Key Insights

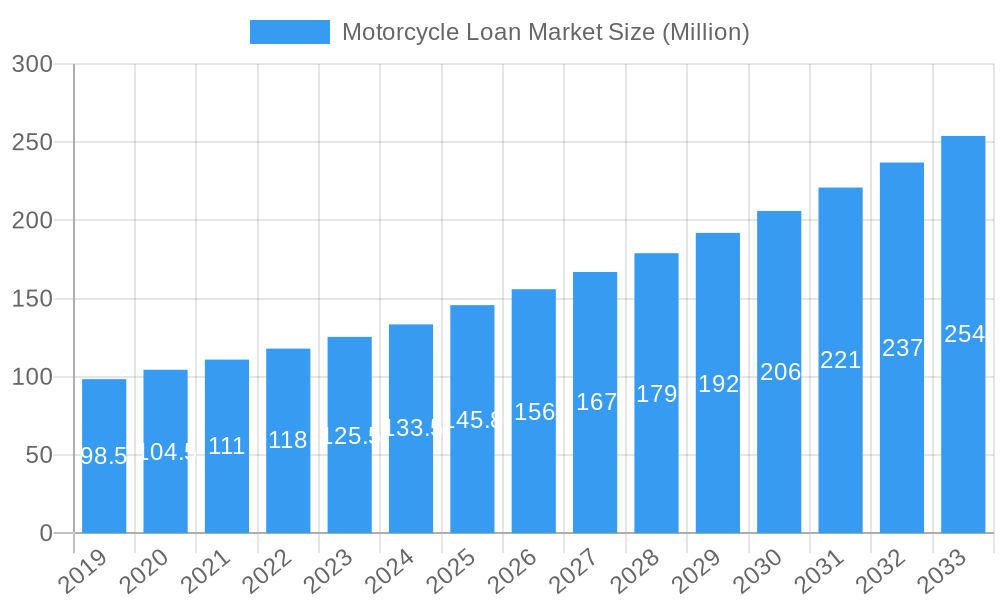

The global motorcycle loan market is poised for significant expansion, projected to reach an impressive USD 145.80 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.61% anticipated through 2033. This growth is primarily fueled by increasing disposable incomes, a rising preference for two-wheelers as an economical and efficient mode of transport in urban and semi-urban areas, and the growing trend of motorcycle customization and hobbyist culture. The demand for motorcycle loans is also being propelled by evolving consumer lifestyles and the burgeoning adventure tourism sector, where motorcycles offer unparalleled access to diverse terrains. Financial institutions, including banks and Non-Banking Financial Companies (NBFCs), alongside Original Equipment Manufacturers (OEMs) and emerging fintech players, are actively participating, offering a spectrum of financing options tailored to diverse customer needs, from flexible repayment tenures to varying loan amounts.

Motorcycle Loan Market Market Size (In Million)

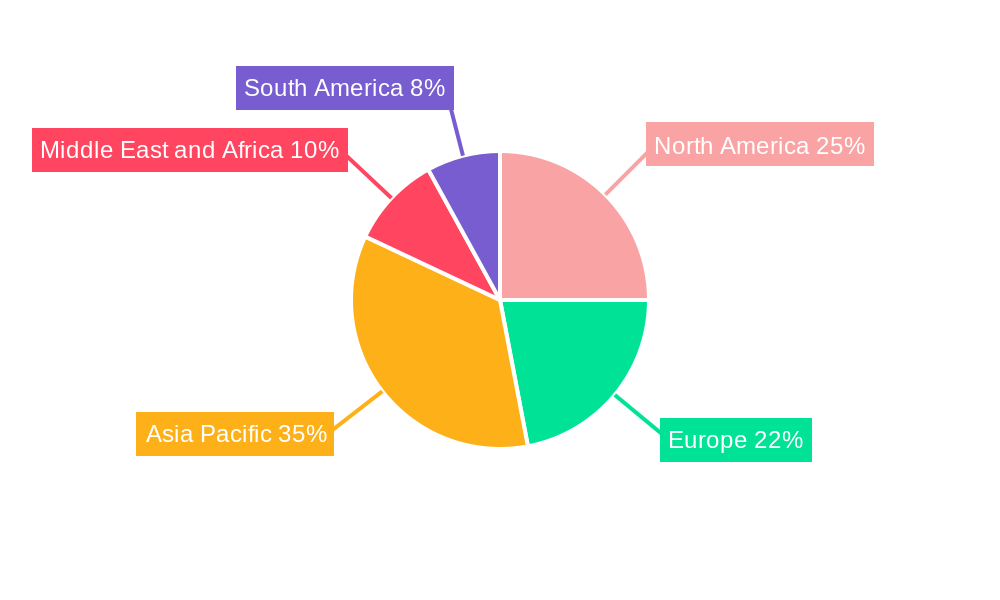

The market segmentation reveals a dynamic landscape. In terms of vehicle type, two-wheelers dominate the demand for financing, reflecting their widespread adoption. Passenger cars and commercial vehicles also contribute to the overall financing ecosystem, albeit with different growth trajectories. The provider landscape is diverse, with traditional banking institutions and NBFCs holding a significant share, while OEMs are increasingly leveraging captive finance arms to drive sales. Fintech companies are emerging as disruptors, offering innovative digital lending solutions that enhance accessibility and convenience. The percentage of the amount sanctioned and the tenure of the loan are key differentiators, with a substantial portion of loans falling within the 51-75% sanction range and tenures extending up to 5 years, indicating a growing commitment to longer-term ownership. Regions like Asia Pacific, particularly India and China, are expected to be significant growth engines, driven by their large populations and increasing motorcycle penetration, while North America and Europe will continue to be mature markets with a steady demand.

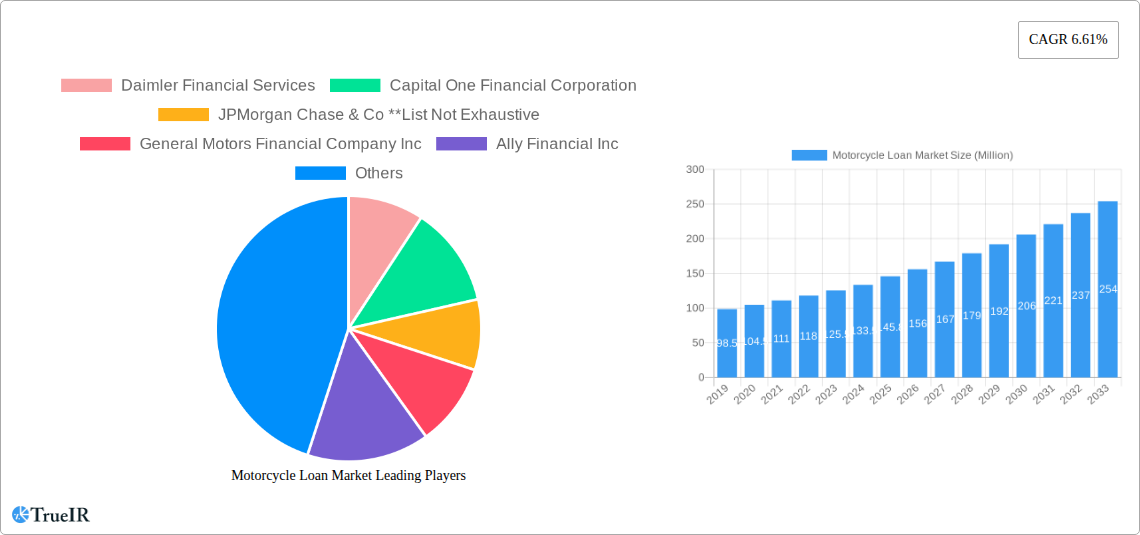

Motorcycle Loan Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the global Motorcycle Loan Market. Leveraging high-volume keywords such as "motorcycle financing," "two-wheeler loans," "auto loans," "NBFC financing," and "OEM finance," this report is meticulously crafted to engage industry professionals, investors, and stakeholders seeking critical insights into market dynamics, growth opportunities, and competitive landscapes. The study encompasses a comprehensive historical analysis from 2019 to 2024, with a base year of 2025 and a robust forecast period extending to 2033.

Motorcycle Loan Market Market Structure & Competitive Landscape

The motorcycle loan market exhibits a moderately concentrated structure, driven by the strong presence of established financial institutions and OEM-backed financing arms. Innovation is primarily fueled by technological advancements in digital lending platforms, improving customer experience and streamlining application processes. Regulatory frameworks, while evolving, aim to ensure consumer protection and financial stability, impacting lending criteria and operational efficiencies. Product substitutes, though limited in direct replacement, include personal loans and savings, which can impact demand for dedicated motorcycle financing. End-user segmentation is diverse, ranging from individual commuters to commercial fleet operators. Mergers and acquisitions (M&A) activity is a significant trend, as seen with Mitsubishi UFJ Financial Group's acquisition of Mandala Multifinance, indicating a consolidation push and a desire to expand market reach. Quantitative data suggests an increasing volume of M&A deals in the past two years, with an estimated volume of $1,000 Million in 2023 alone. Concentration ratios, particularly in developed markets, point to a few key players holding a substantial market share, estimated at over 60% for the top five entities.

- Key structural elements:

- Presence of large banks and specialized NBFCs.

- Significant role of OEM financing arms.

- Emergence of fintech disruptors.

- Innovation drivers:

- Digitalization of loan application and approval processes.

- Data analytics for risk assessment and personalized offers.

- Integration of blockchain for enhanced security and transparency.

- Regulatory impacts:

- Stricter KYC and AML compliance.

- Interest rate caps and lending guidelines.

- Data privacy regulations affecting customer information handling.

- Product substitutes:

- Personal loans for discretionary purchases.

- Savings and cash-based purchases.

- Leasing options in select markets.

- End-user segmentation:

- Individual commuters and hobbyists.

- Delivery and logistics businesses.

- Ride-sharing services.

- M&A trends:

- Strategic acquisitions to expand geographical reach and customer base.

- Consolidation for economies of scale and market dominance.

- Acquisitions of fintech companies to leverage technological capabilities.

Motorcycle Loan Market Market Trends & Opportunities

The motorcycle loan market is poised for substantial growth, driven by an increasing demand for affordable personal transportation, particularly in emerging economies, and a resurgence of interest in motorcycling as a lifestyle choice. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). Technological shifts are revolutionizing the lending landscape, with digital platforms and mobile applications significantly enhancing accessibility and reducing turnaround times for loan approvals. This trend is creating significant opportunities for fintech companies and traditional lenders to innovate their service offerings. Consumer preferences are increasingly leaning towards flexible loan tenures and competitive interest rates, with a growing demand for customized financing solutions that cater to specific income profiles and repayment capacities. The market penetration rate for motorcycle loans is estimated to be around 45% globally, with significant room for expansion, especially in regions with burgeoning two-wheeler adoption. Competitive dynamics are intensifying, with both established financial institutions and new market entrants vying for market share. This is leading to a greater emphasis on customer-centric approaches, loyalty programs, and value-added services. Opportunities lie in tapping into underserved segments, such as rural populations and first-time buyers, by offering simplified documentation and accessible financing options. Furthermore, the increasing adoption of electric motorcycles presents a new avenue for growth, with specialized financing products that align with the unique characteristics and lifecycle of electric vehicles. The integration of AI and machine learning for credit scoring and fraud detection will further optimize lending processes and reduce operational costs. The growing e-commerce ecosystem also presents an opportunity for online loan aggregators and marketplaces to connect borrowers with a wider array of financing options, thereby increasing market efficiency and consumer choice. The overall market size is estimated to reach $350 Billion by 2033, up from approximately $180 Billion in 2024.

Dominant Markets & Segments in Motorcycle Loan Market

The Two-Wheeler segment unequivocally dominates the global motorcycle loan market, driven by their widespread adoption as an economical and efficient mode of transportation, particularly in Asia, Latin America, and Africa. This dominance is further amplified by their lower purchase price compared to passenger cars, making them more accessible to a broader demographic.

Vehicle Type:

- Two-Wheeler: Accounts for an estimated 70% of the total motorcycle loan market. High population density, traffic congestion, and the cost-effectiveness of two-wheelers in urban and semi-urban areas contribute significantly to this segment's leadership. The increasing demand for delivery services and ride-sharing platforms further propels the need for two-wheeler financing.

- Passenger Car: Holds a significant but secondary position, driven by personal mobility needs and family transportation. Its market share is estimated at 25%.

- Commercial Vehicle: While a smaller segment, its growth is tied to the logistics and delivery industry, accounting for approximately 5%.

Provider Type:

- NBFCs (Non-Banking Financial Services): Exhibit strong dominance, estimated at 50% of the market share. Their agility, flexible lending criteria, and focus on niche segments, including those with lower credit scores, make them highly preferred, especially in emerging markets.

- Banks: Hold a substantial share of 35%, leveraging their established customer base and wider range of financial products.

- OEM (Original Equipment Manufacturer): Captures around 10% of the market, offering attractive financing packages directly through dealerships, often tied to specific models and promotions.

- Other Provider Types (Fintech Companies): Represent a growing segment of 5%, rapidly gaining traction through innovative digital platforms and streamlined processes.

Percentage of Amount Sanctioned:

- 51-75%: This range represents the largest segment, estimated at 40%, indicating that most motorcycle buyers finance a significant portion of the vehicle's cost.

- More than 75%: Accounts for approximately 30%, reflecting the need for higher loan amounts for premium or mid-range motorcycles.

- 25-50%: Represents around 20%, often associated with budget-conscious buyers or those with existing savings.

- Less than 25%: Constitutes the remaining 10%, typically for entry-level models or as a supplement to substantial down payments.

Tenure:

- 3-5 Years: This is the most prevalent tenure, estimated at 55%, offering a balance between manageable monthly payments and reasonable loan duration.

- Less than 3 Years: Accounts for 30%, favored by individuals who prefer to repay their loans quickly and avoid long-term debt.

- More than 5 Years: Represents 15%, offering lower monthly installments but incurring higher interest costs over the loan's life.

Market Dominance Drivers:

- Infrastructure Development: Improved road networks in developing countries necessitate affordable personal mobility solutions like motorcycles.

- Urbanization: Growing urban populations lead to increased demand for efficient commuting options, favoring two-wheelers.

- Economic Growth & Disposable Income: Rising disposable incomes enable a larger segment of the population to consider motorcycle purchases.

- Supportive Government Policies: Initiatives promoting affordable transportation and the growth of the automotive sector indirectly benefit the motorcycle loan market.

- Cost-Effectiveness: Motorcycles offer lower operational costs (fuel efficiency, maintenance) compared to cars, making them an attractive choice.

- Technological Advancements in Lending: Digital platforms and fintech solutions are expanding access to financing for previously unbanked or underbanked populations.

Motorcycle Loan Market Product Analysis

The motorcycle loan market is characterized by a range of innovative financing products designed to meet diverse consumer needs. Beyond standard term loans, offerings now include flexible repayment options, customizable EMIs, and partnerships with insurance providers for bundled financing. OEMs are increasingly offering attractive finance schemes directly through their dealerships, often with lower interest rates or special offers on new models, enhancing competitive advantages. Fintech companies are introducing AI-driven credit assessment tools and digital onboarding processes, reducing loan processing times to mere hours and improving market fit by catering to the demand for speed and convenience. Technological advancements are also focusing on data analytics to offer personalized loan products based on individual risk profiles and repayment behaviors, thereby enhancing customer satisfaction and reducing defaults.

Key Drivers, Barriers & Challenges in Motorcycle Loan Market

Key Drivers:

The motorcycle loan market is propelled by several key drivers, including rapid urbanization, leading to increased demand for affordable personal transportation and the growing middle class with rising disposable incomes. Technological advancements in digital lending platforms are significantly improving accessibility and streamlining application processes, while supportive government policies promoting the automotive sector and financial inclusion further fuel growth. The inherent cost-effectiveness of motorcycles as a mode of transport, both in purchase and operation, also remains a significant draw for consumers.

Barriers & Challenges:

Despite the promising growth, the market faces significant challenges. Regulatory complexities and evolving compliance requirements can increase operational costs and slow down expansion. Economic downturns and rising inflation can impact consumer purchasing power and increase the risk of loan defaults. Supply chain disruptions affecting vehicle availability can indirectly limit the demand for financing. Intense competition among lenders, leading to price wars and reduced profit margins, also poses a considerable challenge. Furthermore, a lack of standardized credit scoring mechanisms in some regions can make risk assessment difficult for lenders.

Growth Drivers in the Motorcycle Loan Market Market

The motorcycle loan market is experiencing robust growth driven by several factors. Technological innovation in digital lending, including AI-powered credit assessment and seamless online application processes, is significantly enhancing accessibility and speed. Economic growth in emerging markets, coupled with rising disposable incomes, is expanding the consumer base for motorcycle purchases. Favorable government policies promoting vehicle ownership and financial inclusion, such as subsidized interest rates or tax benefits, further stimulate demand. The inherent cost-effectiveness and practicality of motorcycles as a primary mode of transport, especially in densely populated urban areas, remain a fundamental growth driver.

Challenges Impacting Motorcycle Loan Market Growth

Several challenges are impacting the growth trajectory of the motorcycle loan market. Evolving and stringent regulatory frameworks across different geographies can increase compliance costs and slow down product innovation. Persistent supply chain issues affecting vehicle manufacturing and availability can create bottlenecks in demand for financing. Intense competition from a growing number of lenders, including traditional banks, NBFCs, and fintech companies, is leading to margin pressures and increased marketing expenditure. Macroeconomic uncertainties, such as inflation and potential recessions, can dampen consumer confidence and lead to higher default rates.

Key Players Shaping the Motorcycle Loan Market Market

- Daimler Financial Services

- Capital One Financial Corporation

- JPMorgan Chase & Co

- General Motors Financial Company Inc

- Ally Financial Inc

- Bank of American Corporation

- Ford Motor Credit Company

- GM Financial Inc

- Mitsubishi HC Capital UK PLC

- Toyota Financial Services

Significant Motorcycle Loan Market Industry Milestones

- June 2023: Mitsubishi UFJ Financial Group acquired listed Indonesian motorcycle loan company Mandala Multifinance for 7 trillion IDT (USD 465 million). The Japanese financial giant will hold 70.6% through its subsidiary MUFG Bank and 10% through Adira Dinamika Multi Finance, a subsidiary of Bank Danamon. MUFG will conduct a mandatory tender offer for the remaining 19.4% stake of Mandala Multifinance after the completion of the acquisition, which is expected by early next year. The purchase is subject to regulatory approvals.

- May 2023: Suzuki Motorcycle India inked a pact with Bajaj Finance, the lending arm of Bajaj Finserv, to finance the former's two-wheelers. As part of this agreement, the customers will get easy access to retail financing options on the purchase of Suzuki two-wheelers.

Future Outlook for Motorcycle Loan Market Market

The future outlook for the motorcycle loan market is exceptionally positive, characterized by sustained growth fueled by ongoing urbanization, increasing disposable incomes, and the persistent demand for affordable personal transportation. The accelerating adoption of digital lending technologies will continue to democratize access to finance, particularly in emerging economies, by offering streamlined application processes and faster approvals. Strategic partnerships between OEMs, financial institutions, and fintech companies are expected to create more innovative and customer-centric financing solutions. The burgeoning electric motorcycle segment presents a significant new avenue for growth, with specialized financing products anticipated to emerge. Market expansion into underserved geographies and segments, coupled with a focus on flexible repayment options, will be key to unlocking further potential and capitalizing on the evolving needs of consumers.

Motorcycle Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Two-Wheeler

- 1.2. Passenger Car

- 1.3. Commercial Vehicle

-

2. Provider Type

- 2.1. Banks

- 2.2. NBFCs (Non-Banking Financial Services)

- 2.3. OEM (Original Equipment Manufacturer)

- 2.4. Other Provider Types (Fintech Companies)

-

3. Percentage of Amount Sanctioned

- 3.1. Less than 25%

- 3.2. 25-50%

- 3.3. 51-75%

- 3.4. More than 75%

-

4. Tenure

- 4.1. Less than 3 Years

- 4.2. 3-5 Years

- 4.3. More than 5 Years

Motorcycle Loan Market Segmentation By Geography

-

1. North America

- 1.1. USA

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. UK

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Vietnam

- 3.5. Austrilia

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Egypt

- 4.3. UAE

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Argentina

- 5.2. Colombia

- 5.3. Rest of South America

Motorcycle Loan Market Regional Market Share

Geographic Coverage of Motorcycle Loan Market

Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Motorcycles will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-Wheeler

- 5.1.2. Passenger Car

- 5.1.3. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Banks

- 5.2.2. NBFCs (Non-Banking Financial Services)

- 5.2.3. OEM (Original Equipment Manufacturer)

- 5.2.4. Other Provider Types (Fintech Companies)

- 5.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.3.1. Less than 25%

- 5.3.2. 25-50%

- 5.3.3. 51-75%

- 5.3.4. More than 75%

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than 3 Years

- 5.4.2. 3-5 Years

- 5.4.3. More than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Two-Wheeler

- 6.1.2. Passenger Car

- 6.1.3. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Banks

- 6.2.2. NBFCs (Non-Banking Financial Services)

- 6.2.3. OEM (Original Equipment Manufacturer)

- 6.2.4. Other Provider Types (Fintech Companies)

- 6.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 6.3.1. Less than 25%

- 6.3.2. 25-50%

- 6.3.3. 51-75%

- 6.3.4. More than 75%

- 6.4. Market Analysis, Insights and Forecast - by Tenure

- 6.4.1. Less than 3 Years

- 6.4.2. 3-5 Years

- 6.4.3. More than 5 Years

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Two-Wheeler

- 7.1.2. Passenger Car

- 7.1.3. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Banks

- 7.2.2. NBFCs (Non-Banking Financial Services)

- 7.2.3. OEM (Original Equipment Manufacturer)

- 7.2.4. Other Provider Types (Fintech Companies)

- 7.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 7.3.1. Less than 25%

- 7.3.2. 25-50%

- 7.3.3. 51-75%

- 7.3.4. More than 75%

- 7.4. Market Analysis, Insights and Forecast - by Tenure

- 7.4.1. Less than 3 Years

- 7.4.2. 3-5 Years

- 7.4.3. More than 5 Years

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Two-Wheeler

- 8.1.2. Passenger Car

- 8.1.3. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Banks

- 8.2.2. NBFCs (Non-Banking Financial Services)

- 8.2.3. OEM (Original Equipment Manufacturer)

- 8.2.4. Other Provider Types (Fintech Companies)

- 8.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 8.3.1. Less than 25%

- 8.3.2. 25-50%

- 8.3.3. 51-75%

- 8.3.4. More than 75%

- 8.4. Market Analysis, Insights and Forecast - by Tenure

- 8.4.1. Less than 3 Years

- 8.4.2. 3-5 Years

- 8.4.3. More than 5 Years

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East and Africa Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Two-Wheeler

- 9.1.2. Passenger Car

- 9.1.3. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Banks

- 9.2.2. NBFCs (Non-Banking Financial Services)

- 9.2.3. OEM (Original Equipment Manufacturer)

- 9.2.4. Other Provider Types (Fintech Companies)

- 9.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 9.3.1. Less than 25%

- 9.3.2. 25-50%

- 9.3.3. 51-75%

- 9.3.4. More than 75%

- 9.4. Market Analysis, Insights and Forecast - by Tenure

- 9.4.1. Less than 3 Years

- 9.4.2. 3-5 Years

- 9.4.3. More than 5 Years

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. South America Motorcycle Loan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Two-Wheeler

- 10.1.2. Passenger Car

- 10.1.3. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Banks

- 10.2.2. NBFCs (Non-Banking Financial Services)

- 10.2.3. OEM (Original Equipment Manufacturer)

- 10.2.4. Other Provider Types (Fintech Companies)

- 10.3. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 10.3.1. Less than 25%

- 10.3.2. 25-50%

- 10.3.3. 51-75%

- 10.3.4. More than 75%

- 10.4. Market Analysis, Insights and Forecast - by Tenure

- 10.4.1. Less than 3 Years

- 10.4.2. 3-5 Years

- 10.4.3. More than 5 Years

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daimler Financial Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Capital One Financial Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JPMorgan Chase & Co **List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Motors Financial Company Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ally Financial Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bank of American Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ford Motor Credit Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GM Financial Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi HC Capital UK PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toyota Financial Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Daimler Financial Services

List of Figures

- Figure 1: Global Motorcycle Loan Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 5: North America Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: North America Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 7: North America Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 8: North America Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 9: North America Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 10: North America Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 15: Europe Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 16: Europe Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 17: Europe Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 18: Europe Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 19: Europe Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 20: Europe Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 25: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 26: Asia Pacific Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 27: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 28: Asia Pacific Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 29: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 30: Asia Pacific Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 35: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 36: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 37: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 38: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 39: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 40: Middle East and Africa Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Motorcycle Loan Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 43: South America Motorcycle Loan Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 44: South America Motorcycle Loan Market Revenue (Million), by Provider Type 2025 & 2033

- Figure 45: South America Motorcycle Loan Market Revenue Share (%), by Provider Type 2025 & 2033

- Figure 46: South America Motorcycle Loan Market Revenue (Million), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 47: South America Motorcycle Loan Market Revenue Share (%), by Percentage of Amount Sanctioned 2025 & 2033

- Figure 48: South America Motorcycle Loan Market Revenue (Million), by Tenure 2025 & 2033

- Figure 49: South America Motorcycle Loan Market Revenue Share (%), by Tenure 2025 & 2033

- Figure 50: South America Motorcycle Loan Market Revenue (Million), by Country 2025 & 2033

- Figure 51: South America Motorcycle Loan Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 3: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 4: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 5: Global Motorcycle Loan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 8: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 9: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 10: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: USA Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 17: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 18: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: UK Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 27: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 28: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 29: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: India Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Austrilia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 38: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 39: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 40: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Egypt Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: UAE Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Motorcycle Loan Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 46: Global Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 47: Global Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2020 & 2033

- Table 48: Global Motorcycle Loan Market Revenue Million Forecast, by Tenure 2020 & 2033

- Table 49: Global Motorcycle Loan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Argentina Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Colombia Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of South America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motorcycle Loan Market?

The projected CAGR is approximately 6.61%.

2. Which companies are prominent players in the Motorcycle Loan Market?

Key companies in the market include Daimler Financial Services, Capital One Financial Corporation, JPMorgan Chase & Co **List Not Exhaustive, General Motors Financial Company Inc, Ally Financial Inc, Bank of American Corporation, Ford Motor Credit Company, GM Financial Inc, Mitsubishi HC Capital UK PLC, Toyota Financial Services.

3. What are the main segments of the Motorcycle Loan Market?

The market segments include Vehicle Type, Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 145.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Increasing Sales of Motorcycles will Drive the Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

June 2023: Mitsubishi UFJ Financial Group acquired listed Indonesian motorcycle loan company Mandala Multifinance for 7 trillion IDT ( USD 465 million). The Japanese financial giant will hold 70.6% through its subsidiary MUFG Bank and 10% through Adira Dinamika Multi Finance, a subsidiary of Bank Danamon. MUFG will conduct a mandatory tender offer for the remaining 19.4% stake of Mandala Multifinance after the completion of the acquisition, which is expected by early next year. The purchase is subject to regulatory approvals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence