Key Insights

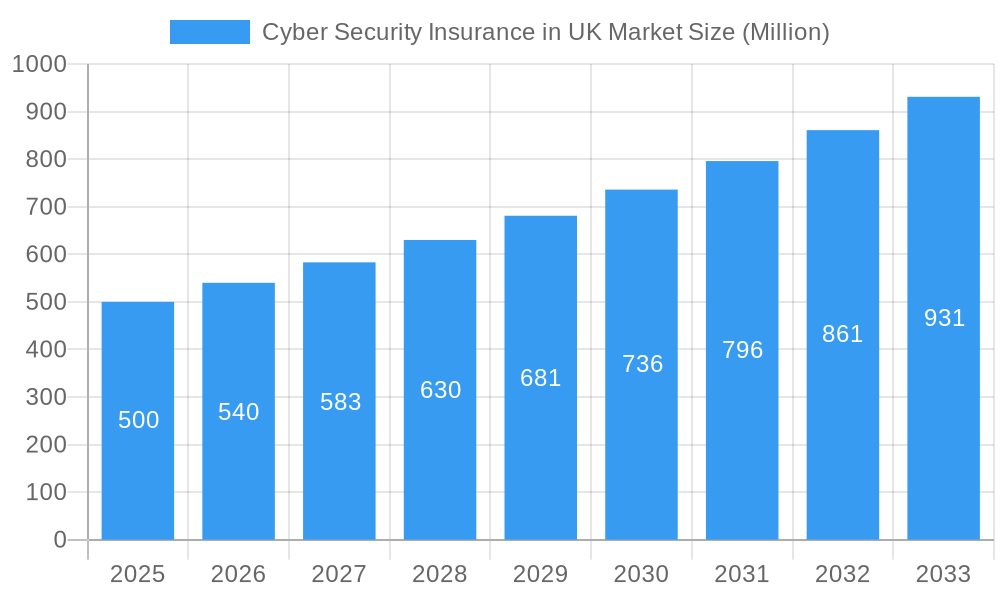

The UK cybersecurity insurance market is experiencing robust growth, driven by the increasing frequency and severity of cyberattacks targeting businesses across various sectors. The market, estimated at £X million in 2025 (assuming a logical extrapolation from the provided global CAGR of 8% and considering the UK's significant economic size and digital infrastructure), is projected to witness a compound annual growth rate (CAGR) mirroring the global trend. This expansion is fueled by several key factors. Firstly, stringent data privacy regulations like GDPR are compelling organizations to invest heavily in cybersecurity measures and insurance coverage to mitigate potential financial and reputational damage from breaches. Secondly, the sophistication of cyberattacks is constantly evolving, with ransomware and data extortion schemes becoming increasingly prevalent and costly. This necessitates comprehensive insurance protection. Thirdly, the rise of cloud computing and the Internet of Things (IoT) expands the attack surface for businesses, further driving demand for cybersecurity insurance. Finally, proactive risk management strategies adopted by many businesses require insurance support for incident response and remediation costs.

Cyber Security Insurance in UK Market Market Size (In Million)

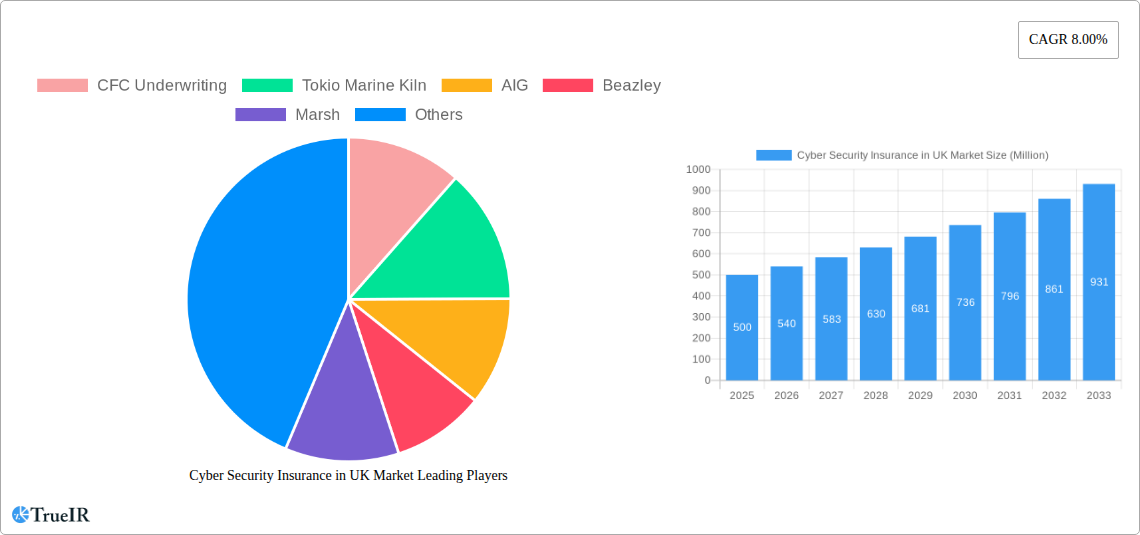

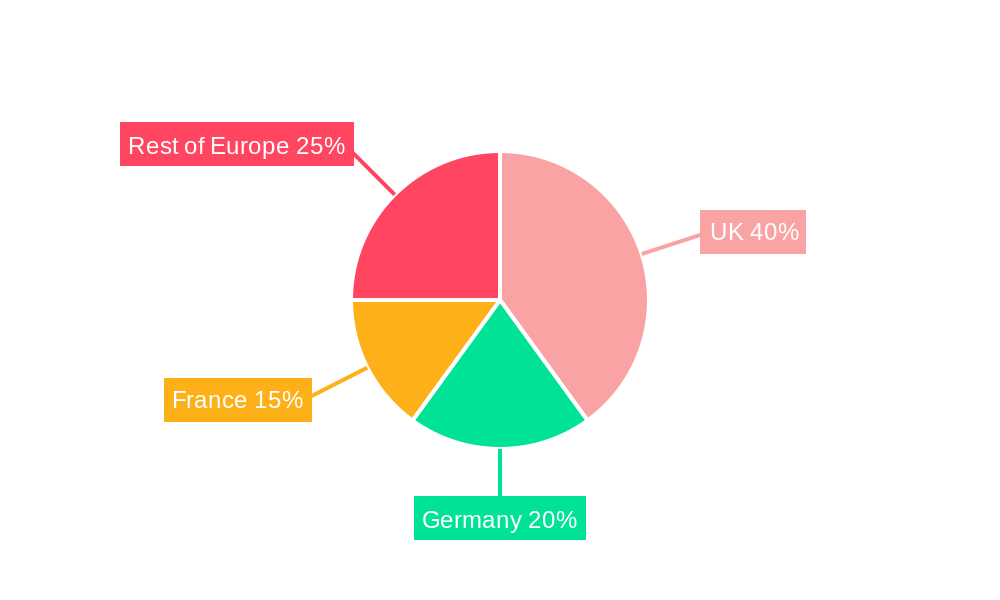

The market segmentation reveals significant opportunities within specific sectors. Banking and financial services, IT and telecom, and healthcare are expected to maintain substantial shares due to their high-value data assets and critical infrastructure. While packaged and standalone insurance solutions cater to diverse needs, the packaged approach, offering bundled services for comprehensive protection, is gaining traction. Key players such as CFC Underwriting, Tokio Marine Kiln, AIG, Beazley, Marsh, Hiscox, AXA XL, Zurich, NIG, and Allianz are competing for market share, characterized by both intense competition and consolidation trends as insurers strive to enhance their offerings and expand their reach. The European region, particularly the UK, Germany, France, and the Netherlands, represents a significant market segment, fueled by strong regulatory frameworks and a high concentration of digitally advanced businesses. Further growth is anticipated through 2033, with the market poised for continued expansion as the cyber threat landscape evolves.

Cyber Security Insurance in UK Market Company Market Share

Cyber Security Insurance in UK Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the UK's burgeoning cyber security insurance market, offering invaluable insights for insurers, businesses, and investors. Leveraging extensive data from 2019-2024 (historical period), with a focus on the base year 2025 and forecasting to 2033, this report illuminates market structure, competitive dynamics, growth drivers, and future trends. The study period covers 2019-2033, providing a comprehensive view of market evolution.

Cyber Security Insurance in UK Market Market Structure & Competitive Landscape

The UK cyber security insurance market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market. Key players such as CFC Underwriting, Tokio Marine Kiln, AIG, Beazley, Marsh, Hiscox, AXA XL, Zurich, NIG, and Allianz, while not an exhaustive list, dominate the landscape.

Market Concentration: The top 5 insurers account for approximately xx% of the market, with the remaining share distributed amongst numerous smaller players and niche providers. This concentration is expected to remain relatively stable in the forecast period, though increased competition from new entrants is anticipated.

Innovation Drivers: The market is driven by continuous advancements in cyber threats and the increasing sophistication of cyberattacks. This fuels demand for innovative products and services, including AI-powered risk assessment tools and enhanced incident response solutions.

Regulatory Impacts: Stringent data protection regulations like GDPR and evolving cyber security standards influence product design and insurer liability, driving demand for comprehensive coverage. Recent regulatory changes and their impact on market dynamics are analyzed in the report.

Product Substitutes: While dedicated cyber insurance is the primary solution, alternative risk management strategies like self-insurance and outsourced security services partially address the risk, impacting the market’s growth trajectory.

End-User Segmentation: The market caters to diverse segments, including banking & financial services, IT & telecom, healthcare, retail, and other sectors, each with varying risk profiles and insurance needs. A detailed analysis of these segments is provided in subsequent sections.

M&A Trends: The market has witnessed a significant volume of mergers and acquisitions (M&A) activity in recent years, estimated at xx deals from 2019-2024, driven by strategic expansion and consolidation efforts. This trend is expected to continue, potentially shaping the competitive landscape further.

Cyber Security Insurance in UK Market Market Trends & Opportunities

The UK cyber security insurance market demonstrates substantial growth potential, with an estimated market size of £xx million in 2025. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, driven by several key factors. Market penetration rates are currently estimated at xx% and are expected to increase significantly in the forecast period as more businesses recognize and address their cyber risks. The increasing frequency and severity of cyberattacks, coupled with heightened regulatory scrutiny and growing awareness of data breaches, are propelling market growth. Technological advancements, such as the development of advanced risk assessment tools and sophisticated incident response solutions, also contribute to growth. The evolving threat landscape is pushing businesses to seek more comprehensive cyber insurance coverage, leading to higher premium values. Furthermore, shifts in consumer preferences towards bundled cyber insurance packages offer new market opportunities, with many businesses integrating cyber security into their broader risk management strategies. The competitive dynamics are evolving rapidly, with both established insurers and new entrants vying for market share by offering differentiated products and services.

Dominant Markets & Segments in Cyber Security Insurance in UK Market

The UK market is currently dominated by the Packaged cyber insurance product type (with xx Million pound market share in 2025), which offers bundled protection across multiple aspects of cyber security. This is driven by strong business preference for simplicity and cost efficiency. Standalone policies still represent a significant share (xx Million pound market share in 2025), especially for larger organizations with specific needs.

By Application Type:

- Banking & Financial Services: This sector dominates the market due to its high value data assets and stringent regulatory requirements. Key growth drivers include increasing regulatory pressure and sophisticated cyber threats.

- IT & Telecom: This segment shows high demand for comprehensive cyber insurance, as these firms are frequent targets of cyberattacks. Growth is fueled by increased digitization and reliance on interconnected systems.

- Healthcare: The sensitivity of patient data and rising compliance pressures are driving strong growth in this sector. Infrastructure investments and government policies designed to protect patient data are essential factors.

- Retail: E-commerce growth and the increasing reliance on digital payment systems have significantly elevated the risk profile in this sector. The growing adoption of omnichannel strategies creates complexities, driving demand for tailored cyber insurance.

- Other Application Types: This sector encompasses a variety of businesses with diverse cyber risks, presenting an evolving and potentially large segment for insurers to target.

London is the leading region within the UK market, due to its high concentration of financial institutions and technology companies.

Cyber Security Insurance in UK Market Product Analysis

The UK cyber insurance market is characterized by a shift toward sophisticated products that address the evolving threat landscape. Innovations include AI-powered risk assessment, proactive threat intelligence, and integrated incident response services. Companies are offering tailored packages with coverage for a range of threats, including ransomware, phishing attacks, and data breaches. The competitive advantage hinges on providing comprehensive, customizable solutions, backed by robust claims handling and risk management expertise.

Key Drivers, Barriers & Challenges in Cyber Security Insurance in UK Market

Key Drivers: Technological advancements, increasing cyber threats, regulatory compliance requirements, and rising awareness of data breaches are all significant drivers of market growth. Government initiatives promoting cyber security also play a crucial role. For example, the UK government's National Cyber Security Centre (NCSC) actively promotes good cyber hygiene, indirectly increasing the demand for cyber insurance.

Challenges and Restraints: The primary challenges are accurate risk assessment and pricing, particularly for emerging threats, alongside fluctuating claims costs which can affect profitability. Regulatory uncertainty and complexities related to data privacy legislation could also impact market growth. The high cost of insurance and difficulty in obtaining coverage for certain sectors also pose significant hurdles. Furthermore, a lack of awareness and understanding about cyber insurance amongst SMEs constitutes a key barrier.

Growth Drivers in the Cyber Security Insurance in UK Market Market

The market's growth is significantly driven by increased awareness of cyber risks and the rising frequency of cyberattacks. Stringent data privacy regulations, coupled with government initiatives promoting cyber security, also boost demand. Technological advancements in threat detection and response capabilities are furthering the need for updated, comprehensive insurance policies.

Challenges Impacting Cyber Security Insurance in UK Market Growth

The market faces challenges such as the difficulty in accurately assessing and pricing cyber risks, leading to volatility in insurance premiums. Regulatory complexities related to data privacy, coupled with a potential skills shortage in the cyber security industry, affect the market’s expansion. Furthermore, intense competition among insurers can lead to price wars, affecting profitability.

Key Players Shaping the Cyber Security Insurance in UK Market Market

- CFC Underwriting

- Tokio Marine Kiln

- AIG

- Beazley

- Marsh

- Hiscox

- AXA XL

- Zurich

- NIG

- Allianz

Significant Cyber Security Insurance in UK Market Industry Milestones

- September 2023: Cowbell expands into the UK market with Cowbell Prime One, a cyber insurance product tailored to SMEs and mid-market businesses. This signifies increased competition and broader access to cyber insurance for smaller companies.

- March 2023: Coalition enters the UK excess cyber insurance market, providing enhanced coverage of up to GBP 10 million (USD 12,126,000) above a primary layer. This development indicates growing demand for higher coverage limits and demonstrates confidence in the UK market’s potential.

Future Outlook for Cyber Security Insurance in UK Market Market

The UK cyber security insurance market is poised for significant growth, driven by persistent cyber threats, increased regulatory pressure, and growing awareness of cyber risks. Strategic opportunities exist for insurers to develop innovative products catering to the evolving needs of diverse sectors. The market's future success hinges on accurate risk assessment, competitive pricing strategies, and robust claims management. The potential for further consolidation through mergers and acquisitions also represents a key aspect of the future market landscape. The increasing use of AI and machine learning in risk assessment and claims processing will shape the sector's future development, boosting efficiency and accuracy.

Cyber Security Insurance in UK Market Segmentation

-

1. Product Type

- 1.1. Packaged

- 1.2. Standalone

-

2. Application Type

- 2.1. Banking & Financial Services

- 2.2. IT & Telecom

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Other Application Types

Cyber Security Insurance in UK Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyber Security Insurance in UK Market Regional Market Share

Geographic Coverage of Cyber Security Insurance in UK Market

Cyber Security Insurance in UK Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Data Privacy Regulations; Business Interruption

- 3.3. Market Restrains

- 3.3.1. Complexity and Lack of Understanding; Cost of Coverage

- 3.4. Market Trends

- 3.4.1. Impact of Cyber Insurance Policy Coverage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Packaged

- 5.1.2. Standalone

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Banking & Financial Services

- 5.2.2. IT & Telecom

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Packaged

- 6.1.2. Standalone

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Banking & Financial Services

- 6.2.2. IT & Telecom

- 6.2.3. Healthcare

- 6.2.4. Retail

- 6.2.5. Other Application Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Packaged

- 7.1.2. Standalone

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Banking & Financial Services

- 7.2.2. IT & Telecom

- 7.2.3. Healthcare

- 7.2.4. Retail

- 7.2.5. Other Application Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Packaged

- 8.1.2. Standalone

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Banking & Financial Services

- 8.2.2. IT & Telecom

- 8.2.3. Healthcare

- 8.2.4. Retail

- 8.2.5. Other Application Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Packaged

- 9.1.2. Standalone

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Banking & Financial Services

- 9.2.2. IT & Telecom

- 9.2.3. Healthcare

- 9.2.4. Retail

- 9.2.5. Other Application Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Packaged

- 10.1.2. Standalone

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Banking & Financial Services

- 10.2.2. IT & Telecom

- 10.2.3. Healthcare

- 10.2.4. Retail

- 10.2.5. Other Application Types

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CFC Underwriting

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tokio Marine Kiln

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AIG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beazley

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marsh

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hiscox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA XL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zurich**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NIG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CFC Underwriting

List of Figures

- Figure 1: Global Cyber Security Insurance in UK Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 11: South America Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Europe Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Asia Pacific Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 30: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 39: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Insurance in UK Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Cyber Security Insurance in UK Market?

Key companies in the market include CFC Underwriting, Tokio Marine Kiln, AIG, Beazley, Marsh, Hiscox, AXA XL, Zurich**List Not Exhaustive, NIG, Allianz.

3. What are the main segments of the Cyber Security Insurance in UK Market?

The market segments include Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Data Privacy Regulations; Business Interruption.

6. What are the notable trends driving market growth?

Impact of Cyber Insurance Policy Coverage.

7. Are there any restraints impacting market growth?

Complexity and Lack of Understanding; Cost of Coverage.

8. Can you provide examples of recent developments in the market?

September 2023: Cowbell is committed to addressing cyber risk challenges on a global scale, and our expansion into the UK is a testament to this. Cowbell Prime One is tailored towards SME and mid-market customers and allows brokers to customize cyber policies for different risk exposures, such as email scams, ransomware, and social engineering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Security Insurance in UK Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Security Insurance in UK Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Security Insurance in UK Market?

To stay informed about further developments, trends, and reports in the Cyber Security Insurance in UK Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence