Key Insights

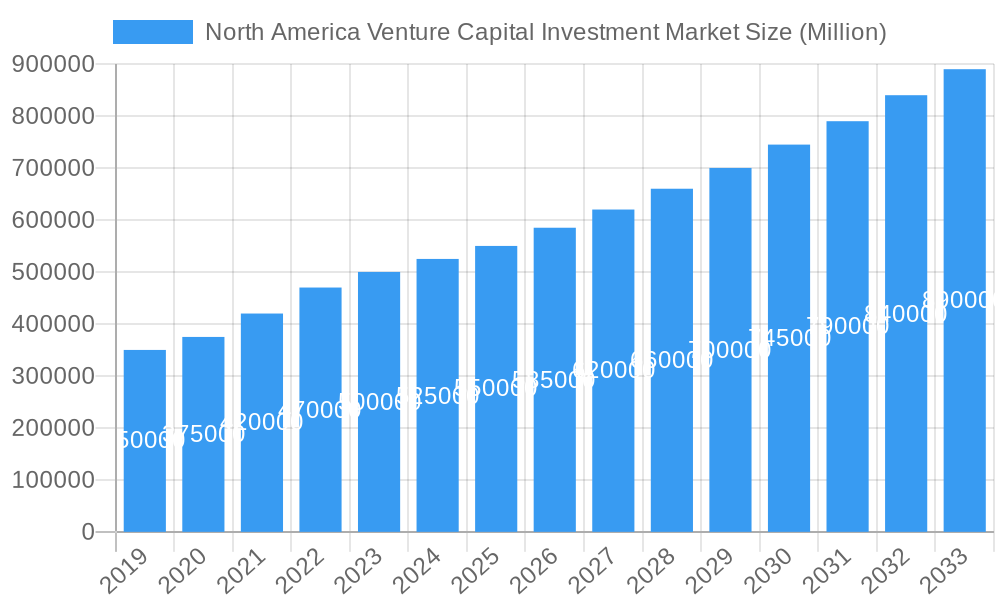

The North America Venture Capital Investment Market is poised for robust expansion, projected to reach a market size of approximately $550 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This dynamic growth is primarily fueled by significant advancements and investments in the Pharma and Biotech sectors, driven by groundbreaking research and development in gene therapies, personalized medicine, and novel drug discovery. The Fintech industry also remains a potent growth engine, with continuous innovation in digital payments, blockchain technology, and artificial intelligence-powered financial services attracting substantial capital. Emerging technologies within IT Hardware and Services, coupled with increasing consumer demand for innovative products, are further bolstering market expansion. While the market demonstrates strong upward momentum, potential restraints include increasing regulatory complexities, particularly in the Pharma and Biotech space, and potential economic downturns that could impact investor confidence and funding availability. However, the inherent resilience and adaptability of the venture capital ecosystem, coupled with a consistent flow of innovative startups, are expected to mitigate these challenges.

North America Venture Capital Investment Market Market Size (In Billion)

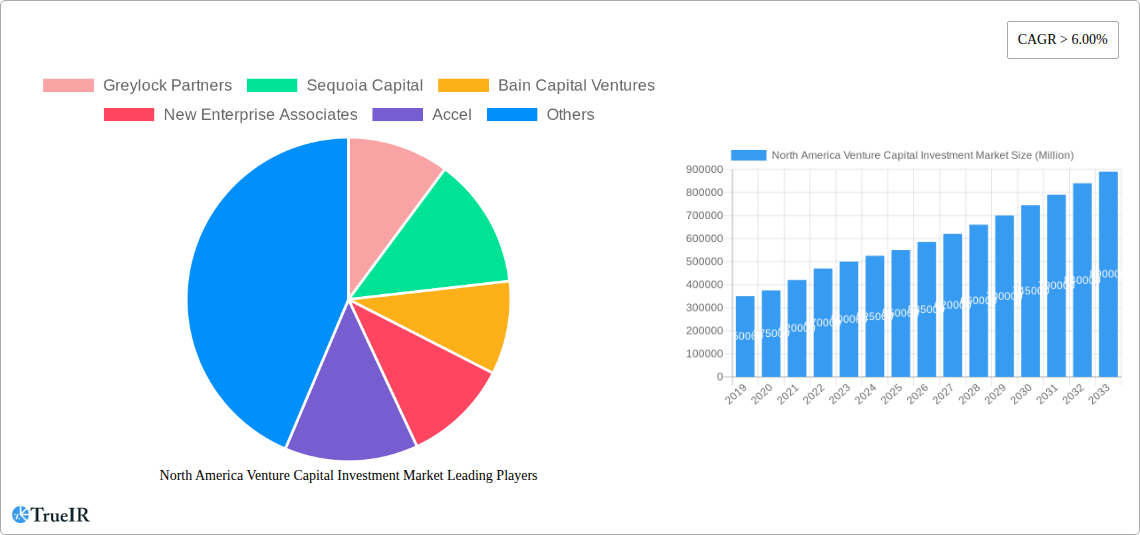

The investment landscape is characterized by a strategic focus on different stages of company development, with substantial capital flowing into Early-stage and Later-stage Investing, reflecting a mature venture capital ecosystem that supports companies from inception through significant scaling. Key industry players like Greylock Partners, Sequoia Capital, and Bain Capital Ventures are actively shaping the market through strategic funding rounds and influential portfolio management. North America, particularly the United States, dominates the regional market share due to its established innovation hubs, access to talent, and supportive entrepreneurial environment. The market's trajectory indicates a sustained period of high investment activity, with venture capital playing a pivotal role in driving technological advancements and economic growth across various sectors, including Consumer Goods and Industrial/Energy, as companies increasingly leverage technology for efficiency and market penetration.

North America Venture Capital Investment Market Company Market Share

Here's the SEO-optimized report description for the North America Venture Capital Investment Market, structured as requested:

North America Venture Capital Investment Market: Market Structure & Competitive Landscape

The North America Venture Capital Investment Market exhibits a dynamic and evolving structure characterized by a high degree of innovation and strategic M&A activity. Market concentration varies across different investment stages and industry verticals, with leading venture capital firms like Greylock Partners, Sequoia Capital, and Bain Capital Ventures often dominating later-stage funding rounds. Innovation drivers are primarily fueled by advancements in technology, particularly in sectors like Fintech and Pharma/Biotech, attracting substantial investment. Regulatory impacts, while present, are generally supportive of entrepreneurial growth, though compliance remains a key consideration. Product substitutes are less direct in the VC landscape, with the primary competition revolving around deal flow and successful exits. End-user segmentation is broad, encompassing startups across all stages and industries. M&A trends indicate a healthy appetite for strategic acquisitions to drive growth and market consolidation, with an estimated 400+ M&A deals observed annually in recent historical periods. Concentration ratios for the top 5 firms are estimated to be between 35-45% in mature segments, while emerging areas show lower concentration. The market is propelled by robust deal-making, with significant capital deployment focused on high-growth potential ventures.

North America Venture Capital Investment Market Market Trends & Opportunities

The North America Venture Capital Investment Market is projected for robust growth, with an estimated market size expected to reach $XXX Billion by 2033, expanding from approximately $XXX Billion in 2024. This significant expansion is underpinned by a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025–2033. Technological shifts are a paramount driver, with AI, machine learning, blockchain, and sustainable technologies continually reshaping investment landscapes. Consumer preferences are increasingly leaning towards solutions offering enhanced convenience, personalization, and sustainability, directly influencing capital allocation towards relevant startups. Competitive dynamics are intensifying, marked by an influx of new fund managers and a diversification of investment strategies, including corporate venture capital and impact investing. Opportunities abound for investors in early-stage ventures poised for disruptive innovation, as well as in later-stage companies seeking capital for scaling and market expansion. Fintech remains a dominant sector, attracting an estimated XX% of total venture capital funding, driven by the digital transformation of financial services. Pharma and Biotech continue to be a strong contender, benefiting from breakthroughs in personalized medicine and drug discovery, accounting for roughly XX% of investments. The IT Hardware and Services sector also shows consistent growth, fueled by cloud computing adoption and the increasing demand for digital infrastructure. Consumer Goods, particularly those leveraging e-commerce and direct-to-consumer models, represent another significant area of investment interest. The market penetration of venture capital in traditional industries is also growing, as legacy businesses embrace technological innovation. Emerging trends like decentralized finance (DeFi), the metaverse, and advanced materials present significant, albeit higher-risk, opportunities for early adopters. The report delves into the nuances of these trends, providing actionable insights for investors looking to capitalize on the evolving venture capital ecosystem across North America. This includes an analysis of investment patterns in emerging markets within North America and the influence of global economic factors on regional venture capital flows. Furthermore, the report explores the growing significance of Environmental, Social, and Governance (ESG) considerations in investment decisions, a trend that is influencing both capital deployment and startup operational strategies.

Dominant Markets & Segments in North America Venture Capital Investment Market

Within the North America Venture Capital Investment Market, Later-stage Investing stands out as a dominant segment, attracting substantial capital flows and exhibiting consistent growth. This is closely followed by Early-stage Investing, which remains crucial for nurturing nascent innovation and building future market leaders. Angel/Seed Investing, while representing a smaller absolute capital amount per deal, is the vital genesis for the entire venture ecosystem.

Industry Dominance:

- Fintech: This sector is a perennial leader, driven by continuous innovation in digital payments, lending, insurtech, and wealth management solutions. Key growth drivers include the increasing adoption of digital financial services, regulatory support for innovation, and the demand for more efficient and accessible financial tools. North America, particularly the United States, serves as a global hub for fintech innovation, attracting significant venture capital.

- Pharma and Biotech: Advancements in genomics, personalized medicine, and novel drug discovery technologies have propelled this industry to the forefront of venture investment. Government funding for research and development, coupled with favorable intellectual property laws, are significant catalysts. The growing need for innovative healthcare solutions, especially in light of global health challenges, further amplifies investment in this sector.

- IT Hardware and Services: This broad category continues to benefit from the digital transformation across all industries. Growth is fueled by demand for cloud computing, cybersecurity solutions, artificial intelligence infrastructure, and the Internet of Things (IoT). Investments in hardware innovation and the development of sophisticated software and service platforms are consistently high.

- Consumer Goods: While seemingly more traditional, the consumer goods sector sees significant VC activity, particularly in areas focused on e-commerce, sustainable products, direct-to-consumer (DTC) brands, and innovative delivery models. Shifting consumer preferences towards ethical sourcing, personalized experiences, and convenience drive investment.

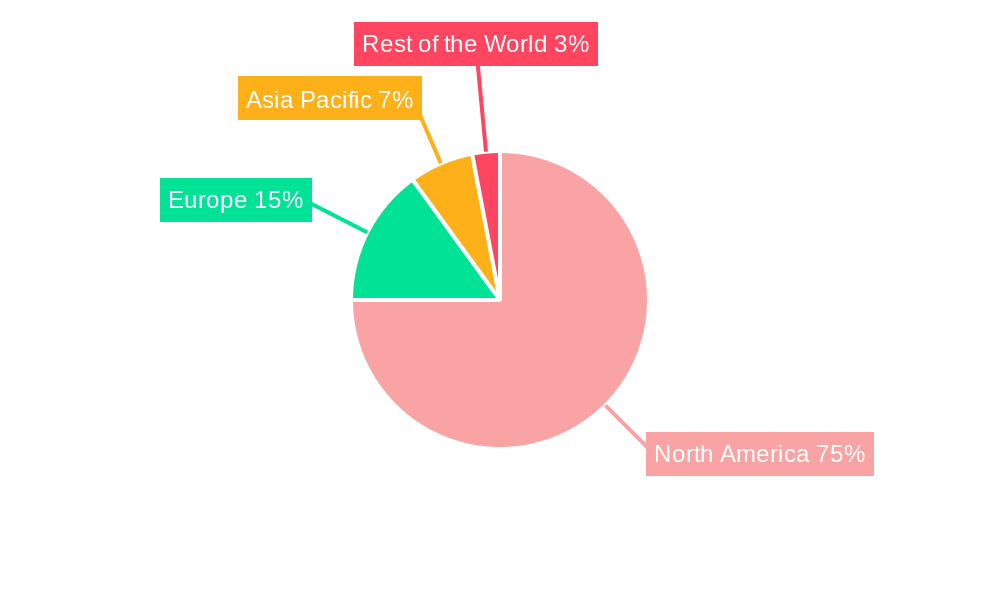

Geographic Dominance: The United States continues to be the dominant market within North America, accounting for the vast majority of venture capital investment. However, Canada is emerging as a significant player, particularly in AI and sustainable technology sectors, with supportive government initiatives and a growing talent pool.

Key Growth Drivers for Dominant Segments:

- Technological Advancements: The relentless pace of technological innovation across AI, machine learning, biotechnology, and digital platforms creates new investment opportunities.

- Market Demand: Growing consumer and enterprise demand for innovative solutions in areas like digital finance, advanced healthcare, and sustainable products.

- Supportive Regulatory Environment: While evolving, the regulatory landscape in North America generally encourages entrepreneurship and investment, particularly in high-growth technology sectors.

- Availability of Skilled Talent: The presence of world-class research institutions and a highly skilled workforce in North America attracts startups and investors alike.

- Capital Availability: The robust presence of venture capital firms, private equity, and institutional investors ensures ample capital is available for promising ventures.

North America Venture Capital Investment Market Product Analysis

The North America Venture Capital Investment Market's product is essentially capital, channeled into innovative startups and established companies. These investments fuel the development and scaling of a wide array of products and services across diverse industries. Key product innovations are driven by technological advancements in AI, biotech, and software development, enabling companies to create disruptive solutions. Competitive advantages are forged through proprietary technology, unique business models, and strong market traction. The market fit is determined by the ability of these funded ventures to address unmet needs or significantly improve existing solutions, leading to substantial market penetration and eventual exits for investors.

Key Drivers, Barriers & Challenges in North America Venture Capital Investment Market

Key Drivers: The North America Venture Capital Investment Market is propelled by a confluence of powerful forces. Technologically, continuous breakthroughs in AI, biotechnology, and sustainable energy create fertile ground for disruptive innovation, attracting significant investment. Economically, a robust entrepreneurial ecosystem, coupled with ample liquidity from institutional investors and high-net-worth individuals, fuels deal flow. Policy-driven factors, such as R&D tax credits and supportive legislation for startups, further incentivize venture capital deployment. The strong performance of technology sectors and a demonstrated history of successful IPOs and acquisitions also act as significant drivers.

Barriers & Challenges: Despite its strength, the market faces considerable challenges. Regulatory hurdles, including evolving data privacy laws and antitrust scrutiny, can create uncertainty and increase compliance costs. Supply chain issues, particularly for hardware-intensive industries, can disrupt production and impact growth trajectories, leading to projected delays in market entry for some startups. Competitive pressures are intense, with a crowded landscape of venture capital firms vying for limited high-quality deal flow, potentially driving up valuations and reducing expected returns. Macroeconomic volatility, including inflation and interest rate fluctuations, can impact investor confidence and the cost of capital.

Growth Drivers in the North America Venture Capital Investment Market Market

The North America Venture Capital Investment Market is experiencing significant growth driven by several key factors. Technological innovation remains a primary catalyst, with advancements in AI, machine learning, and biotechnology creating unprecedented opportunities for disruption and capital infusion. Economic tailwinds, such as a resilient consumer base and a supportive business environment, encourage risk-taking and investment. Policy initiatives aimed at fostering innovation, including research and development incentives and streamlined regulatory frameworks for emerging technologies, also play a crucial role. The increasing digitalization of industries and the persistent demand for novel solutions in sectors like healthcare and clean energy further fuel this growth trajectory, creating a fertile environment for venture capital deployment.

Challenges Impacting North America Venture Capital Investment Market Growth

Several challenges can impede the growth of the North America Venture Capital Investment Market. Regulatory complexities, such as evolving data privacy laws and the increasing antitrust scrutiny of large tech companies, can create uncertainty and increase compliance costs for startups and investors alike. Supply chain disruptions, particularly for hardware-dependent sectors, can lead to production delays and impact the scaling capabilities of portfolio companies. Intense competitive pressures within the venture capital landscape can lead to inflated valuations and a more challenging environment for securing favorable deal terms. Furthermore, macroeconomic volatility, including inflation and rising interest rates, can dampen investor sentiment and increase the cost of capital, potentially slowing down investment activity.

Key Players Shaping the North America Venture Capital Investment Market Market

- Greylock Partners

- Sequoia Capital

- Bain Capital Ventures

- New Enterprise Associates

- Accel

- Khosla Ventures

- Real Ventures

- Tiger Global Management

- Matrix Partners

- Index Ventures

Significant North America Venture Capital Investment Market Industry Milestones

- June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3. This new investment fund targets venture companies in industry sectors with high growth potential, including ICT services such as health tech and fintech, as a limited partner. This fund is expected to support business growth and investment in startups in the United States, Canada, and other countries.

- May 2023: AXA Venture Partners, a global venture capital firm specializing in high-growth, technology-enabled companies, announced the launch of a new strategy, targeting late-stage tech companies with a EUR 1.5 Billion fund. Plans include bringing new talents into its team in North America to efficiently execute its strategy.

Future Outlook for North America Venture Capital Investment Market Market

The future outlook for the North America Venture Capital Investment Market remains exceptionally strong, driven by sustained innovation and an expanding appetite for high-growth ventures. Emerging technologies such as quantum computing, advanced materials, and personalized health solutions are poised to attract significant capital. The continued digital transformation across all sectors, coupled with a growing emphasis on sustainability and ESG principles, will create new investment avenues. Strategic opportunities lie in early-stage investments in disruptive technologies and later-stage funding for scalable businesses with proven market fit. The market is expected to see continued diversification in investor types and an increasing focus on specialized investment funds, promising robust returns and continued economic impact.

North America Venture Capital Investment Market Segmentation

-

1. Stage of Investment

- 1.1. Angel/Seed Investing

- 1.2. Early-stage Investing

- 1.3. Later-stage Investing

-

2. Industry

- 2.1. Fintech

- 2.2. Pharma and Biotech

- 2.3. Consumer Goods

- 2.4. Industrial/Energy

- 2.5. IT Hardware and Services

- 2.6. Other Industries

North America Venture Capital Investment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Venture Capital Investment Market Regional Market Share

Geographic Coverage of North America Venture Capital Investment Market

North America Venture Capital Investment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America

- 3.3. Market Restrains

- 3.3.1. Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment

- 3.4. Market Trends

- 3.4.1. Canada Increasing Venture Capital Scenario is Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Venture Capital Investment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 5.1.1. Angel/Seed Investing

- 5.1.2. Early-stage Investing

- 5.1.3. Later-stage Investing

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Fintech

- 5.2.2. Pharma and Biotech

- 5.2.3. Consumer Goods

- 5.2.4. Industrial/Energy

- 5.2.5. IT Hardware and Services

- 5.2.6. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Stage of Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Greylock Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sequoia Capital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bain Capital Ventures

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Enterprise Associates

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Khosla Ventures

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Real Ventures

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tiger Global Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Matrix Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Index Ventures

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Greylock Partners

List of Figures

- Figure 1: North America Venture Capital Investment Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Venture Capital Investment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 2: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 3: North America Venture Capital Investment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Venture Capital Investment Market Revenue undefined Forecast, by Stage of Investment 2020 & 2033

- Table 5: North America Venture Capital Investment Market Revenue undefined Forecast, by Industry 2020 & 2033

- Table 6: North America Venture Capital Investment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Venture Capital Investment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Venture Capital Investment Market?

The projected CAGR is approximately 20.3%.

2. Which companies are prominent players in the North America Venture Capital Investment Market?

Key companies in the market include Greylock Partners, Sequoia Capital, Bain Capital Ventures, New Enterprise Associates, Accel, Khosla Ventures, Real Ventures, Tiger Global Management, Matrix Partners, Index Ventures.

3. What are the main segments of the North America Venture Capital Investment Market?

The market segments include Stage of Investment, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Fintech and Life Science Industry; Rising Number of Unicorns In North America.

6. What are the notable trends driving market growth?

Canada Increasing Venture Capital Scenario is Fueling the Market.

7. Are there any restraints impacting market growth?

Rising Risk in Market with Global Economic Uncertainity; Majority of Growth limited in ICT and Life Science segment.

8. Can you provide examples of recent developments in the market?

June 2022: Fund Corporation for the Overseas Development of Japan's ICT and Postal Services Inc. announced an investment in Sony Innovation Fund 3, which was a new investment fund targeting venture companies in industry sectors with high growth potential, including ICT services such as health tech and fintech, as a limited partner. This fund was expected to support business growth and Investment in Startups in the United States, Canada, and other countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Venture Capital Investment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Venture Capital Investment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Venture Capital Investment Market?

To stay informed about further developments, trends, and reports in the North America Venture Capital Investment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence