, Memblaze Technology Co Ltd, and PHISON ELECTRONICS, are actively contributing to market competition and innovation through strategic investments in research and development and expanding manufacturing capabilities. While the market enjoys strong growth drivers, potential restraints include the global semiconductor supply chain fluctuations and increasing raw material costs, which could impact production volumes and pricing. However, the sheer volume of domestic demand and the government's focus on self-sufficiency in critical technologies like SSDs are expected to mitigate these challenges. The market is characterized by continuous technological advancements, leading to higher density, faster speeds, and more cost-effective SSD solutions, making them increasingly accessible for a broader range of applications.

China Solidstate Drive Industry Company Market Share

Unlocking the Future: A Comprehensive Analysis of the China Solid-State Drive Industry (2019-2033)

This in-depth report offers an indispensable resource for understanding the dynamic China Solid-State Drive (SSD) industry. Spanning the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period through 2033, this analysis delves into the market structure, competitive landscape, evolving trends, dominant segments, and key players shaping the future of SSDs in China. With projected market sizes reaching billions and a deep dive into technological advancements, this report provides actionable insights for investors, manufacturers, and strategists navigating this rapidly expanding sector.

China Solidstate Drive Industry Market Structure & Competitive Landscape

The China Solid-State Drive industry exhibits a moderately concentrated market structure, characterized by the presence of established global players and a growing number of domestic innovators. Key companies such as Lenovo Group Limited, Huawei Technologies Co Ltd, and ADATA Technology Co Ltd are vying for market share, alongside specialized manufacturers like Maxiotek Corporation and Memblaze Technology Co Ltd. Innovation is a primary driver, with continuous advancements in NAND flash technology and controller integration fueling product differentiation. Regulatory impacts, while present, are largely supportive of domestic technological development and manufacturing capabilities. Product substitutes, primarily Hard Disk Drives (HDDs), are gradually losing ground due to the superior performance of SSDs, though their lower cost remains a factor in certain segments. End-user segmentation spans critical applications, including the enterprise sector demanding high-speed, reliable storage solutions and the client segment focusing on performance and portability for personal computing. Mergers and Acquisitions (M&A) are an emerging trend, as larger entities seek to consolidate their market position and acquire specialized technological expertise, with an estimated M&A volume reaching several hundred million dollars in the historical period.

China Solidstate Drive Industry Market Trends & Opportunities

The China Solid-State Drive (SSD) market is on an unprecedented growth trajectory, driven by escalating demand across various applications and rapid technological advancements. The market size is projected to expand significantly, with the total market value expected to surpass hundreds of billions by 2033. This growth is fueled by a confluence of factors, including the ubiquitous adoption of digital technologies, the burgeoning data center industry, and the increasing performance requirements for consumer electronics and enterprise solutions. Technological shifts are at the forefront, with the transition from SATA interfaces to the faster Peripheral Component Interconnect (PCI) Express, particularly PCIe 5.0, marking a pivotal moment. This evolution is enabling SSDs to achieve sequential read and write speeds of up to 14 GB/s and 7 GB/s, as exemplified by Kioxia's prototype launch in September 2021. Consumer preferences are increasingly leaning towards faster boot times, quicker application loading, and enhanced gaming experiences, making SSDs an indispensable component for modern computing. The competitive dynamics are intensifying, with established players like Transcend Information Inc and LITE-ON Technology Corporation innovating aggressively to capture market share. Emerging players like Teclast Electronics Co Ltd are also making inroads, particularly in cost-sensitive segments. The increasing demand for higher storage capacities, coupled with the ongoing reduction in cost per gigabyte, presents a significant opportunity for market expansion. Furthermore, the integration of AI and machine learning workloads within data centers necessitates high-performance storage, creating a substantial demand for enterprise-grade SSDs. The government's emphasis on developing indigenous semiconductor capabilities further bolsters the domestic SSD industry, fostering innovation and providing a competitive advantage. The growing adoption of cloud computing services also directly translates into increased demand for robust and high-capacity SSD solutions to power these infrastructure. Opportunities also lie in niche markets such as industrial automation, automotive electronics, and Internet of Things (IoT) devices, where the durability and speed of SSDs offer distinct advantages over traditional storage media. The ongoing digital transformation across all sectors of the Chinese economy acts as a powerful catalyst, ensuring sustained growth and innovation within the China SSD market for the foreseeable future.

Dominant Markets & Segments in China Solidstate Drive Industry

The China Solid-State Drive industry's dominance is clearly articulated across its key segments, with the Enterprise application segment and the Peripheral Component Interconnect (PCI) Express interface leading the charge. The enterprise sector is experiencing explosive growth due to China's massive investments in data centers, cloud computing infrastructure, and artificial intelligence initiatives. These applications demand the highest levels of performance, reliability, and scalability that only high-speed SSDs can provide.

- Enterprise Application Segment Dominance:

- Infrastructure Development: Massive government and private sector investments in building and expanding hyperscale data centers across China are a primary growth driver. These facilities require extensive SSD deployments for their vast storage needs, fueling demand for enterprise-grade solutions.

- AI and Big Data: The rapid advancement and adoption of Artificial Intelligence and Big Data analytics in China necessitate ultra-fast data processing and retrieval capabilities, making high-performance SSDs critical components.

- Cloud Computing Expansion: The continuous growth of cloud services, both for consumer and enterprise use, directly correlates with the demand for scalable and high-performance storage solutions provided by SSDs in cloud infrastructure.

- High-Performance Computing (HPC): Research institutions and industries leveraging HPC for complex simulations and modeling rely heavily on fast storage to accelerate their computations.

- Peripheral Component Interconnect (PCI) Express Interface Dominance:

- Speed and Bandwidth: PCIe interfaces, especially the latest generations like PCIe 5.0, offer significantly higher bandwidth and lower latency compared to SATA. This makes them the interface of choice for performance-critical enterprise applications and high-end client devices.

- Technological Advancement: The ongoing evolution of PCIe technology, with each generation offering substantial performance improvements, ensures its continued dominance as the preferred interface for high-performance SSDs. Kioxia's September 2021 launch of a prototype PCIe 5.0 SSD with up to 14 GB/s read speeds underscores this trend.

- Enabling New Workloads: The increased capabilities offered by PCIe SSDs are essential for supporting emerging technologies and workloads that were previously constrained by storage performance limitations.

- Future-Proofing: As industries continue to push the boundaries of digital performance, adopting PCIe interfaces for SSDs provides a future-proof solution for evolving storage needs.

While the Client application segment also represents a substantial market, driven by consumer demand for faster PCs and gaming experiences, its growth is outpaced by the sheer scale and performance requirements of the enterprise sector. Similarly, the Serial Advanced Technology Attachment (SATA) interface, while still prevalent in many existing systems and budget-conscious devices, is gradually being superseded by PCIe in performance-driven markets. The ongoing shift towards faster interfaces and more demanding applications solidifies the dominance of the enterprise segment and the PCIe interface within the China Solid-State Drive industry.

China Solidstate Drive Industry Product Analysis

China's Solid-State Drive industry is characterized by rapid product innovation and a strong focus on enhancing performance, capacity, and reliability. Companies are heavily investing in advanced NAND flash technologies, such as TLC and QLC, alongside sophisticated controller chips to optimize data management and endurance. The primary applications for these SSDs range from high-performance enterprise solutions designed for data centers and cloud computing, requiring robust endurance and rapid data access, to client devices such as laptops and desktops, where speed and responsiveness are paramount. Competitive advantages are being built on the back of faster interface adoption, with PCIe Gen 4 and Gen 5 SSDs gaining significant traction, offering sequential read/write speeds exceeding several gigabytes per second. Innovations also extend to specialized form factors and ruggedized designs for industrial and embedded applications.

Key Drivers, Barriers & Challenges in China Solidstate Drive Industry

Key Drivers:

- Digital Transformation: The pervasive digitalization across all sectors of the Chinese economy, from e-commerce to smart manufacturing, fuels an insatiable demand for data storage and processing.

- Government Support for Technology: National policies promoting technological self-reliance and the development of the domestic semiconductor industry provide a strong impetus for SSD manufacturers.

- Growth of Data Centers and Cloud Computing: China's massive investments in data centers and the expansion of cloud services necessitate high-performance, high-capacity storage solutions.

- Advancements in AI and Big Data: The increasing adoption of AI and big data analytics requires ultra-fast data access and processing, making SSDs indispensable.

- Increasing Demand for Performance: Consumers and businesses alike are demanding faster computing experiences, driving the adoption of SSDs over traditional HDDs.

Barriers & Challenges:

- Global Supply Chain Dependencies: While progress is being made, reliance on certain imported components, particularly advanced semiconductor manufacturing equipment, can pose supply chain risks.

- Intense Global Competition: The SSD market is highly competitive, with established international players exerting significant pressure.

- Talent Acquisition and Retention: Developing and retaining skilled engineers and researchers in the advanced semiconductor field remains a challenge.

- Intellectual Property Protection: Navigating and protecting intellectual property rights in a rapidly evolving technological landscape is crucial.

- Price Sensitivity in Certain Segments: While performance is key, certain market segments remain price-sensitive, requiring a balance between cost and technology.

Growth Drivers in the China Solidstate Drive Industry Market

The China Solid-State Drive industry's growth is propelled by several key factors. Technologically, the relentless evolution of NAND flash density and controller efficiency enables higher capacities and lower costs per gigabyte, making SSDs more accessible. Economic drivers include the robust growth of China's digital economy, which necessitates advanced storage solutions for data centers, cloud computing, and AI applications. Government policies, such as initiatives promoting domestic semiconductor manufacturing and R&D, provide significant support and incentives. Furthermore, the increasing consumer demand for faster computing experiences in laptops, desktops, and gaming consoles acts as a substantial market pull. The expansion of 5G infrastructure also indirectly drives SSD adoption by enabling new data-intensive applications.

Challenges Impacting China Solidstate Drive Industry Growth

Despite its strong growth potential, the China Solid-State Drive industry faces several challenges. Regulatory complexities, while often supportive, can also introduce hurdles in terms of compliance and market access. Supply chain issues, particularly concerning the sourcing of advanced manufacturing equipment and specialized raw materials, can impact production timelines and costs. Competitive pressures from established global SSD manufacturers remain intense, necessitating continuous innovation and cost optimization. Furthermore, the high initial investment required for advanced manufacturing facilities and R&D presents a barrier to entry for new players, potentially limiting market diversification. Ensuring consistent product quality and reliability at scale is also a crucial ongoing challenge.

Key Players Shaping the China Solidstate Drive Industry Market

- Maxiotek Corporation

- Lenovo Group Limited

- Transcend Information Inc

- LITE-ON Technology Corporation

- ADATA Technology Co Ltd

- Teclast Electronics Co Ltd

- Huawei Technologies Co Ltd

- Memblaze Technology Co Ltd

- PHISON ELECTRONICS

Significant China Solidstate Drive Industry Industry Milestones

- September 2021: Kioxia launched its new prototype PCIe 5.0 SSD on WeChat in China, demonstrating a doubling in speed with sequential read and write rates of up to 14 GB/s and 7 GB/s, respectively, signaling a major leap in storage performance.

- August 2022: Ganfeng Lithium initiated the construction of a solid-state battery production facility in Chongqing. Upon completion, this factory is slated to have an impressive annual capacity of 10 GWh each for the production of battery cells and battery packs, indicating a significant investment in next-generation energy storage technologies that could influence the broader electronics component ecosystem.

Future Outlook for China Solidstate Drive Industry Market

The future outlook for the China Solid-State Drive industry is exceptionally promising, driven by continued technological innovation and expanding market applications. Strategic opportunities lie in the ongoing transition to higher-performance interfaces like PCIe 5.0 and beyond, catering to the escalating demands of AI, big data, and high-performance computing. The market potential is further amplified by the increasing adoption of SSDs in emerging sectors such as automotive, industrial IoT, and edge computing. Continued government support for domestic semiconductor manufacturing is expected to foster greater self-sufficiency and competitiveness, while advancements in NAND flash technology will likely lead to even higher capacities and more affordable solutions. The industry is poised for sustained growth, with an anticipated market expansion reaching hundreds of billions in the coming years.

China Solidstate Drive Industry Segmentation

-

1. Application

- 1.1. Enterprise

- 1.2. Clients

-

2. Interface

- 2.1. Serial Advanced Technology Attachment (SATA)

- 2.2. Peripheral Component Interconnect (PCI) Express

China Solidstate Drive Industry Segmentation By Geography

- 1. China

China Solidstate Drive Industry Regional Market Share

Geographic Coverage of China Solidstate Drive Industry

China Solidstate Drive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption in Data Centers; Increasing Deployment in High-end Cloud Applications

- 3.3. Market Restrains

- 3.3.1. High Cost and Smaller Life-time of Solid State Drives

- 3.4. Market Trends

- 3.4.1. Enterprise SSDs Expected To Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Solidstate Drive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise

- 5.1.2. Clients

- 5.2. Market Analysis, Insights and Forecast - by Interface

- 5.2.1. Serial Advanced Technology Attachment (SATA)

- 5.2.2. Peripheral Component Interconnect (PCI) Express

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maxiotek Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Transcend Information Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LITE-ON Technology Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADATA Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teclast Electronics Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huawei Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Memblaze Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PHISON ELECTRONICS*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Maxiotek Corporation

List of Figures

- Figure 1: China Solidstate Drive Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Solidstate Drive Industry Share (%) by Company 2025

List of Tables

- Table 1: China Solidstate Drive Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: China Solidstate Drive Industry Revenue billion Forecast, by Interface 2020 & 2033

- Table 3: China Solidstate Drive Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Solidstate Drive Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: China Solidstate Drive Industry Revenue billion Forecast, by Interface 2020 & 2033

- Table 6: China Solidstate Drive Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Solidstate Drive Industry?

The projected CAGR is approximately 12.79%.

2. Which companies are prominent players in the China Solidstate Drive Industry?

Key companies in the market include Maxiotek Corporation, Lenovo Group Limited, Transcend Information Inc, LITE-ON Technology Corporation, ADATA Technology Co Ltd, Teclast Electronics Co Ltd, Huawei Technologies Co Ltd, Memblaze Technology Co Ltd, PHISON ELECTRONICS*List Not Exhaustive.

3. What are the main segments of the China Solidstate Drive Industry?

The market segments include Application, Interface.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption in Data Centers; Increasing Deployment in High-end Cloud Applications.

6. What are the notable trends driving market growth?

Enterprise SSDs Expected To Grow Significantly.

7. Are there any restraints impacting market growth?

High Cost and Smaller Life-time of Solid State Drives.

8. Can you provide examples of recent developments in the market?

August 2022: Ganfeng Lithium initiated the construction of a solid-state battery production facility. Once completed, the Chongqing factory would have an annual capacity of 10 GWh each for the production of battery cells and battery packs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Solidstate Drive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Solidstate Drive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Solidstate Drive Industry?

To stay informed about further developments, trends, and reports in the China Solidstate Drive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence