Key Insights

The Belgium POS Terminals Market is projected for substantial growth, with an estimated market size of $32.33 billion in the base year 2025 and a CAGR of 8.31% through 2033. This expansion is driven by increasing digital payment adoption, government initiatives promoting cashless transactions, and advancements in payment technologies like contactless and mobile payments. Businesses across sectors are upgrading their systems to improve customer experience, operational efficiency, and transaction security, with retail and hospitality sectors leading this trend.

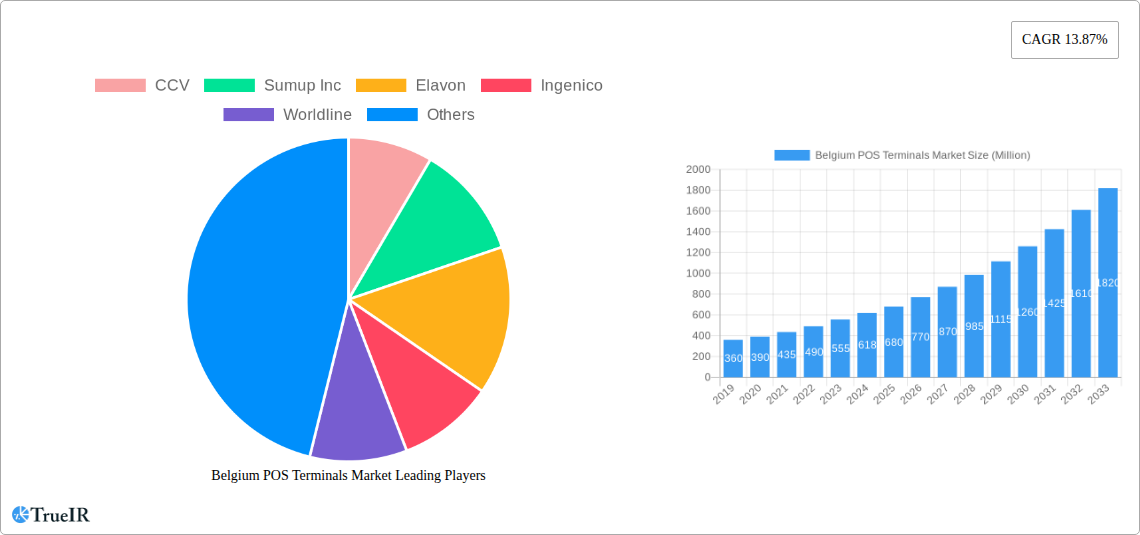

Belgium POS Terminals Market Market Size (In Billion)

The market is diversifying with robust demand for both fixed and mobile POS systems. Mobile POS solutions are increasingly popular due to their flexibility and affordability, catering to small businesses and service industries. The healthcare sector is also expanding its use of POS terminals for efficient patient billing. Potential restraints include initial investment costs for advanced systems and the ongoing need for cybersecurity. Key players are actively innovating and forming strategic partnerships, fostering a dynamic market environment.

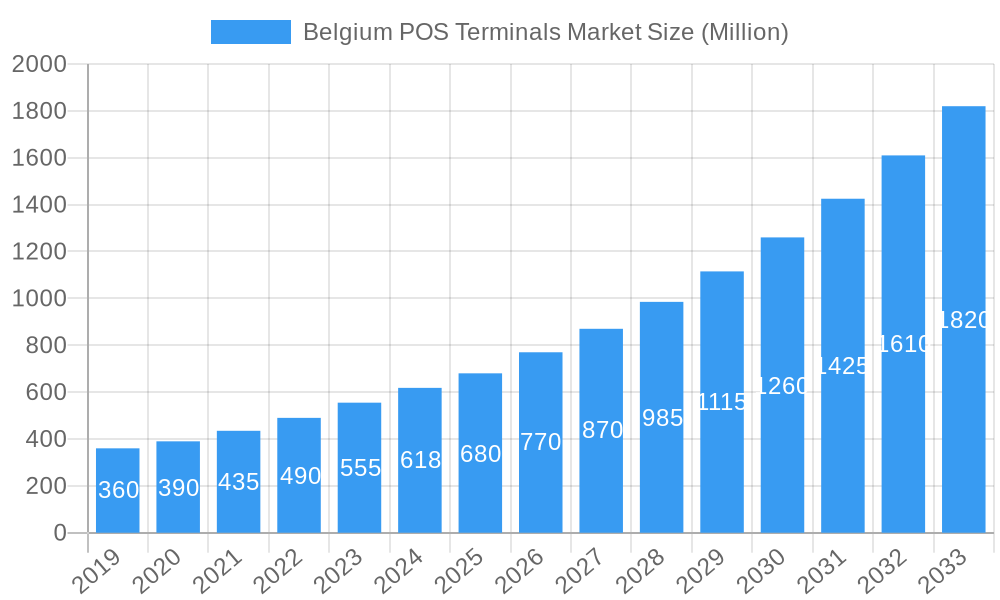

Belgium POS Terminals Market Company Market Share

This report offers a comprehensive analysis of the Belgium POS Terminals Market, focusing on market size, growth trends, and competitive landscape. It examines fixed POS systems, mobile POS solutions, and their adoption in the retail, hospitality, and healthcare sectors. Utilizing keywords such as "Belgium POS systems," "payment terminals Belgium," "digital payments Belgium," and "e-commerce payment solutions," this report provides actionable insights for stakeholders. It also explores the influence of digital currency advancements and emerging metaverse payment opportunities.

Belgium POS Terminals Market Analysis: Growth Forecast & Key Trends | 2019-2033

Study Period: 2019–2033 | Base Year: 2025 | Forecast Period: 2025–2033 | Market Size: $32.33 billion | CAGR: 8.31%

Belgium POS Terminals Market Market Structure & Competitive Landscape

The Belgium POS terminals market exhibits a moderately concentrated structure, with key players vying for market share through innovation and strategic partnerships. The presence of established global payment processors alongside agile fintech disruptors fosters a dynamic competitive environment. Innovation is primarily driven by the increasing demand for seamless, secure, and integrated payment experiences. The regulatory landscape, particularly concerning data privacy (GDPR) and payment security standards, plays a significant role in shaping market entry and product development. Product substitutes, such as purely online payment gateways and mobile payment apps, are present but often complement rather than entirely replace the need for robust POS terminal solutions, especially for brick-and-mortar establishments. End-user segmentation by industry (Retail, Hospitality, Healthcare) reveals distinct needs and adoption rates, with retail often leading in volume. Merger and acquisition (M&A) activities, while not extensively documented with precise figures for this specific market, are a likely strategy for established players seeking to expand their service portfolios and customer bases. For instance, significant M&A volumes are anticipated as companies aim to consolidate their position in the face of evolving payment technologies. The market concentration ratio is estimated to be around 60-70% among the top five players, indicating a significant degree of market power held by a few entities.

Belgium POS Terminals Market Market Trends & Opportunities

The Belgium POS terminals market is experiencing robust growth, fueled by an accelerating digital transformation across various industries. Market size is projected to reach an estimated XX Billion Euros by 2025, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025-2033. This expansion is driven by a confluence of technological advancements, evolving consumer preferences for convenience, and supportive government initiatives promoting cashless transactions. Technological shifts are paramount, with a discernible move towards cloud-based POS solutions, enhanced data analytics capabilities, and the integration of AI for personalized customer experiences. Mobile POS terminals, in particular, are gaining significant traction, offering flexibility and mobility to businesses, especially in the hospitality and small retail sectors. Consumer preferences are increasingly leaning towards contactless payments, mobile wallets, and secure, one-click checkout processes, placing a premium on POS systems that can seamlessly support these functionalities. The competitive landscape is characterized by a blend of established payment giants and innovative startups, each vying to capture market share through differentiated offerings and competitive pricing. Opportunities abound for providers who can offer integrated solutions encompassing payment processing, inventory management, customer relationship management (CRM), and loyalty programs. The increasing adoption of e-commerce alongside traditional retail presents a significant opportunity for omnichannel POS solutions that bridge the online and offline customer journey. Furthermore, the growing emphasis on data security and compliance with evolving payment regulations will create demand for advanced, secure POS hardware and software. The Belgian government's ongoing efforts to digitize the economy and promote e-invoicing further underscore the positive market outlook. The penetration rate of modern POS systems in small and medium-sized enterprises (SMEs) is still evolving, presenting a substantial untapped market for scalable and affordable solutions. The trend towards subscription-based POS models is also gaining momentum, offering lower upfront costs and predictable expenditure for businesses.

Dominant Markets & Segments in Belgium POS Terminals Market

The Belgium POS terminals market is characterized by dominant segments that are shaping its overall growth trajectory.

Dominant Segment by Type: Fixed Point-of-sale Systems currently hold a significant market share due to their established presence in larger retail chains and service-oriented businesses where a dedicated transaction counter is essential. However, Mobile/Portable Point-of-sale Systems are experiencing rapid growth, driven by the increasing need for flexibility in service delivery, particularly in the hospitality sector (restaurants, cafes) and for pop-up shops or mobile vendors. The convenience and reduced infrastructure requirements of mobile POS are major growth drivers.

Dominant Segment by End-User Industry: The Retail sector remains the largest consumer of POS terminals in Belgium. This dominance is attributable to the sheer volume of transactions and the continuous need for efficient checkout processes. The ongoing digital transformation within retail, including the integration of online and offline sales channels (omnichannel retail), further solidifies its position. The Hospitality sector is a close second and is exhibiting higher growth rates for mobile POS solutions, catering to table-side ordering and payment, and reducing service times. While the Healthcare sector is adopting POS solutions for patient billing and in-pharmacy transactions, its market share is comparatively smaller but growing steadily with advancements in digital health records and payment integration.

Key Growth Drivers for Dominant Segments:

- Infrastructure Development: The widespread availability of high-speed internet and mobile network coverage across Belgium supports the adoption of both fixed and mobile POS systems.

- Government Policies: Initiatives promoting cashless economies and digital payments, such as e-invoicing mandates, directly stimulate POS terminal adoption.

- Technological Advancements: The continuous innovation in POS hardware (e.g., faster processors, larger touchscreens, biometric scanners) and software (e.g., cloud-based solutions, AI-powered analytics) makes these systems more attractive and functional.

- Evolving Consumer Behavior: The increasing preference for contactless payments, mobile wallets, and personalized shopping experiences compels businesses to upgrade their POS infrastructure to meet customer expectations.

- Economic Growth: A stable and growing Belgian economy generally translates to increased consumer spending, which in turn drives demand for efficient transaction processing capabilities.

Belgium POS Terminals Market Product Analysis

Product innovation in the Belgium POS terminals market is primarily focused on enhancing user experience, security, and integration capabilities. Advancements include the development of faster, more secure payment terminals with advanced encryption, support for a wider range of payment methods (contactless cards, mobile wallets, QR codes), and integrated features like loyalty program management and customer data capture. Cloud-based POS software offers scalability, remote management, and real-time data analytics, providing businesses with deeper insights into their operations. The competitive advantage lies in offering bundled solutions that integrate payment processing with inventory management, CRM, and marketing tools, creating a comprehensive business management platform. Technological advancements are also enabling greater interoperability between different systems, allowing for seamless data flow across sales channels and back-office operations, thereby optimizing efficiency and improving customer engagement.

Key Drivers, Barriers & Challenges in Belgium POS Terminals Market

Key Drivers:

- Digitalization Push: The strong governmental and societal push towards a cashless economy and the adoption of digital payment methods are primary drivers.

- Technological Innovation: Continuous advancements in hardware and software, including cloud-based solutions and AI integration, enhance functionality and appeal.

- Evolving Consumer Expectations: Demand for fast, secure, and convenient payment options, including contactless and mobile payments, fuels POS terminal upgrades.

- E-commerce Growth: The rise of omnichannel retail necessitates POS systems that can integrate online and offline sales channels.

Barriers & Challenges:

- High Upfront Costs: For smaller businesses, the initial investment in advanced POS hardware and software can be a significant barrier.

- Integration Complexity: Integrating new POS systems with existing legacy systems can be technically challenging and costly.

- Cybersecurity Threats: The increasing sophistication of cyberattacks necessitates robust security measures, adding to the complexity and cost of POS solutions.

- Regulatory Compliance: Adhering to evolving payment regulations and data privacy laws requires continuous updates and can pose a compliance burden.

- Market Saturation & Competition: Intense competition from numerous players can lead to price wars and pressure on profit margins. For instance, the competition among providers for SME clients is estimated to be in the range of 20-30 active players, leading to aggressive pricing strategies.

Growth Drivers in the Belgium POS Terminals Market Market

Key drivers propelling the Belgium POS terminals market include the accelerating shift towards digital and cashless transactions, strongly supported by governmental initiatives promoting e-invoicing and digital payments. Technological innovation remains a cornerstone, with an increasing demand for cloud-based POS systems offering enhanced data analytics, AI-powered personalization, and seamless integration with e-commerce platforms. Consumer preferences are increasingly dictating the market, with a strong demand for contactless payment options, mobile wallets, and streamlined checkout experiences. The growth of omnichannel retail strategies also plays a pivotal role, requiring POS solutions that can unify online and offline sales data and customer interactions. Furthermore, the expansion of the gig economy and the rise of small and medium-sized enterprises (SMEs) are driving the demand for flexible and affordable mobile POS solutions.

Challenges Impacting Belgium POS Terminals Market Growth

Several challenges impact the growth of the Belgium POS terminals market. Regulatory complexities, particularly concerning data privacy (GDPR) and payment processing standards, necessitate continuous investment in compliance and security, which can be a significant hurdle for smaller businesses. Supply chain issues, exacerbated by global disruptions, can lead to delays in hardware availability and increased costs for POS terminal manufacturers and distributors. Intense competitive pressures, with numerous local and international players offering a wide range of solutions, can lead to price erosion and reduced profit margins, especially for providers targeting price-sensitive segments. Additionally, the need for continuous software updates and cybersecurity enhancements represents an ongoing operational cost for businesses relying on POS systems. The cost of integrating new POS systems with existing legacy infrastructure also remains a significant barrier for some enterprises.

Key Players Shaping the Belgium POS Terminals Market Market

- CCV

- Sumup Inc

- Elavon

- Ingenico

- Worldline

- Loyaltek

- Payworld

- Viva Wallet

- BNP Paribas Fortis

- Keyware

Significant Belgium POS Terminals Market Industry Milestones

- September 2022: The European Central Bank (ECB) chose Worldline to prototype the front-end user experience for the digital euro. This strategic involvement highlights Worldline's commitment to shaping the future of payments and its alignment with the ECB's vision for a digital European economy, influencing the development of future payment infrastructure.

- May 2022: Worldline unveiled a unique virtual showroom, marking its pioneering entry into the Metaverse as a payment company. This initiative aims to bridge the gap between virtual and real-world commerce for e-commerce businesses, providing them with tools to leverage the Metaverse's potential and signaling a new frontier for payment solutions and merchant engagement.

Future Outlook for Belgium POS Terminals Market Market

The future outlook for the Belgium POS terminals market is exceptionally promising, driven by sustained digital transformation and evolving consumer behaviors. Key growth catalysts include the continued expansion of cashless payment adoption, further integration of AI and machine learning for personalized customer experiences and predictive analytics, and the increasing demand for omnichannel solutions that seamlessly connect online and offline retail environments. The rise of innovative payment methods, such as biometric authentication and advanced mobile payment solutions, will also shape market demand. Opportunities are ripe for providers who can offer secure, scalable, and cost-effective POS systems that cater to the diverse needs of Belgian businesses, from large enterprises to burgeoning SMEs, further solidifying the market's growth trajectory towards an estimated XX Billion Euros by 2033.

Belgium POS Terminals Market Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

Belgium POS Terminals Market Segmentation By Geography

- 1. Belgium

Belgium POS Terminals Market Regional Market Share

Geographic Coverage of Belgium POS Terminals Market

Belgium POS Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Contactless Payment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium POS Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CCV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumup Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elavon

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ingenico

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Worldline

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Loyaltek

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Payworld

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viva Wallet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas Fortis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Keyware*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CCV

List of Figures

- Figure 1: Belgium POS Terminals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Belgium POS Terminals Market Share (%) by Company 2025

List of Tables

- Table 1: Belgium POS Terminals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Belgium POS Terminals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Belgium POS Terminals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Belgium POS Terminals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Belgium POS Terminals Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: Belgium POS Terminals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium POS Terminals Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the Belgium POS Terminals Market?

Key companies in the market include CCV, Sumup Inc, Elavon, Ingenico, Worldline, Loyaltek, Payworld, Viva Wallet, BNP Paribas Fortis, Keyware*List Not Exhaustive.

3. What are the main segments of the Belgium POS Terminals Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Rising Adoption of Contactless Payment.

7. Are there any restraints impacting market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

8. Can you provide examples of recent developments in the market?

September 2022 - The European Central Bank (ECB) chose Worldline to prototype the front-end user experience for the digital euro. By supporting key and possibly transformative projects like the digital euro, Worldline intends to participate in the growth of the payment industry actively and hence shares the common goal of the ECB and its partners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium POS Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium POS Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium POS Terminals Market?

To stay informed about further developments, trends, and reports in the Belgium POS Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence